Market Overview

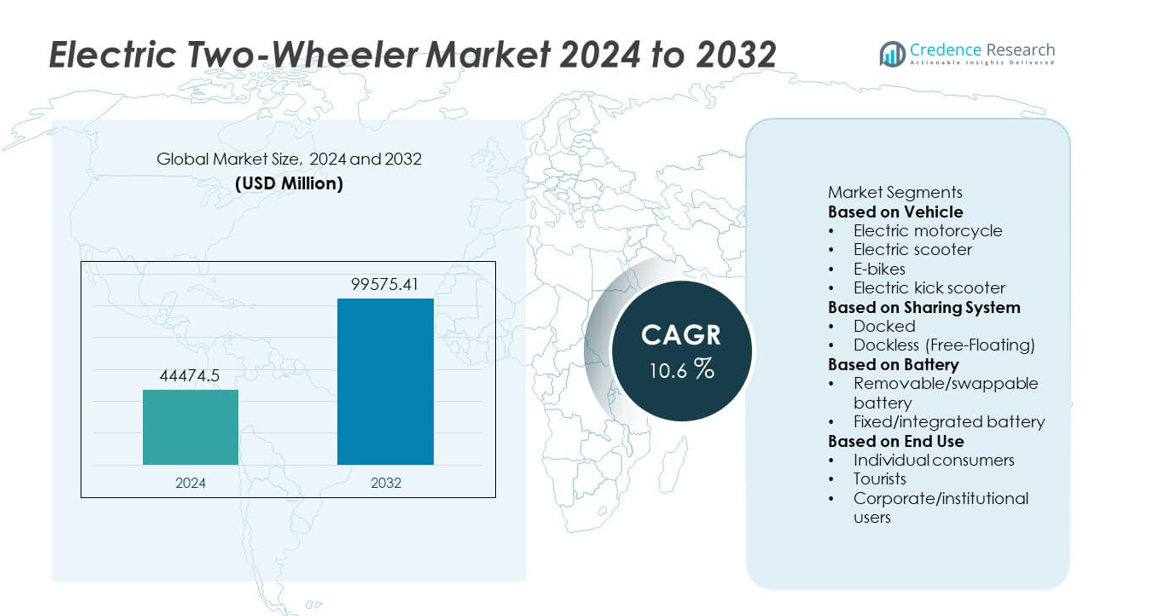

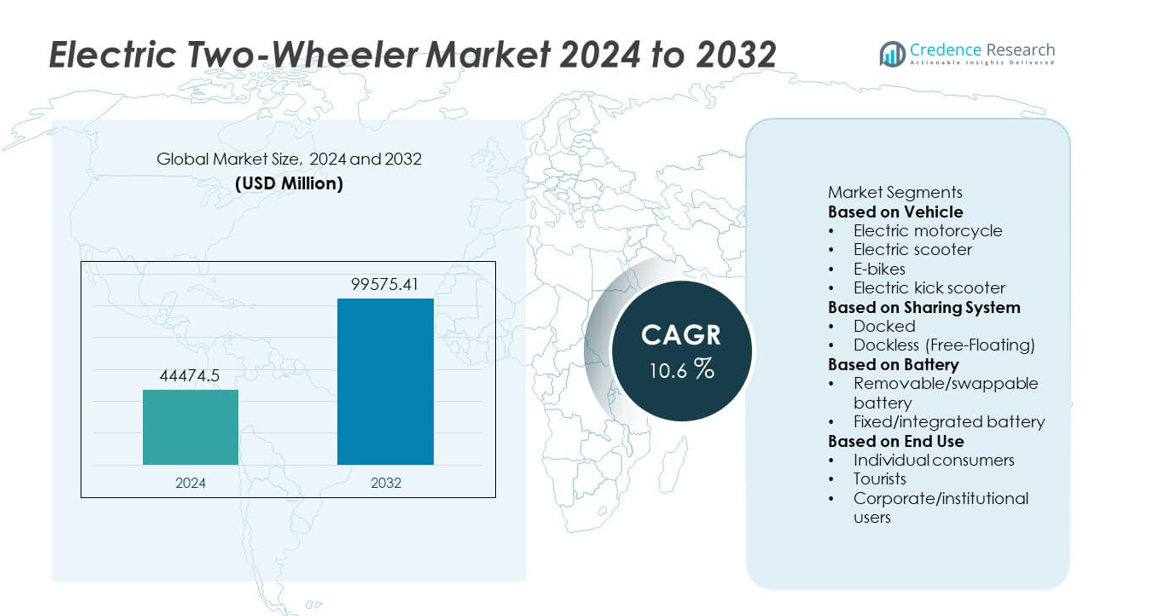

The Electric Two-Wheeler Market was valued at USD 44,474.5 million in 2024 and is projected to reach USD 99,575.41 million by 2032, growing at a CAGR of 10.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Two-Wheeler Market Size 2024 |

USD 44,474.5 million |

| Electric Two-Wheeler Market , CAGR |

10.6% |

| Electric Two-Wheeler Market Size 2032 |

USD 99,575.41 million |

The Electric Two-Wheeler Market is led by key players such as Yulu, Bolt, TIER Mobility, GrabWheels, Bird.co, Voi Technology, Lime Micromobility, Helbiz, Revel, and Dott. These companies are driving innovation through smart connectivity, battery-swapping solutions, and app-based micro-mobility services. Continuous expansion of shared electric scooter and e-bike fleets in major cities supports rapid market penetration. Asia-Pacific emerged as the leading region, holding a 69% market share in 2024, driven by strong local manufacturing and government incentives. Europe followed with 17%, supported by strict emission targets, while North America accounted for 9%, propelled by growing adoption in shared mobility and urban transport solutions.

Market Insights

- The Electric Two-Wheeler Market was valued at USD 44,474.5 million in 2024 and is projected to reach USD 99,575.41 million by 2032, growing at a CAGR of 10.6% during the forecast period.

- Growth is driven by government incentives, rising fuel prices, and increasing adoption of cost-effective, emission-free transport for urban commuting and delivery applications.

- Market trends focus on battery-swapping technology, connected mobility, and the rise of shared e-scooter and e-bike platforms to enhance convenience and reduce operating costs.

- Leading players such as Yulu, Lime Micromobility, TIER Mobility, and Bird.co are investing in smart mobility platforms, lightweight vehicle designs, and regional fleet expansion strategies.

