Market Overview

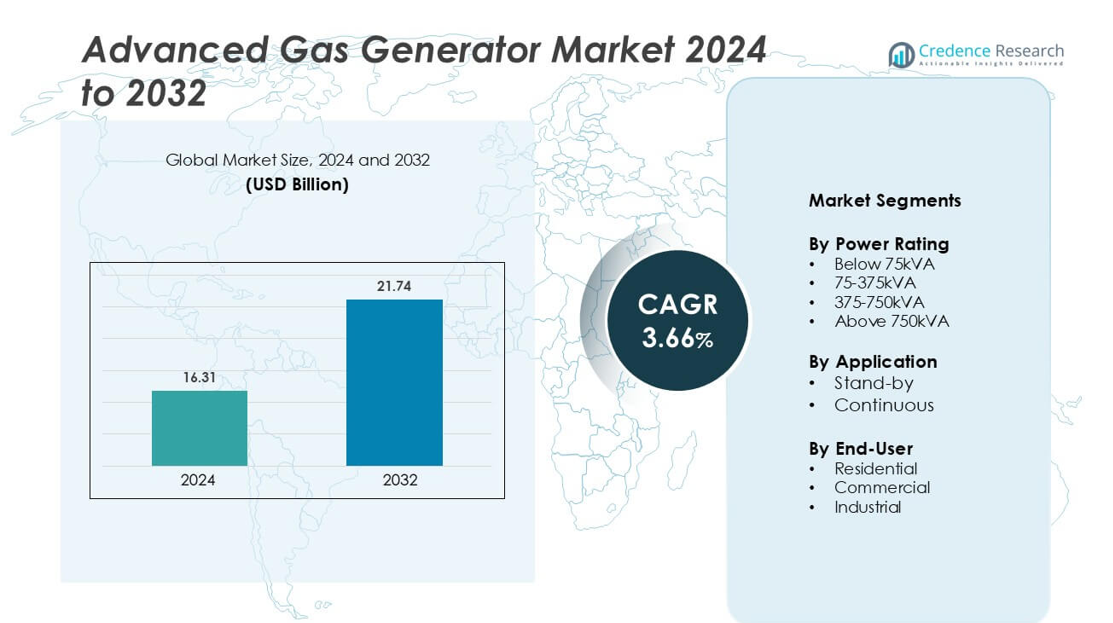

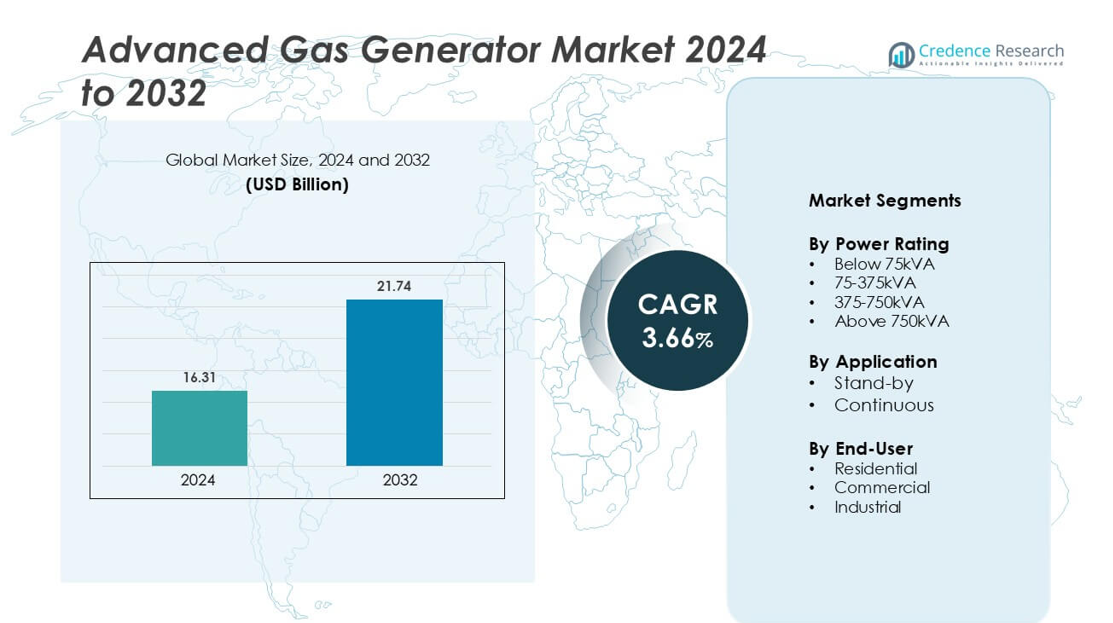

Advanced gas generator Market size was valued USD 16.31 billion in 2024 and is anticipated to reach USD 21.74 billion by 2032, at a CAGR of 3.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Advanced Gas Generator Market Size 2024 |

USD 16.31 billion |

| Advanced Gas Generator Market, CAGR |

3.66% |

| Advanced Gas Generator Market Size 2032 |

USD 21.74 billion |

Advanced gas generator market is shaped by leading global and regional manufacturers that focus on innovation and efficiency. Key players include Cummins Inc., Inmesol S.L.U, Kirloskar Electric Co. Ltd, Briggs & Stratton, Atlas Copco, Generac Power Systems, FG Wilson, Caterpillar Inc., Aggreko, Kohler-SDMO, Himoinsa, Ingersoll Rand, and American Honda Motor Company, Inc. These companies invest in advanced engine technology, hybrid solutions, IoT integration, and real-time monitoring systems to enhance performance and durability. North America leads the global market with a 32% market share, supported by high industrial demand and robust infrastructure. Europe and Asia-Pacific follow, benefiting from growing industrialization, infrastructure projects, and supportive clean energy regulations. Strategic collaborations, capacity expansions, and technology upgrades continue to define competition, driving strong market consolidation and innovation.

Market Insights

- The advanced gas generator market was valued at USD 16.31billion in 2024 and is projected to reach USD 21.74 billion by 2032, growing at a CAGR of 3.66% during the forecast period.

- Rising demand for reliable backup power and the shift from diesel to gas systems are driving adoption across industrial, commercial, and residential sectors.

- Increasing integration of IoT, smart monitoring, and hybrid energy systems is a key trend shaping the market’s technological evolution.

- Leading companies such as Cummins Inc., Caterpillar Inc., Atlas Copco, and Generac Power Systems are focusing on advanced product design, fuel efficiency, and distribution network expansion to stay competitive.

