Market Overview

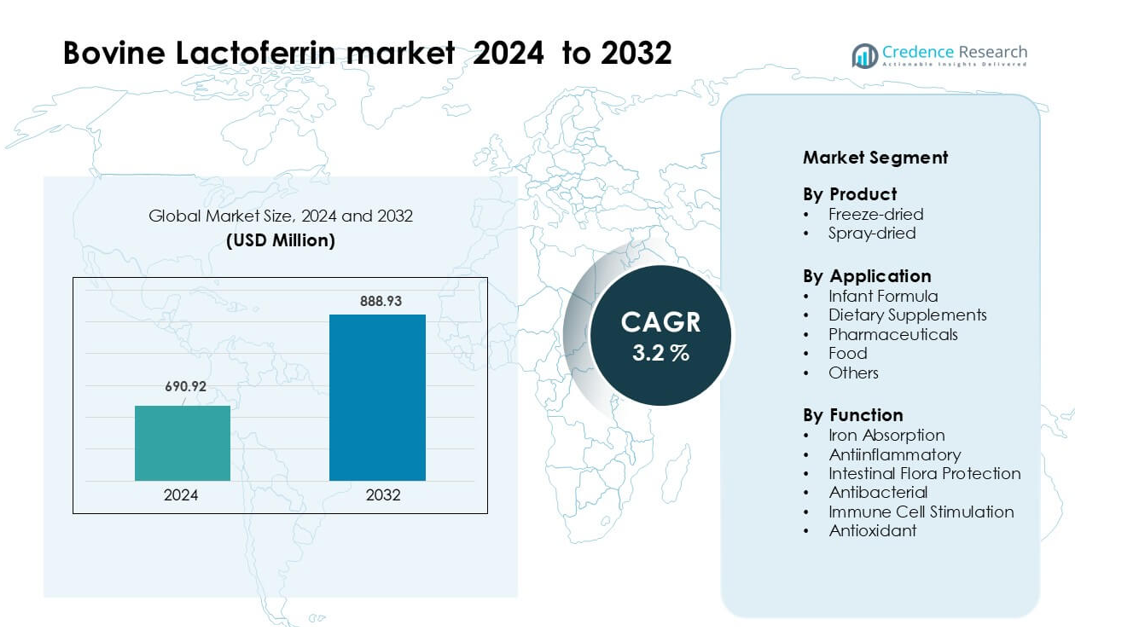

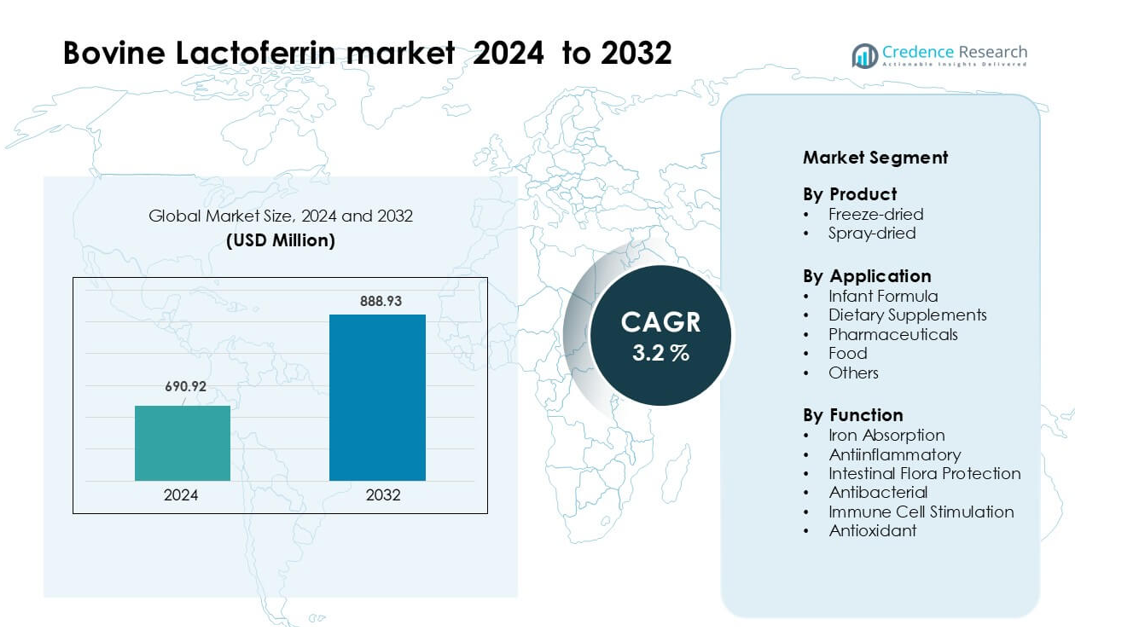

Bovine Lactoferrin market was valued at USD 690.92 million in 2024 and is anticipated to reach USD 888.93 million by 2032, growing at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bovine Lactoferrin Market Size 2024 |

