| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

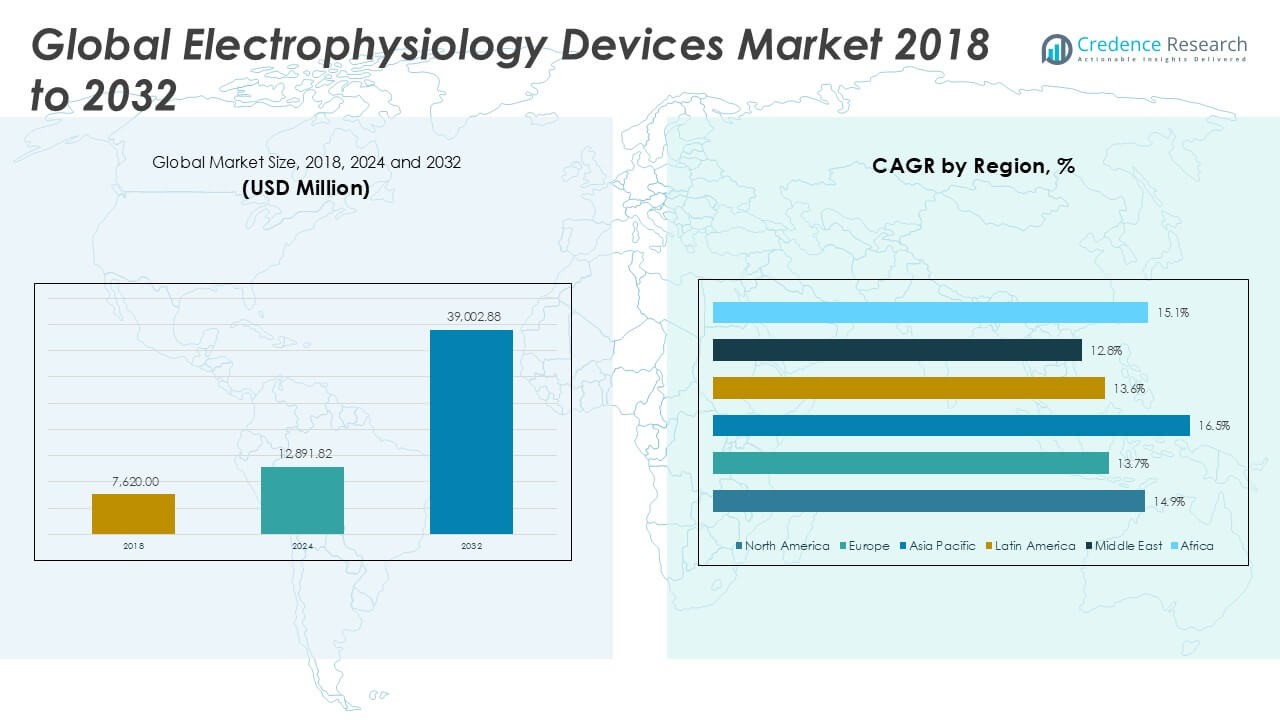

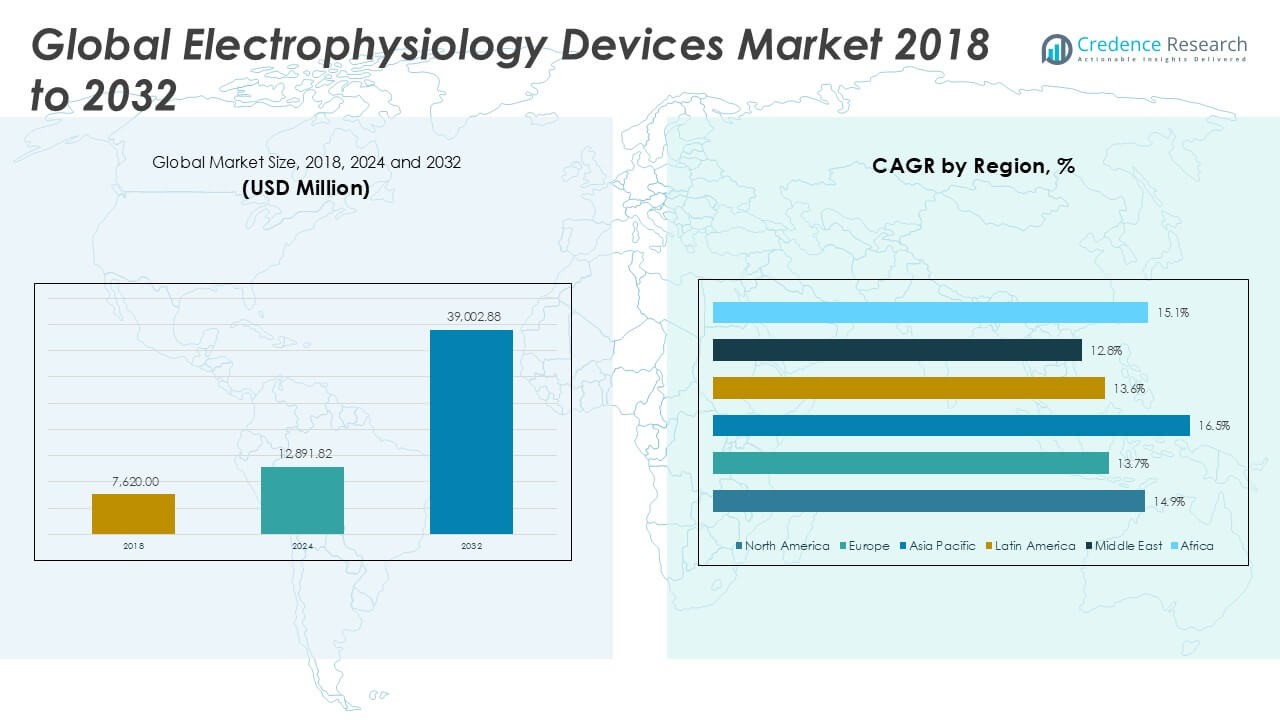

| Electrophysiology Devices Market Size 2024 |

USD 12,891.82 Million |

| Electrophysiology Devices Market, CAGR |

14.90% |

| Electrophysiology Devices Market Size 2032 |

USD 39,002.88 Million |

Market Overview

Electrophysiology Devices Market size was valued at USD 7,620.00 million in 2018 to USD 12,891.82 million in 2024 and is anticipated to reach USD 39,002.88 million by 2032, at a CAGR of 14.90% during the forecast period.

The Electrophysiology Devices Market is experiencing strong growth, driven by rising prevalence of cardiac arrhythmias, increased adoption of minimally invasive procedures, and rapid advancements in ablation and diagnostic technologies. Growing awareness about the benefits of early diagnosis and treatment of cardiac disorders, coupled with an aging global population, continues to propel demand for these devices. Hospitals and specialty clinics are expanding their electrophysiology service lines to meet this rising need, supported by favorable reimbursement policies in many regions. Technological innovations, such as 3D mapping systems and improved catheter designs, are streamlining procedures and improving patient outcomes. Meanwhile, market players are focusing on strategic partnerships and product launches to strengthen their presence. These trends underscore a competitive landscape characterized by ongoing innovation, broader clinical applications, and expanding market access, especially in emerging economies, positioning the Electrophysiology Devices Market for sustained growth over the coming years.

The Electrophysiology Devices Market exhibits a dynamic global presence, with North America leading adoption due to advanced healthcare infrastructure and high rates of cardiac arrhythmias, while Europe benefits from robust cardiac care systems and rising demand for minimally invasive procedures. Asia Pacific stands out for its rapid growth, fueled by expanding healthcare access and increasing awareness of heart rhythm disorders in major countries such as China and India. Latin America and the Middle East & Africa are emerging regions, driven by improving healthcare investments and gradual technology adoption. Key players shaping the competitive landscape include Boston Scientific Corp., Medtronic, and Abbott, each leveraging extensive product portfolios and ongoing innovation to strengthen their market positions. Biosense Webster, a Johnson & Johnson company, is also recognized for its leadership in advanced mapping and ablation technologies, helping to set the pace in clinical performance and device advancement within the global market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Electrophysiology Devices Market size was valued at USD 7,620.00 million in 2018 to USD 12,891.82 million in 2024 and is anticipated to reach USD 39,002.88 million by 2032, at a CAGR of 14.90% during the forecast period.

