| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Book Paper Market Size 2024 |

USD 218.56 Million |

| Mexico Book Paper Market, CAGR |

2.75% |

| Mexico Book Paper Market Size 2032 |

USD 271.62 Million |

Market Overview:

The Mexico Book Paper Market is projected to grow from USD 218.56 million in 2024 to an estimated USD 271.62 million by 2032, with a compound annual growth rate (CAGR) of 2.75% from 2024 to 2032.

Several factors contribute to the expansion of the book paper market in Mexico. The country’s rich literary tradition and increasing literacy rates fuel the demand for printed books across various genres, including educational, literary, and children’s books. Moreover, the rise in educational institutions and the emphasis on physical learning materials bolster the need for book paper. Despite the digitalization of reading materials, a significant portion of the population continues to favor printed books, driven by factors such as tactile experience, reduced eye strain, and the cultural significance of physical books. Additionally, the growing middle class in Mexico, with increasing disposable income, is supporting higher consumption of printed literature. The increasing popularity of local authors and the rise of self-publishing are also contributing to the demand for book paper in the region.

Geographically, the demand for book paper is concentrated in urban centers like Mexico City, Guadalajara, and Monterrey, where educational institutions, publishing houses, and bookstores are prevalent. These regions not only serve as hubs for educational activities but also as cultural epicenters that promote reading and literature. The distribution networks in these areas are well-established, facilitating the efficient supply of book paper to meet the market’s needs. Additionally, the Mexican government’s initiatives to promote literacy and education further support the demand for printed educational materials, thereby positively impacting the book paper market. Rural areas are also beginning to see increased investments in education, which may further drive book paper demand. As digital penetration remains lower in these regions, physical books continue to be an important resource for learning and entertainment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Mexico Book Paper Market is projected to grow from USD 218.56 million in 2024 to USD 271.62 million by 2032, with a CAGR of 2.75%.

- The Global Book Paper Market is projected to grow from USD 10,203.76 million in 2024 to USD 14,364.15 million by 2032, with a CAGR of 4.37%, driven by increasing demand for printed educational materials and books worldwide.

- Mexico’s rich literary tradition and increasing literacy rates are key drivers for the demand for printed books, especially in educational sectors.

- The continued preference for printed books over digital formats, due to tactile experience and reduced eye strain, supports the growth of the market.

- Government initiatives focused on improving education, particularly in rural areas, drive demand for printed textbooks and academic materials.

- The growing middle class and rising disposable income in Mexico are boosting consumption of printed literature across various genres.

- The demand for book paper is concentrated in urban centers like Mexico City, Guadalajara, and Monterrey, which are hubs for education and publishing.

- Challenges include the shift toward digital formats, rising production costs, and the need for sustainable manufacturing practices to meet consumer expectations.

Market Drivers:

Cultural and Educational Significance of Printed Books

One of the primary drivers for the growth of the Mexico book paper market is the cultural importance of printed books. Mexico has a rich literary tradition, with a large number of both international and local authors contributing to the country’s literary landscape. For instance, Mexico hosts the Guadalajara International Book Festival, recognized as the most important publishing gathering in the Spanish-speaking world, reflecting the country’s strong literary tradition and the central role of physical books in its culture. This has fostered a strong preference for physical books among Mexican readers. Printed books are seen as a tangible representation of culture and knowledge, and they play an essential role in the country’s education system. The rising demand for books in educational institutions, especially for textbooks and academic materials, further amplifies the need for book paper. The ongoing significance of physical books in Mexican society supports the book paper market and ensures its continued relevance despite the digital transformation in publishing.

Growth in Literacy and Educational Investments

In recent years, Mexico has made significant strides in improving its literacy rates, driven by both government and private sector efforts. Increased investments in education, particularly in rural areas, are contributing to a higher demand for printed educational materials. Textbooks, workbooks, and reference materials remain fundamental to the educational process in Mexico, especially in regions with limited digital infrastructure. As the Mexican government continues to focus on expanding access to education and enhancing literacy, the demand for book paper for educational purposes will remain strong. These investments help sustain the market for book paper by ensuring a steady consumption of physical educational materials across the country.

