Market Overview

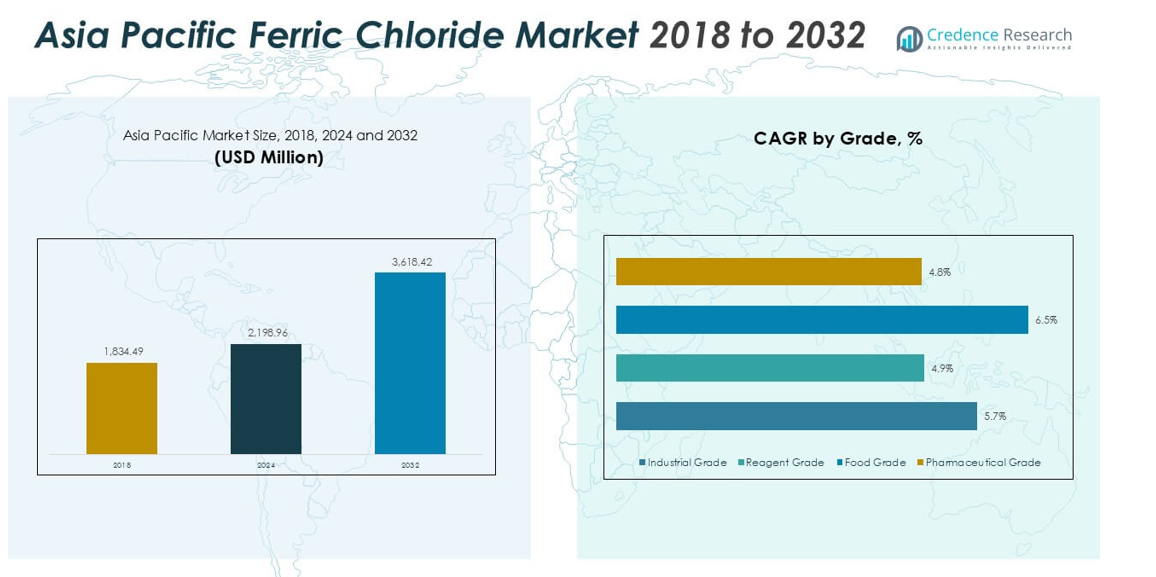

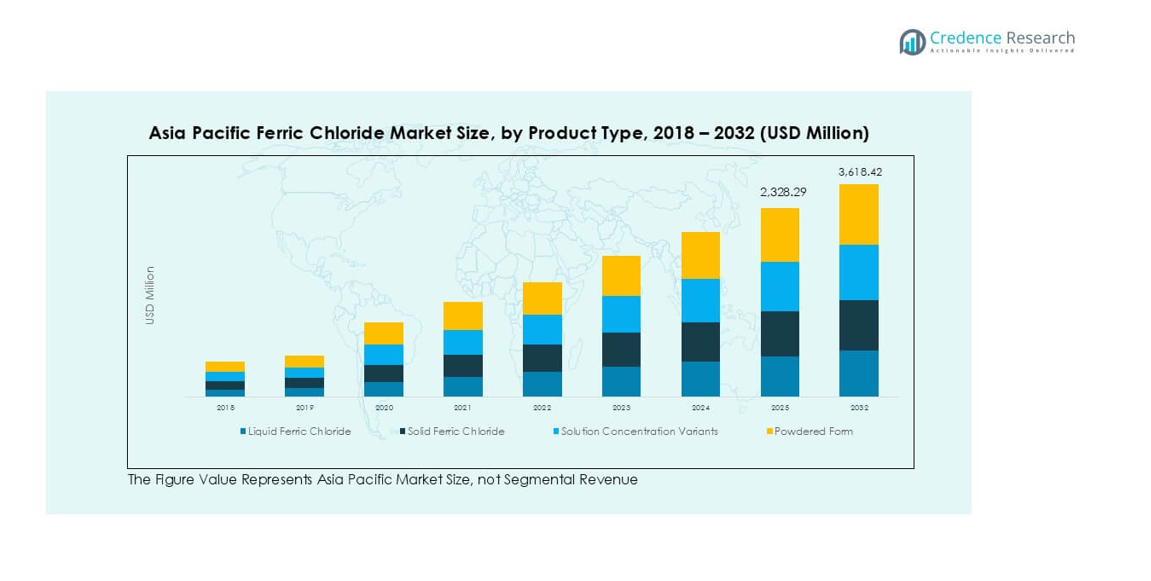

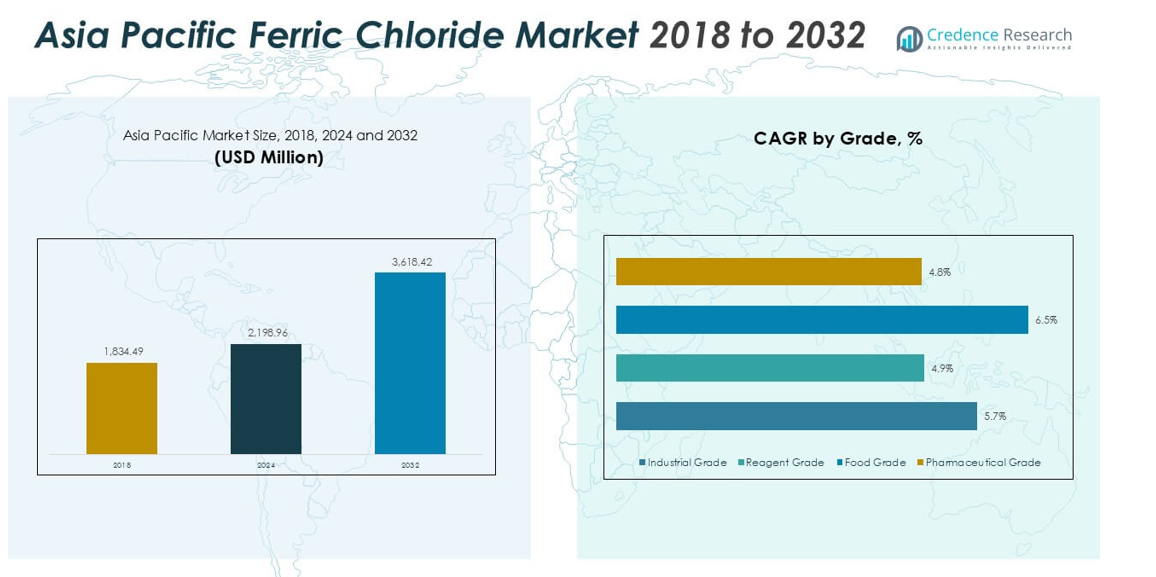

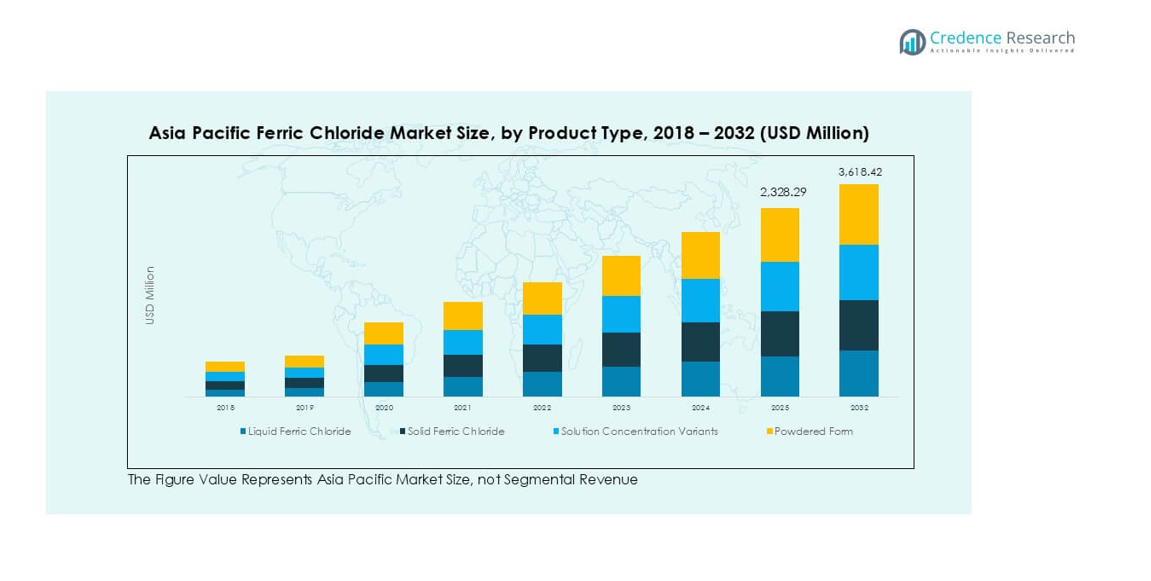

Asia Pacific Ferric Chloride market size was valued at USD 1,834.49 million in 2018 and increased to USD 2,198.96 million in 2024. It is anticipated to reach USD 3,618.42 million by 2032, growing at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Ferric Chloride Market Size 2024 |

