| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| A2 Ice Cream Market Size 2024 |

USD 262.51 million |

| A2 Ice Cream Market, CAGR |

7.45% |

| A2 Ice Cream Market Size 2032 |

USD 485.75 million |

Market Overview:

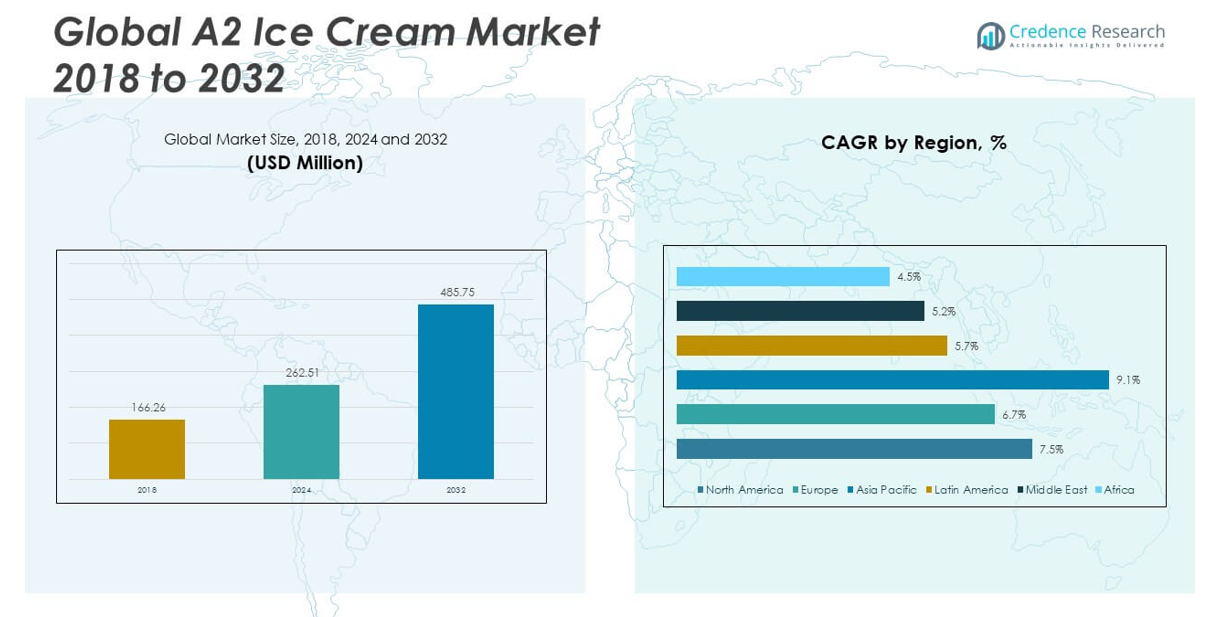

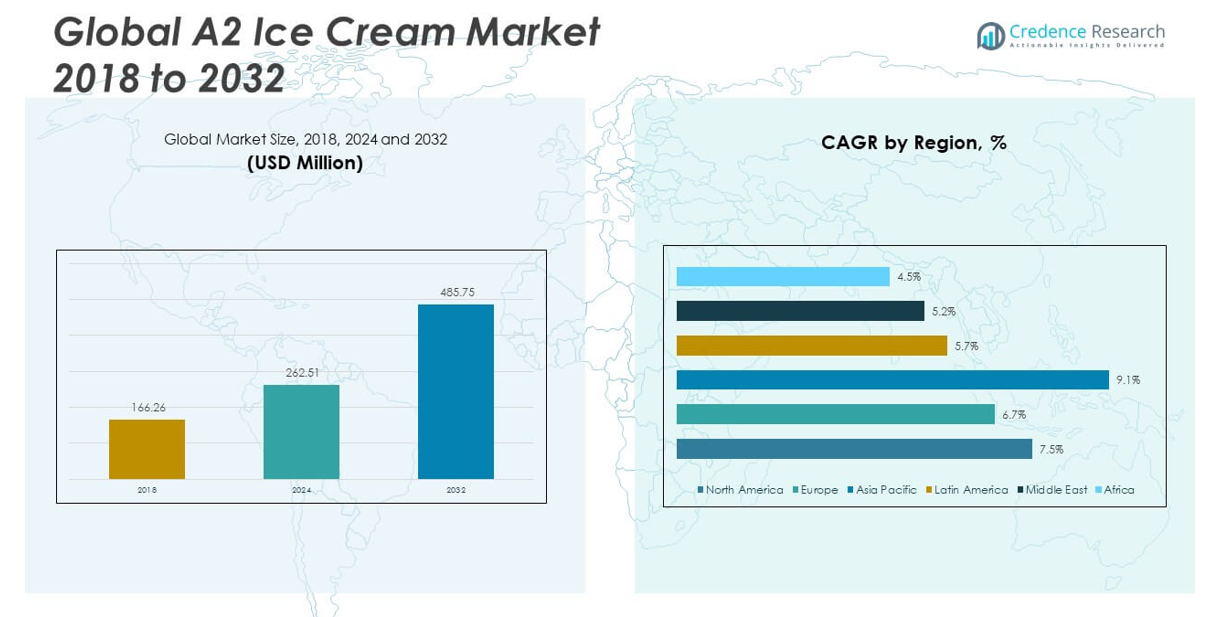

The Global A2 Ice Cream Market size was valued at USD 166.26 million in 2018 to USD 262.51 million in 2024 and is anticipated to reach USD 485.75 million by 2032, at a CAGR of 7.45% during the forecast period.

Several key factors are propelling the growth of the A2 ice cream market. A significant driver is the rising health consciousness among consumers, leading to a preference for products that are perceived as healthier and easier to digest. A2 ice cream, made from milk containing only the A2 beta-casein protein, is marketed as a suitable alternative for individuals who experience discomfort with A1 protein found in regular dairy products. Additionally, the increasing prevalence of lactose intolerance is steering consumers toward A2 dairy products, as they are believed to be more tolerable. The demand for premium and artisanal ice cream offerings is also on the rise, with consumers willing to pay a premium for high-quality, innovative flavors and natural ingredients. Furthermore, advancements in distribution channels, including the growth of online retail platforms, have enhanced accessibility to A2 ice cream products, contributing to market expansion.

Regionally, the A2 ice cream market exhibits varying growth patterns influenced by local consumer preferences, economic conditions, and awareness levels regarding A2 dairy products. North America leads the market. This growth is attributed to high consumer awareness