Market Overview

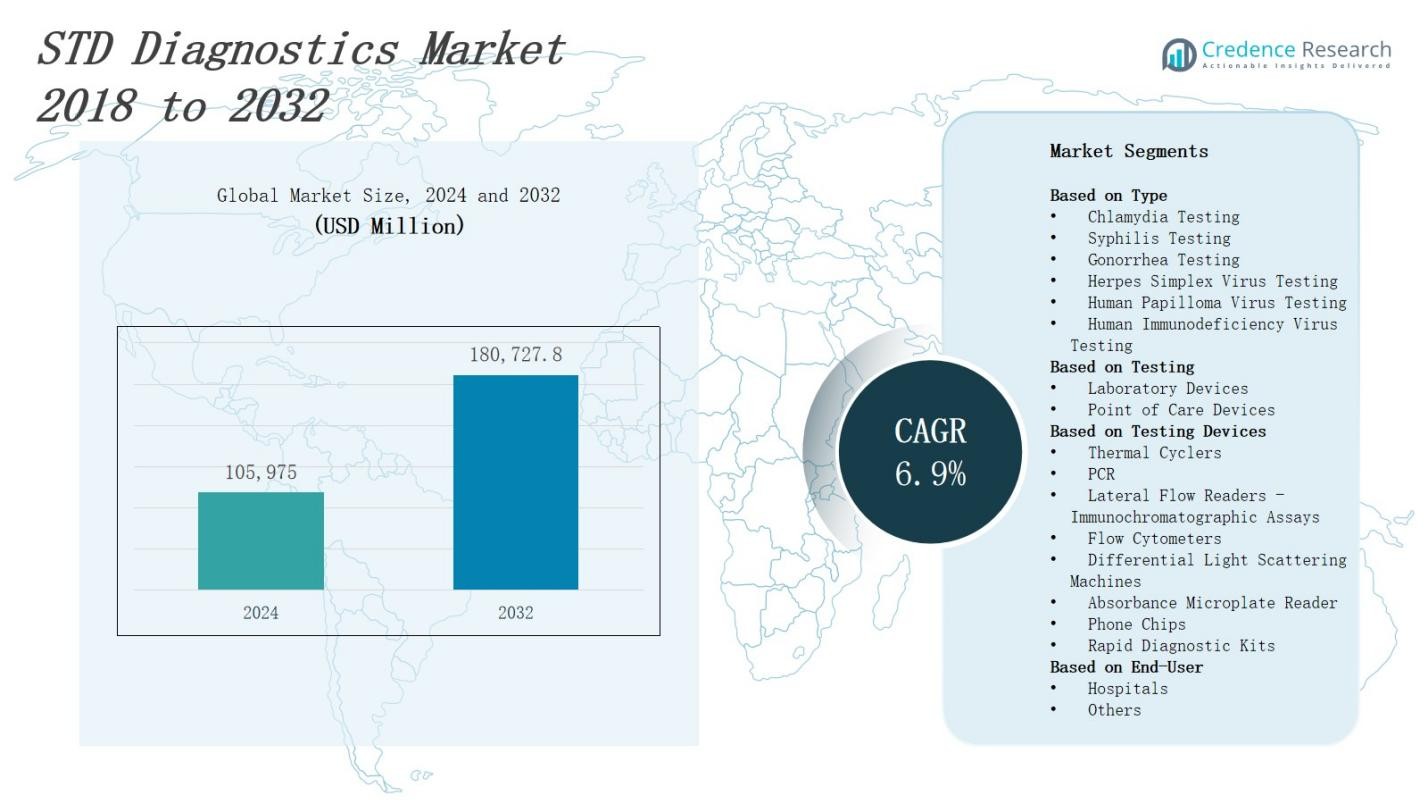

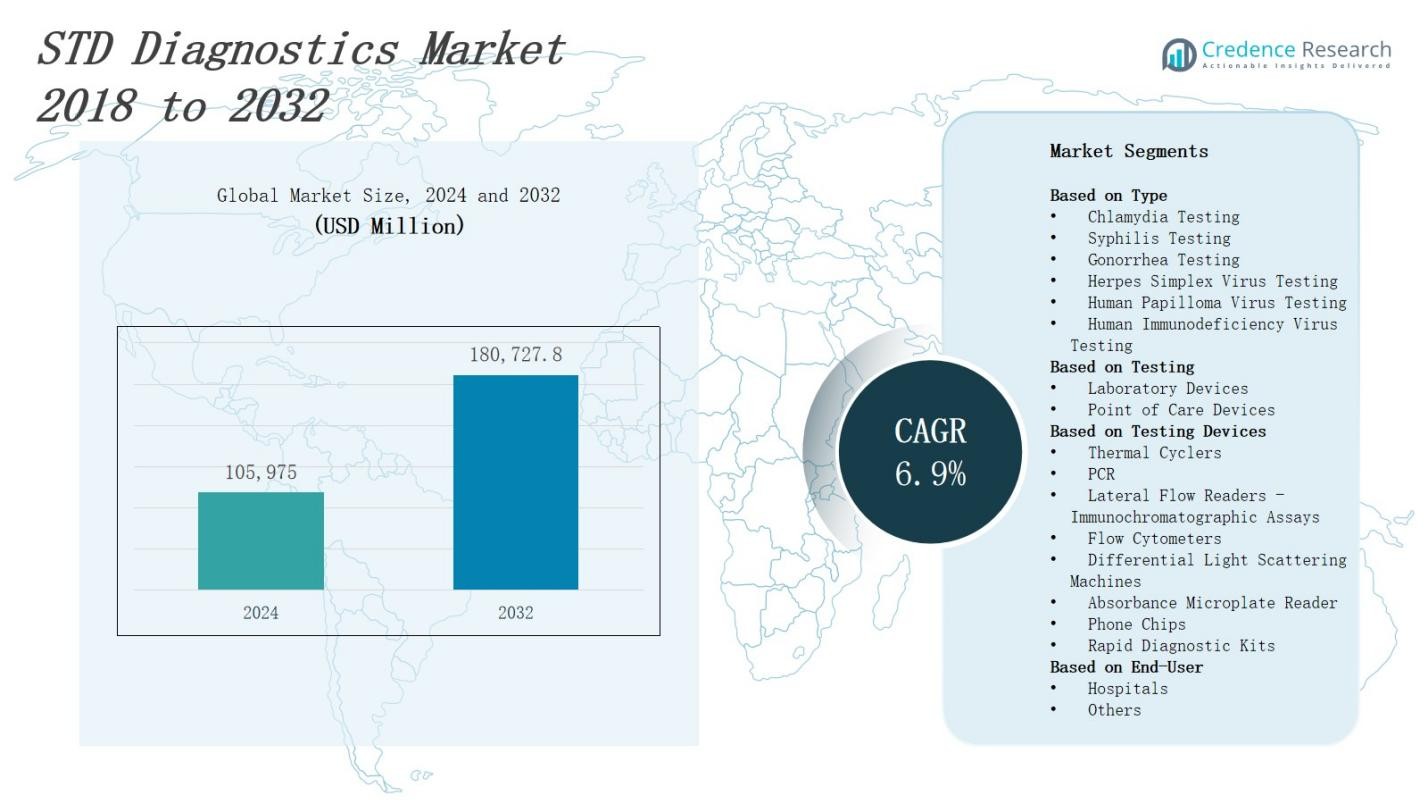

The STD diagnostics market is projected to grow from USD 105,975 million in 2024 to USD 180,727.8 million by 2032, expanding at a CAGR of 6.9%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| STD diagnostics market Size 2024 |

