Market Overview

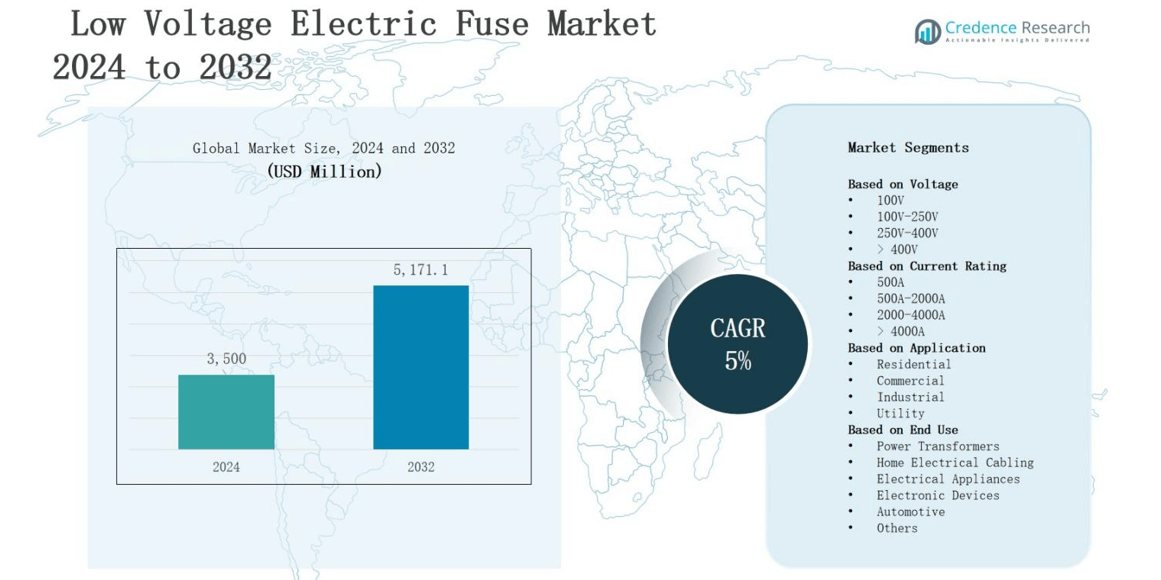

The low voltage electric fuse market is projected to grow from USD 3,500 million in 2024 to USD 5,171.1 million by 2032, registering a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Voltage Electric Fuse Market Size 2024 |

USD 3,500 million |

| Low Voltage Electric Fuse Market, CAGR |

5% |

| Low Voltage Electric Fuse Market Size 2032 |

USD 5,171.1 million |

The low voltage electric fuse market is driven by rising demand for reliable circuit protection in residential, commercial, and industrial applications. Growing electrification, expanding renewable energy projects, and smart grid development further support adoption. Safety regulations and standards push utilities and manufacturers to integrate advanced fuses for improved efficiency and protection. The market also benefits from increasing investments in modernizing power infrastructure and replacing aging electrical systems. Trends include the shift toward compact, energy-efficient fuse designs, integration of smart monitoring capabilities, and growing use of eco-friendly materials to meet sustainability goals while ensuring high performance in diverse environments.

The low voltage electric fuse market demonstrates strong geographical diversity, with Asia-Pacific leading at 32% share, followed by North America at 28% and Europe at 26%. Latin America and the Middle East & Africa each account for 7%, supported by growing electrification and infrastructure projects. Key players shaping the market include Eaton, Legrand, Bel Fuse, Mersen, Fuji Electric, Mitsubishi Electric, Hubbell, Panasonic, Optifuse, Kyocera, and C&S Electric. Their strategies focus on innovation, regulatory compliance, and expanding presence across industrial, residential, commercial, and utility applications.

Market Insights

- The low voltage electric fuse market will grow from USD 3,500 million in 2024 to USD 5,171.1 million by 2032, at a steady 5% CAGR during the forecast period.

