Market Overview

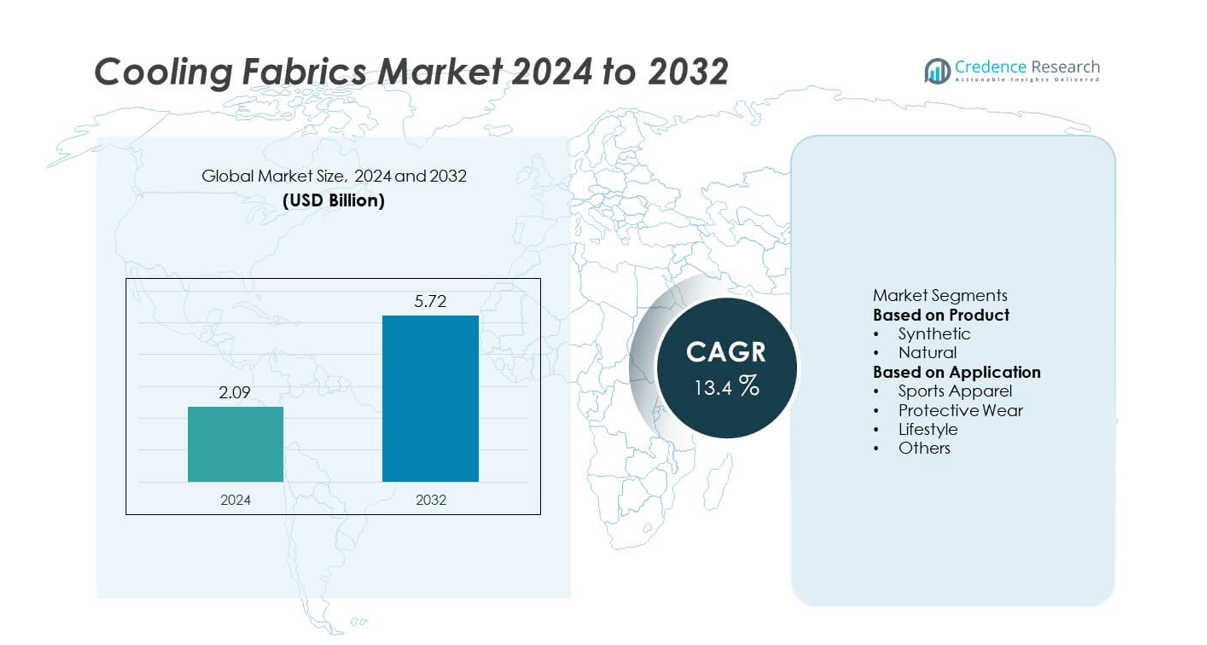

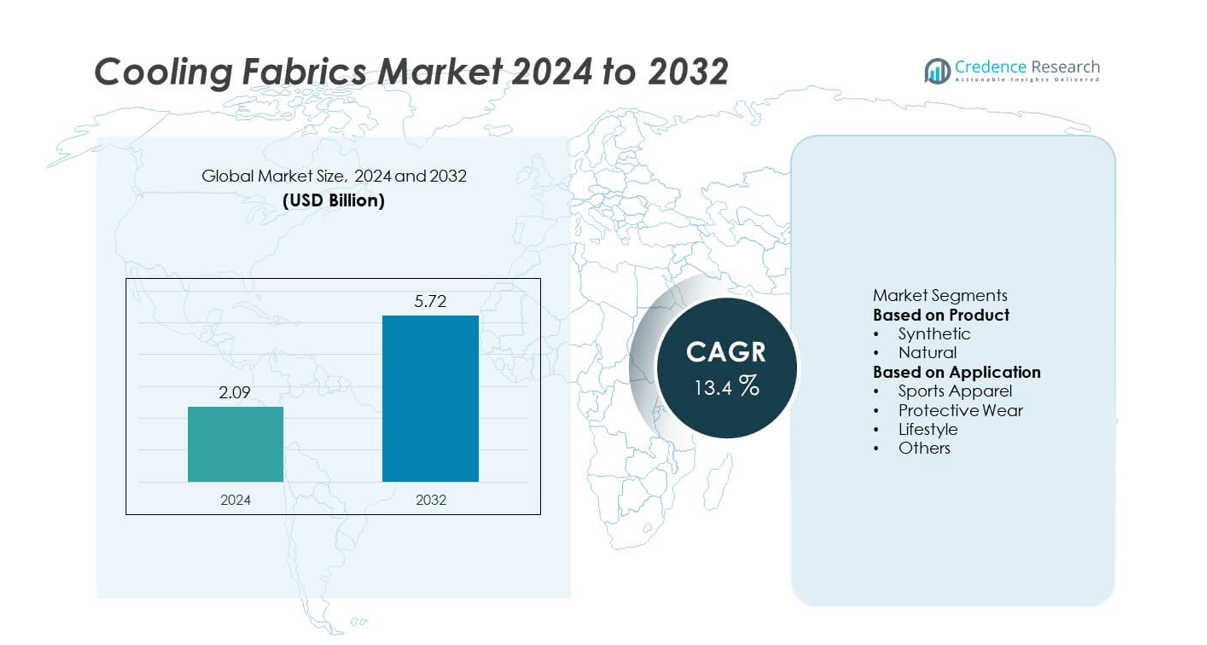

The global cooling fabrics market was valued at USD 2.09 billion in 2024 and is projected to reach USD 5.72 billion by 2032, growing at a CAGR of 13.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cooling Fabrics Market Size 2024 |

USD 2.09 billion |

| Cooling Fabrics Market, CAGR |

13.4% |

| Cooling Fabrics Market Size 2032 |

USD 5.72 billion |

The cooling fabrics market is led by major companies such as HeiQ Materials AG, Coolcore, FORMOSA TAFFETA CO., LTD., Ahlstrom, Libolon, Columbia Sportswear Company, Nan Ya Plastics Corporation, Liebaert, Everest Textile, and Asahi Kasei Corporation. These players dominate through advanced material engineering, sustainable production methods, and strategic partnerships with global apparel brands. Asia-Pacific emerged as the leading region with a 37% share in 2024, supported by strong textile manufacturing capabilities and high demand for performance fabrics. North America followed with a 31% share, driven by innovations in sportswear and protective apparel, while Europe accounted for 26%, emphasizing eco-friendly and functional cooling fabric developments.

Market Insights

- The cooling fabrics market was valued at USD 2.09 billion in 2024 and is projected to reach USD 5.72 billion by 2032, growing at a CAGR of 13.4% during the forecast period.

- Rising demand for temperature-regulating and moisture-wicking fabrics in sportswear, protective wear, and casual clothing is driving market growth globally.

- Key trends include the adoption of sustainable, bio-based, and smart textile technologies that enhance comfort, durability, and energy efficiency.

- The market is moderately competitive, with major players such as HeiQ Materials AG, Coolcore, and Columbia Sportswear Company focusing on innovation and eco-friendly production.

- Asia-Pacific led the market with a 37% share in 2024, followed by North America at 31% and Europe at 26%, while the synthetic fabric segment dominated with a 68% share due to its superior performance and durability across high-temperature and activewear applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The synthetic segment dominated the cooling fabrics market in 2024 with a 71% share, driven by its superior moisture management, durability, and heat dissipation properties. Materials such as polyester and