Market Overview

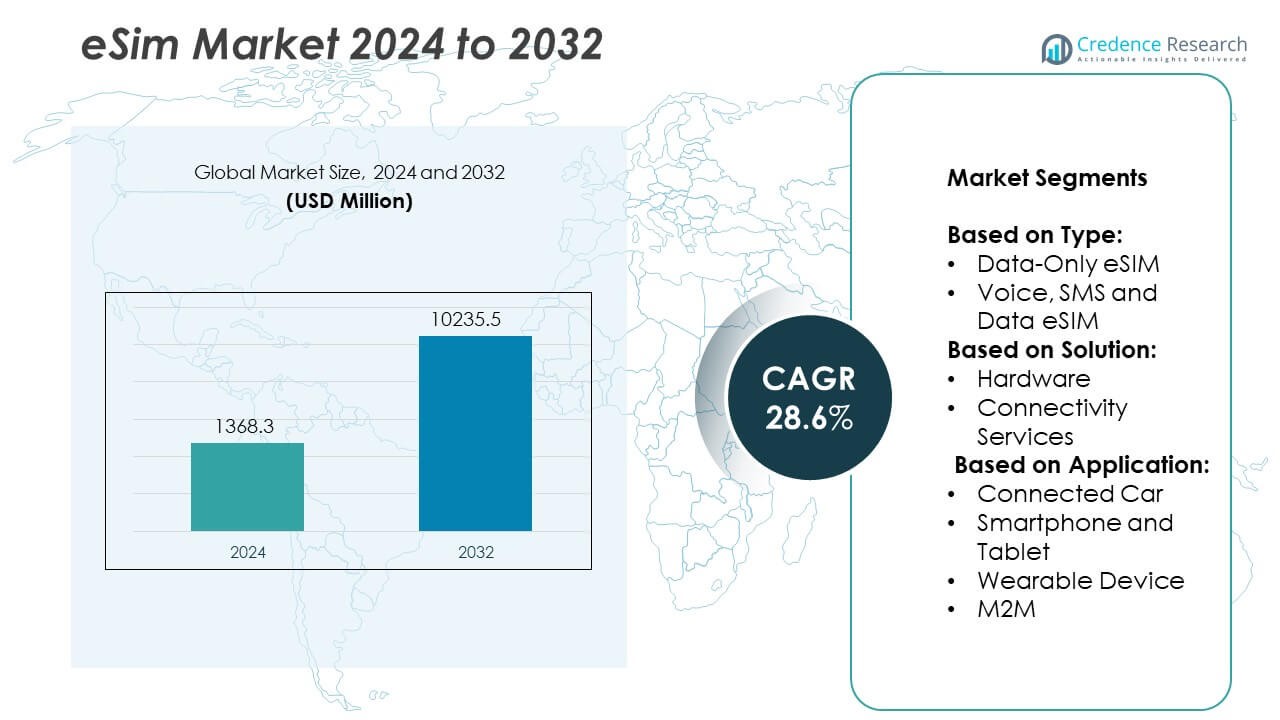

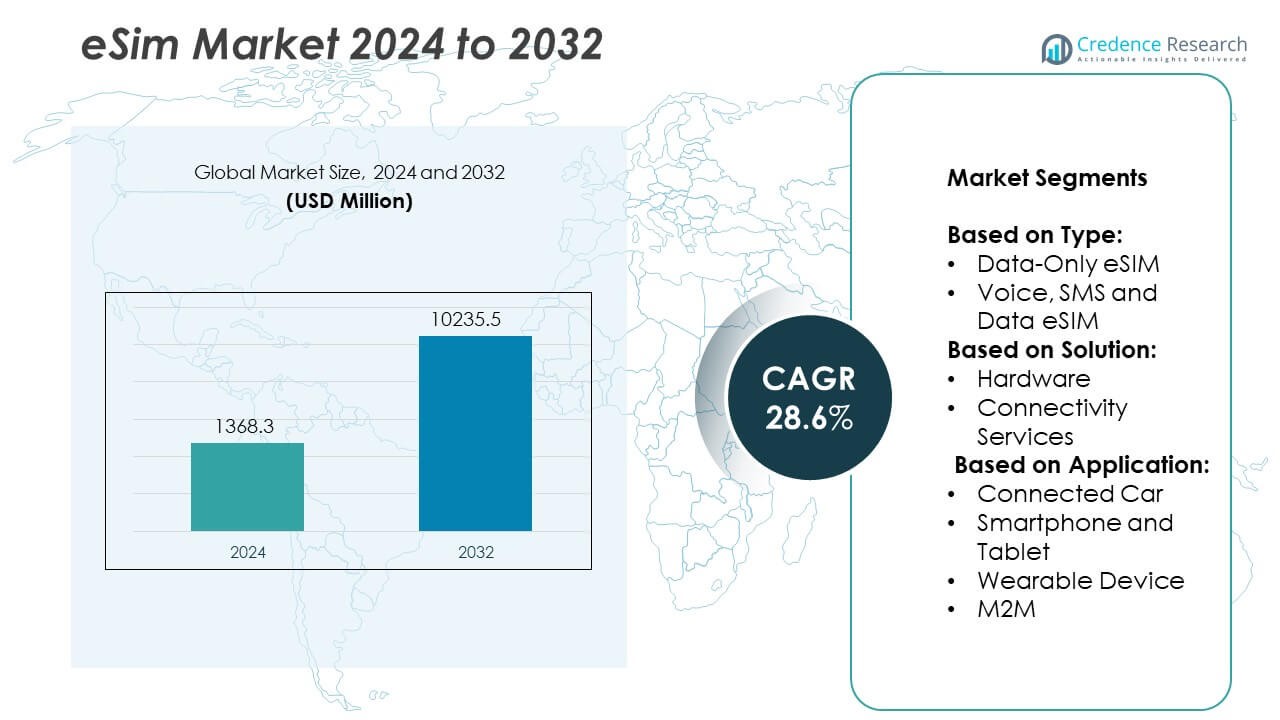

The E SIM market size was valued at USD 1,368.3 million in 2024 and is anticipated to reach USD 10,235.5 million by 2032, growing at a CAGR of 28.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| E SIM market Size 2024 |

USD 1,368.3 Million |

| E SIM market , CAGR |

28.6% |

| E SIM market Size 2032 |

USD 10,235.5 Million |

The eSIM market advances through rising demand for remote SIM provisioning, cross-network flexibility, and seamless integration across IoT and consumer devices. It gains momentum from the widespread adoption of connected vehicles, wearables, and smart consumer electronics requiring space-efficient and durable connectivity solutions. Operators support growth through cloud-based platforms and multi-profile capabilities. The market benefits from 5G rollout, increasing reliance on M2M communication, and regulatory support for digital identity.

The eSIM market demonstrates strong adoption across North America, Europe, and Asia-Pacific, driven by early technology integration, regulatory support, and expanding 5G infrastructure. North America leads with widespread use in smartphones and connected cars, while Europe emphasizes interoperability and cross-border connectivity. Asia-Pacific shows rapid growth due to rising smartphone penetration and industrial IoT deployment. Latin America and the Middle East & Africa present emerging opportunities through smart city initiatives and mobile-first strategies. Key players driving