- North America holds 32% of the market share, followed by Asia-Pacific at 28% and Europe at 25%. The 75–375 kVA segment dominates the market, supported by high demand from industrial and commercial facilities, particularly in manufacturing, healthcare, and data center applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Rating

The 75–375 kVA segment dominates the advanced gas generator market with the highest market share. This range supports both commercial and small industrial operations, offering reliable backup and primary power solutions. Its balanced performance and compact design make it suitable for critical facilities like hospitals, data centers, and manufacturing units. Strong demand in regions with growing infrastructure investments and frequent power fluctuations drives adoption. Manufacturers are also enhancing fuel efficiency and control technologies in this segment to reduce operational costs and improve energy output, further strengthening its position in the market.

- For instance, 75 kVA Three‑Phase Industrial Generator delivers 75 kVA output and comes with a 3200 × 1250 × 1500 mm enclosure, making it compact for critical facilities. Its balanced performance and compact design make it suitable for hospitals, data centers, and manufacturing units.

By Application

The stand-by application segment holds the largest market share in the advanced gas generator market. Businesses and institutions rely on standby systems to ensure uninterrupted power during grid failures. Their fast start-up capability, low maintenance needs, and integration with automated transfer switches make them highly efficient in critical situations. This segment gains strong traction in commercial buildings, healthcare facilities, and data-driven industries. Rising concerns over energy reliability, coupled with stricter safety regulations, drive investments in advanced standby systems, supporting widespread adoption across both developed and emerging markets.

