Market Overview:

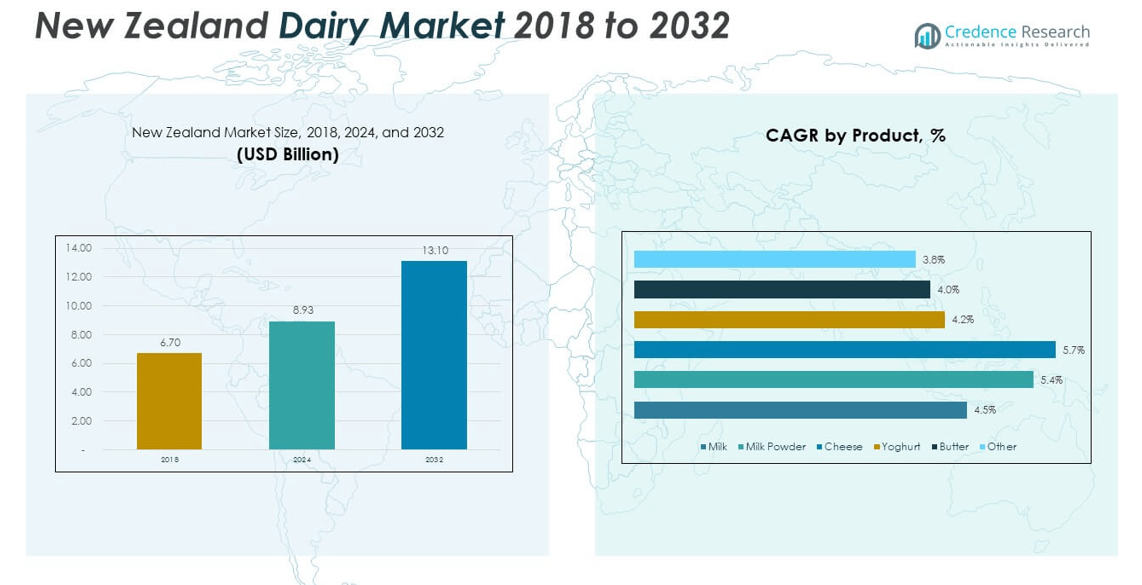

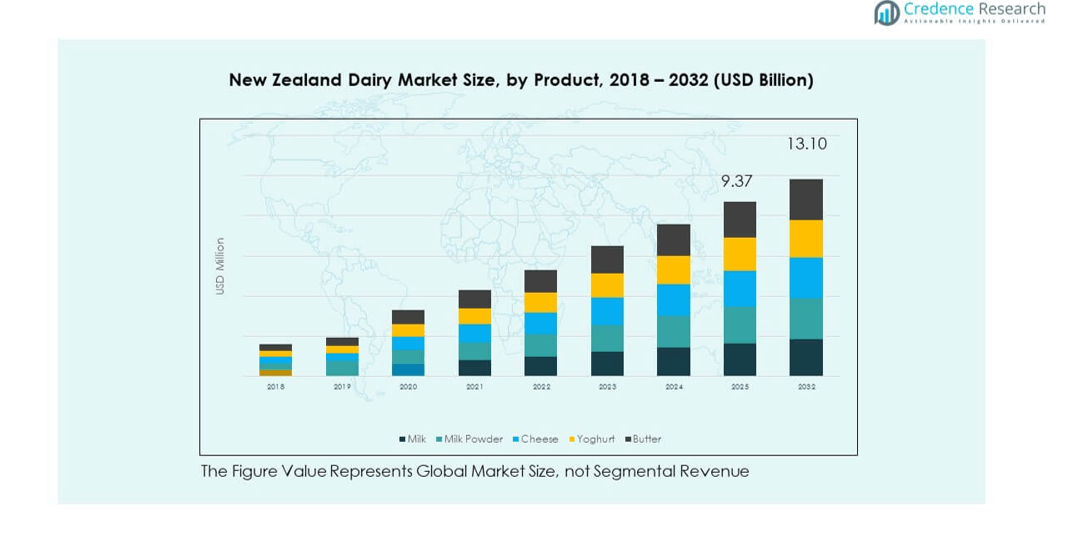

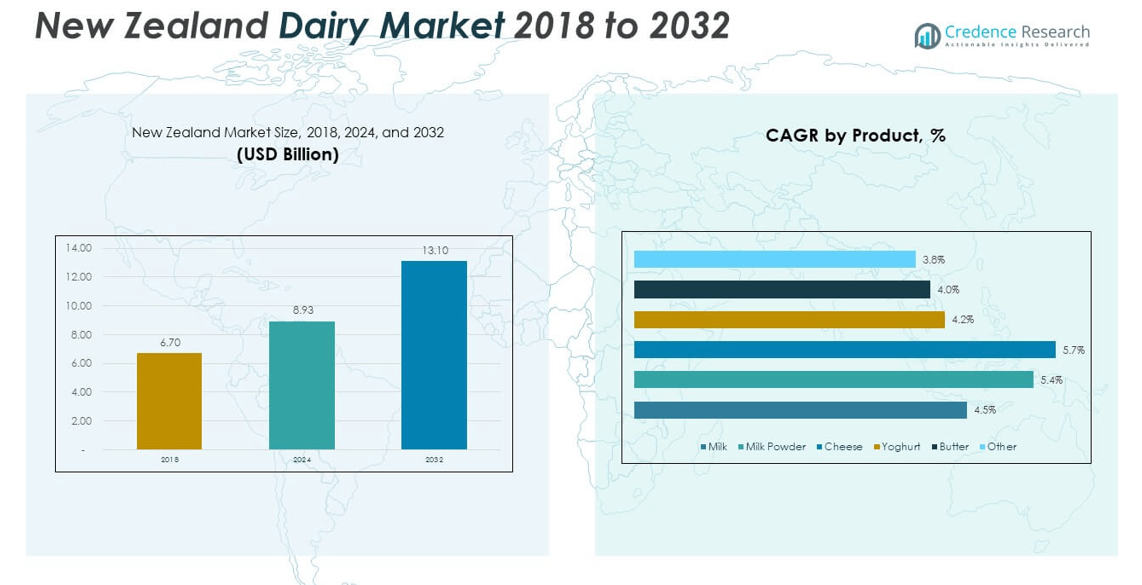

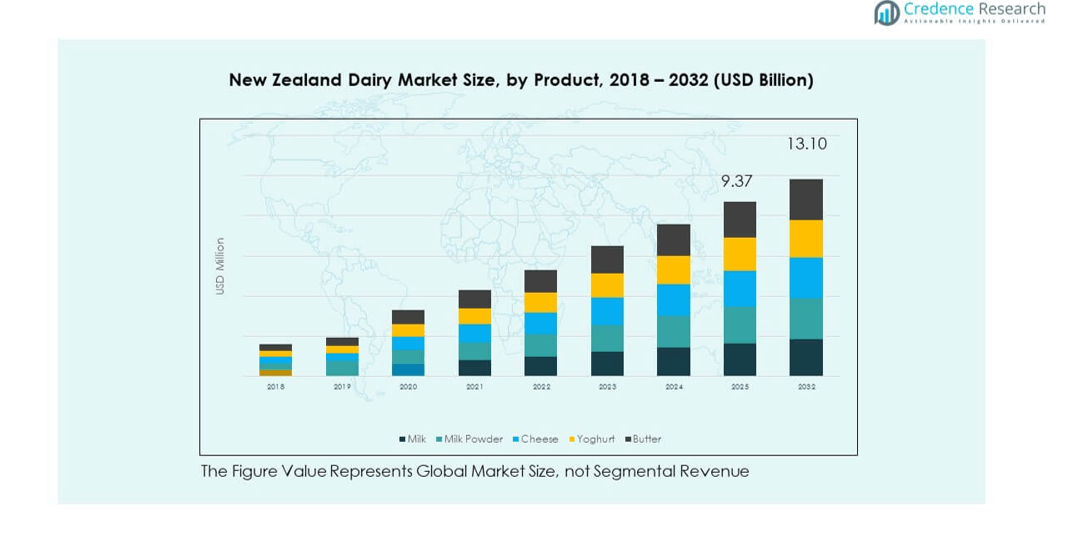

The New Zealand Dairy Market size was valued at USD 6.7 billion in 2018 to USD 8.93 billion in 2024 and is anticipated to reach USD 13.1 billion by 2032, at a CAGR of 4.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| New Zealand Dairy Market Size 2024 |

USD 8.93 billion |

| New Zealand Dairy Market, CAGR |

4.91% |

| New Zealand Dairy Market Size 2032 |

USD 13.1 billion |

The market growth is driven by strong global demand for high-quality dairy products, supported by New Zealand’s reputation as a leading exporter of milk, cheese, butter, and milk powders. Expanding consumer preference for protein-rich and nutritious foods continues to boost dairy consumption, while the industry benefits from advanced farming techniques and sustainable production practices. Strategic trade agreements and a robust supply chain infrastructure further enhance market reach, ensuring steady export flows to key destinations such as China, Southeast Asia, and the Middle East.

