Market Overview

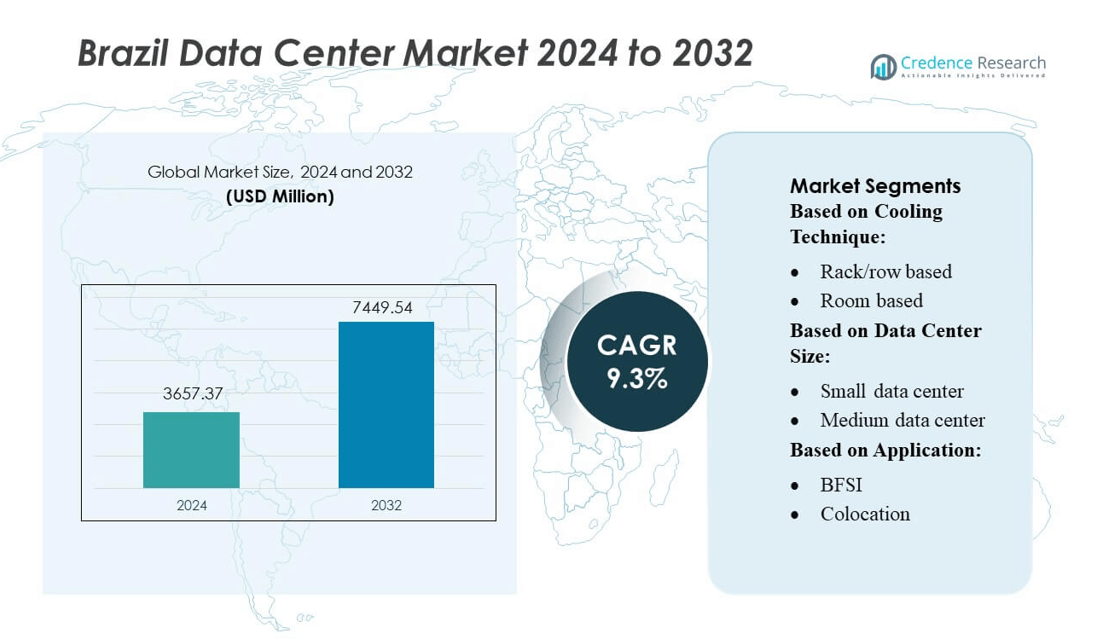

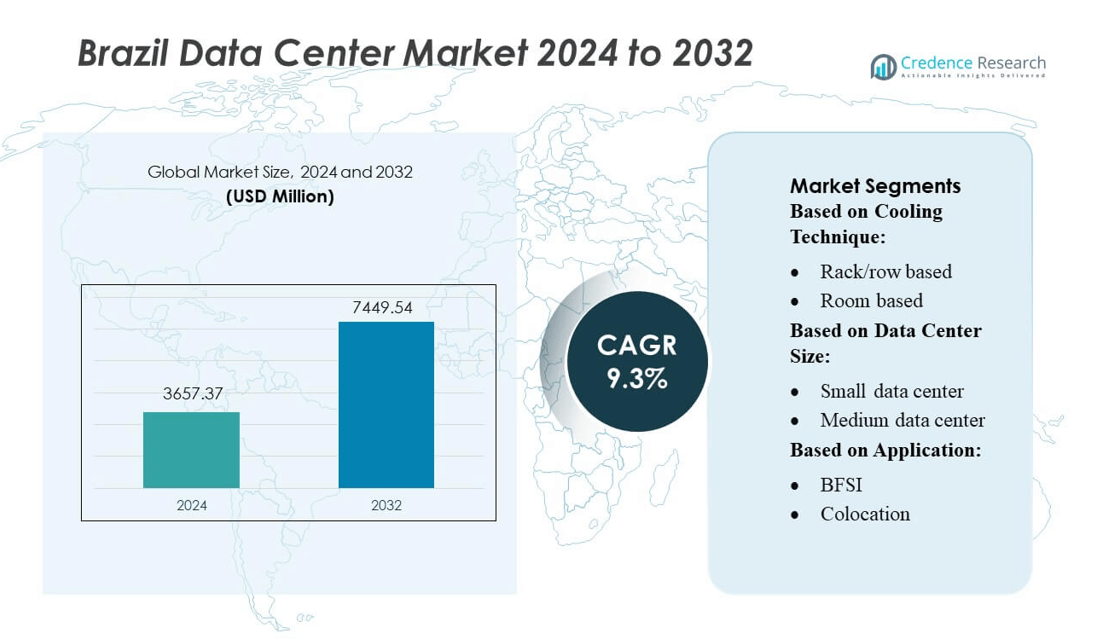

Brazil Data Center Market size was valued USD 3657.37 million in 2024 and is anticipated to reach USD 7449.54 million by 2032, at a CAGR of 9.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Brazil Data Center Market Size 2024 |

USD 3657.37 million |

| Brazil Data Center Market, CAGR |

9.3% |

| Brazil Data Center Market Size 2032 |

USD 7449.54 million |

The Brazil Data Center Market is driven by a strong mix of global cloud providers, regional colocation operators, and technology infrastructure companies that continue to expand capacity to support rising digital demand. Competition centers on delivering scalable, energy-efficient, and AI-ready facilities capable of meeting the needs of enterprise, telecom, and public-sector customers. The Southeast region stands as the clear market leader, accounting for approximately 52% of total data center capacity due to its superior connectivity, robust power infrastructure, and concentration of financial and technology hubs. This region continues to attract the majority of new hyperscale and colocation investments, reinforcing its dominant position in Brazil’s digital ecosystem.

Market Insights

- The Brazil Data Center Market reached USD 3,657.37 million in 2024 and is projected to hit USD 7,449.54 million by 2032, growing at a CAGR of 9.3%, supported by strong cloud adoption and digital transformation.

- Market growth is driven by rising demand for scalable colocation facilities, AI-ready infrastructure, and energy-efficient designs as enterprises modernize IT operations across key industries.

- Key trends include rapid hyperscale expansion, increased deployment of high-density racks, and stronger focus on renewable-powered and low-latency edge data centers.

- Competitive activity intensifies as operators upgrade power and cooling systems, expand interconnection ecosystems, and adopt automation to enhance efficiency and uptime.

