Market Overview

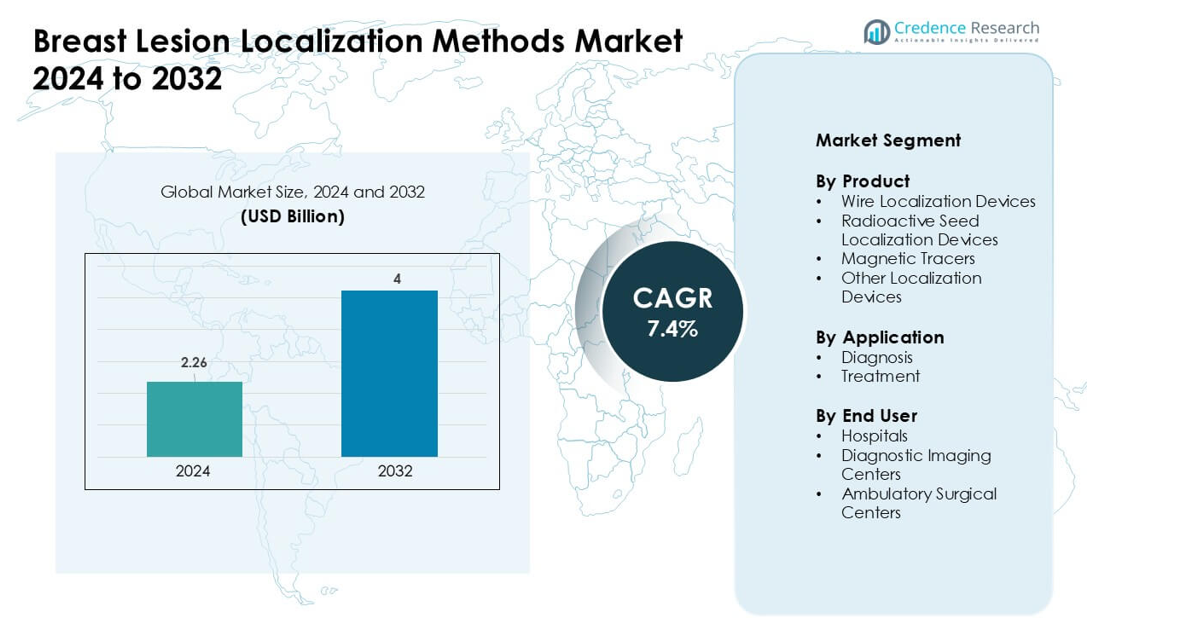

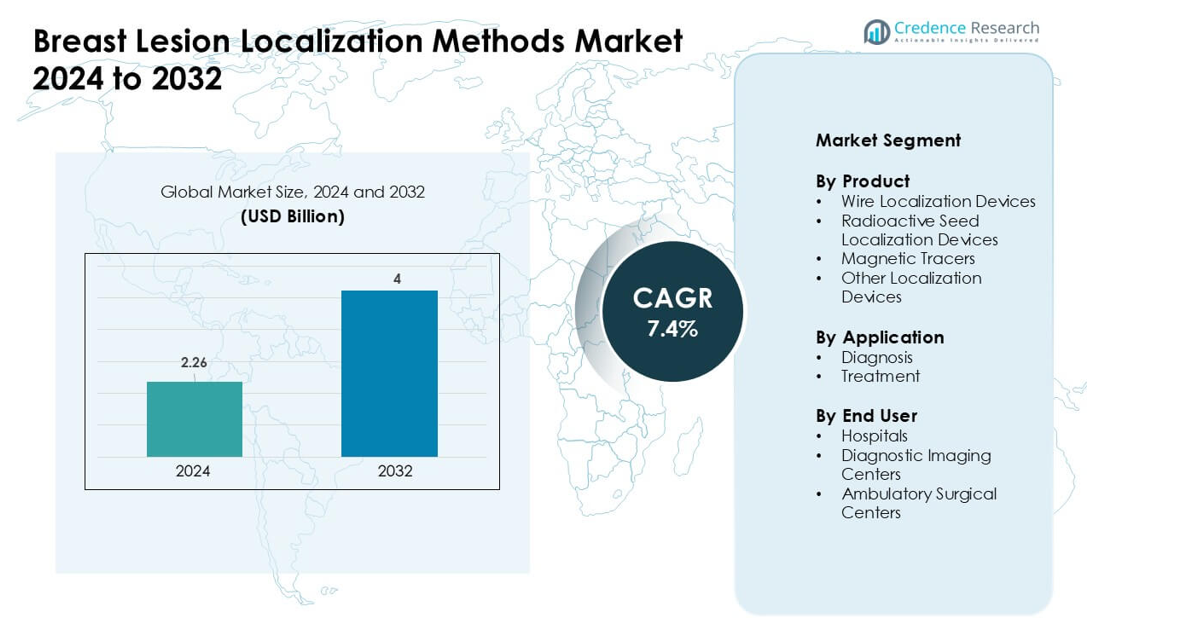

Breast Lesion Localization Methods Market was valued at USD 2.26 billion in 2024 and is anticipated to reach USD 4 billion by 2032, growing at a CAGR of 7.4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Breast Lesion Localization Methods Market Size 2024 |

USD 2.26 billion |

| Breast Lesion Localization Methods Market, CAGR |

7.4% |

| Breast Lesion Localization Methods Market Size 2032 |

USD 4 billion |

The breast lesion localization methods market is shaped by leading players such as MOLLI Surgical Inc. (Stryker), Cook, Argon Medical Devices, STERYLAB S.r.l., BD, Merit Medical Systems, MDL SRL, Theragenics Corporation, and SOMATEX Medical Technologies GmbH (Hologic Inc.). These companies compete through wireless, magnetic, and non-radioactive localization platforms designed to improve surgical accuracy and enhance workflow efficiency across diagnostic and treatment pathways. Their portfolios focus on reducing re-excision rates and increasing patient comfort, which strengthens adoption in high-volume breast care centers. North America led the global market in 2024 with a 41% share, supported by advanced screening infrastructure and strong uptake of next-generation localization technologies.

Market Insights

- The breast lesion localization methods market reached USD 2.26 billion in 2024 and is projected to hit USD 4 billion by 2032, growing at a CAGR of 7.4%.

