| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Plastic Welding Equipment Market Size 2024 |

USD 3,309.68 million |

| U.S. Plastic Welding Equipment Market, CAGR |

7.35% |

| U.S. Plastic Welding Equipment Market Size 2032 |

USD 5,835.65 million |

Market Overview

U.S. Plastic Welding Equipment market size was valued at USD 3,309.68 million in 2024 and is anticipated to reach USD 5,835.65 million by 2032, at a CAGR of 7.35% during the forecast period (2024-2032).

The U.S. plastic welding equipment market is driven by the increasing demand for lightweight, durable plastic components across industries such as automotive, aerospace, electronics, and packaging. The growing emphasis on energy efficiency and fuel economy has accelerated the adoption of plastic parts, especially in automotive manufacturing, where plastic welding plays a critical role. Advancements in welding technologies, including ultrasonic, laser, and hot plate welding, are enhancing precision, speed, and reliability, further boosting market growth. Additionally, the shift toward automation and smart manufacturing processes is creating opportunities for high-performance, programmable welding systems. Environmental regulations promoting recyclable and sustainable plastic materials are also influencing the adoption of advanced welding equipment. As manufacturers seek cost-effective, high-quality bonding solutions, the integration of AI and IoT in plastic welding systems is emerging as a key trend, enabling real-time monitoring, predictive maintenance, and improved process control, thus supporting consistent growth in the U.S. market.

The U.S. plastic welding equipment market is geographically diverse, with key manufacturing hubs spread across the Western, Midwestern, Southern, and Northeastern United States. The Western region, particularly California, is a leader in high-tech applications such as electronics and aerospace, driving demand for precision welding technologies. The Midwest, home to the automotive sector, represents a significant market for plastic welding solutions, particularly in vehicle manufacturing. The South has seen growth in medical device production, contributing to increased demand for sterile and reliable welding methods. The Northeast, with its focus on innovation and research, supports specialized applications, particularly in medical technologies. Key players in the market include Branson Ultrasonics Corporation, Dukane Corporation, Emerson Electric Co., and Leister Technologies AG, among others. These companies lead the industry by offering advanced welding solutions, such as ultrasonic, laser, and infrared welding, and continuously innovate to meet the growing demands of various industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. plastic welding equipment market was valued at USD 3,309.68 million in 2024 and is projected to reach USD 5,835.65 million by 2032, growing at a CAGR of 7.35% during the forecast period.

- The global plastic welding equipment market was valued at USD 11,340.00 million in 2024 and is projected to reach USD 19,842.36 million by 2032, growing at a CAGR of 7.24% from 2024 to 2032.

- Growing demand for lightweight and durable plastic components in the automotive, medical, and electronics industries is driving market growth.

- Advancements in welding technologies, such as ultrasonic and laser welding, are enhancing precision, speed, and efficiency.

- Increased automation and the integration of smart technologies in welding systems are significant trends, improving production efficiency and reducing labor costs.

- High initial investment and maintenance costs, along with material compatibility challenges, are key restraints affecting market growth.

- The Western U.S. holds the largest share of the market, with significant demand from electronics, aerospace, and EV manufacturing.

- Leading companies like Branson Ultrasonics, Dukane Corporation, and Leister Technologies dominate the competitive landscape with advanced product offerings and innovations.

Report Scope

This report segments the U.S. Plastic Welding Equipment Market as follows:

Market Drivers

Rising Demand in Automotive and Transportation Sectors

One of the primary drivers of the U.S. plastic welding equipment market is the growing demand within the automotive and transportation industries. For instance, the U.S. Department of Energy highlights that replacing traditional steel components with lightweight materials such as high-strength polymers can reduce vehicle weight by up to 50%, improving fuel efficiency and lowering emissions. Plastic welding enables the efficient assembly of these components with superior strength and durability. Technologies such as ultrasonic and vibration welding are widely employed in assembling fuel tanks, instrument panels, bumpers, and under-the-hood components. The transition toward electric vehicles (EVs) further reinforces this trend, as EV designs rely heavily on plastic parts to maintain low vehicle weight and ensure optimal battery performance. This sustained demand for advanced plastic joining techniques continues to propel investments in welding equipment across the U.S. automotive manufacturing landscape.

