| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ad Analytics Market Size 2024 |

USD 5,299.57 Million |

| Ad Analytics Market, CAGR |

11.82% |

| Ad Analytics Market Size 2032 |

USD 13,779.34 Million |

Market Overview:

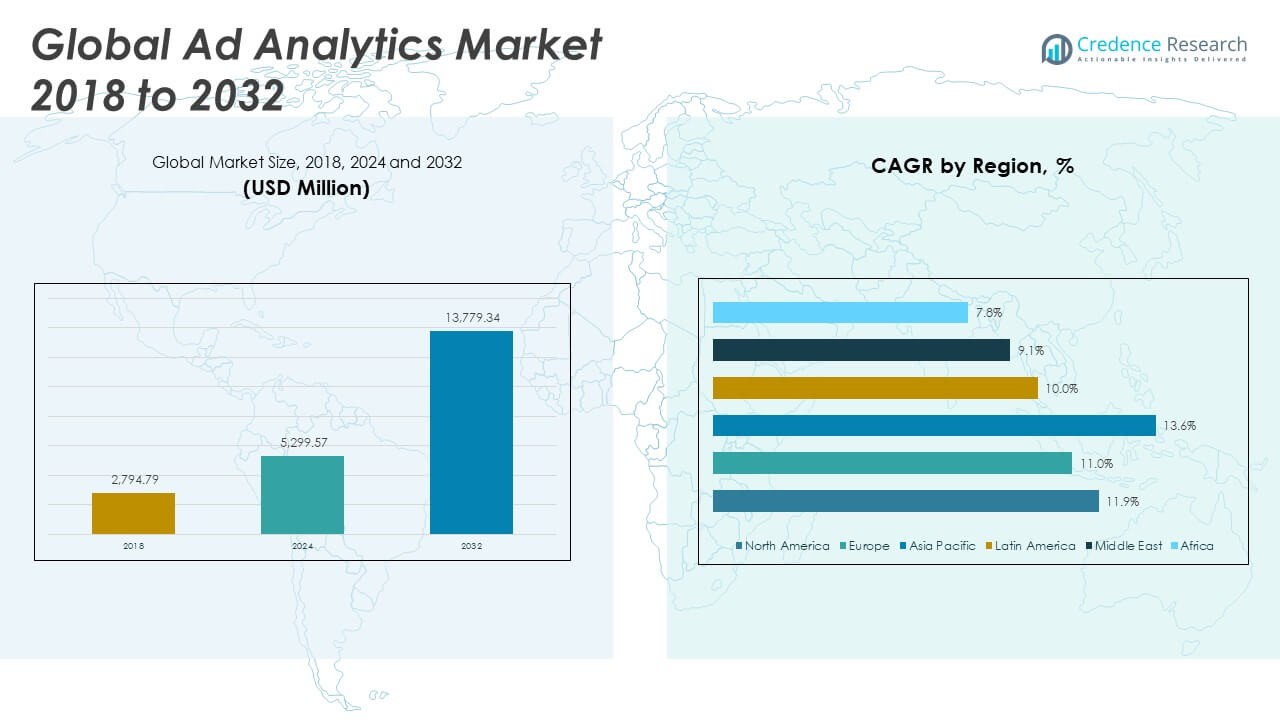

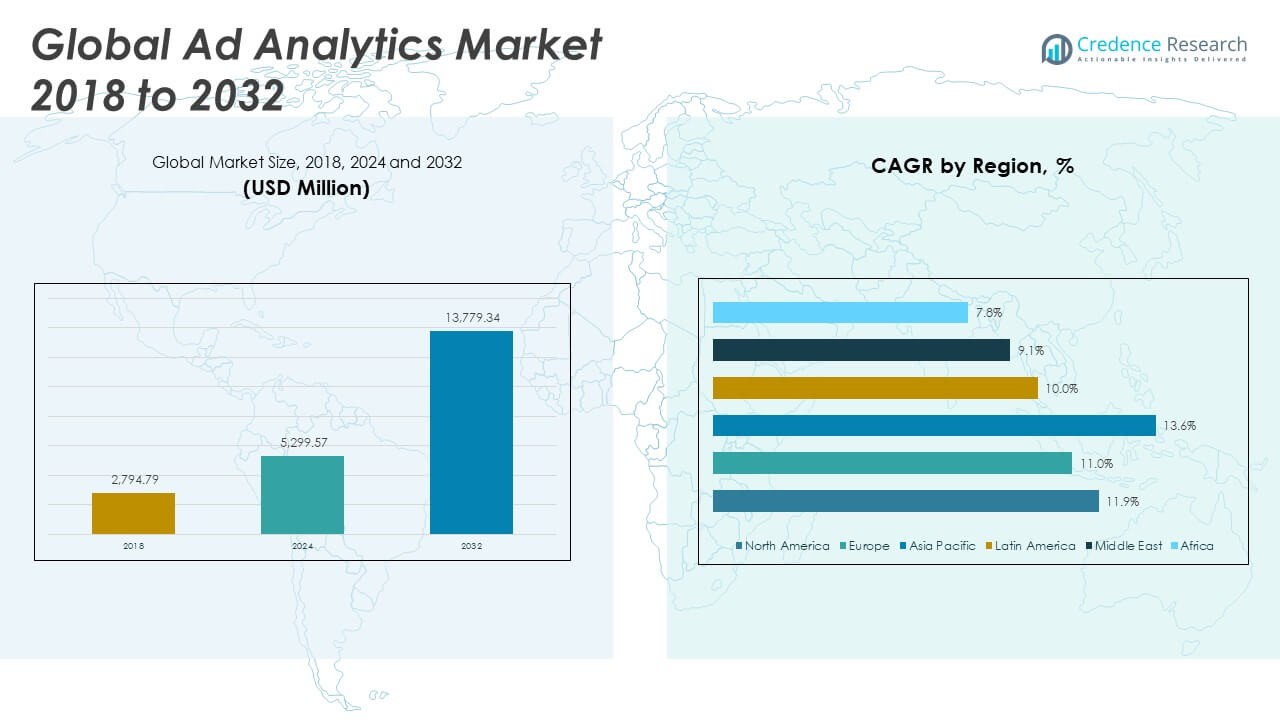

The Global Ad Analytics Market size was valued at USD 2,794.79 million in 2018 to USD 5,299.57 million in 2024 and is anticipated to reach USD 13,779.34 million by 2032, at a CAGR of 11.82% during the forecast period.

One of the primary drivers of this market is the accelerating shift toward digital marketing, which has increased the need for accurate, real-time analytics to measure the effectiveness of campaigns across platforms. Businesses are increasingly leveraging ad analytics solutions to optimize audience targeting, personalize content, and track multi-channel performance metrics. The integration of artificial intelligence (AI) and machine learning (ML) further enhances the value of these tools by enabling predictive analytics, automated reporting, and real-time campaign adjustments. Additionally, the growing availability of consumer data and the pressure on brands to demonstrate ROI from their ad spends are encouraging adoption. The proliferation of mobile devices, social media platforms, and connected TV (CTV) channels is also contributing to the increasing complexity of digital advertising ecosystems, which in turn fuels demand for comprehensive analytics solutions to manage and interpret cross-platform data efficiently.

Regionally, North America holds the largest share of the global ad analytics market, driven by its mature digital advertising landscape, high penetration of analytics tools, and early adoption of AI-based technologies. The presence of major players and tech-savvy advertisers further supports market expansion in the region. Europe follows closely, with strong growth across markets such as the UK, Germany, and France, where data privacy regulations like GDPR have intensified the focus on transparent and compliant analytics solutions. Meanwhile, the Asia Pacific region is expected to witness the fastest growth, fueled by the digital transformation of economies such as China, India, and Southeast Asian nations. The rapid increase in internet users, mobile-first advertising strategies, and expansion of e-commerce platforms are key contributors to this growth. Latin America, the Middle East, and Africa are also emerging as promising markets due to growing digital adoption and rising demand for localized advertising insights.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Ad Analytics Market grew from USD 2,794.79 million in 2018 to USD 5,299.57 million in 2024 and is projected to reach USD 13,779.34 million by 2032, expanding at a CAGR of 11.82%.