nylon are widely used due to their ability to wick sweat and provide enhanced ventilation during physical activity. These fabrics are preferred in sportswear and industrial applications where performance and longevity are crucial. Continuous advancements in microfibers and phase-change materials further enhance thermal regulation efficiency. The growing demand for lightweight, quick-drying textiles continues to strengthen the dominance of synthetic cooling fabrics globally.

- For instance, Coolcore engineered its COOLPRO™ performance fabric using proprietary fiber geometry that provides chemical-free cooling and enhances moisture evaporation. Independent testing by the Hohenstein Institute recognized Coolcore fabrics as an “Innovative Technology” for their ability to reduce surface temperature by up to 30 percent.

By Application

The sports apparel segment held a 46% share of the cooling fabrics market in 2024, supported by rising participation in fitness activities and outdoor sports. These fabrics offer high breathability, temperature control, and UV resistance, improving athlete comfort and performance. Major sportswear brands are investing in innovative cooling technologies such as moisture-activated and body-heat-responsive fibers. The protective wear segment is also expanding due to increasing adoption among industrial workers and defense personnel. Growing consumer preference for performance-oriented and health-conscious clothing continues to drive market growth across multiple applications.

- For instance, Columbia Sportswear Company employs its Omni-Freeze ZERO™ technology, incorporating polymer rings that activate upon contact with sweat to create a prolonged cooling sensation through enhanced evaporative cooling.

Key Growth Drivers

Rising Demand for Sports and Activewear

The global surge in fitness activities and outdoor sports is driving strong demand for cooling fabrics. Athletes and consumers seek breathable, sweat-wicking materials that enhance comfort and performance during workouts. Sportswear brands are integrating advanced cooling technologies such as phase-change materials and micro-ventilated fibers to improve thermal regulation. Growing awareness of health and wellness trends continues to fuel the expansion of performance apparel, especially in markets like North America, Europe, and Asia-Pacific, where athleisure is becoming a mainstream fashion segment.