- The Southeast region leads with 52% market share, while room-based cooling dominates the segment landscape and colocation accounts for the largest application share, reflecting strong enterprise outsourcing preferences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Cooling Technique

In the Brazil data center market, room-based cooling remains the dominant segment, supported by its simple installation, low upfront cost, and suitability for legacy facilities that make up a large share of existing infrastructure. Operators prefer this technique for its broad coverage and easy maintenance, which helps manage thermal loads in large halls. However, rack/row-based cooling is expanding rapidly as newer data centers handle higher rack densities, AI processing, and edge deployments. Its targeted airflow, improved efficiency, and lower energy consumption are driving adoption among modern colocation and cloud facilities that require tighter temperature control.

- For instance, Schneider Electric’s Uniflair in-rack DX unit delivers 3.5 kW of cooling per rack, enabling precise thermal control in edge or high-density environments. This solution is designed for single racks in micro data centers where air cooling is sufficient.

By Data Center Size

Medium-sized data centers lead the Brazil market because they offer an optimal balance of scalability, operational efficiency, and manageable investment levels. These facilities are widely used by regional cloud providers, digital service companies, and enterprises undergoing IT modernization. Their flexible capacity enables quick expansions in response to rising digital traffic. Meanwhile, large data centers are growing as global hyperscalers increase investments in AI-ready infrastructure. Small data centers continue serving localized and edge computing needs, but their market share remains smaller due to limited capacity and slower modernization compared to medium and large facilities.

- For instance, Hitachi Vantara VSP E1090 model (part of the VSP E Series) delivers sub-41 µs latency per its datasheet and supports clustering of up to 65 appliances, which equates to 130 controllers and 260 CPUs, with a total of 4,160 cores.