- For instance, the Cummins Quiet Connect RS13A Standby Generator delivers 13 kW output with an alternator utilizing long-life DC brushes and a 3600 RPM engine designed for automatic transfer switch integration.

By End-User

The industrial segment leads the advanced gas generator market with the largest market share. Industrial facilities demand continuous and reliable power for process stability, equipment safety, and operational efficiency. These generators are used in manufacturing, oil and gas, chemical, and heavy engineering sectors. High load capacity, robust performance, and extended operational life are key factors boosting their adoption. Rising industrialization, especially in Asia-Pacific and the Middle East, further supports demand. Companies are increasingly adopting advanced systems with real-time monitoring and optimized fuel consumption to ensure maximum uptime and operational resilience.

Key Growth Drivers

Rising Demand for Reliable Backup Power

The growing dependence on uninterrupted power supply across industries is driving demand for advanced gas generators. Power outages can disrupt critical operations in sectors such as healthcare, manufacturing, telecommunications, and data centers. Gas generators provide clean, reliable, and fast backup power, ensuring operational continuity. Urbanization and infrastructure development further increase the need for stable power solutions, especially in regions with unstable grid networks. Many organizations also prefer gas generators for their lower emissions and reduced maintenance compared to diesel units. The ability to deliver consistent power during emergencies makes gas generators a preferred choice for both commercial and industrial applications.

- For instance, the HSK78G gas generator series from Cummins operates at ISO electrical efficiency of 42.3 % and accepts low-BTU gas with Methane Index as low as 55.

Expansion of Industrial and Commercial Infrastructure

The rapid growth of industrial and commercial infrastructure globally is a strong driver for the advanced gas generator market. Manufacturing units, commercial complexes, logistics hubs, and healthcare facilities require dependable power systems for critical operations. Gas generators support both standby and continuous power applications, offering flexibility and durability. Government-led infrastructure projects in emerging economies also increase adoption. Companies are modernizing facilities with efficient power systems to reduce downtime and improve energy security. The growing integration of automated power management systems further strengthens market penetration across large-scale facilities and infrastructure projects.

- For instance, Atlas Copco’s QAS generator range (25 kVA to 625 kVA) features a fully overhauled design, start-to-stable power in under six seconds and paralleling up to 20 MVA, suited for large industrial installations. Companies are modernizing facilities with efficient power systems to reduce downtime and improve energy security.

Shift Toward Cleaner and Efficient Power Solutions

The transition to cleaner energy sources is fueling the demand for advanced gas generators. These systems emit lower greenhouse gases compared to diesel units, aligning with global sustainability goals. Stringent emission norms and decarbonization policies are encouraging industries to adopt gas-based power solutions. Manufacturers are developing generators with improved combustion technology, higher fuel efficiency, and lower noise levels. The ability to run on natural gas, LPG, or biogas enhances their versatility. This cleaner, efficient power alternative is gaining traction among industries seeking sustainable operations without compromising on performance and reliability.

Key Trends & Opportunities

Integration of Smart Monitoring and Control Systems

Digitalization is transforming the advanced gas generator market with the integration of IoT-enabled monitoring and control technologies. Real-time data analytics and remote diagnostics allow operators to track performance, predict failures, and optimize maintenance schedules. This reduces downtime and extends equipment life. Smart generators with cloud-based platforms enhance operational transparency and support energy management strategies. The adoption of automated control systems also improves load management, ensuring higher efficiency. As industries move toward Industry 4.0 standards, the demand for intelligent power solutions creates significant opportunities for manufacturers and technology providers.

- For instance, Cummins Inc.’ PowerCommand Cloud platform delivers 24/7 remote monitoring and allows multi-location asset control via web or mobile access.

