Market Overview

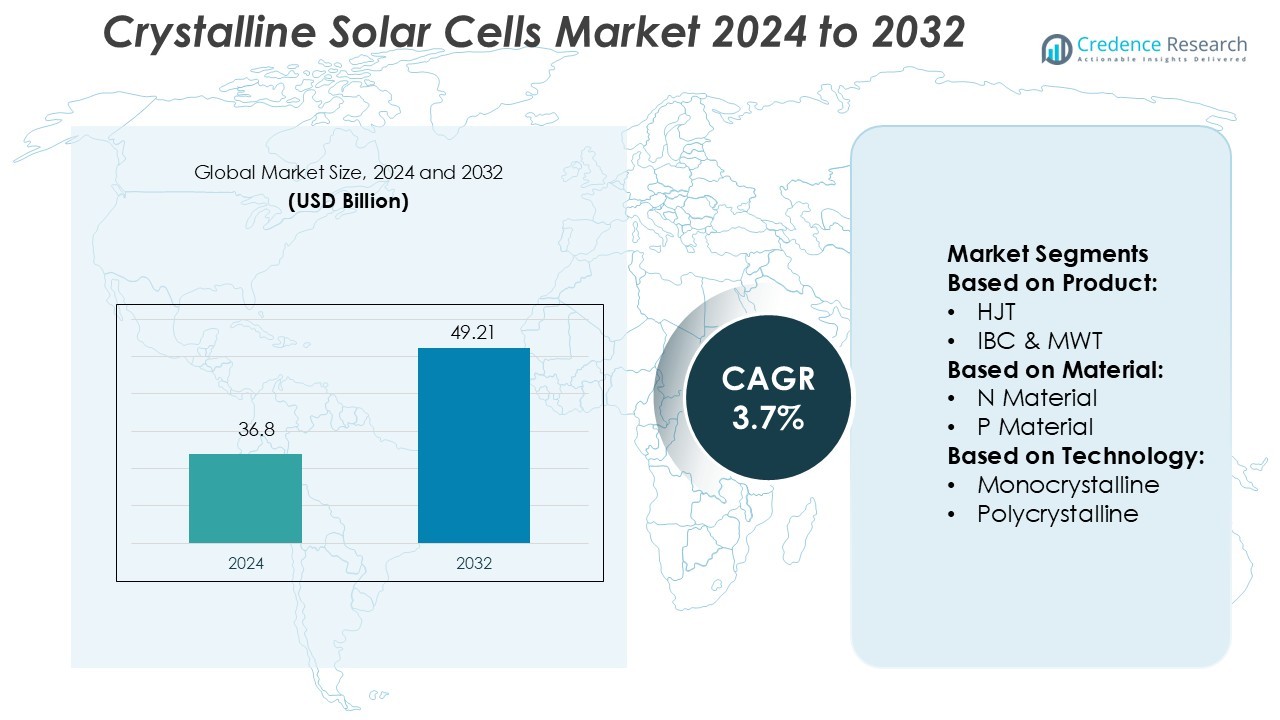

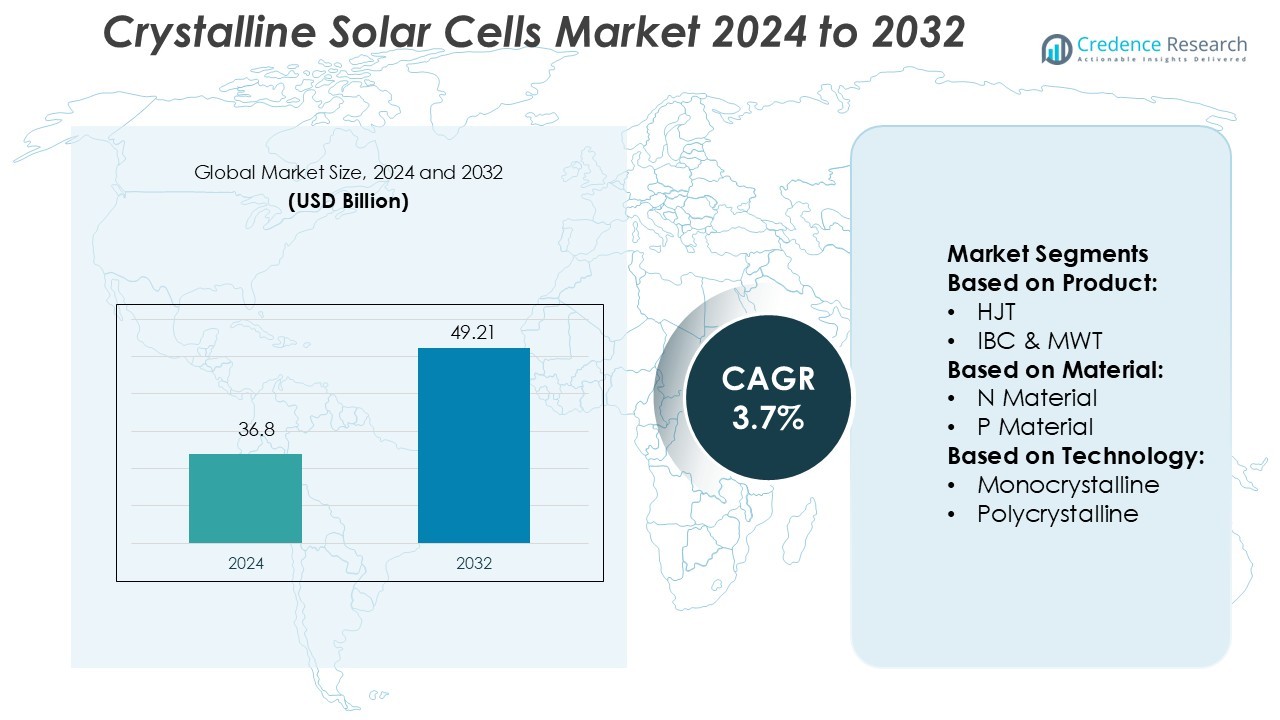

Crystalline Solar Cells Market size was valued USD 36.8 billion in 2024 and is anticipated to reach USD 49.21 billion by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Crystalline Solar Cells Market Size 2024 |

USD 36.8 Billion |

| Crystalline Solar Cells Market, CAGR |

3.7% |

| Crystalline Solar Cells Market Size 2032 |

USD 49.21 Billion |

The crystalline solar cells market is shaped by top players such as Havells, Jinko Solar, Silfab Solar Inc., Singulus Technologies, REC Solar Holdings AS, Meyer Burger, DuPont, Motech Industries, Inc., Canadian Solar, and JA Solar. These companies focus on advancing high-efficiency cell technologies like PERC, TOPCon, and HJT to enhance performance and reduce production costs. Strategic partnerships, capacity expansions, and strong R&D initiatives help them strengthen their global presence. Asia Pacific leads the market with a 39% share, supported by large-scale manufacturing, competitive pricing, and rapid deployment of solar projects. This dominance is driven by strong government incentives, rising electricity demand, and expanding infrastructure investments, making the region a key hub for production and innovation in crystalline solar cell technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The crystalline solar cells market was valued at USD 36.8 billion in 2024 and is projected to reach USD 49.21 billion by 2032, growing at a CAGR of 3.7%.

- Rising demand for renewable energy and falling installation costs drive strong adoption across residential, commercial, and utility-scale segments, with PERC/TOPCon technologies holding the largest share.

- Asia Pacific leads the market with a 39% share, supported by large-scale manufacturing, competitive pricing, and favorable government incentives.

- The market is shaped by leading players focusing on efficiency improvements, production expansion, and strategic partnerships to strengthen global competitiveness.

- High upfront investment costs and supply chain constraints remain key restraints, but increasing technological innovation and supportive regional policies continue to create strong growth opportunities worldwide.