- Rising prevalence of cardiac arrhythmias and growing geriatric population are key factors fueling market demand across both developed and emerging regions.

- Rapid advancements in catheter ablation technologies, 3D mapping systems, and minimally invasive procedures are reshaping treatment protocols and expanding clinical applications.

- North America maintains its leadership due to advanced healthcare infrastructure and early adoption of innovative devices, while Asia Pacific is the fastest-growing region driven by healthcare investments and expanding awareness.

- Key market players such as Boston Scientific Corp., Medtronic, Abbott, and Biosense Webster focus on expanding their product portfolios and engaging in strategic partnerships to enhance their global presence.

- High device costs, limited reimbursement in developing countries, and shortage of skilled electrophysiologists remain persistent restraints that impact broader adoption.

- The market is characterized by increasing collaboration between industry leaders, healthcare providers, and research institutions, fostering innovation and supporting broader access to advanced electrophysiology technologies worldwide.

Market Drivers

Rising Prevalence of Cardiac Arrhythmias and Increasing Aging Population

The global burden of cardiac arrhythmias, particularly atrial fibrillation, continues to escalate, driving robust demand for advanced electrophysiology devices. An aging population, with a higher risk of developing arrhythmias, is significantly contributing to market expansion. The growing incidence of lifestyle diseases such as hypertension and diabetes further elevates the risk of cardiovascular disorders, leading to a greater need for precise diagnosis and effective treatment. Healthcare systems across developed and developing nations are prioritizing early detection and management of heart rhythm disorders, strengthening the adoption of electrophysiology solutions. Public health initiatives and improved access to medical facilities have enhanced awareness, encouraging timely intervention. The Electrophysiology Devices Market benefits directly from these demographic and epidemiological shifts.

For instance, atrial fibrillation affects approximately 33 million people worldwide, with prevalence increasing due to aging demographics.

Technological Advancements and Product Innovation Fuel Market Expansion

Rapid technological progress in ablation catheters, diagnostic catheters, and 3D mapping systems is transforming the landscape of cardiac care. Enhanced device precision, integration with imaging systems, and real-time monitoring capabilities have streamlined complex procedures, resulting in better patient outcomes and shorter recovery times. Companies are launching next-generation devices that offer improved safety and efficacy, supporting physician confidence in minimally invasive interventions. It is witnessing the emergence of pulse field ablation and cryoablation techniques that address limitations of conventional radiofrequency ablation. Ongoing research and development efforts are leading to more reliable, user-friendly devices that cater to the specific needs of hospitals and ambulatory centers. These technological advancements play a pivotal role in sustaining market momentum.

For instance, the integration of AI-driven mapping systems has improved arrhythmia detection and optimized ablation procedures.

Supportive Regulatory Policies and Favorable Reimbursement Landscape

Government policies and regulatory frameworks in major healthcare markets are increasingly supportive of electrophysiology procedures. Streamlined approval processes and the introduction of clear clinical guidelines help accelerate the adoption of new devices. The market gains from favorable reimbursement policies that reduce the financial burden on patients and healthcare providers, fostering greater procedural volumes. Hospitals and specialty clinics are more likely to invest in state-of-the-art equipment when regulatory barriers are minimized and reimbursement mechanisms are robust. Collaborative efforts between device manufacturers and regulatory agencies also expedite product innovation. This regulatory environment enables broader patient access and supports the overall growth trajectory.

Expansion of Healthcare Infrastructure and Growing Investments in Emerging Markets

Significant investments in healthcare infrastructure, particularly in emerging economies, are strengthening the reach of electrophysiology services. Governments and private stakeholders are increasing capital allocation to upgrade hospitals and establish specialized cardiac care centers. The market experiences rising demand in regions with improving economic conditions and expanding insurance coverage. Training programs and educational initiatives for healthcare professionals are raising procedural expertise, supporting safe and effective use of electrophysiology devices. Local manufacturing and distribution partnerships help lower costs and ensure timely availability of devices. This broadening access to advanced cardiac care drives sustainable growth in the global electrophysiology devices sector.

