Market Overview:

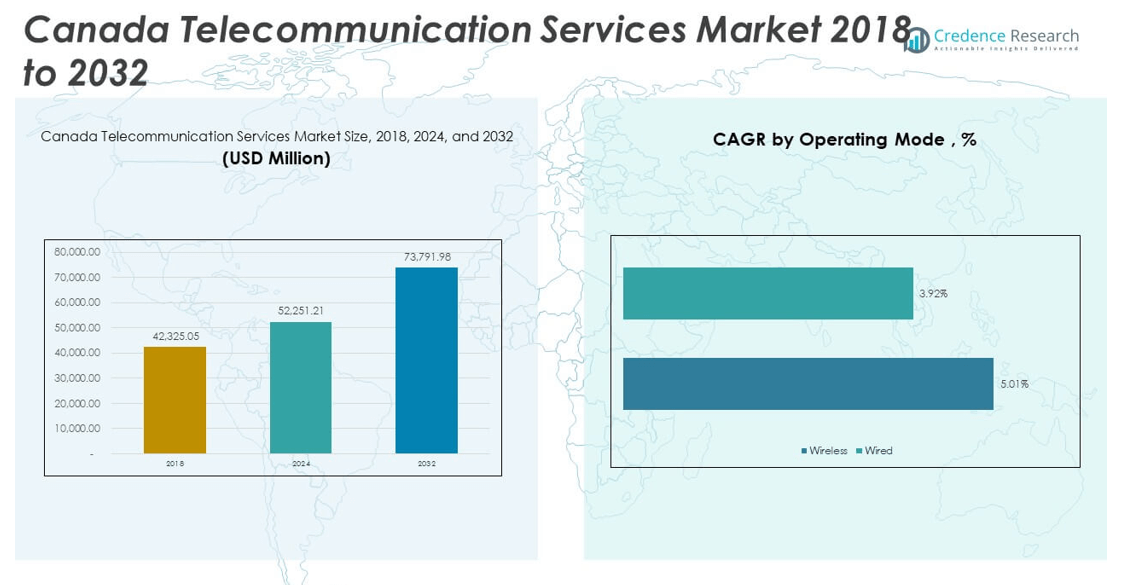

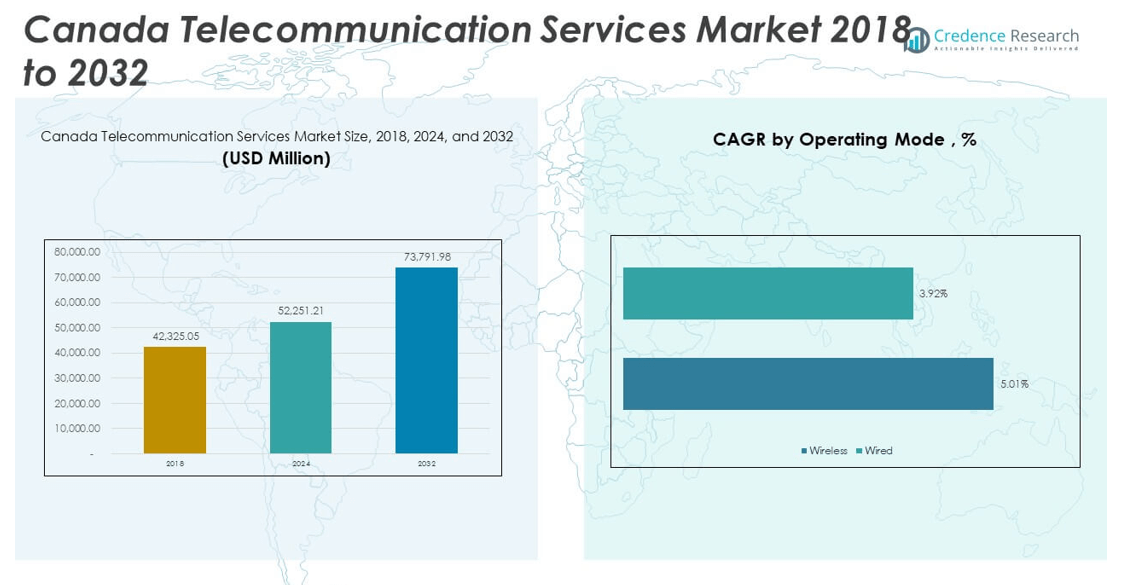

The Canada Telecommunication Services Market size was valued at USD 42,325.05 million in 2018 to USD 52,251.2 million in 2024 and is anticipated to reach USD 73,791.98 million by 2032, at a CAGR of 4.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Telecommunication Services Market Size 2024 |

USD 52,251.2 million |

| Canada Telecommunication Services Market , CAGR |

4.41% |

| Canada Telecommunication Services Market Size 2032 |

USD 73,791.98 million |

The market is driven by the increasing adoption of high-speed internet, the rollout of advanced 5G infrastructure, and growing demand for integrated communication services across residential, commercial, and industrial sectors. Rising smartphone penetration, the expansion of IoT applications, and the need for reliable connectivity in remote areas are further accelerating growth. Additionally, government initiatives to enhance digital inclusion and investments by major telecom operators in network modernization are strengthening the market landscape.

Canada’s telecommunication services market is concentrated in urban hubs such as Toronto, Vancouver, and Montreal, which lead in technology adoption and service demand. Emerging growth opportunities exist in rural and remote regions, where infrastructure expansion is gaining momentum to bridge the digital divide. Regional disparities in connectivity are gradually narrowing as operators focus on extending fiber and 5G coverage, ensuring broader access to advanced communication solutions nationwide.

Market Insights:

- The Canada Telecommunication Services Market was valued at USD 42,325.05 million in 2018, reached USD 52,251.2 million in 2024, and is projected to hit USD 73,791.98 million by 2032, registering a CAGR of 4.41% during the forecast period.

- Rising demand for high-speed internet and data-intensive applications, coupled with rapid 5G deployment, is fueling market expansion.