Regionally, the North Island dominates the New Zealand Dairy Market, contributing the largest share through its concentration of dairy farms, processing facilities, and export infrastructure. The region benefits from favorable climate and pasture conditions, making it the center of large-scale production. The South Island follows with a significant share, driven by larger farm sizes, advanced mechanization, and rising investment in sustainable practices. Smaller regions across New Zealand contribute modestly but play an important role in niche production, particularly in organic and specialty dairy categories. Together, these regions create a balanced supply base that supports both domestic demand and international trade commitments while ensuring long-term resilience of the sector.

Market Insights:

- The New Zealand Dairy Market was valued at USD 8.93 billion in 2024 and is projected to reach USD 13.1 billion by 2032, growing at a CAGR of 4.91%.

- Strong global demand for milk powder, butter, and cheese continues to position the New Zealand Dairy Market as a leading exporter in Asia and beyond.

- Advanced farming practices, including precision agriculture and mechanization, are enhancing efficiency and supporting sustainable production.

- Volatile pricing, fluctuating input costs, and international competition remain key restraints that challenge profitability.

- The North Island dominates domestic output with nearly 65% share, while the South Island contributes significantly through large-scale farms and mechanized systems.

- Rising health awareness and consumer preference for protein-rich and fortified products are fueling consistent growth across multiple dairy categories.

- Strict sustainability regulations increase costs, but they also encourage innovation in environmentally conscious farming and processing practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Strong Global Demand for High-Quality Dairy Products Boosting Market Expansion

The New Zealand Dairy Market benefits from strong international demand for milk powders, butter, and cheese, particularly from fast-growing economies. It secures a leading position in global trade through its consistent reputation for premium quality. Export growth remains supported by rising consumer interest in protein-rich diets. It gains additional momentum from shifting dietary preferences toward healthier, nutrient-dense food categories. Growing urban populations in Asia continue to strengthen import requirements. Large-scale buyers prioritize reliability of supply, which positions New Zealand favorably. Global nutritional trends underline the importance of dairy, reinforcing its competitive standing. Expanding presence in premium product categories strengthens long-term competitiveness. Ongoing demand from food processors ensures stable export opportunities.

- For example, in August 2025, Fonterra’s Eltham site in Taranaki, which supplies cheese to more than 50 export markets, added a new shift dedicated to IQF (Individually Quick Frozen) mozzarella, increasing its annual capacity by 6,000 metric tonnes enough to top over 40 million pizzas each year.

Technological Advancements in Farming Practices Enhancing Productivity and Quality

The New Zealand Dairy Market leverages modern farming methods to improve both yield and efficiency. It integrates data-driven systems to manage herd health and optimize feeding patterns. Farmers adopt precision agriculture tools that reduce wastage and enhance milk quality. Sustainable practices, including water conservation and soil health management, are becoming integral to long-term output. It incorporates environmentally conscious strategies that resonate with international buyers seeking ethically produced dairy. Increased mechanization reduces dependency on labor while maintaining consistent production. The industry’s emphasis on research and development fosters resilience and adaptability. Collaboration with agri-tech firms accelerates innovation adoption across the sector. Continued focus on technology-driven practices builds sustainable growth foundations.

- For instance, Fonterra invested $150 million in 2024 for a new cool store at its Whareroa site to support its Foodservice and Ingredients business, improving supply chain efficiency and meeting strict quality requirements for export markets. This investment directly backs its increased production and export volumes, demonstrating a commitment to technology-led operational efficiencies and quality assurance.

Trade Agreements and Market Access Supporting Export Growth

The New Zealand Dairy Market thrives on strong trade relationships established across diverse regions. It benefits from free trade agreements that reduce tariffs and ease regulatory requirements. Major export destinations, including China and Southeast Asian countries, offer high-growth potential. It leverages trusted international partnerships to secure steady revenue streams. Growing recognition of New Zealand dairy’s premium positioning enhances its brand in competitive markets. Expanded global reach strengthens the sector’s resilience to domestic fluctuations. Policymakers emphasize alignment with export strategies, which increases competitiveness. Growing diplomatic cooperation enhances trust in long-term supply commitments. Broader access to emerging economies creates opportunities for market expansion.

