Market Overview

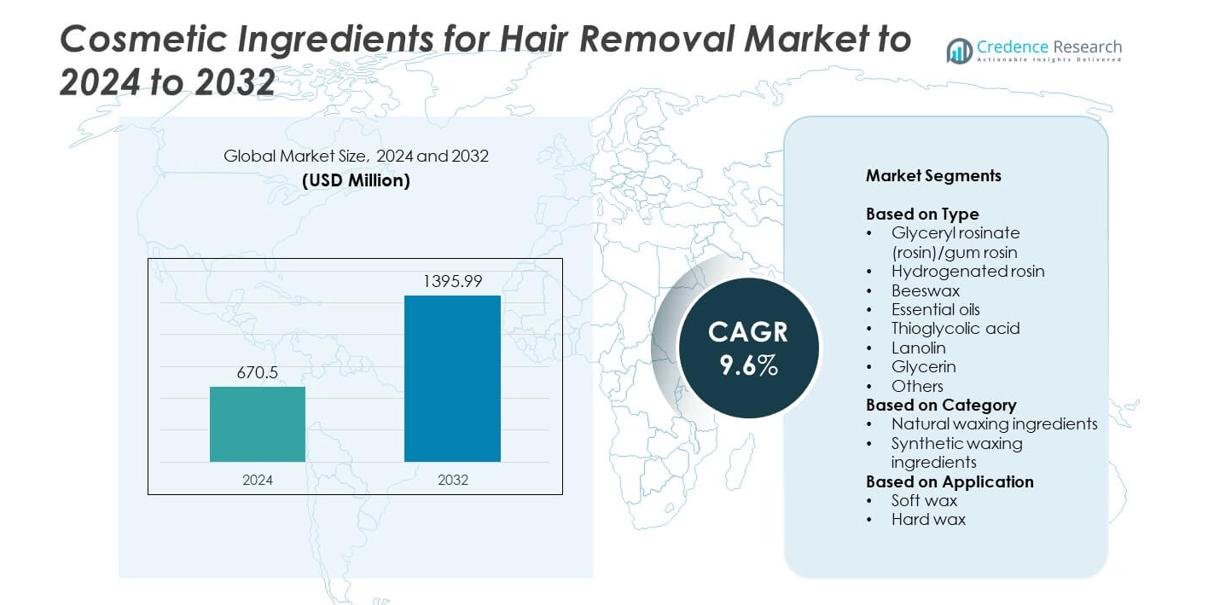

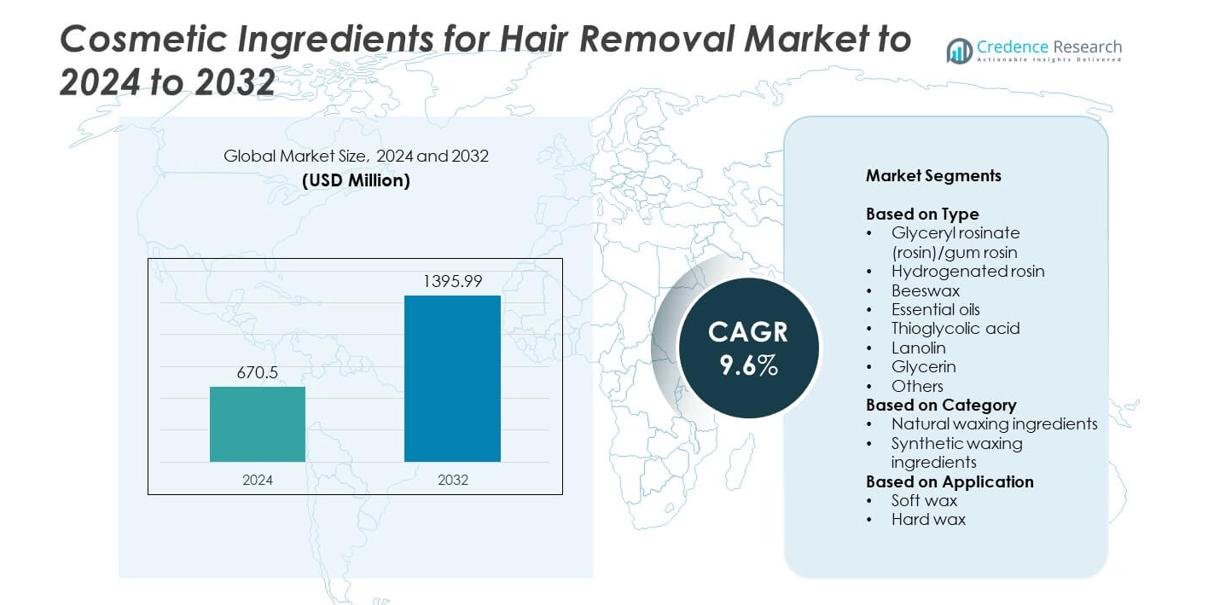

The Cosmetic Ingredients for Hair Removal Market size was valued at USD 670.5 million in 2024 and is anticipated to reach USD 1,395.99 million by 2032, at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cosmetic Ingredients for Hair Removal Market Size 2024 |