- The shift toward digital marketing is a major growth driver, increasing demand for accurate, real-time insights to evaluate campaign effectiveness across multiple platforms.

- AI and machine learning are transforming ad analytics by enabling predictive modeling, audience segmentation, and automated reporting, improving decision-making speed and campaign personalization.

- The complexity of managing multi-channel advertising—across CTV, mobile apps, e-commerce, and social platforms—is fueling demand for unified measurement and cross-platform attribution tools.

- Real-time analytics is gaining traction, offering marketers the ability to make quick optimizations, run A/B tests, and adjust media mix dynamically during live campaigns.

- Cross-platform attribution inconsistencies and the phase-out of third-party cookies pose significant measurement challenges, requiring scalable and privacy-compliant analytics frameworks.

- Regionally, North America leads the market with over 38% share, while Asia Pacific shows the fastest growth, driven by digital transformation in China, India, and Southeast Asia.

Market Drivers:

Rising Demand for Data-Driven Decision-Making Across Advertising Campaigns

Advertisers are under increasing pressure to justify budgets with measurable outcomes, which drives the widespread adoption of ad analytics tools. These solutions provide critical insights into campaign performance, consumer engagement, and media effectiveness, allowing brands to make informed decisions. Organizations now prioritize real-time data collection and analysis to continuously optimize ad spend and content strategy. The Global Ad Analytics Market benefits from this trend, as enterprises shift from traditional media buys toward digital campaigns that require precise tracking and attribution. Companies are deploying analytics to assess multi-channel performance, understand customer behavior, and improve targeting accuracy. The emphasis on maximizing return on investment (ROI) continues to position ad analytics as a strategic necessity.

- For instance, Innovid’s ad analytics platform enabled Renault to achieve a 2.74% click-through rate (CTR) on their Duster campaign, surpassing auto industry benchmarks by 291%. The campaign also delivered an additional 43 seconds of video engagement over a standard 30-second pre-roll, and a 301% lift in video engagement, demonstrating the power of data-driven creative optimization and campaign measurement.

Integration of Artificial Intelligence and Machine Learning for Enhanced Predictive Insights

The adoption of AI and ML within ad analytics platforms is transforming how businesses interpret and act on advertising data. These technologies automate large-scale data analysis, uncover patterns, and predict campaign outcomes, allowing marketers to respond faster and more effectively. With predictive modeling and intelligent recommendations, businesses can optimize creative assets, audience segmentation, and media placement in near real-time. It enables advanced capabilities such as sentiment analysis, content performance prediction, and churn modeling, which are critical for competitive differentiation. The Global Ad Analytics Market is evolving quickly with these innovations, helping brands tailor messages and strategies for better engagement. AI-powered features are becoming standard in modern analytics tools, reflecting market demand for efficiency and personalization.

Increasing Complexity in Multi-Channel Advertising Ecosystems Requires Unified Measurement Tools

The advertising landscape now includes diverse platforms such as mobile apps, social media, connected TV, e-commerce sites, and streaming services. Managing and measuring campaigns across these channels has become complex, making unified ad analytics solutions essential. Marketers need centralized platforms that provide consolidated dashboards, holistic attribution models, and cross-platform comparisons. It simplifies campaign management while ensuring that performance metrics are standardized and actionable. Brands are investing in comprehensive solutions that break down silos between media types and deliver a consistent view of the customer journey. The complexity of today’s advertising ecosystem is directly contributing to the growth of the Global Ad Analytics Market.

- For instance, Branch’s Unified Analytics platform aggregates SKAdNetwork, PAM, IDFA, IDFV, Apple Ads, and Android attribution data into a single deduplicated dashboard, correcting misattributed installs and enabling granular filtering by ad partner, campaign, platform, and time period—allowing marketers to analyze performance across all channels without duplication.

