Market Overview

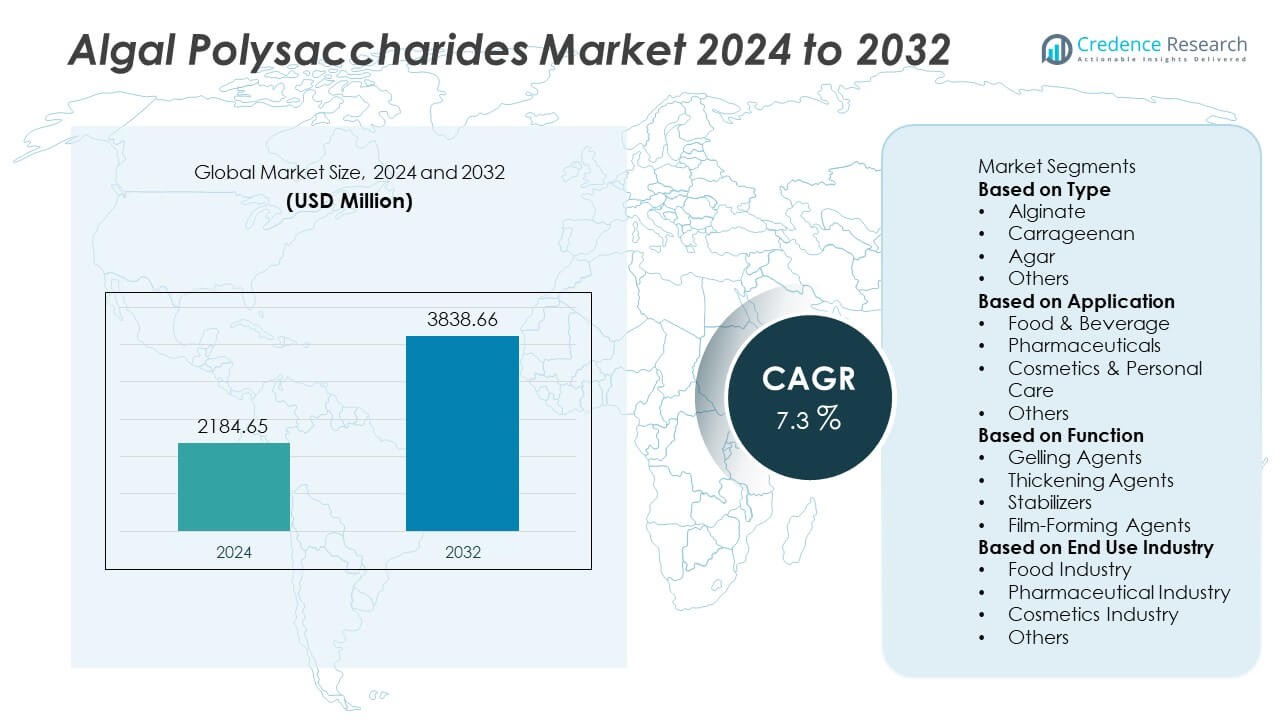

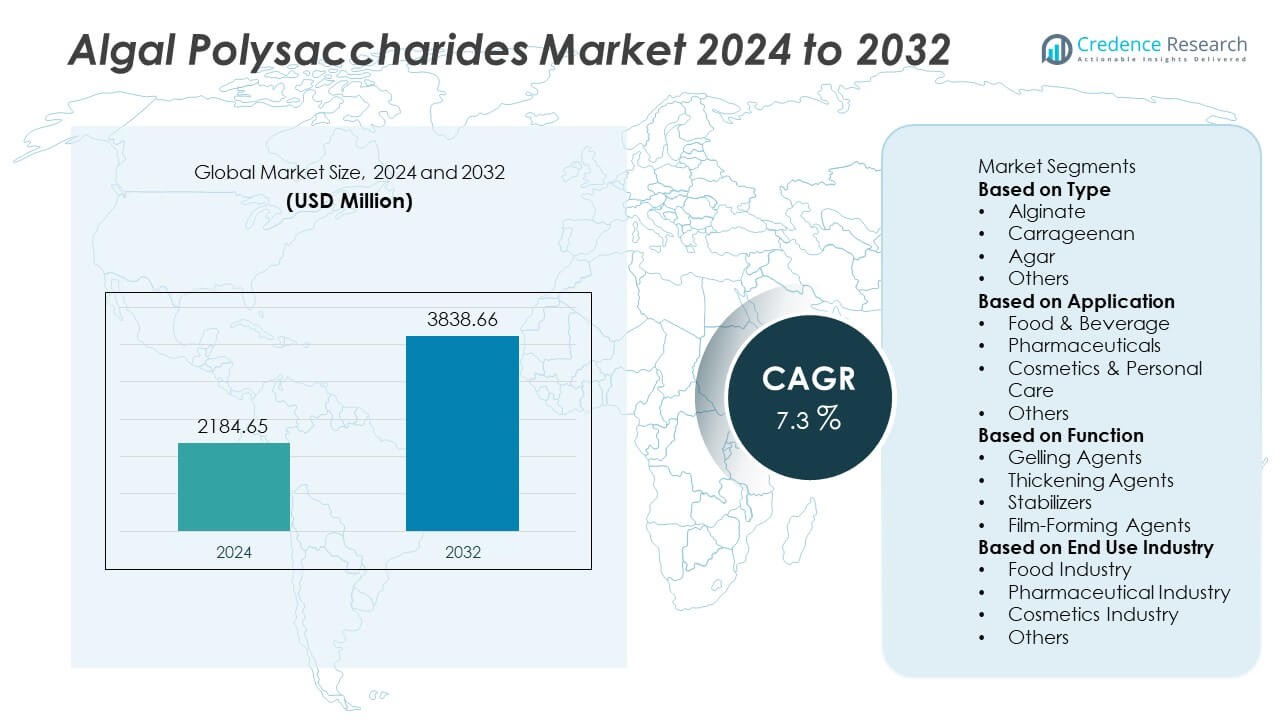

The Algal Polysaccharides Market reached USD 2,184.65 million in 2024 and is projected to reach USD 3,838.66 million by 2032, supported by a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Algal Polysaccharides Market Size 2024 |

USD 2,184.65 Million |

| Algal Polysaccharides Market, CAGR |

7.3% |

| Algal Polysaccharides Market Size 2032 |

USD 3,838.66 Million |

The Algal Polysaccharides market is shaped by leading companies such as Cargill, DuPont Nutrition & Biosciences, FMC Corporation, CP Kelco, Marine Biopolymers Ltd, Kerry Group, Algaia S.A., Gelymar S.A., Ceamsa, and KIMICA Corporation. These players focus on high-purity alginate, carrageenan, and agar grades to serve food, pharmaceutical, and cosmetics sectors. Asia Pacific leads the market with a 31% share, supported by abundant seaweed resources and strong processing capacity. North America follows with a 34% share, driven by strong demand for clean-label hydrocolloids, while Europe holds a 28% share, supported by strict natural-ingredient regulations and advanced marine biotechnology.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Algal Polysaccharides market reached USD 2,184.65 million in 2024 and will grow to USD 3,838.66 million by 2032 at a CAGR of 7.3%.

- Demand rises as food and beverage, pharmaceutical, and cosmetic manufacturers shift toward natural hydrocolloids, with alginate leading the type segment at a 43% share due to strong gelling and stabilizing functions.

- Market trends highlight growing adoption in biodegradable films, plant-based foods, and biomedical applications, supported by advanced extraction technologies and clean-label innovation.

- Competitive dynamics are shaped by key players focusing on high-purity grades, strong supply partnerships, and expansion in Asia Pacific and Europe, while high production costs and supply fluctuations remain major restraints.

- Regionally, North America holds a 34% share, Asia Pacific accounts for 31%, and Europe holds 28%, reflecting strong demand from food processing, pharmaceuticals, and sustainable packaging applications across these major markets.

Market Segmentation Analysis:

By Type

Alginate leads this segment with a 43% share, driven by strong use in food processing, pharmaceuticals, and industrial formulations. The segment grows as manufacturers prefer alginate for its high gel strength, natural origin, and clean-label compatibility. Carrageenan follows due to rising adoption in dairy, plant-based beverages, and processed meats. Agar maintains steady demand in confectionery, microbiology, and vegan product lines. Other polysaccharides gain traction as research expands into bioactive marine compounds. Growing interest in sustainable hydrocolloids and improved extraction technologies continues to support broader uptake across global industries.