USD 670.5 million |

| Cosmetic Ingredients for Hair Removal Market, CAGR |

9.6% |

| Cosmetic Ingredients for Hair Removal Market Size 2032 |

USD 1,395.99 million |

The cosmetic ingredients for hair removal market is led by major companies such as Philips Personal Care B.V., Sally Hansen, Helios Lifestyle Private Limited, Emjoi, Inc., Procter & Gamble, SI&D (Aust) Pty Ltd, Reckitt Benckiser Group PLC, Revitol, Church & Dwight Co., Inc., and Vijohnkart.com. These players focus on innovative, skin-safe, and natural ingredient formulations to meet growing consumer demand for eco-friendly and dermatologically tested products. North America emerged as the leading region, accounting for 34% of the global share in 2024, driven by high consumer spending on personal care and a well-established beauty and wellness industry.

Market Insights

- The cosmetic ingredients for hair removal market was valued at USD 670.5 million in 2024 and is projected to reach USD 1,395.99 million by 2032, growing at a CAGR of 9.6%.

- Increasing consumer preference for natural and skin-friendly ingredients such as beeswax, glyceryl rosinate, and essential oils is driving market expansion.

- The market trend leans toward vegan, sustainable, and hypoallergenic formulations supported by technological innovation in low-irritation wax development.

- Competition remains strong with global players focusing on R&D, clean-label formulations, and sustainable ingredient sourcing to strengthen market positioning.

- North America leads with a 34% market share, followed by Europe at 28% and Asia Pacific at 25%, while glyceryl rosinate remains the dominant ingredient type with a 28% segment share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The glyceryl rosinate segment dominated the cosmetic ingredients for hair removal market, accounting for nearly 28% of the total share in 2024. Its strong adhesion and compatibility with various skin types make it a key base for waxing formulations. Glyceryl rosinate offers enhanced grip on fine and coarse hair, improving removal efficiency and user comfort. Rising consumer preference for gentle, skin-safe hair removal solutions continues to support demand. Moreover, manufacturers increasingly blend glyceryl rosinate with hydrogenated rosin and beeswax to enhance elasticity and temperature stability in premium formulations.

- For instance, Eastman’s Foral™ 85-E (hydrogenated rosin ester) lists a 71–77 °C softening point. Brands use this to design lower-temperature soft waxes with stable adhesion. The spec also fixes acid number at 3–10 mgKOH/g.

By Category

Natural waxing ingredients held the leading share of around 56% in 2024, driven by growing demand for plant-based and allergen-free products. Consumers increasingly prefer waxes formulated with beeswax, natural rosins, and essential oils due to their superior moisturizing and skin-soothing effects. The shift toward sustainable and non-toxic cosmetics has prompted companies to replace synthetic ingredients with biodegradable alternatives. Moreover, beauty brands emphasize cruelty-free and organic certifications, further fueling adoption of natural ingredients across professional and home-use waxing products.

- For instance, Koster Keunen’s organic beeswax shows a 62–65 °C melting point on its cert sheet. The company has held USDA Organic certification since 2008. Its Lomé, Togo program supports a sustainable beeswax supply chain.

By Application

Soft wax emerged as the dominant application segment, capturing nearly 63% of the market in 2024. Its ease of application and effectiveness in removing fine hair make it widely used in salons and at-home kits. Soft wax formulas often include glyceryl rosinate and lanolin, offering strong adhesion and reduced skin irritation. The rising popularity of strip waxing and roll-on systems among consumers seeking quick results supports segment expansion. Manufacturers continue to innovate with low-temperature and hypoallergenic variants to enhance safety and comfort for sensitive skin types.

Key Growth Drivers

Rising Demand for Natural and Skin-Friendly Ingredients

Consumers increasingly prefer hair removal products made with natural ingredients like beeswax, essential oils, and glyceryl rosinate. These ingredients provide effective results while minimizing skin irritation and allergic reactions. The growing awareness of skin health and environmental sustainability encourages cosmetic brands to use biodegradable and plant-derived components. Manufacturers focus on replacing synthetic chemicals with clean-label alternatives to appeal to eco-conscious consumers, driving consistent demand across both professional and personal care segments.