Growing Adoption of Real-Time Analytics to Drive Campaign Optimization and Agility

In today’s competitive environment, the ability to act on data in real time provides a significant strategic advantage. Real-time ad analytics tools allow marketers to monitor campaign performance continuously and make rapid adjustments to creative, targeting, and media mix. It ensures campaigns remain relevant and efficient, especially during high-impact periods such as product launches or seasonal promotions. Real-time capabilities also support A/B testing, dynamic content delivery, and responsive budgeting. As marketing teams adopt agile methodologies, they rely more heavily on these tools to iterate quickly and respond to shifting consumer behaviors. The growing demand for speed and precision is propelling the Global Ad Analytics Market forward.

Market Trends:

Expansion of Privacy-First Advertising Is Reshaping Data Collection and Attribution Models

Stricter data privacy regulations such as GDPR, CCPA, and upcoming global policies are reshaping how advertisers collect and process consumer data. Businesses are now prioritizing first-party data and consent-driven frameworks, moving away from reliance on third-party cookies. This shift is encouraging the development of privacy-centric ad analytics solutions that offer compliant data tracking without compromising insight depth. It is accelerating investments in contextual targeting and anonymized data analysis tools. The Global Ad Analytics Market is adapting to this new standard by embedding privacy-first principles into product design. Vendors that deliver transparent, ethical, and secure analytics capabilities are gaining stronger adoption among data-sensitive industries.

- For instance, Cuebiq’s first-party location data platform processes only opt-in, consented data, applying multi-layered anonymization techniques that remove all personally identifiable information (PII) and replace device-level data with anonymous identifiers. Cuebiq maintains compliance through regular third-party audits, holds certifications from the NAI and TrustArc, and employs a dedicated Chief Privacy Officer to oversee data practices

Rise of Voice Search and Audio Advertising Is Creating Demand for New Analytics Capabilities

With the growing use of smart speakers, voice assistants, and podcast platforms, marketers are tapping into voice-based and audio advertising channels. Traditional visual or click-based metrics are insufficient to evaluate performance in this domain. It drives the need for innovative ad analytics models that can measure engagement through listening behavior, brand recall, and call-to-action responses. Audio recognition, sentiment analysis, and voice-based attribution are emerging as core features within the analytics stack. The Global Ad Analytics Market is witnessing this trend push vendor to enhance their platforms to accommodate non-visual ad formats. As audio platforms gain momentum, analytics solutions must evolve to capture their full performance impact.

- For instance, Spotify’s integration of Megaphone’s dynamic ad insertion (DAI) technology enables real-time, targeted ad placements within podcasts, tailored to listener demographics and behaviors.

Increased Focus on Retail Media Networks Is Driving Specialized Analytics Tools

Retail media networks, operated by large e-commerce platforms and retailers, are becoming vital components of digital ad strategies. These networks generate massive amounts of transactional and behavioral data that brands can use to refine targeting. It creates demand for ad analytics tools that can integrate with retail data ecosystems and deliver product-level performance insights. Features such as on-site conversion analysis, product shelf visibility, and promotion tracking are becoming essential. The Global Ad Analytics Market is evolving to support retail-specific KPIs and dashboards tailored to merchant ecosystems. This trend signals a growing intersection between advertising technology and commerce analytics.

Wider Adoption of Visual Analytics and Creative Intelligence Platforms Is Enhancing Ad Impact

Marketers are now using advanced visual analytics to assess how design elements, colors, and creative formats influence consumer engagement. By analyzing visual content performance across channels, teams can fine-tune messaging and improve brand consistency. It fosters the rise of creative intelligence platforms that combine ad performance data with visual heatmaps and attention metrics. These tools provide valuable feedback for designers and content strategists to iterate quickly. The Global Ad Analytics Market is incorporating these capabilities to enable more creative-led optimization processes. The shift from purely quantitative analysis to creative diagnostics is redefining how brands approach campaign development.

Market Challenges Analysis:

Complexity of Cross-Platform Attribution and Inconsistent Measurement Standards Limit Optimization Efforts

Advertisers face growing challenges in accurately attributing campaign performance across multiple platforms, devices, and formats. The fragmented digital landscape includes social media, mobile apps, connected TVs, websites, and offline channels, each offering different engagement metrics and tracking methodologies. This lack of standardization leads to data silos, making it difficult for marketers to gain a unified view of the customer journey. The Global Ad Analytics Market must overcome this issue by developing more cohesive, interoperable systems that align attribution models and enable consistent reporting. It often requires advanced integrations, significant investment, and technical expertise that not all companies can afford. Without reliable cross-platform attribution, marketing teams struggle to allocate budgets effectively and optimize campaign strategies with precision.

