Market Overview

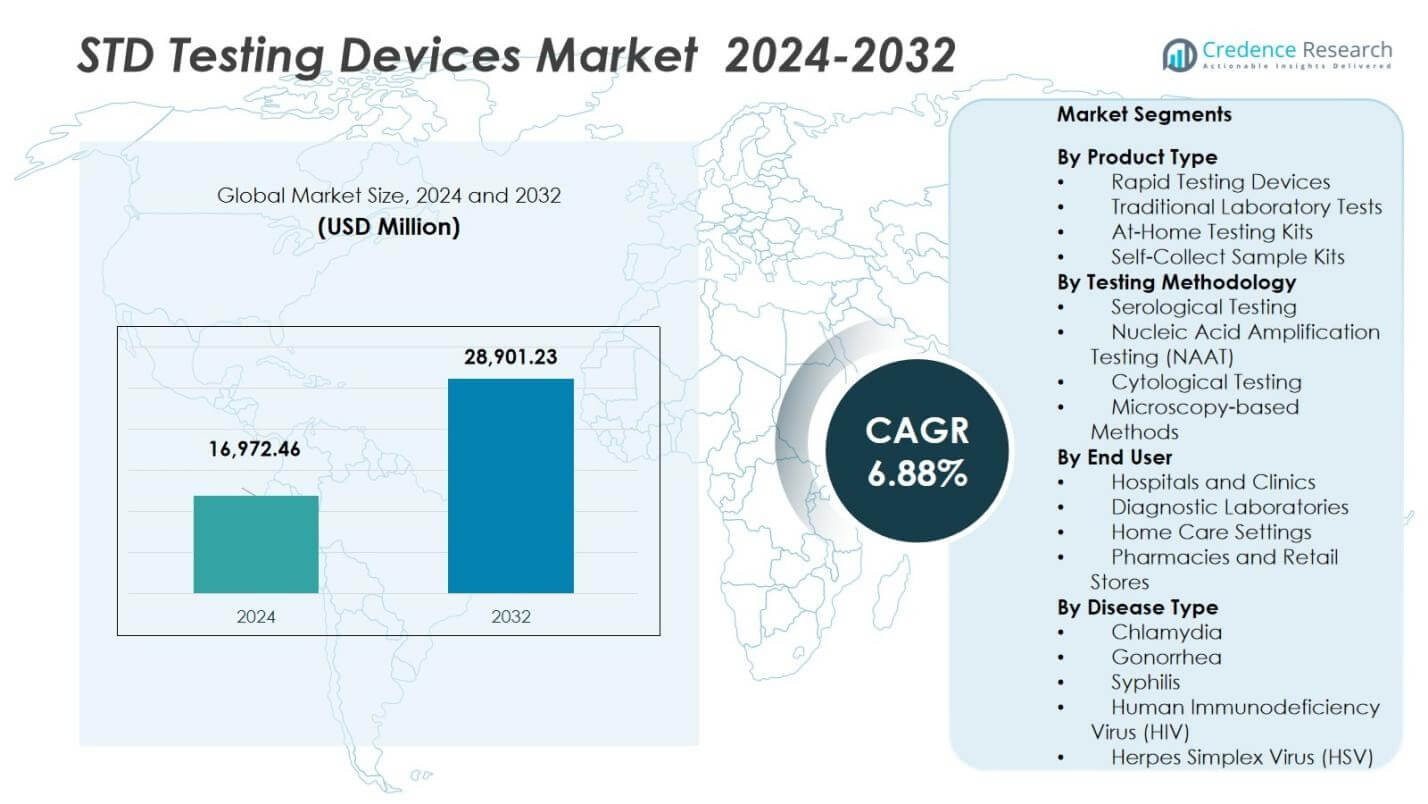

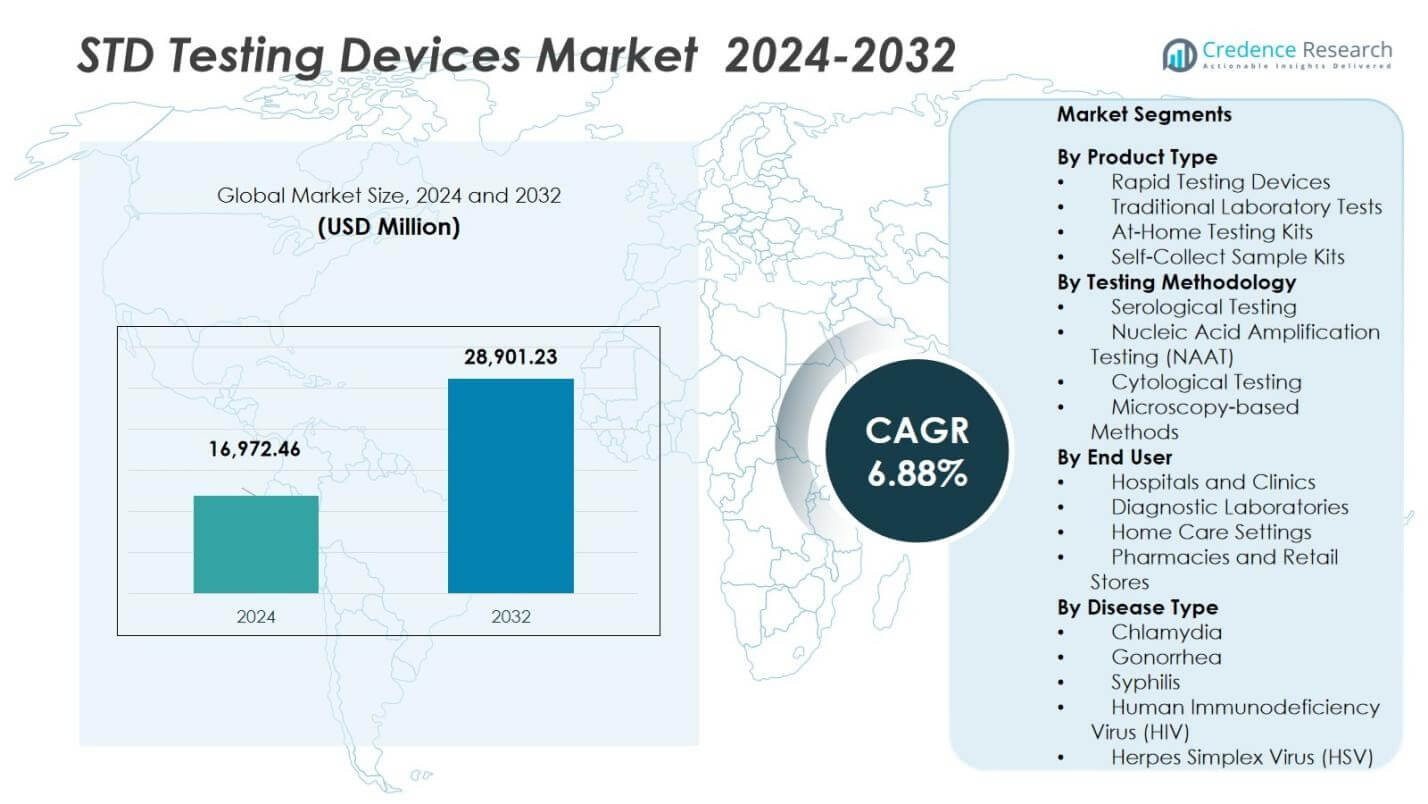

The STD Testing Devices Market size was valued at USD 16,972.46 Million in 2024 and is anticipated to reach USD 28,901.23 Million by 2032, at a CAGR of 6.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| STD Testing Devices Market Size 2024 |

USD 16,972.46 Million |

| STD Testing Devices Market, CAGR |

6.88% |

| STD Testing Devices Market Size 2032 |

USD 28,901.23 Million |

The STD Testing Devices Market features key players such as Abbott Laboratories, F. Hoffmann‑La Roche Ltd., Becton, Dickinson and Company (BD), Hologic Inc., and Cepheid Inc. (a subsidiary of Danaher Corporation), which drive innovation in rapid, molecular and at‑home testing solutions. Geographically, North America is the leading region with a market share of 38.2 % in 2024, underpinned by advanced healthcare infrastructure, high awareness levels and strong diagnostic test adoption. Europe follows with a share of 28 % in 2024, supported by established screening programs and regulatory support for early detection of infections.

Market Insights

- The STD Testing Devices Market was valued at USD 16,972.46 million in 2024 and is projected to grow to USD 28,901.23 million by 2032 at a CAGR of 6.88%.

- Demand for rapid testing devices, which held a 42% segment share, is rising as healthcare providers and consumers prioritise speed and convenience for screening.