Rising Health Awareness and Nutritional Value Driving Local and International Consumption

The New Zealand Dairy Market capitalizes on increasing awareness of the nutritional benefits of dairy products. It caters to rising demand for calcium-rich and protein-enriched food. Consumers in developed economies value functional foods that support active lifestyles. Emerging economies demonstrate greater interest in fortified dairy categories. It adapts offerings to include lactose-free and low-fat alternatives. Growing adoption of dairy in health supplements expands its role beyond traditional consumption. Lifestyle-driven choices sustain demand across multiple age groups. Rising awareness of preventive health encourages consistent dairy intake. Expanding marketing campaigns highlight its role in everyday nutrition.

Market Trends

Premium and Value-Added Product Diversification Shaping Consumer Preferences

The New Zealand Dairy Market is witnessing a clear shift toward premium and value-added product. It sees growing interest in specialty cheeses, organic milk, and functional dairy innovations. Consumers increasingly focus on taste, health, and lifestyle compatibility. Global buyers prioritize products that carry authenticity and sustainability claims. It aligns with wellness-driven consumption patterns in developed markets. Packaging innovations enhance convenience, supporting demand in urban regions. Brands emphasize differentiation through innovation in flavors and formats. Expansion into niche categories such as lactose-free and fortified products further strengthens appeal. Rising willingness of consumers to pay higher prices secures steady margins for producers.

Expansion of Sustainable and Ethical Production Practices Influencing Global Trade

The New Zealand Dairy Market is adopting sustainability at every stage of production. It emphasizes low-carbon farming, renewable energy, and waste reduction strategies. International buyers prioritize environmentally conscious sourcing, strengthening its global appeal. It adapts practices to align with climate goals and regulatory expectations. Farmers implement animal welfare standards that reflect ethical values. Investments in green technologies create competitive advantages in premium markets. It positions sustainability as a driver of both reputation and long-term profitability. Stronger alignment with global certifications enhances credibility in sensitive markets. Continuous government support reinforces the transition toward responsible production.

Digital Transformation and Smart Farming Systems Elevating Efficiency

The New Zealand Dairy Market integrates digital tools across production and distribution chains. It utilizes data analytics to monitor milk quality and streamline supply processes. Precision systems enhance herd health monitoring and disease control. It incorporates automation in processing facilities, improving operational consistency. Real-time data ensures better forecasting of market trends. Technology adoption reduces costs while supporting productivity gains. It demonstrates how innovation secures long-term competitiveness in global markets. Cloud-based platforms improve traceability, which strengthens consumer trust. Collaboration between technology providers and farmers accelerates industry-wide adoption of digital solutions.

- For instance, Tatua Dairy invested NZD 85 million in 2024 to expand its factory, aiming to double production capacity for cream-based products such as sour cream, crème fraîche, mascarpone, and whipping cream, with completion targeted for August 2025.

Rising Global Popularity of Dairy-Based Ingredients in Processed Food and Beverages

The New Zealand Dairy Market is seeing higher demand from food and beverage manufacturers. It supplies whey proteins, caseins, and other ingredients to global processors. Growing application in infant nutrition, sports supplements, and bakery products expands market scope. It diversifies beyond traditional consumption into functional categories. Manufacturers highlight the versatility of dairy as a formulation base. Rising consumer demand for natural food ingredients reinforces its relevance. It strengthens supply contracts with international processors seeking stable sources. Expanding partnerships with multinational food brands ensures long-term demand. Continuous product innovation supports growth in both developed and emerging food sectors.

- For example, Open Country Dairy exports more than 300,000 tonnes of milk powders, proteins, and specialty cheeses each year to over 50 global markets, supplying international food, beverage, and bakery manufacturers with high-quality dairy ingredients.

Market Challenges Analysis

Volatile Global Pricing and Competitive Pressures Restraining Market Growth

The New Zealand Dairy Market faces challenges from global price volatility driven by shifting demand and supply cycles. It remains vulnerable to international competition from European and North American producers. Fluctuating input costs for feed, energy, and logistics create uncertainty. It experiences pressure to maintain profitability despite unstable market conditions. Oversupply in certain regions leads to pricing challenges across export destinations. Currency fluctuations add further complexity to revenue management. It underscores the need for resilience and risk management strategies. Strategic diversification into value-added products offers some relief but requires sustained investment. Competitive pressure demands continuous innovation to preserve market positioning.

