Market Overview

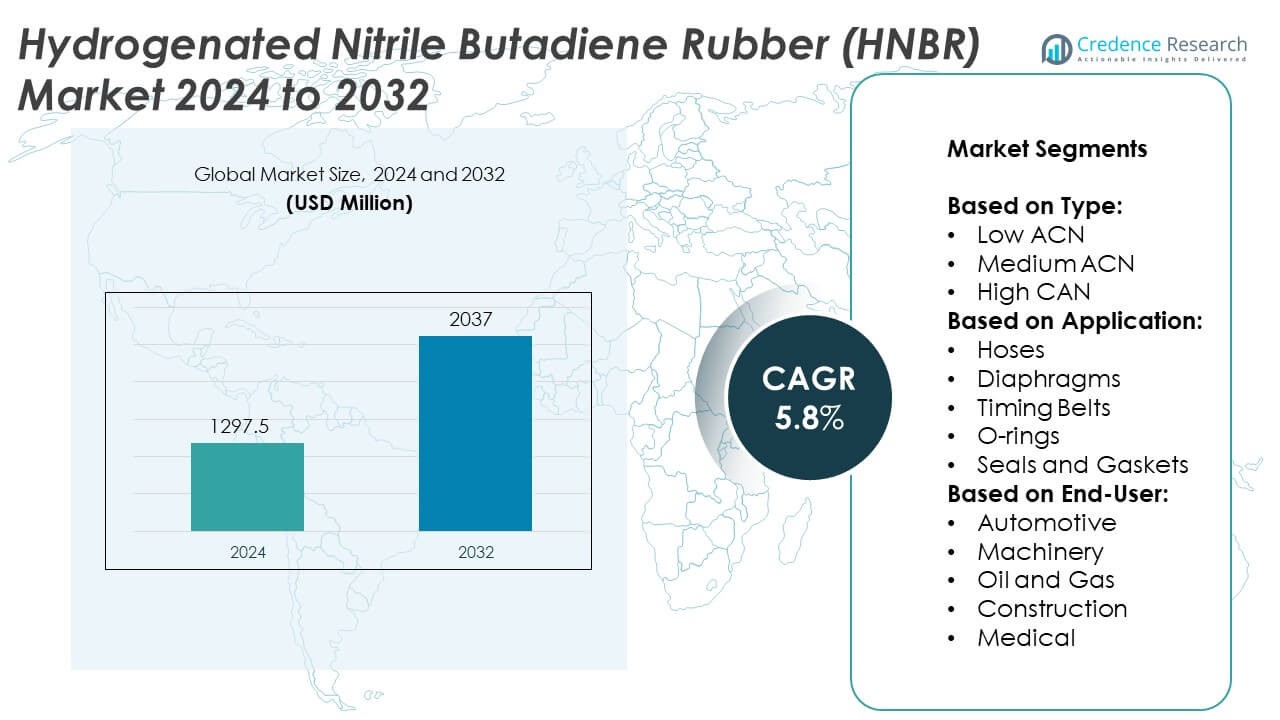

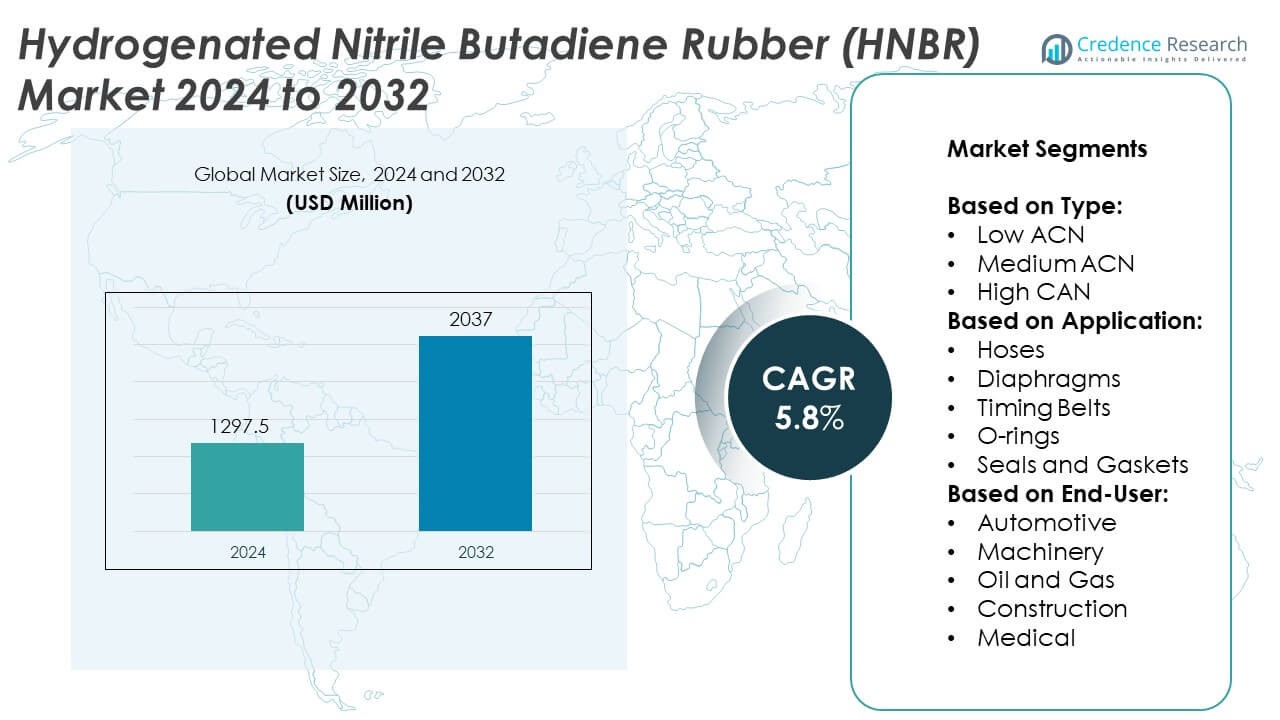

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market size was valued at USD 1297.5 million in 2024 and is anticipated to reach USD 2037 million by 2032, growing at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydrogenated Nitrile Butadiene Rubber (HNBR) market Size 2024 |

USD 1297.5 Million |

| Hydrogenated Nitrile Butadiene Rubber (HNBR) market , CAGR |

5.8% |

| Hydrogenated Nitrile Butadiene Rubber (HNBR) market Size 2032 |

USD 2037 Million |

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market grows steadily due to rising demand for high-performance sealing materials in automotive, oil and gas, and industrial machinery sectors. Its superior resistance to heat, oil, and chemicals drives adoption in advanced engines, hydraulic systems, and energy equipment. Increasing use in electric vehicles and offshore drilling expands its relevance. Material innovation, including customized compounds with enhanced durability and flexibility, strengthens its appeal across emerging applications.

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market exhibits strong geographical presence across Asia-Pacific, North America, and Europe, driven by robust automotive manufacturing, industrial development, and oilfield activities. Asia-Pacific leads in production and consumption due to its expanding automotive base and rapid industrialization. North America and Europe show steady demand supported by advanced manufacturing and stringent quality standards. Key players such as Zeon Corporation, Lanxess AG, and Parker Hannifin Corporation play a vital role in driving innovation, expanding product portfolios, and strengthening supply chains through global operations and strategic partnerships across diverse end-use industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hydrogenated Nitrile Butadiene Rubber (HNBR) market was valued at USD 1297.5 million in 2024 and is expected to reach USD 2037 million by 2032, growing at a CAGR of 5.8% during the forecast period.

- The market is driven by increasing demand for high-performance sealing materials across automotive, oil and gas, and industrial sectors due to HNBR’s superior resistance to heat, oil, and aggressive chemicals.