Advancements in Welding Technologies and Automation

Technological innovations in plastic welding are significantly contributing to market growth. For instance, companies like Dukane and Emerson have developed advanced welding systems that integrate automation and robotics to improve precision and efficiency. Modern welding methods such as laser, infrared, hot plate, and spin welding offer enhanced precision, speed, and repeatability. These techniques enable manufacturers to achieve high-quality welds with minimal material distortion or waste, making them suitable for complex and delicate assemblies. Furthermore, the integration of automation and robotics into welding processes is transforming production lines by improving throughput, consistency, and operator safety. Automated plastic welding systems are increasingly adopted in sectors requiring high-volume production with minimal errors. This technological evolution not only boosts productivity but also meets the rising quality standards demanded by end-use industries such as electronics, packaging, and healthcare, where precision and reliability are critical.

Growing Focus on Sustainability and Recyclability

Environmental considerations are also influencing the adoption of plastic welding equipment in the U.S. Manufacturers are under increasing pressure to reduce their environmental footprint by adopting eco-friendly production practices. Plastic welding enables the reuse and recycling of thermoplastics, contributing to circular manufacturing processes. By allowing defect-free joints without the use of adhesives or fasteners, welding reduces the need for additional materials and simplifies disassembly and recycling at the end of a product’s life. Regulatory frameworks promoting sustainability and restricting harmful emissions further encourage companies to invest in welding equipment that supports the processing of recyclable and biodegradable materials. This trend aligns with broader corporate sustainability goals and enhances the appeal of plastic welding as a green manufacturing solution.

Expansion in Consumer Electronics and Medical Devices

The miniaturization and increased functionality of consumer electronics and medical devices have led to rising demand for precise and reliable plastic welding solutions. In electronics, plastic welding is essential for sealing and assembling compact housings and internal components without compromising structural integrity. Similarly, in the medical field, plastic welding ensures the secure bonding of components in devices such as IV catheters, filters, and diagnostic instruments, where cleanliness and leak-proof integrity are critical. The growing investment in healthcare infrastructure and medical innovations in the U.S. further fuels the demand for specialized welding systems capable of meeting stringent safety and quality standards. These sectors’ expansion contributes significantly to the sustained growth of the plastic welding equipment market.

Market Trends

Integration of Industry 4.0 and Smart Manufacturing

The adoption of Industry 4.0 technologies is a major trend reshaping the U.S. plastic welding equipment market. For instance, manufacturers are integrating IoT-enabled devices and AI-driven analytics to optimize welding processes, as seen in smart factory initiatives by companies like HCLTech. Smart plastic welding equipment can monitor performance, detect anomalies, and execute predictive maintenance, thereby minimizing downtime and improving process reliability. This digital transformation not only enhances productivity but also provides traceability and quality assurance across the production line. As U.S. industries continue their shift toward smart factories, the demand for connected and automated welding solutions is expected to grow steadily.

Rising Demand for Lightweight and High-Performance Materials

Another significant trend is the growing preference for lightweight and high-performance plastics across multiple industries. This shift is particularly evident in the automotive, aerospace, and medical sectors, where materials such as reinforced thermoplastics and composite polymers are becoming more prevalent. To meet this demand, plastic welding equipment is evolving to accommodate a broader range of materials and applications. Advanced welding techniques such as laser and infrared welding are being refined to deliver precise, clean joints on complex materials. The need for high-quality welding of sophisticated plastics is driving equipment innovation and customization, encouraging manufacturers to invest in specialized solutions.

Customization and Modular Equipment Designs

The market is witnessing a notable trend toward modular and customizable plastic welding systems. For instance, Emerson’s Branson 2000X Series offers digital, adaptable plastic welding technology with user-friendly interfaces and remote diagnostics. U.S. manufacturers increasingly prefer equipment that can be tailored to their specific production needs, offering flexibility in welding types, control systems, and integration capabilities. Modular systems allow for easy upgrades, reconfiguration, and scaling as production requirements evolve. This flexibility supports cost-efficiency and reduces the need for frequent capital investments in entirely new systems. Equipment vendors are responding by offering more configurable machines with user-friendly interfaces, remote diagnostics, and easy integration with other automation systems, reinforcing this trend across the industry.

