Market Overview:

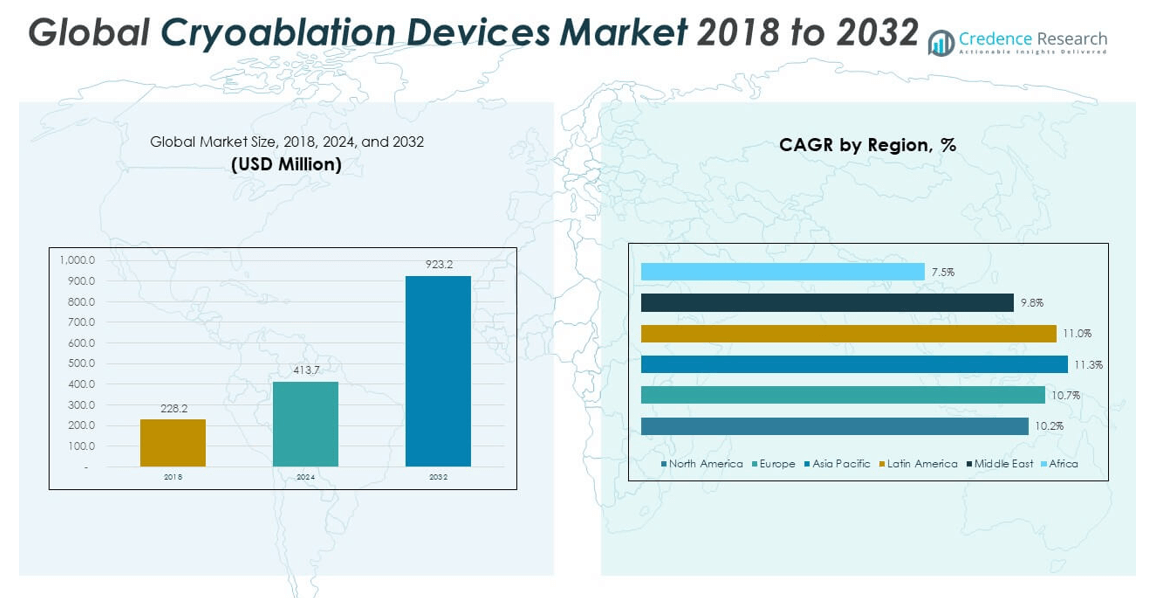

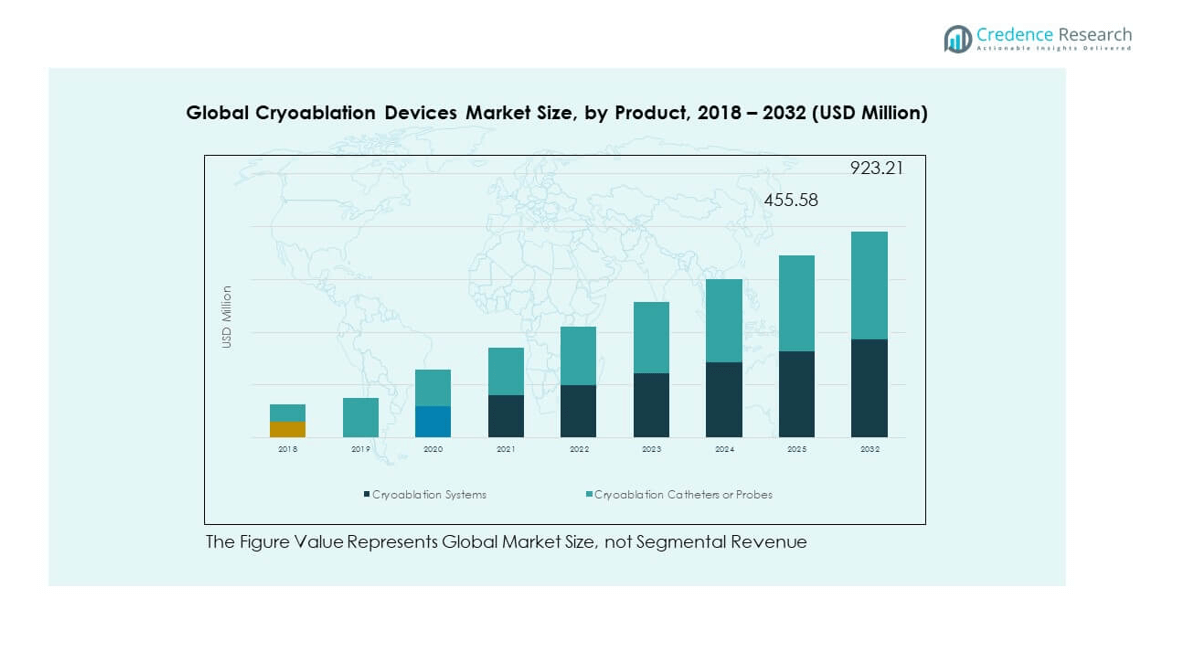

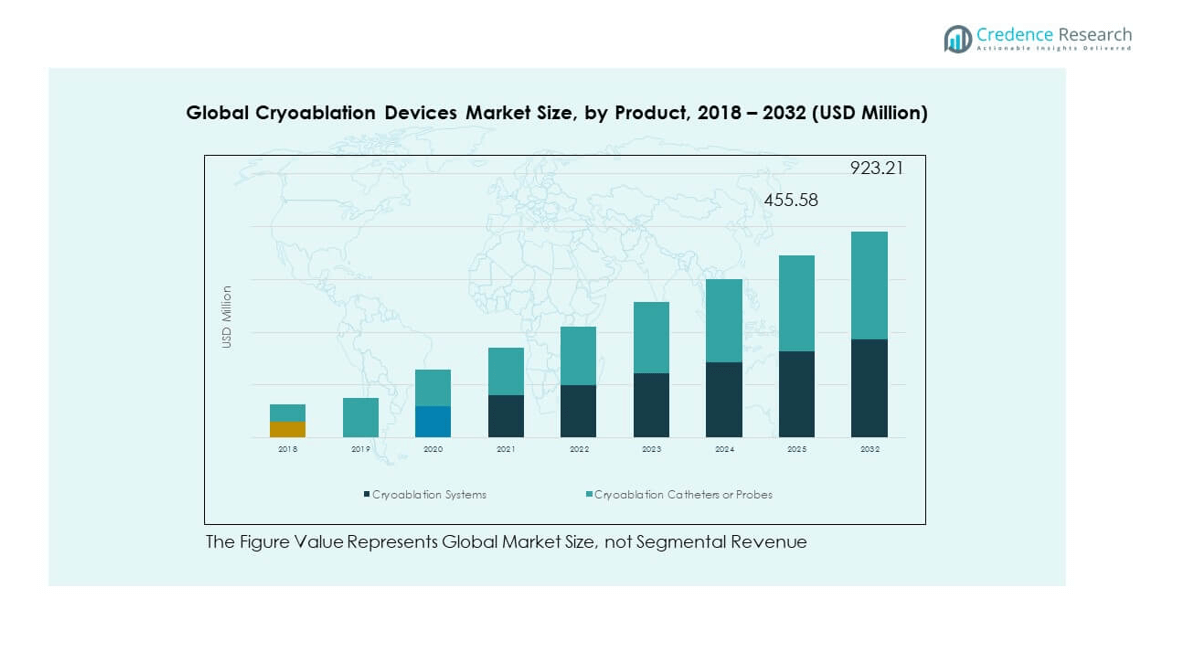

The Cryoablation Devices Market size was valued at USD 228.2 million in 2018 to USD 413.7 million in 2024 and is anticipated to reach USD 923.2 million by 2032, at a CAGR of 10.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cryoablation Devices Market Size 2024 |

USD 413.7 million |

| Cryoablation Devices Market, CAGR |

10.62% |

| Cryoablation Devices Market Size 2032 |

USD 923.2 million |

The market is witnessing significant growth due to the increasing prevalence of cancer and cardiovascular diseases, both of which benefit from minimally invasive treatment options like cryoablation. Advancements in imaging technologies, growing demand for outpatient procedures, and increasing awareness among patients and healthcare providers are driving adoption. Technological innovations that improve precision and reduce recovery time are further expanding clinical applications, especially in treating tumors and arrhythmias. Rising geriatric population and favorable reimbursement policies also contribute to market expansion.

