Market Overview:

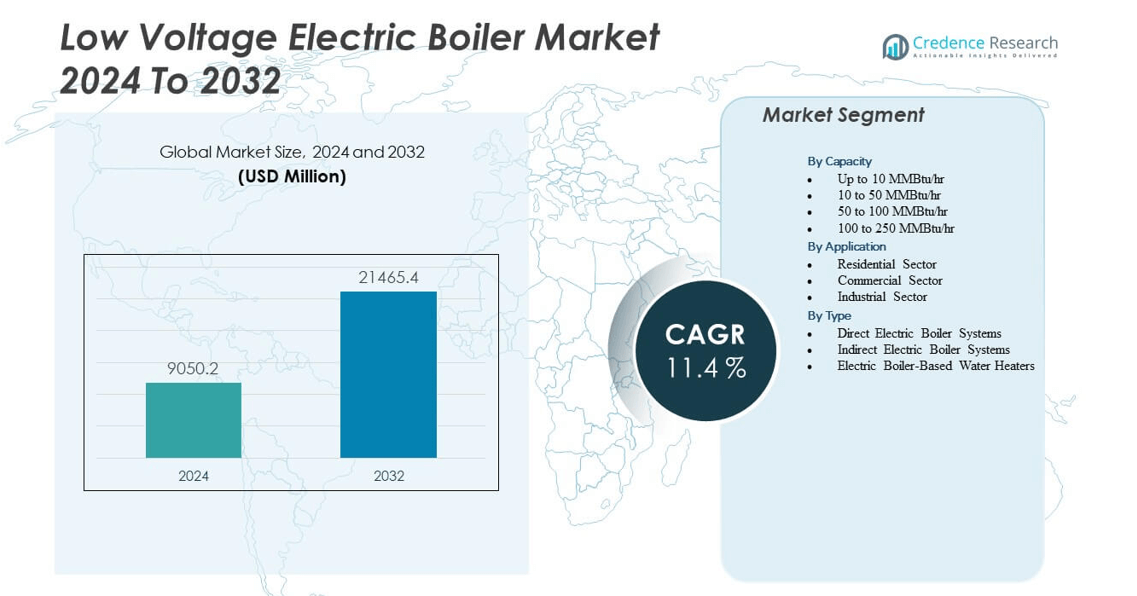

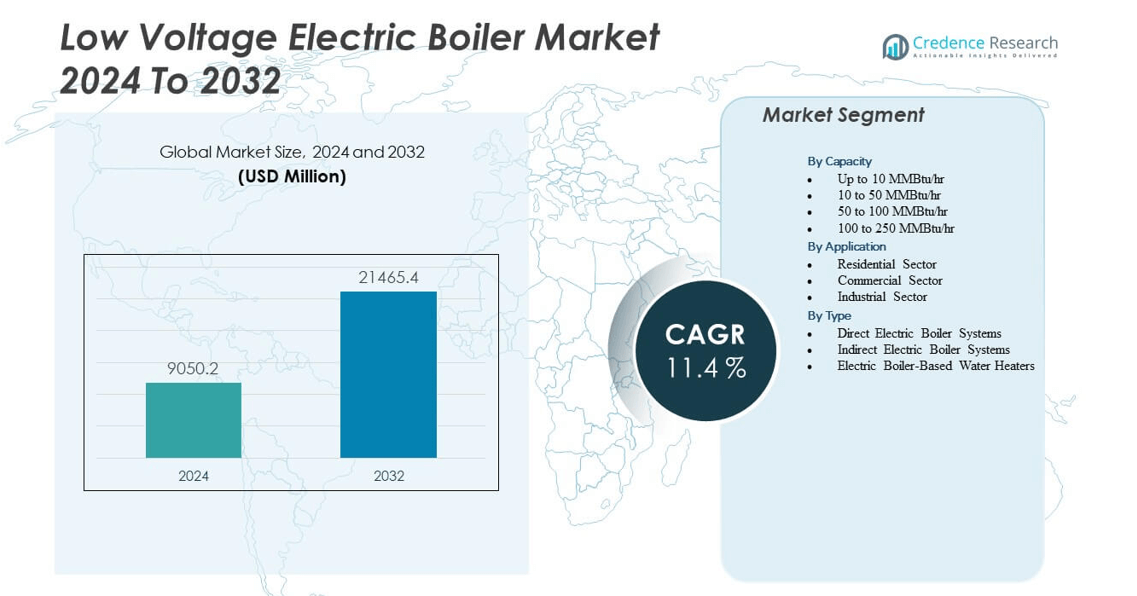

The low voltage electric boiler market is projected to grow from USD 9,050.2 million in 2024 to an estimated USD 21,465.4 million by 2032, with a compound annual growth rate (CAGR) of 11.4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Voltage Electric Boiler Market Size 2024 |

