Market Overview:

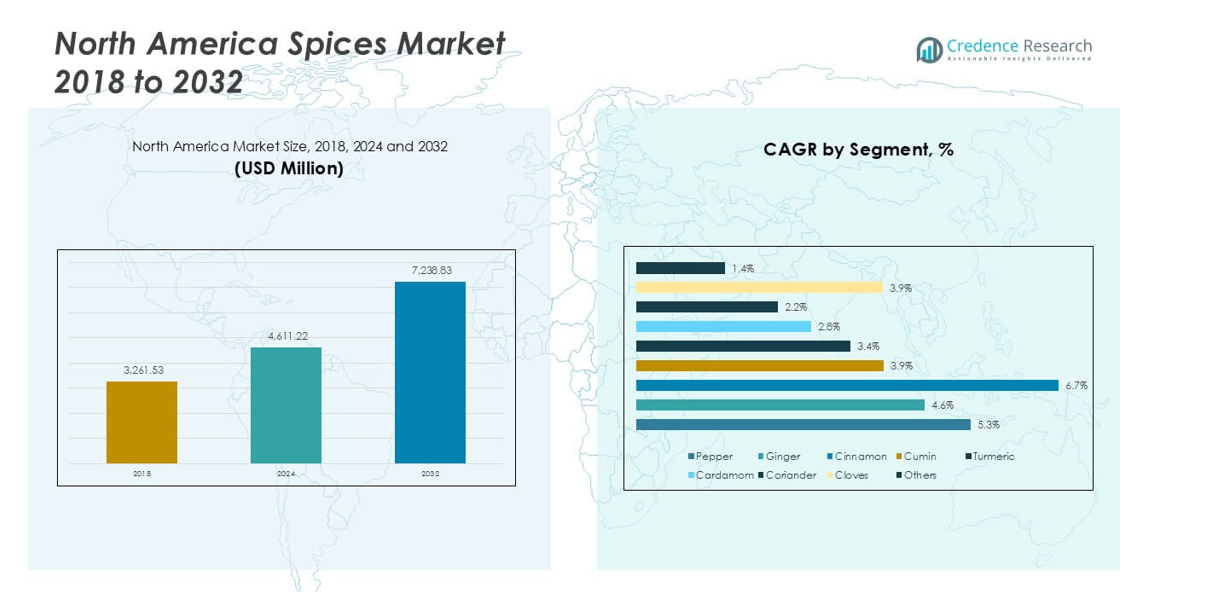

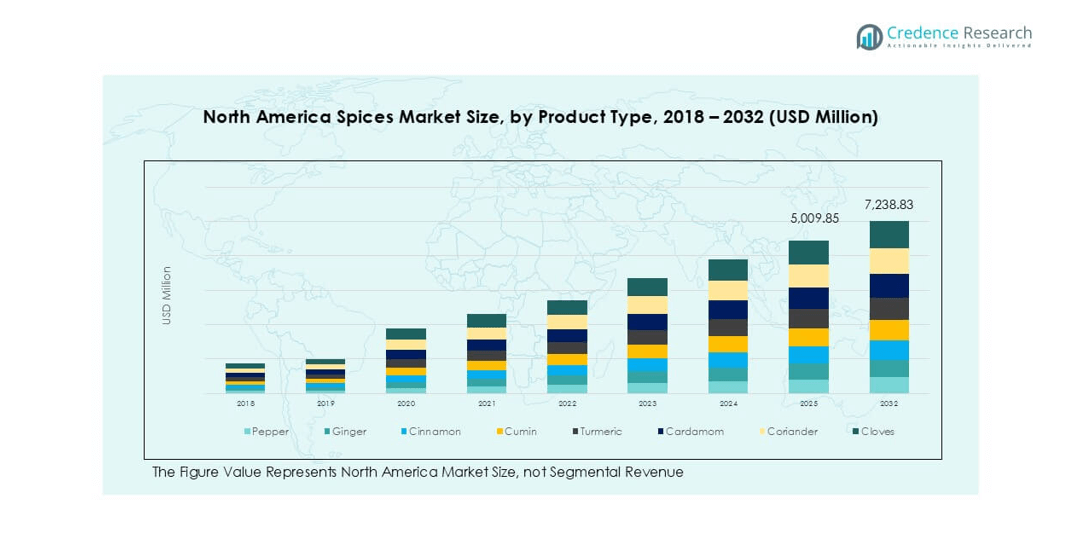

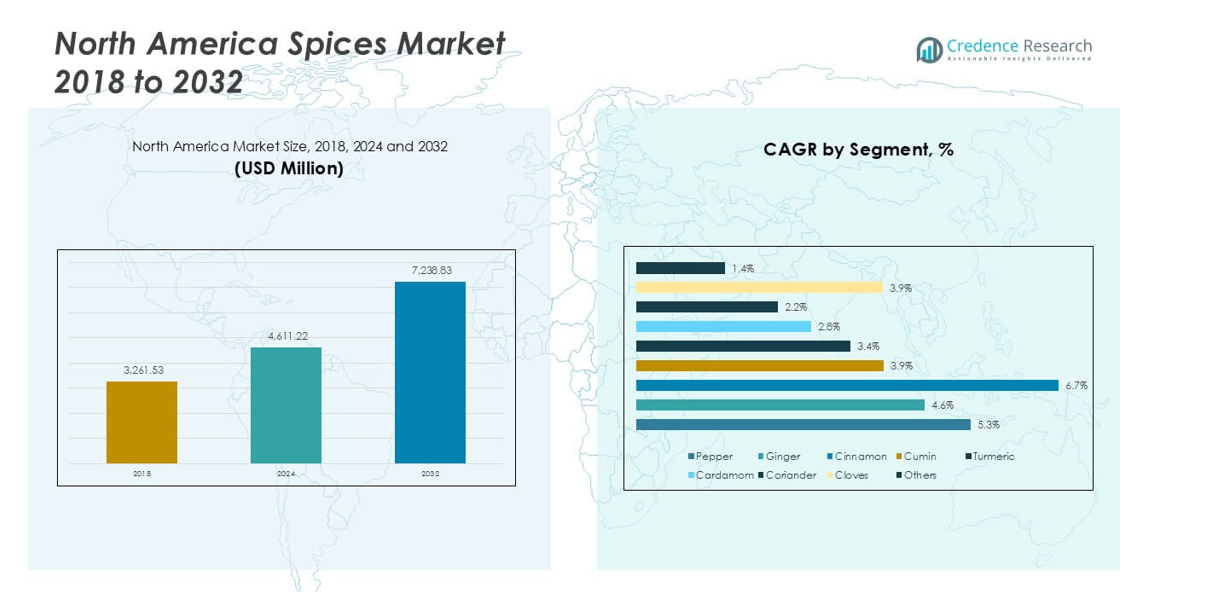

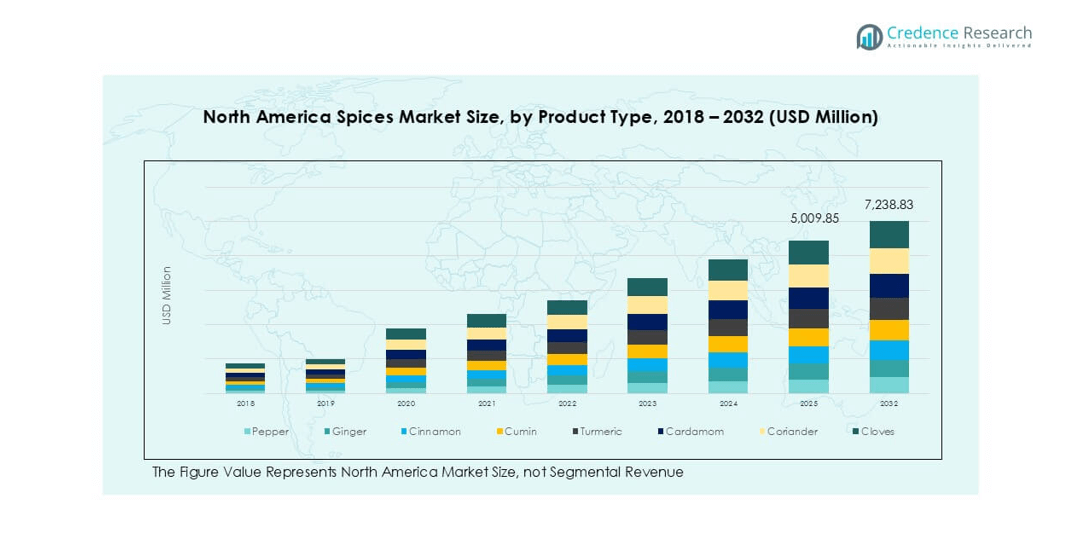

North America spices market size was valued at USD 3,261.53 million in 2018, reaching USD 4,611.22 million in 2024, and is anticipated to reach USD 7,238.83 million by 2032, at a CAGR of 5.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Spices Market Size 2024 |