USD 105,975 Million |

| STD diagnostics market, CAGR |

6.9% |

| STD diagnostics market Size 2032 |

USD 180,727.8 Million |

The STD diagnostics market grows driven by rising prevalence of sexually transmitted infections globally and increasing awareness about early detection. Advances in diagnostic technologies, such as rapid testing and molecular assays, enhance accuracy and turnaround time, fueling adoption. Expanding healthcare infrastructure and government initiatives promoting sexual health screening further support market growth. Rising demand for point-of-care testing and integration of digital health solutions streamline diagnostics and patient management. Trends include development of multiplex testing kits and non-invasive sample collection methods, improving patient compliance and convenience. Increasing investment in research and rising focus on personalized diagnostics also propel market expansion.

The STD diagnostics market spans key regions including North America, Europe, Asia-Pacific, and the Rest of the World. North America leads with 35% market share, driven by advanced healthcare infrastructure and strong screening programs. Europe holds 25%, supported by stringent regulations and public health initiatives. Asia-Pacific commands 30%, fueled by rising healthcare investments and growing awareness. The Rest of the World accounts for 10%, with gradual adoption in Latin America, the Middle East, and Africa. Key players operating globally include Abbott, Cepheid, Hologic, Bio-Rad Laboratories, and DiaSorin.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The STD diagnostics market is projected to grow from USD 105,975 million in 2024 to USD 180,727.8 million by 2032, expanding at a CAGR of 6.9%.

- Rising global prevalence of sexually transmitted infections and increasing awareness about early detection drive market growth.

- Advances in diagnostic technologies such as rapid testing and molecular assays improve accuracy and reduce turnaround time, fueling adoption.

- Expanding healthcare infrastructure and government initiatives promoting sexual health screening support market expansion.

- Growing demand for point-of-care testing and integration of digital health solutions streamline diagnostics and patient management.

- Trends include development of multiplex testing kits and non-invasive sample collection methods, enhancing patient compliance and convenience.

- Increasing investment in research and focus on personalized diagnostics further propel market growth.

Market Drivers

Rising Prevalence of Sexually Transmitted Infections Drives Market Demand

The increasing global incidence of sexually transmitted infections (STIs) fuels growth in the STD diagnostics market. Healthcare providers face mounting pressure to implement effective screening programs to curb transmission rates. Early and accurate detection remains critical to reducing complications and improving patient outcomes. Public health initiatives encourage routine testing, boosting demand for reliable diagnostic tools. Increasing awareness about sexual health promotes proactive testing behaviors among at-risk populations. This growing need for timely diagnosis drives investments in advanced testing solutions and infrastructure expansion worldwide.

- For instance, Roche Diagnostics reported that its cobas® CT/NG test, used for detecting chlamydia and gonorrhea, saw a substantial increase in adoption in 2023 due to its high sensitivity and rapid turnaround time.

Technological Advancements Enhance Diagnostic Accuracy and Efficiency

Innovations in diagnostic technologies significantly impact the STD diagnostics market by improving test sensitivity and specificity. Molecular assays, rapid point-of-care tests, and multiplex platforms offer faster, more accurate results. These technologies reduce reliance on traditional laboratory methods, enabling decentralized testing in diverse healthcare settings. Integration of digital tools and automated systems streamlines workflows and data management. Enhanced diagnostic performance improves clinical decision-making and patient management. Continuous research drives development of novel assays targeting emerging pathogens, expanding the market’s scope and appeal.

- For instance, the Binx io® system offers point-of-care testing with automated sample processing and digital result reporting, facilitating decentralized testing in clinics without full laboratories.

Government Initiatives and Public Health Programs Boost Market Growth

Government policies promoting sexual health screening and disease surveillance support expansion in the STD diagnostics market. Funding for awareness campaigns and subsidized testing increases accessibility, particularly in underserved regions. Regulatory bodies encourage adoption of standardized diagnostic protocols to ensure quality and consistency. Collaborations between public and private sectors enhance distribution networks and affordability of diagnostic kits. Health agencies emphasize prevention strategies, reinforcing routine testing recommendations. These efforts collectively stimulate demand for advanced diagnostics and promote early intervention practices globally.