Market Trends

Integration of Advanced Imaging and Mapping Technologies in Electrophysiology Procedures

The integration of advanced imaging and 3D mapping systems is reshaping electrophysiology procedures, improving accuracy and reducing procedural risks. Hospitals and clinics are deploying real-time imaging tools, which enable precise navigation during catheter-based interventions. The Electrophysiology Devices Market is benefiting from software innovations that synchronize diagnostic and therapeutic devices, allowing physicians to visualize cardiac anatomy and electrical activity in greater detail. This trend enhances the safety and effectiveness of ablation therapies, supporting wider adoption in complex cases. Device manufacturers are investing in research to refine mapping algorithms and develop interoperable platforms. Improved imaging and mapping technologies are making minimally invasive procedures more predictable and patient-centric.

For instance, high-resolution 3D mapping systems are being integrated into hospitals to improve catheter placement accuracy and procedural success rates.

Growing Shift Toward Minimally Invasive Ablation Techniques

The market is experiencing a strong trend toward minimally invasive ablation procedures, driven by patient preference for shorter hospital stays and quicker recovery. It is witnessing increased adoption of novel technologies such as cryoablation and pulse field ablation, which reduce collateral tissue damage compared to conventional methods. These techniques support procedural efficiency and lower complication rates, encouraging clinicians to expand their use in both inpatient and outpatient settings. Industry leaders are focusing on developing compact and flexible ablation catheters to support a broader range of arrhythmia treatments. This shift aligns with global healthcare priorities that emphasize patient comfort and cost-effectiveness. The trend toward minimally invasive ablation is fueling innovation and market expansion.

For instance, catheter ablation procedures for atrial fibrillation have increased significantly due to their effectiveness in restoring normal heart rhythm.

Emphasis on Outpatient Electrophysiology Services and Ambulatory Care

Healthcare systems are increasingly shifting electrophysiology procedures from traditional hospital environments to ambulatory care centers and outpatient facilities. The Electrophysiology Devices Market reflects this trend, as it sees heightened demand for portable, user-friendly devices designed for fast-paced clinical settings. This shift offers healthcare providers significant cost savings while improving patient access to advanced cardiac care. Manufacturers are introducing devices with simplified workflows and integrated monitoring capabilities tailored for outpatient use. Training and certification programs are supporting this transition by equipping clinicians with the necessary expertise for safe and efficient procedures outside hospital settings. The growing focus on outpatient care is reshaping the delivery landscape for electrophysiology services.

Expansion into Emerging Markets and Focus on Local Partnerships

Device manufacturers are targeting emerging markets with tailored product offerings and strategic local partnerships. It is responding to rising demand in regions with rapidly expanding healthcare infrastructure and increasing awareness of cardiac disorders. Companies are establishing collaborations with local distributors and healthcare providers to ensure product accessibility and timely support. The Electrophysiology Devices Market is also seeing growth in training programs for local clinicians, fostering skill development and procedural adoption. Manufacturers are aligning device features with regional regulatory requirements and economic conditions to capture a larger market share. The trend toward global expansion is strengthening the presence of electrophysiology technologies in new and underserved markets.

Market Challenges Analysis

High Cost of Devices and Limited Reimbursement in Developing Regions

The high cost of electrophysiology devices and procedures presents a significant barrier, particularly in developing regions where healthcare budgets remain constrained. Many hospitals and clinics struggle to invest in advanced ablation and diagnostic technologies due to limited financial resources. The Electrophysiology Devices Market feels the impact of uneven reimbursement policies that restrict patient access to necessary treatments. Out-of-pocket expenses for patients can be substantial, reducing the adoption rate in price-sensitive markets. Manufacturers face pressure to balance innovation with affordability, which can slow the introduction of next-generation devices. Limited insurance coverage and fragmented healthcare funding further complicate efforts to expand access to advanced cardiac care.

For instance, reimbursement policies for electrophysiology procedures remain inconsistent, affecting hospital adoption of advanced technologies.

