Market Overview

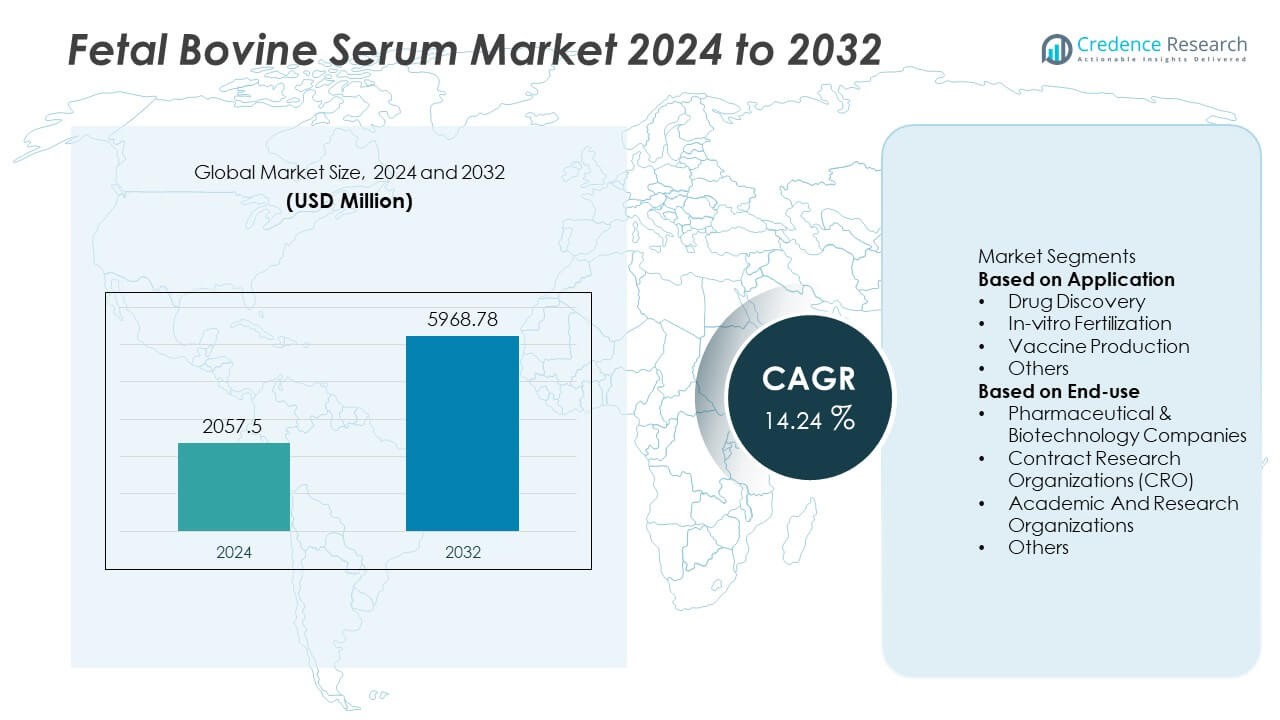

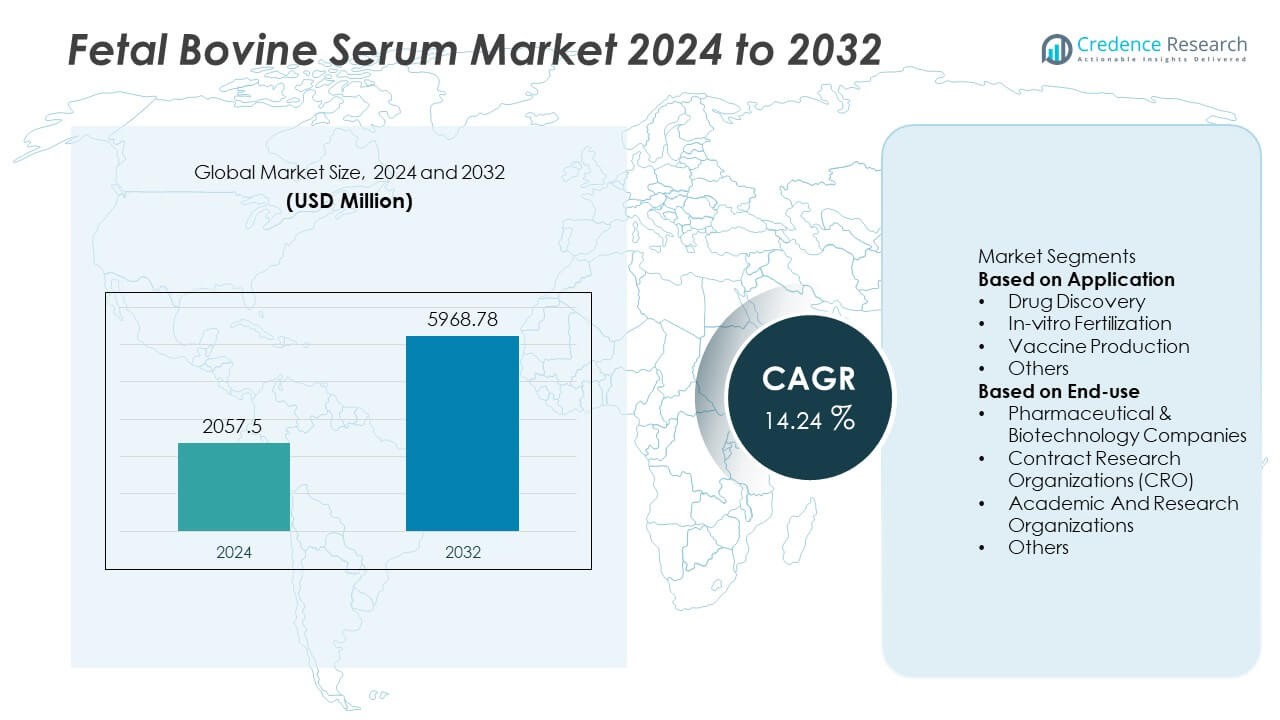

The Fetal Bovine Serum market reached USD 2057.5 million in 2024 and is projected to achieve USD 5968.78 million by 2032. The market is set to expand at a CAGR of 14.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fetal Bovine Serum Market Size 2024 |

USD 2057.5 Million |

| Fetal Bovine Serum Market, CAGR |

14.24% |

| Fetal Bovine Serum Market Size 2032 |

USD 5968.78 Million |

The Fetal Bovine Serum market is shaped by leading players such as Thermo Fisher Scientific Inc., Sartorius AG, Danaher Corporation, Merck KGaA, HiMedia Laboratories, Bio-Techne, PAN-Biotech, Atlas Biologicals, Rocky Mountain Biologicals, and Biowest. These companies strengthen their position through certified sourcing, advanced purification systems, and strict batch-testing standards that support high-quality cell-culture research. North America leads the global market with a 36% market share, supported by strong biopharmaceutical manufacturing, advanced R&D facilities, and consistent demand for premium serum products. Europe follows with 28%, while Asia Pacific holds 24%, reflecting rapid growth in biologics development and expanding CRO activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fetal Bovine Serum market reached USD 2057.5 million in 2024 and will rise to USD 5968.78 million by 2032 at a 14.24% CAGR, supported by expanding cell-culture applications across global research programs.

- Strong growth is driven by rising demand from drug discovery, which leads the application segment with a 42% share, and increasing use in biopharmaceutical and vaccine development pipelines that require consistent, high-quality serum.

- Key trends include a shift toward premium, high-traceability serum grades and growing adoption across Asia Pacific, where rapid biomanufacturing expansion strengthens overall consumption.

- Major players such as Thermo Fisher Scientific, Sartorius, and Merck compete through advanced purification processes, ethical sourcing systems, and strict batch-testing practices that enhance reliability and performance.

- North America leads with a 36% share, followed by Europe at 28% and Asia Pacific at 24%, while the pharmaceutical and biotechnology segment dominates end-use demand with a 48% market share, despite ongoing supply limitations and price volatility.

