Market Overview:

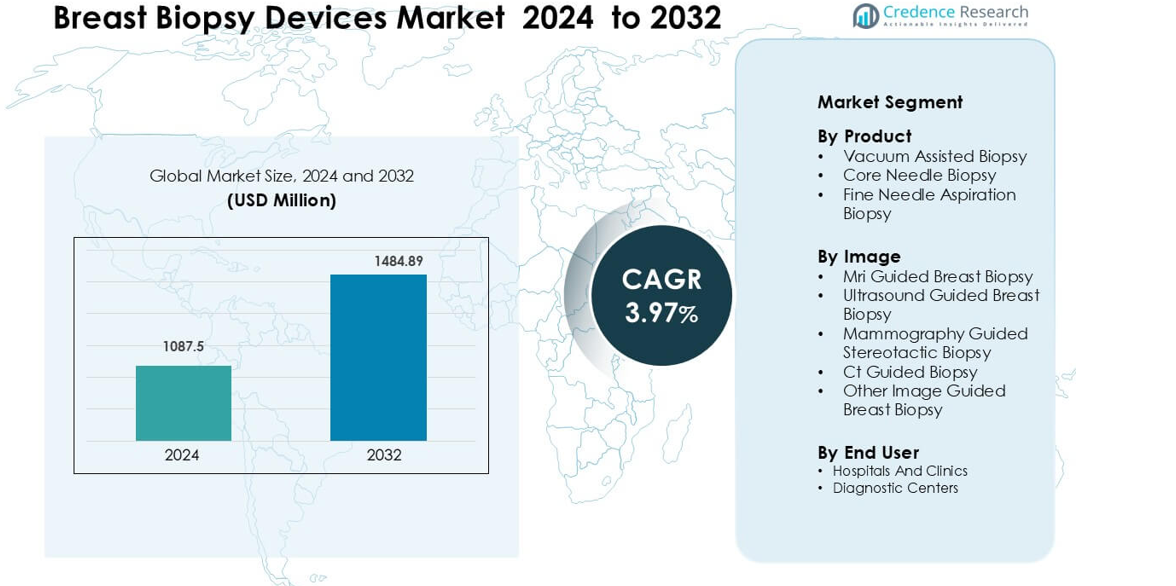

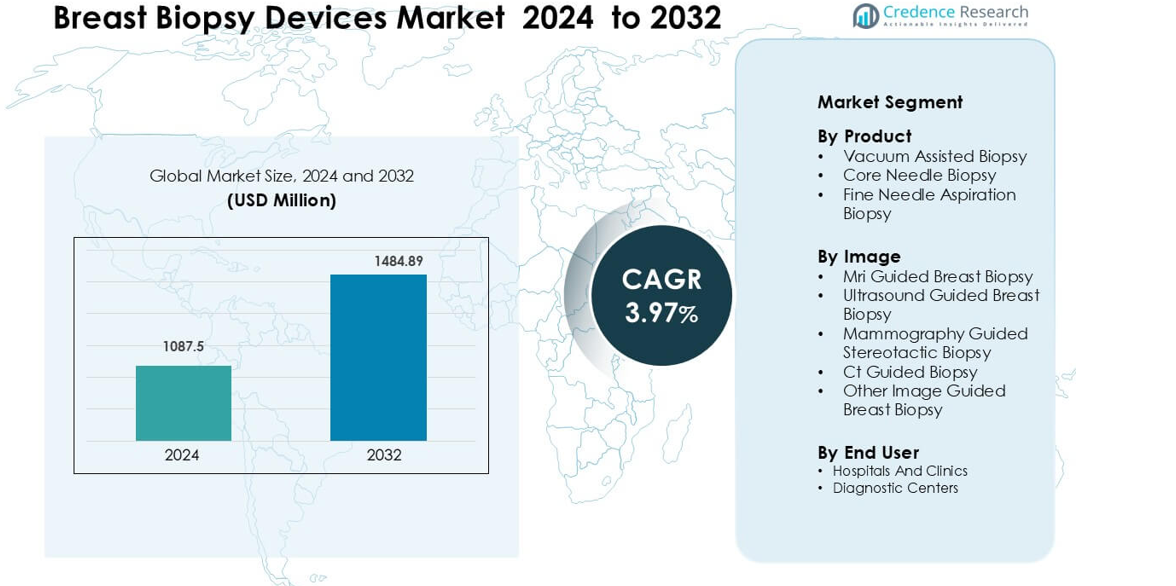

Breast Biopsy Devices Market was valued at USD 1087.5 million in 2024 and is anticipated to reach USD 1484.89 million by 2032, growing at a CAGR of 3.97 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Breast Biopsy Devices Market Size 2024 |

USD 1087.5 million |

| Breast Biopsy Devices Market, CAGR |

3.97% |

| Breast Biopsy Devices Market Size 2032 |

USD 1484.89 million |

The Breast Biopsy Devices Market is shaped by strong competition among major players such as GE Healthcare, Argon Medical Devices, Leica Biosystems, Cook Medical Inc., Hologic, Inc., Medax Srl Unipersonale, Devicor Medical Products, Becton Dickinson and Company, C. R. Bard, Inc., and F. Hoffmann-La Roche Ltd. These companies strengthen their positions through advanced vacuum-assisted systems, improved core needle designs, and integrated imaging-guided biopsy technologies. North America remains the leading region in 2024 with about 38% share, supported by robust screening programs, strong imaging infrastructure, and high adoption of minimally invasive biopsy procedures across hospitals and diagnostic centers.

ghts

ghts

- Breast Biopsy Devices Market was valued at USD 1087.5 million in 2024 and is anticipated to reach USD 1484.89 million by 2032, growing at a CAGR of 3.97 % during the forecast period.

- Vacuum-assisted biopsy leads the product segment with about 49% share, supported by higher tissue yield, fewer insertions, and strong adoption in early-stage lesion assessment.

- AI-supported imaging, MRI-guided targeting, and real-time ultrasound workflows shape current trends as clinics upgrade diagnostic suites for better accuracy and workflow efficiency.

- Competition remains intense among Hologic, GE Healthcare, Becton Dickinson, Cook Medical, Argon Medical Devices, and other players focusing on integrated biopsy-imaging platforms and improved needle designs.