USD 2,198.96 million |

| Asia Pacific Ferric Chloride Market, CAGR |

6.5% |

| Asia Pacific Ferric Chloride Market Size 2032 |

USD 3,618.42 million |

The Asia Pacific ferric chloride market features strong competition among global leaders and regional producers. Companies such as SABIC, BASF, Kemira, Tessenderlo Group, and PVS Chemicals dominate through broad portfolios, scale, and cross-industry applications. Regional firms including Malay-Sino Chemical Industries, Sukha Chemical Industries, Shandong Haoyuan Chemical, and DCW Ltd. compete by offering cost-effective supply tailored to local markets. High-purity applications in electronics are supported by Japanese players like Toagosei Co., Ltd. and Mitsubishi Gas Chemical. On the regional front, China led with 38% share in 2024, followed by Japan and India, reflecting their large-scale industrial bases and regulatory-driven wastewater treatment demand.

Market Insights

- The Asia Pacific Ferric Chloride market size reached USD 2,198.96 million in 2024 and is projected to hit USD 3,618.42 million by 2032, growing at a CAGR of 6.5%.

- Rising demand for water and wastewater treatment is the key growth driver, supported by rapid industrialization and stricter discharge regulations in countries like China and India.

- Market trends highlight growing adoption of high-purity and specialty grades, particularly in electronics, pharmaceuticals, and food processing, where regulatory standards require refined quality.

- Competition remains strong with global leaders such as SABIC, BASF, Kemira, and PVS Chemicals, alongside regional players like Malay-Sino Chemical Industries, Sukha Chemical Industries, and Shandong Haoyuan Chemical focusing on cost efficiency and localized supply.

- Regionally, China dominated with 38% share in 2024, followed by India at 14% and Japan at 15%, while Southeast Asia and South Korea collectively represented about 22%, reflecting both established demand and strong growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

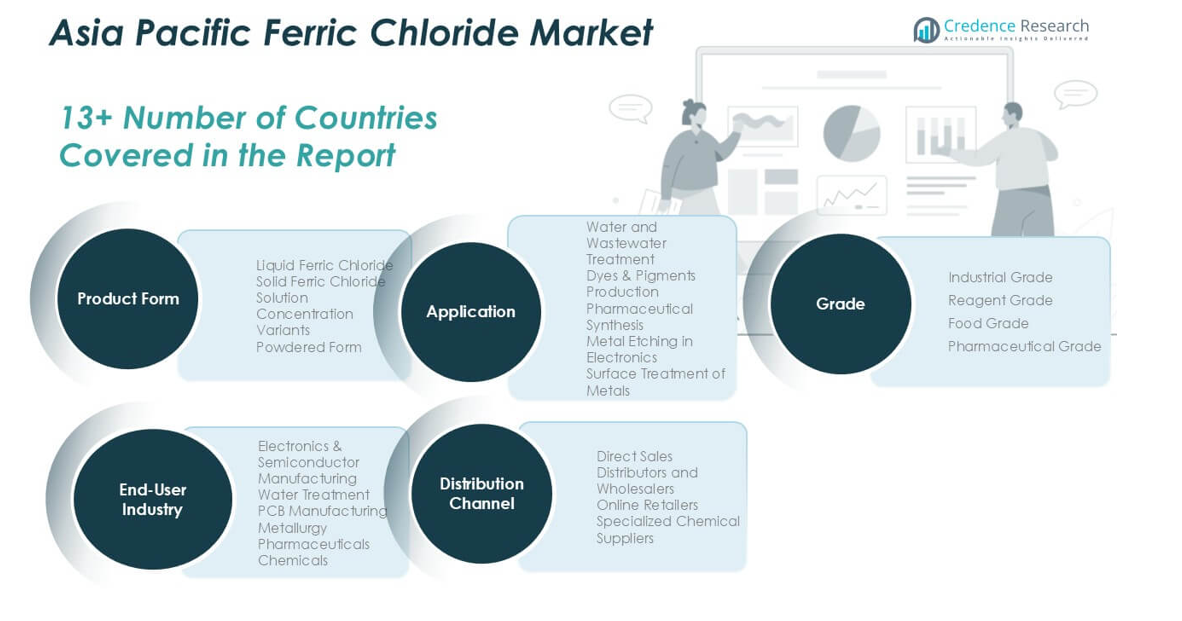

Market Segmentation Analysis:

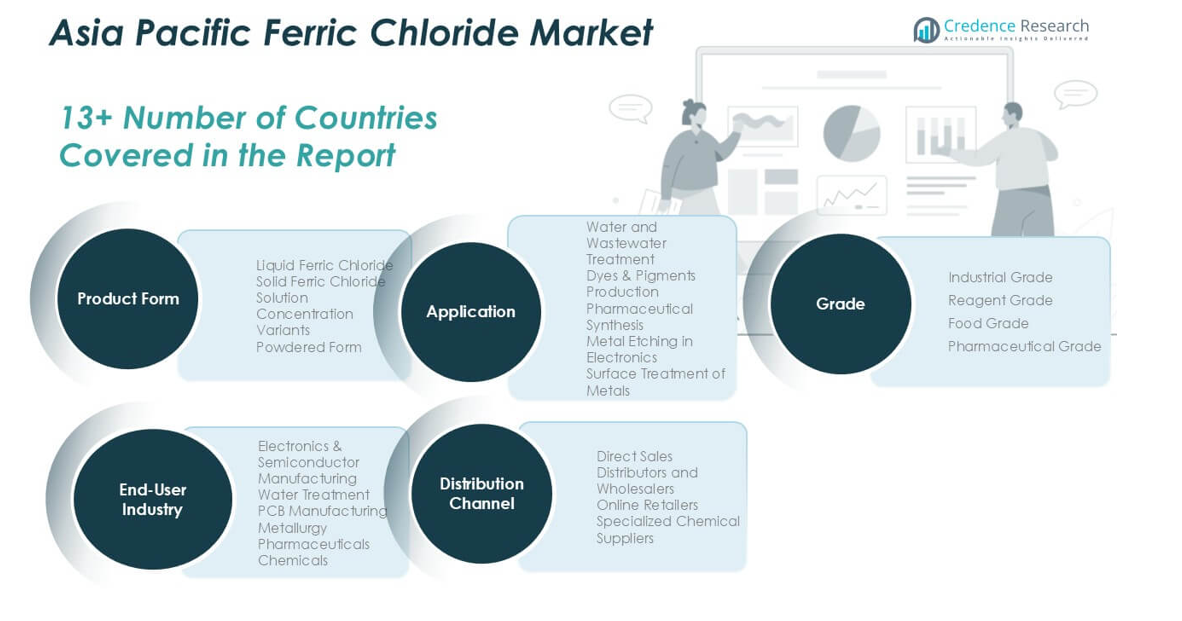

By Product Form

Liquid ferric chloride held the dominant share in 2024, accounting for over 55% of the Asia Pacific market. Its extensive use in large-scale municipal and industrial water treatment plants drives this dominance. The liquid form ensures easier handling, rapid solubility, and reduced operational costs compared to powdered or solid forms. Solution concentration variants also see rising adoption, particularly in customized treatment applications. However, powdered ferric chloride is primarily used in laboratory-scale or specialized settings, limiting its broader uptake across industries.

- For instance, in 2021, Kemira expanded its capacity to produce ferric-based water-treatment chemicals at its UK facility in Goole by over 100,000 tons annually. The company also serves municipal utilities and other customers in the Asia Pacific market with its water treatment chemicals.

By Application

Water and wastewater treatment emerged as the leading application, representing nearly 60% of the market share in 2024. The rapid expansion of urban populations and industrialization across Asia Pacific has increased demand for effective coagulating agents. Governments’ focus on improving municipal water infrastructure and strict discharge regulations in countries like China and India further fuel this demand. Other segments such as dyes and pigments production and metal etching contribute steadily, but remain secondary due to smaller-scale and specialized usage.

- For instance, China Everbright Water treated 1.77 billion cubic meters of wastewater across its plants, where ferric chloride served as a key coagulant.