USD 9,050.2 million |

| Low Voltage Electric Boiler Market, CAGR |

11.4% |

| Low Voltage Electric Boiler Market Size 2032 |

USD 21,465.4 million |

The market is being driven by the rising focus on decarbonization, electrification of heating systems, and the global shift toward renewable energy integration. Governments are implementing stricter emission regulations, creating opportunities for electric boilers to replace conventional fossil-fuel-based heating systems. Growing demand from industries such as food processing, chemical, and pharmaceuticals, along with the increasing adoption of district heating projects, further accelerates growth. Advances in smart boiler technology and digital monitoring also enhance efficiency, reducing operational costs and strengthening market penetration.

Regionally, Europe is leading due to strong regulatory mandates supporting clean energy transitions and widespread adoption of electric heating in industrial and commercial facilities. North America follows with increasing investments in sustainable heating technologies and supportive government policies. Asia-Pacific is emerging as a high-growth region, driven by rapid industrialization, urbanization, and rising investments in green infrastructure across China, Japan, and India. The Middle East is gradually adopting electric boilers for sustainable heating in industrial projects, while Latin America shows potential through renewable energy integration in developing economies.

Market Insights:

- The low voltage electric boiler market is projected to grow from USD 9,050.2 million in 2024 to USD 21,465.4 million by 2032, registering a CAGR of 11.4%.

- Strong demand for electrification of heating systems across industrial, commercial, and residential sectors is driving adoption.

- Government policies supporting emission reduction and renewable integration are creating favorable growth conditions.

- High initial capital costs and grid reliability concerns in developing regions act as key restraints for wider deployment.

- Europe leads the market with 38% share, supported by strict regulations and advanced heating infrastructure.

- North America accounts for 27% share, with strong adoption in commercial and industrial applications.

- Asia-Pacific holds 22% share and is the fastest-growing region due to industrial expansion and supportive policies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Electrification Across Industrial Heating Applications

The Low voltage electric boiler market is expanding rapidly due to the growing demand for electrification of heating systems across industries. Governments and regulatory bodies are actively promoting policies that encourage a shift away from fossil fuels, creating a fertile ground for adoption. Manufacturing sectors such as food processing, textiles, and chemicals are increasingly deploying these boilers to meet environmental compliance. It is supported by industries focusing on operational efficiency and long-term cost reduction. Electrification ensures greater energy efficiency and helps reduce carbon footprints, aligning with sustainability goals. Industrial end-users view this transition as an opportunity to modernize their facilities with cleaner technology. Growing consumer and stakeholder pressure on organizations to commit to sustainable practices reinforces this movement. Such policy, industrial, and consumer-driven changes strongly accelerate the global acceptance of low voltage electric boilers.

Government Initiatives Supporting Energy Efficiency and Sustainability Goals

Governments across developed and developing regions are intensifying their climate action strategies, directly influencing adoption patterns. The Low voltage electric boiler market is witnessing accelerated acceptance as financial incentives, tax credits, and subsidies encourage industrial players to invest. Countries in Europe and North America are leading this initiative by implementing stricter emission caps that limit reliance on coal and gas-fired heating. It is receiving strong regulatory backing to support integration within district heating projects and industrial plants. Organizations find it strategically valuable to adopt technologies that align with mandatory emission reduction targets. Corporate ESG agendas also contribute, with businesses prioritizing greener equipment to enhance brand reputation and meet reporting obligations. This strong regulatory and organizational momentum is reshaping demand across multiple regions. Ongoing policy developments are expected to keep driving investments into low voltage electric boilers.