- Growing adoption in electric and hybrid vehicles, along with expanded use in offshore drilling and renewable energy systems, continues to shape new growth opportunities for HNBR-based components.

- Key market players including Zeon Corporation, Lanxess AG, and Parker Hannifin Corporation focus on material innovation, compound customization, and expansion of regional manufacturing capabilities to strengthen their competitive position.

- High production costs, raw material volatility, and complex hydrogenation processes remain significant restraints limiting broader adoption, particularly in cost-sensitive applications.

- Regionally, Asia-Pacific leads the market due to its strong manufacturing base and growing industrial demand, followed by North America and Europe, which maintain steady growth through advanced engineering applications and high-quality standards.

- The market reflects a clear trend toward durable, emission-compliant elastomers, with increasing interest in tailored compounds that meet performance needs in regulated and high-cycle environments across automotive, energy, and industrial systems.

Market Drivers

Rising Demand from Automotive Sector for High-Performance Sealing Solutions

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market benefits significantly from the automotive industry’s need for durable sealing components. HNBR exhibits superior resistance to heat, oil, fuel, and mechanical stress, making it ideal for timing belts, O-rings, and gaskets. Original equipment manufacturers (OEMs) rely on it to enhance the reliability of powertrain and air conditioning systems. With the shift toward turbocharged and high-efficiency engines, the material’s thermal stability becomes even more critical. Regulatory pressure on emission standards compels automakers to adopt more robust materials. The Hydrogenated Nitrile Butadiene Rubber (HNBR) market gains traction through these consistent performance demands.

- For instance, KACO GmbH + Co. KG integrates HNBR in its dynamic shaft sealing systems used in modern combustion and hybrid powertrains, supporting thermal resistance up to 160°C in continuous operation.

Expanding Use in Oil and Gas Applications Demanding Chemical Resistance

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market grows due to its increasing application in oil and gas exploration and production. Its resistance to sour gas, high pressures, and aggressive chemicals positions it well for seals, blowout preventers, and packers. It maintains structural integrity under downhole conditions where standard elastomers often fail. The push for deeper drilling and enhanced oil recovery requires materials that perform in extreme environments. Operators value it for reducing downtime and operational risk in offshore and onshore assets. The Hydrogenated Nitrile Butadiene Rubber (HNBR) market expands with these critical functional advantages.

- For instance, Lanxess AG introduced a new low-temperature HNBR grade designed for industrial applications that sustain tensile strength over 14 MPa after 70 hours of oil immersion at 150°C, outperforming conventional HNBR compounds.

Strong Growth in Industrial Equipment Requiring Long Service Life

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market sees sustained growth in industrial machinery, where component durability is essential. Equipment manufacturers specify it for hydraulic seals, bearings, and conveyor belts exposed to oils and fluctuating temperatures. Its ability to retain elasticity and tensile strength over long periods supports extended maintenance intervals. Plant operators prioritize materials that reduce failure rates and improve uptime. The rubber’s compatibility with hydraulic fluids and resistance to abrasion supports a range of mechanical systems. The Hydrogenated Nitrile Butadiene Rubber (HNBR) market aligns with these operational efficiency goals.

Regulatory Push Toward Sustainable Materials with Enhanced Performance

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market responds to regulatory emphasis on material safety, emissions, and durability. Industries are replacing older elastomers that degrade under thermal and chemical stress. It offers a balance between performance and compliance, reducing the need for frequent replacements. Manufacturers are adopting it in safety-critical systems across aerospace, medical, and power generation sectors. These sectors require materials that ensure consistent sealing and insulation over long durations. The Hydrogenated Nitrile Butadiene Rubber (HNBR) market strengthens its position through proven reliability and evolving application standards

Market Trends

Integration of HNBR in Hybrid and Electric Vehicle Components

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market reflects growing alignment with the shift toward hybrid and electric vehicles. Automakers use HNBR in battery cooling systems, thermal management modules, and electric drive units. It offers enhanced sealing and thermal resistance in compact and high-voltage environments. OEMs value its ability to maintain performance across wide temperature ranges without degradation. The increase in EV production drives demand for reliable elastomeric components. The Hydrogenated Nitrile Butadiene Rubber (HNBR) market advances through its proven adaptability to evolving automotive platforms.