innovation and ecosystem expansion include KORE Wireless, STMicroelectronics, Thales, and Giesecke+Devrient GmbH, each offering advanced eSIM solutions tailored for both consumer and enterprise applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The eSIM market was valued at USD 1,368.3 million in 2024 and is projected to reach USD 10,235.5 million by 2032, growing at a CAGR of 28.6% during the forecast period.

- The market benefits from increasing adoption of remote provisioning, carrier flexibility, and rising integration in smartphones, wearables, and automotive systems.

- Key drivers include the demand for compact device designs, seamless cross-border connectivity, and large-scale deployment across M2M and IoT ecosystems.

- Major trends include the expansion of multi-profile eSIM solutions, cloud-based subscription platforms, and integration with 5G-enabled infrastructure.

- Leading players such as Thales, STMicroelectronics, KORE Wireless, and Giesecke+Devrient GmbH invest in chip-level innovation, secure provisioning platforms, and global connectivity offerings.

- Infrastructure limitations in emerging regions, fragmented regulatory compliance, and limited operator support in some countries restrain full-scale adoption in certain markets.

- North America leads in connected car and enterprise adoption; Europe emphasizes cross-border interoperability; Asia-Pacific accelerates through smart device penetration, while Latin America and the Middle East & Africa show emerging demand across mobile-first and smart city initiatives.

