Health Awareness, Fitness Habits, and Supply Concerns Fuel Growth, While Packaging Waste and Competition Present Key Hurdles

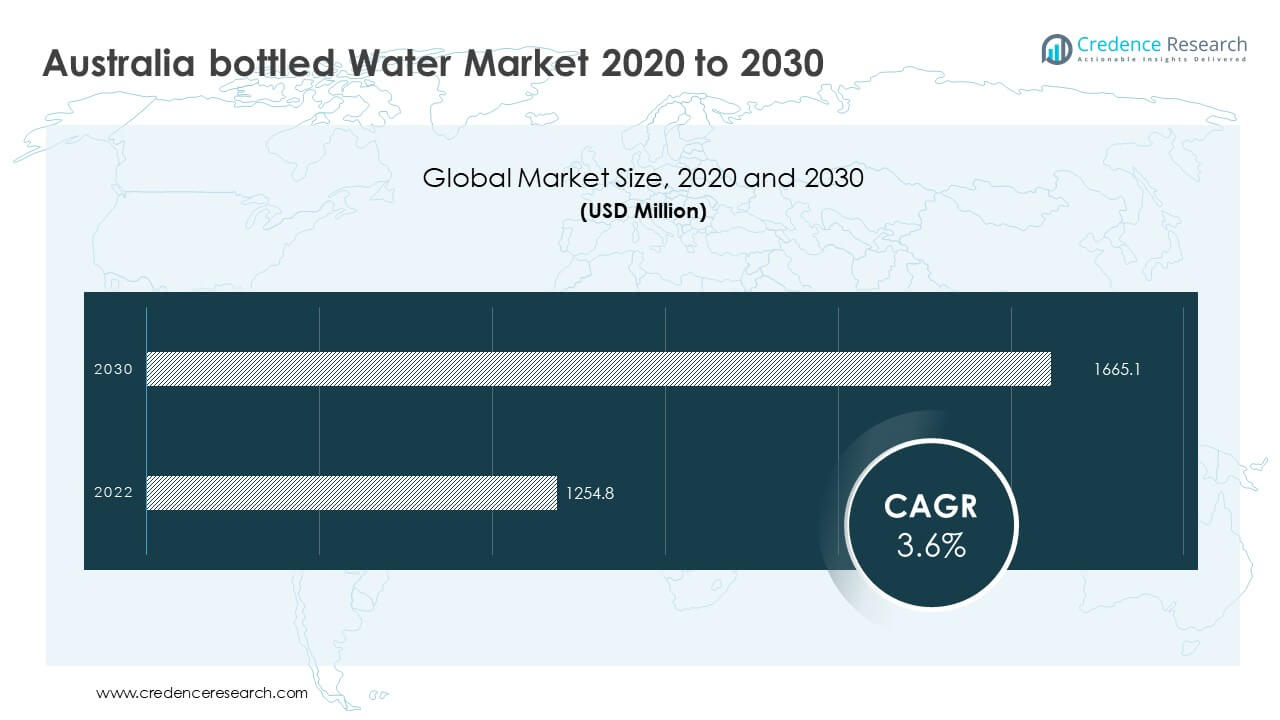

According to a new market analysis by Credence Research, titled “Australia Bottled Water Market By Water Source (Natural Mineral Water, Spring Water, Purified Water, Artesian Water, Glacier Water) By Packaging Type (PET (Polyethylene Terephthalate) Bottles, Glass Bottles, Cartons and Pouches, Cans) By Product Varieties (Still Water, Carbonated Water, Flavored Water, Functional Water, Vitamin-Enhanced Water, Alkaline Water, Electrolyte Water) By Pack Sizes (Individual-Serve Bottles, Multi-Serve Bottles, Bulk Packaging) By Distribution Channels (Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Vending Machines, Wholesalers and Distributors) By End Users (Households, Foodservice and Hospitality, Offices and Corporate, Healthcare Facilities, Outdoor and On-the-Go, Institutional Buyers) – Growth, Future Prospects & Competitive Analysis, 2022 – 2030”, the Australia bottled water market was valued at USD 1254.8 million in 2022. The market is projected to grow at a CAGR of 3.6% during the forecast period, reaching USD 1665.1 million by 2030.

Market Overview

Australia’s bottled water sector has seen stable year-over-year growth due to shifting consumer health preferences, demand for convenience, and occasional disruptions in municipal water quality. The market continues to attract investment and product development, supported by rising per capita consumption and evolving lifestyle habits.

Efforts by government agencies and healthcare providers to promote low-sugar alternatives have helped strengthen bottled water’s position across commercial, institutional, and household use. Demand remains steady despite economic pressures, due to the perceived safety, purity, and taste advantages bottled water provides.

The growing Australian population, supported by net migration, contributes to expanding consumption occasions across retail, foodservice, and on-the-go segments. Bottled water remains an accessible and scalable product class in both urban and regional markets.