Technical Complexity and Shortage of Trained Professionals

Technical complexity and a shortage of skilled electrophysiologists continue to challenge widespread adoption of electrophysiology procedures. Many healthcare providers lack adequately trained staff to perform advanced mapping and ablation techniques safely and effectively. The market faces persistent concerns about procedural risks, device malfunction, and variability in clinical outcomes. It must address significant investments in training and certification to raise clinical competency and patient safety standards. Delays in regulatory approvals for new devices add another layer of difficulty, limiting timely access to innovative solutions. These challenges create operational bottlenecks and hinder the overall growth trajectory of the Electrophysiology Devices Market.

Market Opportunities

Expansion of Electrophysiology Services in Emerging Markets

Expanding healthcare infrastructure in emerging markets presents a major opportunity for the Electrophysiology Devices Market. Governments and private investors are prioritizing investments in modern hospitals and cardiac care centers, supporting the availability of advanced diagnostic and ablation technologies. Growing awareness of cardiac arrhythmias and rising incidence rates are increasing demand for early diagnosis and intervention. Manufacturers can leverage local partnerships and distribution channels to improve market penetration and streamline device delivery. Training programs aimed at local clinicians are further enhancing procedural expertise and patient outcomes. These trends are creating favorable conditions for strong, sustainable growth in developing regions.

Advancements in Device Technology and Personalized Treatment Approaches

Advancements in device technology and the push toward personalized cardiac care open new avenues for market expansion. The Electrophysiology Devices Market benefits from innovations such as AI-driven mapping systems, remote monitoring solutions, and more precise ablation techniques tailored to individual patient profiles. These advancements improve procedural accuracy and reduce complication rates, strengthening physician and patient confidence. Market players are exploring collaborations with research institutions and technology providers to accelerate development and regulatory approval of cutting-edge solutions. Opportunities exist for companies to introduce user-friendly, cost-effective devices that address both clinical needs and economic realities. This focus on next-generation technology positions the market for continued leadership in the evolving landscape of cardiac care.

Market Segmentation Analysis:

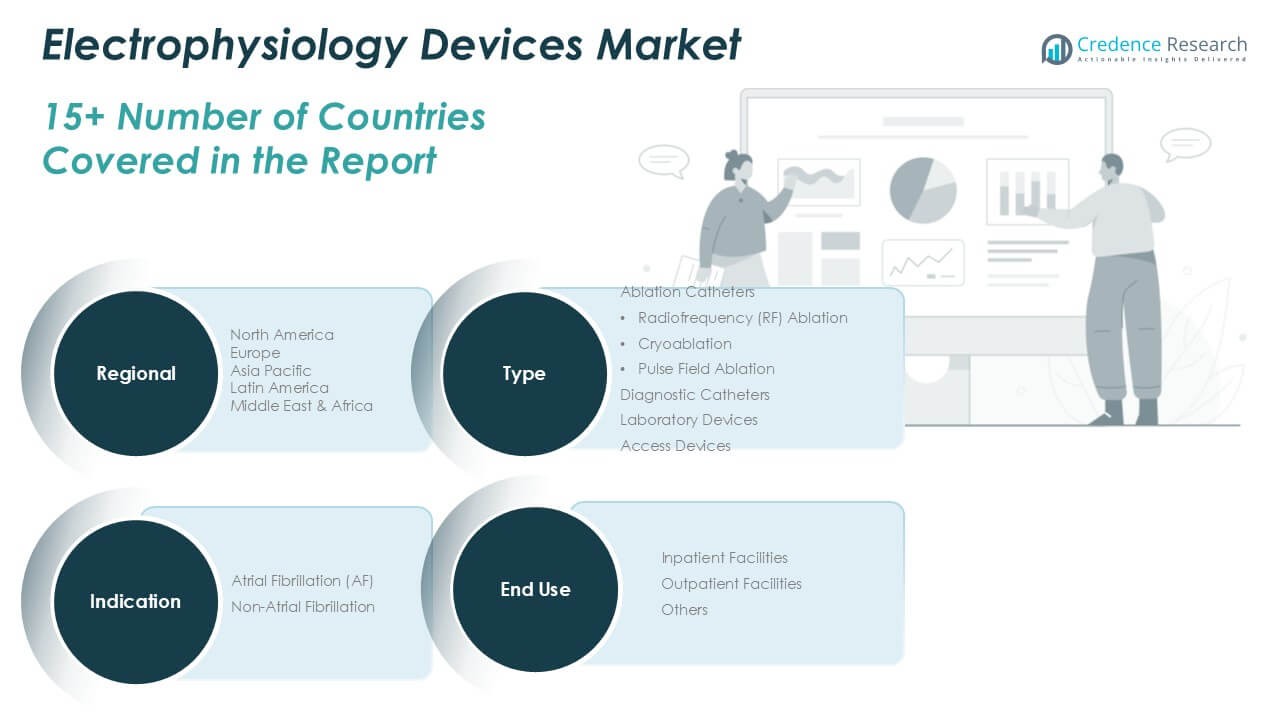

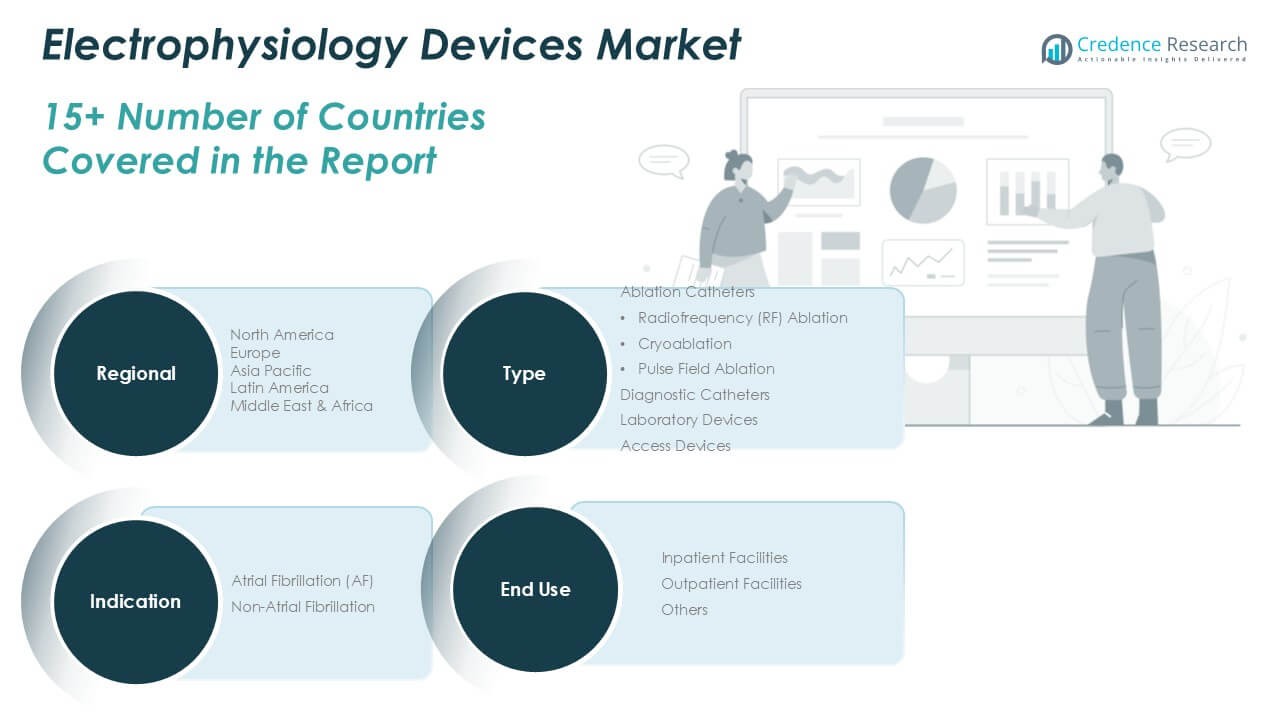

By Type:

Ablation catheters represent the leading segment, driven by their pivotal role in treating cardiac arrhythmias. Among these, radiofrequency (RF) ablation holds a prominent share due to its established efficacy and broad physician adoption. Cryoablation catheters are gaining traction for their ability to minimize collateral tissue damage, offering safer outcomes in select patient populations. Pulse field ablation, an emerging technology, is capturing attention for its potential to deliver targeted therapy with reduced procedural complications. Diagnostic catheters are vital for mapping and identifying arrhythmogenic foci, supporting precise intervention planning. Laboratory devices, including mapping systems and stimulators, enable clinicians to visualize and interpret complex cardiac signals, while access devices facilitate safe entry and navigation during procedures.

By Indication:

The market sees significant demand for devices targeting atrial fibrillation (AF), the most common form of arrhythmia worldwide. Growing awareness and improved screening protocols are fueling adoption of advanced electrophysiology solutions for AF management. Devices for non-atrial fibrillation indications, such as ventricular tachycardia and supraventricular tachycardia, account for a substantial market share, reflecting the broadening application of ablation and diagnostic technologies in diverse clinical scenarios.

By End-Use:

Inpatient facilities including large hospitals and cardiac centers dominate the market due to their capability to manage complex arrhythmia cases and their access to specialized staff and equipment. Outpatient facilities are expanding their electrophysiology service lines, supported by technological improvements that enable minimally invasive procedures with faster recovery times. The “others” category, which encompasses specialty clinics and ambulatory centers, is emerging as an important segment as healthcare systems shift toward more accessible, cost-effective care delivery models. The Electrophysiology Devices Market adapts to these trends by offering tailored solutions that address the distinct needs of each end-user segment.

Segments:

Based on Type:

- Ablation Catheters

- Radiofrequency (RF) Ablation

- Cryoablation

- Pulse Field Ablation

- Diagnostic Catheters

- Laboratory Devices

- Access Devices

Based on Indication:

- Atrial Fibrillation (AF)

- Non-Atrial Fibrillation

Based on End-Use:

- Inpatient Facilities

- Outpatient Facilities

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America held the largest share of the global electrophysiology devices market, accounting for approximately 49% of the total revenue. This dominance is attributed to the region’s advanced healthcare infrastructure, high prevalence of cardiac arrhythmias, and favorable reimbursement policies. The United States, in particular, contributes significantly to this share, driven by the increasing adoption of advanced electrophysiology procedures and the presence of major market players. The region’s commitment to technological innovation and early adoption of novel therapies continues to bolster its market position.

Europe

Europe represents a substantial portion of the electrophysiology devices market, with a market share of approximately 25% in 2024. The region’s growth is fueled by the rising incidence of atrial fibrillation and other cardiac arrhythmias, coupled with an aging population. Countries like Germany, the United Kingdom, and France are leading contributors, owing to their well-established healthcare systems and increasing investment in cardiac care. The European market is also witnessing a surge in the adoption of minimally invasive procedures, further driving the demand for electrophysiology devices.

Asia-Pacific

The Asia-Pacific region is experiencing the fastest growth in the electrophysiology devices market, with a projected CAGR of 14.8% during the forecast period. In 2024, the region accounted for approximately 20% of the global market share. Factors contributing to this rapid growth include increasing awareness of cardiac health, rising healthcare expenditure, and the expansion of healthcare infrastructure in countries like China, India, and Japan. The growing prevalence of cardiovascular diseases and the adoption of advanced medical technologies are expected to further propel the market in this region.

Latin America

Latin America held a market share of around 4% in 2024. The region is witnessing gradual growth in the electrophysiology devices market, driven by the increasing burden of cardiovascular diseases and improving access to healthcare services. Countries such as Brazil and Mexico are leading the market, supported by government initiatives to enhance healthcare infrastructure and the growing adoption of advanced medical devices. However, challenges such as limited reimbursement policies and economic constraints may impact the market’s growth trajectory.

