Market Overview

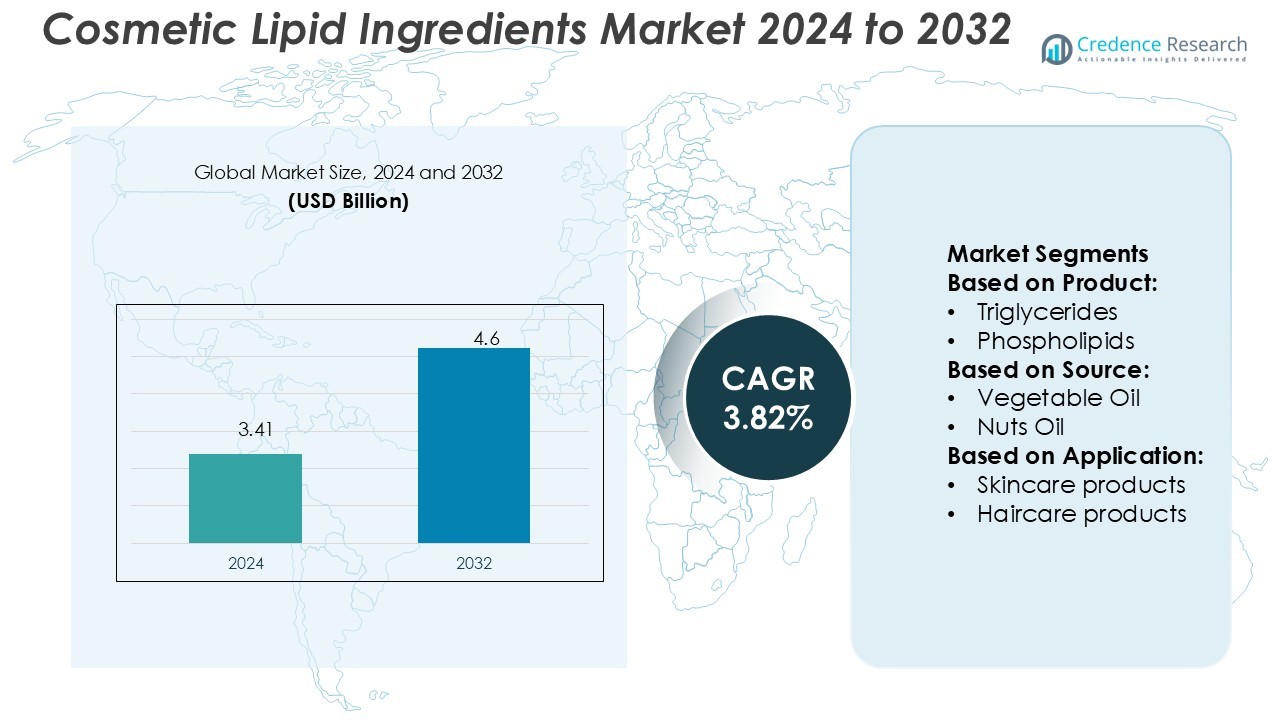

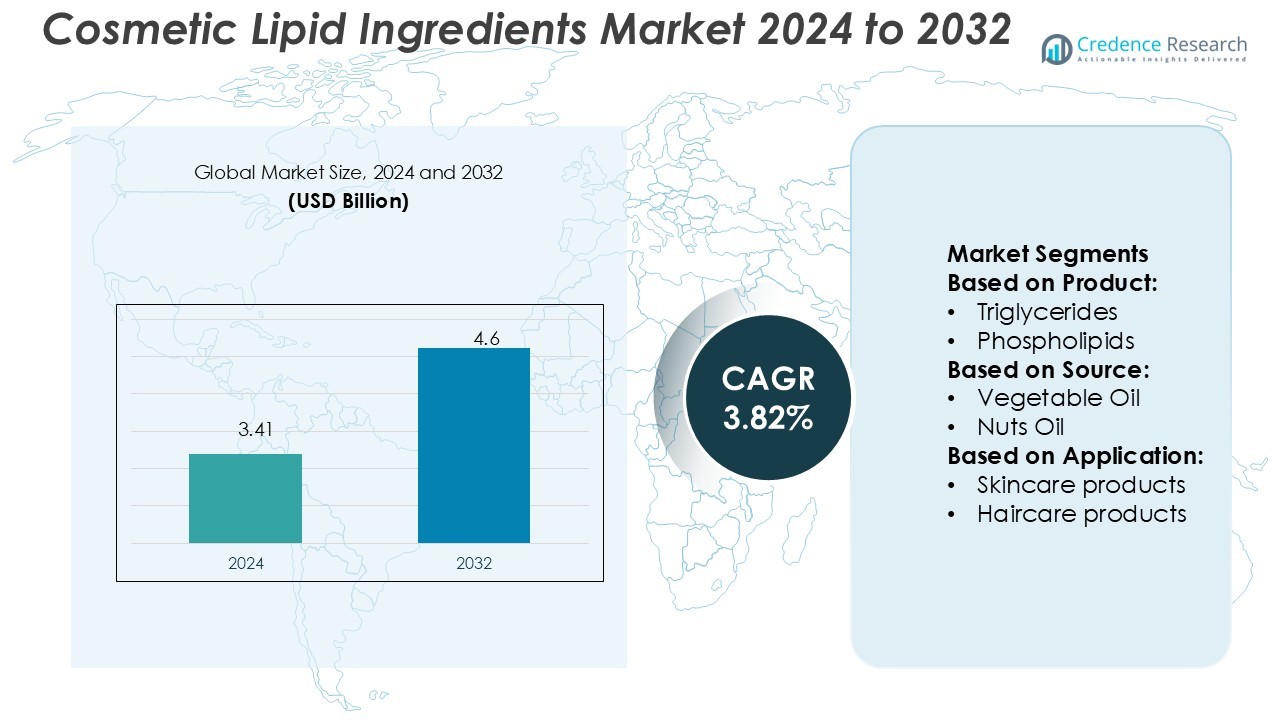

Cosmetic Lipid Ingredients Market size was valued USD 3.41 billion in 2024 and is anticipated to reach USD 4.6 billion by 2032, at a CAGR of 3.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetic Lipid Ingredients Market Size 2024 |

USD 3.41 Billion |

| Cosmetic Lipid Ingredients Market, CAGR |

3.82% |

| Cosmetic Lipid Ingredients Market Size 2032 |

USD 4.6 Billion |

The cosmetic lipid ingredients market is shaped by major players including Symrise, Fermenta Biotech Limited, Merck KGaA, Conagen, Inc., Amyris, International Flavors & Fragrances, Inc., Titan Biotech, Evonik Industries, Bell Flavors & Fragrances, Inc., and Advanced Biotech. These companies focus on developing sustainable, multifunctional lipid ingredients to meet growing demand from skincare, haircare, and makeup segments. They invest in advanced formulation technologies, green chemistry, and fermentation-based processes to enhance product performance and shelf stability. Strategic partnerships and product innovations are key competitive strategies. Asia Pacific leads the market with a 34% share, driven by rapid urbanization, expanding beauty product consumption, and strong manufacturing capabilities, making it a central hub for both production and demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cosmetic lipid ingredients market was valued at USD 3.41 billion in 2024 and is projected to reach USD 4.6 billion by 2032, growing at a CAGR of 3.82% during the forecast period.

- Demand is driven by the rising adoption of natural, clean-label, and multifunctional formulations in skincare and makeup products.

- Key players focus on sustainable sourcing, advanced formulation technologies, and strategic collaborations to strengthen their market positions.

- High production costs and regulatory compliance requirements act as restraints, limiting faster adoption in price-sensitive regions.

- Asia Pacific leads with a 34% share, supported by strong manufacturing capabilities, followed by North America with 31% and Europe with 27%, while skincare products remain the dominant segment, driving overall market growth.

Market Segmentation Analysis:

By Product

Triglycerides hold the largest share of the cosmetic lipid ingredients market. Their emollient properties provide strong hydration and barrier protection, making them ideal for skincare and makeup formulations. They blend easily with other ingredients, improving texture and stability in creams and lotions. For instance, Croda International offers triglyceride-based emollients with enhanced oxidation stability, extending product shelf life. Phospholipids and sphingolipids are growing segments, supporting skin barrier repair and anti-aging benefits. Ionizable lipids are also gaining momentum in advanced formulation development.

