Market Overview:

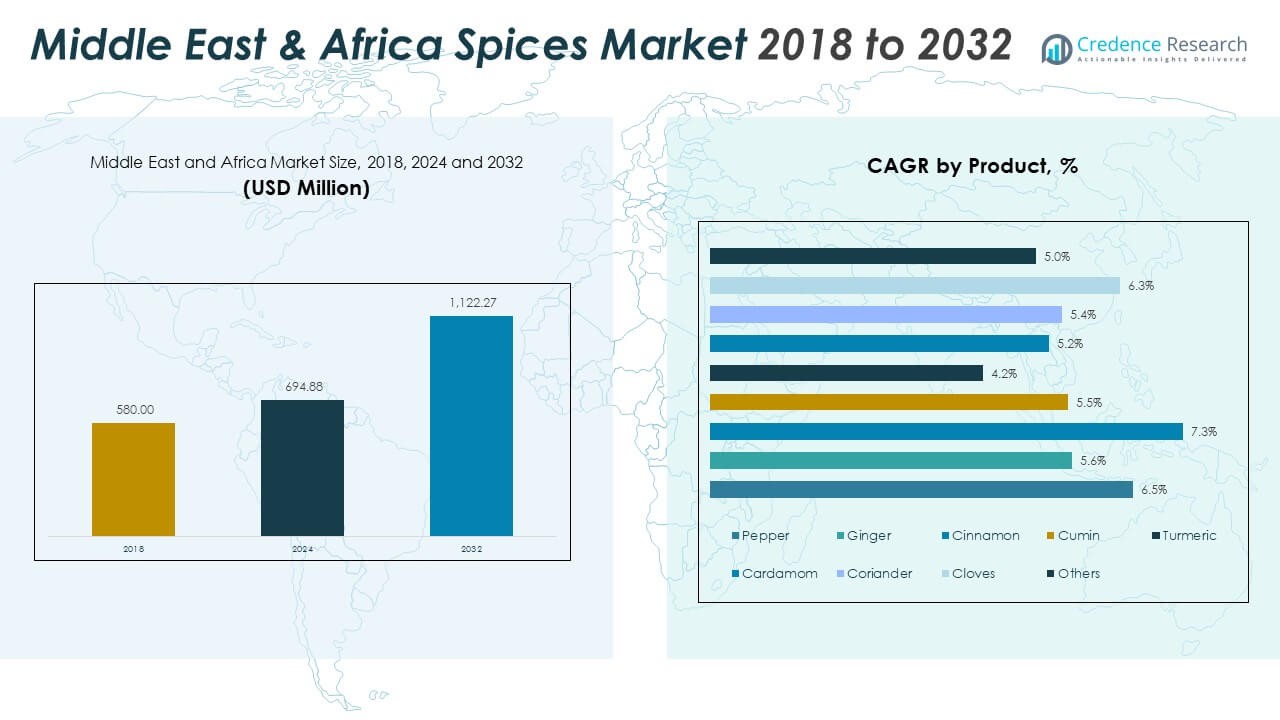

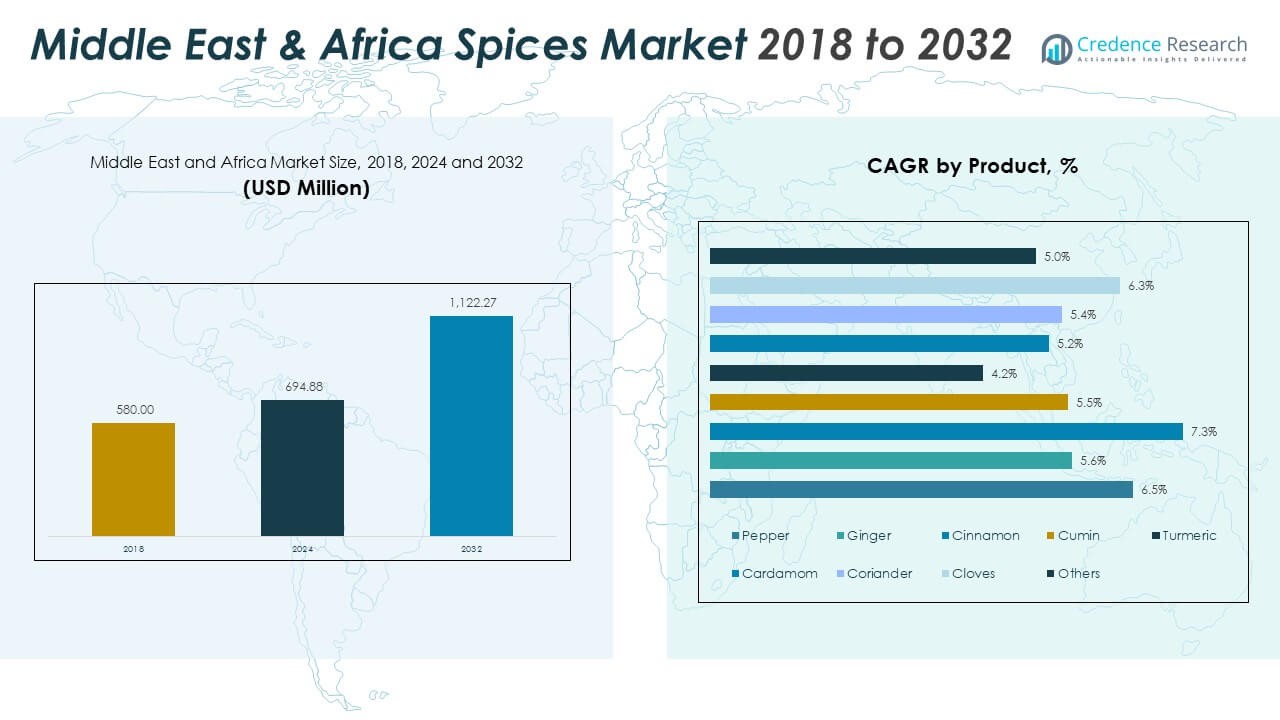

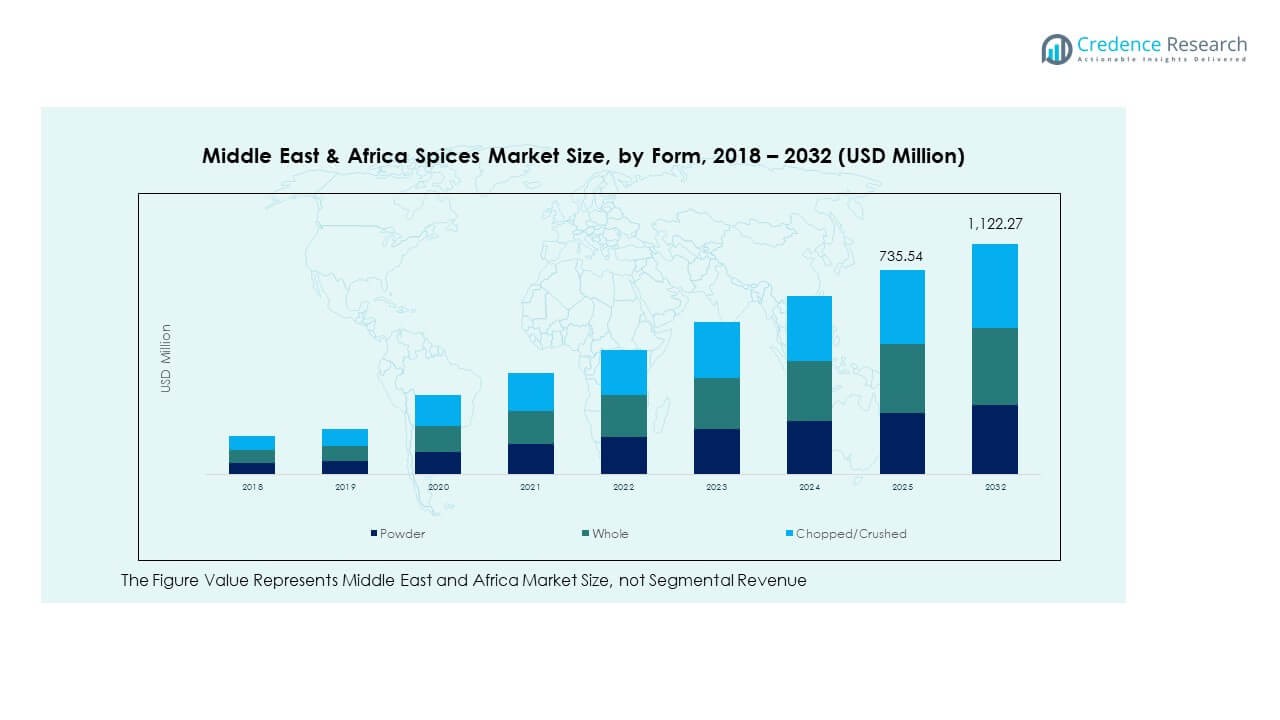

The Middle East & Africa Spices Market size was valued at USD 580.00 million in 2018 to USD 694.88 million in 2024 and is anticipated to reach USD 1,122.27 million by 2032, at a CAGR of 6.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East & Africa Spices Market Size 2024 |