Growing Preference for Point-of-Care and Non-Invasive Testing Solutions

The shift toward patient-centric care drives demand for convenient and rapid STD diagnostic methods. Point-of-care testing allows immediate results during clinical visits, improving treatment timelines and reducing loss to follow-up. Non-invasive sampling techniques, such as urine and self-collected swabs, increase patient compliance and comfort. These features appeal to both healthcare providers and patients seeking accessible, discreet testing options. The STD diagnostics market benefits from the commercialization of user-friendly kits suitable for home use and remote settings. This trend expands market reach and encourages frequent testing behavior.

Market Trends

Rising Prevalence of Sexually Transmitted Infections Drives Market Demand

The increasing global incidence of sexually transmitted infections (STIs) fuels growth in the STD diagnostics market. Healthcare providers face mounting pressure to implement effective screening programs to curb transmission rates. Early and accurate detection remains critical to reducing complications and improving patient outcomes. Public health initiatives encourage routine testing, boosting demand for reliable diagnostic tools. Increasing awareness about sexual health promotes proactive testing behaviors among at-risk populations. This growing need for timely diagnosis drives investments in advanced testing solutions and infrastructure expansion worldwide.

- For instance, Abbott’s m2000 Real Time system, which offers rapid HIV viral load testing, enabling clinicians to initiate timely treatment and monitor therapy success effectively.

Technological Advancements Enhance Diagnostic Accuracy and Efficiency

Innovations in diagnostic technologies significantly impact the STD diagnostics market by improving test sensitivity and specificity. Molecular assays, rapid point-of-care tests, and multiplex platforms offer faster, more accurate results. These technologies reduce reliance on traditional laboratory methods, enabling decentralized testing in diverse healthcare settings. Integration of digital tools and automated systems streamlines workflows and data management. Enhanced diagnostic performance improves clinical decision-making and patient management. Continuous research drives development of novel assays targeting emerging pathogens, expanding the market’s scope and appeal.

- For instance, Cepheid’s GeneXpert system enables rapid molecular testing with high sensitivity for chlamydia and gonorrhea, delivering results within 90 minutes at the point of care.

Government Initiatives and Public Health Programs Boost Market Growth

Government policies promoting sexual health screening and disease surveillance support expansion in the STD diagnostics market. Funding for awareness campaigns and subsidized testing increases accessibility, particularly in underserved regions. Regulatory bodies encourage adoption of standardized diagnostic protocols to ensure quality and consistency. Collaborations between public and private sectors enhance distribution networks and affordability of diagnostic kits. Health agencies emphasize prevention strategies, reinforcing routine testing recommendations. These efforts collectively stimulate demand for advanced diagnostics and promote early intervention practices globally.

Growing Preference for Point-of-Care and Non-Invasive Testing Solutions

The shift toward patient-centric care drives demand for convenient and rapid STD diagnostic methods. Point-of-care testing allows immediate results during clinical visits, improving treatment timelines and reducing loss to follow-up. Non-invasive sampling techniques, such as urine and self-collected swabs, increase patient compliance and comfort. These features appeal to both healthcare providers and patients seeking accessible, discreet testing options. The STD diagnostics market benefits from the commercialization of user-friendly kits suitable for home use and remote settings. This trend expands market reach and encourages frequent testing behavior.

Market Challenges Analysis

High Cost and Limited Reimbursement Hinder Market Penetration

The STD diagnostics market faces challenges due to the high cost of advanced diagnostic tests and limited reimbursement policies in many regions. Expensive molecular assays and multiplex platforms restrict adoption, particularly in low- and middle-income countries. Healthcare providers and patients may hesitate to invest in costly diagnostics without sufficient insurance coverage or government support. This financial barrier slows market growth and limits accessibility to cutting-edge testing solutions. It compels manufacturers to balance innovation with affordability to expand their customer base. Efforts to develop cost-effective diagnostics remain crucial to overcoming this challenge.

