| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Book Paper Market Size 2024 |

USD 10,203.76 million |

| Book Paper Market, CGR |

4.37% |

| Book Paper Market Size 2032 |

USD 14,364.15 million |

Market Overview

The Global Book Paper Market is projected to grow from USD 10,203.76 million in 2024 to an estimated USD 14,364.15 million by 2032, with a compound annual growth rate (CAGR) of 4.37% from 2024 to 2032.

Several factors are propelling the growth of the book paper market. The expansion of the education sector, particularly in emerging economies, has led to increased demand for textbooks and academic materials. Government initiatives aimed at improving literacy rates and educational infrastructure further bolster this demand. Additionally, the enduring preference for physical books among readers, especially for leisure and children’s reading, supports market stability. Technological advancements in printing, such as digital and on-demand printing, have enhanced production efficiency and allowed for greater customization, meeting the evolving needs of publishers and consumers alike. As publishers increasingly target niche audiences and short-run publications, the adaptability of book paper solutions continues to be a strategic advantage.

The Asia-Pacific region dominates the global book paper market, accounting for over 40% of global production in 2023. Countries like China and India are leading contributors, driven by large populations, rising literacy rates, and significant investments in education. Europe maintains a strong market presence, particularly in the premium and coated paper segments, supported by a rich publishing heritage and demand for high-quality printed materials. North America continues to be a significant market, with a steady demand for printed books and a robust publishing industry. Meanwhile, regions like the Middle East and Africa are witnessing growth due to educational reforms and increasing literacy initiatives, although they currently rely heavily on imports to meet demand. Regional players are gradually exploring local manufacturing capacities to reduce dependence on imports and address growing domestic requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Book Paper Market is projected to grow from USD 10,203.76 million in 2024 to USD 14,364.15 million by 2032, with a CAGR of 4.37%, driven by increasing demand for printed educational materials and books worldwide.

- The expansion of the education sector, particularly in emerging economies, is a major driver of the book paper market, fueled by rising student populations and increasing school enrollment rates in regions like Asia-Pacific and Africa.

- Government literacy initiatives continue to support market growth by driving the distribution of printed books, particularly in developing nations where such materials remain essential for improving literacy and educational outcomes.

- Despite the rise of digital media, physical books maintain strong consumer demand, particularly for leisure and children’s books, with readers preferring the tactile experience and emotional connection with print.

- Technological advancements in digital and on-demand printing have increased production efficiency and customization, making it easier for publishers to meet evolving consumer preferences and target niche markets.

- Digital substitution, especially in academic publishing, poses a restraint on the book paper market, with an increasing shift toward e-books and online learning platforms reducing the demand for printed educational resources.

- The Asia-Pacific region dominates the global book paper market, accounting for over 40% of global production, with China and India leading the charge due to large populations, rising literacy rates, and significant educational investments.

Report Scope

This report segments the Book Paper Market as follow

Market Drivers:

Growing Educational Demand

The global book paper market is significantly driven by the expanding education sector. As governments around the world continue to invest in educational infrastructure, particularly in developing economies, the demand for textbooks and academic publications has surged. For instance, Sweden’s government has allocated SEK 685 million in 2023, SEK 658 million in 2024, and SEK 755 million in 2025 to ensure every pupil has access to textbooks, reinforcing the necessity for printed educational materials. The rising student population and increasing school enrollment rates, especially in Asia-Pacific and Africa, have created sustained requirements for printed educational materials. Educational institutions and ministries of education remain key bulk purchasers of book paper, ensuring steady consumption volumes. Additionally, printed books continue to be the preferred medium for formal learning due to their accessibility, durability, and ease of use in areas with limited digital penetration.

Government Literacy Initiatives

Government-backed literacy programs have emerged as critical growth catalysts for the book paper market. Many countries have launched national literacy campaigns and reading enhancement initiatives aimed at improving literacy rates among both children and adults. For instance, in India, the National Book Promotion Policy (NBPP) specifically aims to ensure an adequate supply of quality books, making them accessible and affordable across all regions, including rural and remote areas. These programs often involve the distribution of free or subsidized printed books, which directly increases the demand for book paper. Furthermore, public libraries, literacy centers, and community schools supported by such initiatives regularly procure large quantities of printed materials. In addition to driving paper demand, these efforts reinforce the social value of printed reading materials, encouraging long-term engagement with physical books.