of health benefits associated with A2 milk and a well-established retail infrastructure. Europe follows, with countries like Germany and the UK showing increasing adoption of A2 dairy products, driven by stringent health regulations and a consumer base that values organic and natural productss. The Asia-Pacific region is anticipated to exhibit the highest growth potential, owing to rising disposable incomes, urbanization, and a growing middle class seeking premium, health-oriented dairy options. Countries such as China and India are emerging as key markets for A2 ice cream, with expanding awareness and demand for lactose-friendly alternatives. While regions like South America and the Middle East & Africa currently represent smaller market shares, they present emerging opportunities for market penetration as consumer awareness and demand for health-conscious products increase.

Market Insights:

- The Global A2 Ice Cream Market was valued at USD 166.26 million in 2018 and is projected to reach USD 485.75 million by 2032, growing at a CAGR of 7.45%.

- Rising health consciousness is a major driver, with consumers preferring A2 ice cream as a healthier, more digestible alternative to regular dairy products.

- Lactose intolerance is another key factor fueling growth, as A2 milk offers a solution to those who experience discomfort from lactose, making it more accessible for a wider audience.

- The market is witnessing a shift towards premium and artisanal ice cream, with consumers willing to pay more for high-quality, innovative flavors and natural ingredients.

- E-commerce growth is expanding the reach of A2 ice cream, making it more accessible to health-conscious consumers globally, especially in emerging markets.