Growing Adoption in Emerging and Niche Applications

Plastic welding is gaining traction in emerging and niche applications, further diversifying the U.S. market. Sectors such as renewable energy, electric mobility, and wearable electronics are exploring plastic welding for battery enclosures, sensors, and compact device assemblies. Additionally, the healthcare industry is increasingly relying on ultrasonic and spin welding to manufacture disposable medical products and complex diagnostic tools. These emerging applications demand precision, speed, and contamination-free assembly, which modern welding technologies can deliver. As innovation continues to drive product development in these high-tech fields, plastic welding equipment is poised to play a vital role in supporting scalable and high-quality production.

Market Challenges Analysis

High Initial Investment and Maintenance Costs

One of the key challenges in the U.S. plastic welding equipment market is the high initial capital investment required for advanced welding technologies. For instance, laser welding machines can range from a few thousand dollars for entry-level models to over $100,000 for industrial-grade systems, making them a significant financial commitment for SMEs. Sophisticated equipment such as laser and ultrasonic welders, along with their supporting automation infrastructure, demand significant upfront expenditure. This can be a barrier for small and medium-sized enterprises (SMEs), which may lack the financial flexibility to adopt high-end solutions. Moreover, the ongoing costs related to maintenance, calibration, and training of skilled personnel further add to the total cost of ownership. As a result, some manufacturers may delay or limit investment in new equipment, opting instead to rely on conventional methods that may not align with modern manufacturing standards. These cost concerns can slow the overall adoption of next-generation welding technologies, especially in cost-sensitive sectors.

Complexity of Material Compatibility and Process Optimization

Another major challenge lies in the complexity of achieving optimal welds across a wide variety of plastic materials. Different thermoplastics and composite polymers exhibit diverse melting points, thermal conductivity, and mechanical properties, which can affect the consistency and quality of welds. As manufacturers incorporate newer, high-performance plastics into their products, ensuring compatibility with existing welding processes becomes increasingly difficult. Additionally, process parameters such as heat, pressure, and cycle time must be precisely controlled to prevent defects such as warping, weak joints, or contamination. This demands not only advanced equipment but also highly trained operators and rigorous quality control protocols. The lack of standardized welding practices across industries further complicates the adoption process, often requiring custom solutions and extended development times. These technical hurdles can pose risks to production efficiency and product reliability, challenging manufacturers to continuously adapt and optimize their welding operations.

Market Opportunities

The U.S. plastic welding equipment market presents considerable opportunities, driven by the growing demand for advanced manufacturing solutions across emerging industries. The increasing adoption of electric vehicles (EVs), renewable energy systems, and sustainable packaging materials is generating new applications for plastic welding technologies. EV manufacturing, in particular, relies heavily on plastic components for battery casings, lightweight structures, and interior parts, all of which require precise and reliable welding. As U.S. automakers continue to scale up EV production, the need for specialized welding equipment that supports high-volume and high-precision fabrication will rise significantly. Similarly, the renewable energy sector—especially in solar panel manufacturing and energy storage systems—is beginning to adopt plastic welding methods for component assembly, offering new avenues for market expansion.

In addition, the medical and consumer electronics industries offer untapped potential for growth. The demand for miniaturized, disposable, and hygienic medical devices is increasing rapidly, particularly in light of expanding healthcare infrastructure and growing attention to infection control. Plastic welding methods such as ultrasonic and laser welding are well-suited for producing sealed, contamination-free joints, making them ideal for assembling items like diagnostic devices, IV systems, and surgical tools. In consumer electronics, as devices become smaller and more sophisticated, manufacturers seek advanced welding techniques that can join tiny plastic housings without affecting internal circuitry. Furthermore, advancements in automation, AI integration, and modular machine design provide manufacturers with the flexibility to adopt plastic welding technologies at scale. These innovations not only reduce production costs but also make the technology accessible to a broader range of industries, reinforcing long-term growth potential in the U.S. market.