USD 694.88 Million |

| Middle East & Africa Spices Market, CAGR |

6.22% |

| Middle East & Africa Spices Market Size 2032 |

USD 1,122.27 Million |

The growth of the Middle East & Africa Spices Market is driven by several factors, including the increasing demand for healthy and natural food options. Spices such as turmeric, ginger, and cumin are sought after for their health benefits. Additionally, the rise of regional cuisines and the growing interest in ethnic flavors are pushing consumers to explore diverse spice offerings. The availability of spices through both traditional retail and e-commerce channels is further supporting market growth.

Regionally, the Middle East & Africa Spices Market is dominated by the GCC countries, including Saudi Arabia and the UAE, due to their strong foodservice sectors and affluent populations. Sub-Saharan Africa is emerging as a growth market, driven by urbanization, increasing disposable incomes, and changing dietary habits. North Africa, particularly Morocco and Egypt, also holds significant market share, thanks to their historical spice trade and consumption patterns.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Middle East & Africa Spices Market size was valued at USD 580.00 million in 2018, growing to USD 694.88 million in 2024, and is projected to reach USD 1,122.27 million by 2032, with a CAGR of 6.22% during the forecast period.

- The GCC countries hold the largest market share at 38%, driven by strong demand in foodservice and retail, followed by North Africa at 27%, supported by a history of spice trade and consumption, and Sub-Saharan Africa at 35%, where urbanization is pushing market growth.

- Sub-Saharan Africa is the fastest-growing region, contributing to 35% of the market share, driven by urbanization, increasing disposable income, and the rising demand for convenience and packaged spice products.

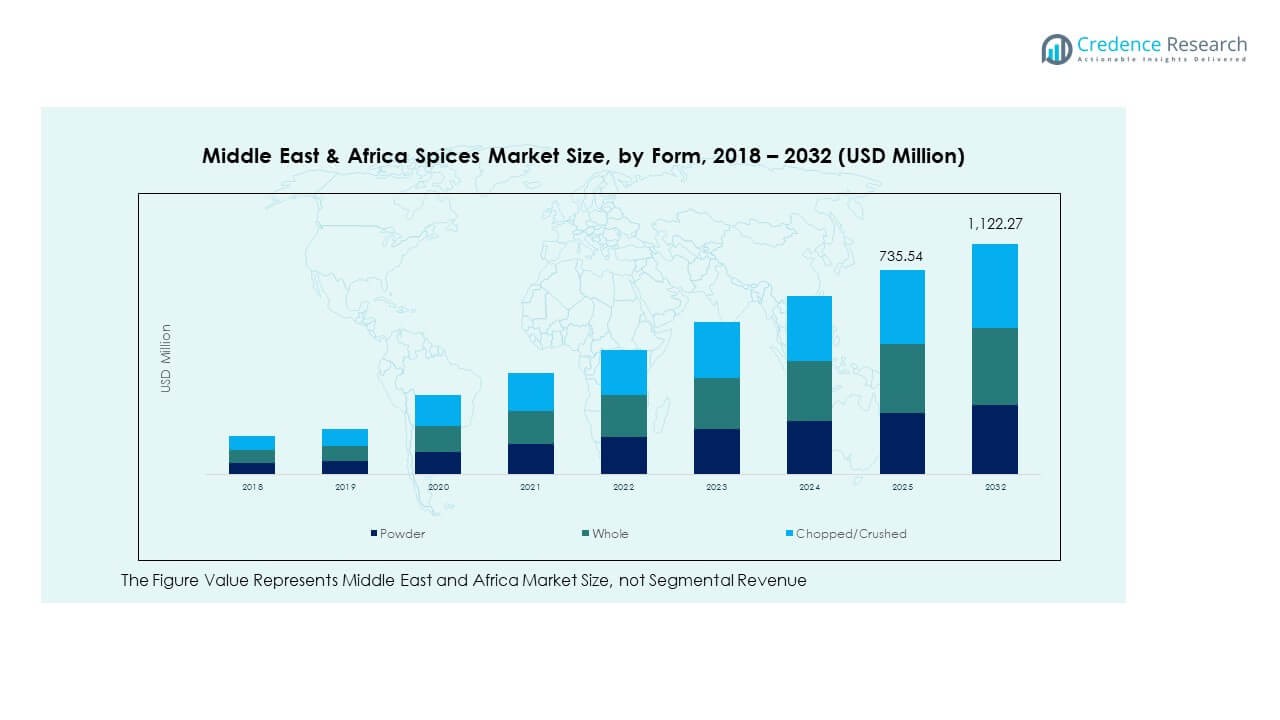

- The powder form of spices leads the market with the largest share, followed by whole spices, while chopped/crushed spices are growing at a steady pace, contributing to market diversification.