Market Segmentation Analysis:

By Application

Drug discovery holds the dominant position in the application segment with a 42% market share, driven by rising demand for high-quality serum to support cell proliferation and viability in early-stage screening. Research teams rely on consistent serum performance to improve assay reliability and accelerate development timelines. Vaccine production follows due to the growing need for robust cell-culture media in viral propagation and antigen generation. In-vitro fertilization also expands as fertility clinics adopt refined culture systems to improve embryo development. The segment grows steadily as laboratories prioritize reproducibility, regulatory compliance, and batch-tested serum options for sensitive workflows.

- For instance, Thermo Fisher Scientific validated a serum lot that supported up to or exceeding 100 million viable CHO cells per milliliter during monoclonal antibody screening and fed-batch or perfusion processes.

By End-use

Pharmaceutical and biotechnology companies lead the end-use segment with a 48% market share, supported by large-scale biologics development, advanced cell-based studies, and expanding R&D pipelines. These organizations invest in premium-grade serum to maintain consistency across research batches and meet stringent quality demands. Contract research organizations gain traction as outsourcing increases across preclinical testing and cell-line development. Academic and research institutes also contribute steady demand for teaching, experimentation, and discovery programs. Overall growth remains strong as end users favor certified, contamination-free serum that improves culture outcomes and reduces variability in scientific processes.

- For instance, biopharmaceutical companies routinely optimize cell culture conditions to achieve high performance, such as cell densities exceeding 10 million cells per milliliter in fed-batch processes, while carefully managing inhibitory metabolites like ammonia.

Key Growth Drivers

Rising Demand for Advanced Cell-Culture Research

Growing reliance on mammalian cell cultures in biologics, vaccine development, and regenerative medicine drives strong demand for high-quality fetal bovine serum. Research groups depend on reliable serum performance to support cell viability, differentiation, and protein expression. The rise in monoclonal antibody development and cell-based assays further strengthens market needs. Pharmaceutical companies expand R&D pipelines that require stable and consistent serum batches. Increased investment in cutting-edge platforms such as stem cell therapy and gene editing also boosts consumption, positioning FBS as a critical input for modern life-science research.

- For instance, Bio-Techne offers a portfolio of GMP (Good Manufacturing Practices) reagents, including proteins, small molecules, and antibodies, that support cell and gene therapy development and manufacturing workflows.

Expansion of Biopharmaceutical and Vaccine Manufacturing

Biopharmaceutical producers accelerate the use of FBS to facilitate large-scale culture expansion, upstream processing, and viral propagation for vaccine production. Growing focus on next-generation vaccines and therapeutic proteins amplifies the need for serum that supports fast cell growth and stable metabolic activity. Recent advancements in recombinant technologies and biologics manufacturing increase the number of processes that depend on serum-supplemented media. Rising global immunization programs also expand demand for serum-based production environments. This trend strengthens the market as companies scale capacity to meet both routine and emergency-driven vaccine needs.

- For instance, Sartorius develops advanced bioprocessing technologies, including single-use bioreactors and intensified cell culture systems, designed to boost productivity for biopharmaceutical and vaccine developers.

Increasing Investments in Research Institutions and CROs

Academic laboratories and contract research organizations increase serum adoption to support a wide range of experiments, including toxicity studies, pathway analysis, and preclinical screening. Growing research funding improves demand for consistent, certified serum batches with enhanced traceability. CROs expand service offerings in drug discovery and biologics research, which increases their reliance on scalable and reproducible culture systems. Universities also strengthen programs in stem cell biology and molecular medicine, raising serum consumption. This broad research expansion creates a steady and diversified demand base for FBS across global scientific institutions.

