Market Overview

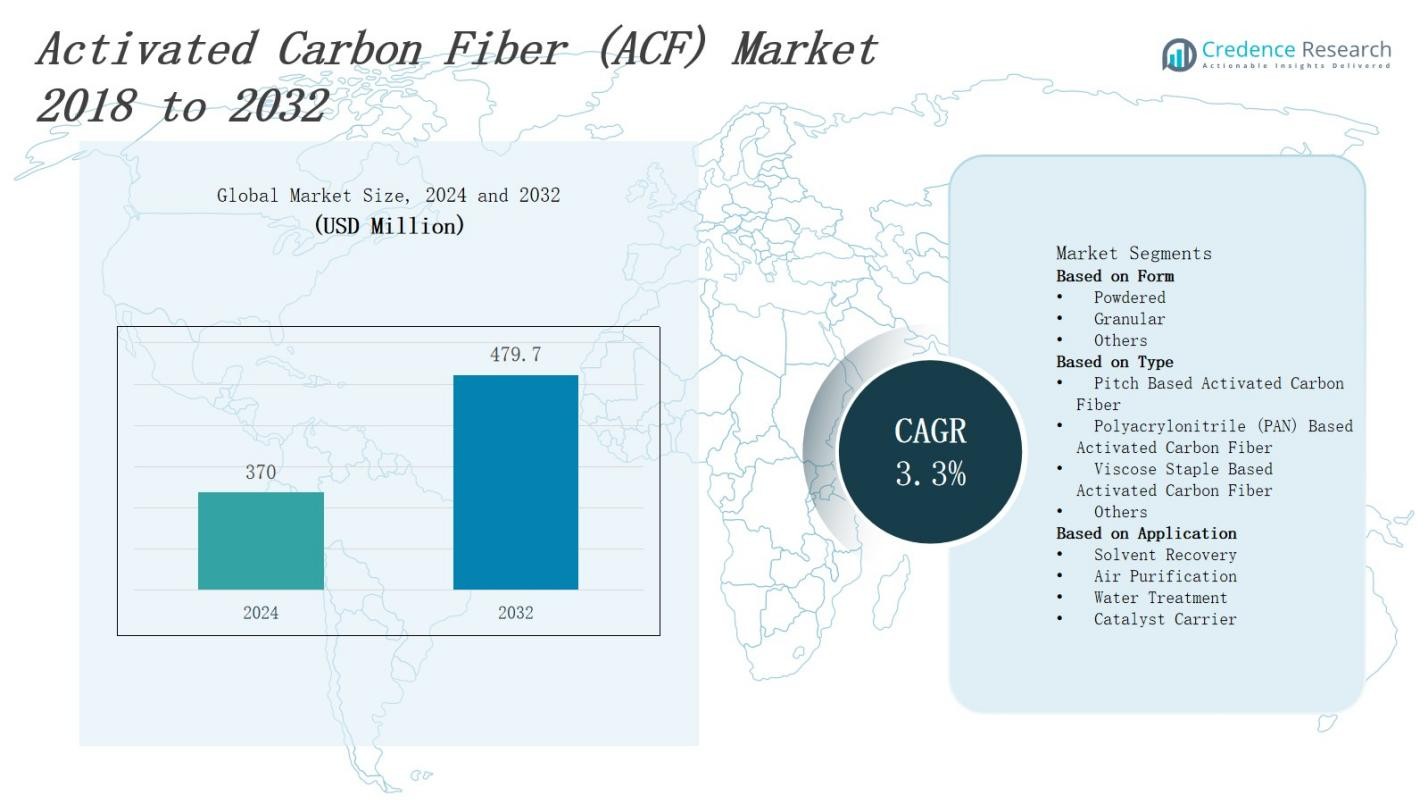

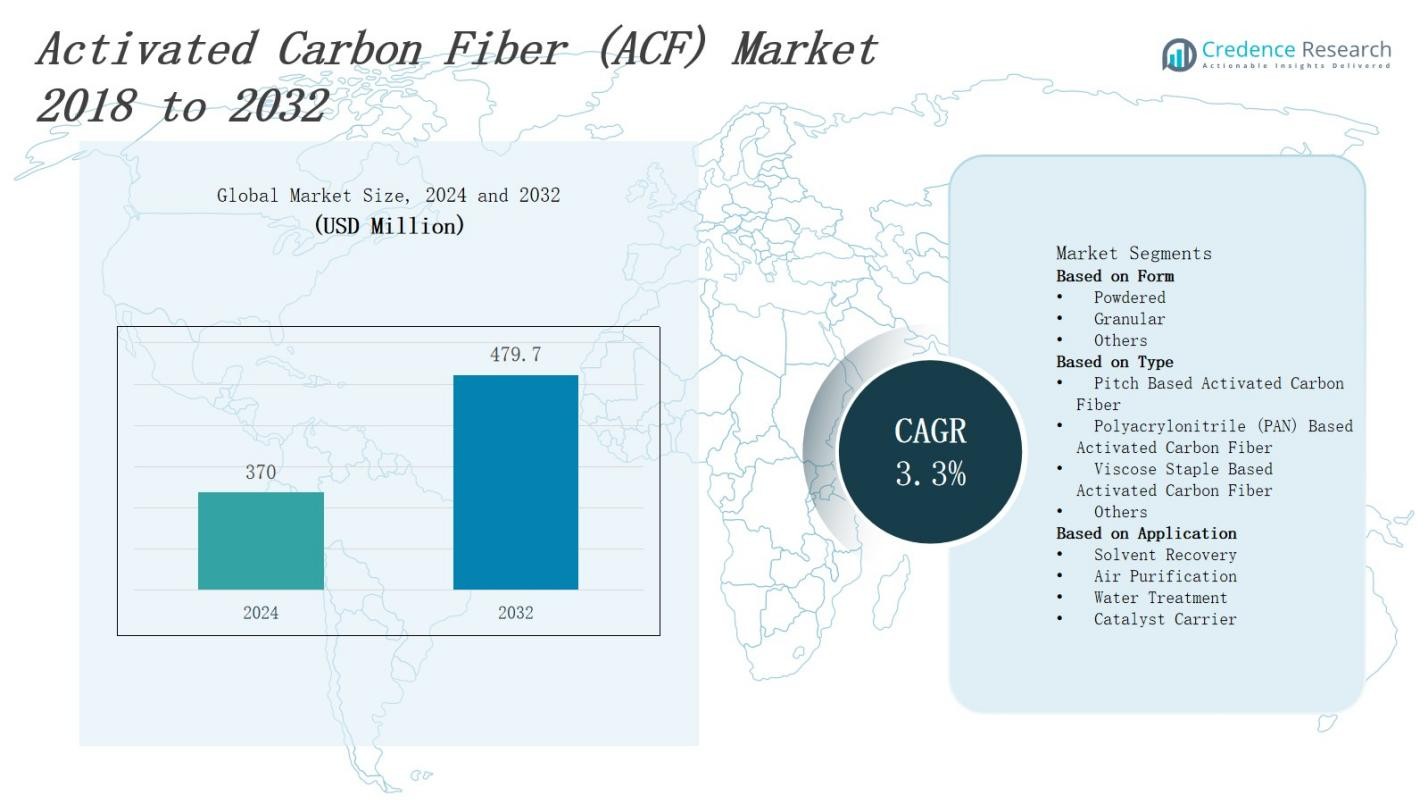

The Activated Carbon Fiber (ACF) Market is projected to grow from USD 370 million in 2024 to USD 479.7 million by 2032, expanding at a CAGR of 3.3%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Activated Carbon Fiber Market Size 2024 |

USD 370 Million |

| Activated Carbon Fiber Market, CAGR |

3.3% |

| Activated Carbon Fiber Market Size 2032 |

USD 479.7 Million |

The activated carbon fiber (ACF) market experiences growth driven by increasing demand for advanced filtration and purification solutions in industries such as water treatment, air purification, and automotive. Rising environmental regulations and heightened awareness of pollution control propel the adoption of ACF due to its superior adsorption efficiency and fast filtration capabilities. Innovations in ACF manufacturing improve its performance, durability, and cost-effectiveness, expanding its applications across healthcare, electronics, and chemical processing. Growing industrialization and urbanization further stimulate market expansion, positioning ACF as a critical material for sustainable environmental management and industrial safety worldwide.