- The Asia‑Pacific region is emerging as a growth zone thanks to expanding infrastructure and rising STD incidence, while North America maintains leadership with a 38.2% regional share and Europe follows with 28%.

- Leading companies such as Abbott Laboratories, Roche, BD and Hologic are focusing on home‑testing kits, point‑of‑care platforms and mobile‑connected diagnostics to strengthen market positioning.

- Regulatory complexity and limited consumer awareness remain key restraints; slower approval processes and patient stigma hinder the uptake of home and self‑collect testing solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The STD Testing Devices Market is categorized into four primary product types: Rapid Testing Devices, Traditional Laboratory Tests, At-Home Testing Kits, and Self-Collect Sample Kits. Among these, Rapid Testing Devices dominate the market, holding a significant market share of 42%. The demand for rapid testing is driven by the need for quick results, ease of use, and increasing adoption in both clinical and home settings. The convenience, speed, and accuracy of these devices are key growth drivers, especially in remote or underserved regions, making them the preferred choice for many consumers and healthcare providers.

- For instance, Abbott’s Determine HIV‑1/2 rapid test can deliver clear results in about 15 minutes and has demonstrated sensitivity around 100% and specificity close to or above 97–98% in multiple evaluations, enabling reliable point‑of‑care screening in clinics and outreach programs.

By Testing Methodology

The testing methodologies in the STD Testing Devices Market include Serological Testing, Nucleic Acid Amplification Testing (NAAT), Cytological Testing, and Microscopy-based Methods. Nucleic Acid Amplification Testing (NAAT) is the dominant sub-segment, commanding 40% of the market share. This methodology is favored due to its high sensitivity and accuracy in detecting sexually transmitted infections at early stages. NAAT’s ability to detect low levels of infection with precision is a key driver for its adoption across diagnostic laboratories and healthcare centers, where accurate results are essential for effective treatment.

- For instance, Nucleic Acid Amplification Testing (NAAT) is widely used to detect Chlamydia trachomatis and Neisseria gonorrhoeae with high sensitivity and specificity, employing methods such as strand displacement amplification and transcription-mediated amplification for accurate detection even from rectal swabs in both men and women.

By End User

The end users of STD testing devices include Hospitals and Clinics, Diagnostic Laboratories, Home Care Settings, and Pharmacies and Retail Stores. Hospitals and Clinics lead this segment, contributing to 45% of the market share. The high volume of patient testing, coupled with advanced healthcare infrastructure and the growing emphasis on early detection of STDs, propels the dominance of hospitals and clinics in this sector. Moreover, the ability of these establishments to provide comprehensive diagnostic services further fuels their market share, making them a pivotal part of the STD testing landscape.

Key Growth Drivers

Increasing Prevalence of STDs

The rising prevalence of sexually transmitted diseases (STDs) worldwide is a major growth driver for the STD testing devices market. With an increasing number of reported cases, particularly among young adults and high-risk populations, there is a growing demand for efficient and accessible testing solutions. Public health campaigns and awareness programs highlighting the importance of early detection further propel market growth. As more individuals seek regular testing to mitigate the spread of infections, demand for both home-based and clinical testing devices continues to rise.

- For instance, Visby Medical’s FDA-approved Women’s Sexual Health Test, released in 2025, a palm-sized PCR test providing at-home results for Chlamydia, Gonorrhea, and Trichomoniasis within 30 minutes, enhancing testing privacy and convenience.

Technological Advancements in Testing Devices

Advancements in testing technology are significantly driving the STD testing devices market. Innovations such as rapid testing devices, home test kits, and self-collect sample kits offer greater convenience and improved accuracy. These technologies provide faster results, enhancing patient satisfaction and enabling immediate treatment decisions. Furthermore, advancements in molecular diagnostic techniques, such as Nucleic Acid Amplification Testing (NAAT), offer higher sensitivity and specificity, addressing the need for more reliable testing options, especially for hard-to-detect STDs.

- For instance, binx health introduced the binx io system, the first FDA 510(k) and CLIA-waived molecular test for chlamydia and gonorrhea. This compact, easy-to-use platform delivers lab-quality results in approximately 30 minutes, allowing for same-visit diagnosis and treatment.