- Asia-Pacific dominates the market with a 69% share, followed by Europe with 17% and North America with 9%, while electric scooters lead the vehicle segment with a 55% share due to their strong urban mobility demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle

The electric scooter segment dominated the Electric Two-Wheeler Market in 2024 with a 55% market share. Its leadership is supported by growing adoption for short-distance urban commuting and delivery services. Electric scooters offer cost efficiency, compact design, and low maintenance, appealing to both individual users and fleet operators. Manufacturers such as Yadea, Hero Electric, and Niu Technologies are expanding smart and connected scooter models with advanced lithium-ion batteries. Increasing demand for eco-friendly personal transport and rapid expansion of city-based e-mobility programs continue to strengthen this segment’s dominance.

- For instance, Yadea’s KS6 Pro electric scooter is powered by a 500 W brushless motor paired with a 15 Ah lithium battery, offering a range of up to 55 km per charge and a top speed of up to 30 km/h. The model integrates an intelligent control system and a triple braking system (disc, drum, and regenerative electric), which aids in energy recovery during daily commutes.

By Sharing System

The dockless (free-floating) segment held a 62% market share in 2024, driven by its flexibility and convenience for users. This system allows riders to pick up and drop vehicles anywhere within service zones, enhancing accessibility. Major cities across Europe, Asia, and North America are adopting dockless models to support sustainable urban transport. Technology integration, including GPS tracking and mobile app-based rentals, further boosts adoption. Operators like Lime and Bird are scaling fleet size and geographic coverage, making dockless sharing a preferred model for micro-mobility expansion.