Sustained Consumer Preference for Print

Despite the growth of digital media, physical books continue to enjoy strong consumer demand, particularly in trade publishing, children’s books, and leisure reading. Many readers cite the tactile experience, lack of screen fatigue, and emotional connection with printed books as reasons for their preference. This enduring attachment to print has maintained a solid foundation for the book paper industry. Furthermore, gift-oriented purchases, collectible editions, and special releases often favor high-quality book paper to enhance the value and presentation of the product. The rise of independent publishing and self-publishing has also contributed to incremental paper demand as more authors opt for short-run, customized prints of their work.

Technological Advancements in Printing

Innovations in printing technologies have streamlined the production of books and optimized the use of book paper. Digital and on-demand printing methods allow publishers to manage smaller print runs cost-effectively, reducing waste and storage needs. These advancements have enabled greater customization and responsiveness to market demand, supporting publishers in maintaining competitiveness while using high-grade paper. Moreover, sustainability trends have encouraged the development of eco-friendly book paper solutions, such as recycled and FSC-certified products, aligning with global environmental goals. As a result, the integration of technology and sustainability is reshaping production standards, enhancing the efficiency and appeal of the global book paper market.

Market Trends:

Rise of Premium and Specialty Papers

A prominent trend in the global book paper market is the increasing demand for premium and specialty paper grades. Publishers and consumers alike are showing greater interest in high-quality papers with enhanced texture, finish, and durability, particularly for illustrated books, coffee-table editions, and collector’s items. Coated and acid-free papers are gaining popularity for their ability to retain print clarity and resist degradation over time. For instance, Monadnock Paper Mills, one of the oldest U.S. mills, supplies premium printing and packaging papers with a focus on innovation and environmental responsibility, serving leading brands worldwide. This trend is especially strong in the trade and educational publishing sectors, where visual appeal and product longevity can influence consumer choices. As the market for limited-edition and boutique publications grows, manufacturers are diversifying their paper offerings to meet this rising preference for quality.

Shift Towards Sustainable Materials

Sustainability continues to shape the dynamics of the global book paper market. Growing environmental awareness among consumers and industry stakeholders has increased the demand for eco-friendly paper products. Publishers are increasingly opting for recycled, chlorine-free, and Forest Stewardship Council (FSC)-certified paper to reduce their ecological footprint. For instance, Stora Enso has launched various eco-friendly paper products, including those made from agricultural residues. In response, paper manufacturers are investing in cleaner production technologies and sustainable sourcing practices. The integration of sustainability is no longer limited to niche segments but is gradually becoming a core requirement across mainstream publishing. Governments and corporate buyers are also imposing stricter environmental procurement standards, encouraging widespread adoption of sustainable paper solutions.

Digital Printing Integration

The advancement and adoption of digital printing technologies are significantly influencing book paper usage and design. Digital printing supports short-run production and rapid prototyping, which are crucial for self-publishing, academic reprints, and localized editions. This flexibility is allowing publishers to manage inventory more efficiently and cater to dynamic reader preferences. As demand for personalized and niche content increases, digital printing is enabling faster turnaround times without compromising print quality. Consequently, there is a growing preference for digital printing-compatible book papers that offer consistent ink absorption, sharp imagery, and superior color reproduction.

Growth in Emerging Markets

Emerging markets are becoming increasingly vital to the expansion of the global book paper industry. Countries in Asia-Pacific, Latin America, and parts of Africa are witnessing robust growth in literacy rates, educational access, and publishing activity. These regions are experiencing a surge in domestic publishing and educational reforms that favor printed materials. Local publishers are collaborating with international paper suppliers to address the growing needs of the student population and general readership. Additionally, rising disposable incomes and urbanization in these markets are fostering increased consumer spending on books, which in turn supports the steady demand for diverse book paper formats.

Market Challenges Analysis:

Digital Substitution and Declining Print Readership

One of the most significant restraints affecting the global book paper market is the rapid shift toward digital media. The proliferation of e-books, audiobooks, and online learning platforms has disrupted traditional publishing and reduced the reliance on printed materials. Educational institutions, particularly in developed economies, are increasingly adopting digital textbooks and learning resources due to their accessibility and cost-effectiveness. This digital transition has led to a gradual decline in the demand for book paper, especially in academic publishing. Younger generations, who are more accustomed to digital content consumption, further contribute to this downward trend in print readership.