Consumer Preference for Printed Literature

While digital books and e-readers have become more popular globally, many Mexican consumers continue to prefer printed literature due to the tactile experience they provide. Many readers, especially older generations, value the physicality of books, finding them easier on the eyes and more comfortable for extended reading. For instance, the National Institute of Statistics and Geography (INEGI) in Mexico reported that in 2022, the average number of books read annually by adults was 3.9. A significant portion, over 40%, read for entertainment, while about a quarter read for work or study. This preference for physical books extends to a variety of genres, including novels, magazines, and children’s books. As a result, Mexican readers are driving the sustained demand for printed books and, by extension, the demand for book paper. The strong consumer inclination towards printed books serves as a critical factor in the market’s growth and longevity.

Rising Middle Class and Disposable Income

The expansion of Mexico’s middle class and the increase in disposable income are also contributing to the growth of the book paper market. As more people achieve a higher standard of living, they are able to invest in books for both educational and leisure purposes. The growing middle class has shifted its consumption patterns, favoring printed materials, particularly in the form of novels, educational resources, and cultural publications. This demographic shift, coupled with the growing availability of books at various price points, supports an increased demand for book paper. The expanding purchasing power of the middle class is expected to continue driving the market for book paper in the coming years.

Market Trends:

Digitalization and E-book Adoption

The Mexican book market has witnessed a notable shift towards digitalization, with increasing adoption of e-books and audiobooks.According to the National Institute of Statistics and Geography (INEGI), over 30% of Mexican readers engaged with digital formats in 2022, marking a significant rise from previous years. This trend reflects a broader global movement towards digital reading, influenced by factors such as convenience, accessibility, and the proliferation of mobile devices.Despite this growth in digital formats, printed books continue to hold cultural and educational significance in Mexico, leading to a dynamic coexistence of both mediums in the market.

Sustainability Initiatives in Paper Production

Environmental concerns have prompted the Mexican paper industry to adopt more sustainable practices. Manufacturers are increasingly utilizing recycled materials and sourcing paper from certified sustainable forests to reduce their ecological footprint. Additionally, there is a growing emphasis on using biodegradable inks and water-based coatings in the production process. For instance, companies like Balaji JMC Paper Mill, inaugurated in Ciudad Juárez, produce 100% recycled test liner paper using state-of-the-art automation and energy-efficient systems, further supporting the industry’s sustainability goals. These initiatives align with global sustainability trends and cater to the rising consumer demand for eco-friendly products.As a result, the Mexican book paper market is experiencing a transformation towards more environmentally responsible production methods.

Impact of Economic Factors on Book Production

Economic fluctuations have had a discernible impact on the Mexican book paper market.In the 2023–2024 period, the National Chamber of the Mexican Publishing Industry (CANIEM) reported a 23.6% decrease in book production and a 22.4% drop in printed editions sold compared to the previous year. These declines are attributed to factors such as inflation, rising production costs, and shifts in consumer spending patterns.Despite these challenges, the market demonstrates resilience, with ongoing efforts to adapt to economic conditions and maintain production levels.

Technological Advancements in Printing

Advancements in printing technology are influencing the Mexican book paper market by enhancing production efficiency and customization capabilities. For instance, Offset Santiago, a leading Mexican printing company, has incorporated both traditional offset and digital offset printing techniques, offering personalized services, a wide variety of materials, and sustainable options such as CO2-neutral certified machinery and FSC-certified paper. The adoption of digital printing techniques allows for shorter print runs, quicker turnaround times, and cost-effective production of personalized materials. This technological shift is particularly beneficial for niche publishers and educational institutions requiring tailored content. As digital printing continues to evolve, it is expected to play a pivotal role in shaping the future landscape of the Mexican book paper market.

