Market Overview

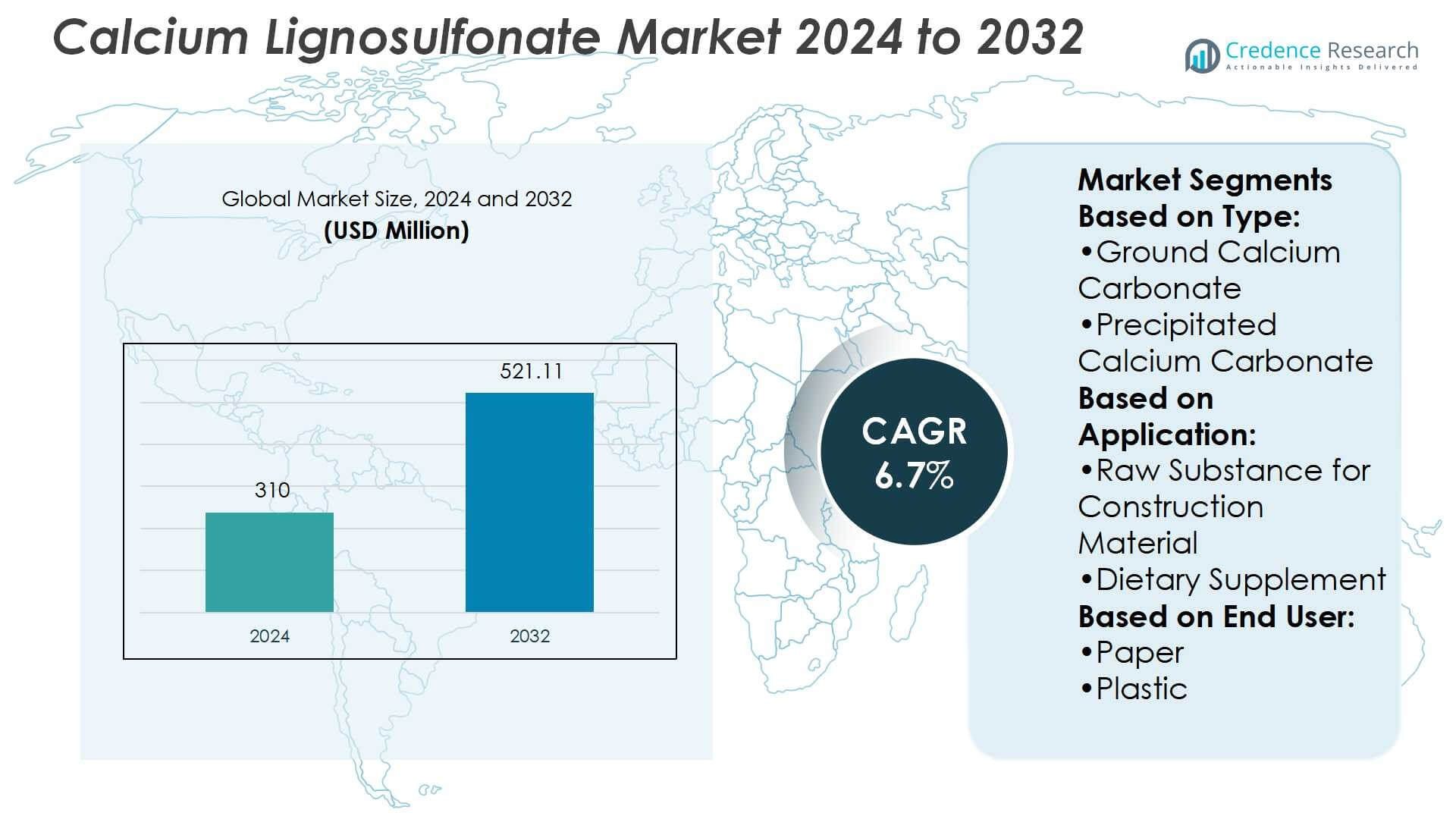

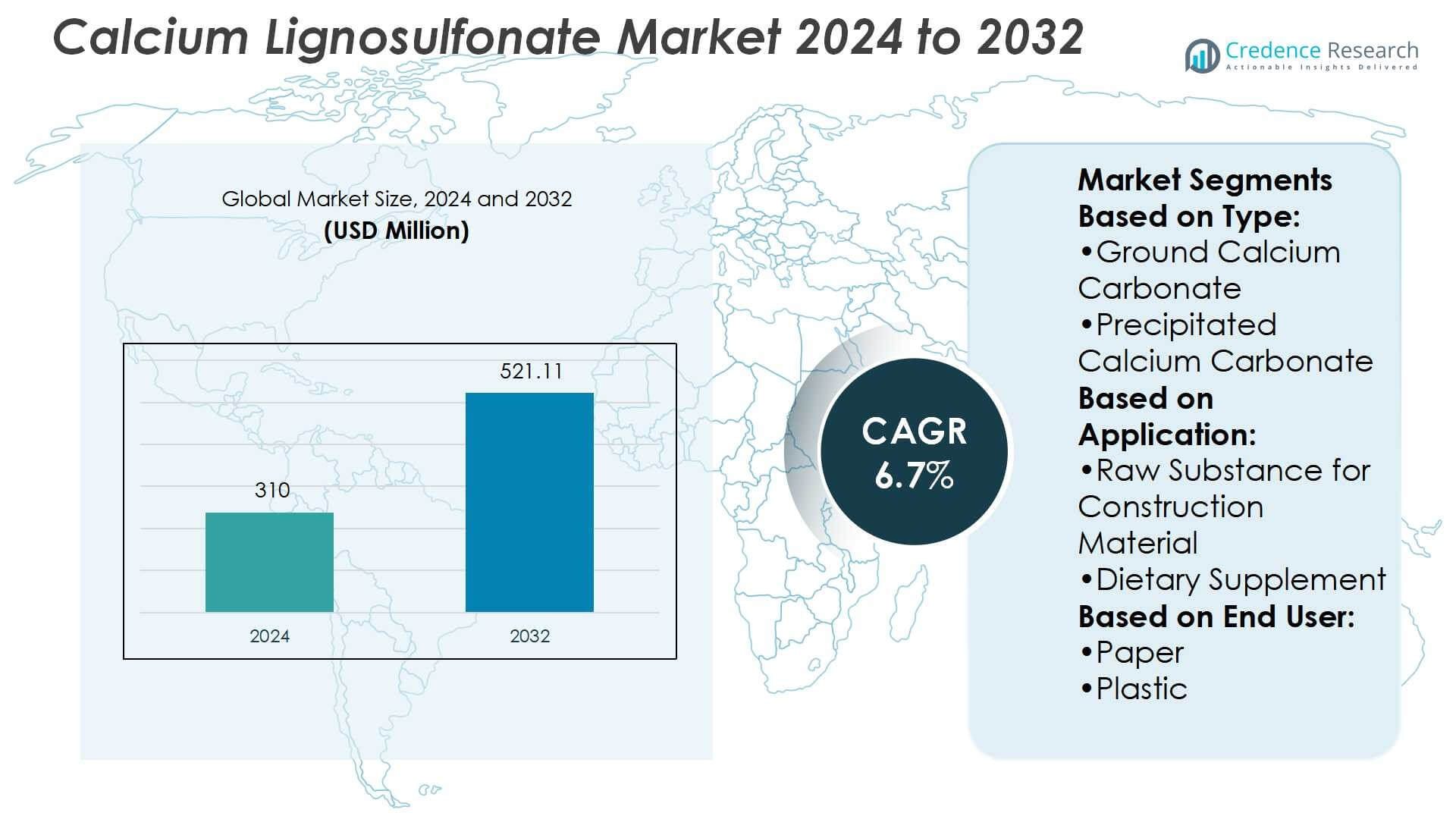

Calcium Lignosulfonate Market size was valued USD 310 million in 2024 and is anticipated to reach USD 521.11 million by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Calcium Lignosulfonate Market Size 2024 |

USD 310 Million |

| Calcium Lignosulfonate Market, CAGR |

6.7% |

| Calcium Lignosulfonate Market Size 2032 |

USD 521.11 Million |

The Calcium Lignosulfonate Market is shaped by leading players such as SCHAEFER KALK GmbH & Co. KG, Graymont Limited, CIMBAR RESOURCES, INC., Omya AG, Imerys S.A., Mississippi Lime Company, Carmeuse, Huber Engineered Materials, Nordkalk, and Minerals Technologies Inc. These companies focus on expanding their product portfolios, enhancing processing technologies, and forming strategic partnerships with end-use industries such as construction, paper, and animal feed. Asia-Pacific leads the global market with 42% share, driven by rapid urbanization, large-scale infrastructure projects, and growing cement demand in China and India. The region’s cost advantages and strong industrial base continue to attract global players seeking long-term growth.

Market Insights

- The Calcium Lignosulfonate Market was valued at USD 310 million in 2024 and is projected to reach USD 521.11 million by 2032, growing at a CAGR of 6.7%.