Key Trends & Opportunities

Shift Toward Premium, High-Traceability Serum Products

Buyers increasingly prefer premium-grade serum with strong traceability, pathogen screening, and region-specific sourcing. Manufacturers respond with enhanced filtration, viral reduction steps, and detailed origin documentation. This shift opens opportunities for brands offering certified, ethically sourced serum with robust quality guarantees. High-purity serum supports advanced applications such as stem cell research, IVF protocols, and vaccine production, where contamination risks must remain low. The trend toward controlled, traceable supply chains strengthens the market for suppliers with strong compliance, batch-testing capabilities, and transparent regulatory alignment.

- For instance, the biotech industry commonly uses multi-stage filtration systems and robust tracking modules to ensure product quality and full trace-origin validation for regulated laboratories.

Rising Use of Serum Alternatives and Supplement Innovation

Although FBS remains the standard, laboratories explore serum-reduced and serum-free media to improve consistency and reduce batch variability. This shift opens opportunities for suppliers offering hybrid supplements that replicate serum growth factors and nutrients with improved reproducibility. Companies invest in developing recombinant supplements and defined media that complement existing FBS workflows. Demand grows for flexible solutions that support both cost optimization and regulatory expectations. This trend encourages innovation across cell-culture platforms, enabling suppliers to diversify portfolios while maintaining strong FBS demand in sensitive and specialized applications.

- For instance, HiMedia Laboratories expanded its recombinant supplement line and validated a defined-media protocol that improves stability for long-term culture processes with products such as their HiMesoXL™ Mesenchymal Stem Cell Expansion Medium.

Key Challenges

Supply Limitations and Price Volatility

FBS supply depends on cattle slaughter rates, seasonal variations, and geographic sourcing constraints, creating recurring fluctuations in availability. These limitations cause price instability that affects procurement planning for research organizations and manufacturers. Growing global demand amplifies competitive pressure on supply chains, especially during periods of restricted collection. Variability in raw serum quality also complicates batch standardization. These challenges push buyers to secure long-term contracts or consider partial serum-free transitions. Supply volatility remains one of the most significant barriers to predictable market growth.

Stringent Regulations and Ethical Concerns

Increasing scrutiny over sourcing practices, animal welfare, and contamination risks challenges producers to meet strict regulatory requirements. Compliance with regional standards for serum collection, traceability, and pathogen screening increases production complexity and cost. Ethical concerns around fetal blood harvesting fuel debates that influence purchasing decisions, especially in academic and European markets. Some laboratories face institutional limits on serum use, encouraging a gradual shift toward defined or recombinant media. These regulatory and ethical pressures require suppliers to strengthen transparency and adopt rigorous quality-control protocols to maintain market confidence.

Regional Analysis

North America

North America holds a 36% market share, driven by strong biopharmaceutical activity, advanced research infrastructure, and high adoption of cell-culture technologies in drug development. Leading manufacturers supply premium, batch-tested serum to support monoclonal antibody production, vaccine programs, and stem cell studies. The region benefits from consistent funding for academic laboratories and large research networks. Strict compliance standards also encourage demand for high-traceability serum products. Growing investments in regenerative medicine and expansion of contract research organizations further strengthen the region’s position in global FBS consumption.

Europe

Europe accounts for a 28% market share, supported by established biotechnology hubs, strong regulatory frameworks, and rising research spending across Germany, the U.K., France, and the Nordic region. Demand increases in vaccine development, cell-based assays, and advanced therapeutic studies that require high-purity serum. Ethical sourcing and traceability remain key priorities, prompting greater use of certified and region-specific serum batches. The region also benefits from strong collaborations between universities and pharmaceutical companies. Growing interest in cell therapy, precision medicine, and toxicology research continues to support steady FBS consumption.

Asia Pacific

Asia Pacific holds a 24% market share, with rapid growth fueled by expanding biomanufacturing capacity, rising investment in pharmaceutical R&D, and a growing presence of CROs. China, India, South Korea, and Japan increase serum demand for biologics development, vaccine production, and stem cell applications. Government-backed research initiatives and infrastructure upgrades improve adoption across public and private laboratories. Competitive production costs also encourage global companies to expand operations in the region. As life-science programs scale, Asia Pacific strengthens its role as a major growth engine for the FBS market.