Geographically, North America leads the Cryoablation Devices Market, driven by a well-established healthcare infrastructure, higher diagnosis rates, and early adoption of advanced medical technologies. Europe follows closely, supported by increasing investment in cancer treatment technologies and supportive regulatory frameworks. Asia Pacific is emerging rapidly, fueled by rising healthcare spending, growing medical tourism, and improving access to healthcare services in countries such as India, China, and South Korea. Meanwhile, Latin America and the Middle East & Africa are gradually developing due to growing awareness and expanding private healthcare sectors.

Market Insights:

- The Cryoablation Devices Market was valued at USD 413.7 million in 2024 and is projected to reach USD 923.2 million by 2032, growing at a CAGR of 10.62%.

- Rising incidence of cancer and cardiac arrhythmias is driving demand for cryoablation as a minimally invasive, tissue-preserving treatment option.

- Technological advancements in cryoablation systems, including image-guided and single-use probes, are enhancing procedural safety and effectiveness.

- High capital investment and limited access in low-resource settings continue to restrict broader market penetration.

- North America leads the Cryoablation Devices Market with over 30% share in 2024, supported by favorable reimbursement and advanced healthcare infrastructure.

- Europe shows steady growth due to strong adoption in oncology, while Asia Pacific is emerging rapidly due to increasing healthcare investments and awareness.

- Hospitals remain the dominant end users, but outpatient facilities are witnessing faster growth due to the shift toward same-day procedures and cost efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Incidence of Cancer and Cardiac Arrhythmias Fuels the Adoption of Cryoablation Devices

The increasing burden of cancer and cardiovascular disorders remains a key driver for the Cryoablation Devices Market. It continues to benefit from the growing demand for minimally invasive procedures in oncology and electrophysiology. Breast, lung, prostate, and kidney cancers frequently qualify for cryoablation treatment due to its safety and precision. In cardiac care, cryoablation effectively treats atrial fibrillation and other arrhythmias, especially in elderly populations. Physicians prefer cryoablation for its low complication rates and shorter recovery time. Rising awareness among patients and healthcare professionals encourages early-stage intervention using these devices. Supportive clinical outcomes and reduced post-operative infections improve its acceptance in mainstream treatment. The expanding target patient pool is strengthening overall market momentum.

- For instance, Medtronic’s Arctic Front Cardiac Cryoablation Catheter achieved a 69.9% rate of freedom from atrial fibrillation at 12 months in clinical studies, demonstrating significant effectiveness in the treatment of arrhythmias.

Technological Advancements in Cryoablation Systems Enhance Procedural Outcomes and Safety

Continuous innovation in cryoablation technology significantly contributes to the market’s growth trajectory. Device manufacturers are introducing next-generation systems with enhanced imaging guidance, temperature control, and energy precision. It improves accuracy, reduces damage to surrounding tissues, and ensures consistent ablation zones. Integration of real-time ultrasound, CT, and MRI with cryoablation devices aids clinicians in planning and executing procedures more effectively. Compact and user-friendly devices support higher procedure volumes in outpatient and ambulatory settings. Cryoablation systems now feature improved catheter flexibility and dual-freeze cycles for better efficacy. These advancements align with the shift toward value-based care and personalized treatment. The growing confidence in safety and long-term effectiveness supports increased adoption.

- For instance, the Visual ICE™ Cryoablation System from Boston Scientific accommodates up to 20 needles on 10 channels and features real-time temperature monitoring through multiple thermal sensors, improving procedural control and protecting critical anatomy during minimally invasive tumor ablation.

Supportive Regulatory Approvals and Expanding Indications Broaden Market Access

Favorable regulatory frameworks and expanded clinical indications accelerate product penetration in the Cryoablation Devices Market. Leading regulatory bodies, including the FDA and EMA, continue approving new cryoablation systems and applications in both oncology and cardiology. It drives product differentiation and competitive expansion across multiple clinical domains. Approvals for treating early-stage cancers and drug-refractory atrial fibrillation broaden the scope of these devices. Hospitals are incorporating cryoablation into routine treatment protocols, especially where surgical risks are high. Research institutions and clinical societies publish updated guidelines encouraging its use. Clinical trial data validate safety and efficacy across age groups, improving insurer reimbursement. Expanding procedural acceptance increases institutional purchasing and installation of cryoablation systems.