- For example, Danfoss partnered with HOFOR, Copenhagen’s largest district heating utility, to implement its Leanheat® software solution. The system uses real-time data, weather forecasts, and demand predictions to optimize supply temperatures across the district heating network. The collaboration has improved efficiency, reduced energy consumption by around 5% in pilot projects, and supported the integration of renewable heat sources into Copenhagen’s heating infrastructure, in line with strong regulatory incentives.

Integration of Renewable Energy Sources with Industrial Heating Systems

The rising global share of renewable energy sources plays a pivotal role in reshaping heating technologies. The Low voltage electric boiler market benefits significantly as these boilers are well-suited to operate on renewable electricity without emissions. Solar and wind power integration with industrial heating solutions is advancing, making operations cleaner and more cost-efficient. It is emerging as a preferred option for facilities aiming to utilize renewable power purchase agreements effectively. Industrial operators value the compatibility of electric boilers with green energy as they improve operational sustainability. Governments and utilities are also investing in infrastructure that enhances grid reliability and renewable integration. Corporate strategies focusing on long-term decarbonization continue to expand the adoption base across industrial, commercial, and residential sectors. Such synergy between renewable energy growth and electrification is cementing electric boilers as a cornerstone of future heating infrastructure.

- For example, ABB upgraded control systems at the Harper Lake solar thermal plant, part of the SEGS complex in California, one of the world’s largest Concentrated Solar Power (CSP) facilities. Using ABB Ability™ Symphony® Plus automation, the modernization enhanced reliability, diagnostics, and overall plant performance. ABB has also supplied advanced control solutions to China’s first commercial CSP plant in Delingha, supporting efficient operations and improved production processes.

Advancements in Digital Monitoring and Smart Boiler Technologies

Technology advancements have become a crucial driver of efficiency, reliability, and adoption. The Low voltage electric boiler market is witnessing the deployment of smart monitoring systems that optimize operational performance. Predictive maintenance, digital controls, and remote monitoring capabilities are ensuring higher efficiency and reduced downtime. It is transforming conventional heating operations into digitally connected and data-driven systems. Manufacturers are focusing on automation and real-time monitoring features to enhance user experience and reduce operating costs. End-users are leveraging advanced analytics to predict faults and extend equipment lifespan. This innovation-driven momentum increases trust among industrial buyers and strengthens product positioning. Digitalization of heating infrastructure creates a competitive edge for businesses seeking long-term sustainability and operational excellence.

Market Trends:

Expansion of District Heating Networks Incorporating Electric Boiler Solutions

Urbanization and modernization of infrastructure are reshaping heating networks globally. The Low voltage electric boiler market is experiencing strong adoption in district heating networks that require efficient, clean, and adaptable systems. Growing investments in sustainable urban energy infrastructure are creating new opportunities. It is enabling cities to integrate renewable energy sources with electric boilers for reliable community-level heating. Policymakers are encouraging low-emission solutions to meet carbon-neutral targets. District heating operators are adopting electric boilers for flexibility and ease of integration into grids. This trend enhances the role of electric boilers in shaping resilient, modern heating frameworks. Expansion of such networks highlights their importance in energy transitions worldwide.

Shift Toward Modular and Scalable Boiler System Designs

Flexibility in installation and capacity adjustment is becoming a central requirement. The Low voltage electric boiler market is advancing with modular and scalable system designs suited for varied industrial demands. Industries seek equipment that can easily adapt to fluctuations in energy consumption and production cycles. It is positioning modular solutions as preferred choices for both small and large-scale operations. Manufacturers are innovating with compact designs that reduce footprint while maintaining performance efficiency. Scalability allows users to align equipment capacity with future expansions, ensuring long-term viability. Cost optimization and operational flexibility further support adoption. Such trends highlight the increasing preference for adaptable and future-ready solutions in heating technology.

- For example, Chromalox offers packaged electric steam boilers with power ratings ranging from 3 kW to 1,620 kW, delivering outputs from 9 lb to 4,883 lb of steam per hour. These systems are designed to meet diverse industrial heating requirements with reliable and efficient performance.