- For instance, material data published by Rahco Rubber, Inc. shows HNBR can withstand continuous operating temperatures up to 325 °F (approximately 163 °C) and retains functional properties down to –40 °F (approximately –40 °C).

Increased Preference for High-Temperature and Oil-Resistant Elastomers

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market observes a shift toward materials that sustain performance under elevated temperatures and prolonged oil exposure. Manufacturers in automotive, oilfield, and industrial sectors prefer it over conventional nitrile rubbers. It meets operational demands in equipment exposed to synthetic lubricants and aggressive fuels. The material’s capacity to retain mechanical properties under stress supports its broader use. New product designs often specify HNBR due to reliability under thermal cycling. The Hydrogenated Nitrile Butadiene Rubber (HNBR) market evolves to meet stringent technical requirements across sectors.

- For instance, Polycomp offers peroxide-crosslinked HNBR compounds with tensile strength exceeding 20 MPa and compression set below 25% after 70 hours at 150°C, making them suitable for long-duration oil exposure in industrial and automotive applications.

Ongoing Material Innovation and Compound Customization by Suppliers

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market benefits from investments in compound engineering and material customization. Suppliers develop HNBR grades with tailored hardness, color, and compression set to meet specific industry needs. It enables end-users to optimize performance for sealing, damping, or insulation. Custom formulations with enhanced peroxide resistance or improved low-temperature flexibility support niche applications. Collaboration between material scientists and OEMs drives compound diversification. The Hydrogenated Nitrile Butadiene Rubber (HNBR) market advances through these precision-engineered product innovations.

Rising Application in Sealing Systems Beyond Automotive and Energy Sectors

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market expands into healthcare, food processing, and industrial automation segments. These industries require elastomers that are both chemically resistant and compliant with safety standards. It supports sanitary sealing systems and mechanical components exposed to frequent cleaning cycles. HNBR meets performance expectations while addressing material compatibility with aggressive media. Demand increases for FDA-compliant and biocompatible variants in regulated environments. The Hydrogenated Nitrile Butadiene Rubber (HNBR) market adapts to these cross-industry functional requirements.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes Limit Wider Adoption

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market faces challenges due to high production costs and complex hydrogenation processes. It requires specialized catalysts and controlled processing conditions, increasing input expenses for manufacturers. These factors create pricing pressure, especially in cost-sensitive markets such as automotive aftermarket and general industrial applications. Competing elastomers like EPDM and conventional nitrile offer lower-cost alternatives, limiting substitution unless performance demands justify the premium. Manufacturers must manage cost-performance trade-offs while maintaining quality and compliance. The Hydrogenated Nitrile Butadiene Rubber (HNBR) market must address these economic constraints to penetrate broader applications.

Volatile Raw Material Supply Chain and Dependence on Petrochemical Feedstock

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market remains exposed to fluctuations in raw material availability and petrochemical feedstock pricing. Butadiene and acrylonitrile, key precursors, experience periodic supply disruptions due to refinery maintenance, regulatory shifts, or geopolitical tensions. This volatility affects pricing stability and long-term supply planning. It impacts contract negotiations with OEMs and tier suppliers who require predictable cost structures. Environmental regulations targeting refinery operations may further influence feedstock availability. The Hydrogenated Nitrile Butadiene Rubber (HNBR) market must build resilient sourcing strategies to mitigate these risks and ensure supply continuity.