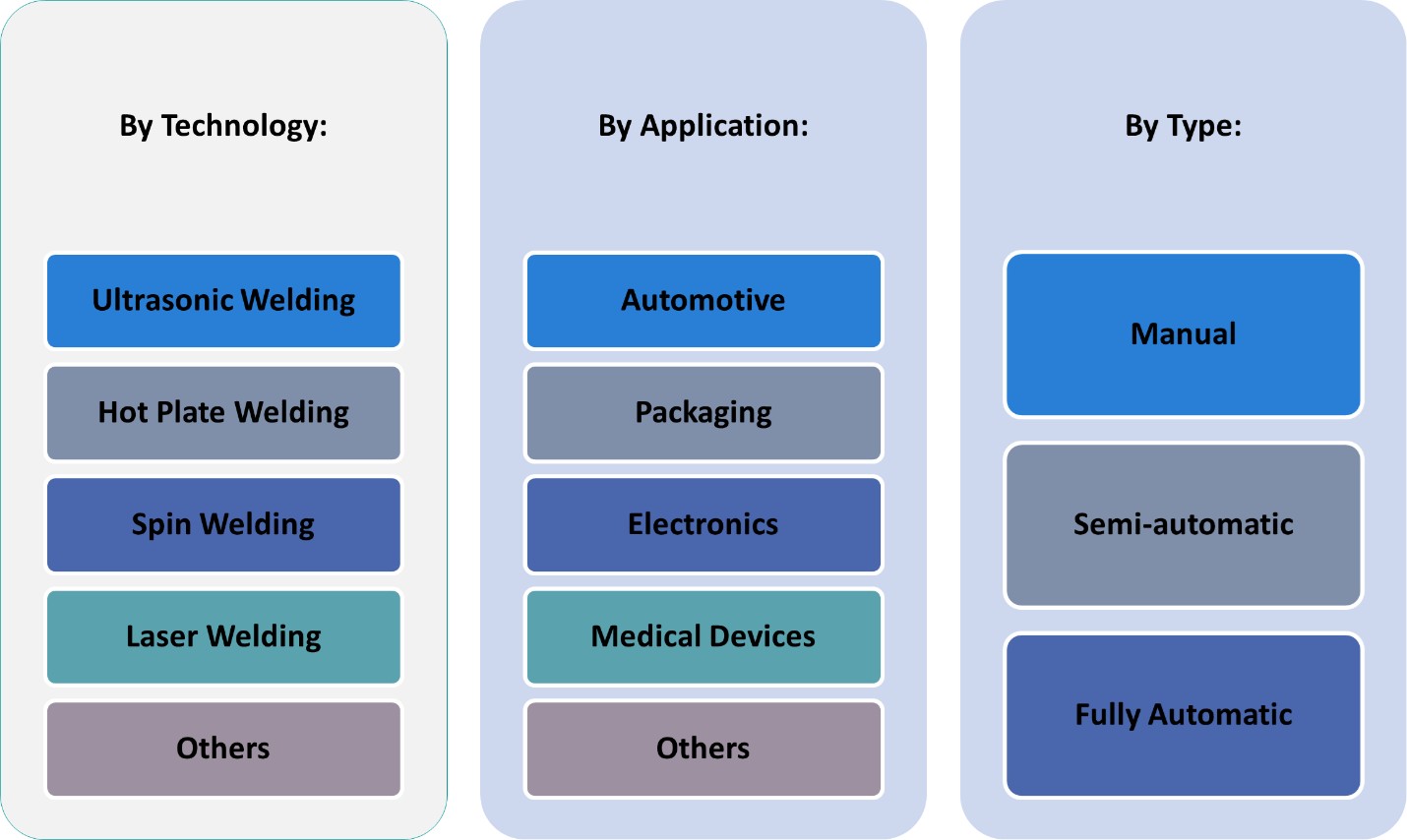

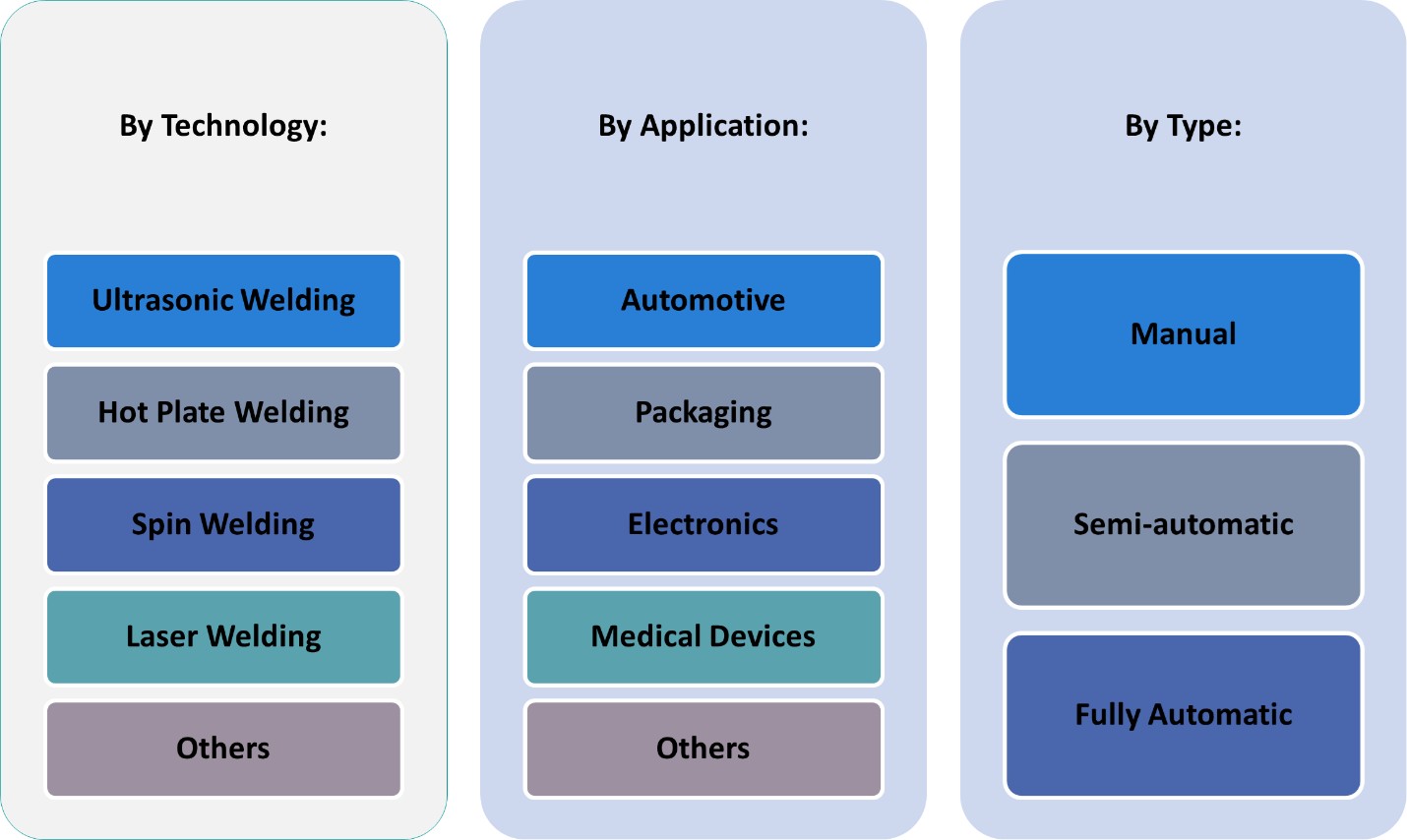

Market Segmentation Analysis:

By Type:

The U.S. plastic welding equipment market, when segmented by type, reveals distinct growth patterns across manual, semi-automatic, and fully automatic systems. Manual welding equipment continues to serve niche and small-scale applications, particularly in workshops and low-volume production settings where flexibility and cost efficiency are prioritized. However, its market share is gradually declining due to rising labor costs and increasing demand for precision. Semi-automatic systems strike a balance between operator control and machine efficiency, making them a popular choice among mid-sized manufacturers. These systems offer improved productivity while maintaining adaptability across various welding tasks. The fastest-growing segment is fully automatic plastic welding equipment, driven by the surge in high-volume manufacturing across automotive, electronics, and medical sectors. Automation enhances consistency, speed, and safety, reducing production costs in the long term. As industries continue to digitize and adopt smart manufacturing practices, fully automated systems are expected to dominate the market, supported by the integration of AI, IoT, and robotics technologies.