- North America leads the market, driven by high consumer awareness and well-established retail infrastructure, with Europe and Asia-Pacific following due to increasing demand for health-focused dairy alternatives.

- Despite growth opportunities, the market faces challenges such as high production costs and limited consumer awareness in certain regions, which can hinder adoption and accessibility.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Health Consciousness and Demand for Digestible Dairy Products

The global A2 Ice Cream Market is witnessing a surge in demand driven by growing health consciousness among consumers. With increasing awareness of the negative effects of A1 protein found in traditional dairy products, more individuals are seeking alternatives that are easier on the digestive system. A2 milk, containing only the A2 beta-casein protein, is considered gentler on the stomach, especially for people who experience discomfort or digestive issues after consuming regular dairy. This shift in consumer preferences is creating an opportunity for A2 ice cream, as people are more inclined to choose dairy products they believe to be healthier. The increasing focus on well-being and better lifestyle choices is shaping the demand for products that offer both taste and digestibility.

- For instance, the a2 Milk Company employs genetic testing to ensure that its milk contains only the A2 beta-casein protein. Cows with the A2A2 genotype produce milk exclusively containing A2 beta-casein.

Lactose Intolerance and A2 Milk’s Role in Offering a Solution

Lactose intolerance affects a significant portion of the global population, especially in regions like Asia-Pacific and parts of Europe. The Global A2 Ice Cream Market benefits from this rising health concern, as A2 milk offers a solution to those who have difficulty digesting regular milk. While traditional dairy products contain lactose, A2 milk is naturally free of the problematic proteins that lead to discomfort. Consumers seeking lactose-free or easily digestible ice cream are turning to A2-based products for a smoother experience. The increasing number of individuals with lactose intolerance, coupled with growing awareness of A2 milk’s potential benefits, is providing a solid foundation for the market’s growth.

- For example, Alec’s Ice Creamsources its A2 milk from single-source family farms and promotes its ice cream as a smoother, more digestible alternative to traditional dairy products. Their messaging targets lactose-intolerant consumers, emphasizing the absence of problematic proteins found in conventional milk.

Shift Toward Premium and Artisanal Ice Cream Options

Consumers are increasingly drawn to premium and artisanal food products, which offer unique flavors, higher quality ingredients, and a more personalized experience. The global preference for healthier, high-quality ice cream is contributing to the expansion of the A2 Ice Cream Market. Premium positioning aligns well with the health-driven trend, as consumers are willing to pay more for products perceived as healthier and more natural. The demand for artisanal products has encouraged brands to experiment with flavor innovation while maintaining health-conscious ingredients. This shift in consumer behavior provides ample opportunities for A2 ice cream brands to position themselves in the premium segment, catering to a niche but growing market of discerning consumers.

Growth of E-commerce and Distribution Channels Expanding Reach

The rise of e-commerce and online grocery shopping has significantly impacted the Global A2 Ice Cream Market. Consumers now have greater access to a wide variety of ice cream brands and products through digital platforms, making it easier to discover and purchase A2-based products. The convenience of home delivery and the growing trend of online shopping for food products are expanding the reach of A2 ice cream brands. With the ability to reach a global audience and bypass traditional retail limitations, brands can better meet the demands of health-conscious consumers. The increased availability of A2 ice cream through online channels is an important growth driver, particularly in regions with emerging interest in A2 dairy products.

Market Trends:

Innovation in Flavors and Product Variants

The Global A2 Ice Cream Market is experiencing a trend towards product diversification, with brands increasingly experimenting with unique and innovative flavors. Companies are developing a wide range of flavor profiles to cater to the growing demand for variety in premium ice cream products. These new flavors go beyond traditional options, introducing exotic and regionally inspired ingredients to attract adventurous consumers. Alongside flavor innovation, there is a growing trend toward creating lactose-free or dairy-free A2 ice cream alternatives, appealing to a broader demographic, including vegan and plant-based diet followers. This diversification enables A2 ice cream brands to appeal to a variety of tastes and dietary preferences, positioning them to capture larger market shares.