Market Opportunities

Expansion of Green Energy Infrastructure and Oilfield Redevelopment Projects

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market presents strong growth potential in green energy and advanced oilfield operations. Renewable energy assets such as wind turbines and hydrogen production units demand high-performance sealing materials. HNBR’s durability under thermal and chemical stress supports its use in turbine gearboxes, electrolyzers, and transmission systems. Oilfield redevelopment projects in North America, the Middle East, and Southeast Asia require robust elastomers for deep-well completion tools. It enables energy operators to maintain operational efficiency and minimize downtime. The Hydrogenated Nitrile Butadiene Rubber (HNBR) market gains momentum from these energy-sector investment cycles.

Emerging Demand from Medical, Food Processing, and Robotics Applications

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market captures new opportunities in regulated industries seeking high-purity and chemically stable elastomers. Medical device manufacturers use it for seals in diagnostic equipment and fluid handling systems. The food processing sector requires materials that resist cleaning agents while complying with FDA and EU safety standards. Robotics and automation segments apply HNBR in pneumatic actuators and dynamic joints due to its mechanical resilience. It performs consistently in sterile, high-cycle environments where failure risks are unacceptable. The Hydrogenated Nitrile Butadiene Rubber (HNBR) market leverages these specialized applications to diversify end-use opportunities.

Market Segmentation Analysis:

By Type:

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market divides into low ACN, medium ACN, and high ACN grades based on acrylonitrile content. Low ACN variants offer superior flexibility and cold resistance, making them suitable for dynamic applications in colder climates. Medium ACN grades provide a balance between oil resistance and mechanical strength, widely used in industrial seals and automotive parts. High ACN types deliver excellent resistance to fuels, oils, and high-pressure environments, often applied in oil and gas components. It allows OEMs to tailor material performance to specific operational demands. The versatility of these grades supports their integration into high-performance systems across industries.

- For instance, DP Seals specifies HNBR seals with tensile strength over 3,500 psi (≥ 3.5 thousand psi), compression set between 5–20%, and suitability for service from –50 °C to 150 °C.

By Application:

Key applications in the Hydrogenated Nitrile Butadiene Rubber (HNBR) market include hoses, diaphragms, timing belts, O-rings, and seals and gaskets. Hoses lead the segment due to their use in automotive, hydraulic, and chemical fluid transfer systems. O-rings and gaskets follow closely, supported by growing demand for leak-proof assemblies in high-pressure and high-temperature environments. Timing belts use HNBR for its resistance to abrasion, thermal cycling, and fuel exposure, essential in advanced engine systems. Diaphragms benefit from the material’s strength and flexibility in fuel control and braking systems. It ensures consistent sealing and mechanical stability across a range of motion-intensive components.

- For Instance, Ge Mao Rubber Industrial Co. Ltd. produces HNBR-lined fuel hoses rated for continuous exposure up to 150°C and pressure resistance above 2 MPa, used in under-hood and powertrain fluid transfer systems.

By End-User:

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market serves end-users in automotive, machinery, oil and gas, construction, and medical sectors. Automotive dominates the segment, driven by the need for durable elastomers in powertrain and under-the-hood applications. Machinery utilizes HNBR in dynamic seals and hydraulic systems, where thermal and chemical resistance is essential. Oil and gas operations adopt it in exploration equipment, packers, and valves exposed to high pressure and sour gas. The construction industry relies on HNBR for long-lasting seals in infrastructure and HVAC systems. It also supports medical device manufacturers requiring biocompatible and chemically stable elastomers in fluid delivery and diagnostic systems.