USD 4,611.22 million |

| North America Spices Market, CAGR |

5.40% |

| North America Spices Market Size 2032 |

USD 7,238.83 million |

The North America spices market is shaped by intense competition among established multinational corporations and regional suppliers. McCormick & Company Incorporated leads with its extensive product range, advanced distribution network, and strong retail presence. Ajinomoto Co., Inc. leverages innovation in flavor technologies to enhance spice-based ingredients, while Olam International focuses on sustainable sourcing and integrated supply chains. Kerry Group PLC and Döhler GmbH strengthen their positions by offering natural and clean-label spice solutions to meet rising consumer demand for healthier alternatives. Regional players such as All Seasonings Ingredients Inc. cater to foodservice operators with custom blends, while Associated British Foods PLC expands through branded products. On the regional front, the United States dominates with over 65% share, followed by Canada at 22% and Mexico at 13%, highlighting the U.S. as the primary growth hub due to its advanced retail structure and higher packaged food consumption.

Market Insights

- The North America spices market was valued at USD 4,611.22 million in 2024 and is projected to reach USD 7,238.83 million by 2032, expanding at a CAGR of 5.40% during the forecast period.

- Rising consumer preference for natural, organic, and functional ingredients drives steady growth, with turmeric, ginger, and cinnamon seeing strong demand due to health-related benefits.

- Key market trends include the adoption of clean-label spice blends, expansion of ethnic cuisines, and growing e-commerce sales channels that offer consumers convenience and variety.

- The competitive landscape is led by players such as McCormick & Company, Ajinomoto Co., Olam International, Kerry Group, Döhler GmbH, All Seasonings Ingredients Inc., and Associated British Foods PLC, all focusing on innovation, sustainability, and product diversification.

- Regionally, the United States accounts for over 65% share, followed by Canada with 22% and Mexico with 13%, while by product type, pepper leads with more than 30% share, and by form, powder dominates with over 55% share

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Pepper held the dominant share of the North America spices market in 2024, accounting for over 30% of total demand. Its widespread use in packaged foods, sauces, and ready-to-eat meals drives its leadership. Ginger follows with rising demand in beverages, bakery, and nutraceuticals due to its health benefits and functional properties. Cinnamon and cumin continue to grow steadily, supported by ethnic cuisine expansion across the U.S. and Canada. Turmeric records strong adoption, fueled by its role in health supplements and functional foods. Cardamom, coriander, cloves, and other niche spices maintain smaller shares but benefit from growing use in premium and gourmet products.

- For instance, in 2025, Frontier Co-op expanded its facility in Belle Plaine, Iowa, with a new 90,000-square-foot building. The expansion was made to add more production and warehouse capacity, allowing the company to meet its continued growth

By Form

Powdered spices dominated the market with more than 55% share in 2024, attributed to their easy application in processed foods, ready meals, and household cooking. The segment’s leadership is driven by rising packaged food consumption and convenience preferences among urban consumers. Whole spices continue to hold a significant share, largely driven by traditional cooking practices and ethnic food demand in households and restaurants. Chopped or crushed spices represent a smaller portion but are gaining traction in foodservice, particularly in gourmet kitchens and ready-to-cook meal kits, where flavor intensity and texture are key drivers of adoption.

- For instance, McCormick & Company manufactures and distributes spices, seasonings, and other flavorings to retail outlets, food manufacturers, and foodservice businesses across the United States and worldwide. It is a major supplier to many well-known packaged food producers and restaurant chains.

Key Growth Drivers

Rising Consumer Preference for Natural and Healthy Ingredients

The North America spices market benefits strongly from shifting consumer preferences toward natural food ingredients. Increasing awareness of health benefits linked with spices such as turmeric for anti-inflammatory properties, ginger for digestive health, and cinnamon for blood sugar regulation drives steady demand. Consumers are actively replacing artificial additives with natural seasonings in both home-cooked meals and packaged foods. The growing popularity of functional foods, herbal teas, and supplements has further expanded spice usage beyond traditional cooking. Major food processors in the region are incorporating natural spices in ready-to-eat meals, beverages, and bakery products to cater to health-conscious buyers. This trend positions spices as essential components of a clean-label diet, supporting consistent market expansion.

- For instance, Sabinsa Corporation supplies its branded Curcumin C3 Complex® to nutraceutical manufacturers in the U.S. and around the world, reinforcing turmeric’s presence in health supplements.