- For instance, Alec’s Ice Cream, recognized as the world’s first ice cream made with gut-friendly A2/A2 dairy and regenerative organic ingredients, introduced nine new premium flavors in 2024, expanding their lineup to 14 total. These flavors include Meyer Lemon Cookie, Triple Chocolate Blackout Cookie, Palm Springs Banana Chocolate Date Shake, and Maple Cardamom Candied Pecan.

Adoption of Sustainable and Eco-friendly Packaging

Sustainability is becoming an essential consideration for the Global A2 Ice Cream Market as environmental concerns grow among consumers. Brands are increasingly adopting eco-friendly packaging solutions, such as biodegradable containers and recyclable materials, to align with consumer expectations for more sustainable products. This trend is a direct response to the rising demand for environmentally responsible brands, particularly among millennials and Gen Z, who prioritize sustainability in their purchasing decisions. The shift towards sustainable packaging is expected to drive the A2 ice cream market’s growth, as consumers actively seek products that contribute to environmental conservation without compromising on quality or taste.

Health-Conscious Consumer Demand for Clean Label Products

A notable trend in the Global A2 Ice Cream Market is the growing preference for clean label products, which contain simple, transparent ingredients without artificial additives or preservatives. Health-conscious consumers are increasingly scrutinizing product labels, seeking ice cream that is free from artificial sweeteners, colors, and chemicals. This trend aligns with the rising awareness of food quality and ingredient sourcing, as consumers demand more transparency from manufacturers. A2 ice cream, being perceived as a more natural and easily digestible product, fits well into this trend. Brands focusing on clean labeling are likely to gain a competitive edge, especially as health-conscious consumers prioritize products that align with their values.

- For example, Noumi Limited emphasizes transparency, with ingredient traceability from farm to product, and leverages third-party certifications for organic and non-GMO claims.

Expansion of Distribution Networks into Emerging Markets

The Global A2 Ice Cream Market is witnessing an expansion of distribution networks into emerging markets, particularly in Asia-Pacific and Latin America. These regions represent significant growth opportunities due to their increasing middle-class populations and rising disposable incomes. As consumer preferences shift towards healthier, premium products, A2 ice cream brands are establishing a presence in these high-growth markets. This expansion is facilitated by improved retail infrastructure, both in physical stores and through online platforms. Brands are strategically entering these regions, capitalizing on the growing awareness of A2 milk’s benefits and the increasing demand for healthier dairy alternatives. This trend is expected to fuel the market’s growth, driving further regional diversification.

Market Challenges Analysis:

High Production Costs and Pricing Pressure

One of the significant challenges facing the Global A2 Ice Cream Market is the high cost of production, which directly impacts pricing strategies. A2 milk, sourced from cows that naturally produce only the A2 beta-casein protein, tends to be more expensive than regular A1 milk, making A2 ice cream costlier to manufacture. This premium price point can limit its accessibility to price-sensitive consumers, particularly in emerging markets. Companies must balance the cost of production with consumer affordability while maintaining profitability. The growing competition from other dairy and non-dairy ice cream alternatives further intensifies pricing pressure, forcing brands to find innovative ways to manage production costs without compromising quality.

Limited Consumer Awareness in Certain Regions

Another challenge for the Global A2 Ice Cream Market is the limited consumer awareness of A2 milk’s benefits in some regions. While there is increasing knowledge of A2 dairy products in developed markets, many consumers in emerging economies remain unfamiliar with the advantages of A2 milk over regular dairy. This lack of awareness can slow the adoption of A2 ice cream in these regions. Brands must invest in consumer education and marketing efforts to highlight the potential health benefits of A2 milk and its role in creating easily digestible products. Without significant awareness campaigns, the market may struggle to reach its full growth potential in these untapped regions.

