Market Overview

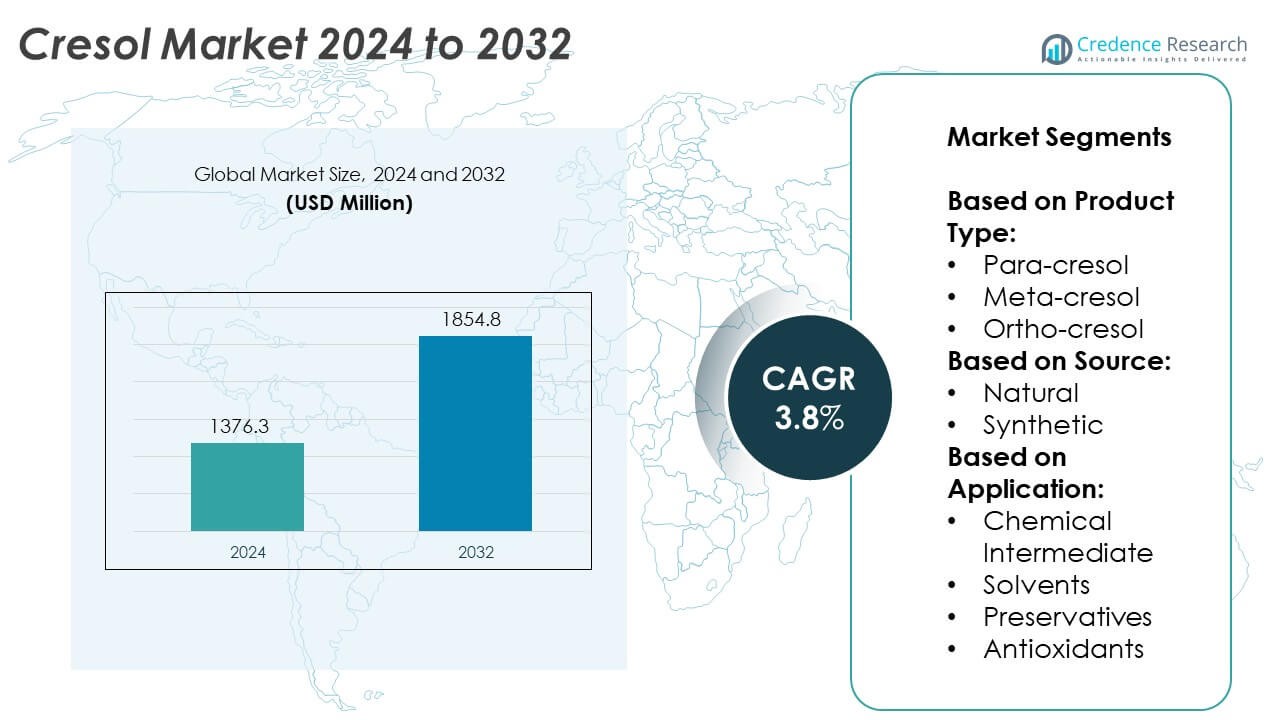

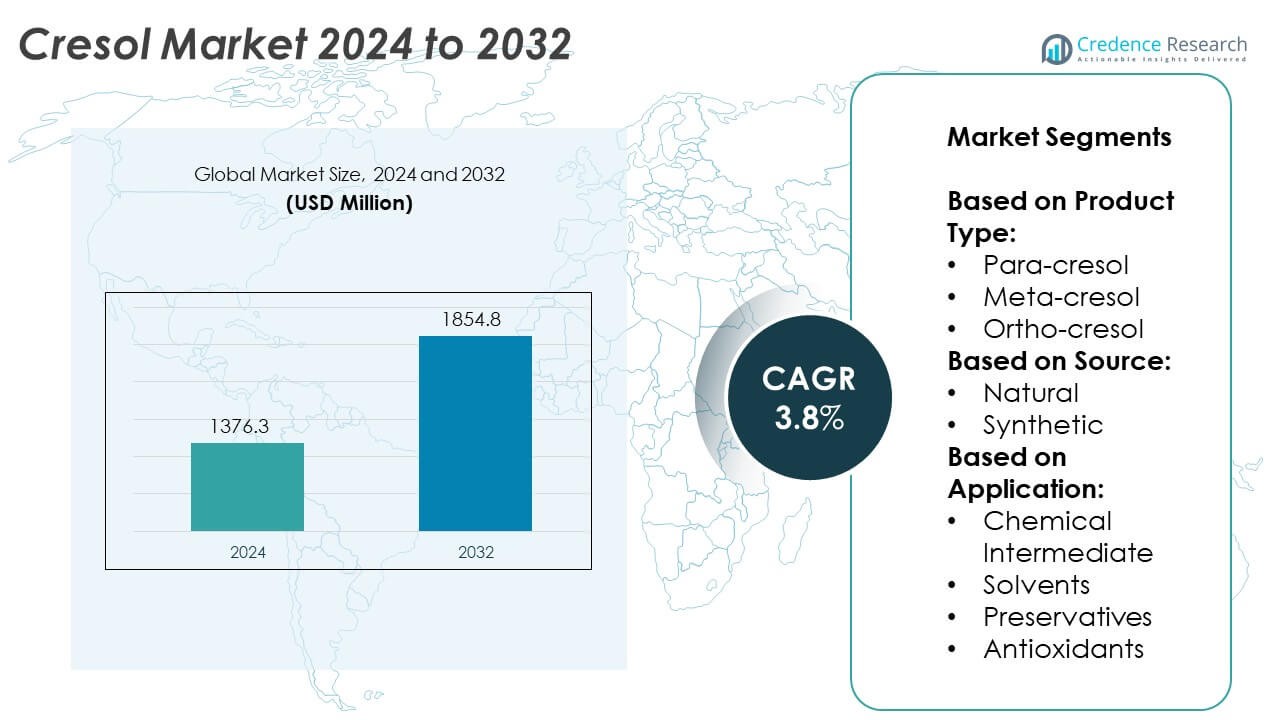

The Cresol market size was valued at USD 1,376.3 million in 2024 and is anticipated to reach USD 1,854.8 million by 2032, registering a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cresol Market Size 2024 |

USD 1,376.3 Million |

| Cresol Market, CAGR |

3.8% |

| Cresol Market Size 2032 |

USD 1,854.8 Million |

The Cresol market is driven by rising demand for specialty chemicals in pharmaceuticals, agrochemicals, and high-performance materials, supported by its role as a key intermediate in antioxidants, disinfectants, and resins. Growth in healthcare infrastructure and agricultural modernization further strengthens consumption. The market trends toward high-purity grades for specialized applications, adoption of sustainable production methods, and expanded use of cresol derivatives in advanced materials and electronics.

The Cresol market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with demand influenced by industrial development, regulatory frameworks, and sector-specific growth. North America and Europe focus on high-purity grades and sustainable production, while Asia-Pacific leads in large-scale manufacturing and expanding end-use industries. Latin America and the Middle East & Africa show steady growth through agrochemicals and industrial applications. Key players shaping the market include Merck KGaA, Mitsui Chemicals, Inc., LANXESS, and Sasol Phenolics, leveraging technological expertise, diversified product portfolios, and strategic expansion to strengthen their competitive positions across multiple regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cresol market was valued at USD 1,376.3 million in 2024 and is projected to reach USD 1,854.8 million by 2032, registering a CAGR of 3.8% during the forecast period.

- The market is supported by strong demand for specialty chemicals used in pharmaceuticals, agrochemicals, resins, and disinfectants, with its versatility driving adoption across multiple industrial sectors.

- High-purity grades are gaining traction for advanced applications in electronics, healthcare, and specialty coatings, while sustainable manufacturing practices and renewable feedstocks are increasingly influencing production strategies.

- Leading companies focus on technological advancements, process optimization, and tailored solutions to serve diverse industries, while expanding their global footprint to access emerging growth markets.

- The industry faces restraints from stringent environmental and safety regulations, high compliance costs, and volatility in raw material prices, particularly phenol and toluene, which impact production stability and profitability.

- North America and Europe emphasize quality and regulatory compliance, Asia-Pacific leads in manufacturing capacity and cost competitiveness, Latin America shows growth in agrochemicals, and the Middle East & Africa expands through industrial and infrastructure projects.