- Demand grows as hospitals expand minimally invasive breast-conserving procedures, with wire localization holding about 47% share due to broad clinical adoption and cost efficiency.

- Wireless and non-radioactive systems gain traction as key trends, driven by workflow flexibility, improved patient comfort, and rising use of magnetic and radar-guided technologies.

- Competition intensifies among MOLLI Surgical Inc. (Stryker), BD, Cook, Argon Medical Devices, SOMATEX Medical Technologies (Hologic Inc.), Merit Medical Systems, MDL SRL, STERYLAB, and Theragenics Corporation as firms focus on precision tools that lower re-excision rates.

- North America led with a 41% share, supported by strong screening programs, while hospitals remained the largest end-user segment with roughly 62% share due to advanced diagnostic and surgical infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Wire localization devices led the product segment in 2024 with about 47% share. Their lead came from wide clinical acceptance, low procedure cost, and strong surgeon familiarity in early-stage breast lesion marking. Hospitals rely on wire systems because they support real-time tactile guidance and simplify intraoperative navigation. Magnetic tracers and radioactive seeds grew due to higher accuracy and reduced re-excision rates, yet adoption stayed slower because these tools need specialized staff and strict workflow handling. Growing demand for minimally invasive breast procedures continues to reinforce the dominance of wire-based solutions across screening and surgical settings.