Market Opportunities:

Expansion into Emerging Markets

The Global A2 Ice Cream Market presents significant opportunities for expansion into emerging markets, particularly in regions like Asia-Pacific, Latin America, and Africa. These regions are experiencing rising disposable incomes, urbanization, and a growing middle class, creating a fertile environment for premium, health-focused products. Increased awareness of lactose intolerance and digestive sensitivities in these regions further supports the demand for A2 ice cream. Brands entering these markets can benefit from the growing appetite for healthier alternatives and capitalize on the relatively untapped consumer base seeking dairy products they can digest more comfortably.

Innovations in Product Offerings and Flavors

The demand for unique and customized ice cream experiences is rising, offering substantial opportunities for innovation within the Global A2 Ice Cream Market. Developing novel flavor profiles and incorporating functional ingredients such as probiotics or plant-based options could attract new consumer segments. As consumers become more health-conscious, incorporating organic, low-sugar, or functional ingredients into A2 ice cream could help capture niche markets. The ability to create diverse, high-quality product offerings will position brands as leaders in a competitive market, opening doors to increased market share and customer loyalty.

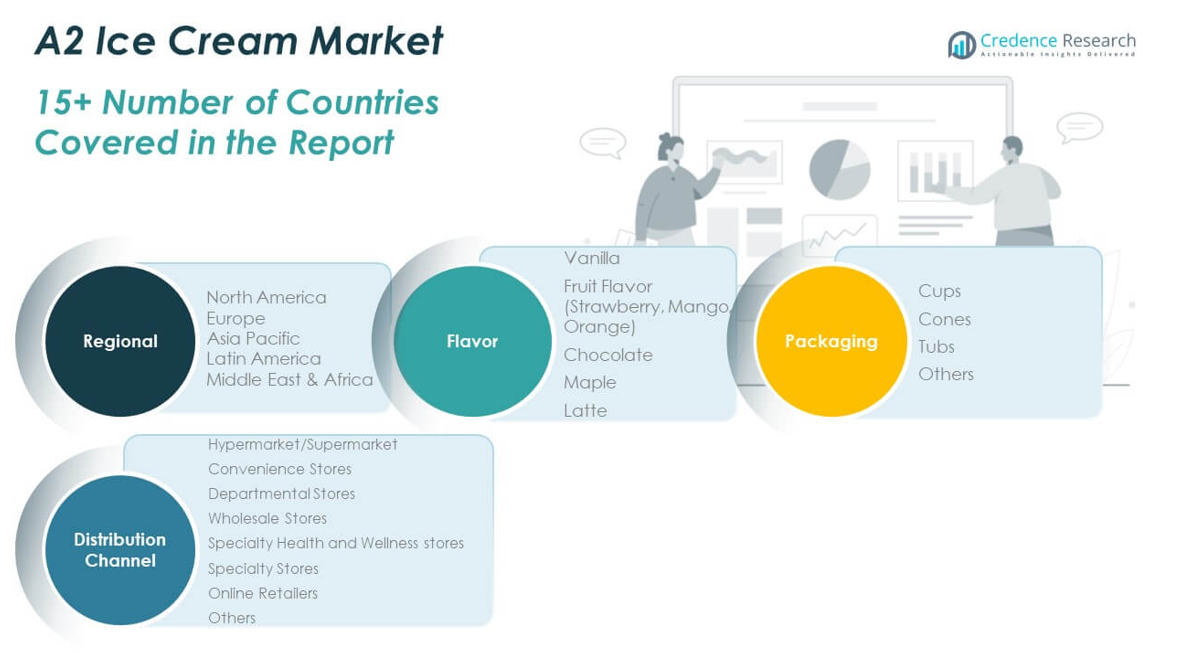

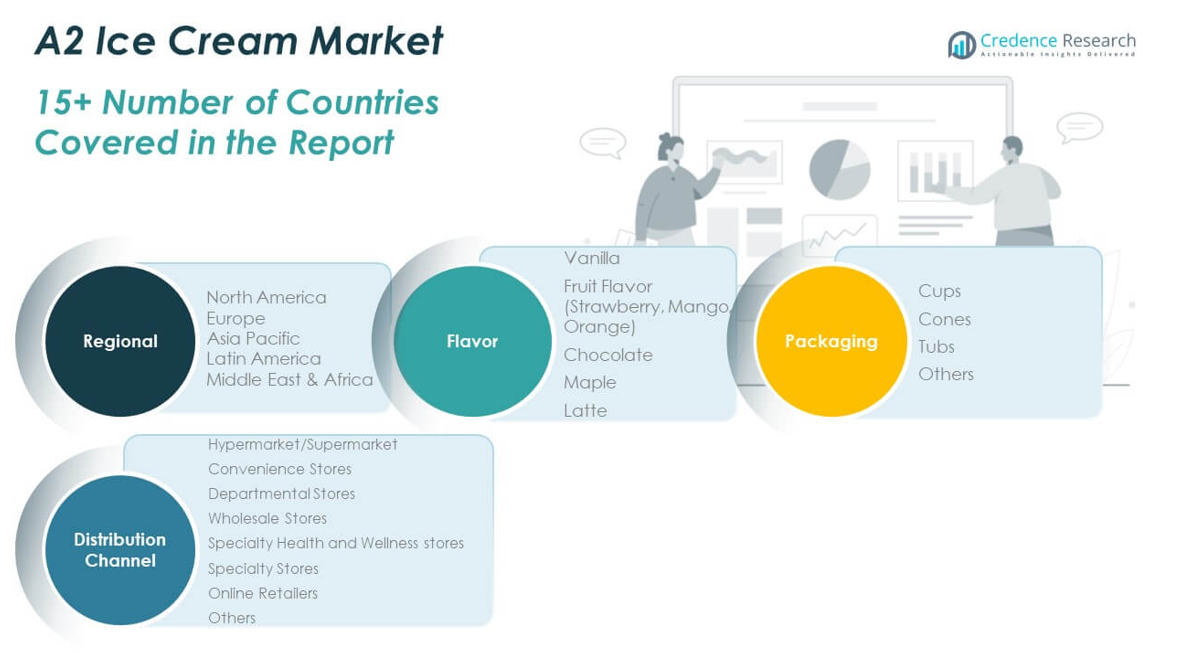

Market Segmentation Analysis:

The Global A2 Ice Cream Market is experiencing growth across various segments, driven by consumer preferences for health-conscious and premium products.