- Increasing smartphone penetration and the integration of IoT devices across sectors are driving sustained service adoption.

- High infrastructure development and maintenance costs, particularly for 5G and fiber networks, pose challenges to profitability.

- Intense competition and stringent regulatory compliance requirements are pressuring margins and operational flexibility.

- Urban hubs such as Toronto, Vancouver, and Montreal lead the market due to advanced infrastructure and high adoption rates.

- Rural and remote regions are emerging growth areas, supported by government funding, satellite internet solutions, and digital inclusion initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for High-Capacity Networks:

The Canada Telecommunication Services Market is propelled by the growing requirement for high-capacity networks that can support increasing data consumption. The surge in streaming services, online gaming, and virtual collaboration tools has elevated expectations for speed and reliability. It is benefiting from large-scale investments in fiber-optic infrastructure, enabling faster connectivity for households and businesses. Enterprises are expanding digital operations, which requires stable and high-bandwidth services. The integration of emerging technologies like augmented reality, virtual reality, and advanced analytics increases the pressure on network capacity. Consumers are more willing to pay for premium services that deliver uninterrupted performance. Rural network expansion efforts further contribute to the demand for robust infrastructure. The market continues to evolve as usage patterns shift toward high-data applications.

- For instance, Bell Canada’s fiber expansion saw the company pass 900,000 new homes and businesses with fiber in a single year, extending its national fiber footprint to around 7.7million premises by the end of 2024. This major infrastructure push is backed by over $14billion in capital expenditures since 2020, ensuring faster and more reliable connectivity for households and businesses.

