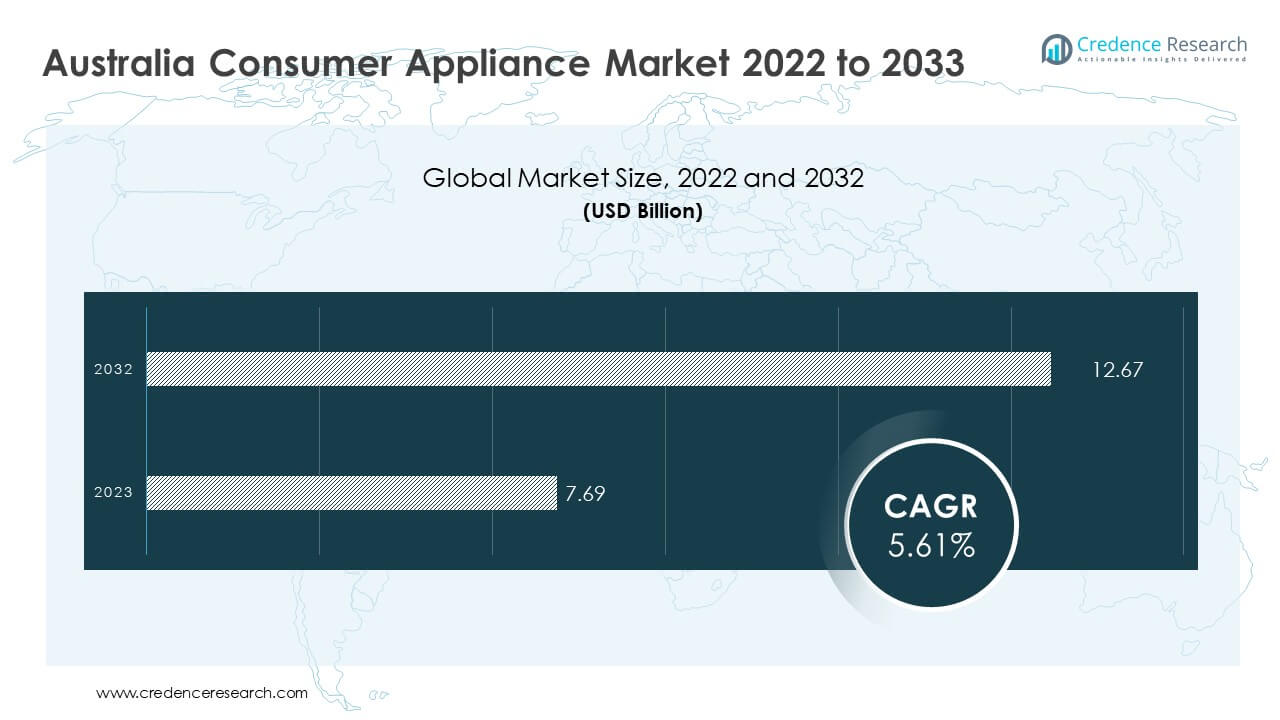

According to a Credence Research report titled “Australia Consumer Appliance Market By Product Type (Kitchen Appliances, Small Appliances, Washing Machines, Air Purifiers, Water Heaters, Water Purifiers, Cloth Dryers/Tumblers, Air Conditioners, Others); By End Use (Domestic, Professional, Hotels, Salon & Grooming Parlors, Cafeteria & Restaurants, Offices & Institutes, Others); By Sales Channel (Offline, Organized Retailer, Unorganized, Online, Company Direct Sales, Independent Vendor/E-Commerce) – Growth, Share, Opportunities & Competitive Analysis, 2024 – 2032“, the market was valued at USD 7.69 billion in 2023 and is expected to reach USD 12.67 billion by 2032, growing at a CAGR of 5.61% during the forecast period. Government incentives for energy-efficient appliances and rising interest in smart technologies are driving consistent demand across product categories.

Government Efficiency Programs Fuel Appliance Replacements

Federal and state-level energy policies are pushing Australian households to adopt energy-efficient appliances. Regulatory measures such as the Minimum Energy Performance Standards (MEPS), mandatory Energy Rating labels, and the Water Efficiency Labelling and Standards (WELS) program are key influences on consumer purchasing decisions. These policies help ensure minimum efficiency benchmarks for appliances across the country.

State governments provide additional support through rebates. Programs offer financial incentives for replacing outdated systems with efficient alternatives, including heat pumps, water heaters, and reverse-cycle air conditioners. These rebates directly reduce upfront costs, making compliant appliances more accessible to mid- and lower-income households.

Power bill reduction is a strong incentive for households, especially as energy prices continue to rise in several regions. For instance, residents in New South Wales and Victoria are actively replacing older appliances to benefit from lower energy use. Sustainability targets are another driver, as both individual consumers and businesses aim to lower environmental footprints. The result is an accelerated replacement cycle and rising demand for efficient appliances across all categories.

Retailers are adapting by stocking high-efficiency models and bundling rebate information at the point of sale. Manufacturers are aligning product portfolios with regulatory requirements and improving performance benchmarks to stay competitive under Australia’s growing energy compliance landscape.