- Rising demand from the construction sector, particularly for concrete admixtures, remains the primary market driver, supported by large-scale infrastructure projects worldwide.

- A key trend is the shift toward eco-friendly and cost-effective additives, with technological advancements in processing enhancing performance across applications such as paper, plastics, and animal feed.

- The competitive landscape is shaped by global players focusing on product diversification, processing innovations, and strategic partnerships, while restraints include raw material supply fluctuations and competition from synthetic substitutes.

- Asia-Pacific dominates with 42% market share, led by China and India, while the construction segment holds the largest share among applications, benefiting from urbanization, industrial growth, and government-backed housing and transportation projects across developing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the Calcium Lignosulfonate Market, the Ground Calcium Carbonate segment dominates with the largest share. Its broad use in construction, paper, and plastics industries supports this lead. Cost efficiency and easy availability make it the preferred option over precipitated calcium carbonate. The segment benefits from growing infrastructure investments, particularly in Asia-Pacific and Europe. Rising demand for fillers and stabilizers in cement and concrete further strengthens market expansion. Meanwhile, precipitated calcium carbonate grows at a steady pace, driven by high-purity applications in pharmaceuticals and specialty plastics.

- For instance, The partnership follows the successful operation of Fortera’s flagship facility in Redding, California, which produces 15,000 tons per year of low-carbon cement using the same ReCarb® process.

By Application

The Raw Substance for Construction Material segment holds the leading share in the Calcium Lignosulfonate Market. Its dominance stems from widespread use in cement additives and concrete water-reducing agents. Rapid urbanization and increasing public infrastructure projects drive the demand for construction materials with enhanced strength and durability. Calcium lignosulfonate improves workability and reduces costs, making it a critical additive in cement production. Other applications, including dietary supplements and pigments, continue to expand, yet remain secondary. The push toward eco-friendly, cost-effective construction solutions sustains this segment’s strong market position.

- For instance, The Omyaloop product line is based on 100% recycled calcium carbonate recovered from other industries that would otherwise be disposed of as waste. They are specifically designed for use in polymer applications, including in recycled polyolefin feedstocks.

By End-User

The Construction sector emerges as the largest end-user in the Calcium Lignosulfonate Market, accounting for the highest share. The sector relies heavily on calcium lignosulfonate for concrete admixtures, offering water reduction and durability benefits. Rapid urban growth in developing nations and large-scale government housing projects accelerate consumption. The paper and adhesives industries also present steady demand, supported by sustainability initiatives and enhanced bonding properties. However, construction remains dominant due to its scale and consistent material requirements. Expansion of smart city projects and modern infrastructure is expected to keep this segment at the forefront.

Key Growth Drivers

Rising Demand in Construction Sector

The construction industry is the primary growth driver for the Calcium Lignosulfonate Market. Calcium lignosulfonate is widely used as a concrete admixture to enhance strength, water reduction, and durability. Expanding infrastructure projects, particularly in Asia-Pacific and the Middle East, fuel demand for cost-effective additives. Government initiatives for housing, transportation networks, and smart cities further accelerate consumption. This trend continues as sustainable and affordable building materials gain importance, positioning calcium lignosulfonate as a critical component in large-scale construction applications across global markets.

- For instance, Carmeuse Americas is doing a pre-FEED (front end engineering and design) study for a carbon capture system for its Butler, Kentucky lime plant. The system is designed to capture over 400,000 metric tonnes of CO₂ per year from lime kiln emissions and sequester it on-site.

Expansion in Paper and Pulp Industry

The paper and pulp industry significantly contributes to market growth by utilizing calcium lignosulfonate as a dispersant and binding agent. Its application improves paper quality, brightness, and production efficiency while reducing costs. Growing demand for packaging and printing paper, especially in emerging economies, drives steady adoption. Sustainability pressures in the paper industry also favor lignosulfonate, as it offers eco-friendly alternatives to synthetic chemicals. With e-commerce expansion and rising consumer goods packaging requirements, the paper sector continues to be a reliable driver of market demand.

- For instance, Nordkalk launched “Next” and “Complete” product lines. Next‐products use at least 33% recycled materials or at least 33% fossil-free energy. Complete‐products are either made entirely from recycled content or produced fossil-free.

Increased Adoption in Animal Feed Additives

Calcium lignosulfonate is gaining momentum in the animal feed sector as a binder and pelleting agent. Its ability to improve feed durability, reduce dust, and ensure nutrient uniformity strengthens its appeal. The rising demand for high-quality livestock feed, coupled with the growth of the meat and dairy industry, fuels this application. Additionally, increasing awareness of cost-efficient, natural, and safe additives supports its market position. Regulatory support for sustainable feed ingredients further drives adoption, making this segment a key contributor to the overall market’s growth trajectory.