By Grade

Industrial grade ferric chloride dominated the market, holding around 65% share in 2024, mainly due to its extensive role in wastewater management and surface treatment applications. Its cost-effectiveness and suitability for bulk industrial processes ensure steady demand from manufacturing hubs across China, India, and Southeast Asia. Reagent grade continues to serve laboratories and niche applications, while food and pharmaceutical grades represent smaller but growing segments, supported by tighter safety regulations and higher quality standards in food processing and pharmaceutical synthesis

Key Growth Drivers

Rising Demand for Water and Wastewater Treatment

Water scarcity and rising pollution levels across Asia Pacific are major drivers for ferric chloride demand. Governments in countries like India and China are investing heavily in municipal water treatment facilities and industrial effluent management to meet stringent discharge norms. Ferric chloride’s strong coagulating properties make it a preferred choice for removing suspended solids and heavy metals from wastewater streams. Rapid urbanization has led to growing pressure on freshwater resources, increasing reliance on advanced treatment solutions. The industrial sector, including textiles, chemicals, and pulp and paper, further boosts demand, as regulatory compliance requires reliable effluent treatment.

- For instance, in 2022, Beijing Enterprises Water Group operated 917 sewage treatment plants and town-size facilities, along with 41 reclaimed water plants, all located in mainland China. The company’s overall daily water treatment capacity exceeded 10 million tons.

Industrial Expansion in Manufacturing Hubs

The expanding manufacturing base in Asia Pacific supports sustained growth in ferric chloride consumption. Industries such as electronics, dyes, and metallurgy use ferric chloride for etching, pigment production, and surface treatment of metals. China, Japan, and South Korea are key hubs where electronics and semiconductor manufacturing rely on high-purity ferric chloride for metal etching processes. The chemical industry also consumes large volumes in dye and pigment production. Rising investments in infrastructure, coupled with foreign direct investment inflows in manufacturing, reinforce industrial-grade ferric chloride demand. The scale of industrial operations in these hubs ensures consistent long-term consumption.

- For instance, LG Display shipped an estimated 52 million smartphone OLED panels and 6.4 million OLED TV panels. For the etching process used to create the fine-line circuitry, the company would have relied on highly controlled, industrial processes such as cupric chloride etchants or advanced dry etching, rather than the hobbyist-grade ferric chloride.

Growth in Pharmaceutical and Food Processing Sectors

The pharmaceutical and food industries are emerging as niche but fast-growing segments for ferric chloride. Pharmaceutical-grade ferric chloride is used in synthesis processes, while food-grade variants serve as clarifying agents in sugar refining and related applications. Rising disposable incomes and changing lifestyles in Asia Pacific are fueling greater demand for processed food and pharmaceuticals. With stricter safety and quality regulations, these sectors require reagent and food-grade ferric chloride of higher purity. Emerging economies such as Vietnam, Thailand, and Indonesia are witnessing stronger pharmaceutical investments, which strengthen demand for high-grade ferric chloride solutions.

Key Trends and Opportunities

Shift Toward High-Purity and Specialty Grades

A growing opportunity lies in the demand for high-purity ferric chloride across electronics, pharmaceuticals, and food processing industries. The semiconductor industry, concentrated in countries like South Korea, Japan, and Taiwan, requires highly refined reagent-grade ferric chloride for precision etching. Similarly, food safety regulations are prompting sugar refiners and beverage producers to adopt food-grade variants. This shift is pushing manufacturers to invest in advanced production technologies that ensure consistency, purity, and compliance with international standards. As a result, suppliers focusing on specialty grades can tap into premium segments with higher margins.

- For instance, Kanto Chemical Co. in Japan supplies a variety of ultra-high-purity chemicals, such as solvents and acids, for the semiconductor and electronics industries. While ferric chloride is used in electronics manufacturing, particularly for etching copper on printed circuit boards (PCBs), it is not the standard ultra-high-purity etchant used in modern integrated circuit (IC) fabs.

Integration into Sustainable Industrial Practices

Sustainability initiatives across Asia Pacific present new opportunities for ferric chloride suppliers. Many industries are adopting circular economy practices, emphasizing efficient wastewater recycling and eco-friendly production methods. Ferric chloride plays a critical role in these strategies by enabling high-efficiency coagulation and reducing sludge volumes in water treatment. Additionally, industries are seeking to minimize chemical consumption while improving treatment efficiency, creating space for advanced ferric chloride formulations. Companies that align with environmental sustainability goals and offer eco-friendly solutions can gain a competitive advantage in industrial and municipal markets.