Rising Data Privacy Concerns and Regulatory Compliance Pose Operational Hurdles for Analytics Providers

Evolving global data privacy laws have placed stringent restrictions on how companies collect, store, and use personal data. These regulations increase compliance costs and force analytics providers to redesign tracking technologies and consent management frameworks. Many traditional tracking methods, including third-party cookies and device IDs, are being phased out, complicating the ability to monitor user behavior accurately. The Global Ad Analytics Market faces growing pressure to maintain functionality while adhering to regional legal frameworks, such as GDPR in Europe and CCPA in California. It must invest in developing privacy-preserving analytics models that balance consumer rights with marketing goals. Navigating this regulatory environment requires ongoing innovation and legal oversight, adding to the operational burden of ad analytics vendors.

Market Opportunities:

Expansion of Emerging Markets and Digital Infrastructure Opens Untapped Growth Potential

The rapid digital transformation in emerging economies is creating significant opportunities for ad analytics solution providers. Markets in Asia Pacific, Latin America, and Africa are witnessing a surge in internet penetration, mobile device usage, and digital media consumption. This shift increases demand for localized, language-specific, and mobile-optimized analytics platforms. The Global Ad Analytics Market can leverage these trends to expand its footprint by offering scalable, cloud-based solutions tailored to regional needs. It also allows vendors to partner with local media networks and agencies to build stronger go-to-market strategies. Growing interest in e-commerce and social commerce further amplifies the need for real-time insights across new user segments.

Integration of Ad Analytics with Business Intelligence and CRM Platforms Enhances Strategic Value

Organizations are increasingly seeking to align marketing analytics with broader business operations to drive holistic decision-making. Integrating ad analytics tools with customer relationship management (CRM), sales automation, and business intelligence (BI) platforms unlocks deeper insights. It supports the creation of end-to-end visibility into customer engagement, campaign ROI, and lifetime value metrics. The Global Ad Analytics Market can capitalize on this opportunity by developing APIs, plug-ins, and native connectors for enterprise ecosystems. This integration enhances strategic agility and empowers cross-functional teams with unified data intelligence. Companies that offer seamless interoperability with business tools will likely gain competitive advantage.

Market Segmentation Analysis:

The Global Ad Analytics Market is segmented by solution, deployment, application, and end use industry, reflecting diverse business needs and technological preferences.

By solution, ad analytics software leads the market due to high demand for real-time performance tracking and campaign optimization. Services and managed services segments also show strong growth, driven by the need for technical support, integration, and ongoing data insights.

By deployment, cloud-based solutions dominate the landscape because of their scalability, cost-efficiency, and ease of access, while on-premise options remain relevant for organizations with strict data governance requirements.

By application, online marketing holds the largest share, supported by the shift to digital-first strategies. Social media marketing and content marketing segments continue to grow as brands focus on engagement and personalization. E-mail marketing maintains a steady presence, while the “others” category includes influencer and mobile marketing.

- For instance, Meta’s AI-driven advertising platform empowers advertisers to generate text variations and image creatives automatically, enabling brands to launch thousands of A/B-tested ad variants across Facebook and Instagram

By end use industry, retail and BFSI sectors are key adopters due to their high customer interaction volumes. Healthcare, education, and travel also invest in analytics to improve audience targeting and campaign ROI. The market supports a broad range of industries aiming to enhance advertising effectiveness.

- For instance, JPMorgan Chase increased its campaign click-through rate (CTR) by up to 450% using Persado’s AI-powered copy generation platform, which analyzed and rewrote marketing copy to generate personalized messages for specific audience segments.