- The powder form of spices holds the dominant share, with a significant portion of the market coming from whole spices. Chopped/crushed spices are expected to grow rapidly due to increasing convenience-oriented demand.

Market Drivers:

Increasing Consumer Awareness of Health Benefits

The growing awareness of the health benefits of spices is a key driver of the Middle East & Africa Spices Market. Consumers are increasingly turning to natural remedies and foods that support overall well-being. Spices such as turmeric, ginger, and cinnamon are widely recognized for their anti-inflammatory and antioxidant properties. These health-conscious choices are prompting more individuals to include spices in their daily diet. As more information becomes available about the medicinal benefits of these spices, their demand is expected to rise significantly. It is clear that consumers are looking for healthier alternatives, which will continue to influence the spice market. This trend aligns with the broader global movement toward organic and plant-based foods.

- For instance, Olam Food Ingredients (ofi) offers its AtSource sustainable sourcing solution, which provides full traceability and transparency on origin and sustainability for spices sourced into the Middle East & Africa. The AtSource Plus platform tracks over 350 metrics on health, environmental, and social impact, with verifiable primary data, ensuring that health-focused consumers and manufacturers access spices verified for their natural and beneficial properties.

Growing Popularity of Ethnic and Regional Cuisines

Ethnic and regional cuisines are gaining more attention, driving demand for specific spices in the Middle East & Africa Spices Market. Consumers are increasingly exploring the authentic flavors of traditional dishes from various cultures. With the rise of social media and food blogs, people have become more experimental with their cooking. Spices that are integral to regional dishes such as Moroccan, Indian, and Middle Eastern are now being incorporated into everyday meals. These growing culinary trends push the demand for a diverse range of spices, including cumin, coriander, and saffron. It reflects an increasing desire for flavor complexity and food authenticity.

- For instance, North African and Ethiopian spice blends like ras el hanout and berbere have seen increased adoption across African restaurants and food producers, with Berbere becoming a culinary cornerstone for regional dishes such as doro wat and injera-based meals in Ethiopia and Eritrea, reflecting the mainstreaming of traditional flavors in both foodservice and home kitchens.

Expansion of Retail and Online Sales Channels

The expansion of retail and online sales channels has been a driving force behind the Middle East & Africa Spices Market growth. Consumers now have easy access to a broader selection of spices through e-commerce platforms and retail outlets. This increased accessibility, combined with convenience, supports market expansion. Traditional brick-and-mortar stores continue to dominate, but online platforms are quickly gaining ground as they provide consumers with access to a variety of spices from around the world. It is this growing infrastructure that allows the spice market to thrive across regions in the Middle East and Africa.

Rising Disposable Income and Urbanization

Rising disposable income and increasing urbanization in the Middle East & Africa are positively impacting the spices market. As more people move into urban areas, their purchasing power increases, allowing them to spend more on food and lifestyle products. Urban centers are home to a diverse population with different tastes and preferences, which further boosts the demand for diverse spice varieties. In parallel, consumers are seeking premium, high-quality products as their economic circumstances improve. It is expected that as the middle class continues to expand, the demand for spices will increase accordingly.

Market Trends:

Increasing Demand for Organic and Natural Spices

Organic and natural spices are gaining popularity in the Middle East & Africa Spices Market. Consumers are becoming more conscious about the potential harmful effects of pesticides and chemicals in food products. This shift in consumer preferences is resulting in greater demand for organic spices, as they are perceived to be healthier and more sustainable. Organic certification offers reassurance to consumers looking for transparency in sourcing and production methods. It is also driving the growth of a niche market focused on certified organic products, particularly in high-income urban areas.

- For instance, AKO The Spice Company has held EU ECO-Regulation organic certification for its spice imports and processing since June 2014, undergoing annual independent audits as well as compliance reviews by FSSC 22000-accredited boards, ensuring each batch meets strict pesticide and chemical-free standards.