Key Challenges

Fluctuating Raw Material Costs

One of the major challenges in the Asia Pacific ferric chloride market is the volatility of raw material prices, particularly hydrochloric acid and iron ore. Price fluctuations affect production costs, reducing margins for manufacturers and creating instability in supply contracts. Smaller producers often struggle to maintain profitability during periods of high input costs, which can limit market participation. This unpredictability also impacts downstream industries, forcing them to explore alternative coagulants or treatment chemicals. As a result, stable raw material supply chains remain critical for sustaining growth.

Environmental and Handling Concerns

Ferric chloride, while effective, poses challenges related to safe handling, storage, and environmental impact. The chemical is corrosive and requires strict safety protocols in transportation and industrial use. Smaller municipalities and industries may lack adequate infrastructure for safe handling, which limits adoption in certain regions. In addition, regulatory pressures concerning hazardous chemical use and disposal could lead to stricter compliance requirements. These factors increase operational costs for producers and end-users, potentially slowing adoption compared to less hazardous treatment alternatives.

Regional Analysis

China

China accounted for the largest share of the Asia Pacific ferric chloride market, holding nearly 38% in 2024. Rapid urbanization, industrial expansion, and large-scale municipal water treatment projects continue to drive consumption. The country’s robust electronics and semiconductor manufacturing base further fuels demand for high-purity ferric chloride in metal etching. Strong regulatory enforcement on wastewater treatment and heavy investments in infrastructure strengthen China’s leadership. Additionally, growth in chemical and dye manufacturing adds to its significant market dominance, making China the key growth engine within the regional market.

Japan

Japan represented about 15% of the regional ferric chloride market in 2024, driven by its well-established electronics and semiconductor industries. The country’s demand centers on reagent-grade ferric chloride used for precise metal etching in advanced manufacturing. Japan’s strict environmental policies also support steady use in wastewater treatment across industries. Rising focus on sustainable industrial practices further encourages adoption. However, the mature nature of Japan’s industrial landscape leads to stable rather than rapid growth, with consistent demand anchored by advanced technology sectors and regulatory-driven environmental compliance.

South Korea

South Korea held nearly 12% of the Asia Pacific ferric chloride market in 2024, strongly influenced by its globally recognized semiconductor and electronics manufacturing industries. The country relies heavily on high-purity reagent-grade ferric chloride for precision metal etching processes. Industrial-grade ferric chloride also finds demand in wastewater treatment, particularly from textile and heavy industries. The government’s emphasis on green growth and stricter wastewater discharge regulations further support adoption. With growing export-driven manufacturing and high investment in advanced technologies, South Korea continues to show steady and specialized demand for ferric chloride.

India

India captured approximately 14% of the regional market in 2024, led by rapid urbanization and expanding municipal water treatment infrastructure. Industrial expansion in sectors such as textiles, chemicals, and pharmaceuticals drives consistent demand for industrial- and pharmaceutical-grade ferric chloride. Government initiatives like the Namami Gange project and strict wastewater treatment norms enhance adoption across industrial and municipal facilities. Additionally, India’s growing pharmaceutical and food industries create emerging opportunities for higher-grade variants. While infrastructure gaps remain, India’s fast-paced industrial and urban growth ensures it will remain one of the strongest growth markets in Asia Pacific.

Australia

Australia accounted for close to 6% of the Asia Pacific ferric chloride market in 2024, primarily supported by strong water and wastewater treatment demand. The country’s focus on sustainable water management in arid regions and advanced municipal treatment facilities drives steady consumption. Industrial applications, though smaller compared to major Asian economies, include metal processing and mining-related wastewater treatment. Regulatory frameworks emphasizing environmental safety standards also contribute to demand stability. While the market size is relatively modest, Australia’s emphasis on sustainability ensures continued reliance on ferric chloride solutions in core water treatment processes.

Southeast Asia

Southeast Asia represented nearly 10% of the regional ferric chloride market in 2024, with countries like Vietnam, Thailand, and Indonesia driving demand. Rapid industrialization, growing urban centers, and increased investment in municipal wastewater treatment plants support adoption. Textile, pulp and paper, and food processing industries are key users, while expanding pharmaceutical manufacturing creates opportunities for higher-grade ferric chloride. Regional governments’ focus on improving sanitation and infrastructure boosts demand further. Although infrastructure challenges persist, Southeast Asia remains a fast-growing market segment, with rising consumption driven by both industrial growth and public sector investments.