Latin America

Latin America represents a 7% market share, supported by expanding biotechnology research in Brazil, Mexico, and Argentina. Local demand rises as universities and research centers adopt modern cell-culture practices for diagnostics, vaccine studies, and agricultural biotechnology. Growing partnerships with global pharmaceutical companies encourage technology transfer and improved laboratory standards. Supply proximity to cattle-producing regions supports availability, although variability in quality and regulatory alignment remains a challenge. Investments in public-health research and infectious-disease programs continue to drive steady serum consumption across the region.

Middle East & Africa

Middle East & Africa hold a 5% market share, driven by rising investments in healthcare research, expanding biotechnology capabilities, and growing vaccine production initiatives in Gulf countries and South Africa. Adoption increases in academic research, diagnostic development, and basic cell-culture applications. Limited local manufacturing capacity leads to high dependence on imports, but improving laboratory infrastructure supports gradual market expansion. Government-led programs promoting scientific innovation and infectious-disease response strengthen regional demand. As more research institutions upgrade cell-culture facilities, the region experiences steady, long-term growth in FBS usage.

Market Segmentations:

By Application

- Drug Discovery

- In-vitro Fertilization

- Vaccine Production

- Others

By End-use

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CRO)

- Academic And Research Organizations

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as Thermo Fisher Scientific Inc., Sartorius AG, Danaher Corporation, Merck KGaA, HiMedia Laboratories, Bio-Techne, PAN-Biotech, Atlas Biologicals, Rocky Mountain Biologicals, and Biowest. These companies compete through high-quality serum offerings, advanced filtration processes, and strong batch-testing protocols that support research consistency. Leading manufacturers invest in expanding production capacity, improving traceability systems, and enhancing viral-reduction technologies to meet strict global standards. Partnerships with research institutes, biopharmaceutical firms, and CROs strengthen distribution networks and increase market reach. Players also focus on ethical sourcing, diversified geographic procurement, and premium-grade product lines to address rising demand in biologics, vaccine development, and cell-based therapies. Continuous innovation in quality control, supply-chain transparency, and region-specific serum grades positions top competitors to maintain leadership in a highly regulated and supply-sensitive market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rocky Mountain Biologicals

- Sartorius AG

- Bio-Techne

- PAN-Biotech

- Biowest

- Atlas Biologicals, Inc.

- Merck KGaA

- Danaher Corporation

- HiMedia Laboratories

- Thermo Fisher Scientific Inc.

Recent Developments

- In June 2025, Cytiva, a subsidiary of Danaher, allocated USD 1.6 billion through 2028 to expand bioprocessing manufacturing capacity across North America, Europe, and Asia, reinforcing its region-by-region strategy.

- In November 2024, Gemini Bioproducts, LLC in the U.S., acquired Bio-Techne’s R&D Systems FBS product rights and inventory, securing Optima, Premium Select, and Premium brands to ensure continued customer supply.

- In November 2024, Lonza announced the successful completion of its first GMP batch at the next-generation mammalian manufacturing facility in Portsmouth, USA.

- In November 2024, Bio‑Techne Corporation decided to discontinue its FBS product line and transferred selected FBS product rights and inventory to Gemini Bioproducts, LLC.

Report Coverage

The research report offers an in-depth analysis based on Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-quality serum will grow as biologics and cell-based therapies expand worldwide.

- Advanced purification and traceability processes will gain wider adoption across major suppliers.

- Pharmaceutical and biotechnology companies will increase long-term procurement to stabilize research workflows.

- Serum demand will rise in vaccine development as global immunization programs strengthen.

- Asia Pacific will emerge as a major growth hub due to expanding biomanufacturing capacity.

- Premium-grade serum with enhanced screening will see higher preference in regulated markets.

- Innovations in defined and hybrid media will complement, not replace, traditional serum use.

- Contract research organizations will boost consumption as outsourcing in drug discovery accelerates.

- Ethical sourcing and region-specific certification will become key differentiation factors.

- Supply-chain diversification will improve as companies strengthen global collection and processing networks.