Market Drivers

Increasing Integration of IoT and M2M Technologies Across Industrial Applications

The eSIM market gains momentum due to the rapid deployment of IoT and machine-to-machine (M2M) communication technologies across sectors such as automotive, logistics, and energy. Businesses seek scalable connectivity solutions to manage thousands of devices without physical SIM interventions. eSIM technology supports seamless provisioning and remote management, aligning well with industrial automation needs. It ensures reliable network access in remote environments, crucial for smart utilities, fleet tracking, and industrial sensors. The market benefits from rising demand for centralized control, cost-efficiency, and reduced downtime in large-scale deployments. It strengthens its position as enterprises shift toward integrated digital ecosystems.

- For instance, KORE Wireless supports over 18 million connected devices globally and delivers IoT connectivity in more than 190 countries, enabling large-scale eSIM-based logistics and asset monitoring solutions.

Growing Demand for Remote SIM Provisioning and Cross-Network Flexibility

Enterprises and consumers value the ability to switch network profiles without physical card replacements. The eSIM market addresses this requirement by offering remote provisioning capabilities that comply with GSMA standards. Telecom operators adopt these platforms to reduce logistics costs and enhance customer retention. eSIM enables users to access local networks when traveling, improving mobile connectivity and reducing roaming charges. It supports multiple operator profiles, allowing flexible network usage across regions. It becomes a core enabler of global connectivity strategies for both individual users and multinational organizations.

- For instance, Deutsche Telekom AG manages over 30 million eSIM-enabled consumer and IoT devices across Europe and provides GSMA-compliant remote SIM provisioning services through its global eSIM management platform.

Rising Adoption of eSIM in Connected Consumer Devices Including Smartphones and Wearables

Consumer electronics manufacturers integrate eSIM into smartphones, smartwatches, tablets, and fitness devices to optimize space and enhance durability. The eSIM market benefits from the shift toward slimmer, water-resistant devices with higher functionality. It eliminates the need for physical SIM trays, allowing manufacturers to streamline device design. Mobile carriers extend support to eSIM-enabled gadgets, enhancing the ecosystem for activation and management. It promotes faster time-to-market for OEMs while offering users a simplified onboarding process. The proliferation of 5G further boosts its appeal across high-performance consumer applications.

Supportive Regulatory Environment and Standardization Encouraging Ecosystem Growth

Government agencies and international telecom bodies implement policies that promote universal eSIM compatibility. The eSIM market responds with interoperable solutions that meet evolving compliance standards and technical frameworks. Regulators encourage digital identity authentication and secure network access via embedded modules. These efforts create a trusted environment for large-scale deployments in sectors such as healthcare, defense, and automotive. It fosters vendor collaboration across device makers, network operators, and solution providers. Market momentum accelerates as standardization lowers entry barriers for new participants.

Market Trends

Expansion of Consumer eSIM Support Across Global Smartphone and Wearable Brands

Leading consumer electronics brands now embed eSIM in flagship smartphones, smartwatches, and tablets. The eSIM market responds to this shift by aligning infrastructure with device manufacturers and mobile network operators. It drives consistent growth through mass-market availability and wider network support. Consumers benefit from faster activation, dual-SIM functionality, and better portability. Device makers eliminate the physical SIM tray, enabling compact designs and improved water resistance. It becomes a defining feature in premium consumer devices across developed and emerging markets.

- For instance, Apple has integrated eSIM into all iPhone 14 models in the United States, supporting dual eSIM functionality and removing the physical SIM slot, Apple shipped over 105 million iPhones globally.

Adoption of eSIM by Automotive OEMs for Embedded Connectivity and Telematics

Automotive manufacturers integrate eSIM into connected vehicles to enable real-time diagnostics, infotainment, and emergency communication. The eSIM market evolves to support advanced vehicle telematics and over-the-air updates. It facilitates secure, long-term connectivity without reliance on removable SIM cards. Automakers utilize it to provision vehicles at the factory and ensure compliance with regional network regulations. The growing electric vehicle ecosystem further amplifies demand for embedded connectivity. It enables seamless cross-border roaming and enhances driver experience in both personal and commercial fleets.

- For instance, Giesecke+Devrient GmbH became the first company in April 2025 to receive GSMA certification for its IoT eSIM product under the SGP.32 standard, enabling secure and compliant integration into regulated environments; the certified eUICC supports over 20 remote SIM profiles and operates across more than 200 global networks.