- For instance, Parissa sells a professional Organic Body Sugar Wax in a 730 ml size. The brand is Leaping Bunny certified cruelty-free. Its range highlights natural, ethically sourced inputs.

Expansion of At-Home Hair Removal Solutions

The popularity of DIY beauty treatments has led to a surge in at-home waxing kits, boosting ingredient demand. Soft wax and rosin-based formulations dominate due to their ease of application and low irritation profile. Consumers seek salon-quality results at home, encouraging brands to improve ingredient performance and packaging convenience. Increased online sales and awareness through digital platforms have strengthened this shift, making at-home waxing a major growth driver for cosmetic ingredient suppliers.

- For instance, some Nair products can remove hair as short as 2 mm, but this capability is specifically advertised for certain products, like the Sensitive Strip Free Wax.

Technological Advancements in Formulation

Continuous innovation in cosmetic chemistry enables the development of advanced waxing formulations with enhanced stability and lower melting points. Manufacturers are incorporating ingredients like hydrogenated rosin and lanolin to improve texture and adhesion. New emulsification and microencapsulation technologies enhance ingredient compatibility and prolong product shelf life. These improvements support the creation of smoother, temperature-tolerant waxes suitable for global climates, expanding the market reach for premium and professional-grade hair removal products.

Key Trends & Opportunities

Shift Toward Sustainable and Vegan Formulations

A major trend in the market is the adoption of vegan and eco-friendly hair removal ingredients. Manufacturers are replacing animal-derived materials with plant-based substitutes without compromising performance. Ingredients like soy wax, natural oils, and plant-based resins are gaining preference among conscious consumers. This trend offers opportunities for brands to introduce certified vegan and cruelty-free products, aligning with evolving global sustainability goals and regulatory standards on ethical cosmetics.

- For instance, the Sally Hansen Wax Strips for Face & Bikini is a specific kit that is marketed as having a vegan formula, is dermatologist tested, and removes hair for up to 4 weeks.

Integration of Skincare Benefits in Hair Removal Products

Manufacturers are incorporating moisturizing and soothing agents such as glycerin, lanolin, and essential oils into wax formulations. This integration provides dual benefits—effective hair removal and skin nourishment. Consumers increasingly favor products that minimize irritation and enhance post-wax smoothness. This approach creates opportunities for multifunctional cosmetic ingredients that cater to sensitive skin, allowing brands to differentiate through added skincare performance and innovation-driven marketing.

- For instance, Waxing kits are available with different formulas tailored to skin types such as sensitive, dry, and normal skin, and for use on multiple areas including legs, arms, underarms, and the bikini line. While some kits include 40 strips and 4 wipes, smaller kits with fewer strips and wipes are also common.

Key Challenges

Allergic Reactions and Sensitivity Concerns

Skin sensitivity remains a major restraint in the cosmetic ingredients for hair removal market. Some synthetic resins, preservatives, or fragrance additives may cause irritation or redness, particularly in sensitive skin types. The growing demand for hypoallergenic and dermatologically tested ingredients puts pressure on manufacturers to reformulate and comply with safety regulations. Achieving effective results while maintaining gentle formulations continues to challenge both ingredient suppliers and cosmetic producers.

Volatility in Raw Material Supply and Pricing

The market faces fluctuations in the availability and cost of key natural materials like beeswax, rosin, and essential oils. Climatic variations, trade restrictions, and high dependency on specific producing regions affect supply consistency. Rising input costs directly impact profit margins for manufacturers and lead to price instability across the value chain. Companies are exploring synthetic substitutes and local sourcing strategies to minimize risk and maintain product affordability.

Regional Analysis

North America

North America held the largest share of 34% in the cosmetic ingredients for hair removal market in 2024. The region’s dominance stems from high consumer spending on personal grooming and the strong presence of professional waxing salons. Demand for natural ingredients such as beeswax, lanolin, and essential oils continues to rise due to growing awareness of skin sensitivity. Manufacturers in the United States and Canada focus on developing hypoallergenic, cruelty-free formulations. Additionally, the popularity of at-home hair removal kits and sustainable beauty trends further strengthens market growth across the region.