- Strong demand comes from residential, commercial, and industrial sectors, with growth supported by electrification, renewable energy projects, smart grid adoption, and increasing investments in modernizing electrical infrastructure.

- By voltage, the 100V–250V segment dominates with 40% share, followed by 250V–400V at 25%, 100V at 20%, and >400V with 15%, reflecting diverse application requirements.

- By current rating, the 500A–2000A segment leads with 38% share, 500A holds 27%, 2000–4000A secures 22%, and >4000A contributes 13%, serving multiple industrial and utility applications.

- By application, industrial leads with 42% share, residential accounts for 25%, commercial holds 20%, and utilities capture 13%, reflecting balanced demand across varied end-use sectors globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Reliable Circuit Protection

The low voltage electric fuse market experiences strong growth due to rising demand for safe and reliable circuit protection across industries. Expanding residential and commercial infrastructure projects require advanced fuses to ensure uninterrupted power supply. Industrial applications such as machinery, HVAC systems, and automation lines increasingly depend on low voltage fuses for operational safety. It provides cost-effective protection against overloads and short circuits. Strong emphasis on worker safety and regulatory compliance further fuels adoption.

- For instance, Siemens has developed advanced low voltage fuses designed specifically for renewable energy applications, safeguarding solar inverters and wind turbines from overloads and faults.

Expansion of Renewable Energy and Grid Modernization

The low voltage electric fuse market benefits from large-scale renewable energy installations and smart grid development. Solar and wind projects need reliable circuit protection for inverters, transformers, and distribution networks. It ensures system reliability by reducing risks of equipment failure and fire hazards. Governments worldwide are investing in grid modernization and transmission upgrades. These projects create demand for advanced fuses capable of handling fluctuating power loads. Growing renewable integration drives steady product innovation.

- For instance, Adani Green Energy developed the world’s largest single-location solar power plant in Khavda, Gujarat, requiring advanced fuse systems to protect its vast inverter and distribution networks during fluctuating loads.

Regulatory Standards and Safety Requirements

The low voltage electric fuse market is shaped by stringent safety standards imposed by global and regional regulatory bodies. Electrical equipment must comply with certifications to reduce fire hazards, equipment failures, and safety incidents. It encourages manufacturers to design products that meet international performance benchmarks. Industrial and commercial users prioritize certified fuses to protect assets and minimize downtime. Compliance-driven demand supports continuous product upgrades. Strong focus on workplace and household safety sustains long-term market growth.

Technological Advancements and Material Innovation

The low voltage electric fuse market continues to expand through advances in design, materials, and monitoring technology. Modern fuses integrate features that improve response times, durability, and compatibility with smart systems. It leverages eco-friendly materials and compact designs for sustainability and space efficiency. Manufacturers adopt digital monitoring functions that provide real-time protection insights. Customers seek products with higher efficiency and adaptability. Ongoing innovation positions low voltage fuses as essential components of evolving power distribution systems.

Market Trends

Integration of Smart Fuse Technologies

The low voltage electric fuse market is witnessing a shift toward smart fuse technologies that enable advanced monitoring and predictive maintenance. These solutions provide real-time fault detection, improve operational safety, and reduce downtime. It allows utilities and industries to identify issues before failures occur. The integration of IoT and digital communication enhances system efficiency and reliability. Growing demand for automation and digitalized power networks strengthens adoption. Smart fuses are becoming a key trend in modern energy management.

- For instance, Aptiv uses semiconductor-based smart fuses in electric vehicles to centrally manage power distribution, detecting wire faults before failure and optimizing energy use by disabling less critical systems during peak loads.