Segments:

Based on Type:

- Low ACN

- Medium ACN

- High CAN

Based on Application:

- Hoses

- Diaphragms

- Timing Belts

- O-rings

- Seals and Gaskets

Based on End-User:

- Automotive

- Machinery

- Oil and Gas

- Construction

- Medical

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 28.4% of the global Hydrogenated Nitrile Butadiene Rubber (HNBR) market in 2024. The region benefits from a mature automotive manufacturing base, particularly in the United States and Mexico, where HNBR is extensively used in under-the-hood components, timing belts, and fuel system seals. The oil and gas industry in the U.S., especially in shale exploration and offshore production, drives strong demand for HNBR-based sealing systems, gaskets, and packers. It supports critical performance in high-pressure environments and aggressive chemical media. Machinery and industrial equipment manufacturers across the Midwest integrate HNBR in hydraulic applications requiring long service intervals. Ongoing investments in refining, petrochemical upgrades, and emission control technologies further reinforce regional adoption. North America’s focus on performance reliability, coupled with technological maturity, maintains its strong market position.

Europe

Europe represented 25.6% of the global Hydrogenated Nitrile Butadiene Rubber (HNBR) market in 2024. The region benefits from high automotive output in Germany, France, and Italy, where OEMs adopt HNBR for high-performance elastomer applications. Demand for long-life seals and gaskets in hybrid and electric powertrain systems remains strong. The presence of well-established industrial machinery and automation companies increases usage in rotary seals, diaphragms, and vibration dampers. Stricter environmental standards across the EU push industries toward advanced elastomers with longer operational life and chemical resistance. The oil and gas sector in the North Sea continues to support HNBR demand for offshore equipment requiring durability under corrosive and high-temperature conditions. It holds a critical role in supporting Europe’s transition toward efficient and low-maintenance engineering systems.

Asia-Pacific

Asia-Pacific held the largest share of the Hydrogenated Nitrile Butadiene Rubber (HNBR) market at 32.1% in 2024. China, Japan, South Korea, and India remain central to regional growth due to their expanding automotive, manufacturing, and energy sectors. The rise in electric vehicle production in China and Japan boosts demand for HNBR components used in battery systems and electric drive assemblies. Rapid industrialization and infrastructure development in Southeast Asia create new avenues for hoses, seals, and diaphragms. The oil and gas sector in China and Australia increasingly integrates HNBR for long-life sealing components in upstream operations. Regional manufacturers invest in HNBR-based solutions to meet growing domestic and export market needs. It anchors its dominance on cost-effective manufacturing, high-volume output, and rising material quality standards.

Latin America

Latin America captured 7.4% of the global Hydrogenated Nitrile Butadiene Rubber (HNBR) market in 2024. Brazil and Mexico lead demand due to their automotive production and oilfield activities. The automotive industry uses HNBR for O-rings, gaskets, and transmission components in mid-range and commercial vehicles. Oil and gas exploration in Brazil’s offshore reserves increases requirements for high-performance sealing elastomers. Industrial equipment manufacturing in Argentina and Colombia further supports steady uptake of HNBR in hydraulic systems. Market penetration remains moderate due to economic volatility, yet manufacturers show growing interest in durable elastomers. It maintains relevance through regional adaptation and export-driven supply chains.

Middle East & Africa

The Middle East & Africa accounted for 6.5% of the Hydrogenated Nitrile Butadiene Rubber (HNBR) market in 2024. Oilfield applications across Saudi Arabia, the UAE, and Nigeria dominate regional consumption. HNBR’s high resistance to sour gas, temperature extremes, and aggressive drilling fluids makes it critical in sealing systems for deep-well and offshore operations. Infrastructure and construction sectors in the Gulf countries use it in HVAC, water management, and industrial sealing systems. South Africa’s automotive and mining industries create additional application areas for HNBR-based components. Regional demand remains concentrated in energy-centric economies with a growing push for operational efficiency. It supports critical infrastructure through material resilience and long service life.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Zeon Corporation

- Lianda Corporation

- Dawn Group Co. Ltd

- Kaco GmbH + Co. KG

- Rahco Rubber Inc

- Seal & Design Inc.