- For instance, HeiQ Materials AG developed HeiQ Smart Temp Dynamic Cooling, a technology that activates cooling when body temperature rises above 28°C and reverts to insulation below 24°C, enhancing thermal adaptability in activewear.

Technological Advancements in Fabric Engineering

Ongoing innovations in textile engineering, such as nanotechnology, moisture-responsive polymers, and microencapsulation, are transforming cooling fabric performance. Manufacturers are developing smart textiles that adjust to body temperature and environmental conditions, enhancing comfort and functionality. The introduction of sustainable synthetic fibers with embedded cooling agents further strengthens adoption in apparel, protective gear, and home textiles. Continuous R&D investment from textile companies and growing collaboration with sportswear brands are accelerating the development of high-efficiency cooling materials.

- For instance, Asahi Kasei Corporation introduced ROICA™ EF, a Global Recycled Standard (GRS) certified stretch fiber made from pre-consumer recycled materials, delivering superior comfort and fit in sustainable fashion textiles.

Increasing Adoption in Industrial and Protective Clothing

The rising need for thermal comfort and worker safety in harsh environments is boosting the adoption of cooling fabrics in protective wear. Industries such as construction, defense, and manufacturing require temperature-regulating textiles to prevent heat stress. Government workplace safety regulations and growing awareness about occupational health are promoting the use of performance cooling gear. Manufacturers are focusing on flame-resistant, durable, and lightweight cooling fabrics that can maintain functionality under extreme heat, driving steady growth in the protective clothing segment.

Key Trends & Opportunities

Shift Toward Sustainable and Eco-Friendly Materials

The market is witnessing a growing trend toward sustainable cooling fabrics made from bio-based or recycled fibers. Consumers and brands are increasingly prioritizing eco-conscious products with minimal environmental impact. Innovations in biodegradable polymers and plant-based cooling fibers are helping manufacturers align with global sustainability goals. Companies are adopting closed-loop production systems to reduce water and chemical usage. This shift presents new opportunities for market expansion, as sustainability becomes a key purchasing factor across the apparel and textile industries.

- For instance, FORMOSA TAFFETA CO., LTD. produces various eco-friendly fabrics from recycled PET under brands like BOOMETEX® and also develops fabrics using ocean waste materials. The company has implemented energy-saving measures and has had its carbon reduction targets approved by the Science Based Targets initiative (SBTi).

Integration of Smart and Functional Textiles

The integration of smart textile technologies is revolutionizing the cooling fabrics market. Advanced fabrics embedded with sensors or conductive fibers can monitor temperature, perspiration, and environmental conditions, enabling personalized comfort. These smart materials are finding applications in medical wear, military uniforms, and sports performance gear. Partnerships between textile producers and electronics firms are accelerating innovation in responsive cooling systems. This trend is opening new business avenues for multifunctional garments that combine comfort, performance, and connectivity.

- For instance, Liebaert has developed NanoStitch® fabrics, which are a line of high-performance fabrics known for comfort, compression, and lightweight feel. The company also manufactures conductive textiles by combining various yarns, including silver and copper, which enable sensor connectivity for different applications, including athletic and medical garments.

Key Challenges

High Production Costs and Limited Mass Adoption

The manufacturing of advanced cooling fabrics involves complex processes and high material costs, which restrict mass production and affordability. Specialized coatings, phase-change materials, and nano-treatments increase overall expenses, limiting adoption in low-cost apparel segments. Small and mid-sized manufacturers face challenges in scaling production while maintaining fabric quality. Cost optimization through automation, material innovation, and localized sourcing remains essential for broader market penetration.

Durability and Performance Degradation Over Time

One of the major challenges for cooling fabrics is maintaining long-term effectiveness after repeated washing and wear. The cooling functionality of treated fabrics can diminish due to mechanical stress or loss of active agents. Ensuring durability while retaining softness and breathability remains a key technical barrier. Manufacturers are investing in advanced bonding techniques and microencapsulation technologies to enhance longevity and maintain consistent performance across product life cycles.

Regional Analysis

North America

North America held a 34% share of the cooling fabrics market in 2024, driven by high consumer demand for performance-based sportswear and outdoor apparel. The United States dominates the region, supported by the strong presence of leading sports brands and advanced textile manufacturers. Growing awareness of heat stress prevention in industrial and military applications further supports adoption. Continuous innovation in moisture-wicking and temperature-regulating materials enhances market growth. Increasing focus on sustainable and bio-based cooling fibers is also gaining traction, as manufacturers align with eco-friendly production trends and stringent environmental standards.