Spices in Functional Foods and Beverages

There is a rising trend of using spices in functional foods and beverages across the Middle East & Africa. Consumers are increasingly looking for products that provide additional health benefits beyond basic nutrition. This includes beverages enriched with spices like ginger, turmeric, and mint, known for their soothing properties. Similarly, functional snacks and foods are incorporating spices to boost flavor and health benefits. Spices are now being seen not only as flavor enhancers but also as ingredients that provide wellness benefits, which is appealing to health-conscious consumers. It represents an evolving trend where food manufacturers are blending spices into innovative new products.

Advances in Spice Processing and Packaging Technologies

Technological advancements in spice processing and packaging are shaping the Middle East & Africa Spices Market. Companies are increasingly investing in modern equipment and techniques that improve the efficiency and quality of spice production. These innovations lead to spices that are fresher, more flavorful, and longer-lasting. Packaging has also evolved, with more attention given to preserving the aroma and potency of spices. Innovative packaging solutions, such as vacuum-sealed bags and glass containers, have helped maintain the spices’ integrity and appeal to consumers. It reflects a growing commitment to quality and sustainability in the industry.

- For instance, Indian manufacturers such as Hathi Masala have industrially deployed cryogenic grinding technology, reaching temperatures as low as −196∘C and achieving extended shelf life for spices, specific tests show microbiological growth reduction and volatile oil retention resulting in longer domestic and export shelf lives.

Customization of Spice Products for Local Preferences

The trend of customizing spice products to cater to local preferences is gaining traction in the Middle East & Africa. Manufacturers are developing spice blends that cater to the unique tastes and culinary traditions of specific regions and countries. These tailored products appeal to consumers looking for a more authentic culinary experience. The demand for regional variations of popular spices like curry powder, za’atar, and ras el hanout is growing, as consumers seek flavors that resonate with their cultural palate. It signifies a more localized approach to spice production, emphasizing the need for more region-specific offerings.

Market Challenges Analysis:

Supply Chain Disruptions and Price Volatility

One of the significant challenges facing the Middle East & Africa Spices Market is the disruption in the supply chain and the volatility in spice prices. Natural disasters, political instability, and fluctuations in fuel prices can severely affect spice production and transportation. This leads to unpredictability in spice availability and pricing, making it difficult for manufacturers and suppliers to maintain consistent pricing strategies. The market also faces challenges related to the perishable nature of spices, which require careful handling and storage. As a result, any disruption in the supply chain can cause delays and lead to increased costs for both suppliers and consumers.

Competition from Substitutes and Counterfeit Products

The Middle East & Africa Spices Market also faces challenges from the increasing competition posed by substitutes and counterfeit products. Spices are sometimes substituted with cheaper alternatives that mimic their taste and appearance, often compromising quality. Additionally, counterfeit spices are a growing concern, as unregulated products are entering the market under false claims of quality. This issue undermines consumer trust and can create a significant market imbalance. Manufacturers need to focus on quality assurance and certifications to maintain their brand integrity and meet regulatory requirements.

Market Opportunities:

Growth in Health-Conscious Consumer Segments

The growing focus on health and wellness presents significant opportunities for the Middle East & Africa Spices Market. Health-conscious consumers are increasingly choosing spices for their medicinal benefits, such as reducing inflammation and boosting immunity. There is a rising demand for functional foods that incorporate spices like ginger, garlic, and turmeric, further supporting market growth. As consumers move towards healthier diets, the spice market is well-positioned to capitalize on these trends by offering products that align with these preferences. This shift provides a valuable opportunity for growth in the market.

Expansion of Spice Blends and Ready-to-Use Products

There is an emerging opportunity for manufacturers in the Middle East & Africa Spices Market to expand into spice blends and ready-to-use products. Busy urban lifestyles are driving the demand for convenient cooking solutions, and spice blends cater perfectly to this need. Pre-packaged spice mixes for specific dishes like curry, shawarma, and tagine are growing in popularity. It provides an opportunity for spice producers to innovate and cater to this demand by offering convenient yet high-quality products that suit modern lifestyles.