Accelerated Rollout of 5G Networks:

The rapid deployment of 5G technology is a key driver shaping the Canada Telecommunication Services Market. Service providers are prioritizing infrastructure upgrades to deliver ultra-low latency and high-speed connectivity. It enables innovative applications such as autonomous vehicles, remote healthcare, and industrial IoT solutions. Government spectrum auctions and supportive policy frameworks encourage faster adoption. Network densification in urban areas ensures consistent performance and coverage. Rural deployments are gradually improving accessibility for underserved populations. Telecom operators are leveraging 5G to diversify revenue streams and offer enterprise-grade solutions. Continuous advancements in equipment and technology are reducing the cost barriers for wider 5G integration. The competitive landscape pushes providers to differentiate services through 5G-enabled capabilities.

- For instance, Rogers Communications launched Canada’s first national 5G standalone (SA) network in January 2021 and has since expanded its 5G coverage to more than 2,300 communities nationwide by mid-2024. Rogers’ use of Ericsson’s 5G Advanced and RedCap technologies further differentiates its network, supporting enterprise IoT and advanced consumer services.

Surge in Smartphone and Mobile Data Usage:

Growing smartphone adoption significantly drives the Canada Telecommunication Services Market. Consumers increasingly rely on mobile devices for communication, entertainment, and business transactions. It results in higher data consumption, prompting operators to expand mobile network capacity. Affordable data plans and device financing options attract new subscribers. The proliferation of mobile applications, from digital payments to AR-based tools, boosts network demand. Service providers introduce bundled packages that combine mobile, internet, and value-added services to enhance loyalty. Upgraded mobile infrastructure supports better quality of service and faster speeds. Rising 4G and 5G penetration further amplifies market momentum. The sector thrives on the shift toward mobile-first lifestyles.

Government Programs for Digital Expansion:

Government-led initiatives to bridge the digital divide remain a strong growth driver for the Canada Telecommunication Services Market. Public funding programs aim to extend high-speed broadband to rural and remote areas. It benefits from policies that encourage competition and innovation in service delivery. Infrastructure subsidies reduce the financial risks for telecom operators expanding into less profitable regions. The push for universal internet access aligns with national economic development strategies. Programs to enhance digital literacy help increase adoption and effective utilization of telecom services. Collaborative efforts between public and private sectors accelerate the pace of infrastructure rollout. Regulatory clarity supports long-term investment planning for operators. These initiatives strengthen both accessibility and service quality across the country.

Market Trends:

Rising Adoption of Cloud-Based Communication Platforms:

The Canada Telecommunication Services Market is witnessing strong uptake of cloud-based communication platforms. Businesses adopt unified communications solutions to streamline operations and support hybrid work models. It enables seamless integration of voice, video, messaging, and collaboration tools. Cloud infrastructure offers scalability for organizations adapting to fluctuating demands. Integration with AI-driven analytics enhances efficiency and customer engagement. Service providers bundle cloud services with network offerings to create comprehensive packages. Enterprises prioritize secure and compliant solutions for sensitive data handling. This trend supports long-term partnerships between telecom operators and corporate clients.

- For instance, TELUS reported 328,000 total net subscriber additions and significant growth across internet, TV, and security services in Q4 2024. TELUS also led a major overhaul of its business communications and AI infrastructure through deep collaborations with Google Cloud, ensuring scalable and secure cloud-based data solutions for nearly 20.2million total technology connections by the end of 2024.

Increased Focus on AI-Driven Network Optimization:

AI integration in network management is reshaping operational strategies within the Canada Telecommunication Services Market. Operators deploy AI-powered systems for predictive maintenance and traffic optimization. It improves network uptime and reduces operational costs. AI tools help personalize customer experiences through targeted service recommendations. Automation in network monitoring ensures faster issue resolution. AI-based fraud detection strengthens cybersecurity measures. Real-time analytics guide capacity planning and service upgrades. The use of AI enhances both performance and efficiency, positioning providers competitively in the market.

- For example, SaskTel’s 2024-2025 strategy includes major investments in 5G, telco cloud, and AI, with a focus on enhancing service reliability and automating data analytics across its network infrastructure. Industry-wide, AI-driven predictive maintenance is credited with cutting operational costs, improving network uptime, and preventing unexpected service outages.