USD 690.92 million |

| Bovine Lactoferrin Market, CAGR |

3.2% |

| Bovine Lactoferrin Market Size 2032 |

USD 888.93 million |

The bovine lactoferrin market is shaped by major players such as Glanbia plc, APS BioGroup, Pharming Group NV, Synlait Milk Ltd., ProHealth, FrieslandCampina, MP Biomedicals, Hilmar Cheese Company, Ingredia SA, and Tatura Milk Industries Ltd. These companies compete through high-purity extraction, advanced processing technologies, and strong supply partnerships with global infant formula and nutrition brands. They also expand production capacity and invest in clinical research to enhance product efficacy and regulatory compliance. Asia Pacific leads the market with about 31% share, driven by strong infant formula consumption and rising demand for premium immune-health ingredients.

Market Insights

- The bovine lactoferrin market reached USD 690.92 million in 2024 and is projected to hit USD 888.93 million by 2032, growing at a CAGR of around 3.2%.

- Strong demand for immune-support ingredients drives growth, with freeze-dried lactoferrin holding about 61% share due to higher purity and strong use in premium nutrition and infant formula.

- Product innovation trends rise as brands adopt microencapsulation, probiotic blends and enhanced-stability powders to improve bioavailability and expand use in supplements, functional foods and medical nutrition.

- Competition intensifies as players such as Glanbia plc, Synlait Milk Ltd., FrieslandCampina and APS BioGroup invest in capacity expansion, advanced purification and long-term supply contracts to meet infant formula and supplement demand.

- Asia Pacific leads the market with 31% share, followed by North America at 34% and Europe at 28%, driven by high infant formula consumption and rising adoption of immunity-focused supplements across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Freeze-dried bovine lactoferrin dominated the product segment in 2024 with about 61% share. Brands selected this form because freeze-drying preserves structural integrity and boosts bioactivity, which helped producers serve high-value nutrition and pharma applications. Demand grew as infant nutrition companies raised use of bioactive ingredients to match natural milk composition. Spray-dried lactoferrin expanded at a steady rate due to lower cost and wider supply, yet freeze-dried variants stayed ahead because premium formulas and medical nutrition continued to favor higher purity and stronger functional stability.

- For instance, Friesland Campina Ingredients in the Netherlands opened a new lactoferrin production facility in Veghel that raised its capacity from 20 metric tonnes to 80 metric tonnes per year, with a purity of at least 95%, enabling more high‑purity freeze‑dried product for infant and medical nutrition.

By Application

Infant formula led the application segment in 2024 with nearly 54% share. Formula makers increased lactoferrin use to support immunity, gut balance and iron uptake in early-life nutrition. Strong approval from regulators and rising launches of fortification-focused baby products pushed adoption across major markets. Dietary supplements grew due to rising adult immunity demand, while pharmaceuticals used lactoferrin for antimicrobial and anti-inflammatory benefits. Food applications also expanded as companies added functional proteins to dairy drinks, bars and fortified powders.

- For instance, Junlebao Dairy launched an infant formula under its Quan Zhen Ai line containing 660 mg (0.66 g) of lactoferrin per liter of reconstituted milk.

By Function

Iron absorption remained the dominant function in 2024 with about 38% share. Healthcare brands adopted lactoferrin because the protein binds iron effectively and improves absorption without causing common side effects linked to synthetic iron salts. Rising awareness of anemia in infants, pregnant women and older adults strengthened this position. Antiinflammatory and antibacterial functions also gained traction as clinical studies highlighted lactoferrin’s role in managing infections and inflammation. Intestinal flora protection and immune cell stimulation grew within probiotics and functional foods targeting gut and immunity support.

Key Growth Drivers

Rising Demand for Immune-Focused Nutrition

The bovine lactoferrin market grows strongly due to rising global demand for immune-support products across infant formula, supplements and functional foods. Parents prefer formula enriched with bioactive proteins that support gut balance and early immune development, which drives bulk purchases from major dairy formulators. Adults also increase intake of lactoferrin as preventive health interest rises after recent infectious disease outbreaks. Strong clinical evidence linking lactoferrin with improved pathogen defense, iron regulation and reduced inflammation encourages wider adoption. This shift supports premium pricing, stable procurement contracts and higher production capacity among dairy ingredient manufacturers.

- For instance, Morinaga Milk’s subsidiary MILEI GmbH doubled its lactoferrin production capacity to approximately 170 tons per year, scaling to supply both infant nutrition and adult supplement lines.