- North America holds the largest regional share at 38%, followed by Europe at 29% and Asia Pacific at 24%, supported by expanding screening programs and rising adoption of image-guided minimally invasive biopsy procedures.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Vacuum-assisted biopsy leads this segment with about 49% share in 2024 due to its higher tissue yield, fewer needle insertions, and shorter procedure time. Clinicians prefer vacuum systems because they reduce sampling error and support accurate diagnosis in early-stage lesions. Core needle biopsy maintains steady demand in routine screening workflows, while fine needle aspiration remains useful in cytology-focused evaluations. Growing focus on minimally invasive tools and improved patient comfort strengthens adoption of vacuum-assisted platforms across hospitals and diagnostic centers.

- For instance, Hologic’s ATEC® vacuum‑assisted breast biopsy system can acquire tissue at a rate of one sample every 4.5 seconds, enabling multiple cores with a single insertion under MRI, stereotactic, or ultrasound guidance.

By Image

Ultrasound-guided breast biopsy dominates this segment with nearly 56% share in 2024 because the method allows real-time imaging, lower procedure cost, and wide availability in screening facilities. Specialists value ultrasound guidance for sampling masses not visible on mammography and for supporting faster workflow throughput. MRI-guided and stereotactic biopsy grow in complex lesion assessment, while CT-guided and other modalities serve niche cases. Rising investment in advanced imaging suites pushes demand for hybrid guidance systems in high-volume centers.

- For instance, BD’s EleVation handheld biopsy device is explicitly designed for ultrasound-guided workflows, offering ergonomic control and vacuum-assisted sampling to maintain diagnostic consistency under real-time imaging.