- Competitive positioning relies on innovation, supply chain efficiency, and strategic partnerships, with key players leveraging research capabilities and market-specific product development to maintain relevance in changing industrial and regulatory environments.

Market Drivers

Growing Demand for Specialty Chemicals in Industrial Applications

The Cresol market benefits from rising consumption of specialty chemicals in manufacturing sectors such as resins, antioxidants, and solvents. It serves as a critical intermediate in the production of industrial resins used for automotive parts, electrical components, and coatings. Industries adopt cresol derivatives for their thermal stability and resistance to chemical degradation. Manufacturers integrate it into processes that require high-purity chemical intermediates to enhance product performance. The versatility of cresol derivatives supports multiple end-use sectors with tailored formulations. Expansion in high-performance materials production strengthens its market relevance across industrial value chains.

- For instance, LANXESS expanded its Leverkusen cresol facility by adding a new reaction unit, increasing annual production capacity by 1,800 metric tons. This expansion, which involved a new reaction system and distillation column, boosted overall production capacity for cresols, a key ingredient in various products like agrochemicals, vitamin E, and flame retardants, by approximately 20 percent.

Expansion of the Agrochemical Industry and Pesticide Production

The Cresol market gains momentum from its application in agrochemical synthesis, particularly in herbicides, fungicides, and insecticides. It plays a significant role in formulating active ingredients that ensure crop protection and yield improvement. Agricultural modernization in emerging economies increases demand for efficient pest-control solutions. Agrochemical producers prefer cresol-based intermediates for their effectiveness and compatibility with large-scale production processes. It aligns with stringent quality standards in agrochemical manufacturing. Growth in global agricultural output directly supports steady consumption of cresol derivatives.

- For instance, Merck KGaA supplies analytical-grade p-cresol with a purity exceeding 99%, ensuring accuracy in chemical synthesis. This high purity level is crucial for research and industrial applications where precise measurements and controlled reactions are essential.

Rising Utilization in Pharmaceutical Intermediates and Healthcare Products

The Cresol market experiences growth through its use in producing pharmaceutical intermediates for antiseptics, disinfectants, and preservatives. It contributes to the synthesis of compounds with broad-spectrum antimicrobial properties. Healthcare facilities require consistent supplies of cresol-derived disinfectants for infection control protocols. Pharmaceutical manufacturers depend on reliable cresol inputs to meet regulatory and safety standards. The substance offers a balance of efficacy, cost efficiency, and stability in healthcare applications. Rising healthcare infrastructure investment sustains its demand across multiple regions.

Technological Advancements in Production Processes and Product Purity

The Cresol market is supported by advancements in manufacturing technology that improve yield, purity, and cost efficiency. It benefits from continuous process optimization that reduces energy consumption and waste generation. Chemical producers invest in automated systems to achieve consistent quality output. Enhanced purification methods allow manufacturers to meet stricter regulatory requirements. Sustainable production techniques increase its competitiveness against alternative intermediates. Innovations in process safety and operational efficiency strengthen long-term market viability.

Market Trends

Shift Toward High-Purity Grades for Specialized Applications

The Cresol market is witnessing increasing adoption of high-purity grades for applications in pharmaceuticals, electronics, and specialty coatings. It addresses stringent quality requirements by delivering consistent chemical properties. Manufacturers invest in refining processes to meet evolving standards in high-value industries. High-purity cresol supports advanced product formulations that require stability and low impurity levels. Demand for precision chemical intermediates drives greater focus on purity optimization. This trend strengthens its position in sectors where performance and compliance are critical.

- For instance, Merck’s m‑cresol product (CAS 108‑39‑4) lists a precise boiling point of 203 °C and a flash point of 86 °C—key parameters for process design and safety control.

Growing Focus on Sustainable and Eco-Efficient Production Methods

The Cresol market is aligning with global emphasis on sustainable manufacturing by adopting energy-efficient processes and waste reduction strategies. It benefits from technologies that reduce emissions and enhance resource utilization. Producers explore renewable feedstocks to improve environmental performance. Adoption of green chemistry principles helps in meeting regulatory expectations and enhancing market reputation. Investment in closed-loop systems reduces operational impact on the environment. These practices reinforce its acceptance in environmentally conscious industries.