Rest of Asia Pacific

The Rest of Asia Pacific held about 5% market share in 2024, covering smaller economies such as New Zealand, Taiwan, and others. Demand here is driven by specific industries such as electronics in Taiwan and advanced water treatment facilities in New Zealand. While the market size is relatively limited, strong environmental regulations and reliance on high-quality water treatment processes sustain steady adoption. The growth potential lies in specialty-grade ferric chloride, particularly in high-tech applications, where compliance with international quality standards is critical. This segment provides niche but stable opportunities within the broader regional landscape.

Market Segmentations:

By Product Form

- Liquid Ferric Chloride

- Solid Ferric Chloride

- Solution Concentration Variants

- Powdered Form

By Application

- Water and Wastewater Treatment

- Dyes & Pigments Production

- Pharmaceutical Synthesis

- Metal Etching in Electronics

- Surface Treatment of Metals

By Grade

- Industrial Grade

- Reagent Grade

- Food Grade

- Pharmaceutical Grade

By End-User Industry

- Electronics & Semiconductor Manufacturing

- Water Treatment

- PCB Manufacturing

- Metallurgy

- Pharmaceuticals

- Chemicals

By Distribution Channel

- Direct Sales

- Distributors and Wholesalers

- Online Retailers

- Specialized Chemical Suppliers

By Geography

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Competitive Landscape

The Asia Pacific ferric chloride market is highly competitive, with the presence of multinational corporations and regional players focusing on diverse end-user needs. Companies such as SABIC, BASF, Kemira, Tessenderlo Group, and PVS Chemicals dominate the market with broad product portfolios and strong global distribution networks. Regional producers like Malay-Sino Chemical Industries, Sukha Chemical Industries, DCW Ltd., and Shandong Haoyuan Chemical strengthen their positions through cost-efficient manufacturing and localized supply. Japanese firms, including Toagosei Co., Ltd. and Mitsubishi Gas Chemical, cater to high-purity applications in electronics, while Chinese players such as Tianjin Xinze Fine Chemical and Huanggang Huachang Chemical expand capacity to serve growing wastewater treatment demand. Strategic partnerships, capacity expansions, and compliance with environmental regulations remain key competitive priorities. Innovation in high-purity and specialty grades also defines the competitive landscape, with leading companies investing in R&D to address emerging opportunities in pharmaceuticals, food processing, and advanced electronics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SABIC

- PVS Chemicals

- Tessenderlo Group

- Kemira

- BASF

- Malay-Sino Chemical Industries (Malaysia)

- Sukha Chemical Industries (India)

- Shandong Haoyuan Chemical (China)

- Tianjin Xinze Fine Chemical (China)

- Toagosei Co., Ltd. (Japan)

- PT Lautan Luas Tbk (Indonesia)

- Shandong Shuangwei Chemical (China)

- DCW Ltd. (India)

- SRL Pvt. Ltd. (India)

- Mitsubishi Gas Chemical (Japan)

- Huanggang Huachang Chemical (China)

Recent Developments

- In February 2022, CAC (Chemieanlagenbau Chemnitz) completed the construction of its first Ferric Chloride plant in Kuwait using its proprietary technology. This development marks a significant milestone for the company, as it expands its capabilities in the production of high-quality Ferric Chloride for water treatment applications. The new plant will enhance the local supply of Ferric Chloride, supporting Kuwait’s growing demand for efficient water treatment solutions. This move is expected to strengthen CAC’s presence in the Middle East market and contribute to the region’s environmental sustainability efforts.

- In January 2022, Renal Business was purchased by Evoqua Water Technologies LLC from the STERIS Group’s Mar Cor Purification and Cantel Medical divisions. The company’s ability to provide tried-and-true water solutions for the healthcare sector in North America was bolstered by the purchase

Report Coverage

The research report offers an in-depth analysis based on Product Form, Application, Grade, End-User Industry, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily with strong demand from water treatment.

- Industrial expansion across Asia Pacific will sustain ferric chloride consumption in multiple sectors.

- High-purity grades will see rising adoption in electronics and semiconductor manufacturing.

- Pharmaceutical and food industries will create niche growth opportunities for specialty variants.

- Government initiatives on wastewater management will drive large-scale municipal usage.

- Regional producers will expand capacity to compete with multinational chemical companies.

- Innovation in eco-friendly and efficient formulations will shape future market strategies.

- Southeast Asia will emerge as one of the fastest-growing markets in the region.

- Regulatory compliance and safety standards will influence demand for higher-grade products.

- Strategic partnerships and technology investments will strengthen competitiveness among key players.