Key Trends & Opportunities

Shift Toward Eco-Friendly Additives

A key trend in the Calcium Lignosulfonate Market is the rising preference for eco-friendly materials. Industries such as construction, paper, and agriculture increasingly adopt lignosulfonates as sustainable substitutes for synthetic chemicals. Their biodegradability and low toxicity align with global sustainability goals and regulatory compliance standards. Companies leveraging eco-friendly branding strategies benefit from this shift, creating opportunities for wider product penetration. As environmental awareness strengthens across industries, calcium lignosulfonate’s role as a cost-effective, natural additive will continue to expand globally.

- For instance, Minerals Technologies achieved 11 out of its 12 environmental targets one year ahead of schedule, reduced its Scope 1 emissions by 14% year over year, and Scope 2 emissions by 10%.

Technological Advancements in Manufacturing

Advancements in lignosulfonate processing and purification present opportunities for improved product quality and expanded applications. Innovations in production enable higher purity grades suitable for pharmaceuticals, personal care, and specialty chemicals. Improved processing also reduces impurities, enhancing performance in demanding industries such as plastics and adhesives. Market players investing in R&D to refine lignosulfonate properties gain a competitive edge. These innovations not only broaden application scope but also strengthen value-added offerings, allowing manufacturers to target niche markets with high-performance and sustainable solutions.

- For instance, Honeywell UOP’s Polybed PSA system purifies hydrogen and removes impurities such as CO2, CO, CH4, water, and nitrogen to achieve very high purity, often exceeding 99.9%.

Key Challenges

Fluctuating Raw Material Supply

A major challenge for the Calcium Lignosulfonate Market is the dependence on lignin, a byproduct of the paper and pulp industry. Variations in pulp production directly affect raw material availability and pricing. Market volatility in forestry and paper sectors further disrupts supply consistency. Limited scalability of raw material sourcing restricts manufacturers from meeting rising demand in construction and animal feed industries. Addressing this challenge requires efficient supply chain management and investment in alternative lignin sources to ensure stable production and pricing.

Competition from Substitutes

The availability of alternative chemical additives poses a challenge to calcium lignosulfonate adoption. Synthetic dispersants, binders, and plasticizers often offer higher performance in specialized applications. Industries such as construction and plastics sometimes favor these alternatives despite their higher cost, due to superior functionality. This competitive pressure limits the full market potential of lignosulfonates. To overcome this challenge, producers must focus on improving product quality, promoting eco-friendly benefits, and creating cost-effective solutions that highlight calcium lignosulfonate’s advantages over synthetic substitutes.

Regional Analysis

North America

North America accounts for 18% of the Calcium Lignosulfonate Market share, driven by strong adoption in construction and paper industries. The U.S. leads the region with rising demand for eco-friendly concrete additives, supported by infrastructure modernization projects. The presence of established pulp and paper manufacturers further sustains consumption. Animal feed applications also expand, supported by large-scale livestock production. Regulatory focus on sustainability promotes calcium lignosulfonate as a substitute for synthetic chemicals. Growing adoption in adhesives and sealants enhances regional growth, with steady demand expected from Canada and Mexico’s construction and agricultural sectors.

Europe

Europe holds 22% of the Calcium Lignosulfonate Market share, benefiting from stringent environmental regulations and strong infrastructure investment. Countries such as Germany, France, and the UK drive consumption, primarily in construction materials and eco-friendly additives. The paper and packaging industry further contributes due to high demand for dispersants and binders. Rising preference for sustainable raw materials supports lignosulfonate over synthetic substitutes. Moreover, the growing focus on green building standards accelerates adoption in cement admixtures. With supportive EU policies and well-developed industrial infrastructure, Europe remains a key regional hub for growth and innovation in lignosulfonate applications.

Asia-Pacific

Asia-Pacific dominates the Calcium Lignosulfonate Market with 42% share, driven by rapid urbanization and large-scale infrastructure projects. China and India lead the region due to expanding construction sectors and growing cement production. The rising demand for affordable housing and transportation networks boosts calcium lignosulfonate consumption as a water-reducing agent. Strong growth in the paper and agricultural industries also supports adoption, while animal feed applications expand with rising livestock production. Government-backed infrastructure programs and industrialization sustain high demand. Asia-Pacific remains the fastest-growing region, fueled by cost advantages, large-scale production, and expanding downstream industries.