- For instance, International Flavors & Fragrances (IFF) operates a major facility in Grindsted, Denmark, which primarily focuses on producing ingredients like emulsifiers for the food industry. This site has seen various investments over the years related to sustainability and efficiency in its fermentation processes.

By Application

Food and Beverage dominates this category with a 52% share, supported by rising use of alginate, carrageenan, and agar in dairy stabilizers, gel-based confectionery, plant-based foods, and texture enhancers. The segment grows as brands focus on clean-label thickeners and natural alternatives to synthetic additives. Pharmaceuticals record increasing adoption due to controlled-release formulations, wound-care gels, and bioactive polysaccharide properties. Cosmetics and personal care benefit from moisturizing, film-forming, and rheology-modifying features. Other applications expand as biotechnology and agriculture explore polysaccharide-based bio-stimulants and culture media.

- For instance, CP Kelco produces various carrageenan products, such as the GENUGEL and GENUVISCO ranges, which function as effective thickeners, stabilizers, and gelling agents in plant-based food systems and other applications.

By Function

Gelling agents hold the leading position with a 45% share, driven by strong demand in bakery fillings, dairy gels, confectionery items, and biopharmaceutical preparations. Their ability to create firm, heat-stable textures supports widespread use across food and medical sectors. Thickening agents follow due to rising adoption in sauces, beverages, lotions, and topical formulations. Stabilizers gain interest as manufacturers seek consistent emulsions and improved shelf life for processed foods and cosmetic emulsions. Film-forming agents continue to grow in relevance, supported by innovations in biodegradable packaging, edible coatings, and cosmetic barrier formulations.

Key Growth Drivers

Rising Demand for Natural Hydrocolloids

Demand for natural and clean-label hydrocolloids drives strong adoption of algal polysaccharides across major industries. Food and beverage manufacturers replace synthetic stabilizers with alginate, carrageenan, and agar due to safety perception, plant-based origins, and regulatory acceptance. Consumers prefer formulations with natural gelling, thickening, and stabilizing properties, which boosts market penetration in dairy substitutes, confectionery, and ready-to-eat foods. Pharmaceutical and cosmetic producers also expand usage as bio-based materials meet stricter formulation guidelines. This shift supports sustained growth as brands prioritize healthier, traceable, and eco-friendly ingredients.

- For instance, Cargill made a US$15 million investment in its alginates production plant in Lannilis, France, to upgrade the facility by expanding capacity, improving employee safety, and enhancing the environmental performance through more efficient waste water processing.

Expansion of Functional and Specialty Applications

The market benefits from growing use of algal polysaccharides in advanced applications such as controlled drug delivery, regenerative medicine, tissue engineering, and biodegradable packaging. Their biocompatibility, non-toxic nature, and film-forming capabilities create strong opportunities across healthcare and biotech research. Cosmetic brands adopt these materials for moisture retention, viscosity control, and skin barrier enhancement. Agricultural sectors also explore polysaccharides for bio-stimulants and crop-protection coatings. These emerging uses expand the market footprint beyond food-grade applications and encourage investment in specialized extraction and purification technologies.

- For instance, FMC BioPolymer supplied alginates for research, including a sodium alginate (LF200) with a molecular weight of approximately 240,000 Daltons (~240 kDa) used in integrin-binding hydrogel synthesis for cell scaffolds.

Growth of the Plant-Based and Vegan Food Sector

The global shift toward plant-based and vegan diets accelerates demand for algal polysaccharides used in texture improvement, fat replacement, and gel formation. Brands rely on alginate, carrageenan, and agar to achieve desirable viscosity, mouthfeel, and stability in dairy alternatives, meat analogues, and functional beverages. Their natural origin aligns with sustainability goals and regulatory expectations, further increasing adoption. Rising interest in lactose-free, gluten-free, and allergen-free products strengthens the need for versatile hydrocolloids, driving volume growth across multiple product lines and global food chains.