Environmental Regulations and Sustainability Requirements Increasing Operational Costs

The New Zealand Dairy Market is confronted with strict sustainability regulations at both domestic and international levels. It requires significant investment in water management, emission control, and waste treatment. Compliance with environmental standards raises operational costs for farmers and processors. It adapts production to align with stricter climate and biodiversity targets. Public expectations around animal welfare create additional scrutiny. Rising pressure to reduce carbon footprints demands capital-intensive solutions. It highlights the balance between growth objectives and sustainable commitments. Long-term competitiveness depends on integrating advanced green technologies and demonstrating transparent sustainability practices. Effective policy collaboration becomes essential for ensuring industry-wide alignment.

Market Opportunities

Expanding Demand in Emerging Asian Economies Creating Growth Potential

The New Zealand Dairy Market holds strong opportunities in emerging Asian economies with rising income levels and dietary diversification. It capitalizes on growing consumer demand for nutrient-rich dairy products. Expanding middle-class populations demonstrate preference for imported premium goods. It strengthens its export networks to serve diverse markets with tailored offerings. Lifestyle changes fuel greater reliance on packaged and convenient dairy formats. It positions itself as a trusted supplier of safe, high-quality nutrition. Growing e-commerce penetration supports wider access to dairy in urban and semi-urban regions. It reinforces long-term trade resilience by diversifying supply across multiple Asian markets.

Innovation in Functional and Specialty Dairy Products Driving Market Expansion

The New Zealand Dairy Market can capture opportunities through continuous innovation in specialty categories. It explores fortified dairy, plant-blend combinations, and health-oriented functional offerings. International buyers look for differentiation, which supports premiumization. It gains traction by aligning with trends in wellness and dietary customization. Value-added innovations improve margins and broaden consumer reach. It develops competitive advantage by addressing evolving health-conscious demand. Strong focus on research partnerships enables faster product development cycles. It ensures sustainable growth by anticipating global shifts in consumer nutrition needs.

Market Segmentation Analysis:

By Product Segment

The New Zealand Dairy Market is dominated by milk, which continues to hold the largest share due to its broad domestic use and export potential. It demonstrates steady demand growth supported by consumer preference for fresh and nutrient-rich options. Milk powder remains a critical export commodity, strengthening the country’s global trade position. Cheese is gaining momentum in both local and international markets, reflecting rising demand for specialty and premium varieties. Yoghurt shows strong adoption across health-conscious consumers seeking probiotics and functional nutrition. Butter sustains consistent demand driven by both household consumption and foodservice applications. Other dairy products, including cream and specialty items, provide niche opportunities and support portfolio diversification.

- For example, Tatua Dairy Companyspecializes in value-added dairy products like dairy whip, culinary creams, and caseinates.

By Animal Segment

The New Zealand Dairy Market is led by cow milk, which dominates production and export revenues due to scale and efficiency in farming practices. It remains the primary driver of supply chains and international competitiveness. Buffalo milk is less prevalent but shows emerging interest in certain markets seeking richer nutritional profiles. Goat milk appeals to niche consumers with dietary sensitivities and continues to expand its specialty positioning. Camel milk reflects limited presence but presents opportunities in wellness-driven and ethnic markets. Sheep milk supports specialty cheese production and holds strong potential in premium categories. It enables producers to address diverse consumer preferences while sustaining long-term market growth.

- For example, Goat milk, primarily supplied by companies like Goat Milk NZ, is exported as specialty infant formula and is increasing in importance, now shipped to more than a dozen countries across Asia and the Middle East. Sheep milk, produced by niche players

Segmentation:

By Product Segment

- Milk

- Milk Powder

- Cheese

- Yoghurt

- Butter

- Other Dairy Products

By Animal Segment

- Cow

- Buffalo

- Goat

- Camel

- Sheep

Regional Analysis

The New Zealand Dairy Market is strongly concentrated in the North Island, which contributes nearly 65% of national production share. The region benefits from favorable climatic conditions, fertile pastures, and proximity to export-oriented processing facilities. It hosts some of the largest dairy cooperatives and processing plants, reinforcing its role as the hub of the national industry. It sustains growth through a combination of efficient farm practices and well-developed transport infrastructure that supports rapid movement of raw milk to processing sites. High-density farming clusters enhance economies of scale, positioning the North Island as the backbone of national dairy supply. It remains the preferred region for investment and capacity expansion.