- For instance, Merck Millipore’s Cresol‑red product (CAS 1733‑12‑6) features a density of 0.998 g/cm³ specified for pharmaceutical reagent use.

Increasing Use of Cresol Derivatives in High-Performance Materials

The Cresol market sees growing integration of its derivatives in advanced materials for automotive, aerospace, and industrial equipment. It supports development of resins, laminates, and coatings with superior durability and resistance to extreme conditions. Manufacturers leverage its chemical versatility to enhance product specifications. Demand for lightweight yet robust materials expands its relevance in high-performance applications. Collaboration between chemical producers and end-user industries drives product innovation. This trend boosts its value across diverse industrial domains.

Rising Application in Electronic and Semiconductor Manufacturing

The Cresol market is expanding into electronics manufacturing through its role in producing photoresists, insulating materials, and precision coatings. It enables production of components that meet miniaturization and performance requirements. Electronic manufacturers value its stability and adaptability in cleanroom environments. Integration into semiconductor processing chemicals strengthens its strategic importance. Growing consumer electronics demand fuels consistent requirement for cresol-based inputs. This trend positions it as a critical component in advanced electronics supply chains.

Market Challenges Analysis

Stringent Regulatory Frameworks and Compliance Pressures

The Cresol market faces operational constraints due to stringent environmental and safety regulations governing production, storage, and transportation. It must comply with limits on emissions, waste disposal, and worker exposure levels. Regulatory bodies in major markets enforce strict protocols that require investment in advanced control systems and monitoring equipment. Compliance costs affect profitability, particularly for small and medium-sized producers. Delays in obtaining permits or approvals can hinder capacity expansion plans. Constant updates to regulatory requirements create uncertainty in long-term planning.

Volatility in Raw Material Prices and Supply Chain Vulnerabilities

The Cresol market is challenged by fluctuations in raw material availability and costs, particularly phenol and toluene. It relies on consistent supply from petrochemical feedstocks, which are sensitive to crude oil price movements and geopolitical disruptions. Price instability impacts production budgets and contract stability with end users. Global supply chain disruptions, including port delays and transportation bottlenecks, further strain timely delivery. Producers face difficulty in maintaining competitive pricing while ensuring quality standards. Dependence on limited raw material suppliers increases exposure to market volatility.

Market Opportunities

Expanding Role in Advanced Material Development and Specialty Applications

The Cresol market holds significant potential in supporting the development of advanced materials for high-growth industries such as electronics, automotive, and aerospace. It enables production of resins, laminates, and coatings that deliver superior mechanical strength, thermal stability, and chemical resistance. Increasing demand for lightweight, high-performance components opens opportunities for innovative cresol-based formulations. Collaboration between chemical producers and end-user industries can accelerate product customization. Emerging applications in renewable energy equipment and electric vehicles expand its strategic relevance. Growing investment in specialty chemical production strengthens its pathway to long-term market expansion.

Rising Demand from Emerging Economies and Healthcare Sector Growth

The Cresol market benefits from expanding industrial capacity and infrastructure projects in emerging economies. It supports manufacturing sectors that are scaling production to meet domestic and export requirements. Rapid urbanization and healthcare infrastructure investment drive demand for cresol derivatives in disinfectants, antiseptics, and pharmaceutical intermediates. Producers can tap into underserved markets by offering high-quality and cost-efficient solutions. Increasing awareness of hygiene and infection control elevates its consumption in healthcare and institutional applications. Strong growth prospects in Asia-Pacific, Latin America, and parts of the Middle East provide a diversified base for future revenue generation.

Market Segmentation Analysis:

By Product Type:

The Cresol market segments into para-cresol, meta-cresol, and ortho-cresol, each serving distinct industrial requirements. Para-cresol holds a dominant position due to its extensive use in producing antioxidants, fragrances, and pharmaceutical intermediates. It is favored for its stability and performance in high-value applications. Meta-cresol finds demand in resin manufacturing and agrochemicals, where it supports the synthesis of herbicides and antioxidants. Ortho-cresol caters to niche applications in solvents, dyes, and disinfectants, offering strong antibacterial properties. The diversity of product types enables producers to target multiple industries with tailored solutions. This segmentation enhances the adaptability of the market to varied industrial needs.