- For instance, Lime Micromobility operates a global fleet of e-scooters and e-bikes that exceeded 270,000 vehicles in early 2025, deploying them across its network of over 280 cities. Its vehicles are equipped with IoT modules for real-time fleet tracking, with many featuring swappable batteries to reduce downtime.

By Battery

The removable or swappable battery segment accounted for a 57% market share in 2024. Its popularity is due to the convenience of quick battery replacement and minimal downtime for riders. This technology supports better energy management and allows fleet operators to optimize vehicle availability. Companies such as Gogoro and Ather Energy are developing large-scale battery-swapping networks to enhance accessibility. The flexibility and cost-effectiveness of removable systems make them ideal for both personal and commercial applications, driving widespread adoption in densely populated urban areas worldwide.

Key Growth Drivers

Government Incentives and Emission Regulations

Supportive government policies and emission control regulations are major drivers for the electric two-wheeler market. Subsidies, tax exemptions, and purchase incentives encourage consumers to shift from fuel-powered to electric vehicles. Countries across Asia and Europe are setting stricter emission targets, boosting EV adoption. Urban areas are also introducing low-emission zones, accelerating the replacement of conventional scooters and bikes. These initiatives reduce ownership costs and promote local manufacturing, strengthening electric mobility ecosystems and driving strong adoption across commuter and delivery segments.

- For instance, India’s government provided Yulu with support to expand its electric fleet under local manufacturing incentives. Yulu’s stated goal is to deploy 100,000 electric vehicles by 2025. Its Miracle GR scooter is powered by a lithium-ion battery, achieving a significant range per charge while contributing to zero tailpipe emissions in urban areas.

Technological Advancements in Battery and Charging Systems

Advancements in lithium-ion and solid-state batteries are transforming the performance and reliability of electric two-wheelers. Improved energy density, faster charging, and enhanced battery life have made electric models more practical for daily commuting. Manufacturers are integrating regenerative braking and smart energy management systems to improve efficiency. Fast-charging and swappable battery technologies are reducing range anxiety and downtime. Continuous R&D investment in compact and lightweight battery solutions continues to strengthen vehicle performance, driving consumer confidence and large-scale adoption worldwide.

- For instance, Gogoro developed its swappable battery network with over 2,500 GoStations supporting 540,000 daily battery swaps across Taiwan. Each smart lithium-ion pack stores 1.7 kWh of energy and completes a full swap in less than 6 seconds, enabling seamless power continuity for shared e-scooter fleets operated by partners like Yamaha and Hero MotoCorp.

Rising Urbanization and Growing Demand for Affordable Mobility

Increasing urban population density and traffic congestion are pushing demand for compact and affordable mobility solutions. Electric two-wheelers offer cost-effective alternatives to cars and public transport for short-distance travel. Their low maintenance, reduced fuel dependency, and eco-friendly operation appeal to both individuals and commercial users. The rapid growth of e-commerce and last-mile delivery services further supports fleet electrification. With improving infrastructure and digital ride-sharing platforms, electric two-wheelers are becoming a practical choice for urban transportation in emerging and developed markets.

Key Trends & Opportunities

Expansion of Shared Mobility and Micro-Mobility Services

The rise of shared mobility platforms is driving demand for electric scooters and bikes in urban areas. Companies are investing in large-scale e-fleet deployments to offer affordable, app-based rentals. Dockless systems and smart GPS tracking have made shared electric vehicles more convenient for daily use. Governments are supporting these initiatives as part of sustainable city mobility programs. The growing preference for flexible, short-distance travel options creates opportunities for manufacturers and operators to collaborate on connected, low-emission transport solutions.