By Application

The colocation segment holds the largest share of the Brazil data center market, driven by enterprises shifting from on-premises setups to shared facilities that reduce CAPEX, enhance reliability, and provide access to strong connectivity ecosystems. Colocation demand is further supported by fintech expansion, cloud adoption, and rising interconnection needs across industries. BFSI forms one of the strongest growth drivers due to increasing digital banking, payment systems, and regulatory requirements for secure data handling. Government, healthcare, and energy sectors also contribute steadily as digital transformation initiatives accelerate and critical services adopt modern, compliant digital infrastructure.

Key Growth Drivers

Rising Cloud Adoption and Digital Transformation

Brazil’s data center market grows significantly as enterprises accelerate cloud migration, driven by digital transformation programs across banking, e-commerce, and government services. Companies increasingly adopt hybrid and multi-cloud architectures, generating strong demand for scalable compute and storage infrastructure. The expansion of SaaS platforms and digital payments also requires low-latency environments, pushing cloud providers to invest in localized data centers. As businesses modernize legacy systems, the need for high-performance, secure, and compliant facilities continues to strengthen, positioning cloud adoption as one of the most influential growth drivers in the country.

- For instance, Nortek’s FANWALL® Technology—documented in its official engineering specifications—uses multiple small, independent fans that provide up to 70% airflow turndown, enabling precise cooling control as cloud workloads fluctuate.

Expansion of Colocation and Interconnection Ecosystems

Colocation demand rises sharply as enterprises seek cost-effective, scalable alternatives to in-house infrastructure. Organizations benefit from robust interconnection ecosystems that support fast data exchange among cloud providers, fintechs, content platforms, and telecom carriers. Brazil’s growing digital economy, combined with its role as South America’s connectivity hub, strengthens the need for dense colocated environments. This trend supports investment in carrier-neutral facilities, edge nodes, and peering points. The ability to scale capacity on demand, avoid CAPEX, and access reliable power and cooling makes colocation a primary driver of sustained market expansion.

- For instance, STULZ CyberRow precision cooling system delivers between 11 kW and 58 kW of cooling capacity per unit and is known for its high efficiency, especially at part load or when utilizing available free cooling.

Increasing Investments in Hyperscale and AI Infrastructure

Hyperscale cloud providers and global technology firms are rapidly expanding in Brazil to support rising demand for AI, big data processing, and GPU-intensive workloads. New large-scale campuses introduce high-density racks, advanced cooling technologies, and renewable-energy integration to meet performance and sustainability targets. AI adoption across banking, retail, logistics, and public services requires strong compute capacity, making hyperscale data centers essential to Brazil’s digital modernization. This investment surge accelerates the development of advanced facilities, enhances regional compute availability, and strengthens Brazil’s position as a strategic digital infrastructure hub in Latin America.

Key Trends & Opportunities

Growth of Edge Data Centers and Low-Latency Applications

Brazil experiences rising demand for edge data centers as 5G rollout, IoT expansion, and real-time digital applications accelerate nationwide. Industries such as retail, gaming, logistics, and autonomous systems require ultra-low latency performance closer to end users. Edge facilities enable faster processing, reduce data transport costs, and support mission-critical applications like telemedicine and smart-city operations. This trend creates strong opportunities for regional operators to deploy micro-data centers in secondary cities, improving network efficiency while expanding digital infrastructure beyond major hubs such as São Paulo and Rio de Janeiro.

- For instance, NTT demonstrated APN-connected data centers with a round-trip latency of just 0.9 milliseconds over a 100 Gbps link, and jitter below 0.1 microsecond, proving its suitability for real-time applications.

Rising Focus on Green Data Centers and Renewable Energy Adoption

Sustainability becomes a central trend in Brazil’s data center industry as operators seek energy-efficient designs, liquid cooling systems, and renewable power integration. With rising electricity costs and environmental pressures, providers increasingly adopt solar, wind, and hydro-based energy sources to lower operational expenses and meet ESG commitments. Green data centers attract global enterprises that prioritize carbon reduction, creating opportunities for operators offering high PUE efficiency and certified green facilities. The strong availability of renewable resources across Brazil positions the country to become a regional leader in sustainable digital infrastructure.