By Application

Diagnosis dominated the application segment in 2024 with nearly 58% share. The dominance stems from rising use of localization tools in mammography-guided biopsies and early detection workflows. Clinicians prefer precise lesion marking methods to improve sampling accuracy and reduce false-negative findings. Treatment applications expanded with wider use of targeted excision procedures and improved surgical navigation systems, but adoption remained lower due to higher complexity and selective use in confirmed cancer cases. The rise in screening awareness and early-stage identification continues to strengthen demand in diagnostic pathways.

- For instance, Hologic’s LOCalizer™ RFID system is used in mammography-guided breast procedures and is designed to localize RFID tags at depths of up to 7 cm, supporting reliable lesion identification during diagnostic and surgical excisions.

By End User

Hospitals held the largest share in 2024 with around 62% of total demand. Their lead results from high patient volume, advanced imaging infrastructure, and access to multidisciplinary breast care teams. Hospital settings favor localization systems because they support integrated diagnostic-to-surgery workflows and enable rapid coordination between radiologists and surgeons. Diagnostic imaging centers showed steady growth as outpatient screening programs expanded. Ambulatory surgical centers gained traction due to shorter recovery times and cost-efficient procedures, yet they remained secondary users compared with large hospital networks.

- For instance, outpatient breast centers increasingly use Endomag’s Magseed® system, which allows magnetic seeds to be placed days or weeks before surgery, enabling flexible scheduling and reliable localization of non-palpable breast lesions in routine clinical practice.

Key Growth Drivers

Growing Adoption of Minimally Invasive Breast Procedures

The breast lesion localization methods market grows due to rising demand for minimally invasive procedures that support early detection and precise surgical planning. Healthcare providers prefer techniques that allow accurate lesion marking with reduced tissue disruption and lower repeat-surgery risk. Growth in image-guided screening programs also drives adoption, as clinicians rely on localization tools to improve biopsy accuracy and ensure safer excisions. Patients increasingly choose minimally invasive options because these methods reduce pain, shorten recovery, and improve cosmetic outcomes. The shift toward breast-conserving surgery strengthens the need for technologies that support precise targeting during diagnostic and therapeutic workflows.

- For instance, Merit Medical’s SCOUT® radar localization system enables non-wire breast lesion localization with a detection depth of up to 6 cm, supporting reliable lesion identification and precise excision in minimally invasive breast procedures.

Increase in Global Breast Cancer Screening Programs

Expanding breast cancer screening initiatives continues to fuel demand for advanced localization methods. Many countries invest in digital mammography, ultrasound, and MRI programs, which increases detection of non-palpable lesions that require accurate marking before biopsy or surgery. Early identification of abnormalities pushes healthcare systems to adopt reliable localization tools that improve diagnostic confidence. Rising awareness campaigns and government-led screening policies broaden the base of women undergoing routine checks. As participation rates climb, clinicians turn to scalable and easy-to-use localization systems to manage growing caseloads. This creates sustained market growth across both developed and developing regions.

Technological Advancements in Localization Systems

Rapid innovation in magnetic tracers, radar-guided systems, and wireless localization devices drives market expansion. Modern methods eliminate wire protrusion, reduce scheduling constraints, and improve surgical precision through real-time guidance. Hospitals invest in these technologies because they help lower re-excision rates and enhance workflow coordination between radiology and surgery. Advances in imaging compatibility also support more accurate lesion identification, especially in dense breast tissue. Industry players continue to introduce platforms that simplify placement procedures and enhance operating room efficiency. As tools become more user-friendly and less resource-intensive, adoption increases across high-volume clinical centers and outpatient facilities.

- For instance, Endomag’s Magseed® magnetic localization system can be detected at depths of up to about 6 cm and allows magnetic seeds to be placed days or weeks before surgery, enabling reliable localization of non-palpable breast lesions in multicenter clinical use.

Key Trends & Opportunities

Shift Toward Wireless and Non-Radioactive Localization

A major trend is the shift from traditional wire systems to wireless and non-radioactive technologies. Devices using magnetic, radar, or radiofrequency guidance improve surgical flexibility and reduce patient discomfort. These platforms allow decoupled scheduling between radiology and surgery, which enhances hospital workflow and reduces procedural delays. Non-radioactive alternatives also avoid regulatory burdens linked to radioactive seed handling. As health systems prioritize safety and efficiency, wireless solutions gain strong momentum. This trend supports wider adoption in both large hospitals and ambulatory surgical centers.