Expansion of Over-the-Top (OTT) Service Partnerships:

The growth of OTT services influences the structure of the Canada Telecommunication Services Market. Partnerships between telecom operators and streaming platforms add value for subscribers. It drives demand for higher bandwidth and improved network stability. Operators introduce bundled packages combining connectivity with premium content subscriptions. The rise of 4K and immersive media formats requires stronger infrastructure. OTT collaborations improve customer retention and average revenue per user. Service differentiation through content offerings becomes a competitive strategy. This trend aligns telecom services with evolving entertainment and information consumption patterns.

Shift Toward Sustainable and Energy-Efficient Operations:

Sustainability initiatives are gaining traction in the Canada Telecommunication Services Market. Operators invest in renewable energy sources and energy-efficient network equipment. It reduces operational costs and aligns with environmental goals. Infrastructure modernization lowers energy consumption while improving service quality. Recycling programs for outdated equipment support e-waste reduction efforts. Green data centers improve resource utilization and operational resilience. Companies incorporate sustainability into brand identity to appeal to environmentally conscious consumers. This shift reflects a long-term commitment to responsible growth and regulatory compliance.

Market Challenges Analysis:

High Capital Requirements for Infrastructure Development:

The Canada Telecommunication Services Market faces persistent challenges due to the high capital requirements of network expansion and modernization. Building advanced fiber-optic and 5G networks demands substantial investment, which can strain the budgets of smaller providers. It is further complicated by the rising costs of materials, equipment, and skilled labor. Extending services to rural and remote areas often entails logistical difficulties and limited immediate returns. Balancing competitive pricing with cost recovery is a critical issue in saturated markets. Continuous technological upgrades require ongoing expenditure, impacting profitability. Infrastructure deployment delays can slow down service adoption. These financial and operational burdens limit the speed and scale of market growth.

Regulatory Compliance and Competitive Pressures:

The Canada Telecommunication Services Market operates under strict regulatory frameworks that require significant compliance efforts. Meeting standards related to spectrum allocation, service quality, and data privacy involves ongoing investments. It faces intense competition from both established telecom giants and emerging digital service providers. Price-based competition can erode margins, while service innovation demands rapid adaptation to technological shifts. Regulatory changes may alter operational strategies or delay planned rollouts. Compliance with consumer protection regulations adds complexity to service management. Competitive intensity forces companies to continuously innovate to maintain relevance. These challenges require agility and resilience in business planning.

Market Opportunities:

Connectivity Expansion in Underserved Regions:

Extending connectivity to rural and remote regions presents a major opportunity for the Canada Telecommunication Services Market. Government funding and public-private partnerships create favorable conditions for infrastructure deployment. It allows operators to access untapped customer bases and enhance nationwide coverage. Emerging satellite internet technologies offer reliable alternatives for challenging terrains. Fixed wireless access solutions enable cost-effective expansion. Serving these areas contributes to both commercial growth and social development goals. Telecom companies can secure long-term loyalty by meeting critical connectivity needs. This opportunity also supports broader digital inclusion objectives.

Enterprise-Focused Service Innovation:

The growing need for advanced enterprise communication solutions creates strong potential for the Canada Telecommunication Services Market. Businesses demand secure, high-performance networks to support cloud adoption, remote work, and IoT-driven operations. It enables operators to offer tailored solutions such as dedicated bandwidth, managed IT services, and advanced cybersecurity. Sector-specific offerings in telehealth, e-learning, and smart manufacturing enhance value propositions. Collaborations with technology providers accelerate product innovation. Addressing niche industry requirements helps diversify revenue streams. This approach strengthens competitive positioning and drives sustained market growth.