Focus on Compact and Energy-Efficient Designs

The low voltage electric fuse market emphasizes compact and energy-efficient designs that meet space-saving requirements in modern infrastructure. Miniaturized electrical systems, especially in residential and commercial spaces, drive demand for smaller, high-performance fuses. It supports improved energy efficiency and cost reduction in large installations. Lightweight and durable fuse structures offer enhanced performance under varying loads. Growing consumer preference for efficient power distribution fuels innovation in compact fuse products. This trend continues to reshape product development strategies globally.

- For instance, TCS has implemented technology-driven solutions that optimize power distribution in industrial setups, focusing on energy efficiency and load management.

Sustainability and Eco-Friendly Material Adoption

The low voltage electric fuse market is increasingly shaped by sustainability initiatives and the use of eco-friendly materials. Manufacturers adopt lead-free, recyclable, and halogen-free materials to meet environmental regulations. It aligns with global sustainability targets and reduces environmental impact. Demand for green building standards and energy-efficient infrastructure promotes adoption of environmentally friendly fuses. End-users prioritize products that support long-term energy goals. This trend reflects rising awareness of sustainable solutions across the electrical and power distribution sectors.

Rising Adoption in Renewable and Distributed Energy Systems

The low voltage electric fuse market is expanding with greater use in renewable and distributed energy systems. Solar, wind, and microgrid projects require advanced fuses to protect components from overcurrents. It ensures system reliability under fluctuating load conditions. Growing investments in decentralized energy generation create strong demand for specialized fuses. Technological advancements in energy storage and hybrid systems further drive usage. This trend reinforces the importance of low voltage fuses in future-ready power distribution networks worldwide.

Market Challenges Analysis

High Competition and Pricing Pressure

The low voltage electric fuse market faces challenges from intense competition and pricing pressure among global and regional players. Numerous manufacturers supply similar products, making differentiation difficult and leading to reduced profit margins. It pushes companies to invest heavily in innovation and quality improvements while maintaining cost efficiency. Buyers in both developed and emerging markets often prioritize cost over advanced features, limiting premium adoption. Continuous price competition strains smaller manufacturers and restricts long-term profitability.

Technological Shifts and Compatibility Issues

The low voltage electric fuse market is challenged by rapid technological shifts and compatibility concerns with evolving electrical systems. Smart grids, renewable integration, and digital monitoring require advanced fuse designs that many traditional models cannot support. It compels manufacturers to continuously upgrade products, raising R&D costs and compliance requirements. Complex installation environments demand precise compatibility, creating risks of malfunction and performance failure. The need for constant adaptation increases operational burdens and delays widespread adoption across cost-sensitive markets.

Market Opportunities

Expansion in Renewable Energy and Smart Infrastructure

The low voltage electric fuse market presents strong opportunities through its growing role in renewable energy projects and smart infrastructure. Solar and wind installations require reliable fuses to safeguard inverters, transformers, and distribution systems. It supports system stability by handling variable loads in renewable power generation. Rising investments in smart cities and grid modernization increase demand for advanced fuse technologies. Governments and private investors prioritize safer, efficient, and sustainable electrical infrastructure. These factors create consistent growth prospects for manufacturers.

Rising Demand Across Emerging Economies

The low voltage electric fuse market benefits from increasing urbanization, industrialization, and electrification in emerging economies. Rapid infrastructure development in Asia-Pacific, Latin America, and Africa creates demand for low voltage protection devices. It provides affordable solutions for residential, commercial, and small-scale industrial use. Expanding construction activities and rural electrification programs further boost adoption. Local manufacturers and global suppliers have the opportunity to capture untapped markets. The growing emphasis on safety standards in developing regions strengthens long-term growth opportunities.

Market Segmentation Analysis:

Based on Voltage

In the low voltage electric fuse market, the 100V–250V segment dominates with nearly 40% share in 2024. Its leadership is driven by widespread use in residential and commercial buildings for appliances, lighting, and small machinery. The 250V–400V segment holds about 25% share, supported by demand in industrial circuits and HVAC systems. The 100V segment accounts for 20%, serving small devices and electronics. The >400V segment captures 15%, fueled by utility and renewable grid applications requiring advanced safety.