Regulatory Complexities and Diagnostic Accuracy Concerns Impact Market Expansion

Navigating diverse regulatory frameworks across global markets presents a significant obstacle for the STD diagnostics market. Manufacturers encounter prolonged approval processes and stringent compliance requirements that delay product launches. Variability in regulatory standards complicates market entry, especially for novel technologies. Concerns over diagnostic accuracy and false positives or negatives affect healthcare provider confidence and patient trust. It demands rigorous validation and quality control measures to ensure reliability. Overcoming regulatory hurdles and maintaining high diagnostic performance are essential for sustainable market growth and widespread adoption.

Expansion into Emerging Markets with Growing Healthcare Infrastructure

The STD diagnostics market holds significant opportunities in emerging economies where healthcare infrastructure is rapidly developing. Increasing government investments and public health initiatives focus on improving sexual health awareness and access to diagnostic services. Rising urbanization and changing lifestyles contribute to higher demand for reliable STD testing. It creates potential for companies to introduce affordable, scalable diagnostic solutions tailored to local needs. Partnerships with regional healthcare providers and NGOs can accelerate market penetration. Targeting these markets supports broader disease control efforts and fosters long-term growth.

Advancement in Personalized and Precision Diagnostics Enhances Market Potential

Personalized medicine trends open new avenues for the STD diagnostics market through tailored diagnostic approaches based on individual risk profiles. It leverages genomic and proteomic data to identify specific pathogen strains and drug resistance patterns. This enables customized treatment plans that improve patient outcomes and reduce antimicrobial resistance. Investment in next-generation sequencing and biomarker discovery enhances diagnostic accuracy and clinical relevance. The shift toward precision diagnostics aligns with growing demand for targeted therapies and value-based healthcare. It offers manufacturers opportunities to innovate and differentiate their product portfolios.Top of Form

Market Opportunities

Expansion into Emerging Markets with Growing Healthcare Infrastructure

The STD diagnostics market holds significant opportunities in emerging economies where healthcare infrastructure is rapidly developing. Increasing government investments and public health initiatives focus on improving sexual health awareness and access to diagnostic services. Rising urbanization and changing lifestyles contribute to higher demand for reliable STD testing. It creates potential for companies to introduce affordable, scalable diagnostic solutions tailored to local needs. Partnerships with regional healthcare providers and NGOs can accelerate market penetration. Targeting these markets supports broader disease control efforts and fosters long-term growth.

Advancement in Personalized and Precision Diagnostics Enhances Market Potential

Personalized medicine trends open new avenues for the STD diagnostics market through tailored diagnostic approaches based on individual risk profiles. It leverages genomic and proteomic data to identify specific pathogen strains and drug resistance patterns. This enables customized treatment plans that improve patient outcomes and reduce antimicrobial resistance. Investment in next-generation sequencing and biomarker discovery enhances diagnostic accuracy and clinical relevance. The shift toward precision diagnostics aligns with growing demand for targeted therapies and value-based healthcare. It offers manufacturers opportunities to innovate and differentiate their product portfolios.

Market Segmentation Analysis:

By Type

The STD diagnostics market segments by type include Chlamydia, Syphilis, Gonorrhea, Herpes Simplex Virus, Human Papilloma Virus, and Human Immunodeficiency Virus testing. Each segment targets specific pathogens with tailored diagnostic methods to meet clinical needs. Chlamydia and Gonorrhea testing dominate due to their high prevalence, while HIV and HPV testing remain critical for managing chronic infections. It drives development of specialized assays to improve detection accuracy and treatment outcomes across disease types. This segmentation supports targeted screening and effective public health interventions.