By End User

Hospitals and clinics hold the largest share at about 61% in 2024 driven by higher patient inflow, wider imaging capability, and immediate access to multidisciplinary care teams. Surgeons and radiologists in these settings adopt advanced biopsy platforms to support accurate staging and treatment planning. Diagnostic centers expand gradually as outpatient screening programs increase, offering shorter wait times and cost-efficient procedures. Growth across both settings is supported by rising awareness, improved imaging access, and early breast cancer detection initiatives.

Key Growth Drivers

Rising Global Breast Cancer Burden

The rising global breast cancer burden acts as a major driver for the Breast Biopsy Devices Market. Screening programs expand every year as health agencies report higher detection rates among women aged 30–60. Growing use of mammography and ultrasound increases the number of suspicious lesions that require tissue confirmation. Hospitals prefer modern biopsy systems because these devices offer higher accuracy and support early diagnosis strategies. Many countries now fund population-wide screening, which pushes the demand for minimally invasive biopsy tools. The shift toward early-stage detection also boosts adoption of vacuum-assisted systems due to better tissue yield and fewer repeat procedures.

- For instance, the study found that the diagnostic accordance rate for the Mammotome VAB group was 99.6%, which was significantly higher than the 94.7% for the core-needle biopsy group.

Growth in Minimally Invasive Diagnostic Procedures

Demand for minimally invasive diagnostics continues to rise as patients and clinicians seek procedures that reduce pain, scarring, and recovery time. Breast biopsy devices align with this shift by offering fast sampling under local anesthesia with shorter clinical visits. Vacuum-assisted and core needle biopsy systems replace open surgical biopsies in many care settings because they offer similar diagnostic accuracy with lower risk. Hospitals adopt these methods to improve workflow efficiency and reduce overall procedure cost. Expansion of outpatient diagnostic centers further accelerates demand for compact, easy-to-use biopsy systems designed for rapid turnaround and improved patient experience.

- For instance, in a long‑term follow-up study of 161 lesions that showed imaging-histologic discordance after a 14‑gauge core‑needle biopsy, US-guided vacuum-assisted removal (VAR) had an “upgrade to malignancy” rate of 4.6% (4/88), while surgical excision of discordant lesions had a rate of 24.7% (18/73), suggesting VAR can reduce unnecessary surgery.

Expansion of Imaging-Guided Biopsy Capabilities

Expansion of imaging-guided capabilities drives strong adoption across the global market. Ultrasound, MRI, and stereotactic mammography systems now integrate biopsy guidance features that improve lesion targeting and reduce sampling error. These upgrades help clinicians detect small, non-palpable tumors earlier. As imaging penetration grows in emerging regions, more centers adopt biopsy devices compatible with multiple imaging modalities. Vendors also introduce systems that pair AI-based image enhancement with guided biopsy pathways, allowing more accurate sampling of complex lesions. These improvements support evidence-based diagnosis and reduce false-negative rates, which strengthens clinical confidence in modern biopsy tools.

Key Trends and Opportunities

Increased Integration of AI-Enhanced Imaging

AI integration in imaging offers strong opportunities for the Breast Biopsy Devices Market. Machine learning tools assist clinicians by detecting suspicious regions, improving lesion characterization, and mapping optimal biopsy paths. Early deployments in radiology suites show better sampling precision, especially for dense breast tissue. Companies developing biopsy systems compatible with AI-assisted imaging will gain an advantage as hospitals upgrade diagnostic workflows. These tools also reduce procedure time and support consistent quality across high-volume centers, positioning AI-linked biopsy tools as a key growth opportunity over the next decade.

- For instance, Hologic’s Genius AI® Detection PRO reads both 2D and DBT (tomosynthesis) images, correlates prior exams, and assigns lesion scores from 1 to 10 in a study, this interface reduced reading time by 24% versus conventional workflows.