Emergence of Multi-Profile and Multi-IMSI eSIM Capabilities for Enterprise Applications

Enterprises adopt eSIM solutions with support for multiple profiles and IMSIs to optimize connectivity across geographies. The eSIM market accelerates integration with cloud platforms and remote SIM management tools. It empowers businesses to manage distributed IoT devices without manual configuration or SIM swaps. Telecom providers enhance service offerings by supporting automated profile switching based on cost or coverage. It aligns with enterprise goals of reducing downtime and operational complexity. Adoption intensifies in logistics, healthcare, and energy sectors managing critical assets.

Growing Alignment Between eSIM Standards and Secure Authentication Protocols

Industry stakeholders continue to align eSIM with emerging digital identity and secure access protocols. The eSIM market reflects this shift by enhancing security layers and interoperability across ecosystems. It enables encrypted data exchange and secure provisioning over untrusted networks. Compliance with GSMA specifications and integration with Trusted Execution Environments gain priority. Governments and enterprises seek trusted identity mechanisms for both consumer and industrial devices. It supports broader adoption in regulated environments including banking, defense, and public infrastructure.

Market Challenges Analysis

Fragmented Network Support and Limited Interoperability Across Regional Operators

Telecom operators in several regions remain cautious about full-scale eSIM integration due to infrastructure gaps and competitive concerns. The eSIM market encounters friction where mobile carriers hesitate to support remote provisioning or limit access to eSIM-compatible plans. It restricts user flexibility and slows the adoption curve in less mature telecom markets. Some operators fear losing control over customer relationships and billing structures. Device users often face inconsistent support across regions, affecting the user experience. It challenges OEMs and service providers attempting to scale global connectivity solutions.

Complex Regulatory Environment and Compliance Barriers for Cross-Border Deployments

Governments impose varied rules on mobile identity, SIM registration, and data protection, complicating eSIM implementation. The eSIM market must navigate a fragmented regulatory landscape that impacts deployment speed and operational costs. It requires close coordination with local authorities to meet telecom and cybersecurity compliance standards. Multinational enterprises struggle to manage uniform connectivity policies across multiple jurisdictions. Delays in certification or policy alignment hinder market access in high-growth regions. It demands significant investment in legal, technical, and procedural adaptation from ecosystem stakeholders.

Market Opportunities

Accelerating Demand for Cross-Border Connectivity in Travel and Logistics Industries

Global travel recovery and expansion in cross-border logistics create new use cases for seamless, multi-network connectivity. The eSIM market meets this need by offering instant access to local networks without physical SIM cards. It supports international travelers, logistics providers, and fleet managers seeking reliable coverage across regions. Businesses reduce roaming charges and eliminate delays linked to SIM procurement and activation. Travel tech platforms and shipping companies partner with eSIM providers to bundle global data services. It opens scalable revenue channels across tourism, transport, and freight operations.

Integration with Next-Generation Networks and Cloud-Based Subscription Platforms

5G rollout and cloud-native infrastructure drive eSIM compatibility with advanced digital ecosystems. The eSIM market aligns with mobile operators and technology vendors to support real-time provisioning, analytics, and network slicing. It enhances subscription flexibility through cloud-based management platforms tailored for consumer and enterprise use. Telecom operators deploy eSIM as a foundation for personalized mobile plans and device bundles. It allows service providers to onboard users quickly while improving operational efficiency. The synergy with 5G, IoT, and AI creates sustained opportunities across connected environments.

Market Segmentation Analysis:

By Type:

The eSIM market divides into Data-Only eSIM and Voice, SMS, and Data eSIM segments. Voice, SMS, and Data eSIM holds a dominant share due to its broader compatibility with smartphones and tablets. It enables full-service mobile functionality and appeals to users seeking traditional telecom services without a physical SIM. Telecom operators support this segment through bundled voice and data plans. Data-Only eSIM gains traction in connected devices such as tablets, IoT sensors, and smartwatches. It provides efficient data connectivity where voice and messaging are non-essential. It supports cost-effective deployment in non-voice applications across consumer and industrial devices.

- For instance, Soracom provides eSIM-based Data-Only connectivity across more than 160 countries and supports over 4 million IoT connections worldwide through its global cellular platform.

By Solution:

Hardware and Connectivity Services define the core solution categories. Hardware accounts for a larger share, driven by embedded chipsets in smartphones, vehicles, and wearables. The demand for compact, durable components supports its adoption by OEMs focused on water-resistant and space-efficient designs. Connectivity Services grow steadily with telecom providers offering cloud-based platforms for remote provisioning and SIM management. It plays a critical role in enterprise and M2M applications requiring scalable, cross-border connectivity. The eSIM market leverages both hardware integration and service flexibility to enable seamless user experiences across ecosystems.