Market Challenges Analysis:

Digital Transformation and E-book Preference

One of the significant challenges faced by the Mexico book paper market is the growing preference for digital formats over traditional printed books. As more readers turn to e-books and audiobooks for their convenience and accessibility, the demand for printed books, particularly in the younger demographic, has experienced a decline. The rising use of smartphones, e-readers, and tablets for reading materials poses a direct threat to the traditional book paper market. Although physical books remain popular, particularly in educational contexts, the increasing shift to digital reading presents a long-term challenge for the industry.

Economic Pressures and Rising Production Costs

The Mexican book paper market faces the challenge of rising production costs, primarily due to the fluctuations in the prices of raw materials, such as wood pulp and chemicals used in paper production. The devaluation of the Mexican peso also impacts the cost of imported raw materials, making the production process more expensive. These economic pressures have resulted in increased production costs, which may lead to higher prices for printed books. This, in turn, may reduce consumer spending on books, further dampening demand for paper-based products. Publishers and manufacturers are under pressure to balance production costs while maintaining affordability for consumers.

Environmental Regulations and Sustainability Demands

Another challenge in the market is the increasing pressure to adopt sustainable production practices. While there is a shift toward environmentally friendly paper production, the transition requires significant investment in new technologies and processes. For instance, the General Law of Ecological Balance and Environmental Protection (LGEEPA), which outlines guidelines for sustainable development across the country. Companies must navigate a complex landscape of environmental regulations, including obtaining necessary permits, conducting environmental impact assessments, and adhering to waste management laws. The rising cost of sustainable materials, combined with stricter environmental regulations, places additional financial strain on manufacturers. Adhering to these sustainability standards may lead to higher production costs, potentially making it difficult for smaller publishers and manufacturers to compete. As consumers and governments demand eco-friendlier products, companies in the book paper industry must navigate the complexities of sustainability without sacrificing profitability.

Market Opportunities:

The Mexican book paper market has significant growth potential due to the country’s increasing focus on education and literacy. As educational content, particularly textbooks and academic materials, continues to be in high demand, there is a substantial opportunity for book paper manufacturers. Government initiatives aimed at improving educational infrastructure and increasing school enrollment contribute to a consistent need for printed educational materials. Furthermore, the growing publishing industry, especially in the education sector, presents opportunities for manufacturers to provide specialized paper products tailored to educational content. This growing demand for educational resources creates a steady market for book paper.

Mexico’s strategic geographical location and established trade agreements enhance its position as a key player in the regional paper market. With a concentrated paper manufacturing industry, there are opportunities for collaboration and further consolidation, which could lead to improved efficiencies and expanded production capacity. Additionally, the rising demand for paper products in neighboring countries, driven by educational and industrial needs, provides avenues for export growth. By enhancing production capabilities and optimizing distribution networks, Mexico has the opportunity to expand its reach within the region and strengthen its position in the global paper market. This growing regional demand offers significant opportunities for manufacturers to tap into new markets and increase their market share.