Growing Adoption of Hybrid Power Solutions

The rise of hybrid energy systems combining gas generators with renewable energy sources is opening new opportunities. Many businesses are integrating solar and wind power with gas-based generation to ensure a stable and efficient energy supply. Hybrid solutions optimize fuel consumption, lower operational costs, and enhance energy resilience. They also support sustainability goals by reducing reliance on fossil fuels. Industrial users, commercial buildings, and remote facilities benefit from hybrid models due to their flexible power configurations and scalability. This trend is expected to drive significant technological advancements and partnerships across the energy ecosystem.

- For instance, HIMOINSA’s gas-generator models paired with photovoltaic arrays deliver approximately 30 % of energy from solar and 70 % from the generator’s output in hybrid setups.

Expanding Demand from Emerging Markets

Emerging economies are witnessing strong growth in industrialization and infrastructure investments, creating new opportunities for gas generator suppliers. Regions like Asia-Pacific, Latin America, and the Middle East are investing heavily in manufacturing, energy, and logistics sectors. Power grid instability and increasing energy consumption encourage businesses to adopt advanced power backup solutions. Governments are also supporting cleaner energy technologies, accelerating the shift from diesel to gas generators. The expansion of SMEs and commercial facilities further broadens the addressable market. This growing demand from developing regions is a major opportunity for global players.

Key Challenges

High Initial Investment and Installation Costs

The advanced gas generator market faces challenges due to the high capital investment required for equipment procurement and installation. Compared to diesel units, gas generators involve higher setup costs, including fuel infrastructure and system integration. For small and medium businesses, this upfront expense can act as a barrier to adoption. Complex installation processes and the need for specialized maintenance further add to overall costs. While long-term operational savings are significant, the initial financial burden often delays procurement decisions. Overcoming this challenge requires financing solutions and cost-efficient product designs.

Inconsistent Fuel Supply and Infrastructure Gaps

Another major challenge is the inconsistent availability of natural gas and supporting infrastructure, especially in developing regions. Many industrial zones lack reliable pipeline networks or adequate fuel storage facilities. This can limit the operational reliability of gas generators, particularly in remote areas. Dependence on a steady gas supply makes these systems vulnerable to disruptions caused by supply chain or regulatory issues. Limited infrastructure development also slows large-scale adoption. Addressing this challenge requires coordinated efforts between energy suppliers, governments, and manufacturers to build robust fuel distribution networks.

Regional Analysis

North America

North America holds a 32% market share in the advanced gas generator market, supported by a strong industrial base and rising investments in energy infrastructure. The U.S. leads adoption, driven by the need for reliable power backup across data centers, healthcare facilities, and commercial buildings. Stringent environmental regulations encourage industries to shift from diesel to gas-based systems. High natural gas availability and the presence of established manufacturers further strengthen the region’s position. The increasing use of smart monitoring technologies also supports widespread deployment across critical infrastructure and industrial facilities.

Europe

Europe accounts for a 25% market share, driven by its focus on sustainable energy solutions and strict emission regulations. Countries like Germany, the U.K., and France are leading adopters, integrating advanced gas generators into power backup and hybrid energy systems. Government incentives promoting cleaner energy sources further boost demand. The region’s mature industrial and commercial sectors rely on reliable power systems to ensure operational continuity. Continuous advancements in energy efficiency technologies and the strong presence of global manufacturers contribute to the region’s steady market growth.

Asia-Pacific

Asia-Pacific holds a 28% market share, driven by rapid industrialization, urban expansion, and infrastructure development. Countries such as China, India, and Japan are key growth centers, supported by rising energy consumption and grid instability. Industrial facilities and commercial establishments increasingly rely on gas generators to ensure uninterrupted operations. Governments are investing in natural gas infrastructure, making the region attractive for generator manufacturers. The increasing presence of manufacturing clusters and data center facilities accelerates adoption, positioning Asia-Pacific as a major growth hub in the global market.

Middle East & Africa

The Middle East & Africa region holds an 8% market share, supported by large-scale energy and oil & gas projects. Power reliability remains a critical factor for industries, especially in remote or off-grid areas. Countries like Saudi Arabia and the UAE are major adopters, supported by ongoing infrastructure investments. Rising demand from industrial zones and commercial facilities is accelerating the use of gas generators as primary and standby power sources. Strategic partnerships with international players and growing LNG infrastructure further drive market expansion in the region.