Shift Toward Outpatient and Ambulatory Surgical Procedures Increases Demand for Cryoablation

The healthcare industry’s pivot to outpatient care supports the Cryoablation Devices Market’s expansion. Hospitals and specialty clinics increasingly prefer cryoablation due to its ability to deliver effective results with shorter procedure times. It enables same-day discharge, reducing hospitalization costs and improving patient turnover. Ambulatory surgical centers use cryoablation devices to manage early-stage tumors and arrhythmias with minimal infrastructure. The convenience of local anesthesia, reduced scarring, and faster recovery appeals to both patients and providers. Cost efficiency and workflow optimization influence hospital investments in portable and reusable cryoablation tools. As payers emphasize cost containment, low-complication technologies like cryoablation gain wider traction. This procedural shift sustains high demand across developed and emerging economies.

Market Trends:

Integration of Imaging and Navigation Software Improves Precision in Cryoablation Procedures

One of the prominent trends in the Cryoablation Devices Market is the integration of imaging and navigation systems into ablation workflows. Advanced imaging modalities such as MRI, CT, and ultrasound are now built into cryoablation platforms. It allows real-time visualization of the target tissue and helps prevent procedural errors. Physicians benefit from improved guidance when navigating anatomical complexities in organs like the lungs and kidneys. Image-guided systems reduce dependence on operator skill, increasing procedural consistency. High-resolution thermal imaging tools also monitor iceball formation and ensure adequate margins. Integrated platforms support remote diagnostics and cloud-based data storage, enhancing post-procedure evaluation. The combination of ablation and visualization drives procedural confidence and patient safety.

Growing Use of Cryoablation in Veterinary and Pediatric Applications Expands Market Reach

The application of cryoablation beyond traditional adult human cases is gaining momentum. Pediatric hospitals are adopting cryoablation systems for treating cardiac arrhythmias and rare tumors in children. It minimizes trauma and promotes faster recovery compared to open surgery. Veterinary practices use cryoablation for tumor removal and pain management in animals, creating new market segments. The Cryoablation Devices Market is responding with scaled-down, portable systems suitable for these specialized applications. Veterinary oncology and cardiology segments are increasingly integrating cryoablation into treatment protocols. Pediatric cardiology departments appreciate its low thermal injury risk, especially in smaller anatomical structures. Device manufacturers are customizing probes and catheters for pediatric and animal anatomy. These emerging use cases diversify the market landscape.

Rise in Cryoablation Device Leasing and Rental Models Supports Wider Adoption

Hospitals and clinics are increasingly adopting cryoablation devices through leasing or rental agreements rather than direct capital purchases. This shift in procurement model reflects the need to manage budget constraints while adopting modern technologies. The Cryoablation Devices Market is benefiting from this flexibility, allowing smaller and mid-sized healthcare centers to implement advanced systems. Manufacturers and service providers now offer turnkey solutions that include training, maintenance, and software upgrades. Subscription-based models lower the financial entry barrier for institutions seeking to adopt cryoablation for oncology or electrophysiology. This trend supports faster market penetration across rural and Tier-2 cities. Equipment-as-a-service models ensure uptime, encourage usage, and generate long-term revenue streams for vendors.

- For instance, Cryomed became the first company in the EU to introduce flexible leasing and rental models for its cryotherapeutic devices, including the Cryomed Pro and Cryomed Mini models. With a 20% down payment and the remaining cost split into 12 monthly installments, over 1,500 customers worldwide—including clinics and sports centers—have accessed these devices.

Strategic Collaborations Between Hospitals and MedTech Firms Accelerate Innovation

Collaboration between device manufacturers and healthcare institutions is driving co-development of cryoablation technologies. Hospitals are partnering with medtech companies to tailor cryoablation devices to specific clinical needs. It fosters innovations such as single-use cryoprobes, AI-assisted temperature monitoring, and robotic integration. Academic hospitals conduct multi-center trials to validate new indications and techniques. These collaborations often extend to joint regulatory submissions and educational programs. Knowledge exchange between clinicians and engineers enhances product design and usability. Vendor support through on-site training, simulation labs, and remote monitoring increases procedural adoption. These partnerships strengthen the Cryoablation Devices Market by aligning product development with real-world clinical feedback.