Market Segmentation Analysis:

By Product

PERC/PERL/PERT/TOPCON leads the crystalline solar cells market with the largest share. These cells offer higher energy conversion efficiency than conventional BSF cells, which boosts their adoption in utility-scale solar farms and rooftop projects. Their advanced passivation layers reduce recombination losses and enhance durability, supporting long-term output stability. Governments promoting renewable energy and falling installation costs further accelerate adoption. The segment benefits from continuous improvements in cell structure and manufacturing processes, making it the dominant product category in large-scale photovoltaic deployments.

- For instance, JinkoSolar announced that its 182 mm N-type TOPCon solar module achieved a conversion efficiency value of 25.42 % as tested by TÜV SÜD on a 2 m² large-size module.

By Material

P Material dominates the crystalline solar cells market, supported by its cost-effectiveness and mature manufacturing ecosystem. P-type wafers provide stable performance, making them ideal for large-scale installations. Manufacturers prefer this material due to its wide availability, ease of processing, and compatibility with high-efficiency cell architectures like PERC. Its strong presence in both residential and commercial sectors ensures consistent demand. Growing government incentives and increased grid connectivity projects reinforce the position of P Material as the leading segment in global installations.

- For instance, Ritter XL Solar commissioned a 3,388 m² vacuum-tube collector field in Wels, Austria, which supplies district heating networks with operating temperatures between 75 °C and 100 °C, demonstrating scalability for urban energy systems.

By Technology

Monocrystalline technology holds the largest market share due to its superior efficiency and longer lifespan. These cells deliver better energy output per square meter, making them well-suited for space-constrained installations. Manufacturers favor monocrystalline modules for their low degradation rates and improved temperature performance. The segment’s strong growth is also driven by decreasing production costs and the widespread adoption of high-purity silicon wafers. Rapid expansion of utility-scale solar farms and urban rooftop systems further consolidates its dominant position in the market.

Key Growth Drivers

Rising Demand for Clean and Sustainable Energy

The global shift toward clean energy strongly drives the crystalline solar cells market. Governments and private players are investing heavily in solar power to reduce carbon emissions and meet net-zero targets. Crystalline solar cells offer high efficiency and long service life, making them ideal for residential, commercial, and utility-scale projects. Supportive policies such as tax credits, renewable energy auctions, and feed-in tariffs further boost installations. This growing demand for sustainable power solutions strengthens market expansion across developed and emerging economies.

- For instance, GREENoneTEC operates eight highly automated robotic production lines that together achieve an annual output of over 1,600,000 m² of flat-plate collector panels.

Technological Advancements in Cell Efficiency

Ongoing innovation in cell structures, such as PERC, TOPCon, and HJT, enhances power conversion rates. These advanced technologies reduce energy losses and improve overall system performance, attracting large-scale investments. Manufacturers are optimizing wafer quality, passivation layers, and metallization techniques to boost output. These advancements make solar projects more cost-efficient and reliable. High-efficiency cells also enable smaller installations to generate more power, expanding the market’s appeal in urban and space-limited areas. This technology-driven growth plays a critical role in accelerating adoption.

- For instance, REC launched its Alpha Pro M Series using heterojunction (HJT) cell technology achieving an efficiency of 22.5% and power output ranging from 610 to 640 Wp.

Government Incentives and Policy Support

Policy frameworks supporting renewable energy have become key growth enablers. Many countries offer subsidies, tax benefits, low-interest financing, and net metering programs to encourage solar adoption. Public investments in infrastructure and favorable regulatory structures further accelerate project development. International climate commitments also drive the rapid installation of solar capacity. These policy measures create a stable and attractive investment environment for manufacturers and developers, strengthening the crystalline solar cells market’s long-term growth trajectory.

Key Trends & Opportunities

Integration of Bifacial and Advanced Cell Designs

Bifacial and advanced crystalline cell designs are gaining momentum due to higher energy yields. These cells capture sunlight from both sides, increasing power output by 10–30% compared to traditional modules. Integration with PERC, TOPCon, and HJT technologies further enhances efficiency. Growing utility-scale installations are adopting bifacial panels to maximize ROI and reduce LCOE. Manufacturers investing in these advanced designs can meet the rising demand for high-performance modules, opening new opportunities in both developed and emerging markets.