Market Segmentation Analysis:

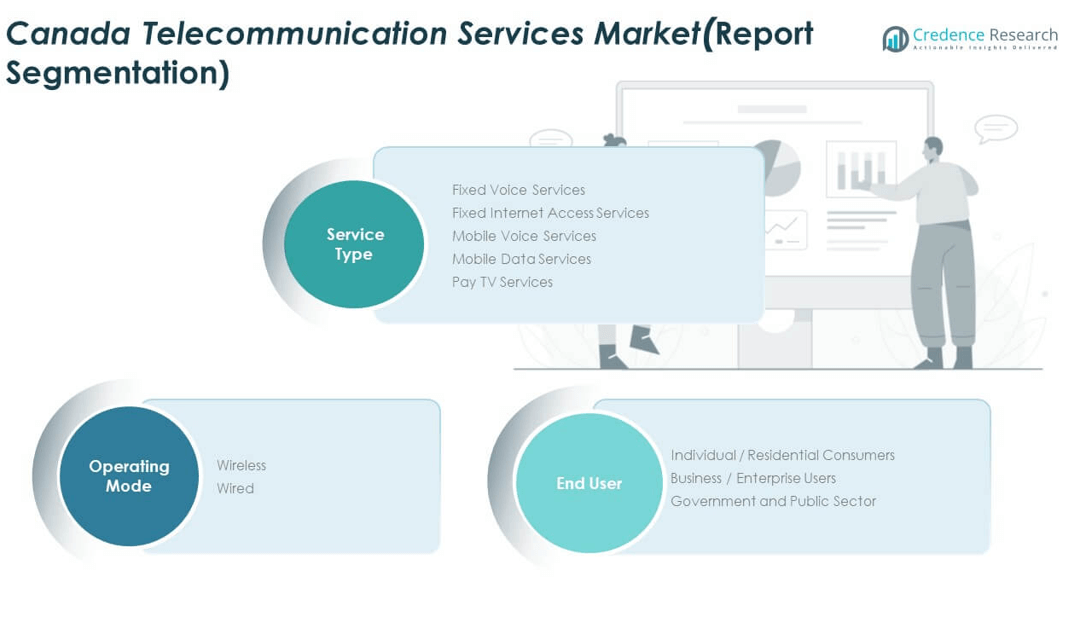

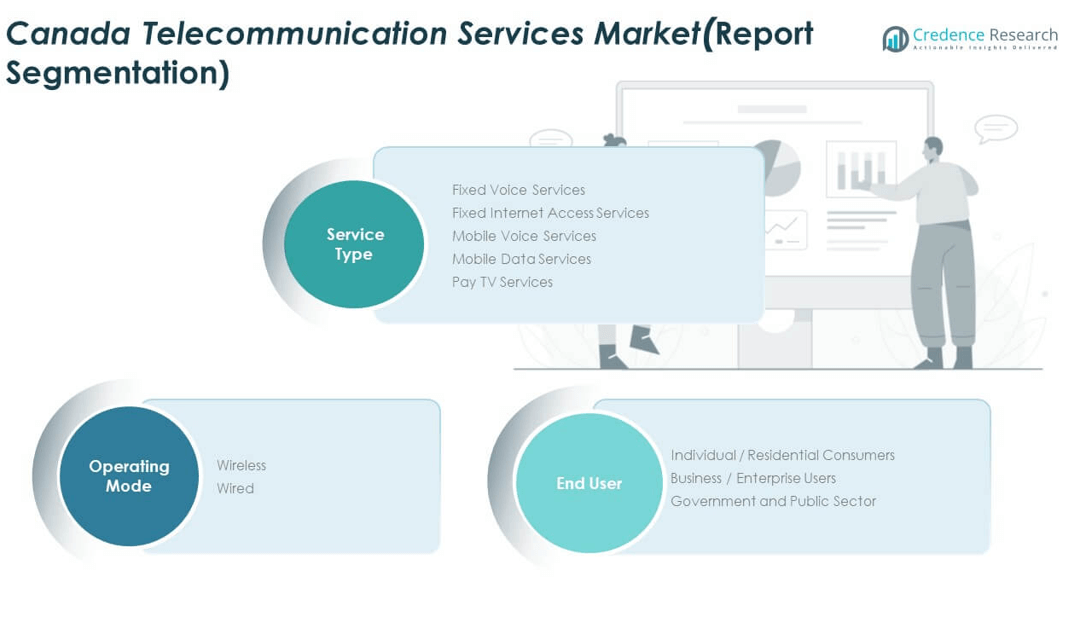

By Service Type

The Canada Telecommunication Services Market spans multiple service categories, each addressing distinct consumer and enterprise needs. Fixed voice services maintain relevance for legacy communication requirements, while fixed internet access services grow steadily through fiber-optic network expansion. Mobile voice services remain widely used, but mobile data services lead in demand, driven by rising smartphone adoption and data-intensive applications. Pay TV services sustain a stable customer base, supported by bundled offerings and partnerships for premium content delivery.

- For instance, Quebecor’s Videotron ended 2024 with 1,732,600 internet subscribers in Quebec and added hundreds of thousands of new lines via network expansions that now reach 80% of Canada’s population. Continued growth in mobile lines also reflects rising demand for mobile-first and bundled packages.

By Operating Mode

Wireless services dominate market share, benefiting from extensive 4G and 5G rollouts and the increasing preference for mobile-first communication solutions. Wired services retain strong adoption in urban centers and enterprise environments, where high-capacity fixed-line infrastructure supports critical operations. Both operating modes are essential in meeting diverse connectivity demands across regions.

- For example, TELUS PureFibre—Canada’s only 100% fiber-to-the-home network in Western Canada—reached millions of premises by mid-2025, with more than 3.3million premises covered and over 99% national LTE coverage in parallel. This dual-mode investment ensures the diverse and evolving connectivity needs of Canadians are met.

By End User

Individual and residential consumers form the largest market segment, emphasizing affordable and high-speed connectivity for everyday communication and entertainment. Business and enterprise users prioritize secure, scalable, and high-performance solutions to enable cloud adoption, IoT applications, and remote work capabilities. The government and public sector focus on secure and resilient communication networks to support public administration, essential services, and emergency response systems. This diversity in end-user demand underpins the market’s stability and growth potential.