Rising Focus on Zero-Emission Heating Technologies in Energy-Intensive Sectors

Decarbonization targets are accelerating interest in zero-emission alternatives across industries. The Low voltage electric boiler market is benefiting from its ability to provide efficient heating without direct emissions. Energy-intensive industries such as chemicals, pharmaceuticals, and textiles are adopting electric boilers as part of broader sustainability agendas. It is enabling them to meet regulatory and customer-driven environmental expectations. Companies are publicizing their sustainability achievements, creating reputational advantages. Industry leaders are investing in advanced designs that improve energy utilization and minimize waste. Growing emphasis on cleaner industrial processes drives ongoing innovation. This trend is reinforcing the market’s position as a viable replacement for fossil-fuel systems.

- For example, Bosch deployed an electric steam boiler (ELSB) in an Icelandic pilot facility part of a sustainable packaging operation capable of producing 4,000 kg per hour of steam. The boiler operates entirely on renewable power sources like wind and hydropower, making the steam generation fully carbon-neutral. It also delivers high efficiency, system flexibility, and process reliability.

Increasing Investments in Research and Development of Advanced Boiler Materials

Material innovation is strengthening efficiency and reliability across heating systems. The Low voltage electric boiler market is witnessing investments in advanced alloys, coatings, and insulation materials. Such developments are improving durability and extending operational lifespan. It is reducing maintenance costs and increasing adoption across industries that require reliability under demanding conditions. Manufacturers are prioritizing materials that can handle higher pressures and temperatures while maintaining efficiency. Enhanced safety standards and performance certification are supporting confidence in adoption. Strategic collaborations with research institutions are further accelerating development. This continuous improvement in design and materials is shaping the future direction of electric boilers.

Market Challenges Analysis:

High Initial Capital Costs and Economic Barriers to Large-Scale Adoption

The Low voltage electric boiler market faces challenges in scaling due to significant upfront investment requirements. High installation costs compared with traditional fossil-fuel boilers discourage some industrial and commercial users. It creates hesitation among small and medium enterprises that operate on constrained budgets. Financial barriers are particularly strong in developing markets where cost sensitivity is high. Industries often prioritize short-term cost savings over long-term operational benefits, limiting immediate adoption. Utility infrastructure upgrades required to support electric boiler deployment also add to costs. Lack of awareness about lifecycle savings reinforces financial resistance. These barriers collectively slow down broader market penetration in certain regions.

Grid Reliability Issues and Lack of Supporting Infrastructure in Developing Regions

Infrastructure limitations remain a critical restraint for emerging economies. The Low voltage electric boiler market encounters difficulties where electricity grids lack reliability or capacity to support heavy industrial loads. It creates risks of downtime and inefficiency for users relying on stable heating operations. Limited renewable integration in some regions also reduces the sustainability benefits of adopting electric boilers. Industries located in rural or semi-urban areas often face capacity constraints that hinder adoption. Investment in smart grid infrastructure is progressing slowly in many developing economies. Dependence on fossil fuels remains strong, limiting energy diversification. These challenges underscore the importance of policy support and infrastructure modernization for future market growth.

Market Opportunities:

Expansion of Renewable Energy Projects and Green Industrial Infrastructure

The global energy transition is creating significant opportunities for sustainable heating systems. The Low voltage electric boiler market is benefiting as renewable energy projects expand and integrate with industrial applications. It is positioned as a reliable solution for industries seeking zero-emission heating systems aligned with decarbonization goals. Companies are adopting electric boilers to enhance ESG performance and meet regulatory expectations. Large-scale infrastructure projects focusing on renewable integration create avenues for widespread deployment. Urbanization and smart city initiatives also add to growth prospects. Industrial leaders see adoption as an opportunity to reinforce competitiveness. This environment provides strong momentum for future demand.

Strategic Collaborations and Innovation in Advanced Boiler Technologies

Partnerships between manufacturers, utilities, and technology developers are creating growth avenues. The Low voltage electric boiler market is witnessing joint initiatives aimed at accelerating product innovation and expanding reach. It is helping companies introduce new models with higher efficiency and improved digital control systems. Collaborations with research institutes enable breakthroughs in materials and design. Strategic alliances are also fostering access to new markets, particularly in Asia and the Middle East. Vendors are focusing on after-sales services and lifecycle management to strengthen customer loyalty. Industrial operators benefit from bundled solutions that combine efficiency with sustainability. These collaborations open pathways for long-term market expansion.