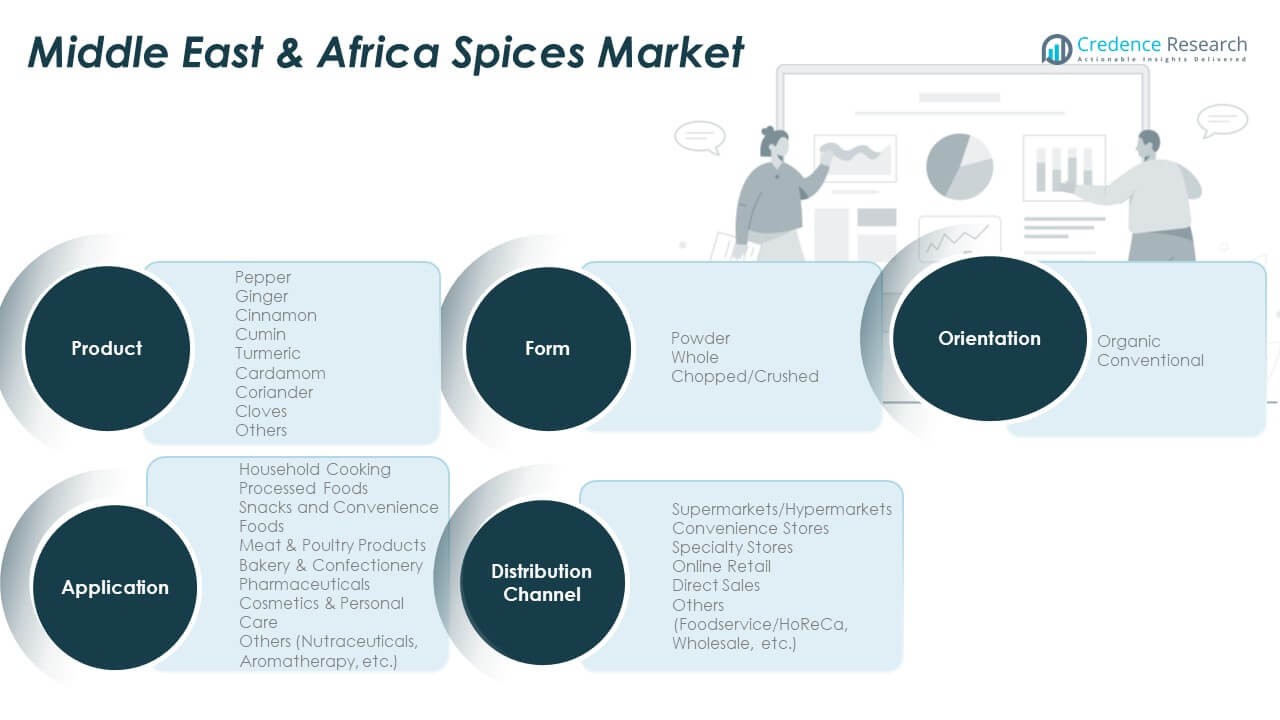

Market Segmentation Analysis

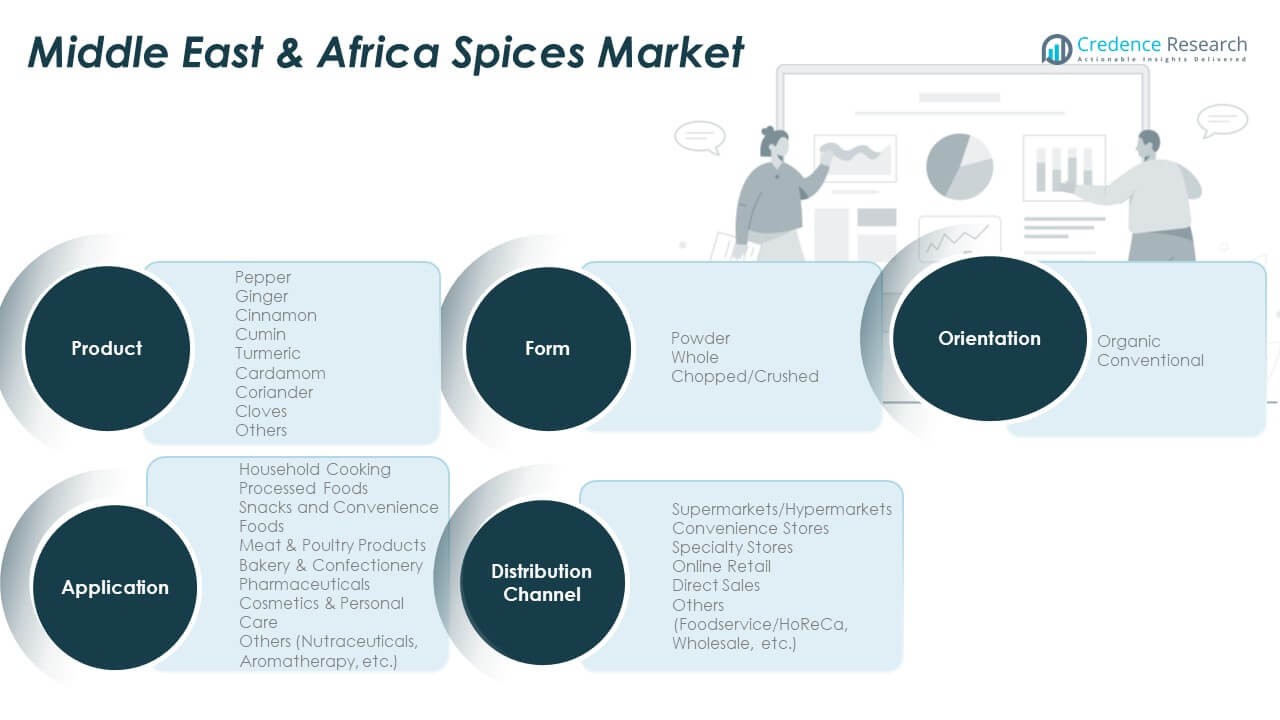

By Product:

The Middle East & Africa Spices Market is driven by a diverse range of spices, with pepper, ginger, and cumin leading in demand. Pepper remains the most widely used spice, owing to its versatility in various cuisines. Ginger is gaining popularity due to its medicinal benefits, contributing to the growing trend of health-conscious consumption. Turmeric and cardamom follow closely, valued for their strong flavor and health benefits. Cinnamon, coriander, and cloves are also significant, often used in regional cuisines. The “Others” category includes niche spices, which contribute to the market’s overall growth.

By Form:

The form of spices significantly impacts consumer preferences in the Middle East & Africa Spices Market. Powdered spices dominate the market due to their ease of use and versatility in cooking. Whole spices are popular for consumers who prefer freshly ground flavors and longer shelf life. Chopped or crushed spices are increasingly being used in convenience products, offering ready-to-use solutions for consumers. The choice of spice form varies based on regional cuisine, with consumers seeking fresh or pre-ground options to suit their cooking habits and convenience.

- For example, Frontier Co-op, the parent of Simply Organic, launched the first nationally distributed Regenerative Organic Certified® bottled spices line in 2024, backed by third-party certification. These products implement advanced zero-synthetic farming and documented social/environmental standards.

By Orientation:

Organic spices are gaining traction in the Middle East & Africa Spices Market as health-conscious consumers prioritize natural and chemical-free options. Organic spices, though more expensive, are seen as a healthier choice due to their perceived purity and sustainability. Conventional spices, however, still account for a significant market share, being more widely available and cost-effective. The growing demand for organic products is expected to further boost the market for organic spices, particularly in high-income urban regions.