Raw Material Volatility and Supply Chain Disruptions

Another critical challenge facing the book paper market is the volatility in raw material prices and disruptions in the global supply chain. The production of book paper heavily depends on wood pulp, the price of which fluctuates due to factors such as deforestation regulations, environmental policies, and geopolitical tensions. In recent years, supply chain constraints stemming from transportation delays, energy shortages, and pandemic-induced shutdowns have increased the operational costs for paper manufa cturers. These issues not only impact pricing stability but also hinder timely delivery to publishers and distributors. Additionally, stringent environmental regulations in regions like Europe and North America are placing further pressure on manufacturers to adopt costlier sustainable production methods. For instance, regulatory changes like the European Union’s Deforestation Regulation (EUDR) require pulp and paper companies to provide transparent, verifiable records proving their products are deforestation-free, further complicating supply chains and increasing compliance costs

Sustainability Compliance and Competitive Pressures

Compliance with sustainability standards poses both a financial and operational burden for small and mid-sized paper producers. While larger firms are investing in eco-friendly technologies, smaller players struggle to meet evolving regulatory expectations, leading to consolidation within the industry. Simultaneously, intense competition from alternative packaging and printing substrates, which are often more affordable or adaptable, adds to the pressure on traditional book paper manufacturers. Navigating these challenges while maintaining profitability remains a persistent concern for industry stakeholders.

Market Opportunities:

The global book paper market presents substantial opportunities driven by the resurgence of print culture and niche publishing segments. As readers seek tangible, screen-free experiences, there is growing demand for high-quality printed books, particularly in categories such as art, photography, children’s literature, and graphic novels. Publishers are increasingly investing in visually rich and collectible editions, which require premium-grade paper and specialized printing processes. This trend offers paper manufacturers the chance to supply differentiated products with enhanced textures, coatings, and environmental certifications. Additionally, the self-publishing boom and rise of small, independent presses are contributing to increased demand for versatile paper solutions that support short-run and on-demand printing models.

Emerging markets provide another significant growth avenue for the book paper industry. Expanding literacy initiatives, government-sponsored education programs, and rising school enrollment rates in countries across Asia-Pacific, Latin America, and Africa are accelerating the need for printed educational materials. These regions are witnessing a surge in domestic publishing activity, supported by economic development and cultural emphasis on education. Paper manufacturers that can deliver cost-effective, durable, and eco-friendly solutions tailored to local needs stand to gain a competitive edge. Moreover, with digital fatigue becoming more prevalent, particularly in academic and professional environments, the market is well-positioned to capture renewed interest in printed learning resources. This intersection of educational growth, consumer sentiment, and product innovation presents a favorable landscape for long-term expansion in the global book paper market.

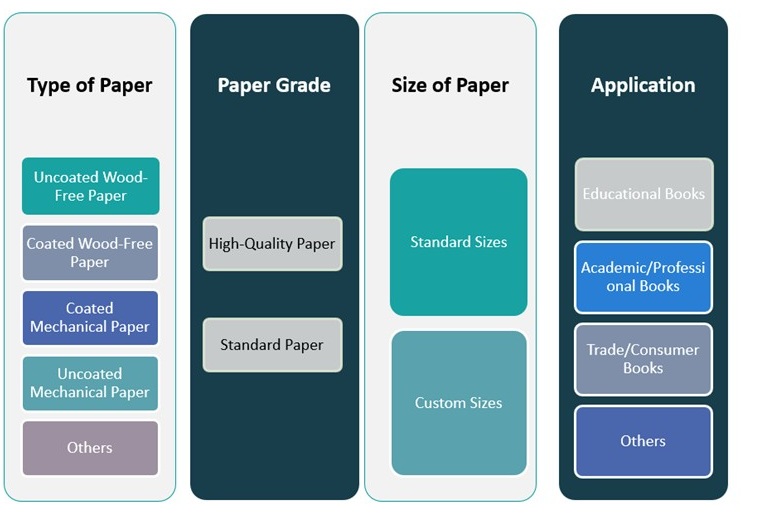

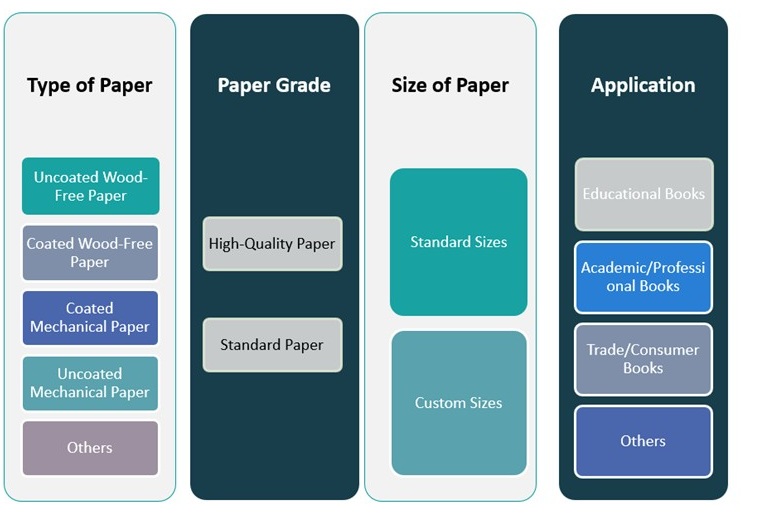

Market Segmentation Analysis:

The global book paper market is segmented into four major categories: type of paper, paper grade, size of paper, and application. Each segment plays a distinct role in shaping market dynamics and meeting the diverse requirements of publishers and consumers.

By type of paper, uncoated wood-free paper holds a significant share due to its widespread use in textbooks and general reading materials, valued for its readability and print clarity. Coated wood-free and coated mechanical papers are preferred for illustrated and high-end publications, offering smooth finishes and enhanced visual appeal. Uncoated mechanical paper, being more cost-effective, finds use in mass-market and educational printing, while the “others” category accommodates niche and specialty paper variants.

By paper grade, high-quality paper is gaining traction in premium segments such as coffee-table books, art books, and children’s literature. Meanwhile, standard paper remains dominant in bulk printing applications, such as school textbooks and general trade books.

By size, standard paper sizes are preferred globally for cost-efficiency and production ease, while custom sizes are increasingly used for branding and specialty publications, especially by self-publishers and boutique publishers.

By application, educational books represent the largest segment, driven by government initiatives and rising school enrollment globally. Academic and professional books maintain consistent demand from institutions and professionals. Trade and consumer books reflect strong market stability due to enduring reader preference for physical books. The “others” segment includes notebooks, religious texts, and specialized educational content. This diversified segmentation enables paper manufacturers and publishers to tailor products for specific end-use scenarios and regional demands.

Segmentation:

By Type of Paper:

- Uncoated Wood-Free Paper

- Coated Wood-Free Paper

- Coated Mechanical Paper

- Uncoated Mechanical Paper

- Others

By Paper Grade:

- High-Quality Paper

- Standard Paper

By Size of Paper:

- Standard Sizes

- Custom Sizes

By Application:

- Educational Books.

- Academic/Professional Books

- Trade/Consumer Books

- Others

Regional Analysis:

The Asia-Pacific region holds the largest share of the global book paper market, accounting for 42.5% of total revenue in 2024. This dominance is primarily attributed to high population density, growing literacy rates, and significant investments in the education sector across countries like China, India, Indonesia, and Vietnam. China alone represents a major share of global production, supported by a robust domestic publishing industry and government-driven educational reforms. India’s expanding student population and emphasis on printed academic materials continue to fuel strong demand for book paper. Additionally, increasing disposable income and consumer preference for printed leisure books in urban areas further contribute to regional growth.

Europe follows as the second-largest market, capturing 26.3% of the global share in 2024. The region benefits from a longstanding publishing tradition, particularly in countries like Germany, the UK, and France, where demand for high-quality print materials remains consistent. The European market emphasizes premium, coated, and sustainable book papers used for illustrated publications and limited-edition releases. Moreover, regulatory support for FSC-certified and recycled paper continues to shape procurement patterns in the region. Educational institutions and public libraries in Europe maintain strong reliance on printed content, reinforcing steady consumption across various paper grades.

North America accounts for 18.7% of the global book paper market in 2024. While digital media has disrupted traditional publishing in the U.S. and Canada, there remains a stable demand for printed books, particularly in trade, academic, and children’s segments. The rise of independent and self-publishing in the U.S. has contributed to consistent paper usage, especially with the growth of on-demand printing. Consumers continue to value printed books for their tactile appeal, while environmental concerns drive demand for sustainably sourced paper products.

The Latin American market represents 7.5% of the global share and is witnessing gradual growth due to expanding literacy programs and improving educational access. Countries like Brazil and Mexico are investing in school infrastructure and textbook distribution, creating long-term opportunities for book paper suppliers. Meanwhile, the Middle East and Africa collectively hold 5% of the market, with growth driven by government-backed educational reforms and increased demand for Arabic and local language publications. Although these regions rely heavily on imports, local players are beginning to develop domestic manufacturing capabilities, presenting future opportunities for market expansion.

Key Player Analysis:

- International Paper

- Nippon Paper Industries

- Domtar Corporation

- Asia Pulp and Paper

- Kruger Inc.