Expansion of Ethnic Cuisine and Foodservice Industry

The rapid adoption of ethnic cuisines across North America has significantly boosted spice consumption. Rising popularity of Indian, Middle Eastern, and Latin American dishes has increased the use of spices such as cumin, coriander, chili, and cardamom in mainstream cooking. The foodservice industry, including quick-service restaurants and fine dining establishments, is leveraging diverse spices to enhance menus and attract multicultural consumers. Moreover, the growing immigrant population continues to sustain demand for authentic flavors, leading to greater imports and local blending of spices. Packaged food producers are also launching spice-rich convenience products to meet evolving tastes. This cultural shift toward bold flavors is expected to remain a long-term growth catalyst, expanding spice penetration across multiple food categories.

- For instance, Olam Food Ingredients (ofi), a global supplier of food and beverage ingredients, processes and distributes various spices, including cumin and chili, for the North American restaurant and retail markets. In 2024, ofi continued its strategy of delivering sustainable, natural, and value-added food ingredients.

Increasing Demand for Packaged and Ready-to-Eat Foods

The growing reliance on packaged, frozen, and ready-to-eat meals in North America drives demand for spices as essential flavoring agents. Urban lifestyles, rising dual-income households, and time constraints encourage consumers to opt for convenience foods that require seasoning to maintain taste and freshness. Food processors are investing heavily in spice-infused sauces, marinades, and seasoning blends to enhance product appeal. Powdered spices, in particular, dominate in this segment due to ease of integration during production. Retailers are also offering pre-mixed spice blends tailored to popular dishes, creating a new consumption channel. As the packaged food sector continues to expand, spice demand is expected to accelerate, supported by continuous innovation in spice-based product formulations.

Key Trends & Opportunities

Rising Adoption of Organic and Sustainably Sourced Spices

A major trend shaping the North America spices market is the rising preference for organic and sustainably sourced products. Consumers are increasingly demanding transparency in sourcing, pushing suppliers to invest in certified organic farming practices and fair-trade initiatives. Retail shelves now feature organic turmeric, ginger, and cinnamon, responding to clean-label and eco-conscious buyers. Major food brands are reformulating recipes with sustainably sourced spices to strengthen brand loyalty. This trend also opens opportunities for global suppliers from India, Sri Lanka, and Vietnam to expand exports of certified organic spices to North America. With consumer focus on health, sustainability, and ethics, this segment presents significant long-term opportunities.

- For instance, Frontier Co-op works with thousands of smallholder farmers across Asia and Latin America to source certified organic products. The program supports these farming communities by investing in business development, regenerative organic agricultural practices, and community well-being projects.

Growth of E-Commerce and Direct-to-Consumer Channels

The rapid rise of e-commerce platforms has transformed spice distribution in North America, creating direct-to-consumer opportunities for both established players and niche brands. Online retail giants and specialty spice companies are leveraging digital platforms to reach consumers with diverse product offerings, from gourmet blends to ethnic spice kits. Subscription models and customized spice boxes are gaining traction, especially among millennials and younger households seeking convenience and variety. E-commerce also enables smaller regional spice companies to expand their reach without heavy investment in physical retail. This shift toward online spice sales is expected to accelerate further, supported by growing consumer trust in digital grocery platforms and demand for doorstep delivery.

Key Challenges

Price Volatility and Supply Chain Dependence on Imports

One of the key challenges for the North America spices market is its high dependence on imports, making it vulnerable to supply chain disruptions and price volatility. Spices like cardamom, cinnamon, and black pepper are largely sourced from Asia and Africa, where unpredictable weather, crop failures, and political instability can affect availability and costs. Transportation delays and global shipping fluctuations also impact delivery timelines, creating challenges for manufacturers and retailers. These uncertainties make it difficult for companies to maintain consistent pricing and profit margins. Developing resilient supply chains and local sourcing alternatives remains a critical challenge for sustained market stability.

Stringent Food Safety and Quality Regulations

The North American spices market faces regulatory hurdles related to food safety, pesticide residues, and contamination risks. Agencies such as the U.S. Food and Drug Administration (FDA) and the Canadian Food Inspection Agency (CFIA) enforce strict compliance standards for imported and domestically processed spices. Instances of adulteration or microbial contamination can lead to costly recalls, brand damage, and loss of consumer trust. Manufacturers must invest in advanced quality testing, traceability systems, and certified suppliers to meet compliance. While these regulations ensure consumer safety, they also increase operational costs for businesses. Navigating complex regulatory frameworks remains a key barrier for both new entrants and existing spice producers.

