Market Overview

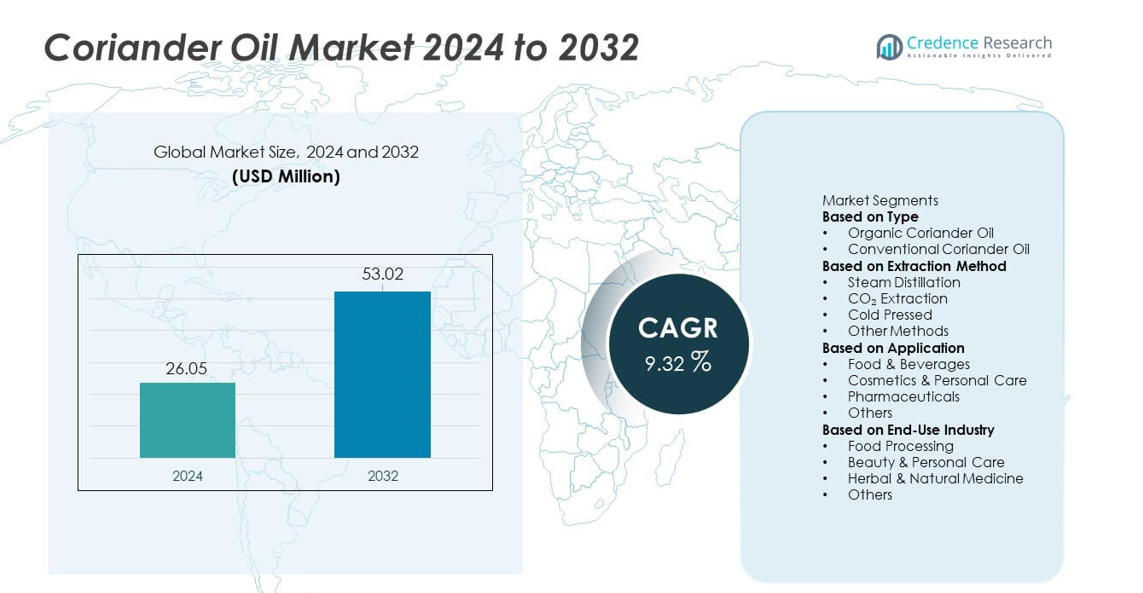

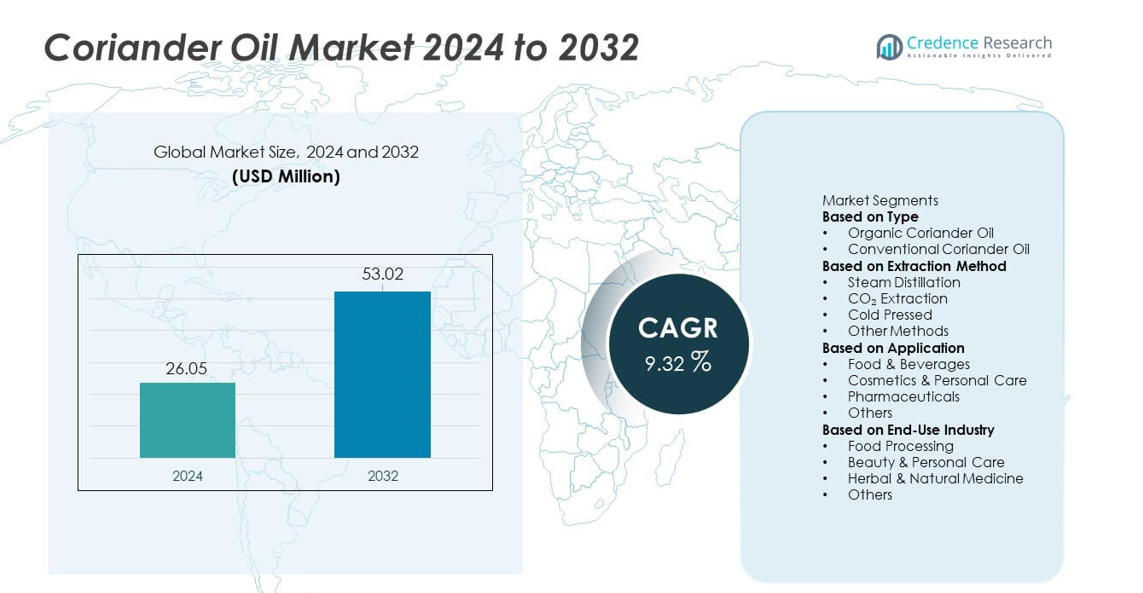

The Coriander Oil market was valued at USD 26.05 million in 2024 and is projected to reach USD 53.02 million by 2032, registering a CAGR of 9.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coriander Oil Market Size 2024 |