- For instance, large medtech collaborations like those between Philips and Medtronic have resulted in co-developed, integrated ablation-imaging systems, with Philips investing €250 million to acquire navigation imaging developer EPD Solutions for its KODEX-EPD system

Market Challenges Analysis:

High Capital Investment and Operational Costs Limit Accessibility in Resource-Constrained Settings

One of the primary challenges in the Cryoablation Devices Market is the high upfront investment required for equipment and supporting infrastructure. It includes the cost of cryogenerators, probes, imaging systems, and disposables, which may not be feasible for smaller hospitals or rural centers. Maintenance expenses and the need for skilled professionals further escalate operational costs. This restricts adoption in cost-sensitive markets, where healthcare infrastructure is still developing. Public hospitals in low-income countries may not prioritize such technologies despite clinical advantages. Disparities in access across regions slow market growth. The absence of standardized reimbursement in many regions adds complexity. Hospitals must weigh long-term benefits against immediate capital strain, delaying investment decisions.

Technical Limitations and Procedural Risks Impede Broader Clinical Integration

Despite being minimally invasive, cryoablation procedures carry inherent risks and technical challenges. Precise targeting is critical, especially in organs close to major blood vessels or nerves. Inadequate ice coverage can lead to incomplete ablation and tumor recurrence. Physicians require extensive training to achieve consistent outcomes. The Cryoablation Devices Market also faces limitations in treating large or irregularly shaped tumors. Equipment malfunctions or temperature miscalculations can lead to tissue damage. Regulatory scrutiny on device reliability adds pressure on manufacturers. It must maintain a balance between innovation and procedural safety. Addressing these challenges is vital to increasing confidence among clinicians and patients alike.

Market Opportunities:

Expansion of Cryoablation into Emerging Oncology Indications Offers Growth Potential

New clinical research is validating cryoablation as a viable treatment for various soft tissue cancers, including pancreatic, liver, and adrenal tumors. These new applications present major opportunities in the Cryoablation Devices Market. It allows expansion beyond traditional areas like kidney and prostate cancer. Oncologists are exploring combination therapies involving cryoablation and immunotherapy, increasing treatment options. This shift encourages hospitals to diversify their oncology services using existing cryoablation platforms. Growing demand for organ-sparing techniques further supports its clinical utility. The opportunity to serve these specialized procedures will fuel innovation in probe design and multi-modal integration.

Emerging Markets Provide a Large Untapped Customer Base for Cryoablation Systems

Emerging economies in Asia, Latin America, and the Middle East present untapped opportunities due to rising investments in healthcare infrastructure. The Cryoablation Devices Market can benefit from increasing cancer screening rates and adoption of advanced therapies in these regions. It aligns well with government-led initiatives promoting minimally invasive technologies. Rising medical tourism and public-private partnerships accelerate demand for effective and cost-efficient solutions. Vendors offering portable, lower-cost models stand to gain in these markets. With proper training and pricing models, manufacturers can establish a strong foothold in regions experiencing rapid healthcare modernization.

Market Segmentation Analysis:

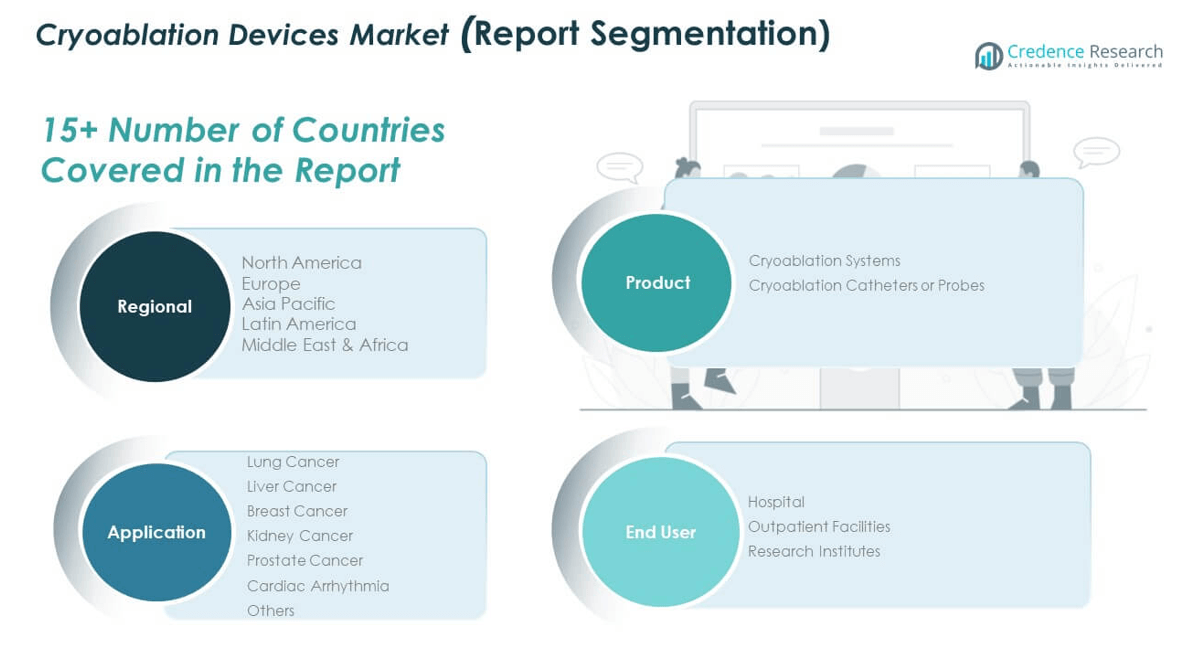

The Cryoablation Devices Market is segmented by product, application, and end user, each contributing to its evolving structure and growth.

By product, cryoablation systems hold a dominant share due to their integrated functionality and widespread use in hospitals. Cryoablation catheters or probes are gaining momentum, driven by advancements in minimally invasive procedures and device flexibility.

- For example, Medtronic’s Arctic Front cryoablation systems, including the Arctic Front Advance Pro, have been used in over one million procedures globally. The Advance Pro features a 40% shorter tip for enhanced visualization and precise pulmonary vein isolation during cardiac interventions.

By application, cardiac arrhythmia represents a significant share, with growing adoption of cryoablation in electrophysiology, especially for atrial fibrillation. Lung, liver, kidney, and prostate cancers form a strong oncology segment, reflecting rising demand for tissue-sparing alternatives. Breast cancer cryoablation is expanding in early-stage treatment and palliative care, while the “others” category captures emerging applications in pain management and benign tumors.

- For example, Stanford Health Care played a pioneering role in advancing balloon cryoablation for atrial fibrillation, contributing to the development and clinical adoption of this technique.

By end user, hospitals lead the Cryoablation Devices Market due to access to specialized infrastructure and trained personnel. Outpatient facilities are rapidly increasing their share, driven by the push toward cost-effective care and faster recovery. Research institutes contribute to technology validation and procedural innovation, fostering clinical expansion across multiple specialties. Each segment reflects the broader shift toward precision, safety, and minimally invasive interventions.

Segmentation:

By Product:

- Cryoablation Systems

- Cryoablation Catheters or Probes

By Application:

- Lung Cancer

- Liver Cancer

- Breast Cancer

- Kidney Cancer

- Prostate Cancer

- Cardiac Arrhythmia

- Others

By End User:

- Hospitals

- Outpatient Facilities

- Research Institutes

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Cryoablation Devices Market size was valued at USD 71.78 million in 2018 to USD 127.54 million in 2024 and is anticipated to reach USD 276.96 million by 2032, at a CAGR of 10.2% during the forecast period. It accounted for approximately 30.84% of the global market share in 2024. The region leads the Cryoablation Devices Market due to early adoption of minimally invasive technologies and high demand for advanced cancer and cardiovascular treatments. Robust healthcare infrastructure and favorable reimbursement policies support the widespread use of cryoablation procedures. The presence of leading medical device manufacturers and active clinical research enhances product development and clinical integration. High incidence of atrial fibrillation and solid tumors also boosts procedural volumes. Strong physician awareness and availability of training programs further contribute to growth. The U.S. dominates regional demand, with Canada showing steady progress in cryotherapy adoption.