- For instance, Littelfuse’s FLNR and FLSR_ID Series Class RK5 fuses offer cost-effective, time-delay protection widely adopted in these applications.

Based on Current Rating

The 500A–2000A segment leads the low voltage electric fuse market with 38% share in 2024, supported by industrial equipment, transformers, and commercial distribution systems. The 500A segment accounts for 27%, largely used in residential and small-scale applications. The 2000–4000A range holds 22% share, serving heavy machinery and large commercial facilities. The >4000A segment secures 13% share, driven by specialized applications in utilities and critical infrastructure requiring higher fault protection.

- For instance, Eaton’s Bussmann series includes high-speed fuses rated up to 2000A designed for industrial motor protection and power conversion, frequently deployed in manufacturing plants.

Based on Application

The industrial segment dominates the low voltage electric fuse market with 42% share in 2024, supported by automation, machinery safety, and uninterrupted operations. The residential sector accounts for 25%, driven by appliance protection and home electrical systems. The commercial segment holds 20%, boosted by office complexes, retail centers, and data facilities. The utility segment secures 13% share, supported by demand in power distribution, renewable energy integration, and grid modernization projects across both developed and emerging regions.

Segments:

Based on Voltage

- 100V

- 100V-250V

- 250V-400V

- > 400V

Based on Current Rating

- 500A

- 500A-2000A

- 2000-4000A

- > 4000A

Based on Application

- Residential

- Commercial

- Industrial

- Utility

Based on End Use

- Power Transformers

- Home Electrical Cabling

- Electrical Appliances

- Electronic Devices

- Automotive

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The low voltage electric fuse market in North America holds 28% share in 2024, supported by strong demand across residential, commercial, and industrial sectors. It benefits from modernization of power grids, expansion of renewable projects, and adoption of smart fuse technologies. Stringent safety regulations and energy efficiency standards drive replacement and upgrade demand. The presence of leading manufacturers strengthens innovation and product availability. Industrial automation and data center growth further enhance adoption. The region remains a key hub for high-value applications and advanced fuse designs.

Europe

Europe accounts for 26% share of the low voltage electric fuse market in 2024, led by strong regulatory frameworks and emphasis on sustainable infrastructure. It experiences high adoption in industrial, commercial, and utility applications. Strict compliance standards encourage the use of certified, eco-friendly fuses. The region is witnessing steady growth in renewable integration, particularly solar and wind projects requiring reliable protection. Urbanization and smart city projects also add to market expansion. Ongoing technological innovation sustains Europe’s competitive position.

Asia-Pacific

Asia-Pacific dominates the low voltage electric fuse market with 32% share in 2024, driven by rapid urbanization, industrialization, and growing electrification. It gains momentum from large-scale infrastructure development, manufacturing expansion, and residential construction. Rising investments in renewable energy projects across China, India, and Southeast Asia increase demand for advanced fuses. Governments prioritize safety standards and grid modernization, boosting adoption in both utilities and commercial sectors. The presence of regional manufacturers ensures competitive pricing. Asia-Pacific remains the fastest-growing regional market.

Latin America

Latin America holds 7% share in the low voltage electric fuse market in 2024, supported by growing electrification programs and industrial development. It benefits from expanding construction activities and rising focus on reliable power distribution. Governments in Brazil, Mexico, and Chile are investing in renewable projects, which create opportunities for fuse adoption. It also faces demand from residential expansion in urban areas. Local production capabilities remain limited, which opens room for international suppliers. Market growth continues at a steady pace.