USD 26.05 million |

| Coriander Oil Market, CAGR |

9.32% |

| Coriander Oil Market Size 2032 |

USD 53.02 million |

The top players in the Coriander Oil market—Albert Vieille, Ultra International B.V., Berje Inc., Firmenich International SA, Givaudan, Lionel Hitchen Essential Oils, Bontoux S.A.S., Young Living Essential Oils, doTERRA International, and The Lebermuth Company, Inc.—drive market growth through high-purity essential oils, advanced extraction technologies, and strong supply partnerships with coriander-producing regions. These companies focus on organic formulations, clean-label compliance, and expanding applications across food, cosmetics, pharmaceuticals, and aromatherapy. Asia Pacific leads the market with a 33% share, supported by abundant raw material availability and strong manufacturing capacity, while North America holds 31% due to rising demand for natural wellness products, and Europe follows with 29%, driven by premium essential oil consumption and strict quality standards.

Market Insights

- The Coriander Oil market reached USD 26.05 million in 2024 and is projected to reach USD 53.02 million by 2032 at a CAGR of 9.32%, showing strong global expansion.

- Market growth accelerates as demand rises for natural, clean-label ingredients, with Organic Coriander Oil holding a 56% segment share driven by food, cosmetics, and wellness applications.

- Key trends include increased adoption in aromatherapy, premium skincare, herbal supplements, and natural food flavoring, supported by the shift toward plant-based and chemical-free products.

- Competition strengthens as leading companies such as Albert Vieille, Givaudan, Firmenich, Ultra International, and doTERRA invest in sustainable sourcing, high-purity extraction methods, and certified organic product lines.

- Regional demand is led by Asia Pacific at 33%, followed by North America at 31% and Europe at 29%, supported by strong essential oil production, rising natural product consumption, and expanding herbal wellness markets across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Organic Coriander Oil leads this segment with a market share of 56%, driven by rising global demand for clean-label essential oils used in food, cosmetics, and therapeutic products. Consumers prefer organic variants due to their higher purity, chemical-free composition, and compliance with natural product standards. Conventional Coriander Oil continues to serve industrial applications that prioritize cost efficiency, including large-scale flavoring, fragrance production, and household products. Growth in this segment is supported by expanding use of natural oils in wellness, aromatherapy, and premium personal care formulations, strengthening demand for high-quality organic coriander oil.

- For instance, Albert Vieille, a company specializing in 100% pure and natural aromatic raw materials, has expanded its range of offerings, which are sourced from certified farms. The company is known for its focus on sustainable and responsible sourcing practices and pure ingredients.

By Extraction Method

Steam Distillation dominates the extraction segment with a market share of 62%, supported by its efficiency, high oil yield, and suitability for food-grade and cosmetic-grade coriander oil. This method preserves aroma compounds and ensures consistent quality, making it widely preferred across major industries. CO₂ Extraction gains traction for producing highly concentrated and solvent-free oils used in premium applications. Cold Pressed methods cater to niche therapeutic and aromatherapy uses, while other extraction techniques serve specialized formulations. Market growth is driven by cleaner extraction technologies and rising demand for pure, natural essential oils.

- For instance, Ultra International operates facilities in places such as Uttar Pradesh and is involved in the production of essential oils via processes including steam distillation. The company provides coriander seed oil, which is produced from the seeds of the plant through steam distillation to obtain 100% pure essential oil.

By Application

Food & Beverages hold the largest market share of 41%, driven by the widespread use of coriander oil as a natural flavor enhancer in sauces, seasonings, bakery products, and herbal beverages. Its antibacterial and digestive properties support rising use in health-focused formulations. Cosmetics & Personal Care applications expand as brands adopt coriander oil for its anti-inflammatory and fragrance benefits in skincare and haircare products. Pharmaceuticals use the oil in herbal remedies, digestive medications, and antimicrobial formulations. Demand grows across all segments as industries shift toward plant-based ingredients and natural functional additives.

Key Growth Drivers

Rising Demand for Natural and Clean-Label Ingredients

Global consumers continue to shift toward plant-based and chemical-free products, increasing the demand for coriander oil across food, cosmetics, and wellness applications. Its natural antioxidant, antimicrobial, and digestive properties make it a preferred ingredient in herbal formulations. Food processors use coriander oil as a natural flavoring agent, while personal care brands incorporate it for its skin-soothing benefits. This movement toward clean-label products strengthens adoption across multiple industries and accelerates overall market growth.

- For instance, Givaudan expanded its natural ingredients program by engaging in responsible sourcing practices for various botanicals, including coriander seeds, in collaboration with partners like the Union for Ethical BioTrade (UEBT).