Europe

Europe accounted for 28% of the global cosmetic ingredients for hair removal market in 2024. The region’s growth is driven by increasing adoption of eco-friendly and vegan waxing products across Germany, France, and the United Kingdom. Stringent EU cosmetic regulations have encouraged manufacturers to replace synthetic resins with natural alternatives like glyceryl rosinate and hydrogenated rosin. European consumers prefer low-irritation and dermatologically tested formulations, particularly for sensitive skin. Rising demand for sustainable packaging and organic certifications also supports market expansion, with brands focusing on transparency and ethical ingredient sourcing.

Asia Pacific

Asia Pacific captured a 25% share of the cosmetic ingredients for hair removal market in 2024, emerging as the fastest-growing region. Rapid urbanization, changing beauty standards, and expanding middle-class populations in China, Japan, and India are fueling product demand. Local manufacturers increasingly adopt natural and cost-efficient ingredients to cater to diverse skin types. The popularity of at-home waxing kits and salon chains across urban centers boosts consumption. Growing awareness of personal grooming among younger consumers and increased social media influence are further driving ingredient innovation and product diversification in the region.

Latin America

Latin America represented around 8% of the global cosmetic ingredients for hair removal market in 2024. Brazil and Mexico lead the region with a strong waxing culture and widespread salon-based treatments. Rising consumer preference for organic and skin-nourishing ingredients such as beeswax and essential oils supports market growth. Regional manufacturers focus on cost-effective natural blends to serve both premium and mass-market segments. Increasing e-commerce penetration and awareness of at-home beauty solutions are expanding accessibility, while collaborations with global brands strengthen product availability and ingredient quality in the market.

Middle East & Africa

The Middle East and Africa accounted for 5% of the cosmetic ingredients for hair removal market in 2024. Growing beauty awareness and cultural emphasis on personal care drive steady demand, particularly in Gulf Cooperation Council countries. The market benefits from expanding retail networks and increased adoption of imported, high-quality hair removal formulations. Consumers favor natural and fragrance-infused ingredients suited for warm climates and sensitive skin. Local manufacturers are investing in sustainable and halal-certified cosmetic ingredients to attract younger consumers, positioning the region as an emerging growth frontier in the global market.

Market Segmentations:

By Type

- Glyceryl rosinate (rosin)/gum rosin

- Hydrogenated rosin

- Beeswax

- Essential oils

- Thioglycolic acid

- Lanolin

- Glycerin

- Others

By Category

- Natural waxing ingredients

- Synthetic waxing ingredients

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The cosmetic ingredients for hair removal market features leading players such as Philips Personal Care B.V., Sally Hansen, Helios Lifestyle Private Limited, Emjoi, Inc., Procter & Gamble, SI&D (Aust) Pty Ltd, Reckitt Benckiser Group PLC, Revitol, Church & Dwight Co., Inc., and Vijohnkart.com. The market is highly competitive, driven by innovation in natural and skin-safe formulations. Companies are focusing on expanding product portfolios through clean-label ingredients and eco-friendly alternatives. Strategic collaborations with cosmetic manufacturers are strengthening global supply chains and distribution reach. Continuous R&D investments in hypoallergenic, vegan, and temperature-stable formulations support product differentiation. Firms are increasingly adopting sustainable sourcing and biodegradable materials to align with evolving regulatory standards. Digital marketing and e-commerce channels are playing a vital role in expanding consumer access and brand visibility. Overall, the competitive environment emphasizes innovation, sustainability, and consumer safety as core market differentiators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Reckitt Benckiser (Veet): Launched “Smoothest Way to Sexy” intimate-grooming campaign promoting Veet Pure Sensitive.

- In 2025, Church & Dwight (Nair): Won Allure Best of Beauty “Best Depilatory Cream” for Nair Cocoa Butter Body Cream.

- In 2023, Philips India launched BRR454 Facial Hair Remover in India aiming to cater to multitasking women by providing such innovative devices.

Report Coverage

The research report offers an in-depth analysis based on Type, Category, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for plant-based and vegan hair removal ingredients will continue to rise globally.

- Manufacturers will invest more in hypoallergenic and dermatologically safe formulations.

- Technological innovation will improve ingredient texture, melting point, and product stability.

- The popularity of at-home waxing kits will expand ingredient consumption among consumers.

- Sustainability and eco-friendly certifications will become essential for brand competitiveness.

- Growth in e-commerce platforms will boost accessibility of premium waxing products.

- Natural resins and essential oils will replace synthetic ingredients in large-scale formulations.

- Partnerships between cosmetic brands and raw material suppliers will enhance product quality.

- Emerging markets in Asia Pacific and Latin America will drive high-volume demand.

- R&D investment will focus on multifunctional ingredients that combine skincare and hair removal benefits.