- For instance, Fermenta Biotech offers a range of enzymes for various applications, including lipases (e.g., CALB) used for the synthesis of specialty lipids and Penicillin G Amidase (e.g., Fermase PS 250) used for the manufacture of beta-lactam antibiotics.

By Source

Plant-based sources dominate the market, supported by a strong consumer shift toward clean beauty. Lipids derived from vegetable oils, nut oils, and fruit seeds offer high biocompatibility and antioxidant properties. These sources align with sustainability goals and regulatory preferences for natural ingredients. For example, BASF offers plant-based lipid complexes with improved stability and moisturizing effects for skin barrier protection. Fruit seed oils show strong growth potential due to their rich fatty acid profiles, making them attractive for premium skincare products.

- For instance, Merck scaled up a SAFC synthetic cholesterol product, we have increased our capacity by 50 times, helping biomanufacturers bring lifesaving therapies to patients faster.

By Application

Skincare products lead the application segment with the highest market share. Cosmetic lipids enhance hydration, barrier function, and absorption in creams, lotions, and serums. Their multifunctional properties make them essential in anti-aging and moisturizing formulations. Companies such as Evonik offer lipid-based delivery systems that improve bioavailability and product performance. Haircare products and makeup also show strong growth, driven by demand for natural ingredients and multifunctional formulations. Decorative cosmetics benefit from lipids’ texture-enhancing and stability-improving functions.

Key Growth Drivers

Rising Demand for Natural and Clean-Label Products

The growing preference for plant-derived and clean-label cosmetics is boosting the use of lipid ingredients. Consumers are increasingly favoring formulations that are free from synthetic additives and align with sustainable values. Lipids from vegetable oils, nut oils, and fruit seeds offer strong moisturizing and barrier-enhancing properties. Companies such as BASF and Croda are expanding their natural lipid portfolios to meet this demand. This shift is encouraging brands to reformulate existing products and introduce new premium skincare lines centered on natural ingredients.

- For instance, Conagen develops p-coumaric acid (PCA) as a clean-label preservative via precision fermentation. In a separate commercial launch, Conagen and its partner Blue California delivered Rosavel™, a rosmarinic acid preservative that achieved 98% purity.

Growing Use in Skincare and Anti-Aging Applications

Cosmetic lipids play a crucial role in improving skin hydration, elasticity, and barrier function. The rising popularity of anti-aging creams, serums, and moisturizers is creating significant growth opportunities. Triglycerides and phospholipids are key components in these formulations due to their excellent compatibility and absorption properties. Leading manufacturers such as Evonik are offering lipid-based delivery systems to boost active ingredient performance. This trend is driving product innovation and increasing the adoption of lipids in both mass-market and premium skincare ranges.

- For instance, Amyris produces a fermentation-derived squalane with purity up to 97 %, offering a molecular match for human skin and broad adoption across global beauty brands.

Technological Advancements in Formulation Science

Advances in formulation technologies are improving the stability, bioavailability, and multifunctionality of lipid ingredients. Companies are developing structured lipids and encapsulation techniques to enhance ingredient delivery and product performance. These innovations allow brands to create lightweight, non-greasy textures while maintaining hydration benefits. For example, Croda has introduced lipid blends with improved oxidation resistance for longer shelf life. The integration of smart lipid carriers in skincare and makeup formulations is strengthening market growth and supporting the development of next-generation cosmetic products.

Key Trends & Opportunities

Shift Toward Sustainable and Ethical Sourcing

Sustainability is a major market trend, with brands prioritizing renewable and ethically sourced ingredients. Plant-based lipids are gaining traction as they align with environmental goals and meet consumer expectations for transparency. Manufacturers are investing in traceable supply chains to ensure quality and compliance with global regulations. This shift supports brand differentiation in competitive markets. Opportunities are emerging for suppliers that offer certified organic and sustainably sourced lipid ingredients, which appeal to eco-conscious consumers in both developed and emerging markets.

- For instance, Titan Biotech operates GMP-facilitated manufacturing facilities in Bhiwadi, Rajasthan (approximately 60 km from Delhi), and holds ISO 13485 and ISO 9001 certifications.