Expansion of Aromatherapy and Wellness Applications

The aromatherapy and wellness sector increasingly adopts coriander oil for stress relief, relaxation, and therapeutic uses. Its warm, calming aroma and proven calming effects make it popular in diffusers, massage oils, and wellness blends. The global rise of spa treatments, home aromatherapy, and holistic healing practices boosts demand. As consumers show greater interest in natural remedies and emotional wellbeing, coriander oil gains stronger traction in premium therapeutic formulations and essential oil combinations.

- For instance, Young Living produces essential oils, including coriander, through careful production processes, which generally include low-temperature steam distillation to help retain beneficial active compounds like linalool.

Growing Use in Pharmaceuticals and Herbal Medicine

Pharmaceutical manufacturers integrate coriander oil into herbal medicines, digestive aids, anti-inflammatory solutions, and antimicrobial formulations. Its strong therapeutic profile supports applications in cough syrups, topical treatments, and herbal supplements. The increasing preference for natural active ingredients over synthetic chemicals fuels adoption. Demand rises further as healthcare practitioners and consumers embrace traditional remedies and preventive health solutions. Expansion of herbal medicine markets in Asia, Europe, and North America boosts long-term demand for coriander oil.

Key Trends & Opportunities

Rising Application in Premium Cosmetics and Skincare

Beauty and personal care brands increasingly use coriander oil for its anti-inflammatory, antibacterial, and aromatic qualities. The oil supports skin rejuvenation, acne control, and anti-aging formulations. Demand expands for natural fragrances and essential-oil-based cosmetics, creating opportunities for suppliers offering high-purity, organic-grade coriander oil. As consumer awareness of plant-based skincare grows, brands integrate coriander oil into serums, lotions, shampoos, and aromatherapy-infused beauty products. This trend strengthens market expansion across the global cosmetics sector.

- For instance, Firmenich produces cosmetic-grade coriander seed essential oil which is rich in naturally derived linalool, the major constituent, typically composing around 70% of the oil.

Expanding Use in Natural Food and Beverage Formulations

Food and beverage manufacturers incorporate coriander oil as a natural flavoring in sauces, herbal teas, meat seasonings, and functional beverages. Clean-label and organic product trends create strong opportunities for coriander oil suppliers. Rising demand for ethnic flavors, digestive health drinks, and natural preservatives further expands usage. As consumers seek recognizable and plant-derived ingredients, coriander oil becomes a valuable additive in both premium and mass-market food products.

- For instance, Bontoux S.A.S. produces and supplies a wide range of essential oils and natural extracts, including coriander oil, and utilizes industrial expertise and specialized processing techniques to ensure quality and traceability.

Key Challenges

Price Volatility and Limited Raw Material Availability

Coriander seed production fluctuates with climatic conditions, affecting oil yield and pricing stability. Supply inconsistencies drive higher costs for essential oil manufacturers and limit availability for large-scale buyers. This volatility challenges long-term planning for food, cosmetic, and pharmaceutical companies reliant on coriander oil. Ensuring reliable sourcing and improving farming practices remain critical to stabilizing market growth.

Quality Variability Due to Extraction and Regional Differences

Differences in extraction methods, seed quality, and geographic origin lead to inconsistent oil composition and aroma profiles. Variability affects product standardization for industries requiring precise specifications. Manufacturers face challenges in ensuring purity, consistent chemical composition, and contaminant-free oil. Meeting global quality standards requires controlled processing, certified suppliers, and strict testing methods, increasing compliance and production costs.

Regional Analysis

North America

North America holds a market share of 31% in the Coriander Oil market, driven by rising consumer preference for natural ingredients in food, cosmetics, and wellness products. The region benefits from strong adoption of essential oils in aromatherapy, herbal supplements, and clean-label food formulations. The U.S. leads demand due to expanding organic product consumption and growing interest in natural personal care solutions. Manufacturers focus on high-purity, sustainably sourced coriander oil to meet strict regulatory and quality standards. Increasing use in premium skincare, functional foods, and therapeutic blends further supports regional market growth.

Europe

Europe accounts for a market share of 29%, supported by strong demand for organic essential oils, natural cosmetics, and plant-based food additives. Countries such as Germany, France, and the U.K. drive consumption through established aromatherapy markets and stringent clean-label regulations. The region benefits from mature herbal medicine and wellness industries, enhancing usage in pharmaceuticals and therapeutic applications. Growth in natural fragrance formulations and eco-conscious personal care products continues to stimulate demand. The expanding organic food sector further strengthens coriander oil adoption across Europe’s health-focused consumer base.

Asia Pacific

Asia Pacific leads application-driven growth with a market share of 33%, supported by extensive coriander cultivation, low-cost production, and growing usage in traditional medicine, cosmetics, and food processing. India, China, and Southeast Asian countries contribute significantly to manufacturing and consumption due to established herbal practices and rising natural ingredient demand. The region sees growing use of coriander oil in digestive remedies, aromatherapy, and natural skincare. Expanding food processing industries and rising disposable incomes further drive adoption. Strong supply availability positions Asia Pacific as a key producer and exporter in the global market.