By Application:

In terms of application, the automotive sector holds a dominant share in the U.S. plastic welding equipment market due to the widespread use of plastic components in vehicle interiors, exteriors, and powertrains. The demand for lightweight and fuel-efficient vehicles has further intensified the need for high-performance plastic welding solutions. The electronics industry also represents a significant segment, requiring precise and miniature welding systems to assemble components in smartphones, wearables, and other devices. Medical devices are another fast-growing application area, driven by the need for clean, reliable welding in sterile environments, particularly for disposable products and diagnostic tools. The packaging industry leverages plastic welding for sealing, assembling, and reinforcing flexible plastic materials, particularly in food and pharmaceutical applications. Meanwhile, the “Others” segment—which includes sectors like consumer goods, construction, and renewable energy—presents steady opportunities, especially as new product designs increasingly incorporate plastic materials. The diversity in applications ensures a stable and broad-based demand across the U.S. market.

Segments:

Based on Type:

- Manual

- Semi-automatic

- Fully Automatic

Based on Application:

- Electronics

- Packaging

- Automotive

- Medical Devices

- Others

Based on Technology:

- Ultrasonic Welding

- Hot Plate Welding

- Spin Welding

- Laser Welding

- Others

Based on the Geography:

- Western United States

- Midwestern United States

- Southern United States

- Northeastern United States

Regional Analysis

Western United States

The Western United States holds the largest share of the U.S. plastic welding equipment market, accounting for approximately 33% of the total market. This dominance is largely attributed to the region’s strong presence in high-tech manufacturing hubs, particularly in California and Washington. The electronics and aerospace industries, both prominent in the West, demand precision plastic welding solutions for the assembly of lightweight components and protective housings. Additionally, the rise in electric vehicle manufacturing and the growth of the renewable energy sector in the region have driven further adoption of automated plastic welding systems. Silicon Valley’s focus on innovation has also accelerated the integration of AI and IoT technologies into plastic welding operations, making the Western region a leader in adopting smart manufacturing techniques.

Midwestern United States

The Midwestern United States captures around 28% of the market, bolstered by its well-established industrial base. Known as the manufacturing heartland of the U.S., states like Michigan, Ohio, and Illinois are home to a dense network of automotive and machinery manufacturers. The automotive sector, in particular, has driven strong demand for plastic welding equipment to support the production of interior and exterior vehicle components. The region’s emphasis on automation, lean manufacturing, and cost efficiency has encouraged widespread adoption of semi-automatic and fully automatic welding systems. The Midwest also benefits from a skilled workforce and centralized logistics infrastructure, making it an attractive region for plastic product fabrication and assembly operations.

Southern United States

The Southern United States holds approximately 22% of the market share, supported by its expanding presence in medical devices, packaging, and consumer goods manufacturing. States such as Texas, North Carolina, and Georgia have seen increasing investments in industrial infrastructure, particularly in healthcare and plastics processing. The growing demand for disposable medical products and sterile packaging has led to a higher need for reliable, hygienic plastic welding solutions. Additionally, the region’s competitive labor costs and favorable business environment have attracted both domestic and international manufacturers. As automation technologies become more accessible, the South is likely to experience further growth in demand for advanced welding equipment.

Northeastern United States

With a 17% market share, the Northeastern United States represents a smaller but strategically important region in the plastic welding equipment landscape. The region is home to a concentration of research institutions, specialized manufacturers, and medical technology companies. This has led to a steady demand for high-precision welding solutions in the production of medical devices, laboratory instruments, and electronics. While manufacturing activity in the Northeast is generally smaller in scale compared to other regions, the emphasis on high-value, innovation-driven applications sustains its relevance. The region also plays a vital role in setting industry standards and fostering R&D initiatives that influence product development across the national market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Branson Ultrasonics Corporation

- Dukane Corporation

- Emerson Electric Co.

- DRADER Manufacturing Industries Ltd.

- Wegener Welding LLC

- Leister Technologies AG

- Herrmann Ultraschalltechnik GmbH & Co. KG

- Bielomatik Leuze GmbH & Co. KG

- Frimo Group GmbH

- Sonics & Materials, Inc.