The activated carbon fiber (ACF) market spans key regions including North America, Europe, Asia Pacific, and the Rest of the World. North America and Europe lead due to stringent environmental regulations and advanced industrial infrastructure, while Asia Pacific drives growth with rapid industrialization and rising pollution concerns. The Rest of the World, including Latin America, the Middle East, and Africa, shows gradual adoption fueled by infrastructure development. Key players such as Kuraray Co., Ltd., Mitsubishi Chemical Corporation, and Murata Manufacturing Co., Ltd. actively expand their presence across these regions to meet growing demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The activated carbon fiber (ACF) market is projected to grow from USD 370 million in 2024 to USD 479.7 million by 2032, expanding at a CAGR of 3.3%.

- Increasing demand for advanced filtration in water treatment, air purification, and automotive sectors drives market growth, supported by rising environmental regulations and pollution awareness.

- Technological advancements improve ACF’s adsorption efficiency, durability, and cost-effectiveness, broadening its applications in healthcare, electronics, and chemical processing.

- North America and Europe lead the market with shares of 30% and 28%, respectively, due to stringent regulations and advanced industrial infrastructure.

- Asia Pacific holds 27% of the market, fueled by rapid industrialization, urbanization, and government investments in pollution control infrastructure.

- The Rest of the World, including Latin America, the Middle East, and Africa, accounts for 15%, showing gradual adoption driven by infrastructure development and environmental awareness.

- High production costs and competition from alternative filtration materials challenge the market, pushing manufacturers to innovate for better performance and cost efficiency.

Market Drivers

Rising Demand for Advanced Filtration Solutions

The activated carbon fiber (ACF) market benefits from growing demand for efficient filtration in water treatment, air purification, and industrial processes. It offers high adsorption capacity and rapid filtration, making it ideal for removing contaminants and pollutants. Governments enforce stricter environmental regulations that require effective purification technologies. Industries seek sustainable solutions to comply with these standards, increasing ACF adoption. Its lightweight and porous structure enhance performance, supporting its use in diverse applications.

- For instance, Kuraray has developed advanced ACF products that capture organic pollutants and heavy metals in water treatment, improving overall purification efficiency.

Stringent Environmental Regulations and Pollution Control

Stringent environmental policies globally accelerate the activated carbon fiber (ACF) market growth by pushing industries to adopt superior filtration materials. Regulatory agencies mandate reductions in airborne and waterborne pollutants, compelling companies to implement advanced purification methods. It supports compliance with these laws by efficiently capturing toxic substances and volatile organic compounds. These requirements drive investments in ACF technology, boosting demand across automotive, manufacturing, and municipal sectors focused on pollution control.

- For instance, companies like Carbon Activated Corporation in California provide customized ACF products extensively used in air and water purification systems to help industries comply with such regulations.

Technological Advancements Enhancing Performance

Technological improvements in activated carbon fiber manufacturing improve adsorption efficiency, durability, and cost-effectiveness, expanding market potential. Innovations optimize pore structure and surface area, increasing contaminant capture capabilities. Enhanced production techniques reduce costs, making it accessible for broader applications. It meets evolving industry needs for reliable and sustainable filtration materials. Ongoing research focuses on tailoring ACF properties for specific applications, strengthening its position in competitive filtration markets worldwide.

Expanding Industrial and Healthcare Applications

The activated carbon fiber (ACF) market grows due to its increasing use across industrial, healthcare, and electronic sectors. It removes impurities in pharmaceutical production and protects sensitive electronics from pollutants. Industrial users adopt ACF for chemical processing and gas purification to improve operational safety and efficiency. Growing urbanization and industrialization raise demand for cleaner air and water, promoting wider adoption. Its versatility and effectiveness make it a preferred choice in various high-demand environments.