- For instance, Rittal’s Blue e+ chillers use hybrid heat-pipe technology and inverter-controlled components to deliver precise cooling with ± 0.5 K temperature accuracy, while reducing refrigerant volume by up to 55%, according to Rittal product specs.

Increasing Demand for High-Density and AI-Ready Facilities

The rapid adoption of AI, cloud-native systems, and GPU-accelerated workloads drives demand for high-density racks and advanced cooling solutions. Data centers increasingly shift toward liquid cooling, modular designs, and optimized airflow management to support power-intensive applications. This trend creates opportunities for operators to upgrade existing facilities and develop new AI-ready campuses. Enterprises across banking, retail, and manufacturing continue deploying AI models that require strong compute capacity, reinforcing the need for future-ready infrastructure capable of supporting higher power usage effectiveness (PUE) and scalable processing environments.

Key Challenges

High Energy Costs and Power Infrastructure Constraints

Brazil’s data center market faces challenges due to fluctuating energy prices and the pressure of maintaining stable, cost-efficient power supply for high-density operations. Many regions experience grid limitations, increasing the complexity of deploying large-scale facilities. Operators must invest heavily in redundant power systems, backup generators, and renewable integration to ensure consistent uptime. These constraints raise operational expenditures and slow expansion plans, particularly in secondary cities. Balancing high performance with energy efficiency becomes crucial as data centers scale to support cloud, AI, and digital-service growth across the country.

Regulatory, Compliance, and Talent Shortages

Strict data-sovereignty rules, cybersecurity mandates, and sector-specific compliance requirements increase operational complexity for data center operators. Meeting regulatory standards demands continuous investment in security systems, certifications, and monitoring tools. At the same time, Brazil faces a shortage of skilled professionals in data center engineering, network design, and facility operations, slowing project execution and increasing labor costs. The scarcity of specialized cooling, electrical, and IT technicians further limits market growth. These regulatory and workforce pressures pose significant challenges for operators aiming to expand capacity and maintain competitive service levels.

Regional Analysis

North America

North America holds the largest share of the global data center market at around 38–40%, driven by strong hyperscale investments, mature cloud adoption, and dense interconnection ecosystems. The United States remains the core hub, led by major cloud providers and colocation operators expanding AI-ready and high-density facilities. Demand is further strengthened by 5G growth, enterprise hybrid-cloud adoption, and the rapid rise of GPU-intensive workloads. Canada contributes to regional expansion through renewable-energy-based data centers. Overall, North America remains the world’s most advanced and capacity-rich data center region.

Europe

Europe accounts for approximately 25–27% of the global data center market, supported by strong regulatory frameworks, digital-sovereignty initiatives, and government-led cloud modernization. Key markets—including Germany, the UK, the Netherlands, and France—drive capacity growth through hyperscale expansions and colocation demand from financial services, manufacturing, and public institutions. Sustainability commitments are a major influence as operators shift toward renewable energy and energy-efficient cooling systems. Increasing demand for AI infrastructure and compliance-driven data localization further strengthens Europe’s position as a critical global data center hub.

Asia-Pacific

Asia-Pacific is the fastest-growing region, holding about 28–30% of global market share, fueled by rapid digitalization, expanding cloud ecosystems, and massive population-driven data consumption. Key markets such as China, India, Japan, Singapore, and Australia attract large investments from global hyperscalers and regional telecom operators. Growth is driven by e-commerce expansion, fintech adoption, 5G rollout, and AI-driven workloads. While power and land constraints challenge high-density hubs like Singapore and Tokyo, strong investment pipelines and large-scale campus developments continue positioning Asia-Pacific as the primary global growth engine.