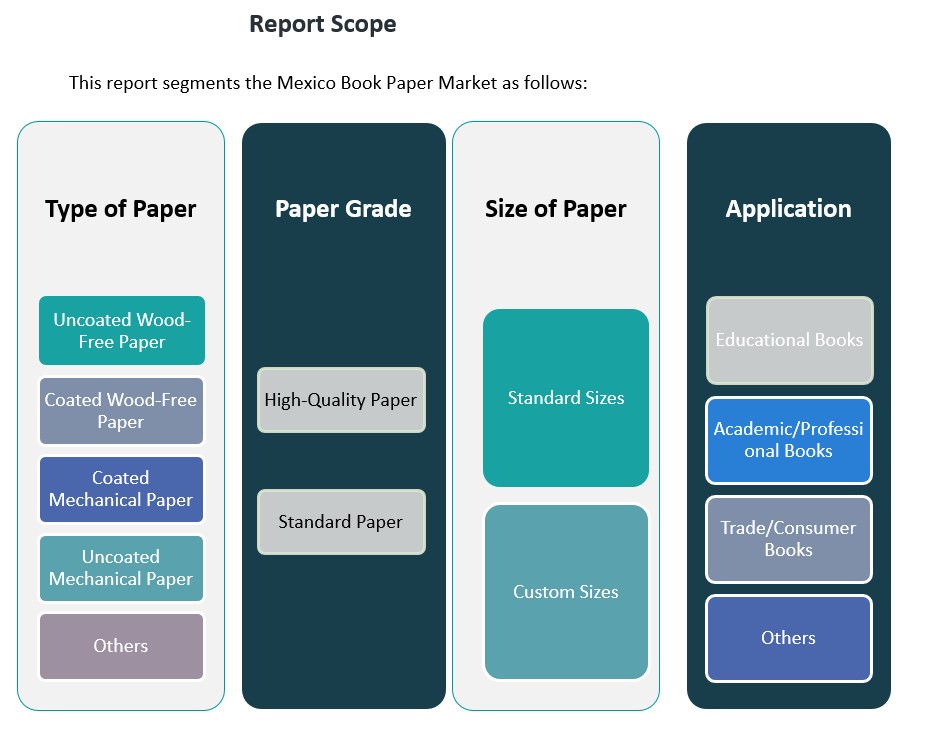

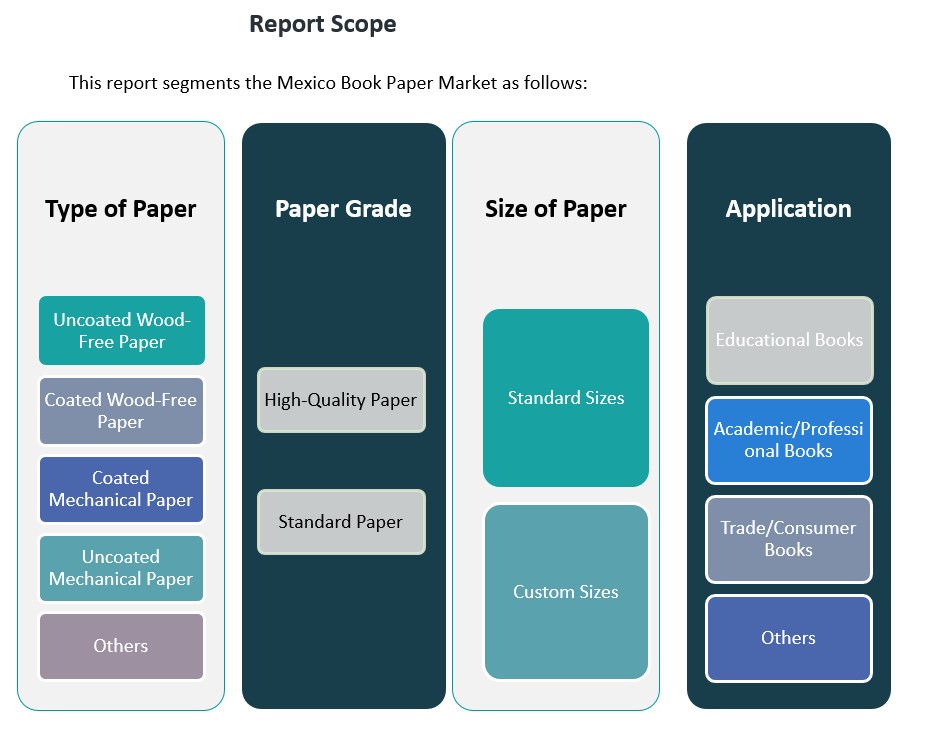

Market Segmentation Analysis:

By Type of Paper

The Mexico book paper market is segmented by paper type into Uncoated Wood-Free Paper, Coated Wood-Free Paper, Coated Mechanical Paper, Uncoated Mechanical Paper, and Others. Uncoated wood-free paper dominates the market due to its widespread use in educational and professional publishing. Coated wood-free paper, known for its high-quality print results, is commonly used in premium book production, including academic texts and high-end consumer publications. Coated mechanical paper and uncoated mechanical paper are typically used for mass-market books and trade publications due to their cost-effectiveness. The “Others” category includes specialized papers for niche applications, although it holds a smaller market share.

By Paper Grade

The market is also segmented by paper grade into high-quality paper and standard paper. High-quality paper, used for luxury books, academic texts, and professional publications, holds a significant share due to the demand for premium print finishes. Standard paper, more affordable and versatile, is used in large volumes for educational textbooks, trade books, and other mass-market applications.

By Size of Paper

The market is further divided by paper size into standard and custom sizes. Standard-sized papers are primarily used in educational and professional publishing, where consistency and cost-efficiency are key. Custom sizes cater to specialized publishing needs, such as art books and unique publications, though they account for a smaller portion of the market.

By Application

Applications of book paper include educational books, academic/professional books, trade/consumer books, and others. Educational books form the largest segment, driven by government initiatives and a growing emphasis on literacy. Academic and professional books also represent a significant portion, driven by the demand for specialized content in higher education and professional fields. Trade and consumer books have steady demand, with a growing interest in leisure reading.

Segmentation:

By Type of Paper:

- Uncoated Wood-Free Paper

- Coated Wood-Free Paper

- Coated Mechanical Paper

- Uncoated Mechanical Paper

- Others

By Paper Grade:

- High-Quality Paper

- Standard Paper

By Size of Paper:

- Standard Sizes

- Custom Sizes

By Application:

- Educational Books.

- Academic/Professional Books

- Trade/Consumer Books

- Others

Regional Analysis:

Central Mexico

Central Mexico, encompassing Mexico City, Puebla, and Querétaro, is the dominant region in the book paper market, contributing approximately 40% of the national demand. Mexico City serves as the publishing and educational hub, housing numerous universities, publishing houses, and bookstores. The region’s robust infrastructure and high literacy rates drive the demand for educational and academic books, leading to significant consumption of book paper.

Northern Mexico

Northern Mexico, including states like Nuevo León, Coahuila, and Chihuahua, accounts for about 25% of the market share. This region’s proximity to the United States facilitates trade and access to international publishing standards. Cities like Monterrey are industrial and educational centers, contributing to the demand for both educational and trade books. The presence of international publishers and printing facilities further bolsters the region’s consumption of book paper.

Western Mexico

Western Mexico, comprising Jalisco, Michoacán, and Colima, holds a market share of approximately 20%. Guadalajara, the capital of Jalisco, is renowned for its International Book Fair, one of the most significant in the Spanish-speaking world. The city’s vibrant cultural scene and educational institutions drive the demand for various book genres, including academic, literary, and children’s books, thereby influencing the regional book paper market.

Southern Mexico

Southern Mexico, including Oaxaca, Chiapas, and Guerrero, represents about 10% of the market. While this region has a lower consumption rate, it is witnessing growth due to increased educational initiatives and government programs aimed at improving literacy. The demand for educational materials is gradually rising, leading to a steady increase in book paper consumption.

Eastern Mexico

Eastern Mexico, encompassing Veracruz and Tabasco, contributes around 5% to the market. The region’s consumption is primarily driven by educational institutions and local publishing houses. Although the demand is relatively modest, ongoing educational reforms and infrastructural developments are expected to foster growth in the coming years.