Market Trends

Increasing Adoption of Sustainable and Eco-Friendly Materials

The activated carbon fiber (ACF) market reflects a strong trend toward sustainable and environmentally friendly materials. Manufacturers focus on producing ACF using renewable raw materials and eco-efficient processes to reduce carbon footprints. It appeals to industries aiming to meet environmental regulations and consumer demand for greener products. Companies integrate recycled materials and optimize production methods to minimize waste. This trend strengthens ACF’s market position as a sustainable solution for filtration and purification applications worldwide.

- For instance, Toyobo Co., Ltd. in Japan partners with Kobe University to develop next-generation activated carbon fibers for carbon capture and storage, focusing on environmentally friendly applications that reduce industrial CO2 emissions.

Integration of Advanced Functionalities in Filtration Applications

The activated carbon fiber (ACF) market witnesses growing incorporation of multifunctional properties to enhance filtration efficiency. It combines adsorption with antibacterial, catalytic, and anti-fouling capabilities, increasing its effectiveness across sectors. Developers innovate ACF composites tailored for specific contaminants and operational conditions. This trend boosts its adoption in healthcare, water treatment, and air purification, where enhanced performance drives higher demand. The ability to address complex pollution challenges positions ACF as a versatile filtration material.

Expansion of Applications in Emerging Industrial Sectors

Emerging industries such as electronics, energy storage, and automotive increasingly incorporate activated carbon fiber (ACF) due to its unique physical and chemical properties. It supports battery electrodes, gas storage, and emission control technologies, enhancing product efficiency and sustainability. The activated carbon fiber ACF market benefits from these expanding applications, which drive research and investment. This trend opens new growth avenues and encourages technological advancements that improve ACF’s adaptability across innovative industrial uses.

- For instance, BMW’s use of carbon fiber reinforced polymers in electric vehicle bodies, such as the BMW i3, where the lightweight and strong material enhances energy efficiency and structural integrity.

Growth in Customized and High-Performance ACF Solutions

Customization and performance optimization represent a key trend shaping the activated carbon fiber (ACF) market. Suppliers collaborate with end-users to develop ACF products with tailored pore sizes, surface chemistry, and mechanical strength. It enables precise targeting of contaminants, improving filtration effectiveness for specific industry requirements. This approach increases market competitiveness and customer satisfaction. The demand for specialized ACF materials stimulates continuous innovation and reinforces its role as a critical component in advanced filtration technologies.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes

The activated carbon fiber (ACF) market faces challenges due to high production costs and complex manufacturing techniques. It requires advanced technology and stringent quality control to maintain consistent performance, increasing capital investment. Limited availability of raw materials and energy-intensive processes further elevate expenses. These factors hinder widespread adoption, especially among small and medium-sized enterprises. Cost pressures push manufacturers to innovate more efficient production methods but achieving scalability without compromising quality remains difficult.

Market Competition from Alternative Filtration Materials

The activated carbon fiber (ACF) market encounters strong competition from other filtration media such as granular activated carbon, polymer membranes, and ceramic filters. These alternatives often offer lower initial costs or specific advantages tailored to particular applications. It must continuously demonstrate superior performance and durability to justify premium pricing. Market fragmentation and varying end-user requirements challenge ACF suppliers to differentiate products effectively. Overcoming these competitive pressures demands ongoing research and development to enhance functionality and cost efficiency.

Market Opportunities

Expanding Demand in Water Treatment and Air Purification Sectors

The activated carbon fiber (ACF) market presents significant opportunities in water treatment and air purification industries driven by growing concerns over environmental pollution and public health. It offers superior adsorption properties that efficiently remove contaminants, making it highly valuable for municipal and industrial applications. Increasing investments in infrastructure upgrades and pollution control programs worldwide create a steady demand for advanced filtration materials. The market can capitalize on government initiatives focused on clean water and air quality improvement to expand its reach and adoption.

Growth Potential in Emerging Industrial and Healthcare Applications

Emerging sectors such as healthcare, electronics, and energy storage provide promising growth avenues for the activated carbon fiber (ACF) market. It supports critical applications including pharmaceutical purification, gas storage, and battery manufacturing, where its unique properties enhance product performance. Rapid industrialization and technological advancement drive demand for specialized and high-performance filtration solutions. The activated carbon fiber ACF market can leverage these trends by investing in research and customization to meet specific industry needs and broaden its application scope.