Latin America

Latin America represents around 6–7% of the global data center market, with Brazil holding the largest share within the region. The region’s growth is driven by rising cloud adoption, increasing digitization of banking and government services, and expanding subsea cable connectivity. Brazil, Chile, and Mexico are the leading hubs, attracting hyperscale and colocation investments to support low-latency cloud services. Despite challenges such as uneven power availability and high capital costs, Latin America offers strong future growth potential due to expanding digital demand and improved regional connectivity infrastructure.

Middle East

The Middle East accounts for roughly 3–4% of global data center market share, but it is one of the fastest-emerging regions due to large government-led digital transformation programs. Countries such as the UAE, Saudi Arabia, and Qatar are investing heavily in hyperscale facilities, smart-city initiatives, and cloud localization strategies. Abundant solar energy supports the development of sustainable, high-capacity data centers. As global tech companies expand regional availability zones and enterprises adopt cloud-first strategies, the Middle East is rapidly strengthening its position as a strategic data center destination.

Market Segmentations:

By Cooling Technique:

- Rack/row based

- Room based

By Data Center Size:

- Small data center

- Medium data center

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Brazil Data Center Market features leading global and regional players such as Schneider Electric, Hitachi Ltd., Nortek Air Solutions LLC, STULZ GMBH, NTT Ltd., Rittal GmbH & Co. KG, Mitsubishi Electric Corporation, Johnson Controls, Fujitsu, and Dell Inc. The Brazil Data Center Market continues to intensify as global cloud providers, colocation operators, and infrastructure solution companies expand their presence to meet rising digital demand. Competition focuses heavily on delivering energy-efficient designs, scalable modular facilities, and AI-ready high-density architectures capable of supporting advanced workloads. Providers increasingly prioritize renewable energy integration, advanced cooling technologies, and automation to reduce operational costs and enhance uptime. Strategic partnerships with telecom operators, hyperscale cloud platforms, and enterprise customers play a key role in strengthening market reach. As demand for low-latency, secure, and compliant infrastructure accelerates, companies differentiate through innovation, sustainability, and strong interconnection ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schneider Electric

- Hitachi, Ltd.

- Nortek Air Solutions, LLC

- STULZ GMBH

- NTT Ltd.

- Rittal GmbH & Co. KG

- Mitsubishi Electric Corporation

- Johnson Controls

- Fujitsu

- Dell Inc.

Recent Developments

- In May 2025, Sanmina Corporation, a manufacturing solutions company, announced its definitive agreement to acquire the data center infrastructure manufacturing business of ZT Systems.

- In February 2025, Alibaba Cloud establishes second data center in Thailand with richer product portfolio for generative AI and industry-specific solutions. The expansion was specifically designed to meet the growing demand for cloud computing services and support the development of generative AI applications in the region.

- In December 2024, AWS announced redesigned data center infrastructure to support AI and sustainability, featuring liquid cooling, improved power distribution, and new rack designs that will enable a sixfold increase in rack power density over the next two years.

- In May 2024, Equinix, Inc. launched its first two International Business Exchange (IBX) data centers in Malaysia: JH1 in Johor and KL1 in Kuala Lumpur. These facilities are operational and intended to serve local and international customers while enhancing regional connectivity

Report Coverage

The research report offers an in-depth analysis based on Cooling Technique, Data Center Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as cloud adoption accelerates across enterprises and public institutions.

- Hyperscale investments will increase to support AI, big data, and high-density workloads.

- Colocation demand will rise as businesses shift from on-premises infrastructure to scalable shared facilities.

- Renewable-energy integration will strengthen as operators prioritize sustainability and efficiency.

- Edge data centers will grow to support 5G, IoT, and low-latency digital services across more regions.

- Advanced cooling technologies will gain adoption to manage increasing rack densities.

- Data-sovereignty requirements will drive more local storage and processing capacity.

- Interconnection ecosystems will expand as digital platforms seek faster and more reliable connectivity.

- Modernization of legacy facilities will accelerate to meet high-performance and compliance standards.

- Strategic partnerships between telecom operators, cloud providers, and data center firms will shape future growth.