Middle East & Africa

The Middle East & Africa region accounts for 7% share of the low voltage electric fuse market in 2024, driven by infrastructure development and power sector investments. It gains momentum from utility-scale projects, particularly in GCC countries, supporting strong fuse demand. Growing urbanization and electrification programs in Africa create opportunities for expansion. Industrial and oil sector activities also contribute significantly to adoption. Governments prioritize reliable power infrastructure to meet rising demand. The region shows steady progress despite pricing challenges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Optifuse

- Legrand

- Fuji Electric

- Eaton

- Bel Fuse

- Hubbell

- Panasonic

- Mitsubishi Electric

- Kyocera

- C&S Electric

- Mersen

Competitive Analysis

The low voltage electric fuse market is highly competitive, with global and regional players focusing on innovation, safety, and cost efficiency. It features established companies such as Eaton, Legrand, Bel Fuse, Mersen, Fuji Electric, Mitsubishi Electric, Hubbell, and Panasonic, alongside specialized providers like Optifuse, Kyocera, and C&S Electric. Intense competition drives continuous product development, with players introducing compact, eco-friendly, and smart monitoring fuse solutions to address evolving industry needs. Manufacturers invest in research and development to meet strict regulatory standards and cater to growing demand from residential, commercial, industrial, and utility sectors. Strategic partnerships, mergers, and distribution network expansions strengthen global reach and market presence. Regional players compete by offering affordable products tailored to local infrastructure requirements, while global leaders emphasize premium technologies and high reliability. The market is shaped by pricing pressure and technology differentiation, encouraging companies to balance innovation with affordability. Continuous investments in renewable energy and smart grid projects create further opportunities for established players to reinforce their leadership in this dynamic landscape.

Recent Developments

- In May 2023, CNC Electric launched its RT18 Low Voltage Fuse series, designed to protect circuits from overloads, short circuits, semiconductor devices, and electric motors.

- In April 2025, Eaton introduced a dual-trigger pyro fuse for electric vehicles, enhancing circuit safety and reliability with a backup triggering mechanism.

- In October 2024, Littelfuse, Inc. unveiled the 871 Series Ultra-High Amperage SMD Fuse, offering ratings of 150A and 200A within a compact surface-mounted design

Market Concentration & Characteristics

The low voltage electric fuse market shows moderate to high concentration, with leading players such as Eaton, Legrand, Bel Fuse, Mersen, Fuji Electric, Mitsubishi Electric, Hubbell, Panasonic, Optifuse, Kyocera, and C&S Electric holding significant influence. It is characterized by continuous innovation in compact, energy-efficient, and eco-friendly designs to meet evolving regulatory and safety standards. Competition is shaped by product reliability, cost efficiency, and technological differentiation. Global leaders dominate premium segments through advanced monitoring and smart fuse solutions, while regional players focus on affordable, locally tailored products. The market serves diverse applications across residential, commercial, industrial, and utility sectors, reinforcing steady demand. Strategic alliances, mergers, and distribution expansions remain key features, supporting broader market reach. Strong growth in renewable integration, electrification, and smart grid development creates consistent opportunities. Despite pricing pressure and intense rivalry, the market continues to evolve with an emphasis on safety, sustainability, and high-performance solutions across global power networks.

Report Coverage

The research report offers an in-depth analysis based on Voltage, Current Rating, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Smart fuses with monitoring capabilities will see wider adoption across industries and utilities.

- Renewable energy projects and distributed generation will strongly drive demand for advanced fuse solutions.

- Compact, energy-efficient fuse designs will dominate due to space constraints and efficiency requirements.

- Eco-friendly materials in fuse production will grow, aligned with global sustainability and regulatory standards.

- Industrial automation expansion will create strong demand for reliable fuses in heavy machinery operations.

- Residential and commercial electrification growth will ensure steady consumption of low voltage electric fuses.

- Utilities will prioritize advanced fuses to improve reliability and safety in smart grid modernization.

- Global companies will strengthen presence through mergers, partnerships, and broader regional distribution channels.

- Emerging economies will expand opportunities through infrastructure growth and rapid urbanization projects globally.

- Regulatory bodies emphasizing safety standards will drive continuous innovation in fuse technologies worldwide.