Market Segmentation Analysis:

By Form

The activated carbon fiber (ACF) market segments by form into powdered, granular, and others, each serving distinct application needs. Powdered ACF offers high surface area and rapid adsorption, making it suitable for fine filtration and purification processes. Granular ACF provides better mechanical strength and ease of handling, preferred in large-scale industrial filtration. Other forms include fibers and fabrics used in specialized applications. It adapts to diverse industry requirements, enhancing its versatility and market penetration across sectors.

- For instance, Awa Paper produces innovative ACF materials focused on water and air purification, serving sectors that require environmentally sustainable filtration solutions with high efficiency and adaptability mainly in Japan and Southeast Asia.

By Type

The activated carbon fiber (ACF) market divides into pitch-based, polyacrylonitrile (PAN)-based, viscose staple-based, and other types. Pitch-based ACF exhibits high density and thermal stability, ideal for heavy-duty filtration and energy storage. PAN-based ACF offers superior adsorption capacity and mechanical strength, commonly used in air and water purification. Viscose staple-based ACF balances cost and performance, fitting moderate filtration demands. It supports tailored solutions across industries by leveraging the unique properties of each type.

- For instance, Osaka Gas produces pitch-based activated carbon fibers (e.g., product A-10) with about 1,000 m²/g surface area, known for high adsorption of ammonia and heat resistance allowing regeneration at up to 900°C. These are used in gas purification and water treatment.

By Application

The activated carbon fiber (ACF) market segments by application into solvent recovery, air purification, water treatment, and catalyst carrier. It plays a vital role in solvent recovery by efficiently adsorbing organic vapors, reducing emissions and costs. Air purification utilizes ACF to capture pollutants and improve indoor air quality. Water treatment relies on ACF to remove contaminants and ensure safe drinking water. In catalyst carrier applications, it enhances reaction efficiency in chemical processes. These diverse uses drive steady demand and broaden market scope.

Segments:

Based on Form

Based on Type

- Pitch Based Activated Carbon Fiber

- Polyacrylonitrile (PAN) Based Activated Carbon Fiber

- Viscose Staple Based Activated Carbon Fiber

- Others

Based on Application

- Solvent Recovery

- Air Purification

- Water Treatment

- Catalyst Carrier

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The North American activated carbon fiber (ACF) market holds a significant share of 30%, driven by strong industrial growth and stringent environmental regulations. It benefits from well-established water treatment and air purification industries demanding advanced filtration materials. Leading manufacturers invest heavily in R&D to develop high-performance ACF products tailored for regional needs. Increasing awareness about pollution control and government initiatives to improve air and water quality further stimulate market growth. The presence of key end-use sectors such as automotive, healthcare, and chemical processing supports sustained demand. Technological advancements and adoption of eco-friendly solutions enhance North America’s competitive position in the global market.

Europe

Europe commands a 28% share of the activated carbon fiber (ACF) market, backed by rigorous environmental standards and advanced infrastructure. It supports diverse applications in solvent recovery, water treatment, and catalyst carrier industries. Strong regulatory frameworks push industries to adopt ACF for pollution reduction and process optimization. The market benefits from high consumer awareness and government policies promoting sustainable materials. Ongoing innovation and collaborations among manufacturers and research institutes boost product development. Europe’s focus on clean energy and emission control technologies reinforces demand for high-quality ACF solutions.

Asia Pacific

The Asia Pacific region captures 27% of the activated carbon fiber (ACF) market, led by rapid industrialization, urbanization, and increasing pollution concerns. It experiences rising demand from growing water treatment facilities, automotive emission controls, and expanding electronics manufacturing. Governments implement strict environmental regulations and invest in infrastructure to improve air and water quality. The region offers opportunities for market expansion due to increasing investments in filtration technologies. Cost advantages and availability of raw materials attract manufacturers to establish production facilities. Asia Pacific’s dynamic market environment drives continuous adoption of advanced ACF products.