Market Segmentation Analysis:

By capacity, the low voltage electric boiler market is segmented into up to 10 MMBtu/hr, 10 to 50 MMBtu/hr, 50 to 100 MMBtu/hr, and 100 to 250 MMBtu/hr. Smaller capacity systems up to 10 MMBtu/hr dominate residential and light commercial installations due to compact design and efficiency. Mid-range capacities between 10 and 50 MMBtu/hr are increasingly used in schools, hospitals, and office complexes where consistent heating is required. Larger units above 50 MMBtu/hr find applications in industrial facilities where higher thermal loads and reliability are critical. It provides flexibility across end-user segments, making capacity-based adoption diverse and growth-oriented.

- For example, Laars Heating Systems offers compact commercial electric boilers with power ratings ranging from 60 kW to 300 kW. These designs deliver 100% efficiency through electric resistance heating, feature a small installation footprint, enable zero local emissions, and require no venting.

By application, the market covers residential, commercial, and industrial sectors. Residential demand is supported by rising consumer preference for clean and cost-efficient heating solutions. The commercial sector, including healthcare, hospitality, and retail, is expanding adoption to meet sustainability commitments. Industrial demand represents a major share, driven by manufacturing, food processing, and chemical sectors seeking reliable low-emission heating technologies. It demonstrates strong adoption potential where compliance with environmental regulations is critical.

By type, the market is divided into direct electric boiler systems, indirect electric boiler systems, and electric boiler-based water heaters. Direct systems are favored for their simplicity and efficiency in small-scale applications. Indirect systems are widely deployed in larger facilities where integration with existing heating networks adds value. Electric boiler-based water heaters are gaining traction across residential and commercial environments where hot water supply reliability is essential. It reflects a diverse product portfolio designed to meet varying operational and end-user needs.

- For example, Raypak manufactures heavy-duty commercial electric water heaters available in capacities ranging from 85 to 175 gallons. These units offer approximately 98% thermal efficiency and suit general commercial hot water applications such as hotels, gyms, restaurants, and eyewash stations.

Segmentation:

By Capacity

- Up to 10 MMBtu/hr

- 10 to 50 MMBtu/hr

- 50 to 100 MMBtu/hr

- 100 to 250 MMBtu/hr

By Application

- Residential Sector

- Commercial Sector

- Industrial Sector

By Type

- Direct Electric Boiler Systems

- Indirect Electric Boiler Systems

- Electric Boiler-Based Water Heaters

By Regional

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe holds the largest market share of 38% in the low voltage electric boiler market, driven by strict emission regulations, advanced energy efficiency standards, and strong adoption across residential and commercial sectors. Countries such as Germany, the UK, and France lead installations due to robust renewable integration and government-backed carbon reduction programs. It is supported by district heating expansion, which increasingly incorporates electric boilers as clean alternatives to fossil-fuel systems. Industrial demand is also strong across chemicals, food processing, and manufacturing. Regional manufacturers play a critical role in supplying advanced, digitally connected boilers. The well-established infrastructure and high awareness of sustainability goals continue to sustain Europe’s leading position.

North America accounts for 27% of the global market share, supported by rising demand from commercial and industrial users seeking cost-efficient, low-emission heating systems. The United States leads adoption, backed by federal and state-level initiatives promoting energy-efficient technologies. It is gaining momentum in applications across universities, healthcare facilities, and food processing industries where reliability and compliance are key. Strong presence of established boiler manufacturers enhances market growth. Canada contributes with significant adoption in sustainable heating projects linked to renewable integration. Market growth in North America is further supported by investments in modernizing heating infrastructure.

Asia-Pacific represents 22% of the global market share and is the fastest-growing region due to rapid industrialization, urban expansion, and increasing policy emphasis on decarbonization. China, Japan, and India are at the forefront of adoption, supported by infrastructure modernization and renewable energy integration. It is increasingly viewed as a sustainable solution for industries transitioning from coal-based heating to electricity-driven systems. Governments in the region are implementing favorable regulations and incentives, encouraging industries to shift to electric boilers. Rising demand from commercial facilities and manufacturing hubs contributes to significant growth potential. Asia-Pacific is expected to strengthen its share in the global market over the forecast period.