Competitive Analysis:

The global book paper market is characterized by a competitive landscape dominated by several key players who leverage extensive production capacities and global distribution networks. Leading companies such as International Paper, UPM-Kymmene, Asia Pulp & Paper, Stora Enso, and Svenska Cellulosa Aktiebolaget (SCA) play pivotal roles in supplying high-quality paper products to meet diverse publishing needs. These firms focus on innovation, sustainability, and strategic partnerships to maintain their market positions. For instance, UPM-Kymmene emphasizes sustainable forestry practices and has invested in advanced paper production technologies to enhance product quality and environmental compliance. In addition to these major players, regional manufacturers contribute significantly to the market, especially in Asia-Pacific, where countries like China and India have burgeoning publishing industries. These regional companies often cater to local demands and preferences, providing cost-effective solutions and fostering competitive pricing. The market’s competitive dynamics are further influenced by the rise of digital media, prompting traditional paper manufacturers to diversify their product offerings and explore eco-friendly alternatives. Overall, the competitive landscape of the global book paper market is shaped by a blend of established multinational corporations and agile regional players, all striving to adapt to evolving consumer preferences and technological advancements.

Recent Developments:

- In January 2025, International Paper completed its acquisition of DS Smith plc, creating a global leader in sustainable packaging solutions with a strong presence in both North America and Europe. This strategic move is expected to deliver significant synergies of at least $514 million and enhance the company’s customer value proposition through expanded offerings, innovation, and geographic reach. The acquisition also resulted in International Paper obtaining a secondary listing on the London Stock Exchange and establishing a new EMEA headquarters in DS Smith’s former main office.

- In February 2025, Nippon Paper Industries, together with Sumitomo Corporation and Green Earth Institute, announced the establishment of a joint venture named Morisora Bio Refinery LLC. The new company, scheduled to be established in March 2025, will focus on the production and sale of bioethanol and other biochemicals derived from woody biomass. The joint venture will construct a semi-commercial plant at Nippon Paper’s Iwanuma Mill, aiming to begin production in 2027, with ambitions to support the adoption of sustainable aviation fuel in Japan by 2030. Additionally, in August 2024, Nippon Paper agreed to transfer all shares of its subsidiary Daishowa Uniboard Co., Ltd. to A&A Material Corporation, with the transaction set for October 1, 2024, as part of its strategy to shift management resources to growth businesses.

- in November 2024, when the European Commission approved the takeover of Asia Pulp & Paper Group by Jackson Wijaya Limantara, owner of Paper Excellence Group (now rebranded as Domtar). This acquisition brings APP, a major player in pulp, paper, and packaging, under the control of the same group that owns Domtar, further consolidating the global paper industry.

Market Concentration & Characteristics:

The global book paper market exhibits moderate to high market concentration, with a few dominant multinational players controlling a significant share of global supply. Companies such as International Paper, UPM-Kymmene, Stora Enso, and Asia Pulp & Paper have established strong footholds through large-scale production capabilities, integrated supply chains, and extensive distribution networks. These major players typically lead in product innovation, sustainable practices, and cost optimization, setting benchmarks for industry performance. Despite the dominance of global leaders, regional manufacturers play a crucial role in catering to localized needs, especially in emerging economies where educational demand is rising. The market is characterized by diverse paper grades, ranging from uncoated mechanical to premium coated varieties, designed to serve distinct publishing segments. As digital disruption and sustainability concerns evolve, the market is increasingly defined by adaptability, environmental compliance, and responsiveness to shifting consumer preferences. This blend of scale, specialization, and regional diversity defines the competitive and operational landscape of the book paper industry.

Report Coverage:

The research report offers an in-depth analysis based on type of paper, paper grade, size of paper, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The global book paper market is projected to witness steady growth, driven by expanding educational infrastructure in developing countries.

- Rising demand for premium-quality paper in luxury and illustrated book segments will create niche opportunities.

- Sustainability initiatives will accelerate the adoption of recycled and FSC-certified paper products across regions.

- Digital printing advancements will support the rise of short-run and personalized book production, boosting paper usage.

- Emerging markets in Asia-Pacific, Africa, and Latin America will continue to fuel growth through increasing literacy rates.

- The shift toward eco-friendly paper manufacturing processes will become a key competitive differentiator.

- Strategic mergers and acquisitions among major players will enhance production capabilities and global reach.

- Continued consumer preference for physical books in leisure and children’s segments will sustain baseline demand.

- Regulatory frameworks focused on environmental compliance will reshape manufacturing and sourcing practices.

- Technological innovation in coating and texture enhancement will elevate the appeal of physical books in the digital age.