Regional Analysis

United States

The United States dominated the North America spices market in 2024, accounting for over 65% share. High consumption of packaged and ready-to-eat foods continues to fuel spice demand. Growing popularity of ethnic cuisines such as Indian, Mexican, and Middle Eastern has further increased the use of turmeric, cumin, and chili-based spices. The rising trend of health-conscious eating supports adoption of natural and organic spice products. Strong retail presence, advanced distribution networks, and product innovations by local and international brands strengthen the U.S. position as the leading regional market.

Canada

Canada held around 22% share of the North America spices market in 2024, supported by rising multicultural food preferences. Immigration-driven demand for authentic ethnic cuisines has boosted consumption of coriander, cardamom, and ginger. Increasing awareness of the health benefits of turmeric and cinnamon has also driven adoption in functional foods and beverages. The Canadian retail sector has expanded organic and sustainably sourced spice offerings, appealing to eco-conscious consumers. Foodservice providers and specialty restaurants further drive demand, making Canada a steadily growing market within the region with strong long-term growth opportunities.

Mexico

Mexico contributed nearly 13% share of the North America spices market in 2024, with strong reliance on traditional spice usage in everyday cooking. Chili peppers, cumin, and coriander remain dominant in local cuisines, fueling consistent domestic demand. Spices are widely integrated into sauces, marinades, and packaged foods, supporting growth in both retail and foodservice channels. Rising exports of processed foods and seasonings have also enhanced spice consumption. While the market is smaller compared to the U.S. and Canada, Mexico’s cultural dependence on spices ensures stable demand and positions it as an important contributor to regional growth.

Market Segmentations:

By Product Type

- Pepper

- Ginger

- Cinnamon

- Cumin

- Turmeric

- Cardamom

- Coriander

- Cloves

- Others

By Form

- Powder

- Whole

- Chopped/Crushed

By Geography

- United States

- Canada

- Mexico

Competitive Landscape

The North America spices market is highly competitive, with global and regional players focusing on innovation, sustainability, and supply chain efficiency. McCormick & Company Incorporated leads the market with a wide range of seasonings and strong retail distribution. Ajinomoto Co., Inc. leverages advanced flavor technologies to expand spice-based ingredient offerings in packaged foods. Olam International emphasizes integrated supply chains and sustainable sourcing to strengthen its presence. Kerry Group PLC and Döhler GmbH are investing in natural and clean-label spice solutions tailored to health-conscious consumers. Regional firms such as All Seasonings Ingredients Inc. provide customized blends for foodservice, while Associated British Foods PLC focuses on expanding branded products. Companies are adopting strategies like organic product launches, e-commerce distribution, and partnerships with food manufacturers to gain a competitive edge. The growing demand for ethnic flavors and organic spices ensures that players continue to innovate and expand their portfolios.

[cr_cta type=”customize_now”

Key Player Analysis

Recent Developments

- In March 2024, McCormick & Company released a new collection of organic spices such as the Moroccan harissa, the Japanese shichimi togarashi, and the Indian garam masala spice. This line fits with the side trend of consumers looking for organic and exotic spices.

- In February 2024, Everest Spices, one of the Indian leading companies in spices, launched their pre-mixed spices targeting regions such as Mexican and Italian regions. This was intended to broaden the expands of its product range so as to take advantage of the international markets.

- In January 2024, Olam Food Ingredients (ofi) announced the expansion of its facilities for the processing of spices in Vietnam seeking to boost the production of black pepper as well as cinnamon to address the increasing international market demand.

- In November 2023, Spiceology announced a collaboration with a well-recognized chef to create a brand of spices that include habanero and pomelo and maple bacon. The goal was to reach out to food lovers and the home chefs.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily, supported by rising packaged food consumption.

- Demand for organic and sustainably sourced spices will expand due to eco-conscious consumer preferences.

- Ethnic cuisine popularity will increase spice adoption across foodservice and household cooking.

- Functional foods and nutraceuticals will drive higher use of turmeric, ginger, and cinnamon.

- E-commerce and direct-to-consumer channels will strengthen spice distribution and accessibility.

- Innovation in spice blends and seasoning mixes will enhance product diversification.

- Clean-label trends will push manufacturers to focus on natural and additive-free spices.

- Supply chain resilience will become a priority to address import dependence and volatility.

- Food manufacturers will increasingly partner with spice producers for custom formulations.

- The United States will remain the leading market, while Canada and Mexico will show consistent growth.