- For instance, Mitsui Chemicals operates a phenol-cresol production line with an annual capacity of 42,000 metric tons to supply agrochemical intermediates. This production is part of their broader efforts to provide materials for the agricultural sector and contribute to a sustainable future.

By Source:

The Cresol market is classified into natural and synthetic sources. Synthetic cresol dominates due to its consistent quality, cost efficiency, and scalability in large-scale manufacturing. It meets the stringent purity standards required for pharmaceutical, agrochemical, and industrial applications. Natural cresol, derived from coal tar or plant-based sources, holds a smaller share but appeals to applications emphasizing eco-friendly and bio-based inputs. It finds interest among producers seeking differentiation in specialized markets. Increasing environmental regulations may encourage further exploration of renewable feedstock-based cresol production. The balance between cost efficiency and sustainability shapes sourcing decisions across the industry.

- For instance, Atul Ltd. expanded its para‑cresol production capacity from 28,000 to 36,000 tonnes per annum. Atul Ltd. is the world’s largest para-cresol producer, holding almost 55% of the total global capacity at a single location.

By Application:

The Cresol market serves key applications including chemical intermediates, solvents, preservatives, and antioxidants. Chemical intermediates form the largest segment, with cresol acting as a precursor for resins, herbicides, and industrial chemicals. It plays a crucial role in high-performance material manufacturing for automotive, electronics, and aerospace industries. Solvent applications benefit from cresol’s effective solvency and stability in varied formulations. In preservatives, it offers antimicrobial properties valued in wood treatment, personal care, and industrial preservation. Antioxidant applications rely on cresol derivatives to enhance product lifespan and performance under thermal or oxidative stress. The wide application base ensures stable demand from multiple end-use sectors.

Segments:

Based on Product Type:

- Para-cresol

- Meta-cresol

- Ortho-cresol

Based on Source:

Based on Application:

- Chemical Intermediate

- Solvents

- Preservatives

- Antioxidants

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32.4% of the Cresol market share, supported by strong industrial manufacturing, advanced chemical processing capabilities, and consistent demand from the pharmaceutical and agrochemical sectors. The United States leads regional consumption due to its robust production of antioxidants, disinfectants, and specialty resins. It benefits from a mature infrastructure for chemical synthesis and an extensive network of end-user industries. Pharmaceutical manufacturers in the region rely on high-purity cresol for antiseptics and disinfectant formulations, meeting stringent regulatory standards. Canada contributes through niche applications in specialty chemicals and wood preservation. Ongoing investment in R&D strengthens the role of North America in driving product innovation and quality improvement.

Europe

Europe holds 27.6% of the Cresol market share, driven by stringent environmental regulations, a mature industrial base, and innovation in specialty chemicals. Germany, France, and the United Kingdom remain primary consumers, integrating cresol derivatives into coatings, resins, and agrochemicals. The region’s chemical industry emphasizes sustainable manufacturing practices, encouraging producers to adopt low-emission and resource-efficient production processes. It also benefits from strong demand in pharmaceutical and healthcare sectors, particularly in disinfectants and preservatives. The presence of leading specialty chemical manufacturers supports supply chain stability and product quality. European markets focus on high-purity grades to meet the exacting standards of high-performance applications.

Asia-Pacific

Asia-Pacific commands 29.1% of the Cresol market share, supported by rapid industrialization, expanding manufacturing capacity, and a growing pharmaceutical sector. China dominates consumption with large-scale production of agrochemicals, antioxidants, and resins, catering to both domestic and export markets. India and Japan contribute significantly through their strong pharmaceutical, electronics, and specialty chemical industries. It benefits from cost-competitive manufacturing and a steady supply of raw materials. Rising demand for healthcare products and disinfectants across densely populated urban centers further stimulates market growth. Investments in production facilities and technological advancements continue to position Asia-Pacific as a dynamic growth hub.

Latin America

Latin America holds 6.5% of the Cresol market share, with Brazil and Mexico leading regional demand. The agricultural sector’s expansion drives significant use of cresol derivatives in herbicides, fungicides, and other agrochemicals. It also finds applications in preservatives for wood and industrial materials. The region benefits from increasing investment in industrial chemicals and growing awareness of advanced crop protection solutions. While infrastructure limitations pose challenges, emerging production capabilities are improving supply stability. Collaboration with global suppliers supports knowledge transfer and technology adoption in local industries.