Expansion of Infant Formula Fortification

Infant formula makers act as the largest growth engine because brands now reformulate products to resemble human breast milk more closely. Lactoferrin serves this purpose well due to its natural presence in colostrum and strong bioactive profile. Regulatory approvals across North America, Europe and Asia support higher inclusion levels, which boosts procurement volumes from leading dairy processors. Demand rises further as birth rates stabilize in emerging markets and parents prefer premium, fortified products. New product launches, clinical claims and improved distribution through pharmacies and e-commerce strengthen overall consumption patterns and support long-term market expansion.

- For instance, Friesland Campina Ingredients nearly quadrupled its lactoferrin production capacity in Veghel by expanding from 20 metric tonnes to 80 metric tonnes per year, specifically to supply early‑life nutrition customers.

Growing Applications in Pharmaceuticals

Pharmaceutical companies increase use of bovine lactoferrin because research shows promising benefits in inflammation control, antibacterial protection and iron-related disorders. Drug developers explore lactoferrin as a supportive therapy for anemia, gut disorders and viral infections, which expands clinical programs across multiple regions. Its strong safety profile allows inclusion in pediatric and elderly products, creating a broad patient base. Rising focus on natural therapeutic ingredients encourages partnerships between dairy processors and pharma firms. As clinical evidence grows, formulators scale development of tablets, sachets and medical nutrition blends, lifting long-term demand and adding new revenue streams.

Key Trends & Opportunities

Increasing Product Innovation and Formulation Diversity

Manufacturers invest in new formulations such as microencapsulated lactoferrin, blends with probiotics and enhanced-stability powders. These innovations help improve bioavailability, control oxidation and support use across beverages, gummies and medical foods. Food companies also explore lactoferrin-infused snacks, dairy drinks and fortified powders to target immunity and gut health consumers. This trend widens market reach, improves consumer acceptance and attracts premium pricing. Growing R&D pipelines and patented extraction technologies create strong differentiation among suppliers and open new opportunities across functional food and clinical nutrition categories.

- For instance, Glanbia Nutritionals launched its FerriUp™ whey‑protein concentrate, which naturally delivers lactoferrin along with vitamin B12 and 80% protein through a selective‑transfer membrane system suitable for ready‑to‑mix powders.

Rising Penetration in Adult Supplements

Adult supplement brands increase their use of lactoferrin as consumers shift toward natural solutions for immunity, gut support and inflammation management. Manufacturers launch capsules, chewables and liquid formulations that highlight iron balance and antimicrobial benefits. Marketing campaigns focused on wellness and preventive care further expand awareness. E-commerce platforms strengthen global access, while subscription models enhance repeat purchases. This trend creates opportunities for dairy processors to sell higher-purity grades and expand supply agreements with nutraceutical firms looking to add clinically backed bioactive ingredients.

- For instance, FrieslandCampina Ingredients’ Biotis™ Lactoferrin, manufactured under food-grade conditions, is specifically used in dietary supplements to support adult immune health by binding iron and modulating infection risk.

Key Challenge

Supply Constraints and Limited Raw Material Availability

The market faces constraints because lactoferrin extraction depends heavily on high-quality bovine milk, which limits production expansion. Dairy processors must invest in specialized filtration and purification systems that require high capital costs. Seasonal fluctuations and regional supply imbalances increase price volatility, making it harder for smaller brands to maintain consistent product lines. Any disruption in dairy output, regulatory changes or disease outbreaks can reduce raw material access. These challenges restrict scalability, especially in emerging markets with weaker dairy infrastructure.

Regulatory Complexity and Approval Barriers

Strict regulations governing infant formula, supplements and medical foods create hurdles for rapid product launches. Authorities often require clinical evidence to confirm safety, purity and functional claims, which increases development time and cost. Differences in standards across North America, Europe and Asia complicate global distribution for manufacturers. Frequent updates to import rules, labeling norms and ingredient thresholds require constant compliance monitoring. These factors slow market entry for new players and increase operational complexity for established companies aiming to expand product ranges across multiple regions.

Regional Analysis

North America

North America held about 34% share of the bovine lactoferrin market in 2024, driven by strong consumption of fortified infant formula, immune-health supplements and medical nutrition products. Consumers in the U.S. and Canada showed high preference for premium bioactive proteins backed by clinical evidence, which strengthened demand across retail and pharmacy channels. Major dairy processors expanded purification capacity and partnered with nutrition brands to secure long-term supply. Regulatory clarity for lactoferrin use in infant formula further supported growth, while rising interest in immune and gut-health products pushed wider adoption in functional foods and adult supplements.