Segmentation:

By Service Type

- Fixed Voice Services

- Fixed Internet Access Services

- Mobile Voice Services

- Mobile Data Services

- Pay TV Services

By Operating Mode

By End User

- Individual / Residential Consumers

- Business / Enterprise Users

- Government and Public Sector

Regional Analysis:

Western Canada

Western Canada holds a market share of 24.8% in the Canada Telecommunication Services Market, supported by robust infrastructure in Alberta, British Columbia, Manitoba, and Saskatchewan. The region benefits from a strong mix of urban and rural connectivity projects, with major cities like Vancouver and Calgary driving high adoption of broadband and mobile services. Investments in fiber-optic networks and 5G rollout are enhancing service quality, while satellite and fixed wireless solutions address remote community needs. The growing demand for advanced enterprise communication solutions in the energy, mining, and agriculture sectors supports revenue growth. Competitive pricing and bundled service packages are boosting subscriber retention. It maintains steady growth potential through continued government and private sector collaboration.

Central Canada

Central Canada accounts for 52.6% of the Canada Telecommunication Services Market, making it the dominant region due to the concentration of economic and population centers in Ontario and Quebec. Strong demand for high-speed internet, IPTV, and mobile services in urban hubs like Toronto, Ottawa, and Montreal fuels market expansion. The presence of corporate headquarters and technology hubs drives adoption of advanced data and cloud communication solutions. Infrastructure upgrades, such as fiber-to-the-home and expanded 5G coverage, are strengthening service reliability and capacity. It benefits from higher consumer purchasing power and strong uptake of bundled telecom offerings. Strategic partnerships between telecom providers and content streaming companies are also contributing to market leadership.