Europe

The Europe Cryoablation Devices Market size was valued at USD 65.69 million in 2018 to USD 119.47 million in 2024 and is anticipated to reach USD 267.82 million by 2032, at a CAGR of 10.7% during the forecast period. It represents 28.88% of the global market share in 2024. Europe shows strong demand for cryoablation systems in oncology and cardiac care, supported by national health systems and early-stage cancer screening programs. Countries like Germany, France, and the UK are leading adopters of cryoablation in both hospital and outpatient settings. Regulatory approval pathways, such as CE Marking, support quicker product availability. Healthcare providers in the region prioritize minimally invasive procedures with proven cost-effectiveness. Aging populations and chronic disease burdens drive procedural volumes. Clinical trials and academic partnerships also fuel innovation.

Asia Pacific

The Asia Pacific Cryoablation Devices Market size was valued at USD 52.24 million in 2018 to USD 98.24 million in 2024 and is anticipated to reach USD 229.79 million by 2032, at a CAGR of 11.3% during the forecast period. It holds a 23.75% share of the global market in 2024. Asia Pacific is the fastest-growing region, driven by rising healthcare expenditure and rapid adoption of modern treatment technologies. Countries such as China, India, Japan, and South Korea are expanding cryoablation applications in both public and private healthcare sectors. Rising incidence of cancer and cardiovascular disorders encourages procedural expansion. Government-led initiatives to improve diagnostic and surgical infrastructure support wider access to advanced ablation tools. Medical tourism in the region offers another growth avenue. Local and global manufacturers are entering partnerships to scale distribution.

Latin America

The Latin America Cryoablation Devices Market size was valued at USD 21.82 million in 2018 to USD 40.33 million in 2024 and is anticipated to reach USD 92.32 million by 2032, at a CAGR of 11.0% during the forecast period. It contributed 9.75% to the global market share in 2024. Latin America is experiencing growing demand for cryoablation procedures, supported by the expansion of private healthcare facilities and improved access to oncology and cardiology services. Brazil and Mexico lead adoption due to their evolving medical infrastructure and rising patient volumes. Device availability has improved through local distribution networks and targeted marketing. Regional health initiatives promote minimally invasive treatments in urban centers. Challenges remain in reaching rural populations, but telemedicine and mobile healthcare are helping bridge this gap. Public-private collaborations and international aid programs are facilitating technology transfer.

Middle East

The Middle East Cryoablation Devices Market size was valued at USD 10.91 million in 2018 to USD 19.00 million in 2024 and is anticipated to reach USD 40.07 million by 2032, at a CAGR of 9.8% during the forecast period. It accounted for 4.59% of the global market share in 2024. The Middle East is steadily adopting cryoablation technologies, driven by rising cancer prevalence and increasing investment in healthcare modernization. Countries like the UAE and Saudi Arabia are prioritizing advanced oncology and cardiology treatments in line with national health strategies. Specialized cancer centers and private hospitals are early adopters of cryoablation systems. High-income patient segments in urban areas support demand for minimally invasive procedures. Import regulations and training requirements pose some hurdles, but partnerships with global firms are easing these barriers. Market expansion will depend on healthcare diversification and clinical capacity building.

Africa

The Africa Cryoablation Devices Market size was valued at USD 5.80 million in 2018 to USD 9.13 million in 2024 and is anticipated to reach USD 16.25 million by 2032, at a CAGR of 7.5% during the forecast period. It holds 2.21% of the global market share in 2024. Africa remains in the early stages of cryoablation adoption due to limited healthcare infrastructure and diagnostic capabilities. South Africa and Egypt show moderate progress in deploying cryotherapy in select urban hospitals. Access remains a challenge in rural areas, where awareness and affordability issues persist. International aid programs and medical missions have introduced cryoablation in pilot projects. Mobile health units and telemedicine may play a role in extending reach. Regional governments are beginning to invest in non-surgical cancer care technologies. Market development will require sustained investment in healthcare systems, practitioner training, and public awareness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Boston Scientific Corporation

- Medtronic

- MicroPort Scientific Corporation

- CooperSurgical, Inc.