Latin America

Latin America captures a 7% market share in the advanced gas generator market, driven by rising demand for stable power supply in manufacturing, commercial, and residential sectors. Brazil and Mexico are key markets, benefiting from increasing industrial activity and infrastructure upgrades. Power grid instability in several areas pushes businesses toward dependable backup solutions. Supportive energy policies encouraging cleaner fuel use also foster adoption of gas-based systems. The region’s evolving energy landscape and expanding commercial sector are creating favorable opportunities for both global and regional manufacturers

Market Segmentations:

By Power Rating

- Below 75 kVA

- 75-375 kVA

- 375-750 kVA

- Above 750 kVA

By Application

By End-User

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the advanced gas generator market is shaped by the presence of globally established manufacturers and regional players. Leading companies include Cummins Inc., Inmesol S.L.U, Kirloskar Electric Co. Ltd, Briggs & Stratton, Atlas Copco, Generac Power Systems, FG Wilson, Caterpillar Inc., Aggreko, Kohler-SDMO, Himoinsa, Ingersoll Rand, and American Honda Motor Company, Inc. These companies focus on product innovation, enhanced fuel efficiency, hybrid integration, and real-time monitoring capabilities. North America dominates the competitive landscape with a 32% market share, supported by strong industrial demand and advanced infrastructure. Europe and Asia-Pacific follow closely, with increasing adoption of gas-based generators across commercial and industrial sectors. Strategic collaborations, expansion of distribution networks, and investments in clean energy technology are key strategies used to strengthen market positions. This consolidated but competitive environment drives continuous technological advancement and global expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cummins Inc. (United States)

- Inmesol S.L.U (Spain)

- Kirloskar Electric Co. Ltd (India)

- Briggs & Stratton (United States)

- Atlas Copco (Sweden)

- Generac Power Systems (United States)

- FG Wilson (United Kingdom)

- Caterpillar Inc. (United States)

- Aggreko (United Kingdom)

- Kohler-SDMO (France)

- Himoinsa (Spain)

- Ingersoll Rand (Ireland)

- American Honda Motor Company, Inc (United States)

Recent Developments

- In October 2024, HIMOINSA has unveiled its Yanmar-powered HGY series generators, designed for critical power supply needs. The HGY series boasts Yanmar engines, with current offerings ranging from 1250kVA to 3500kVA, and plans to extend this range up to 4,000 kVA in the future. The series features the GY175L engine family, which includes models with 12 and 16 cylinders, and is set to introduce future developments with 20-cylinder engines, all equipped with electronic controls. This launch underscores HIMOINSA’s commitment to environmental responsibility, aiding end-users in their pursuit of achieving Net Zero emissions.

- In July 2022, Cummins introduced its inaugural Centum series genset range through a virtual program. This series boasts high power density and performance, catering to users’ power needs while occupying a compact footprint. Furthermore, the Centum series C1500D6E/C1250D6E gensets come equipped with features such as high altitude/ambient performance, compliance with U.S. EPA standards from Tier 2 to Tier 4, and are designed for easy operation and low maintenance

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced gas generators will grow as industries prioritize reliable backup power.

- Integration of IoT and smart control systems will enhance monitoring and operational efficiency.

- Hybrid power solutions combining gas and renewable energy will gain wider adoption.

- Industrial expansion in emerging markets will create strong opportunities for suppliers.

- Stricter emission regulations will drive the shift from diesel to gas-based systems.

- Technological advancements will improve fuel efficiency and reduce maintenance costs.

- Distributed power generation will increase reliance on flexible and scalable gas generators.

- Global manufacturers will strengthen their presence through strategic partnerships and M&A.

- Natural gas infrastructure development will support broader market penetration.

- Growing focus on sustainable energy solutions will shape long-term industry growth.