Rising Adoption of Outpatient and Ambulatory Diagnostic Models

The shift toward ambulatory and outpatient care models creates new opportunities for biopsy device manufacturers. Patients prefer fast, low-cost biopsies that avoid hospital admission, while diagnostic centers expand capacity for image-guided procedures. Compact vacuum-assisted platforms and portable ultrasound-guided devices support these workflows by reducing infrastructure requirements. This trend allows vendors to target mid-sized imaging clinics that perform high-volume screening. Countries strengthening early detection programs provide large potential for outpatient deployment, making this shift a major opportunity for long-term market growth.

- For instance, the Hologic Brevera® breast biopsy system has a console weighing 90.7 kg (200 lbs) and a reusable driver of just 500 g, making it relatively compact and mobile enough for use in high‑throughput outpatient diagnostic centers.

Key Challenges

High Cost of Advanced Biopsy Systems

High device cost remains a significant challenge in the Breast Biopsy Devices Market, especially for vacuum-assisted platforms and MRI-guided systems. Many small diagnostic centers cannot afford system upgrades due to limited reimbursement or capital expenditure constraints. High-end devices require dedicated imaging suites, trained staff, and periodic maintenance, which raises overall operating costs. These barriers slow adoption in low- and middle-income regions where screening budgets are limited. Vendors offering cost-optimized systems or flexible financing models may help reduce this barrier, but price sensitivity will remain a persistent challenge.

Shortage of Skilled Radiologists and Trained Technicians

A growing shortage of trained radiologists and breast imaging specialists limits the adoption of advanced biopsy procedures. Many regions lack personnel experienced in ultrasound-guided and MRI-guided sampling, leading to longer wait times and lower diagnostic throughput. Skilled users are essential because biopsy accuracy depends on image interpretation and precise needle placement. Training programs expand slowly compared to rising screening demand, especially in emerging markets. Without a strong workforce pipeline, hospitals may delay procurement of advanced biopsy systems. This skills gap will continue to affect installation rates and clinical utilization across several countries.

Regional Analysis

North America

North America leads the Breast Biopsy Devices Market with about 38% share in 2024 due to strong screening programs, high imaging penetration, and broad adoption of vacuum-assisted and image-guided systems. Hospitals and diagnostic centers benefit from advanced radiology infrastructure, strong reimbursement, and rapid integration of AI-supported workflows. The U.S. dominates regional demand as clinics expand ultrasound-guided and stereotactic biopsy capacity. Growing emphasis on early detection and rising patient awareness continue to support market expansion. Canada follows similar trends with increased MRI-guided biopsy use in specialized cancer centers.

Europe

Europe holds nearly 29% share in 2024, driven by well-structured national screening programs and strong clinical preference for minimally invasive biopsy methods. Countries such as Germany, France, and the U.K. invest in upgraded imaging suites, supporting higher adoption of ultrasound-guided and vacuum-assisted devices. The region benefits from rising breast cancer incidence and widespread adherence to diagnostic guidelines that require tissue confirmation of suspicious lesions. Expansion of ambulatory diagnostic centers also pushes demand for compact biopsy systems. Eastern Europe shows growing uptake as imaging access improves and cancer awareness campaigns expand.

Asia Pacific

Asia Pacific accounts for about 24% share in 2024 and represents the fastest-growing region due to rising screening coverage, rapid hospital infrastructure development, and a growing female population at higher diagnostic risk. China and Japan lead adoption with increased investment in ultrasound and MRI-guided biopsy capabilities. India and Southeast Asia show strong demand for cost-efficient core needle and vacuum-assisted systems as awareness programs expand. Urban cancer centers drive procurement of advanced diagnostic tools, while government screening initiatives continue to widen patient access. Increasing imaging penetration fuels strong long-term market potential.

Latin America

Latin America holds nearly 6% share in 2024, supported by gradual improvements in breast cancer screening and rising diagnostic capability in major countries such as Brazil, Mexico, and Argentina. Larger urban hospitals invest in ultrasound-guided biopsy devices due to strong suitability for dense breast tissue and lower operating cost. Limited reimbursement and uneven imaging access slow uptake in rural areas. However, ongoing public health programs and rising private-sector investment support steady adoption of minimally invasive biopsy tools. Growing awareness and expanding radiology networks improve regional demand despite budget constraints.