Latin America

Latin America holds a market share of 4%, driven by increasing interest in natural wellness products, herbal cosmetics, and plant-based food flavors. Brazil and Mexico lead demand due to expanding essential oil applications in aromatherapy, household products, and traditional herbal remedies. The region benefits from a growing organic food sector and rising consumer preference for clean-label ingredients. While limited industrial capacity poses challenges, investments in natural product manufacturing and expanding retail distribution channels continue to support market growth across the region.

Middle East & Africa

The Middle East & Africa region captures a market share of 3%, supported by rising use of natural oils in personal care, herbal medicine, and aromatherapy. GCC countries drive demand through premium beauty markets and growing consumer interest in plant-based wellness products. Africa shows increasing consumption due to expanding natural remedy practices and improving supply chains. However, limited processing capacity and dependence on imports create challenges. Ongoing interest in natural fragrances, organic food additives, and therapeutic applications contributes to steady market expansion across the region.

Market Segmentations:

By Type

- Organic Coriander Oil

- Conventional Coriander Oil

By Extraction Method

- Steam Distillation

- CO₂ Extraction

- Cold Pressed

- Other Methods

By Application

- Food & Beverages

- Cosmetics & Personal Care

- Pharmaceuticals

- Others

By End-Use Industry

- Food Processing

- Beauty & Personal Care

- Herbal & Natural Medicine

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape or analysis features major players such as Albert Vieille, Ultra International B.V., Berje Inc., Firmenich International SA, Givaudan, Lionel Hitchen Essential Oils, Bontoux S.A.S., Young Living Essential Oils, doTERRA International, and The Lebermuth Company, Inc. These companies compete by developing high-purity coriander oil, expanding organic product lines, and strengthening sourcing networks across key coriander-growing regions. Leading players focus on advanced extraction technologies, traceability, and quality certification to meet rising demand from food, cosmetics, pharmaceutical, and aromatherapy sectors. Strategic partnerships with growers and continuous investment in sustainable farming practices enhance supply reliability. Many companies also expand their essential oil portfolios, integrate clean-label formulations, and innovate natural fragrance and flavor solutions. As demand for premium and therapeutic-grade coriander oil rises, manufacturers emphasize purity, consistency, and compliance with global regulatory standards to reinforce their market positions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Albert Vieille

- Ultra International B.V.

- Berje Inc.

- Firmenich International SA

- Givaudan

- Lionel Hitchen Essential Oils

- Bontoux S.A.S.

- Young Living Essential Oils

- doTERRA International

- The Lebermuth Company, Inc.

Recent Developments

- In September 2025, Ultra International B.V. reported that distillation of coriander herb oil concluded in Moldova, with material delivered to processing facilities, reflecting ongoing supply chain activities in the essential oils sector.

- In May 2025, Berje Inc. reported crop conditions for coriander herb oil improving, though availability remained somewhat limited, and good quality organic coriander seed oil became available with moderate demand. Berje highlighted the oil’s sweet and spicy qualities used in various flavorings including candy and pickles.

- In March 2024, Symrise AG announced it was entering a joint venture with the Virchow Group, a leading Indian pharmaceutical group, to manufacture personal care ingredients in India. This collaboration aims to create a more resilient global value chain and meet the growing demand for cosmetic ingredients in the APAC region and beyond.

- In 2023, LMR Naturals continued to demonstrate this commitment. A significant initiative highlighted in January 2023 was the pioneering of a methodology to calculate the carbon footprint of natural fragrance ingredients in concert with the consulting firm Carbone 4. This was done to establish an efficient reduction strategy and support customers’ objectives

Report Coverage

The research report offers an in-depth analysis based on Type, Extraction Method, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for coriander oil will rise as consumers prefer natural and clean-label ingredients.

- Organic coriander oil will gain stronger adoption across food, cosmetics, and wellness markets.

- Aromatherapy and spa applications will expand due to rising interest in relaxation and emotional wellness.

- Premium skincare brands will use coriander oil for anti-inflammatory and aromatic benefits.

- Pharmaceutical and herbal medicine sectors will integrate coriander oil into digestive and antimicrobial formulations.

- Sustainable farming and ethical sourcing will become key focus areas for manufacturers.

- Advanced extraction technologies will improve purity, aroma quality, and chemical consistency.

- Growth in functional foods and herbal beverages will increase usage as a natural flavoring agent.

- Online retail distribution will expand access to therapeutic-grade coriander oil.

- Asia Pacific and North America will remain major growth hubs due to high production and rising natural product consumption.