Rising demand for digital gifting solutions, integration with mobile wallets, and consumer preference for convenience drive robust market growth

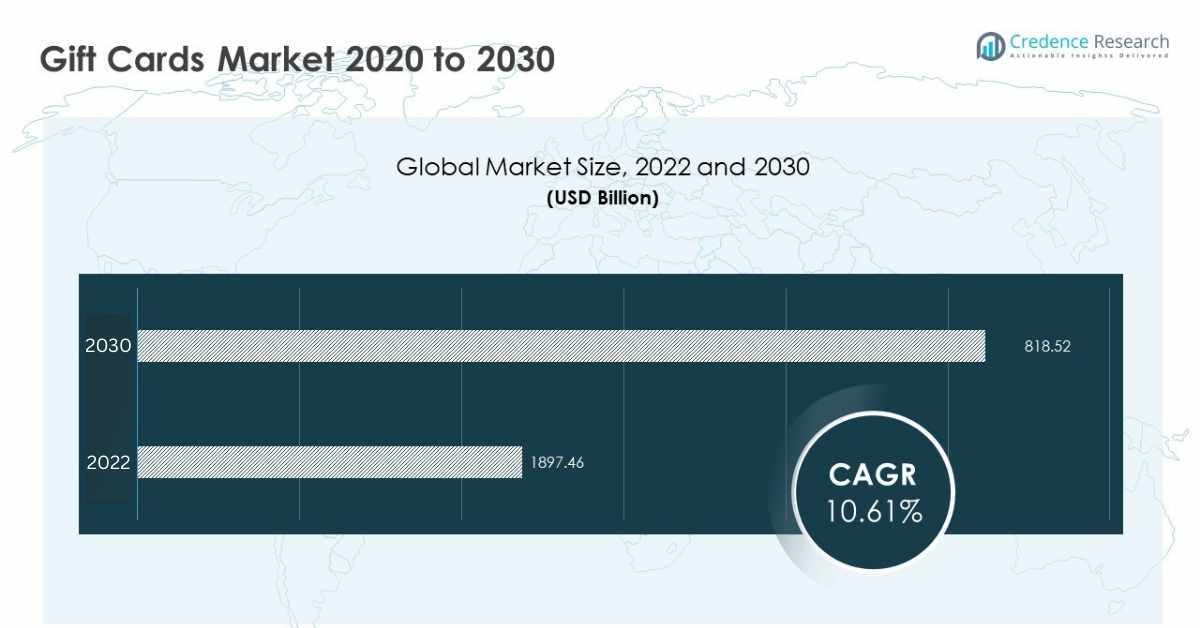

According to a new market research report published by Credence Research, “Gift Cards Market By Material Merchant Type (Restaurants, Department Stores, Grocery Stores, Supermarkets/Hypermarkets, Discount Stores, Coffee Shops, Entertainments, Salons/Spa, Book Stores, Home Décor Stores, Gas Stations, Visa/Master Card/American Express Gift Cards, Others) By Merchant Type (Universal Accepted Open Loop, Restaurant Closed Loop, Retail Closed Loop, Miscellaneous Closed Loop, E-Gifting) By End User – Growth, Future Prospects and Competitive Analysis, 2022 – 2030”, the global gift cards market was valued at USD 818.52 billion in 2022 and is projected to reach USD 1897.46 billion by 2030, growing at a CAGR of 10.46% during the forecast period.

Gift cards have become a central element of modern consumer spending, bridging convenience, personalization, and digital innovation. They serve as a versatile gifting solution, widely adopted for personal, festive, and corporate purposes. The global gift cards market continues to demonstrate strong momentum, propelled by the growing adoption of digital channels, proliferation of e-commerce, and the widespread integration of mobile payment technologies.

Browse market data Figures spread through 220 + Pages and an in-depth TOC on “Gift Cards Market”

Convenience for Gift Givers

A major factor driving the global gift cards market is the unparalleled convenience these products offer. Gift cards eliminate the uncertainty and time associated with selecting a personalized present, offering a simple yet thoughtful alternative. This advantage is particularly significant for individuals purchasing gifts for recipients with diverse or unknown preferences. By choosing gift cards, givers ensure recipients retain flexibility to purchase items they truly desire or require.

Statistical evidence highlights this trend. During the COVID-19 pandemic, open-loop gift card sales surged by 31.5%, while 46% of U.S. consumers purchased a gift card via social media platforms in 2020. Millennials remain one of the largest consumer groups, representing 37% of all gift card buyers, while December alone accounted for nearly half (48.28%) of total digital gift card sales in 2020. These figures underscore the growing reliance on gift cards as a universal, stress-free gifting method.