Middle East & Africa

The Middle East & Africa region accounts for around 3% share in 2024, driven by targeted investments in oncology centers and growing use of image-guided diagnostics in Gulf countries. The UAE and Saudi Arabia lead adoption due to rising breast cancer awareness and strong healthcare modernization efforts. Africa shows slower uptake due to limited imaging infrastructure and shortages of trained radiologists, pushing demand for basic core needle biopsy tools. International partnerships and government screening initiatives are expanding access, supporting gradual market growth as diagnostic capacity improves across key nations.

Market Segmentations:

By Product

- Vacuum Assisted Biopsy

- Core Needle Biopsy

- Fine Needle Aspiration Biopsy

By Image

- Mri Guided Breast Biopsy

- Ultrasound Guided Breast Biopsy

- Mammography Guided Stereotactic Biopsy

- Ct Guided Biopsy

- Other Image Guided Breast Biopsy

By End User

- Hospitals And Clinics

- Diagnostic Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Breast Biopsy Devices Market features strong activity from leading manufacturers such as Hologic, GE Healthcare, Leica Biosystems, Devicor Medical Products, Argon Medical Devices, Becton Dickinson, Cook Medical, Medax Srl Unipersonale, C. R. Bard, Inc., and F. Hoffmann-La Roche Ltd. These companies compete through advanced vacuum-assisted systems, improved core needle designs, and image-guided solutions tailored for ultrasound, MRI, and stereotactic platforms. Vendors focus on enhancing sampling accuracy, reducing procedure time, and improving patient comfort to strengthen clinical adoption. Many manufacturers invest in AI-linked imaging upgrades and integrated workflow software to support precise targeting of small or non-palpable lesions. Partnerships with hospitals and diagnostic centers help expand product reach, while regulatory approvals for minimally invasive tools accelerate market presence. Continuous upgrades in needle design, tissue acquisition systems, and compatibility with modern imaging suites shape strong competition across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GE Healthcare

- Argon Medical Devices

- Leica Biosystems

- Cook Medical Inc.

- Hologic, Inc.

- Medax Srl Unipersonale

- Devicor Medical Products, Inc.

- Becton Dickinson and Company

- R. Bard, Inc.

- Hoffmann-La Roche Ltd.

Recent Developments

- In October 2025, Leica Biosystems expanded its Aperio Digital Pathology portfolio at Pathology Visions 2025 with Aperio HALO AP and the Aperio AI Store. These AI-enabled platforms support high-throughput, image-based analysis of cancer biopsy slides, improving speed and consistency in reading specimens from breast and other tumor types.

- In April 2025, GE HealthCare highlighted its Serena Bright contrast-guided breast biopsy system at the SBI 2025 Breast Cancer Imaging Symposium. Serena Bright lets clinicians see CEM lesions and perform the biopsy on the same mammography system, helping streamline workflows and reduce patient anxiety during breast biopsy procedures

Report Coverage

The research report offers an in-depth analysis based on Product, Image, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for minimally invasive biopsy systems will rise as screening coverage expands.

- Vacuum-assisted devices will gain wider adoption due to higher accuracy and lower repeat rates.

- Image-guided biopsy platforms will integrate more AI features to support precise lesion targeting.

- Hospitals will invest in advanced ultrasound and MRI-compatible biopsy tools to improve workflow efficiency.

- Outpatient diagnostic centers will perform a growing share of biopsy procedures as care shifts outside hospitals.

- Compact and portable biopsy systems will see stronger demand in emerging markets with limited infrastructure.

- Training programs for radiologists and technicians will expand to address skill shortages in guided procedures.

- Hybrid imaging-biopsy solutions will become standard in high-volume cancer centers.

- Vendors will compete through improved needle design, faster tissue acquisition, and enhanced safety profiles.

- Global awareness campaigns and early detection initiatives will continue to drive higher biopsy procedure volumes.

ghts

ghts