Browse market data figures spread through 220+ pages and an in-depth TOC on “ Australia bottled Water Market“

Health Priorities and Sugar Reduction

Consumer preference for healthy drinks is a major factor in the market’s continued expansion. Several Australian states have restricted or eliminated sugary drinks from hospitals and other public institutions. These changes highlight bottled water as a healthier and more socially responsible choice.

Consumers increasingly avoid high-calorie beverages, seeking hydration options without added sugars or artificial ingredients. Bottled water meets these needs while aligning with public health messaging and wellness campaigns. As awareness grows around diabetes, obesity, and dental health, bottled water is positioned as a safe and calorie-free option suitable for all age groups.

Retailers and beverage companies have adapted by expanding their bottled water offerings. Flavored, vitamin-enhanced, and functional waters have been developed to maintain interest among health-conscious consumers without reverting to high-sugar alternatives.

Hydration Tied to Fitness and Active Lifestyles

Physical activity rates in Australia remain high, with growing participation in structured and recreational sports. National surveys show frequent involvement in swimming, running, walking, and gym use. These habits have increased the demand for portable, reliable hydration options.

Bottled water supports immediate access to hydration during and after physical activity. Its portability and resealable packaging make it suitable for gym bags, events, and outdoor use. Fitness-focused branding also helps bottled water appeal to performance-minded consumers.

The link between hydration and exercise has expanded bottled water’s visibility in sports marketing and wellness media. This trend continues to influence purchasing decisions across age and income groups, helping sustain volume growth across both still and enhanced water formats.

Environmental Impact and Rising Packaging Expectations

Plastic packaging presents a serious challenge to long-term growth. Consumer concerns over plastic waste and landfill contributions have pushed the industry to find more sustainable alternatives. Government regulations are tightening, with bans on single-use plastics increasing in frequency.

Brands must now navigate rising operational costs to meet recycling targets, source recyclable materials, and shift to reusable or biodegradable packaging formats. Failure to address sustainability concerns risks reputational damage and decreased market share among environmentally aware consumers.

Intense competition among global and domestic brands places added pressure on companies to differentiate through packaging, sourcing, or innovation. Additionally, variations in natural water availability affect sourcing for spring and mineral water brands. These supply risks require contingency planning, especially during drought or contamination events.

Maintaining consistent quality standards and complying with national regulations also remains critical. Any lapse can impact consumer trust and long-term brand equity.

Market Segmentation

By Water Source

- Natural Mineral Water

- Spring Water

- Purified Water

- Artesian Water

- Glacier Water

By Packaging Type

- PET (Polyethylene Terephthalate) Bottles

- Glass Bottles

- Cartons and Pouches

- Cans

By Product Varieties

- Still Water

- Carbonated Water

- Flavored Water

- Functional Water

- Vitamin-Enhanced Water

- Alkaline Water

- Electrolyte Water

By Pack Sizes

- Individual-Serve Bottles

- Multi-Serve Bottles

- Bulk Packaging

By Distribution Channels

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Vending Machines

- Wholesalers and Distributors

By End Users

- Households

- Foodservice and Hospitality

- Offices and Corporate

- Healthcare Facilities

- Outdoor and On-the-Go

- Institutional Buyers

Competitive Landscape

The Australia bottled water market remains highly competitive, with multinational corporations and regional producers operating in parallel. Brand recognition, pricing, distribution coverage, and sustainability credentials all influence market performance.

Key Players:

- Balance Water Company

- Coca-Cola Company

- Natural Waters of Viti Ltd

- Antipodes Water

- JUST Water

- Metro Beverage Co.

- VOSS Water

- Santa Vittoria Italian Mineral Water

- Beloka Water

- Nestlé Waters

- Others

Major brands offer wide product ranges across source types and packaging styles. Premium positioning, functional attributes, and regional sourcing differentiate higher-priced offerings, while value brands focus on accessibility and volume sales. Sustainability strategies vary by company, with ongoing investment in recyclable packaging, carbon reduction, and water stewardship initiatives.

Private label and budget-friendly bottled water brands are expanding in supermarkets and online platforms, creating new competition for established names. Successful players balance brand equity with cost-efficiency and supply chain resilience.

Future Outlook

The Australia bottled water market is expected to maintain steady growth driven by long-term health trends, population increases, and broad lifestyle alignment. Environmental compliance and sustainable innovation will play an increasingly central role in shaping market dynamics and consumer acceptance.

Investment in renewable packaging, diversified sourcing, and retail expansion will define leadership positions in the years ahead. Digital commerce and subscription models may also grow as delivery infrastructure and consumer preferences evolve.

Regulatory developments in plastic use, water rights, and labeling will influence operational strategy. Companies able to meet new standards while maintaining product quality and affordability will be best positioned for sustained success.

About Us:

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 2000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives.

Contact Us

Credence Research Inc.

North America – +1 304 308 1216

Australia – +61 4192 46279

Asia Pacific – +81 5050 50 9250

+64 22 017 0275

India – +91 6232 49 3207

sales@credenceresearch.com

www.credenceresearch.com