By Flavor Segment includes vanilla, fruit flavors such as strawberry, mango, and orange, chocolate, maple, and latte. Vanilla continues to be the dominant flavor, but fruit-based flavors are gaining popularity due to their perceived freshness and health benefits. Chocolate remains a staple, while maple and latte cater to niche markets seeking unique, indulgent tastes.

By Packaging Segment, cups, cones, and tubs dominate, with cups and tubs seeing higher demand due to their convenience and larger serving sizes. Cones are popular in single-serve, on-the-go consumption, particularly in regions with high street vendor presence. Other packaging options, including eco-friendly alternatives, are gaining traction as sustainability concerns rise.

- For instance, Scally’s of Clonakilty(Ireland), Utilizes custom eco-friendly ice cream tubs made from food-grade paperboard lined with PLA (bioplastic), which is compostable and biodegradable. Their packaging is printed with water-based inks, supporting both sustainability and brand visibility.

By Distribution Channel Segment is diverse, with hypermarket/supermarkets leading the market due to their wide product range and reach. Convenience stores are growing in popularity, offering quick and easy access to A2 ice cream products. Specialty health and wellness stores and specialty stores cater to the growing demand for organic, natural, and premium options. Online retailers are expanding their share, offering convenience and access to a broader selection of A2 ice cream products. Other distribution channels, such as wholesale stores, also play a role in the market’s reach. Each segment reflects consumer demand for premium, accessible, and health-focused ice cream options.

- For instance, Emmi Group(Switzerland), distributes its A2 ice cream through both specialty stores and supermarkets across Europe, catering to health-conscious and lactose-intolerant consumers.