- Polycomp

- Mantaline

- Parker Hannifin Corporation

- Ge Mao Rubber Industrial Co. Ltd

- Lanxess AG

Competitive Analysis

The competitive landscape of the Hydrogenated Nitrile Butadiene Rubber (HNBR) market features leading players such as Zeon Corporation, Lanxess AG, Parker Hannifin Corporation, Mantaline, Kaco GmbH + Co. KG, Dawn Group Co. Ltd, Polycomp, Lianda Corporation, Rahco Rubber Inc, Ge Mao Rubber Industrial Co. Ltd, and Seal & Design Inc. These companies compete on product quality, compound customization, global distribution, and technical support across end-use industries. They invest heavily in R&D to develop HNBR grades with enhanced temperature resistance, fuel compatibility, and mechanical durability. Manufacturers aim to support evolving applications in electric vehicles, deep-well drilling, and advanced industrial equipment. Many players expand their reach through strategic partnerships with OEMs and industrial system integrators to align product performance with end-user specifications. Regional manufacturing hubs and vertical integration provide cost and supply chain advantages, especially in Asia-Pacific. Sustainability and regulatory compliance also shape competition, with firms introducing formulations that meet environmental and safety standards. Technical service, material traceability, and rapid prototyping capabilities further differentiate suppliers in high-specification markets. The HNBR market remains moderately consolidated, with key players holding strong global positions while regional firms compete on niche formulations and responsiveness to localized needs. Competitive focus centers on performance reliability, customer collaboration, and operational flexibility.

Recent Developments

- In June 2025, the company Dawn Group Co. Ltd launched “Shandong Dawn HNBR polymers,” promoting high-performance elastomers with superior thermal stability.

- In 2024, Lanxess AG introduced a new HNBR grade with enhanced low-temperature flexibility targeting aerospace and Arctic pipeline markets, improving performance in sub‑zero environments.

- In 2023, Zeon expanded its HNBR production facility in Pasadena, Texas, increasing capacity by 25% (approximately 2,000 metric tons per year).

Market Concentration & Characteristics

The Hydrogenated Nitrile Butadiene Rubber (HNBR) market displays a moderately concentrated structure, with a few global players controlling a significant share of production capacity and technological expertise. It is characterized by high entry barriers due to complex hydrogenation processes, capital-intensive manufacturing, and the need for advanced R&D capabilities. The market emphasizes performance consistency, regulatory compliance, and material customization, especially for critical applications in automotive, oil and gas, and industrial equipment. Buyers demand long product life cycles, chemical resistance, and thermal stability, placing pressure on suppliers to maintain quality and technical precision. It supports long-term contracts and strong OEM relationships, often requiring co-development of specialized grades. The industry values vertical integration for raw material control and manufacturing efficiency, particularly in Asia-Pacific. Product differentiation occurs through compound formulation, end-use certification, and application-specific support. The market continues to evolve toward sustainability, with a growing focus on low-emission, durable elastomers that reduce maintenance and downtime. It remains sensitive to shifts in energy markets, industrial investment, and automotive trends, reinforcing the importance of innovation, logistics capability, and responsive technical service in maintaining competitive positioning.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Hydrogenated Nitrile Butadiene Rubber (HNBR) market will see steady growth driven by increased demand from automotive and industrial sectors.

- Rising adoption of electric vehicles will expand the use of HNBR in thermal management and battery systems.

- Oil and gas applications will continue to support long-term demand due to the material’s chemical and pressure resistance.

- Manufacturers will invest more in compound innovation to meet evolving regulatory and performance standards.

- Asia-Pacific will remain the dominant production and consumption region due to its industrial expansion and cost advantages.

- HNBR will gain traction in medical and food-grade applications requiring clean, compliant elastomers.

- Advanced machinery and automation will rely on HNBR for durable seals in high-cycle operations.

- Global suppliers will focus on improving supply chain resilience and reducing lead times.

- Sustainability goals will encourage the development of longer-life, low-maintenance HNBR materials.

- Strategic partnerships between material producers and OEMs will shape future product development and application alignment.