Competitive Analysis

The U.S. plastic welding equipment market is highly competitive, with several leading players at the forefront of innovation and technology. Branson Ultrasonics Corporation, Dukane Corporation, Emerson Electric Co., DRADER Manufacturing Industries Ltd., Wegener Welding LLC, Leister Technologies AG, Herrmann Ultraschalltechnik GmbH & Co. KG, Bielomatik Leuze GmbH & Co. KG, Frimo Group GmbH, and Sonics & Materials, Inc. are some of the dominant companies in this sector. These companies leverage advanced welding technologies such as ultrasonic, laser, infrared, and vibration welding to cater to various industries, including automotive, electronics, medical devices, and packaging. The industry is dominated by players offering diverse welding solutions, including ultrasonic, laser, infrared, and vibration welding technologies, each tailored to meet specific demands across various industries like automotive, medical devices, electronics, and packaging. Key differentiators among competitors include the integration of automation and smart manufacturing features, such as IoT-enabled systems and real-time data analytics, which enhance operational efficiency and quality control. Companies are increasingly focusing on developing systems that reduce operational costs while improving weld quality and speed. Moreover, the adoption of fully automated systems is gaining momentum due to the increasing demand for high-volume, precision-based production. This shift toward automation is making plastic welding more accessible to manufacturers across industries that require cost-effective solutions for large-scale production.

Recent Developments

- In March 2025, Leister transferred its laser plastic welding business to Hymson Novolas AG, a subsidiary of Hymson Laser Technology Group Co. Ltd. The transition ensures continuity and further development of existing product lines, with a new Laser Technology Center established in Switzerland. Leister will now focus more on its core competencies: plastic welding (hot air, infrared) and industrial process heat.

- In February 2025, Herrmann continues to set industry standards with its ultrasonic welding solutions, particularly for medical devices and sensitive components. The company emphasizes individualized process development, intelligent process control, and digital quality monitoring for reproducible, high-strength welds. Herrmann will showcase new applications and integration options at K 2025, focusing on automation and sustainability in medical and packaging industries.

- In January 2025, Dukane highlighted its patented Q-Factor, Melt-Match®, Low Amplitude Preheat, and Ultra-High Frequency (260–400 Hz) vibration welding technologies, emphasizing their leadership in process control and diagnostics.

- In May 2024, Emerson launched the Branson™ GLX-1 Laser Welder, designed for the automated assembly of small, intricate plastic parts. The GLX-1 features a compact, modular design suitable for cleanroom environments, advanced servo-based actuation, and the ability to “un-weld” plastics for closed-loop recycling. It uses Simultaneous Through-Transmission Infrared® (STTlr) laser-welding technology for high efficiency, weld strength, and aesthetics. Enhanced connectivity, security, and data collection features support Industry 4.0 integration.

Market Concentration & Characteristics

The U.S. plastic welding equipment market exhibits moderate to high market concentration, with a few key players dominating the landscape while several smaller companies serve niche applications. The industry is characterized by a blend of large, established manufacturers offering a wide range of advanced welding technologies and smaller firms specializing in specific welding methods or custom solutions. The competitive environment is shaped by factors such as technological innovation, the ability to offer integrated and automated systems, and the customization of products to meet specific industry needs. While larger companies benefit from economies of scale and extensive distribution networks, smaller players often differentiate themselves through specialized products and high-touch customer service. The market is also witnessing an increasing trend towards mergers and acquisitions as companies look to expand their product portfolios and enhance technological capabilities. Overall, the market remains dynamic, with growth driven by demand for precision, automation, and sustainability across industries.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. plastic welding equipment market is expected to grow steadily due to increasing demand for advanced manufacturing techniques.

- Technological innovations, such as automation and robotics, will drive improvements in plastic welding equipment efficiency and precision.

- There will be a growing shift towards eco-friendly plastic welding solutions, focusing on energy efficiency and reducing emissions.

- Industry-specific applications, particularly in automotive, aerospace, and medical sectors, will continue to boost demand for specialized plastic welding equipment.

- The rise of lightweight materials and composites will influence the development of new plastic welding technologies.

- Companies will increasingly adopt digital controls and IoT-enabled devices for better monitoring and data analysis in welding operations.

- The demand for welding equipment that ensures higher durability and performance in harsh environments is expected to increase.

- As industries seek cost-effective and scalable production methods, plastic welding technologies will be integrated into larger manufacturing systems.

- Advancements in materials such as thermoplastics and composites will lead to the creation of more versatile and durable welding tools.

- There will be continued focus on sustainability, driving the growth of equipment that enables the recycling and reuse of plastic materials