- For instance, Telit Cinterion delivers GSMA-compliant eSIM modules across 300 operators and supports over 20 million devices globally through its OneEdge™ cloud-based connectivity platform.

By Application:

Smartphones and Tablets represent the largest application segment due to mass-market adoption by leading manufacturers and mobile users. The eSIM market expands through pre-installed support in flagship devices, enabling users to switch carriers without changing physical cards. Wearable Devices also show strong growth as brands integrate eSIM in smartwatches and fitness trackers for standalone connectivity. Connected Car applications gain momentum as automakers embed eSIM to support navigation, diagnostics, and infotainment systems. M2M applications benefit from eSIM’s remote management capabilities, enabling telecom-independent operation across logistics, energy, and industrial automation. It ensures consistent performance across millions of distributed endpoints.

Segments:

Based on Type:

- Data-Only eSIM

- Voice, SMS and Data eSIM

Based on Solution:

- Hardware

- Connectivity Services

Based on Application:

- Connected Car

- Smartphone and Tablet

- Wearable Device

- M2M

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 34.7% of the global eSIM market share, driven by high adoption across consumer electronics, automotive, and enterprise sectors. The region benefits from early regulatory support, widespread 5G infrastructure, and strong partnerships between device manufacturers and telecom providers. Leading smartphone makers pre-install eSIM functionality in premium devices, encouraging mass-scale user activation. Mobile carriers in the United States and Canada actively promote eSIM-based plans, reducing logistics costs and improving customer retention. The automotive industry in North America integrates eSIM into connected vehicles to enable telematics, diagnostics, and emergency response capabilities. The region’s enterprise market also deploys eSIM in M2M and IoT solutions, particularly in logistics and energy, where centralized remote provisioning provides operational flexibility. It maintains its lead through innovation, favorable policy frameworks, and mature digital ecosystems.

Europe

Europe holds 27.9% of the global eSIM market, supported by regulatory mandates and the presence of technologically advanced telecom operators. Countries such as Germany, France, the United Kingdom, and the Netherlands show high penetration in smartphones and wearables with eSIM compatibility. The European Union’s push for digital identity and interoperability accelerates eSIM acceptance across both consumer and industrial segments. Mobile network operators offer remote SIM provisioning as part of their standard offerings, enabling seamless network transitions and simplified activation. Automakers in Germany and Sweden integrate eSIM into connected car platforms to comply with regional telematics and emergency call regulations. Industrial automation, healthcare monitoring, and utility applications also contribute to demand for scalable eSIM-based connectivity. It benefits from harmonized policies and growing emphasis on cross-border connectivity.

Asia-Pacific

Asia-Pacific captures 23.1% of the eSIM market, with rapid growth in countries such as China, Japan, South Korea, and India. The region’s smartphone ecosystem quickly adapts to eSIM technology, with manufacturers launching mid- and high-end models featuring embedded SIMs. Telecom regulators in markets like South Korea and Japan support eSIM deployment through standardization and consumer portability frameworks. In China, large-scale deployments in industrial IoT and connected vehicles increase adoption across manufacturing and transport sectors. India presents strong potential through partnerships between mobile operators and device brands promoting digital-first services. Wearables, M2M modules, and smart home devices also see accelerating adoption of eSIM for uninterrupted connectivity. It experiences strong growth fueled by a large consumer base, fast digitization, and regional innovation.

Latin America

Latin America holds 8.4% of the global eSIM market share, with growing demand from mobile-first users and the automotive sector. Brazil and Mexico lead regional adoption, supported by increasing smartphone penetration and gradual telecom modernization. Mobile network operators begin to expand support for eSIM-enabled devices, though availability remains inconsistent across some countries. Automakers leverage eSIM for fleet connectivity and real-time tracking in commercial vehicles. The region faces challenges in infrastructure development but shows a positive trend in consumer adoption through partnerships with global OEMs. It shows potential through rising urban digitization and government interest in connected mobility solutions.