- Galil Medical Inc.

- AtriCure, Inc.

- IceCure Medical

- METRUM CRYOFLEX Sp. z o.o.

- CPSI Biotech

- Other Key Players

Competitive Analysis:

The Cryoablation Devices Market features a competitive landscape with several global and regional players focused on product innovation, clinical efficacy, and strategic partnerships. Major companies such as Medtronic, Boston Scientific, Galil Medical, and AtriCure dominate the market through broad product portfolios and strong distribution networks. It sees continuous investment in R&D to enhance device precision, safety, and procedural versatility. Companies are expanding into emerging markets to leverage rising demand and establish early brand recognition. Mergers, acquisitions, and collaborations with hospitals and research centers are common strategies to expand clinical applications and geographic reach. Competition is driven by pricing, ease of use, and compatibility with imaging systems. New entrants focus on niche segments and low-cost solutions to gain traction. The market’s high-growth potential continues to attract innovation-focused players with scalable technology platforms.

Recent Developments:

- In July 2025, MicroPort Scientific Corporation welcomed a strategic investment from the Shanghai Healthcare M&A Fund (SHMAF). This collaboration is expected to support MicroPort’s expansion and innovation efforts, particularly in high-end medical devices, adding significant backing for future mergers, acquisitions, and ecosystem growth within China and globally.

- In November 2024, Medtronic completed its acquisition of Fortimedix Surgical, a Netherlands-based developer of articulating surgical instruments. This acquisition is aimed at strengthening Medtronic’s portfolio in minimally invasive and robotic-assisted surgery, aligning with industry trends favoring next-generation endoscopy and surgery solutions.

- In October 2024, Boston Scientific Corporation advanced its role in cardiac ablation by launching the FARAWAVE NAV Ablation Catheter and FARAVIEW Software. These new technologies, which are now available in the U.S., provide navigation and advanced visualization capabilities to improve outcomes in pulsed field ablation procedures.

- In October 2024, AtriCure, Inc. launched the cryoSPHERE MAX cryoablation probe, introducing a device with a larger ball tip that enhances cryo nerve block therapy efficiency. This innovation reduces freezing time by 50% compared to AtriCure’s original cryoSPHERE probe and over 30% compared to the cryoSPHERE+ model, marking a significant step in procedural speed and efficacy for pain management applications.

Market Concentration & Characteristics:

The Cryoablation Devices Market is moderately concentrated, with a few dominant firms holding significant market share due to their technological leadership and regulatory approvals. It is characterized by continuous innovation, clinical integration, and growing preference for minimally invasive procedures. High entry barriers, including capital investment and regulatory compliance, limit new competition. The market favors companies that can align product performance with clinical workflow and cost-efficiency. It exhibits high growth potential across oncology and cardiology, encouraging cross-specialty device designs. Product differentiation often lies in energy control, probe flexibility, and image-guidance compatibility. The market values reliability, procedural safety, and service support as key buying factors.

Report Coverage:

The research report offers an in-depth analysis based on product, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Cryoablation Devices Market will see expanded use in oncology as clinical validation supports its effectiveness across multiple tumor types, including lung, liver, and prostate.

- Demand for cryoablation in cardiac electrophysiology will rise, particularly in treating atrial fibrillation, as physicians seek safer alternatives to radiofrequency ablation.

- Technological integration with real-time imaging systems like MRI, CT, and ultrasound will improve procedural accuracy and reduce recurrence risks.

- Emerging economies in Asia Pacific, Latin America, and the Middle East will drive future growth due to rising healthcare investments and awareness of minimally invasive treatments.

- Development of compact, mobile, and single-use cryoablation devices will support the shift toward outpatient procedures and ambulatory surgical centers.

- Collaborations between medtech companies and academic hospitals will result in device improvements and enhanced clinician training.

- Broader insurance coverage and favorable reimbursement in key markets will increase patient access to cryoablation therapies.

- Applications in veterinary and pediatric care will open new niche segments and support steady demand.

- Innovations in cryogen control and probe design will improve safety, reduce complications, and streamline workflows.

- Regulatory approvals for new clinical indications will enable product diversification and wider procedural adoption.