Segmentation:

By Solution:

- Ad Analytics Software

- Services

- Managed Services

By Deployment:

By Application:

- Online Marketing

- E-mail Marketing

- Content Marketing

- Social Media Marketing

- Others

By End Use Industry:

- Retail

- BFSI (Banking, Financial Services, and Insurance)

- Education

- Healthcare

- Manufacturing

- Travel and Hospitality

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Ad Analytics Market size was valued at USD 1,188.74 million in 2018 to USD 2,230.09 million in 2024 and is anticipated to reach USD 5,814.95 million by 2032, at a CAGR of 11.9% during the forecast period. North America dominates the Global Ad Analytics Market with a market share of 38%, driven by high digital ad spend, strong cloud infrastructure, and early adoption of AI-powered tools. The presence of leading advertising technology firms and data analytics vendors in the United States supports innovation and widespread adoption. It benefits from well-established regulatory frameworks that promote transparency and performance tracking. Enterprises in this region continue to invest in advanced marketing intelligence to support personalization, attribution, and cross-platform performance measurement. The U.S. and Canada lead in integrating analytics with customer experience platforms, CRM systems, and programmatic advertising. Growth is also reinforced by the increasing use of connected TV, OTT platforms, and mobile-first campaigns.

The Europe Ad Analytics Market size was valued at USD 856.16 million in 2018 to USD 1,569.27 million in 2024 and is anticipated to reach USD 3,859.77 million by 2032, at a CAGR of 11.0% during the forecast period. Europe holds 25% of the Global Ad Analytics Market, supported by strong demand for data transparency, user privacy, and regulatory compliance. GDPR has influenced businesses to prioritize privacy-centric analytics, leading to the development of compliant measurement frameworks. It has seen rising adoption across sectors such as retail, automotive, and finance, where accountability in advertising performance is critical. Countries like the UK, Germany, and France lead regional growth with a focus on real-time and omnichannel insights. The market is also witnessing increased collaboration between media agencies and analytics providers to meet regional language and cultural expectations. Investments in digital transformation and cloud adoption continue to shape the analytics ecosystem in this region.

The Asia Pacific Ad Analytics Market size was valued at USD 521.09 million in 2018 to USD 1,073.61 million in 2024 and is anticipated to reach USD 3,172.35 million by 2032, at a CAGR of 13.6% during the forecast period. Asia Pacific accounts for 21% of the Global Ad Analytics Market and is the fastest-growing regional market, driven by rapid digitization in China, India, Japan, and Southeast Asia. Expanding internet usage, mobile penetration, and e-commerce platforms contribute significantly to analytics adoption. It is characterized by mobile-first strategies and strong demand for video, influencer, and social media analytics. Countries in this region are embracing AI-powered tools to improve ROI in dynamic consumer markets. The proliferation of retail media networks and regional advertising platforms drives the need for localized, scalable analytics solutions. Start-ups and tech-driven enterprises are leading innovation across both enterprise and SME segments.

The Latin America Ad Analytics Market size was valued at USD 123.62 million in 2018 to USD 231.31 million in 2024 and is anticipated to reach USD 527.57 million by 2032, at a CAGR of 10.0% during the forecast period. Latin America holds 6% of the Global Ad Analytics Market and is steadily expanding due to increased investments in digital infrastructure and mobile advertising. Brazil and Mexico lead adoption, fueled by growing consumer demand for online content and social media engagement. It is seeing strong interest from regional brands and agencies in real-time ad optimization and performance measurement. Cost-effective analytics platforms with multilingual support are gaining traction among small and medium businesses. Programmatic advertising and cross-channel targeting have accelerated the use of insights-driven marketing in the region. Government efforts to improve internet access and digital education also support long-term growth.

The Middle East Ad Analytics Market size was valued at USD 70.52 million in 2018 to USD 120.98 million in 2024 and is anticipated to reach USD 259.43 million by 2032, at a CAGR of 9.1% during the forecast period. The Middle East contributes 4% to the Global Ad Analytics Market, with key growth centered in the UAE and Saudi Arabia. Economic diversification strategies and investment in digital media ecosystems are driving demand for marketing analytics. It reflects rising digital ad budgets among telecom, banking, and government sectors. Adoption of cloud platforms and AI tools is gaining momentum, particularly in urban centers and tech hubs. There is a growing preference for data visualization and dashboard tools that support Arabic content and user interfaces. The region is actively embracing digital transformation, opening new opportunities for ad analytics vendors.