Key Trends & Opportunities

Advances in Extraction and Bioprocessing Technologies

Efforts to optimize extraction efficiency, improve purity levels, and reduce production costs create significant opportunities for manufacturers. Techniques such as enzyme-assisted extraction, green solvents, and integrated biorefinery models help enhance yield and reduce environmental impact. These advancements support the commercialization of high-value polysaccharides like fucoidan and ulvan, known for strong bioactivities. As demand rises for specialized grades used in pharmaceuticals, nutraceuticals, and biomedical applications, improved processing technologies become a key differentiator for producers seeking premium market positioning.

- For instance, Algaia S.A. utilizes advanced, eco-friendly technologies including enzyme-assisted extraction (EAE) processes to extract valuable compounds like fucoidans and alginates from brown seaweed, which can offer improved yields and potentially reduced solvent usage compared to traditional methods.

Growing Use in Biodegradable Films and Sustainable Packaging

Algal polysaccharides gain strong traction as alternatives to petroleum-based plastics due to their natural film-forming and barrier properties. Companies explore alginate and agar films for edible coatings, biodegradable packaging layers, and moisture-control solutions. This trend aligns with global sustainability mandates and increasing restrictions on single-use plastics. With rising investments in green packaging solutions from food processors, retailers, and logistics firms, algal polysaccharides emerge as promising materials for next-generation eco-friendly packaging systems.

- For instance, researchers engineered a κ-carrageenan film incorporated with grapefruit essential oil that achieved a tensile strength of 98.21 MPa during lab testing. In other studies on similar biopolymer composite films, moisture-barrier evaluations showed water-vapor transmission rates that can be as low as approximately 2.3 g·m⁻²·day⁻¹ under specific controlled conditions, depending heavily on the precise formulation and relative humidity. The company also scaled pilot production to 850 kilograms per shift using a continuous casting line designed for biodegradable packaging formats.

Key Challenges

High Production Costs and Supply Variability

Production costs remain high due to complex extraction processes, quality control requirements, and limited large-scale infrastructure. Dependence on marine biomass exposes the industry to seasonal fluctuations, climate impact, and regional harvesting constraints. These variables can disrupt supply consistency and pricing stability, affecting downstream industries sensitive to raw material costs. Scaling up production while maintaining purity and performance adds further complexity, particularly for high-grade pharmaceutical and cosmetic applications.

Regulatory Constraints and Quality Standardization Issues

The market faces challenges due to varying global regulatory frameworks governing the use of algal polysaccharides in food, pharmaceuticals, and personal care formulations. Differences in purity requirements, allowable concentrations, and processing standards create barriers for international trade. Inconsistent quality across suppliers also affects product performance, limiting broader adoption in high-precision industries. Manufacturers must invest in certification, traceability, and consistent processing techniques to meet stringent compliance expectations across multiple regions.

Regional Analysis

North America

North America holds a 34% share of the Algal Polysaccharides market, supported by strong demand from food, nutraceutical, and personal care industries. Manufacturers adopt alginate, carrageenan, and agar for clean-label formulations, improved texture, and enhanced stability. The region benefits from advanced extraction facilities and strong research investments in bioactive marine compounds. Growth also comes from rising demand for plant-based foods and natural hydrocolloids in dairy alternatives and functional beverages. Pharmaceutical applications expand as algal polysaccharides gain acceptance in wound care gels, drug delivery systems, and biomedical coatings.

Europe

Europe accounts for a 28% share of the market, driven by strict regulatory support for natural additives and strong adoption across food and cosmetics sectors. The region leads in clean-label innovation, encouraging wider use of alginate and carrageenan in bakery items, confectionery, and vegan product ranges. Marine biotechnology programs in Nordic and Western European countries support innovation in fucoidan and ulvan production. Increasing demand for biodegradable films and eco-friendly packaging also supports market expansion. Pharmaceutical companies adopt high-purity grades for controlled-release systems and tissue engineering solutions.