Shift Toward Home-based Testing

The growing preference for home-based testing is a major contributor to the market’s growth. With increased consumer awareness about privacy, convenience, and the need for at-home healthcare solutions, home STD testing kits are seeing significant demand. These devices provide individuals with an easy and discreet option to check for STDs without visiting healthcare facilities. The COVID-19 pandemic has further accelerated this shift, making consumers more inclined toward self-testing and online healthcare solutions, thereby boosting the adoption of at-home STD testing devices.

Key Trends & Opportunities

Growth of Point-of-Care Testing

Point-of-care (POC) testing is gaining traction in the STD testing devices market, driven by the need for quick, on-the-spot results. POC testing devices, such as rapid test kits, enable patients to receive results in real-time, facilitating immediate decision-making and reducing the waiting time associated with traditional laboratory tests. This trend presents a significant opportunity for manufacturers to develop innovative POC devices that offer high accuracy and are easy to use in non-laboratory settings like clinics, pharmacies, and even home environments.

- For instance, Abbott’s Alinity m STI Assay offers simultaneous testing for multiple sexually transmitted infections with results available in less than two hours, allowing clinicians to prescribe targeted treatments during the same patient visit.

Integration of Mobile Health (mHealth) Solutions

The integration of mobile health solutions with STD testing devices is another growing trend. Many testing devices now feature connectivity to smartphones or apps, enabling users to track results, receive guidance, and even consult with healthcare professionals remotely. This trend opens up opportunities for manufacturers to expand the functionality of STD testing devices, making them more user-friendly and accessible. Furthermore, mHealth integration enhances data management, allowing healthcare providers to monitor trends and improve patient care, creating a new avenue for market growth.

- For instance, the LYNX and MyChoices mobile apps developed through NIH partnerships, which enable young men who have sex with men to order HIV self-test kits and STI self-collection kits via the app, receive results digitally, and access prevention services.

Key Challenges

Regulatory and Compliance Issues

One of the significant challenges in the STD testing devices market is navigating the complex regulatory and compliance landscape. Different regions have varying standards and regulations governing the approval and marketing of medical devices, particularly diagnostic tools. Companies must invest significant resources in meeting these regulatory requirements, which can delay product launches and increase costs. Additionally, the need to maintain high standards of quality and accuracy in testing devices further complicates the regulatory process, creating barriers for new entrants and even established players.

Limited Consumer Awareness and Acceptance

Despite the increasing prevalence of STDs, limited consumer awareness and acceptance of certain testing methods remain a challenge. While awareness of STD prevention and testing is growing, some individuals still hesitate to utilize available testing options due to privacy concerns, fear of stigma, or a lack of understanding about the importance of regular testing. This reluctance to adopt testing devices, particularly home-based kits, can hinder market growth. Overcoming these barriers through education and increased accessibility is crucial for expanding the market and achieving widespread adoption.

Regional Analysis

North America

The North American region leads the global STD testing devices market with a share of 38.2 % in 2024. The stronghold arises from advanced healthcare infrastructure, robust reimbursement policies, and high awareness of sexually transmitted infections. Healthcare providers in the United States and Canada increasingly adopt rapid and point‑of‑care devices, thereby expanding testing coverage. Key drivers include heightened screening initiatives, advanced diagnostics technologies, and widespread availability of home‑testing solutions. The region’s mature market status also fosters innovation, fueling continuous growth in device adoption across clinical and consumer settings.

Europe

Europe accounts for an estimated market share of 28 % in 2024 in the STD testing devices sector. This region benefits from well‑established public‑health programmes, regulatory frameworks, and a dense network of diagnostic laboratories and clinics. Countries such as the United Kingdom, Germany and France are witnessing rising uptake of nucleic acid amplification testing (NAAT) and self‑collect kits. The driver is an emphasis on early detection and prevention of sexually transmitted infections, supported by government‑run screening campaigns and increasing consumer interest in at‑home testing options, which together bolster device demand.

Asia‑Pacific

The Asia‑Pacific region holds 22 % of the global STD testing devices market in 2024. Rapid healthcare infrastructure expansion, rising prevalence of STDs and growing public‑health awareness in economies such as China and India underpin its growth. In addition, the increasing affordability of rapid testing devices and self‑collect sample kits is boosting adoption among younger populations. Manufacturers are targeting this region with market entry strategies, local partnerships and cost‑effective solutions. The large target population and expanding access to diagnostics provide a substantial platform for device‑market expansion in the forecast period.