- For instance, Cianna Medical’s SAVI SCOUT® radar localization system uses infrared and radar technology to enable wire-free, non-radioactive breast lesion localization and allows reflector placement days before surgery, improving scheduling flexibility and reducing patient discomfort in hospital and ambulatory settings.

Growing Opportunities in Outpatient and Ambulatory Settings

Ambulatory surgical centers present strong growth opportunities due to rising demand for faster, cost-efficient procedures. Modern localization devices enable safe same-day interventions and support streamlined workflows suited for outpatient care. As insurers encourage migration toward lower-cost settings, clinics adopt localization tools that reduce operative time and improve patient flow. Continuous upgrades in imaging equipment across community centers further expand the market. The shift toward decentralized breast care creates new opportunities for vendors offering compact, easy-to-integrate localization platforms.

- For instance, Sirius Medical’s Pintuition® magnetic localization system is used in ambulatory breast centers and allows non-radioactive magnetic seeds to be placed ahead of surgery, supporting efficient outpatient workflows without same-day wire placement.

Key Challenges

Workflow Limitations with Traditional Wire Localization

Traditional wire localization faces challenges due to scheduling constraints, patient discomfort, and limited flexibility during surgery. Wire placement requires same-day coordination between radiologists and surgeons, which strains hospital workflow. The external wire can cause anxiety, restrict patient movement, and complicate positioning during excision. Surgeons also face limited incision-planning options because wire direction dictates the approach. These drawbacks reduce efficiency in high-volume centers and drive clinicians to seek more advanced alternatives, though cost barriers slow complete transition.

High Cost of Advanced Localization Technologies

The main challenge for broader adoption lies in the higher cost of wireless, magnetic, and radar-based systems. Many small hospitals and outpatient centers face budget constraints that limit investment in premium platforms. These technologies often require specialized training, additional equipment, and periodic maintenance, increasing the overall expense. Reimbursement gaps in several regions further restrict uptake, especially in price-sensitive markets. While advanced systems offer clinical and operational benefits, the financial burden slows replacement of traditional methods and creates uneven adoption across healthcare settings.

Regional Analysis

North America

North America led the breast lesion localization methods market in 2024 with around 41% share. The region benefits from strong adoption of advanced wireless and magnetic localization systems supported by high screening participation and robust diagnostic infrastructure. Hospitals and imaging centers use modern tools to reduce re-excision rates and improve workflow efficiency. Favorable reimbursement policies and widespread integration of mammography, MRI, and ultrasound platforms strengthen clinical use. The presence of major device manufacturers and continuous technology upgrades further support regional dominance. Growing focus on early detection keeps the market stable across both the U.S. and Canada.

Europe

Europe held nearly 30% share in 2024, driven by structured national screening programs and high penetration of digital breast imaging systems. Healthcare providers adopt localization tools to support breast-conserving surgery and standardized diagnostic workflows. Countries such as Germany, the U.K., and France show strong preference for non-radioactive and wire-free technologies to improve patient comfort and reduce regulatory burden. Investments in hospital modernization and rising adoption in outpatient settings increase demand. The region maintains steady growth as clinical guidelines emphasize accurate lesion targeting and early-stage cancer management.

Asia-Pacific

Asia-Pacific accounted for about 22% share in 2024, supported by rapid healthcare expansion, rising breast cancer cases, and growing investments in diagnostic imaging. Urban hospitals adopt advanced localization methods to improve accuracy in dense breast tissue and reduce surgical complications. Emerging economies such as China and India scale national screening programs, increasing the number of detected non-palpable lesions requiring localization. Technology adoption varies across markets, but demand grows steadily due to rising awareness and improved access to imaging. The region shows strong long-term potential with increasing focus on early diagnosis.