- For instance, ROSI established a state-of-the-art facility in Saint-Honoré, France, with the capacity to recycle 3,000 tonnes of photovoltaic modules annually, enabling direct recovery of silicon, silver, and copper from on-grid solar arrays that reach end-of-life.

Expansion of Rooftop and Distributed Solar

Distributed solar projects are becoming a key growth opportunity as energy independence gains importance. Crystalline solar cells, particularly monocrystalline types, suit rooftop installations due to their compact size and high efficiency. Urbanization and rising electricity costs drive households and businesses to install small-scale solar systems. Governments offering rooftop installation incentives further accelerate deployment. This trend expands market reach beyond utility-scale projects, supporting steady demand across residential, commercial, and industrial applications.

- For instance, solar panel recycling facilities often use high-capacity equipment to recover valuable materials like glass, which can make up more than 70% of a panel’s weight. Efficient recovery of materials from end-of-life installations helps reduce landfill waste.

Supply Chain Localization and Capacity Expansion

Governments and companies are focusing on localizing solar manufacturing to reduce import dependence. Several nations are expanding wafer, cell, and module production capacities to secure supply chains. Incentives for domestic production support rapid capacity growth, lowering costs and ensuring stable availability of crystalline solar cells. This localization trend opens investment opportunities for new entrants and strengthens the global value chain. It also enhances market resilience against trade disruptions and global supply fluctuations.

Key Challenges

High Initial Installation and Capital Costs

Despite falling module prices, upfront costs for solar installations remain significant. Expenses related to inverters, mounting structures, grid integration, and storage systems can deter adoption, especially in price-sensitive regions. Financing challenges and limited access to credit further slow down project execution. While long-term savings offset these costs, the initial investment remains a barrier for many consumers and small businesses. This cost challenge affects market penetration in developing economies where budget constraints are more pronounced.

Supply Chain Volatility and Material Constraints

Fluctuations in raw material prices and supply chain disruptions pose major challenges. Dependence on specific regions for silicon wafers and other components creates vulnerabilities during geopolitical tensions or trade restrictions. Logistic delays and rising transportation costs further impact pricing stability. Manufacturers face difficulties maintaining consistent production and delivery schedules. Such supply constraints can limit capacity expansion, increase project costs, and delay installations, slowing the market’s overall growth momentum.

Regional Analysis

North America

North America holds a 23% market share in the crystalline solar cells market, supported by strong renewable energy policies and rapid utility-scale project development. The U.S. leads regional growth with federal tax credits, net metering programs, and state-level incentives. The expansion of rooftop solar in residential and commercial sectors further accelerates adoption. Technological advancements in high-efficiency modules and favorable financing options strengthen the market outlook. Investments in grid modernization and storage integration create additional opportunities, positioning North America as a key hub for advanced solar technologies and large-scale clean energy infrastructure.

Europe

Europe accounts for a 26% market share, driven by ambitious decarbonization goals and strict renewable energy targets. Countries such as Germany, Spain, and France are at the forefront of solar capacity expansion, supported by feed-in tariffs and subsidy programs. Rapid adoption of rooftop solar, combined with utility-scale projects, boosts market growth. Investments in smart grids and energy storage strengthen system efficiency and reliability. The European Union’s Green Deal and carbon neutrality goals further encourage the use of high-efficiency crystalline solar cells, ensuring continued dominance in sustainable energy development.

Asia Pacific

Asia Pacific leads the crystalline solar cells market with a 39% market share, driven by large-scale manufacturing and rapid installation rates. China and India dominate the region, supported by government incentives, competitive pricing, and strong domestic supply chains. Urbanization, rising electricity demand, and declining module costs accelerate adoption in residential and commercial sectors. Utility-scale solar farms continue to expand, further strengthening regional capacity. Major players are investing in high-efficiency technologies like PERC and TOPCon to meet increasing demand, solidifying Asia Pacific’s position as the global growth engine for crystalline solar cells.