This driver is reinforced by the expansion of corporate gifting practices, where businesses increasingly adopt gift cards as recognition tools for employee rewards, client appreciation, and promotional campaigns. The widespread acceptance of gift cards across retail categories such as dining, entertainment, groceries, and online shopping further accelerates their adoption globally.

Rise of Digital and Mobile Wallets

The most prominent trend shaping the global gift cards market is the rapid transition toward digital platforms and integration with mobile wallets. Consumers increasingly favor gift cards that can be stored and redeemed electronically, aligning with the broader shift toward cashless and contactless payment ecosystems. Mobile wallets such as Apple Pay and Google Pay now allow users to store multiple gift cards, enhancing convenience, security, and accessibility.

Additionally, digital gift card marketplaces are gaining traction by consolidating offerings from diverse retailers into centralized online platforms. This not only simplifies comparison and purchase decisions but also drives greater transparency and efficiency for consumers. E-gift cards now account for nearly half (48%) of total gift card spending, surpassing physical alternatives and confirming the accelerating digital transition.

This shift is particularly attractive for tech-savvy consumer segments and younger demographics who prioritize immediacy and personalization in their gifting practices. Retailers benefit by capturing consumer data through digital transactions, enabling more targeted marketing and customer engagement strategies. As digital ecosystems expand, the synergy between gift cards and mobile wallets will remain a dominant growth catalyst.

Security Vulnerabilities and Fraud Risks

Despite robust growth, the gift cards market faces persistent challenges related to fraud and security vulnerabilities. The increasing prevalence of cyberattacks targeting digital transactions has amplified concerns around consumer trust and market stability. Gift card fraud schemes have evolved to include automated bot attacks, balance hijacking, and phishing campaigns.

For instance, security firm Distil Networks uncovered GiftGhostBot, a sophisticated bot that targeted over 1,000 websites with the specific aim of depleting gift card balances. This incident illustrates the susceptibility of the sector to fraudulent activities and highlights the need for enhanced cybersecurity measures.

Such threats not only undermine consumer confidence but also impose financial and reputational risks on retailers and issuers. Addressing these challenges requires continuous investment in fraud detection, transaction monitoring, tokenization technologies, and consumer awareness initiatives. Until these risks are comprehensively mitigated, security concerns will remain a notable impediment to the market’s otherwise strong growth trajectory.

Market Segmentation Analysis

By Material Merchant Type

- Restaurants

- Department Stores

- Grocery Stores

- Supermarkets/Hypermarkets

- Discount Stores

- Coffee Shops

- Entertainments

- Salons/Spa

- Book Stores

- Home Décor Stores

- Gas Stations

- Visa/Master Card/American Express Gift Cards

- Others

By Merchant Type

- Universal Accepted Open Loop

- Restaurant Closed Loop

- Retail Closed Loop

- Miscellaneous Closed Loop

- E-Gifting

By End User

- Business

- Individuals

By Price Range

- High (Above 400 US$)

- Medium (200–400 US$)

- Low (0–200 US$)

Major Key Players:

- The Up Group

- Best Buy Company, Inc.

- com, Inc.

- Starbucks Corporation

- Walmart Stores

- National Gift Card Corporation

- Edge Loyalty Systems Pty. Ltd.

- Target Corporation

- InComm

- QwickSilver Solutions

- Gyft

- Blackhawk Network Holdings, Inc.

- Edenred Group

North America continues to dominate the global gift cards market, accounting for over 45% of total share in 2022. The region’s mature market dynamics, strong consumer adoption, and advanced digital infrastructure are central to its leadership. Gift cards are deeply embedded in U.S. consumer culture, particularly during seasonal peaks such as Christmas, when demand experiences significant surges.

Additionally, the region demonstrates strong demand for gift cards across occasions including birthdays, graduations, baby showers, Mother’s Day, and corporate recognition events. Leading retailers and digital platforms such as Amazon, iTunes, Walmart, and Giant Eagle reinforce North America’s position as the global hub for gift card innovation and adoption.

Other regions, including Europe and Asia Pacific, are witnessing rising adoption, driven by growing digital payment ecosystems, increasing smartphone penetration, and shifting consumer lifestyles. Emerging markets in Asia Pacific, particularly China and India, are expected to experience rapid growth due to expanding e-commerce and mobile wallet usage, making the region a key growth frontier.

About Us:

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 2000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives.

Contact Us

Credence Research Inc.

North America – +1 304 308 1216

Australia – +61 4192 46279

Asia Pacific – +81 5050 50 9250

+64 22 017 0275

India – +91 6232 49 3207

sales@credenceresearch.com

www.credenceresearch.com