- For instance, Lets Get Checked provides at-home Chlamydia and Gonorrhea testing with lab analysis, offering fast turnaround and reliable results supported by certified diagnostic labs.

By Testing

The market divides testing into laboratory devices and point-of-care (POC) devices. Laboratory-based diagnostics offer high-throughput, sensitive analysis suitable for centralized healthcare facilities. POC devices provide rapid, on-site results, facilitating immediate clinical decisions and improved patient management. It benefits healthcare providers by offering flexibility across care settings, from hospitals to remote clinics. Growing demand for POC solutions drives innovation in portable and user-friendly testing technologies, enhancing accessibility and convenience. This balance addresses diverse diagnostic requirements globally.

- For instance, Alpha-fetoprotein (AFP) testing in labs uses a statistical approach called Multiple of the Median (MoM) to screen neural tube defects during pregnancy, normalizing individual test results for clinical accuracy.

By Testing Devices

The STD diagnostics market includes testing devices such as thermal cyclers, PCR systems, lateral flow readers for immunochromatographic assays, flow cytometers, differential light scattering machines, absorbance microplate readers, phone chips, and rapid diagnostic kits. PCR technology remains a cornerstone due to its high sensitivity and specificity for pathogen identification. Lateral flow readers and rapid diagnostic kits support quick, easy-to-use testing in various settings. Emerging platforms like phone chips integrate diagnostics with mobile technology, expanding accessibility. It fosters technological advancement to meet evolving diagnostic demands efficiently.

Segments:

Based on Type

- Chlamydia Testing

- Syphilis Testing

- Gonorrhea Testing

- Herpes Simplex Virus Testing

- Human Papilloma Virus Testing

- Human Immunodeficiency Virus Testing

Based on Testing

- Laboratory Devices

- Point of Care Devices

Based on Testing Devices

- Thermal Cyclers

- PCR

- Lateral Flow Readers – Immunochromatographic Assays

- Flow Cytometers

- Differential Light Scattering Machines

- Absorbance Microplate Reader

- Phone Chips

- Rapid Diagnostic Kits

Based on End-User

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a 35% share of the STD diagnostics market, driven by advanced healthcare infrastructure and widespread adoption of innovative diagnostic technologies. High prevalence of sexually transmitted infections and well-established screening programs increase demand for accurate and rapid testing solutions. It benefits from strong government support and funding for sexual health initiatives. The presence of major diagnostic companies and research institutions accelerates product development and commercialization. Growing awareness about early diagnosis and prevention fuels market growth. North America remains a key region for technology adoption and regulatory advancements in STD diagnostics.

Europe

Europe accounts for 25% of the STD diagnostics market, supported by stringent regulatory frameworks and comprehensive public health programs targeting sexually transmitted infections. It features well-developed healthcare systems that emphasize routine screening and early detection. The region promotes the use of advanced molecular diagnostics and point-of-care devices in both clinical and community settings. It benefits from collaborations between government agencies and private sector players to enhance accessibility. Rising investments in sexual health awareness campaigns and research contribute to steady market expansion. Europe maintains a strong focus on improving diagnostic accuracy and patient outcomes.

Asia-Pacific

Asia-Pacific represents 30% of the STD diagnostics market, led by rapid urbanization, increasing healthcare expenditure, and growing awareness about sexual health. It experiences rising incidence rates of STIs in several countries, driving demand for accessible and affordable diagnostic solutions. It offers vast growth potential due to expanding healthcare infrastructure and government initiatives promoting screening programs. The region witnesses increasing adoption of point-of-care devices and mobile health technologies to overcome resource limitations. Partnerships between global diagnostic firms and local manufacturers accelerate market penetration. Asia-Pacific remains a vital market for both emerging and established diagnostic technologies.