Rising Popularity of Multifunctional Ingredients

Consumers prefer products that offer multiple benefits in a single formulation. Lipid ingredients provide hydration, barrier protection, and texture enhancement, making them ideal for multifunctional skincare and makeup products. This trend reduces the need for multiple formulations and appeals to minimalist beauty routines. Companies like Evonik and Lipoid are developing lipid complexes that combine emollient, antioxidant, and delivery functions. This creates strong opportunities for brands to launch innovative products with cleaner labels and improved performance.

- For instance, Chemical manufacturers have implemented process modifications and purification steps, such as vacuum stripping, to reduce 1,4-dioxane levels in ethoxylated surfactants. This is in response to regulatory pressure and consumer demand for cleaner products.

Expanding Applications in Premium and Specialty Products

The premium beauty segment is increasingly adopting lipid-based formulations. These ingredients enhance sensory feel and product stability, making them ideal for high-performance skincare and decorative cosmetics. Growing demand for personalized and dermocosmetic products is expanding lipid use in targeted formulations. Brands are leveraging advanced lipid carriers to deliver actives effectively and enhance product differentiation. This expansion into specialized segments is opening new revenue streams for ingredient manufacturers and cosmetic brands globally.

Key Challenges

High Production and Raw Material Costs

The production of high-quality lipid ingredients requires advanced extraction and refining processes. Natural plant-based lipids often involve higher sourcing and processing costs compared to synthetic alternatives. This impacts pricing strategies for both manufacturers and end-product brands. Fluctuations in raw material availability, especially for premium oils, further add to the cost burden. Smaller cosmetic brands face challenges in maintaining margins while offering natural lipid-based formulations, which may limit broader market adoption in cost-sensitive regions.

Regulatory and Quality Standard Compliance

Cosmetic lipid ingredients must meet strict regulatory and quality standards across different regions. Variations in labeling rules, purity requirements, and certification processes create complexities for manufacturers. Non-compliance can delay product launches or lead to reformulation, increasing costs. Meeting organic and sustainable certification standards further adds to operational challenges. Companies must invest in testing, documentation, and transparent sourcing to ensure market acceptance. These regulatory hurdles can slow market entry and limit the scale of expansion for new players.

Regional Analysis

North America

North America holds a 31% share of the cosmetic lipid ingredients market, driven by strong demand for premium skincare and clean-label beauty products. The U.S. leads regional adoption, supported by high consumer awareness and robust cosmetic manufacturing infrastructure. Brands are integrating triglycerides and phospholipids into anti-aging, moisturizing, and multifunctional skincare formulations. Regulatory clarity and a mature retail ecosystem accelerate innovation and product launches. Companies like Croda and BASF have expanded their sustainable lipid ingredient portfolios to meet this demand. Growing interest in plant-based and ethically sourced ingredients is further strengthening the market across skincare and makeup segments.

Europe

Europe accounts for 27% of the market share, supported by strong regulatory frameworks and high consumer preference for natural ingredients. Countries such as Germany, France, and Italy lead adoption, with a strong focus on sustainable and certified organic lipids. The EU’s stringent cosmetic standards drive innovation in plant-based and biodegradable lipid solutions. Major manufacturers, including Evonik and Lipoid, are investing in advanced lipid technologies to enhance texture and efficacy in skincare and decorative cosmetics. Increasing demand for multifunctional and eco-friendly products aligns with the region’s emphasis on clean beauty and ethical sourcing, ensuring steady market growth.

Asia Pacific

Asia Pacific leads the global cosmetic lipid ingredients market with a 34% share, driven by rapid urbanization and rising skincare awareness in countries like China, Japan, South Korea, and India. The region’s booming beauty and personal care sector fuels strong demand for plant-based lipids, particularly triglycerides and fruit seed oils. Local and global brands are launching innovative skincare and makeup formulations tailored to diverse consumer preferences. Investments in manufacturing and R&D are increasing, making the region a hub for cost-effective production. Expanding e-commerce channels and a growing middle-class population further enhance market penetration.