Europe

Europe accounted for nearly 28% share in 2024, supported by strong adoption of fortified infant formula, clean-label supplements and clinical-grade nutrition products. Countries such as Germany, the U.K. and France led demand due to established dairy processing infrastructure and strict quality standards that favored high-purity lactoferrin. Growing awareness of iron balance, immune support and gut-health benefits expanded use in premium formulations. Regulatory approvals for lactoferrin inclusion in infant and medical nutrition also strengthened procurement from major brands, while investments in advanced filtration technologies improved regional production capability.

Asia Pacific

Asia Pacific dominated global demand with about 31% share in 2024, driven by high infant formula consumption in China, Japan, South Korea and Australia. Parents in the region preferred products enriched with bioactive proteins that support immunity and gut health, which boosted procurement from global and regional ingredient suppliers. Expanding middle-class spending and strong e-commerce distribution increased access to lactoferrin-based supplements. Growing investments in dairy processing and rising clinical validation of lactoferrin’s benefits supported long-term growth, making the region the fastest-growing market for premium nutritional ingredients.

Latin America

Latin America captured roughly 4% share in 2024, with demand rising slowly as awareness of immune-support ingredients grew across Brazil, Mexico and Argentina. Infant formula enrichment remained the main driver, supported by improving retail distribution and rising interest in premium baby nutrition. Regional dairy processors adopted advanced filtration technologies at a gradual pace, which limited local production capacity. Supplement brands also started introducing lactoferrin-based immunity products, although price sensitivity restricted widespread adoption. Strengthening healthcare awareness and urbanization trends supported steady market expansion.

Middle East & Africa

The Middle East & Africa region held close to 3% share in 2024, driven mainly by growing demand for fortified infant formula in the Gulf countries. Higher disposable incomes in Saudi Arabia, the UAE and Qatar supported purchases of premium bioactive-rich nutrition products. Limited regional production kept reliance on imports high, especially from Europe and Oceania. Awareness of gut-health and immune-support benefits increased interest in supplements, though adoption remained slower in African markets due to affordability constraints. Rising investments in modern retail and healthcare education steadily improved long-term demand.

Market Segmentations:

By Product

By Application

- Infant Formula

- Dietary Supplements

- Pharmaceuticals

- Food

- Others

By Function

- Iron Absorption

- Antiinflammatory

- Intestinal Flora Protection

- Antibacterial

- Immune Cell Stimulation

- Antioxidant

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The bovine lactoferrin market features strong competition led by key players such as Glanbia plc, APS BioGroup, Pharming Group NV, Synlait Milk Ltd., and ProHealth. These companies focus on high-purity extraction, advanced filtration systems, and supply security to meet growing global demand from infant formula, supplement, and medical nutrition brands. Leading processors expand production capacity and invest in bioactive research to improve stability, bioavailability, and functional claims. Strategic partnerships with dairy farms and nutrition companies help secure long-term contracts, while new entrants compete through cost-efficient spray-drying and regional distribution strength. Companies also enhance product portfolios with microencapsulated and blended formulations to serve premium markets. Regulatory compliance, especially for infant formula standards, remains a key differentiator, favoring firms with robust quality systems. As demand grows across North America, Europe, and Asia Pacific, competitors invest in global expansion, localized supply chains, and clinical research to strengthen positioning and capture share in high-value nutrition categories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Glanbia plc

- APS BioGroup

- Pharming Group NV

- Synlait Milk Ltd.

- ProHealth

- FrieslandCampina

- MP Biomedicals

- Hilmar Cheese Company

- Ingredia SA

- Tatura Milk Industries Ltd.

Recent Developments

- In 2025, Ingredia emphasized its Proferrin® lactoferrin (≈ 95% purity) in its product portfolio, promoting its antiviral and antimicrobial benefits for immune- and gut-health applications.

- In February 2023, Morinaga Milk Industry Co., Ltd. acquired shares of Le May Production, a company focused on the import and export of infant and toddler milk. The company aims to contribute to the construction of nutritional infrastructure in Asia

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Function and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for lactoferrin will rise as consumers focus more on immunity and gut health.

- Infant formula producers will increase inclusion levels to match breast milk composition.

- Supplement brands will expand product lines using higher-purity and microencapsulated lactoferrin.

- Pharmaceutical interest will grow as research supports antiinflammatory and antimicrobial benefits.

- Production capacity will expand through advanced filtration and improved extraction technologies.

- Supply chains will move toward regional production to reduce dependence on imported dairy inputs.

- Regulatory approvals across major markets will support broader use in medical and clinical nutrition.

- Food manufacturers will integrate lactoferrin into functional beverages, dairy snacks and fortified powders.

- Companies will invest more in clinical trials to strengthen safety and efficacy claims.

- Asia Pacific will continue to drive global consumption due to strong infant formula demand.