Atlantic Canada and Northern Territories

Atlantic Canada and the Northern Territories hold a combined market share of 22.6%, with growth driven by initiatives to close connectivity gaps in rural and remote areas. Provinces like Nova Scotia, New Brunswick, and Newfoundland and Labrador are seeing steady adoption of mobile and broadband services, supported by government-backed rural internet programs. In the Northern Territories, satellite and fixed wireless remain critical for service delivery due to challenging geography and sparse populations. It faces higher infrastructure costs, but partnerships with technology providers are improving network efficiency. Demand for reliable communication in fishing, tourism, and government sectors is supporting market stability. Ongoing digital inclusion efforts are expected to sustain gradual growth in these regions.

Key Player Analysis:

- Rogers Communications Inc.

- Bell Canada

- Canada Tower Inc.

- Quebecor Group

- Telus Corporation

- Acushnet Company

- SaskTel

- TeraGo Networks

- Xplornet Communications

- Iristel Inc.

- Other Key Players

Competitive Analysis:

The Canada Telecommunication Services Market is dominated by a few large, vertically integrated players with extensive infrastructure and nationwide coverage. It is characterized by the strong presence of incumbents such as Rogers Communications, BCE Inc. (Bell Canada), and Telus Corporation, alongside emerging regional operators and niche service providers. Competitive strategies focus on 5G deployment, bundled service offerings, and digital platform integration. Operators compete on network quality, customer experience, and value-added services while investing in advanced technologies such as IoT, AI-driven analytics, and cloud solutions. Strategic partnerships and mergers strengthen market positioning and service capabilities.

Recent Developments:

- In July 2025, Rogers Communications Inc. introduced a new satellite-to-mobile text messaging service called Rogers Satellite, available via a free beta trial to all Canadians through October. This launch is the result of strategic partnerships with SpaceX and Lynk Global and aims to expand coverage—especially in Canada’s most remote regions—by leveraging direct-to-device (D2D) satellite connectivity.

- In November 2024, Bell Canada (BCE) reached a definitive agreement to acquire Ziply Fiber, a major fiber internet provider in the Pacific Northwest of the U.S., for about C$7 billion including debt. The FCC approved this transaction in July 2025, allowing Bell to significantly expand its fiber footprint, aiming to cover more than 12 million locations across North America by 2028. This deal is part of Bell’s strategy to diversify its operating landscape and access growth in the underpenetrated U.S. fiber market.

- In March 2025, Northleaf Capital Partners announced a strategic partnership with Shared Tower Inc. (operating as Canada Tower Inc.), pledging an initial C$100 million investment to accelerate the development of shared telecom infrastructure. The collaboration aims to improve connectivity across Canada under a shared infrastructure model, providing long-term benefits for consumers and service providers.

Market Concentration & Characteristics:

The Canada Telecommunication Services Market exhibits high concentration, with a small number of major players controlling the majority share. It is defined by extensive capital investment requirements, significant regulatory oversight, and strong brand loyalty among consumers. Barriers to entry remain high due to the need for large-scale infrastructure and spectrum licensing. The market demonstrates stable revenue streams supported by long-term contracts, bundled offerings, and recurring service demand. Continuous technological innovation, such as 5G expansion and fiber network upgrades, drives competitive differentiation.

Report Coverage:

The research report offers an in-depth analysis based on Service Type, Operating Mode, and End User segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of 5G coverage into rural and underserved areas.

- Rising demand for high-speed fiber-optic internet services.

- Increased adoption of IoT-enabled applications across industries.

- Growth in cloud-based communication and collaboration tools.

- Enhanced focus on AI-powered network optimization.

- Strategic mergers and partnerships to expand service portfolios.

- Development of sustainable and energy-efficient infrastructure.

- Greater integration of satellite internet for remote connectivity.

- Intensified competition through bundled service offerings.

- Expansion into enterprise-grade digital solutions and managed services.