Latin America

Latin America represents 7 % of the global STD testing devices market in 2024. Growth is driven by national public‑health initiatives aimed at STI screening and prevention, especially in Brazil and Mexico, and the gradual introduction of at‑home testing kits. Nonetheless, the region faces infrastructure and budgetary constraints compared to developed markets. Improvement in supply chains, increased partnerships between diagnostic firms and public sectors, and rising awareness of sexual health across the population are expected to enhance device penetration and expand the regional market over the coming years.

Middle East & Africa

The Middle East & Africa (MEA) region accounts for 4 % of the global STD testing devices market in 2024. The region’s growth is primarily supported by expanding healthcare access, higher testing uptake in key markets like South Africa and Saudi Arabia, and international non‑governmental programmes focused on STI control. Key barriers include limited healthcare infrastructure in some geographies and variable regulatory frameworks. However, increasing donor‑funded STI screening campaigns, rising mobile healthcare adoption and the introduction of affordable rapid/home tests are creating expanding opportunities for device manufacturers in MEA.

Market Segmentations:

By Product Type

- Rapid Testing Devices

- Traditional Laboratory Tests

- At-Home Testing Kits

- Self-Collect Sample Kits

By Testing Methodology

- Serological Testing

- Nucleic Acid Amplification Testing (NAAT)

- Cytological Testing

- Microscopy-based Methods

By End User

- Hospitals and Clinics

- Diagnostic Laboratories

- Home Care Settings

- Pharmacies and Retail Stores

By Disease Type

- Chlamydia

- Gonorrhea

- Syphilis

- Human Immunodeficiency Virus (HIV)

- Herpes Simplex Virus (HSV)

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the STD Testing Devices market features major key players such as Abbott Laboratories, F. Hoffmann‑La Roche Ltd. (Roche), Becton, Dickinson and Company (BD), Hologic Inc., Cepheid (a Danaher company) and Thermo Fisher Scientific Inc.. The market is marked by high competition as companies focus on innovation, strategic collaborations and geographic expansion to gain advantage. Firms are investing in home‑testing kits, rapid point‑of‑care devices and molecular diagnostic platforms to differentiate their offerings. Meanwhile, smaller players are forming partnerships or niche‑focusing on self‑collect sample kits and emerging markets to capture share. Regulatory approvals, reimbursement policies and brand trust are key differentiators in gaining adoption among hospitals, diagnostics laboratories and consumers. Overall, the competitive dynamic is intensifying as players scale production, enhance distribution networks and leverage digital health integration to meet growing demand across clinical and home settings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Roche received U.S. FDA clearance with a CLIA waiver for its cobas® liat molecular assays (CT/NG and CT/NG/MG) to diagnose sexually transmitted infections at the point of care.

- In March 2025, bioLytical Laboratories launched its INSTI Multiplex HIV‑1/2 & Syphilis Antibody Test in Australia, offering a rapid dual‑infection testing option with results in about 60 seconds.

- In December 2024, OraSure Technologies announced the acquisition of Sherlock Biosciences’ molecular diagnostics platform to expand its rapid STD testing pipeline.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Testing Methodology, End User, Disease Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of at‑home testing kits will increase markedly as consumers demand privacy, convenience and faster access to test results.

- Integration of digital health platforms (mobile apps, cloud‑connected devices, tele‑consultation) will enable remote monitoring and boost device adoption.

- Emerging markets in Asia‑Pacific, Latin America and MEA will contribute growing share as healthcare infrastructure expands and awareness of STDs rises.

- Manufacturers will increasingly focus on multiplex testing devices capable of detecting multiple infections in a single run to improve cost‑efficiency and patient outcomes.

- Point‑of‑care testing devices will gain traction in both clinical and non‑clinical settings, reducing dependency on centralized laboratories.

- Regulatory bodies will streamline approvals and reimbursement policies for rapid and at‑home STD tests, accelerating market rollout.

- Data analytics and AI integration will support predictive diagnostics, offering tailored screening and early detection pathways.

- Partnerships between diagnostic firms, pharmacies and e‑commerce platforms will expand distribution channels and end‑user reach.

- Persistent social stigma and regulatory barriers will drive innovation in discreet testing solutions and educational campaigns to enhance uptake.

- Sustained investment in R&D will result in improved sensitivity and specificity of tests, enabling earlier diagnosis and better disease control outcomes.