Latin America

Latin America captures an 8% market share, driven by rising energy demand and growing investment in renewable infrastructure. Brazil, Chile, and Mexico lead the region with supportive policies and declining installation costs. Increasing adoption of distributed generation systems and utility-scale projects strengthens market development. Abundant solar resources make the region attractive for foreign investments and long-term PPAs. Governments are promoting grid integration and financing solutions to accelerate deployment. These factors position Latin America as an emerging market with strong potential for crystalline solar cell expansion in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 4% market share, with growth supported by high solar irradiation and increasing diversification of energy sources. Countries like the UAE, Saudi Arabia, and South Africa are investing in large-scale solar parks and hybrid renewable systems. Government-led initiatives, cost reductions, and favorable auction mechanisms drive adoption. The region’s focus on reducing dependence on fossil fuels further accelerates deployment. Limited infrastructure and financing barriers remain, but increasing foreign investments and partnerships are strengthening MEA’s role as a developing but promising market for crystalline solar cells.

Market Segmentations:

By Product:

By Material:

By Technology:

- Monocrystalline

- Polycrystalline

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The crystalline solar cells market is highly competitive, with key players including Havells, Jinko Solar, Silfab Solar Inc., Singulus Technologies, REC Solar Holdings AS, Meyer Burger, DuPont, Motech Industries, Inc., Canadian Solar, and JA Solar. The crystalline solar cells market is witnessing intense competition driven by rapid technological innovation and capacity expansion. Leading manufacturers are investing heavily in advanced cell architectures such as PERC, TOPCon, and HJT to achieve higher efficiency and lower production costs. Companies are expanding manufacturing footprints across multiple regions to secure supply chains and meet rising global demand. Strategic collaborations and R&D initiatives focus on improving wafer quality, passivation layers, and energy conversion rates. The adoption of automation and AI-based quality control enhances manufacturing precision and output. Growing investments in bifacial modules and thin-wafer technologies are setting new performance standards. This competitive environment accelerates innovation, improves cost efficiency, and strengthens market positioning across residential, commercial, and utility-scale solar projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Havells

- Jinko Solar

- Silfab Solar Inc.

- Singulus Technologies

- REC Solar Holdings AS

- Meyer Burger

- DuPont

- Motech Industries, Inc.

- Canadian Solar

- JA Solar

Recent Developments

- In January 2025, JinkoSolar Holding Co Ltd announced that it has achieved a conversion efficiency of 33.84% for its N-type TOPCon-based perovskite tandem solar cell, surpassing the previous record of 33.24%.

- In January 2025, ITI Limited issued a tender for the establishment of a 500 MW fully automated solar photovoltaic (SPV) module manufacturing line on a turnkey basis.

- In August 2024, Tongwei launched the TNC-G12/G12R series modules marked a significant industry milestone. These modules offer superior power output, efficiency, and quality, leveraging its proprietary solar cell technology and setting a new benchmark for high-performance solar solutions.

- In July 2024, First Solar, Inc. acquired the intellectual property rights related to TetraSun, Inc.’s innovative thin-film solar technology. This acquisition has enabled the company to initiate legal proceedings against several crystalline silicon solar manufacturers for alleged infringement of the patent portfolio.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Global adoption of high-efficiency solar cells will accelerate with falling module costs.

- Advanced technologies like TOPCon and HJT will dominate new installations.

- Bifacial solar modules will see strong demand in utility-scale projects.

- Automation and AI will improve manufacturing efficiency and product reliability.

- Supply chain localization will reduce dependency on a few major manufacturing hubs.

- Government policies and incentives will continue to drive large-scale solar adoption.

- Rooftop and distributed solar installations will expand in urban and commercial areas.

- Investments in R&D will push conversion efficiency to higher levels.

- Energy storage integration will strengthen the role of solar in power grids.

- Global competition will intensify, driving innovation and cost optimization.