By Application:

The Middle East & Africa Spices Market sees diverse applications, with household cooking leading in consumption. Processed foods and snacks are also major contributors to the market, as they increasingly incorporate spices for enhanced flavor. Spices are crucial in meat & poultry products, bakery & confectionery, and pharmaceuticals, where their functional and preservative properties are valued. Cosmetics and personal care products are incorporating spices for their antioxidant properties. The “Others” category covers niches like nutraceuticals and aromatherapy, expanding the application scope of spices in the region.

- For example, SPAR Group South Africa’s digital platform “SPAR2U” recorded a 174% increase in on-demand delivery volumes for food and grocery items including spices in the first half of 2025, as published in multiple retail industry news sources and the company’s interim financial results.

By Distribution Channel:

Supermarkets and hypermarkets are the primary distribution channels for spices in the Middle East & Africa Spices Market, offering wide accessibility to consumers. Convenience stores play an important role, especially in urban areas, where consumers seek quick and easy access to spices. Specialty stores provide premium and organic spice options, catering to health-conscious buyers. Online stores are growing in popularity due to the increasing digital penetration in the region. Direct sales and other channels, including foodservice and wholesale, also contribute to the market’s dynamic distribution landscape.

Segmentation

By Product:

- Pepper

- Ginger

- Cinnamon

- Cumin

- Turmeric

- Cardamom

- Coriander

- Cloves

- Others

By Form:

- Powder

- Whole

- Chopped/Crushed

By Orientation:

By Application:

- Household Cooking

- Processed Foods

- Snacks and Convenience Foods

- Meat & Poultry Products

- Bakery & Confectionery

- Pharmaceuticals

- Cosmetics & Personal Care

- Others (Nutraceuticals, Aromatherapy, etc.)