Latin America and the Middle East & Africa collectively account for 13% of the market share, driven by emerging industrial applications and growing awareness of clean heating technologies. Brazil and Mexico are leading adoption in Latin America, supported by urban development and sustainability commitments. In the Middle East, industrial projects in the UAE and Saudi Arabia are integrating electric boilers as part of energy diversification strategies. It is gradually gaining traction in regions where infrastructure development supports renewable adoption. Limited grid stability and high capital costs remain challenges, but ongoing investment in sustainable projects provides a promising outlook. These regions are expected to contribute steadily to global expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Vaillant Group

- Ariston Thermo Group

- Ferroli

- Elnur Gabarrón

- Baxi Heating (BDR Thermea Group)

- Bosch Industriekessel (Robert Bosch)

- Cleaver-Brooks

- LAARS Heating Systems

- Precision Boilers

- Lochinvar

- Acme Engineering Products

- Viessmann

- ACV

- Babcock Wanson

- O. Smith Corporation

Competitive Analysis:

The low voltage electric boiler market is defined by strong competition among established global heating equipment manufacturers and specialized boiler producers. Leading players such as Vaillant, Ariston Thermo, Viessmann, Bosch, and Baxi emphasize product innovation, energy efficiency, and compliance with emission standards to strengthen their market positions. It is characterized by continuous investment in digital control systems, smart monitoring, and renewable energy integration. Mid-sized companies like Precision Boilers, Elnur Gabarrón, and Acme Engineering Products enhance competitiveness by focusing on niche industrial applications and custom solutions. Partnerships with utilities and infrastructure projects expand market presence across regions. Competitive strategies revolve around product differentiation, regional expansion, and sustainability-driven branding, creating a dynamic and evolving market landscape.

Recent Developments:

- In March 2025, Vaillant Group launched its latest heat pump technology called the Vaillant aroTHERM Split plus, designed for efficient and quiet operation, suitable for new constructions and renovation projects. This heat pump improves heating and cooling adaptability while emphasizing ease of installation and usage.

- In February 2025, Cleaver-Brooks launched the LVR electric hydronic boiler, a new product offering in the low voltage electric boiler market that emphasizes energy-efficient heating solutions specifically designed for commercial, institutional, and light industrial applications.

- In June 2025, Ariston Thermo Group acquired an 80% majority stake in Z.R.E., an Italian manufacturer specializing in industrial electric heating solutions. This acquisition expands Ariston’s Components Division and enhances their capabilities in industrial electric heaters such as band heaters and tubular heating elements, fortifying their presence in professional and industrial markets.

Market Concentration & Characteristics:

The low voltage electric boiler market demonstrates moderate to high concentration, with a mix of multinational corporations and regional specialists competing for share. It is dominated by European players with strong distribution networks, while North American and Asian companies steadily increase their presence. The market features high barriers to entry due to capital requirements, regulatory standards, and technological expertise. Differentiation is largely achieved through efficiency, reliability, and integration with renewable energy systems. Buyers show strong preference for suppliers offering lifecycle services and long-term cost savings. Competitive intensity is reinforced by global sustainability trends that demand innovation and regulatory compliance.

Report Coverage:

The research report offers an in-depth analysis based on Capacity, Application and Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The low voltage electric boiler market will expand further with growing integration of renewable power into heating applications across industrial and commercial facilities.

- Rising government policies focused on decarbonization will accelerate replacement of fossil-fuel boilers with electric systems across multiple regions.

- Manufacturers will increasingly invest in smart technologies, enabling predictive maintenance, remote monitoring, and higher operational efficiency.

- The residential sector will adopt compact and efficient electric boilers to meet sustainable housing and energy-conscious consumer preferences.

- Industrial users will drive strong demand as they align heating operations with emission-reduction targets and long-term cost savings.

- Advancements in materials and design will improve boiler durability, energy utilization, and compliance with stricter safety regulations.

- Strategic collaborations between manufacturers and utilities will support deployment in large-scale infrastructure and district heating projects.

- Emerging economies will provide significant growth potential as infrastructure modernization and clean energy projects expand.

- Competitive intensity will increase, with players differentiating through product innovation, lifecycle services, and sustainability branding.

- Long-term growth will be reinforced by global energy transition strategies that prioritize electrification of heating systems.