- For instance, Third Lane Mobility Inc., the parent company of Bird and Spin, operates a micromobility fleet that serves cities and university campuses across North America, Europe, and the Middle East.

Integration of Smart and Connected Technologies

Electric two-wheelers are rapidly integrating digital technologies such as IoT, telematics, and AI-driven systems. These features enable real-time tracking, remote diagnostics, and predictive maintenance. Manufacturers are adding smartphone connectivity, GPS navigation, and digital dashboards to enhance rider experience. Connected features also help fleet operators optimize usage and monitor performance. This trend supports data-driven mobility solutions and improves operational efficiency. As consumer expectations shift toward convenience and intelligence, connected electric two-wheelers will become standard across both personal and commercial markets.

- For instance, Voi Technology introduced its Voiager 5 e-scooter equipped with an IoT system capable of transmitting location and performance data. The V5 includes a high-precision GPS antenna for sub-meter accuracy to assist with parking, improving safety and enabling predictive maintenance through data analysis. Rider engagement is enhanced via its connected mobile platform, which uses a QR code for unlocking and other features.

Key Challenges

High Initial Cost and Battery Replacement Expense

Despite operational savings, electric two-wheelers still face challenges from high upfront costs. Batteries represent a major portion of vehicle price, limiting affordability for mass consumers. The expense of battery replacement after a few years of usage further impacts total ownership cost. Although declining battery prices are improving accessibility, cost competitiveness with petrol-based models remains a concern in developing regions. Financial support, leasing programs, and battery-as-a-service models will be essential to overcome this challenge and increase market penetration.

Limited Charging Infrastructure and Range Constraints

stations, creating inconvenience for riders. Range limitations also discourage potential buyers, particularly in areas with poor grid support. Manufacturers and energy providers are now collaborating to expand charging networks and deploy compact home chargers. Overcoming infrastructure barriers through public-private partnerships and standardized charging systems will be critical for enabling consistent, large-scale market growth.

Regional Analysis

Asia-Pacific

Asia-Pacific held the largest market share of 69% in 2024, driven by high adoption in China, India, and Southeast Asia. Strong government incentives, urban congestion, and rising fuel costs have accelerated the shift toward electric mobility. China leads the market with large-scale production and domestic consumption supported by companies such as Yadea, AIMA, and Niu Technologies. India and Indonesia are expanding manufacturing capabilities and EV infrastructure under national electrification programs. Affordable pricing, battery-swapping networks, and growing e-commerce delivery demand continue to strengthen Asia-Pacific’s leadership in the global electric two-wheeler market.

Europe

Europe captured a 17% market share in 2024, supported by stringent emission regulations and growing urban sustainability initiatives. Countries like Germany, France, and the Netherlands are promoting electric mobility through subsidies and charging infrastructure investments. The rising popularity of e-bikes and shared electric scooters in metropolitan areas has fueled demand. Manufacturers are focusing on performance, design, and integration of connected technologies to appeal to eco-conscious consumers. Strong environmental policies and expansion of smart mobility services will continue to support Europe’s role as a fast-growing region in the electric two-wheeler market.

North America

North America accounted for a 9% market share in 2024, driven by increasing adoption in the U.S. and Canada. The market benefits from rising fuel costs, government rebates, and the growth of last-mile delivery services. Electric bikes and scooters are gaining traction in urban centers as cities promote clean and compact transport options. Companies like Bird, Lime, and Harley-Davidson’s LiveWire are expanding product portfolios to capture consumer and commercial segments. Investments in charging infrastructure and strong regulatory backing will further enhance regional growth over the forecast period.

Latin America

Latin America held a 3% market share in 2024, led by emerging adoption in Brazil, Mexico, and Colombia. Economic focus on affordable and sustainable transport options is driving interest in electric scooters and e-bikes. Local governments are introducing pilot projects and incentive schemes to promote electric mobility in urban areas. Manufacturers are partnering with regional distributors to establish assembly units and charging networks. Although adoption is at an early stage, growing environmental awareness and urban delivery demand indicate significant potential for market expansion in the coming years.