Middle East & Africa

The Middle East & Africa account for 5.9% of the global eSIM market, driven by smart city initiatives and expanding mobile infrastructure. Countries such as the UAE, Saudi Arabia, and South Africa lead regional eSIM adoption, with telecom providers offering commercial eSIM services to both individuals and enterprises. Governments invest in IoT frameworks to support national digital transformation strategies, creating demand for scalable connectivity solutions. Wearable tech, M2M modules, and connected vehicle solutions gain traction, especially in high-income urban centers. The region’s adoption remains in the early phase but benefits from favorable policy direction and infrastructure investments. It progresses steadily through strategic partnerships and localized innovation efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The leading players in the eSIM market include Thales, STMicroelectronics, Giesecke+Devrient GmbH, KORE Wireless, Arm Limited, NXP Semiconductors, Infineon Technologies AG, Sierra Wireless, Deutsche Telekom AG, and Workz. These companies maintain a competitive edge through a combination of technological expertise, secure provisioning platforms, and strong industry partnerships. Thales and Giesecke+Devrient GmbH dominate the secure element and remote subscription management space by offering end-to-end eSIM enablement solutions compliant with GSMA standards. STMicroelectronics and Infineon Technologies AG focus on embedded hardware components optimized for space efficiency, power management, and multi-profile storage capabilities. NXP Semiconductors enhances its value by aligning with automotive OEMs and consumer device manufacturers seeking secure connectivity modules. KORE Wireless and Sierra Wireless address enterprise demand with device connectivity platforms tailored for M2M and IoT applications across logistics, healthcare, and utilities. Arm Limited supports chipset vendors through architectural frameworks that enable secure eSIM operation in constrained environments. Deutsche Telekom AG contributes operator-grade provisioning services through its global connectivity infrastructure. Workz scales its competitiveness by delivering GSMA-certified platforms to emerging markets at cost-effective rates. The market remains dynamic, with players competing on security, flexibility, and multi-regional deployment capability to meet growing demand across industrial and consumer ecosystems.

Recent Developments

- In June 2025, Nigerian tech company EmoSIM launched a global eSIM solution. This innovative service allows users to connect to mobile networks in 190 countries without physical SIM cards or roaming charges.

- In May 2025, GCT Semiconductor Holding Inc. and Giesecke+Devrient GmbH announced a strategic partnership to introduce an advanced SGP.32 eSIM solution featuring Integrated Profile Activation Device support for multi-network IoT devices. This partnership leverages embedded SIM technology to deliver intelligent, location-aware connectivity for headless 4G and 5G IoT devices, enabling seamless and dynamic network access without the need for physical SIM cards.

- In March 2025, Giesecke+Devrient (G+D), a provider of eSIM technology, partnered with Amazon Web Services (AWS) to transform their eSIM offerings by leveraging cloud-native, scalable deployments.

Market Concentration & Characteristics

The eSIM market exhibits moderate to high concentration, with a limited number of global players holding significant control over core technologies, hardware manufacturing, and remote provisioning infrastructure. It features vertically integrated firms that combine secure element design, eUICC chipsets, subscription management platforms, and compliance with GSMA standards. The market favors vendors with strong operator partnerships, global certification, and proven interoperability across devices and networks. It shows high barriers to entry due to the complexity of certification, regulatory alignment, and the need for robust security infrastructure. Leading participants compete on scalability, reliability, and the ability to support multi-profile, multi-IMSI capabilities across consumer and industrial use cases. It reflects strong demand for embedded connectivity in high-growth applications such as smartphones, connected vehicles, and IoT devices. The market remains innovation-driven, shaped by 5G integration, remote SIM lifecycle management, and cross-border mobility requirements. It continues to evolve with emphasis on interoperability, cost optimization, and cloud-native subscription management.

Report Coverage

The research report offers an in-depth analysis based on Type, Solution, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- eSIM adoption will increase across mid-range smartphones as more OEMs expand compatibility beyond flagship models.

- Automotive manufacturers will standardize eSIM integration for connected vehicle platforms and telematics systems.

- Enterprises will scale deployment of eSIM in IoT applications to manage remote assets with greater efficiency.

- Telecom operators will expand support for multi-profile and multi-IMSI features to attract global users.

- Cloud-based subscription management platforms will become a central component of eSIM service delivery.

- eSIM will play a critical role in enabling seamless 5G connectivity for both consumer and industrial devices.

- Cross-border travelers and logistics companies will adopt eSIM for cost-efficient, uninterrupted mobile access.

- Device makers will eliminate physical SIM trays in favor of compact, embedded designs to save space and enhance durability.

- Regulatory bodies will enforce more unified eSIM standards, improving interoperability across regions.

- New partnerships between hardware vendors, mobile operators, and software providers will accelerate ecosystem development.