Latin America

Latin America holds 9% of the Calcium Lignosulfonate Market share, supported by growth in construction and agricultural industries. Brazil and Mexico drive regional demand with expanding cement production and infrastructure development. Rising livestock farming also contributes through increasing use of calcium lignosulfonate in animal feed additives. The paper and pulp industry provides additional opportunities, particularly in packaging applications. However, supply chain challenges and economic fluctuations limit full-scale adoption. Despite these constraints, increasing urbanization and government-backed housing projects position the region as a growing market, offering long-term potential for sustained demand.

Middle East & Africa

The Middle East & Africa accounts for 9% of the Calcium Lignosulfonate Market share, with rising demand centered on construction and infrastructure projects. Gulf nations, including Saudi Arabia and the UAE, drive adoption through large-scale urban developments and government investments in cement and concrete additives. In Africa, growth stems from public infrastructure programs and agricultural sector expansion, particularly in animal feed applications. Limited industrial capacity and raw material supply challenges restrict market penetration. However, increasing focus on sustainable construction materials and government-backed megaprojects create opportunities for stronger adoption in the coming years.

Market Segmentations:

By Type:

- Ground Calcium Carbonate

- Precipitated Calcium Carbonate

By Application:

- Raw Substance for Construction Material

- Dietary Supplement

By End User:

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Calcium Lignosulfonate Market players including SCHAEFER KALK GmbH & Co. KG (Germany), Graymont Limited (Canada), CIMBAR RESOURCES, INC. (U.S.), Omya AG (Switzerland), Imerys S.A. (France), Mississippi Lime Company (U.S.), Carmeuse (Belgium), Huber Engineered Materials (U.S.), Nordkalk (Finland), and Minerals Technologies Inc (U.S.). The Calcium Lignosulfonate Market features a highly competitive landscape, characterized by a mix of global and regional manufacturers focusing on innovation and market expansion. Companies prioritize developing cost-effective, eco-friendly products tailored to construction, paper, animal feed, and plastics applications. Strategic investments in advanced processing technologies enhance product quality and broaden application potential across diverse industries. Market participants also emphasize partnerships with cement producers, paper mills, and feed manufacturers to strengthen distribution networks and ensure consistent demand. Expansion into high-growth regions, particularly Asia-Pacific, remains a core strategy, supported by increasing infrastructure projects and industrialization. Competitive dynamics are further shaped by mergers, acquisitions, and collaborations, enabling players to scale operations, optimize supply chains, and maintain a strong foothold in the evolving global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SCHAEFER KALK GmbH & Co. KG (Germany)

- Graymont Limited (Canada)

- CIMBAR RESOURCES, INC. (U.S.)

- Omya AG (Switzerland)

- Imerys S.A. (France)

- Mississippi Lime Company (U.S.)

- Carmeuse (Belgium)

- Huber Engineered Materials (U.S.)

- Nordkalk (Finland)

- Minerals Technologies Inc (U.S.)

Recent Developments

- In April 2025, a new calcium sulphate fertilizer plant operated by SUL4R-PLUS officially opened in Marissa, Illinois. The facility boasts an impressive production capacity of 100,000 tons annually, positioning it as a significant regional supplier.

- In April 2024, BASF provides certified compostable biopolymer ecovio for the creation of black twines used in commercial greenhouses to grow annual fruits and vegetables. Ecovio T 2206 holds EN13432 certification for industrial compostability.

- In March 2024, Omya International AG implemented a price increase for its calcium carbonate products in Europe, highlighting its commitment to sustainability and its continued support for the Paper and Board sector.

- In July 2023, Mineral Technologies Inc. signed an agreement with leading global paper company to upgrade a precipitated calcium carbonate plant in Brazil with its NewYield LO PCC technology. This technology converts paper mill waste into functional filler pigment, reducing disposal costs and raw material consumption while enhancing paper quality.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand in the global construction industry.

- Growing use in concrete admixtures will strengthen its role in infrastructure projects.

- The paper and pulp industry will continue to drive consistent demand for lignosulfonates.

- Increasing adoption in animal feed will create long-term opportunities for market players.

- Eco-friendly product development will gain momentum as sustainability regulations tighten.

- Technological advancements in processing will enhance product quality and application scope.

- Emerging economies will lead demand growth with urbanization and industrial expansion.

- Strategic collaborations and mergers will reshape the competitive market landscape.

- Supply chain optimization will remain essential to address raw material fluctuations.

- Expansion into specialty applications will open new growth avenues across industries.