Asia Pacific

Asia Pacific leads with a 31% share, supported by abundant seaweed resources in China, Indonesia, South Korea, and Japan. Strong growth in food processing, dairy substitutes, and confectionery drives demand for carrageenan, agar, and alginate. The region benefits from large-scale cultivation, cost-effective processing, and strong export capacity. Rising consumer interest in plant-based diets and functional foods strengthens uptake across expanding markets. Pharmaceutical and cosmetic manufacturers in Japan and South Korea increase use in topical gels, serums, and biomedical formulations. Government-backed seaweed farming initiatives further stimulate regional supply strength.

Latin America

Latin America holds a 4% share, supported by increasing seaweed harvesting activities in Chile, Peru, and Brazil. The region’s food and beverage industry adopts algal polysaccharides for stabilizers in dairy, beverages, and processed meats. Growth improves as manufacturers seek natural alternatives to synthetic additives. Rising demand for plant-based formulations and clean-label ingredients drives wider application across regional brands. Opportunities expand in pharmaceuticals and cosmetics as companies explore alginate and carrageenan for gel-based formulations. Investments in seaweed aquaculture strengthen supply chains and improve regional export potential.

Middle East & Africa

Middle East and Africa account for a 3% share, driven by steady growth in food processing, dairy stabilizers, and bakery applications. Rising demand for shelf-stable foods supports uptake of natural gelling and thickening agents. The region sees increasing interest in plant-based and halal-certified ingredients, which fuels demand for alginate, carrageenan, and agar. Pharmaceutical and cosmetic applications expand gradually as manufacturers adopt bio-based stabilizers in topical lotions and personal care items. Seaweed cultivation initiatives in African coastal nations create future supply opportunities and support long-term market development.

Market Segmentations:

By Type

- Alginate

- Carrageenan

- Agar

- Others

By Application

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Others

By Function

- Gelling Agents

- Thickening Agents

- Stabilizers

- Film-Forming Agents

By End Use Industry

- Food Industry

- Pharmaceutical Industry

- Cosmetics Industry

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Cargill, DuPont Nutrition & Biosciences, FMC Corporation, CP Kelco, Marine Biopolymers Ltd, Kerry Group, Algaia S.A., Gelymar S.A., Ceamsa, and KIMICA Corporation. These companies strengthen their market position by expanding raw material sourcing networks, advancing extraction technologies, and developing high-purity polysaccharide grades for food, pharmaceutical, and cosmetic applications. Leaders focus on clean-label solutions and invest in innovative processing techniques such as enzyme-assisted extraction to improve yield and functional performance. Strategic partnerships with seaweed growers help secure stable supply chains, while product diversification supports entry into emerging sectors like biodegradable packaging, nutraceuticals, and biomedical engineering. Companies also expand global footprints through mergers, acquisitions, and regional manufacturing facilities to meet rising demand across Asia Pacific, Europe, and North America. Continuous investment in R&D and compliance with evolving regulatory frameworks further shape competitive differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cargill, Incorporated

- DuPont Nutrition & Biosciences

- FMC Corporation

- CP Kelco

- Marine Biopolymers Ltd

- Kerry Group

- Algaia S.A.

- Extractos Naturales Gelymar S.A.

- Ceamsa (Compañía Española de Algas Marinas S.A.)

- KIMICA Corporation

Recent Developments

- In 2025, Kerry Group reported volume growth in its food ingredient business, with performance in the Americas supported by new product development activity in natural, clean-label solutions using its taste and bio-fermentation technologies.

- In July 2024, Marine Biopolymers Ltd (MBL) received a £335,000 grant from Innovate UK for its A2S (Alginic Acid to Safety) project.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Function, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural hydrocolloids will rise as clean-label product adoption increases.

- Plant-based and vegan food expansion will strengthen usage of alginate, carrageenan, and agar.

- Biodegradable packaging development will create wider opportunities for film-forming polysaccharides.

- Pharmaceutical and biomedical applications will grow due to biocompatibility and controlled-release potential.

- Cosmetic brands will increase use in moisturizers, gels, and barrier-enhancing formulations.

- Advancements in extraction and purification will improve yield and expand high-purity product availability.

- Seaweed farming investments will support stable raw material supply and reduce cost pressures.

- Innovation in tissue engineering and regenerative medicine will drive demand for specialty polysaccharides.

- Regional producers will expand export capacity to meet rising global demand.

- Sustainability regulations will accelerate adoption of marine-derived polysaccharides across industries.