Rest of the World

The Rest of the World holds a 15% share of the activated carbon fiber (ACF) market, with growing adoption in Latin America, the Middle East, and Africa. It experiences gradual growth fueled by infrastructure development and increasing awareness of environmental issues. Emerging industries and expanding healthcare sectors create demand for effective filtration solutions. Governments introduce regulations aimed at reducing pollution, encouraging ACF use. Market players focus on developing region-specific products and strengthening distribution networks. The region offers potential for future growth due to ongoing industrial and environmental improvements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nippon Kynol, Inc.

- Murata Manufacturing Co., Ltd.

- Neenah Gessner GmbH

- Mitsubishi Chemical Corporation

- Nantong Senyou Fiber Products Co., Ltd.

- Hayleys Group

- Kuraray Co., Ltd.

- Kureha Corporation

- Awa Paper Mfg. Co., Ltd.

- Cabot Corporation

- Osaka Gas Chemicals Group

- SGL Carbon SE

Competitive Analysis

The activated carbon fiber (ACF) market features a competitive landscape dominated by key global and regional players focused on innovation and capacity expansion. Companies invest in research to enhance ACF performance, targeting specific industry needs such as water treatment, air purification, and industrial filtration. It experiences pressure to balance product quality with cost efficiency to maintain market share. Strategic partnerships and acquisitions enable players to strengthen their product portfolios and geographic reach. The market also sees competition from alternative filtration technologies, pushing ACF manufacturers to differentiate through advanced features and customization. Continuous development of eco-friendly and high-performance ACF products drives competition, positioning leading companies to capitalize on growing environmental regulations and industrial demand worldwide.

Recent Developments

- In April 2024, Kuraray Co., Ltd. introduced a new range of activated carbon fiber (ACF) air purification products designed for industrial use. These products enhance volatile organic compound (VOC) removal and perform effectively in high-temperature environments, targeting sectors like automotive, electronics, and petrochemicals.

- In February 2024, Mitsubishi Chemical Group developed a high-heat-resistant ceramic matrix composite (CMC) using pitch-based carbon fibers, capable of withstanding temperatures up to 1,500°C, aimed at aerospace and space applications.

- In April 2025, Kuraray acquired Nelumbo Inc., a California-based technology company specializing in advanced surface modification for fibers and polymer products.

- In May 2024, Indcarb Activated Carbon Private Limited launched inline water filters for purifiers that use coconut shell-based activated carbon. This product targets improved water quality for both residential and industrial users, meeting the rising demand for effective water purification solutions.

Market Concentration & Characteristics

The activated carbon fiber (ACF) market exhibits a moderately concentrated structure, dominated by several key global players that invest heavily in research, development, and capacity expansion. It features significant entry barriers due to complex manufacturing processes and high production costs, which limit the presence of smaller competitors. Leading companies focus on innovation to enhance product performance, targeting industries such as water treatment, air purification, automotive, and healthcare. The market demands continuous improvements in adsorption efficiency, durability, and cost-effectiveness to maintain competitiveness. It also faces pressure from alternative filtration technologies, requiring manufacturers to differentiate through specialized applications and customization. Strategic partnerships and geographic expansion further characterize the market’s competitive dynamics. The activated carbon fiber ACF market’s concentration fosters technological advancements while encouraging investment in sustainable and high-performance filtration solutions to meet growing environmental regulations and industrial demands worldwide.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The activated carbon fiber (ACF) market will expand due to increasing demand for efficient filtration solutions.

- Growing environmental regulations will drive broader adoption of ACF in industrial applications.

- Innovations will enhance ACF performance, durability, and cost-effectiveness.

- New applications in healthcare and electronics will emerge, boosting market growth.

- Manufacturers will focus on sustainable production methods to meet eco-friendly standards.

- Expansion in emerging economies will create new market opportunities.

- Technological advancements will enable customized ACF products for specific industries.

- Collaboration between key players will strengthen global market presence.

- Demand for clean water and air will sustain continuous growth in filtration markets.

- Competitive pressures will encourage ongoing research and development activities.