Europe

Europe accounted for a 28% share of the global cooling fabrics market in 2024, fueled by rising demand for eco-friendly and high-performance textiles. Countries such as Germany, France, and Italy are leading contributors, supported by strong fashion and sportswear industries. The region’s emphasis on sustainable production, circular textile models, and REACH-compliant materials is driving innovation. European manufacturers are integrating nanotechnology and advanced fiber engineering into apparel and protective wear. Growing health awareness, combined with consumer preference for breathable and lightweight fabrics, continues to expand product adoption across both lifestyle and industrial sectors.

Asia-Pacific

Asia-Pacific dominated the cooling fabrics market with a 30% share in 2024, supported by rapid industrialization, rising disposable incomes, and growing sports participation. China, India, and Japan are major producers and consumers, driven by expanding textile manufacturing capabilities and a growing athleisure market. Increasing awareness of personal comfort and heat protection in humid climates fuels regional demand. Manufacturers are adopting sustainable materials and investing in R&D to improve durability and cost-efficiency. The growing influence of global sportswear brands and domestic innovation in smart textiles are strengthening Asia-Pacific’s leadership in cooling fabric production and export.

Latin America

Latin America captured a 5% share of the global cooling fabrics market in 2024, led by growing interest in activewear and climate-appropriate clothing. Brazil and Mexico dominate regional consumption due to expanding middle-class populations and urban lifestyles. Rising temperatures and increased outdoor activity participation drive demand for breathable and sweat-absorbing fabrics. Local manufacturers are collaborating with international brands to introduce affordable cooling apparel. Although the market remains in its early stage, investments in modern textile manufacturing and growing consumer awareness of comfort-oriented products are fostering gradual market expansion across the region.

Middle East and Africa

The Middle East and Africa region accounted for a 3% share of the cooling fabrics market in 2024, supported by the region’s hot climatic conditions and increasing awareness of heat management solutions. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are witnessing growing adoption of cooling textiles in sportswear, workwear, and military applications. Expanding fitness culture and tourism sectors are also contributing to demand. While limited textile infrastructure poses a challenge, rising imports and investments in localized production facilities are expected to enhance regional market presence over the forecast period.

Market Segmentations:

By Product

By Application

- Sports Apparel

- Protective Wear

- Lifestyle

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the cooling fabrics market includes key players such as HeiQ Materials AG, Coolcore, FORMOSA TAFFETA CO., LTD., Ahlstrom, Libolon, Columbia Sportswear Company, Nan Ya Plastics Corporation, Liebaert, Everest Textile, and Asahi Kasei Corporation. These companies compete through advanced fabric technologies, sustainability-driven innovation, and strong global distribution networks. Market leaders focus on developing temperature-regulating, moisture-wicking, and phase-change fabrics for sportswear, protective clothing, and lifestyle applications. Strategic collaborations with apparel brands and research institutions are enhancing product functionality and consumer reach. Additionally, major players are investing in eco-friendly cooling textiles using recycled fibers and bio-based polymers to meet growing environmental demands. Continuous R&D in smart textile integration and enhanced durability is intensifying competition as manufacturers aim to balance comfort, performance, and sustainability in next-generation cooling fabrics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HeiQ Materials AG

- Coolcore

- FORMOSA TAFFETA CO., LTD.

- Ahlstrom

- Libolon

- Columbia Sportswear Company

- Nan Ya Plastics Corporation

- Liebaert

- Everest Textile

- Asahi Kasei Corporation

Recent Developments

- In June 2025, Coolcore and Nature Coatings launched a new sustainable cooling fabric line using BioBlack TX, replacing petroleum pigments while preserving cooling performance through evaporative structures.

- In February 2025, Coolcore and Noble Biomaterials launched COOLPRO fabric, combining Coolcore’s cooling fiber geometry with Noble’s Ionic+ Pro antimicrobial yarn that resists odor beyond 100 wash cycles.

- In 2025, Coolcore teamed with Nature Coatings to release sustainable cooling fabrics using BioBlack TX pigment and Biomimetic Fiber Geometry™, offering cooling without heavy chemicals.

- In June 2024, HeiQ held a webinar on HeiQ Smart Temp, which showed fabrics treated could lower temperature by up to 2.5 °C compared to untreated fabrics

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing demand for breathable and temperature-regulating textiles.

- Advancements in nanotechnology and smart fabrics will enhance cooling efficiency and durability.

- Sustainable and bio-based cooling fabrics will gain strong traction across global markets.

- Sportswear and outdoor apparel brands will increasingly adopt advanced cooling fabric technologies.

- Integration of phase-change materials will improve moisture control and thermal comfort.

- Asia-Pacific will remain the leading region due to its strong textile manufacturing base.

- North America will see rising adoption in athletic and protective clothing segments.

- Collaborations between fabric producers and fashion brands will accelerate product innovation.

- Growing consumer focus on comfort and performance will drive premium product demand.

- Investments in eco-friendly and recyclable cooling fabrics will define future market competitiveness.