Key Player Analysis:

- Bio Pappel

- Scribe

- Grupo Gondi

- Smurfit Kappa

- Masisa

Competitive Analysis:

The Mexico book paper market is highly competitive, with several key players dominating production and distribution. Major paper manufacturers such as Papelería Nacional, Grupo Gondi, and Smurfit Kappa lead the market, providing a wide range of paper products for the book publishing industry. These companies have extensive manufacturing capabilities, robust distribution networks, and strong relationships with local and international publishers, enabling them to meet the growing demand for educational, academic, and trade books. In addition to these large players, smaller regional manufacturers contribute to the market, focusing on niche paper types and specialized products. The competitive landscape is influenced by the increasing shift toward sustainability, with several companies investing in eco-friendly paper production processes and sustainable sourcing. This trend presents an opportunity for companies to differentiate themselves by catering to the growing demand for environmentally responsible paper products.

Recent Developments:

- In April 2025, Labelexpo Mexico 2025 showcased significant advancements in printing and labeling technologies, which are expected to influence the production and innovation of book paper and other stationery products in the Mexican market.

- In July 2024, Smurfit Kappa Mexico partnered with ABB to modernize its Paper Machine at the Cerro Gordo mill north of Mexico City. This project is expected to significantly boost production efficiency and output, with ABB providing advanced control systems and engineering services. The collaboration is set to help Smurfit Kappa achieve its production goals and maintain competitiveness in the Mexican packaging market.

- In February 2022, Bio Pappel, the largest manufacturer of paper and paper products in Mexico and Latin America, completed the acquisition of Midwest Paper Group Holdings Inc. through its U.S. subsidiary, McKinley Paper Company. This move expanded Bio Pappel’s reach in North America, particularly in high-quality recycled containerboard and natural kraft packaging grades, strengthening its supply chain and sustainability initiatives.

Market Concentration & Characteristics:

The Mexico book paper market exhibits a high degree of concentration, with a limited number of companies dominating production. Notably, Bio Pappel, the largest paper manufacturer in Latin America, plays a pivotal role in the book paper sector. Through its acquisition of Grupo Papelero Scribe, Bio Pappel has solidified its position in the production of paper for books, including paper bond and recycled paper products. This consolidation has enabled the company to meet the diverse needs of the publishing industry, from educational materials to trade books. In addition to Bio Pappel, other significant players such as Smurfit Kappa and Papelería Nacional contribute to the market’s dynamics. These companies offer a range of paper products, including uncoated and coated papers, catering to various segments of the book publishing industry. Their extensive distribution networks and established relationships with publishers and educational institutions further reinforce their market presence. The market’s characteristics are shaped by factors such as technological advancements in paper production, environmental considerations, and shifting consumer preferences. The increasing demand for sustainable and eco-friendly paper products has prompted manufacturers to invest in recycling technologies and sustainable sourcing practices. Moreover, the rise of digital media poses challenges to traditional paper-based publishing, influencing the types of paper products in demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on type of paper, paper grade, size of paper, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Mexico book paper market is expected to maintain steady growth, driven by increasing educational demand and government investments in literacy programs.

- Digital transformation will continue to pose challenges, but physical books will remain essential for educational and cultural purposes.

- The shift toward eco-friendly paper production will intensify, as manufacturers adopt more sustainable practices to meet consumer and regulatory demands.

- Innovations in paper production technology will improve cost efficiency and product quality, allowing for more customization in book printing.

- Rising disposable incomes and a growing middle class will increase demand for premium book products in the educational and trade sectors.

- The demand for recycled paper will grow as environmental awareness rises, pushing manufacturers to invest in recycling technologies.

- The educational book segment will continue to dominate, with a focus on textbooks and academic materials.

- The expansion of e-commerce and online retailing will require more efficient packaging solutions, indirectly impacting the book paper market.

- Regional disparities will continue, with Central and Northern Mexico maintaining the largest share due to their educational and industrial activities.

- Strategic partnerships between publishers and paper manufacturers will strengthen to meet the evolving needs of the market.