The Africa Ad Analytics Market size was valued at USD 34.66 million in 2018 to USD 74.32 million in 2024 and is anticipated to reach USD 145.28 million by 2032, at a CAGR of 7.8% during the forecast period. Africa represents 2% of the Global Ad Analytics Market and is at a nascent stage of development, though it holds long-term growth potential. Countries like South Africa, Nigeria, and Kenya are witnessing rising adoption of digital advertising and mobile technologies. It is driven by improved internet connectivity, social media penetration, and e-commerce growth. Marketers are increasingly seeking analytics tools that work in low-bandwidth settings and support regional payment models. Local content creation and regional language support remain key considerations for technology providers. As digital literacy and online commerce expand, demand for actionable marketing insights will continue to rise.

Key Player Analysis:

- Google

- Meta

- Adobe

- Microsoft

- Oracle

- Salesforce

- IBM

- Amazon

- SAS Institute

- HubSpot

- Adobe Analytics

- Tableau

Competitive Analysis:

The Global Ad Analytics Market features a competitive landscape shaped by leading technology firms, marketing platform providers, and specialized analytics vendors. Major players focus on expanding product portfolios, integrating AI capabilities, and enhancing cross-channel attribution tools. It is witnessing increased merger and acquisition activity aimed at consolidating analytics and media performance capabilities. Companies prioritize cloud-based delivery models, customizable dashboards, and API compatibility to meet diverse enterprise needs. Vendors also compete by offering real-time insights, multilingual interfaces, and privacy-compliant data processing. Strategic partnerships with digital advertising platforms, e-commerce providers, and CRM systems strengthen market positioning. Innovation in predictive modeling, creative analytics, and customer journey mapping continues to drive differentiation. The market favors agile vendors that can scale globally while supporting localized campaign intelligence. Strong R&D investment and integration with business intelligence tools are critical factors influencing competitive advantage in this dynamic and evolving market.

Recent Developments:

- In September 2023, Spaulding Ridge, a US-based cloud advisory and implementation company, completed the acquisition of Solistic Decision Sciences, a marketing analytics and data cloud specialist. This acquisition has significantly strengthened Spaulding Ridge’s capabilities in leveraging marketing intelligence, particularly for Salesforce Data Cloud and Marketing Cloud offerings, enabling more advanced customer insights and data-driven actions within the global ad analytics market.

- In October 2023, Act-On Software, a US-based provider of enterprise marketing automation solutions, launched Act-On Advanced Analytics. This new product suite, powered by AI, provides marketers with deep-dive analytics, customizable reporting, natural language querying, and AI-driven insights, allowing for enhanced marketing performance analysis and improved alignment between marketing and sales teams.

Market Concentration & Characteristics:

The Global Ad Analytics Market exhibits moderate to high market concentration, with a mix of global tech giants and niche analytics providers dominating the competitive landscape. It is characterized by rapid technological innovation, high demand for real-time insights, and integration with digital marketing ecosystems. The market favors companies that offer scalable, cloud-based platforms with advanced AI capabilities and cross-channel attribution. It supports a customer base ranging from large enterprises to small and medium-sized businesses seeking performance-driven advertising strategies. The market is dynamic, with frequent product enhancements, strategic partnerships, and acquisitions shaping vendor positioning. High customization, privacy compliance, and actionable reporting define the core features demanded by users across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on solution, deployment, application, and end use industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- AI-driven analytics platforms will become central to real-time campaign optimization.

- Privacy-first solutions will see widespread adoption to address global data regulations.

- Integration with CRM, BI, and e-commerce platforms will drive unified marketing strategies.

- Visual and creative intelligence tools will enhance content performance measurement.

- Voice, audio, and connected TV analytics will gain prominence in cross-channel campaigns.

- Emerging markets will offer high-growth opportunities due to rapid digital transformation.

- Cloud-based deployment models will dominate due to scalability and cost efficiency.

- Retail media networks will boost demand for product-level and transactional insights.

- Predictive analytics will shape proactive decision-making across customer touchpoints.

- Investments in multilingual and localized analytics solutions will expand regional market reach.