Latin America

Latin America recorded roughly 5% share in 2024, driven by expanding screening practices and gradual improvements in diagnostic infrastructure. Larger hospitals in Brazil, Mexico, and Argentina increasingly adopt modern localization tools to support breast-conserving procedures, though wire-based systems remain dominant due to cost constraints. Limited reimbursement and uneven access to advanced imaging slow broader uptake. Growth remains moderate but steady as governments promote awareness campaigns and invest in oncology services. Adoption improves particularly in urban centers where specialized breast care units continue to expand.

Middle East & Africa

The Middle East & Africa region captured nearly 2% share in 2024, reflecting limited screening participation and constrained access to advanced diagnostic tools. Wealthier Gulf countries show higher adoption of wireless and magnetic localization methods, supported by modern hospital infrastructure and private healthcare spending. In contrast, many African nations rely on basic imaging and traditional wire-based systems due to affordability challenges. International health initiatives and rising investment in oncology centers create gradual growth potential. Improvements in breast cancer awareness and diagnostic capability are expected to support slow but steady market expansion.

Market Segmentations:

By Product

- Wire Localization Devices

- Radioactive Seed Localization Devices

- Magnetic Tracers

- Other Localization Devices

By Application

By End User

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the breast lesion localization methods market features strong participation from MOLLI Surgical Inc. (Stryker), Cook, Argon Medical Devices, STERYLAB S.r.l., BD, Merit Medical Systems, MDL SRL, Theragenics Corporation, and SOMATEX Medical Technologies GmbH (Hologic Inc.). These companies compete by advancing wireless, magnetic, and non-radioactive localization platforms that support accurate lesion targeting and streamline surgical workflows. Many players expand portfolios through product upgrades that reduce re-excision rates and improve clinician flexibility during breast-conserving procedures. Strategic collaborations with hospitals, imaging centers, and research institutions strengthen market reach and accelerate clinical adoption. Companies also focus on training programs that help surgeons transition from traditional wire systems to modern techniques. Growing emphasis on workflow efficiency, patient comfort, and regulatory compliance drives continuous innovation across the competitive landscape. North America maintained the highest adoption rate in 2024, supported by strong presence of leading manufacturers and advanced breast care infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MOLLI Surgical Inc. (Stryker)

- Cook

- Argon Medical Devices

- STERYLAB S.r.l.

- BD

- Merit Medical Systems

- MDL SRL

- Theragenics Corporation

- SOMATEX Medical Technologies GmbH (Hologic Inc.)

Recent Developments

- In October 2025, Merit Medical Systems Announced that its SCOUT radar localization technology has been used in 750,000 patients worldwide, underscoring strong global adoption of wire-free breast lesion localization and the new multi-reflector SCOUT MD system for more precise mapping and soft-tissue applications.

- In September 2024, Theragenics Corporation Expanded operations to offer contract manufacturing services for radiopharmaceuticals, leveraging its radioisotope infrastructure used in brachytherapy and breast tumor localization seeds, and promoted these capabilities at ASTRO 2024 alongside its brachytherapy and breast tumor localization portfolio.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of wireless and non-radioactive localization systems will rise across major hospitals.

- Magnetic and radar-guided platforms will gain wider clinical acceptance for precise targeting.

- Screening expansion will increase demand for accurate lesion marking in early detection programs.

- Workflow-friendly technologies will reduce scheduling constraints between radiology and surgery teams.

- Outpatient and ambulatory centers will adopt compact systems for same-day procedures.

- Integration with advanced imaging, including digital mammography and MRI, will enhance accuracy.

- Vendors will invest in surgeon training programs to support faster transition from wire methods.

- Regulatory focus on safety and traceability will drive use of non-radioactive alternatives.

- AI-based imaging and navigation support tools will strengthen clinical decision-making.

- Emerging regions will see steady growth as diagnostic infrastructure and cancer awareness improve.