Browse market data figures spread through 220+ pages and an in-depth TOC on “Australia Consumer Appliance Market“

Smart and Connected Appliances See Rapid Uptake

Australia’s appliance sector is shifting toward smart technologies. Consumers are increasingly purchasing devices that integrate with mobile apps, home assistants, and other smart systems. Smart refrigerators, washing machines, ovens, and HVAC systems are leading this transition.

Data from recent market surveys show a doubling in sales of smart appliances over the past 12 months. Smart refrigerators and washing machines are the most purchased products in this category. Consumers value features such as remote control, cycle customization, and real-time monitoring.

Government reports indicate that households with at least one smart appliance have grown significantly year over year. A higher percentage of households in urban centers now integrate smart appliances as part of broader smart home ecosystems. Mobile connectivity, AI-based usage optimization, and voice assistant integration are among the most desired features.

Major appliance manufacturers are responding by expanding AI-enabled product lines. New products now offer food recognition, automatic cycle selection, and energy usage insights. For example, one leading brand recently launched a smart oven that detects food type and applies optimal cooking settings without user input. These advances simplify user interaction while improving energy efficiency.

This trend is expected to continue as broadband access improves and younger consumers favor more technologically advanced solutions. Smart appliances are also being promoted as future-proof investments. As sustainability and digital control become household priorities, the market will continue to shift toward connected devices with value-added features.

Cost Barriers and Connectivity Gaps Slow Rural Adoption

While demand for smart and efficient appliances is strong in cities, cost and connectivity issues limit growth in rural regions. High upfront prices for premium models restrict adoption among households with limited disposable income. Price-sensitive consumers often opt for non-smart, standard models.

Many rural areas lack consistent broadband and Wi-Fi infrastructure, which restricts full use of smart features. Remote diagnostics, voice integration, and app-based control depend on stable connections. Without reliable internet access, these features become unusable. Consumers in affected regions may not see enough value in paying higher prices for features they cannot use.

Retail distribution also varies across geographies. Regional areas are served primarily by unorganized retailers, which limits access to newer, more advanced models. Online sales are growing but still face challenges such as delayed delivery and limited after-sales support in remote regions.

Manufacturers and policy makers need to consider pricing strategies and infrastructure upgrades. Entry-level smart appliances and localized customer support can help bridge the adoption gap. Expanding digital infrastructure is critical to long-term market development outside metropolitan areas. Without these changes, growth in rural segments will remain slower than in urban centers.

Market Segmentation

By Product Type

-

Kitchen Appliances

-

Small Appliances

-

Washing Machines

-

Air Purifiers

-

Water Heaters

-

Water Purifiers

-

Cloth Dryers/Tumblers

-

Air Conditioners

-

Others

By End Use

-

Domestic

-

Professional

-

Hotels

-

Salon & Grooming Parlors

-

Cafeteria & Restaurants

-

Offices & Institutes

-

Others

By Sales Channel

-

Offline

-

Organized Retailer

-

Unorganized

-

-

Online

-

Company Direct Sales

-

Independent Vendor/E-Commerce

-

By Region

-

New South Wales

-

Victoria

-

Queensland

-

Western Australia

-

South Australia

-

Tasmania and Northern Territory

Regional Analysis

New South Wales

New South Wales holds the largest market share at 34%. The region’s urbanization, high income levels, and strong infrastructure support advanced consumer preferences. Sydney drives much of this demand, with dense residential development and rapid adoption of smart home products.

Consumer surveys highlight a preference for appliances with high Energy Star ratings and smart features. Products such as smart refrigerators and connected washing machines are becoming common in both new homes and renovation projects. Retail chains in the region stock a wide range of efficient and connected products, helping boost adoption rates.

Infrastructure in New South Wales enables stable internet access, which supports real-time use of connected features. Government policies promoting energy conservation have found strong local support, further reinforcing the region’s lead in appliance upgrades. Retailers and service providers benefit from strong demand, making New South Wales a primary focus for new product launches.

Key Players

-

Samsung Electronics

-

General Electric (GE) Appliances

-

Bosch Group

-

Haier Group

-

Midea Group

-

Sharp Corporation

-

LG Electronics Inc.

-

Panasonic Corporation

-

Hisense Group

-

Godrej Appliances

Manufacturers are adapting their strategies to align with consumer and regulatory demands. Energy efficiency, digital control, and localized features are key product focus areas. Brands are introducing mid-range smart models to improve affordability. AI and machine learning are being embedded in more appliances to meet growing interest in personalized automation.

Supply chains are being optimized to support online sales and fast delivery. Partnerships with energy programs and state governments are helping manufacturers position their products as rebate-eligible, making them more attractive to consumers.

About Us:

Credence Research is a viable intelligence and market research platform that provides quantitative B2B research to more than 2000 clients worldwide and is built on the Give principle. The company is a market research and consulting firm serving governments, non-legislative associations, non-profit organizations, and various organizations worldwide. We help our clients improve their execution in a lasting way and understand their most imperative objectives.

Contact Us

Credence Research Inc.

North America – +1 304 308 1216

Australia – +61 4192 46279

Asia Pacific – +81 5050 50 9250

+64 22 017 0275

India – +91 6232 49 3207

sales@credenceresearch.com

www.credenceresearch.com