Middle East & Africa

The Middle East and Africa accounted for a 2% market share in 2024, reflecting early-stage adoption supported by government sustainability programs. The UAE, Saudi Arabia, and South Africa are investing in electric mobility as part of long-term carbon reduction strategies. Growing urbanization and tourism-related transport demand are creating opportunities for electric scooter deployment. However, limited charging infrastructure and high import costs remain challenges. With planned EV infrastructure investments and supportive policies, the region is expected to witness steady growth in electric two-wheeler adoption during the forecast period.

Market Segmentations:

By Vehicle

- Electric motorcycle

- Electric scooter

- E-bikes

- Electric kick scooter

By Sharing System

- Docked

- Dockless (Free-Floating)

By Battery

- Removable/swappable battery

- Fixed/integrated battery

By End Use

- Individual consumers

- Tourists

- Corporate/institutional users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Two-Wheeler Market includes major players such as Yulu, Bolt, TIER Mobility, GrabWheels, Bird.co, Voi Technology, Lime Micromobility, Helbiz, Revel, and Dott. These companies focus on expanding product portfolios, improving battery technology, and developing sustainable shared mobility solutions. Strategic collaborations with city authorities and energy providers are strengthening their market presence across urban regions. Many players are integrating IoT-based fleet management, smart connectivity, and AI-driven analytics to enhance operational efficiency. Regional startups are emphasizing affordability and localized production to gain market traction. Meanwhile, established companies are investing in fast-charging and swappable battery systems to reduce downtime and improve user convenience. The increasing focus on micro-mobility, digital platforms, and environmentally responsible transport solutions continues to intensify competition in the global electric two-wheeler market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Yulu

- Bolt

- TIER Mobility

- GrabWheels

- co

- Voi Technology

- Lime Micromobility

- Helbiz

- Revel

- Dott

Recent Developments

- In April 2025, Lime entered an exclusive agreement with Redwood Materials (founded by ex-Tesla CTO JB Straubel) to recycle lithium-ion batteries from its shared e-bikes and scooters in the U.S., Germany, and the Netherlands. Lime sends end-of-life batteries (5–7 years old, ~500 charge cycles) to Redwood’s Nevada facility.

- In 2025, Yulu expanded its presence in the quick-commerce segment via its Yulu Dex low-speed electric scooter line, emphasizing delivery use cases under 25 km/h.

- In August 2024, Lime officially entered the Japanese market with its e-scooter service in Tokyo, marking its first expansion into East Asia. The launch, which began on August 19, 2024, introduces 200 Gen4.1 and Gen4.1 Seated e-scooters across six wards: Shibuya, Shinjuku, Meguro, Setagaya, Toshima, and Nakano.

- In 2024, Yulu turned EBITDA positive and announced plans to deploy 100,000 electric vehicles by 2025, scaling its shared mobility footprint.

- In 2024, TIER Mobility and Dott finalized their merger, retiring the TIER brand and operating all scooters and e-bikes under the Dott platform in 427 cities

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Sharing System, Battery, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The electric two-wheeler market will expand rapidly as urban areas adopt clean mobility.

- Battery technology improvements will enhance range, performance, and charging efficiency.

- Shared mobility and rental platforms will continue driving large-scale adoption in cities.

- Manufacturers will focus on lightweight designs and modular battery architectures for better efficiency.

- Public and private investments in charging networks will strengthen operational convenience.

- Partnerships between automakers and energy firms will accelerate battery-swapping infrastructure development.

- Government policies and emission targets will remain key growth enablers worldwide.

- Connected technologies will enhance vehicle monitoring, fleet management, and user experience.

- Emerging markets will see increased adoption due to affordable pricing and local manufacturing initiatives.

- Sustainability goals and digital innovation will shape the next phase of electric two-wheeler transformation.