Middle East and Africa

The Middle East and Africa region accounted for approximately 2% of the global electrophysiology devices market in 2024. The market in this region is in the nascent stage, with growth driven by increasing awareness of cardiac health, rising prevalence of heart diseases, and efforts to improve healthcare infrastructure. Countries like Saudi Arabia, the United Arab Emirates, and South Africa are investing in healthcare development, which is expected to create opportunities for market expansion. Nonetheless, factors such as limited access to advanced medical technologies and a shortage of skilled healthcare professionals may pose challenges to market growth.

Key Player Analysis

- Boston Scientific Corp.

- Medtronic

- Abbott

- Biosense Webster

- Biotronik

- General Electric Company

- Siemens Healthcare AG

- MicroPort Scientific Corporation

- Koninklijke Philips N.V.

Competitive Analysis

The competitive landscape of the Electrophysiology Devices Market is defined by the strong presence and continuous innovation of leading players such as Boston Scientific Corp., Medtronic, Abbott, Biosense Webster, Biotronik, General Electric Company, Siemens Healthcare AG, MicroPort Scientific Corporation, and Koninklijke Philips N.V. These companies leverage robust R&D capabilities to introduce next-generation ablation catheters, advanced diagnostic systems, and real-time mapping technologies that address evolving clinical needs. Boston Scientific Corp. and Medtronic maintain leadership through expansive product portfolios and global reach, while Abbott and Biosense Webster distinguish themselves with advanced mapping and ablation solutions widely adopted in cardiac care centers. Strategic partnerships, acquisitions, and investments in emerging markets allow these players to strengthen market penetration and respond to regional healthcare demands. The focus on technological differentiation, such as AI integration, interoperable systems, and minimally invasive devices, remains central to their growth strategies. Companies also invest in clinician training programs and after-sales support to foster brand loyalty and support safe device adoption. Continuous efforts to secure regulatory approvals and align with local healthcare standards help sustain their competitive edge. Collectively, these leaders drive innovation, shape clinical practice, and set quality benchmarks for the global electrophysiology devices industry.

Recent Developments

- In August 2023, Biosense Webster received approval for various atrial fibrillation ablation products that can be utilized in a workflow without fluoroscopy during catheter ablation procedures.

- In August 2023, Boston Scientific Corporation (US) launched the POLARx cryoablation system. This system is used to treat patients with paroxysmal atrial fibrillation.

- In May 2023 Abbott Laboratories launched the Tactiflex ablation catheter which is sensor-enabled and it is used to treat the most common abnormal heart rhythm.

Market Concentration & Characteristics

The Electrophysiology Devices Market demonstrates a moderately concentrated competitive landscape, dominated by a few key multinational corporations that hold significant market shares. These leading players invest heavily in research and development to introduce innovative products that address complex cardiac arrhythmias, driving technological advancements in the field. It features high entry barriers due to stringent regulatory requirements, substantial capital investment, and the need for specialized clinical expertise. The market is characterized by ongoing product differentiation, with companies focusing on improving device accuracy, safety, and procedural efficiency. Collaboration with healthcare providers and continuous training programs help maintain strong customer relationships and support adoption. Emerging markets offer growth potential, but established regions continue to command the majority of revenue. The Electrophysiology Devices Market’s characteristics highlight a blend of innovation-driven competition and strategic partnerships, creating a dynamic environment that balances technological progress with clinical demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Indication, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electrophysiology devices market is expected to grow steadily due to the increasing prevalence of cardiac arrhythmias.

- Technological advancements in mapping and ablation systems will enhance procedural efficiency and outcomes.

- Rising demand for minimally invasive procedures will continue to drive adoption of advanced electrophysiology devices.

- Growing awareness about early diagnosis and treatment of heart rhythm disorders will support market expansion.

- The integration of artificial intelligence and machine learning in electrophysiology systems will improve precision and decision-making.

- Emerging economies will offer significant growth opportunities due to improving healthcare infrastructure and increasing patient awareness.

- Strategic collaborations between hospitals and device manufacturers will facilitate the development of innovative treatment solutions.

- Increased investments in research and development will lead to next-generation electrophysiology technologies.

- The rising geriatric population globally will fuel demand for cardiac monitoring and therapeutic interventions.

- Regulatory approvals for novel electrophysiology devices will accelerate their commercialization and market penetration.