Rest of the World

The Rest of the World holds 10% share in the STD diagnostics market, including Latin America, Middle East, and Africa. Growing awareness and improving healthcare infrastructure fuel gradual adoption of STD testing solutions. It faces challenges such as limited access to advanced diagnostics and varying regulatory environments. However, rising government focus on disease control programs and international aid initiatives support market development. The region shows increased uptake of rapid diagnostic kits and point-of-care testing to address resource constraints. It presents emerging opportunities for manufacturers targeting underserved populations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GenMark Diagnostics, Inc. (U.S.)

- Cepheid (U.S.)

- DiaSorin (Italy)

- Abbott (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.

- Hologic Inc. (U.S.)

- BD (U.S.)

- OraSure Technologies, Inc. (U.S.)

- Danaher (U.S.)

- bioMérieux SA (U.S.)

- Biocartis (Belgium)

Competitive Analysis

The STD diagnostics market features intense competition among global and regional players focusing on innovation, product quality, and market expansion. Key companies invest heavily in research and development to enhance diagnostic accuracy, speed, and ease of use. It drives continuous introduction of advanced molecular assays, rapid diagnostic kits, and point-of-care devices tailored to diverse healthcare settings. Strategic partnerships, mergers, and acquisitions enable companies to strengthen their distribution networks and broaden their geographic presence. Competitive pricing and regulatory compliance remain critical factors influencing market share. Leading firms prioritize expanding their product portfolios to address emerging pathogens and co-infections. They also emphasize digital integration and user-friendly platforms to improve patient experience. The market’s competitive landscape fosters technological advancements and increases accessibility, positioning it for sustained growth globally.

Recent Developments

- In October 2024, Labcorp partnered with NOWDiagnostics to exclusively distribute the FDA-authorized First to Know Syphilis Test, improving accessibility for syphilis detection.

- In 2024, Abingdon Health launched a full-service commercial office and laboratory in Madison, Wisconsin, to support its expansion in the STD diagnostics market.

- In June 2023, Newfoundland Diagnostics and Atomo Diagnostics collaborated to distribute rapid at-home HIV self-test kits across the UK and Europe.

- In February 2023, Mylab launched three rapid detection kits targeting sexually transmitted infections such as HIV, Hepatitis C, and Syphilis, aiming to provide quicker and more affordable diagnosis.

Market Concentration & Characteristics

The STD diagnostics market exhibits a moderately concentrated structure, dominated by a few key global players that hold significant market share through extensive product portfolios and strong distribution networks. It features intense competition centered on technological innovation, regulatory compliance, and strategic partnerships to expand geographic reach and enhance service offerings. Market leaders invest heavily in research and development to introduce advanced molecular assays, rapid diagnostic kits, and point-of-care devices that improve diagnostic accuracy and speed. It experiences continuous entry of emerging companies focusing on niche applications and cost-effective solutions targeting underserved regions. The market’s characteristics include a growing emphasis on patient-centric, non-invasive testing methods and integration with digital health platforms to enhance user experience. Manufacturers balance innovation with affordability to address diverse healthcare settings worldwide. This competitive dynamic drives rapid technological advancements and supports sustainable growth in the global STD diagnostics market.

Report Coverage

The research report offers an in-depth analysis based on Type, Testing Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The STD diagnostics market will benefit from continued technological innovation in rapid and molecular testing methods.

- Increased focus on early detection and prevention will drive demand for advanced diagnostic solutions.

- Expansion of point-of-care testing will improve accessibility and patient convenience globally.

- Integration of digital health platforms will streamline diagnostics and enhance patient management.

- Growth in emerging markets will create new opportunities for affordable and scalable diagnostic products.

- Development of multiplex testing kits will support simultaneous detection of multiple infections.

- Non-invasive sample collection methods will increase patient compliance and testing frequency.

- Personalized diagnostics will enable targeted treatment and better disease management.

- Strategic partnerships between diagnostic companies and healthcare providers will expand market reach.

- Regulatory advancements will facilitate faster approval and adoption of novel diagnostic technologies.