Latin America

Latin America holds a 5% market share, supported by growing consumer interest in natural beauty products. Brazil and Mexico are the leading markets, driven by increasing awareness of skincare benefits and rising disposable income. The demand for plant-based and sustainably sourced lipids is increasing as local brands embrace eco-conscious formulations. Expansion of global cosmetic brands and improved retail distribution are boosting regional adoption. Triglycerides and nut oil derivatives are the most widely used ingredients. While regulatory frameworks are less stringent than in Europe, growing consumer education is creating opportunities for premium skincare and makeup formulations.

Middle East & Africa

The Middle East & Africa region accounts for 3% of the market share, showing steady growth driven by expanding urban populations and rising personal care spending. Markets such as the UAE, Saudi Arabia, and South Africa are witnessing increased demand for skincare products with natural lipid ingredients. Hot and arid climates fuel demand for hydrating and barrier-protecting formulations using triglycerides and phospholipids. Global brands are expanding their presence through retail and e-commerce channels, supported by rising consumer preference for clean-label beauty. However, limited local manufacturing capacity and price sensitivity remain key challenges to faster market penetration.

Market Segmentations:

By Product:

- Triglycerides

- Phospholipids

By Source:

By Application:

- Skincare products

- Haircare products

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cosmetic lipid ingredients market features key players such as Symrise, Fermenta Biotech Limited, Merck KGaA, Conagen, Inc., Amyris, International Flavors & Fragrances, Inc., Titan Biotech, Evonik Industries, Bell Flavors & Fragrances, Inc., and Advanced Biotech. The cosmetic lipid ingredients market is highly competitive, with companies focusing on innovation, sustainability, and product differentiation. Manufacturers are investing heavily in R&D to develop advanced lipid formulations with enhanced stability, bioavailability, and multifunctional benefits. Sustainable sourcing of plant-based lipids is a key strategic priority, aligning with the growing clean beauty movement. Many players are integrating green chemistry and fermentation technologies to produce high-purity ingredients that support eco-friendly claims. Strategic partnerships, acquisitions, and global expansion are common approaches to strengthen market presence. The competition is driven by the rising demand for natural, ethical, and high-performance cosmetic formulations across skincare, haircare, and makeup segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Symrise

- Fermenta Biotech Limited

- Merck KGaA

- Conagen, Inc.

- Amyris

- International Flavors & Fragrances, Inc.

- Titan Biotech

- Evonik Industries

- Bell Flavors & Fragrances, Inc.

- Advanced Biotech

Recent Developments

- In March 2024, Roquette acquired IFF Pharma Solutions, a producer of excipients for oral dosage solution. This acquisition was likely to strengthen Roquette’s position in the market.

- In February 2024, Evonik introduced Vecollage Fortify L, a new vegan collagen designed for the beauty and personal care market. This product capitalizes on Evonik’s strengths in biotechnology, collagen, and skincare to address the growing demand for vegan collagen in products including anti-aging and hydrating creams.

- In January 2024, L’Oreal Group’s venture capital arm, BOLD (Business Opportunities for L’Oreal Development), disclosed an investment in Timeline, a consumer health company. Specializing in aging and longevity, Timeline incorporates Mitopure, its proprietary technology, into a range of topical skincare products and supplements.

- In March 2023, Symrise expanded the Diana food bioactives range with innovative and distinctive nutricosmetic ingredients aimed at enhancing anti-aging, skin conditioning, skin brightening, hair care, and nail care. The range features organically sourced bioactives including vitamin C, vitamin A, collagen type I, and polyphenols.

Report Coverage

The research report offers an in-depth analysis based on Product, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for clean-label and plant-based formulations.

- Sustainable sourcing practices will become a core focus for manufacturers.

- Technological advancements will improve lipid functionality and stability.

- Fermentation-based production will gain traction for eco-friendly ingredient development.

- Multifunctional lipid ingredients will drive innovation in skincare and makeup products.

- Premium beauty brands will increase their reliance on natural lipid-based formulations.

- Strategic partnerships will enhance product portfolios and global reach.

- Regulatory compliance and certification will shape competitive strategies.

- Emerging markets will play a larger role in future growth.

- Personalized and targeted cosmetic formulations will accelerate lipid ingredient adoption.