Segmentation:

By Flavor Segment

- Vanilla

- Fruit Flavor (Strawberry, Mango, Orange)

- Chocolate

- Maple

- Latte

By Packaging Segment

By Distribution Channel Segment

- Hypermarket/Supermarket

- Convenience Stores

- Departmental Stores

- Wholesale Stores

- Specialty Health and Wellness Stores

- Specialty Stores

- Online Retailers

- Others

By Regional Segment

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America A2 Ice Cream Market

The North America A2 Ice Cream Market size was valued at USD 69.22 million in 2018, growing to USD 108.11 million in 2024, and is anticipated to reach USD 200.62 million by 2032, at a CAGR of 7.5% during the forecast period. North America holds a significant share of the Global A2 Ice Cream Market, primarily driven by the increasing consumer awareness of lactose intolerance and the demand for healthier dairy alternatives. The United States, as the largest market, plays a crucial role in the region’s growth, where premium and organic food trends continue to thrive. Retail chains, both physical and online, are rapidly expanding their A2 ice cream offerings, making it more accessible to a broader audience. The shift towards cleaner and more transparent labels, coupled with the growing preference for premium products, supports the robust expansion in the region.

Europe A2 Ice Cream Market

The Europe A2 Ice Cream Market size was valued at USD 49.64 million in 2018, growing to USD 75.69 million in 2024, and is anticipated to reach USD 132.29 million by 2032, at a CAGR of 6.7% during the forecast period. Europe remains a key market, with high consumer awareness around health and wellness. Countries like the United Kingdom, Germany, and France are witnessing increased demand for A2-based dairy products, driven by health-conscious consumers seeking easily digestible options. The region’s stringent regulations regarding food safety and labeling further drive the demand for premium and natural ingredients in ice cream. The rise of sustainable packaging and eco-friendly practices also contributes to the market’s growth, as European consumers prioritize environmentally responsible brands.

Asia Pacific A2 Ice Cream Market

The Asia Pacific A2 Ice Cream Market size was valued at USD 32.66 million in 2018, growing to USD 55.81 million in 2024, and is anticipated to reach USD 116.69 million by 2032, at a CAGR of 9.1% during the forecast period. The Asia Pacific region is poised for the highest growth in the Global A2 Ice Cream Market, driven by rising disposable incomes, urbanization, and a growing middle class. Countries such as China and India are emerging as key players, with an increasing preference for dairy alternatives due to lactose intolerance and digestive sensitivities. The market is further bolstered by the expanding availability of A2 ice cream in modern retail outlets and online platforms, catering to health-conscious consumers in the region.

Latin America A2 Ice Cream Market

The Latin America A2 Ice Cream Market size was valued at USD 7.35 million in 2018, growing to USD 11.46 million in 2024, and is anticipated to reach USD 18.60 million by 2032, at a CAGR of 5.7% during the forecast period. The Latin American market is experiencing gradual growth, supported by a rising middle-class population and an increased focus on healthy, premium food products. Brazil and Mexico represent the largest markets in the region, with consumers becoming more aware of the digestive benefits of A2 milk. Despite being a smaller segment compared to other regions, the demand for A2 ice cream is expected to grow as more consumers seek lactose-free and natural alternatives.

Middle East A2 Ice Cream Market

The Middle East A2 Ice Cream Market size was valued at USD 4.73 million in 2018, growing to USD 6.84 million in 2024, and is anticipated to reach USD 10.71 million by 2032, at a CAGR of 5.2% during the forecast period. The region’s market for A2 ice cream is gaining traction as consumers become more aware of the benefits of A2 milk and its digestibility compared to regular dairy. Countries such as the UAE and Saudi Arabia are witnessing an increase in demand for premium, health-conscious food products, including A2 ice cream. The growth is also supported by a rising expat population that is familiar with A2 products, further expanding the market potential.