The South Island holds approximately 30% of the market share, with Canterbury and Southland emerging as prominent dairy farming zones. It demonstrates growth supported by larger farm sizes and high levels of mechanization. It benefits from expanding irrigated land, which allows consistent pasture quality and productivity. The South Island is increasingly recognized for its role in supplying high-quality milk used in specialty powders and value-added exports. Strong sustainability practices and environmental compliance frameworks position the region as a model for responsible dairy production. It continues to attract both domestic and international investment in processing and logistics facilities.

The remaining 5% of market share comes from smaller-scale dairy production spread across other parts of New Zealand. These regions play a role in serving local demand while complementing national exports. It often includes family-owned farms that maintain strong ties to local supply chains. Smaller regions are adapting through niche production such as organic milk and specialty cheeses, targeting domestic consumers and selective export markets. It enhances the diversity of the national industry by supporting specialty categories that align with changing consumer preferences. Collectively, these smaller contributions provide resilience and flexibility, ensuring that the New Zealand Dairy Market sustains growth across diverse geographies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Fonterra Cooperative Group

- a2 Milk Company

- Tatua

- Westland Milk Products

- DCANZ (Dairy Companies Association of New Zealand)

- Miraka

- New Zealand Dairy Products Bangladesh Ltd

- Whitestone Cheese Co.

- Open Country Dairy

- Blue River Dairy

- Other Key Players

Competitive Analysis:

The New Zealand Dairy Market is shaped by a mix of large cooperatives, specialized producers, and emerging niche players. Fonterra Cooperative Group holds a dominant position with extensive processing capacity and a global export network. The a2 Milk Company has built strong brand recognition through differentiated product offerings targeting health-conscious consumers. Tatua and Westland Milk Products focus on value-added products and specialty categories, strengthening their market presence. Miraka and Open Country Dairy emphasize sustainable production and efficient supply chains to gain competitive advantage. Smaller firms such as Whitestone Cheese Co. and Blue River Dairy serve premium and artisanal segments, enhancing product diversity. It remains highly competitive, with companies investing in product innovation, sustainability, and international expansion to secure long-term growth.

Recent Developments:

- In Feb 2025, The a2 Milk Company announced a strategic partnership with Daddylab, a prominent Chinese food quality and safety reviewer, to trace and test products as part of the company’s ambitious expansion into China. This collaboration aims to strengthen consumer trust and product safety in a key growth market. Alongside this partnership, the company reported robust business performance, higher earnings, and issued its first dividend, signaling continued growth momentum.

- In July 2024, Fonterra partnered with Nourish Ingredients to drive innovation in dairy fats. The collaboration taps into Nourish Ingredients’ precision fermentation capabilities especially their Creamilux™ lipid to enhance product texture and flavor across categories such as cheese, cream, and butter.

Market Concentration & Characteristics:

The New Zealand Dairy Market demonstrates high concentration, with cooperatives accounting for the majority of production and exports. It features a strong emphasis on efficiency, sustainability, and premium branding to maintain global competitiveness. Market structure is characterized by scale advantages in large firms and innovation-driven growth in smaller producers. It integrates advanced farming practices and robust export infrastructure, ensuring resilience and adaptability in dynamic global conditions. Strong regulatory alignment enhances credibility in international markets. Continuous investment in research and product development sustains its long-term leadership.

Report Coverage:

The research report offers an in-depth analysis based on Product and Animal. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The New Zealand Dairy Market is expected to strengthen its global position by expanding premium and value-added product categories that align with evolving consumer preferences.

- Sustainability will remain central, with farmers and processors adopting low-carbon practices and advanced resource management to meet environmental commitments.

- Digital transformation across supply chains will enhance efficiency, improve traceability, and support stronger relationships with global buyers.

- Demand for functional and fortified dairy will grow, encouraging companies to diversify portfolios with health-focused innovations.

- Trade agreements will continue to open new opportunities, allowing the industry to deepen access in high-growth regions while protecting existing export strengths.

- Consumer interest in organic and specialty dairy will expand, creating opportunities for niche producers to gain stronger market presence.

- Larger cooperatives are likely to invest in new technologies and global partnerships, reinforcing leadership in both traditional and emerging categories.

- Domestic consumption will reflect rising interest in healthy and convenient dairy options, strengthening demand for yoghurts and ready-to-drink formats.

- Product diversification into dairy-based ingredients for infant nutrition, sports supplements, and food processing will support long-term revenue growth.

- Continuous investment in branding and innovation will position the sector as a resilient and trusted supplier within the international dairy ecosystem.