Middle East & Africa

The Middle East & Africa represents 4.4% of the Cresol market share, with consumption concentrated in industrial hubs such as South Africa, Saudi Arabia, and the United Arab Emirates. Demand is supported by infrastructure development projects, oil and gas sector requirements, and the production of specialty chemicals. It serves as a critical input in industrial resins, coatings, and disinfectants used in construction and maintenance. Limited local production capacity leads to a reliance on imports from Asia-Pacific and Europe. Efforts to diversify economies and invest in manufacturing capabilities are expected to gradually enhance regional market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KANTO KAGAKU

- Mitsui Chemicals, Inc.

- RICCA Chemical Company

- com

- Vigon International, LLC.

- Sasol Phenolics

- Merck KGaA

- LANXESS

- TCI AMERICA

- Dorf Ketal

Competitive Analysis

The Cresol market features prominent players such as Merck KGaA, KANTO KAGAKU, Mitsui Chemicals, Inc., Dorf Ketal, LANXESS, Vigon International, LLC., TCI AMERICA, RICCA Chemical Company, nacalai.com, and Sasol Phenolics. These companies compete through product quality, technological capabilities, and diversified application portfolios. They focus on maintaining consistent supply, meeting stringent regulatory standards, and offering high-purity grades to serve sectors such as pharmaceuticals, agrochemicals, and specialty chemicals. Strategic investments in advanced manufacturing processes enable higher yields and lower operational costs. Partnerships with end-user industries enhance product customization and market reach. Geographic expansion into high-growth regions supports access to emerging industrial hubs. Continuous innovation in production efficiency, sustainability, and application-specific formulations allows these companies to strengthen their market position while addressing evolving customer requirements.

Recent Developments

- In March 2025, LANXESS Showcased sustainable, efficient sustainable water treatment in various industrial sectors.

- In 2023, Kyowa Hakko expanded its presence in LATAM with a launch in Mexico. Partnering with Mexican manufacturers Quickest, Kyowa Hakko aims to extend the availability of its Immune postbiotic for immune support to a wider audience.

- In December 2023, Mitsui Chemicals, Inc. Completed acquisition of ISCC PLUS certification for all seven phenol‑chain products. This certification covers phenol, acetone, alpha-methylstyrene, bisphenol A, epoxy resin, isopropyl alcohol (IPA), and methyl isobutyl ketone (MIBK). The acquisition of ISCC PLUS certification for IPA and MIBK in July and April respectively, completed the certification for all seven products.

Market Concentration & Characteristics

The Cresol market exhibits moderate to high concentration, with a mix of global chemical majors and specialized producers controlling a significant portion of supply. It is characterized by vertically integrated operations, advanced manufacturing capabilities, and strong regulatory compliance. Leading companies leverage technological expertise, diversified product portfolios, and established distribution networks to serve multiple sectors including pharmaceuticals, agrochemicals, and specialty chemicals. Competitive dynamics are shaped by product quality, purity levels, and the ability to meet stringent environmental and safety standards. The market benefits from stable demand across core applications, yet it remains sensitive to raw material price fluctuations and regulatory changes. Innovation in sustainable production methods and high-purity formulations is an emerging characteristic, aligning with industry trends toward environmental responsibility and performance optimization. Geographic expansion into high-growth economies and partnerships with end-use industries enhance resilience and broaden market access. The balance between cost efficiency, compliance, and product differentiation defines competitive positioning across the global landscape.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow in pharmaceuticals, agrochemicals, and high-performance material applications.

- High-purity grades will see increased adoption for electronics and healthcare uses.

- Sustainable production technologies will become a stronger focus for manufacturers.

- Emerging economies will contribute significantly to production and consumption growth.

- Strategic collaborations will enhance product innovation and market reach.

- Regulatory compliance will continue to influence production processes and investment decisions.

- Technological advancements will improve yield, efficiency, and cost control.

- Diversification of raw material sources will reduce supply chain risks.

- Expansion into specialty chemical applications will strengthen market opportunities.

- Competitive advantage will depend on quality, customization, and sustainability performance.