Africa A2 Ice Cream Market

The Africa A2 Ice Cream Market size was valued at USD 2.65 million in 2018, growing to USD 4.62 million in 2024, and is anticipated to reach USD 6.85 million by 2032, at a CAGR of 4.5% during the forecast period. The African market is relatively smaller, but it holds potential for growth, driven by a young population and increasing urbanization. Key markets such as South Africa are seeing a gradual shift towards premium dairy alternatives, including A2 ice cream, as consumers become more health-conscious. Despite challenges related to consumer awareness and limited product availability, the rising demand for lactose-free and healthier options positions the African market for steady growth in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- The Milk Company

- Braum’s Inc.

- Alec’s Ice Cream

- GoDesi Milk

- Miller’s Bio Farm

- United Farmers Creamery

- Appleby Farms Ice Cream

- MOO-ville Creamery

- Thayumanavar Dairy Farms Pvt Ltd

- Amos Miller Organic Farm

- Highland Farms

Competitive Analysis:

The Global A2 Ice Cream Market is highly competitive, with several key players focusing on product differentiation and innovation to capture consumer attention. Leading brands include companies such as Nestlé, Danone, and Bulla Dairy, which have introduced A2 milk-based ice cream offerings to cater to the growing demand for healthier, more digestible dairy products. These companies leverage their established distribution networks and brand recognition to expand market reach. Smaller, niche brands are also entering the market, offering premium, artisanal flavors and positioning themselves as healthier alternatives. Price sensitivity remains a challenge, particularly in price-conscious regions, prompting brands to adopt strategies that balance cost with quality. Sustainability initiatives, such as eco-friendly packaging, are gaining importance as consumers prioritize environmentally responsible products. Innovation in flavor and packaging continues to drive competition, with brands seeking to differentiate themselves by offering unique, high-quality A2 ice cream options.

Recent Developments:

- In May 2025, Alec’s Ice Cream launched its innovative “Culture Cup” nationwide, introducing a single-serve, gut-friendly A2/A2 dairy ice cream featuring a crackable chocolate shell, over a billion live probiotics plus prebiotics, and less than 10g of unrefined cane sugar per serving. The product is made from grass-fed A2 dairy, contains under 160 calories per cup, and boasts 90% regenerative, third-party verified ingredients, positioning it as a clean-label, functional indulgence for health-conscious consumers.

Market Concentration & Characteristics:

The Global A2 Ice Cream Market is moderately concentrated, with a mix of established multinational corporations and emerging niche players. Major players such as Nestlé, Danone, and Bulla Dairy dominate the market, leveraging their extensive distribution channels and strong brand recognition. These companies focus on product innovation, offering a variety of A2-based ice creams to meet the growing demand for healthier and more digestible dairy alternatives. Smaller, specialized brands are carving out niches by offering premium and artisanal options that emphasize natural ingredients and sustainability. The market is characterized by increasing product diversification, with brands experimenting with unique flavors and functional ingredients. Price competition remains significant, especially in emerging markets, where affordability plays a crucial role in consumer choice. The presence of both large and small players fosters a dynamic, competitive landscape, driving continuous innovation and growth.

Report Coverage:

The research report offers an in-depth analysis based on flavor, packagingand distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global A2 Ice Cream Market will see sustained growth due to rising consumer awareness of the health benefits of A2 milk.

- Increased demand for lactose-free and easily digestible dairy products will continue to drive market expansion, especially in regions with high lactose intolerance.

- The premium segment will grow as consumers increasingly seek healthier, natural ingredients in their ice cream choices.

- Product diversification with innovative flavors and functional ingredients will become a key differentiator for brands.

- Online retail platforms will play an increasingly vital role in expanding market reach, particularly in emerging markets.

- Sustainability will be a major focus, with brands adopting eco-friendly packaging and ethical sourcing practices.

- Expansion into untapped markets, particularly in Asia-Pacific and Latin America, will open new growth opportunities.

- Competitive pressures will rise, with both large companies and small artisanal brands vying for consumer attention.

- Increased investments in marketing and consumer education will boost awareness of A2 ice cream benefits.

- Technological advancements in production will help reduce costs, making A2 ice cream more accessible to a broader audience.