By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Direct Sales

- Others (Foodservice/HoReCa, Wholesale, etc.)

Regional Analysis

In the Gulf Cooperation Council (GCC) sub‑region, including Saudi Arabia and the UAE, the Middle East & Africa Spices Market holds an estimated 38% market share. The GCC benefits from high disposable income, modern retail infrastructure and strong import networks, which drive robust spice consumption. Urbanization and a growing expatriate population in cities like Dubai and Riyadh further support demand. Retailers in this sub‑region focus on premium and organic spice offerings, boosting value‑segment growth. The market here remains relatively mature but still offers incremental growth through product premiumization. Manufacturers prioritise GCC expansion to capture this lead share and establish brand presence early.

In North Africa, which includes Egypt, Morocco and Algeria, the market share stands at approximately 27%. Local cuisines feature spice‑rich recipes, which sustains consistent consumption. The region’s role in spice production and trade adds supply advantages for local manufacturers and importers. Retail penetration still trails the GCC, giving scope for branded spice adoption growth. Economic shifts and growing tourism in Morocco and Egypt contribute to rising demand for packaged and convenience spice products. Challenges such as variable logistics and regulatory complexity present barriers, yet the region’s share remains strong and stable.

Sub‑Saharan Africa, including Nigeria, Kenya and South Africa, accounts for around 35% of the region’s spices market. It is an emerging growth zone with rising urban populations and increasing demand for convenient food solutions incorporating spices. Many consumers shift from traditional loose spices to branded options, creating opportunities for new players. Infrastructure development and improving supply chains support this transition. However, price sensitivity and fragmented distribution networks constrain rapid uptake of premium segments. Despite these constraints, this sub‑region offers the highest potential growth among the three.

Key Player Analysis

- Ajinomoto Co., Inc.

- Associated British Foods plc

- Baria Pepper

- Kerry Group

- The Bart Ingredients Co. Ltd.

- DS Group

- McCormick & Company, Inc.

Competitive Analysis

The competitive landscape in the Middle East & Africa Spices Market features several multinational and regional players. McCormick & Company, Inc. operates across multiple markets in the region, leveraging strong brand equity and global supply chains to scale presence. Associated British Foods plc also participates in spice and seasoning categories, leveraging its regional manufacturing and distribution networks. Kerry Group Plc supports blended spice solutions and functional ingredients, enhancing its position in both retail and industrial segments. Ajinomoto Co., Inc. extends its spice portfolio into flavour enhancement for ingredients and food‑service applications. Baria Pepper operates with strong regional sourcing capabilities for raw spices, enabling cost advantages for downstream brands. These companies compete on product innovation, supply‑chain efficiency, local sourcing strategies and premiumisation of offerings. Local companies often focus on cost‑competitive blends and private‑label contracts. Overall rivalry remains high, and firms invest in branded outreach, organic certifications and expanded distribution to strengthen market positioning.

Recent Developments

- In January 2025, DS Group officially unveiled new television commercials (TVCs) for Catch Spices, their prominent brand, which signals active promotional efforts in the spice segment relevant to both India and, by virtue of brand expansion, the wider region including the Middle East and Africa.

- In January 2025, Kerry Group launched its 2025 Taste Charts, specifically highlighting major flavor trends and expanded efforts in Africa, including hot and spicy ingredient solutions. Kerry’s increasing engagement in the Middle East and Africa is supported by recent partnerships, local R&D expansion, and tailored flavor innovation strategies as confirmed by company statements and industry media.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Form, Orientation, Application and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for organic and natural spices is expected to continue growing as consumers become more health-conscious.

- E-commerce platforms will play an increasingly vital role in spice distribution, reaching a larger customer base.

- Regional spice blends tailored to local preferences will gain popularity in both retail and foodservice segments.

- There will be a rise in demand for value-added and premium spice products, especially in GCC countries.

- Urbanization across Sub-Saharan Africa will drive the demand for convenience products such as pre-blended spices and ready-to-use mixes.

- The Middle East & Africa Spices Market will see further product innovations, including functional foods and beverages enriched with spices.

- Competition will intensify as global and regional brands expand their footprint, especially in emerging markets.

- Regulatory frameworks and compliance standards will evolve, ensuring quality control and sustainability practices.

- Increasing disposable income in key regions will fuel higher consumption of premium and organic spice varieties.

- Advancements in spice processing and packaging technologies will enhance product shelf life, contributing to overall market growth.