Market Overview:

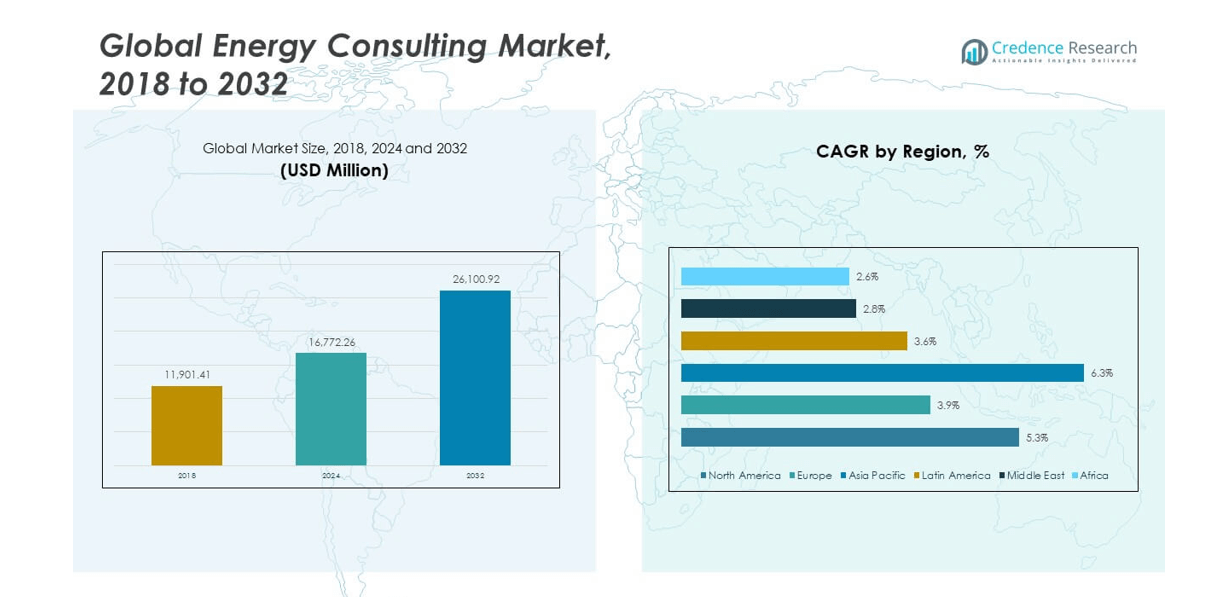

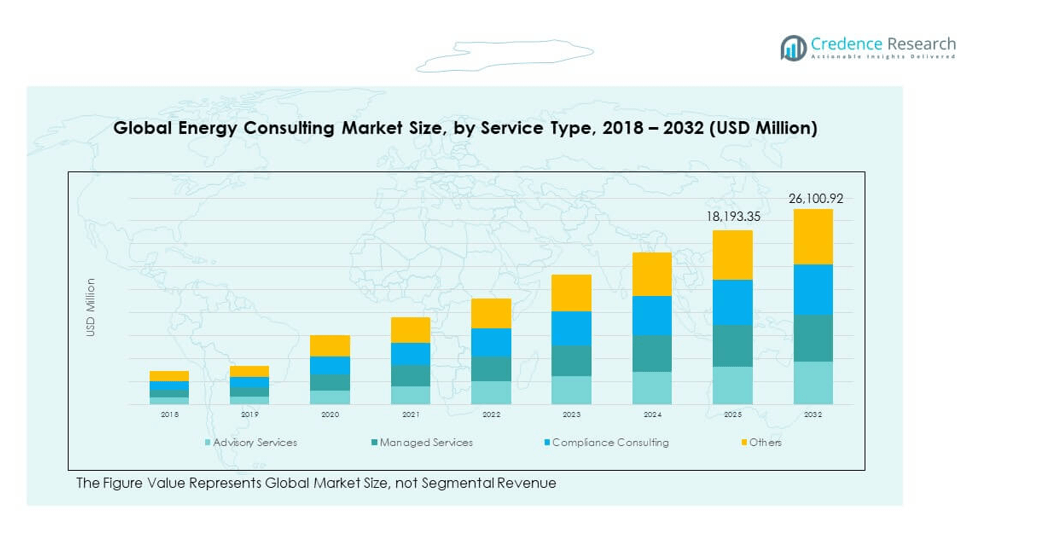

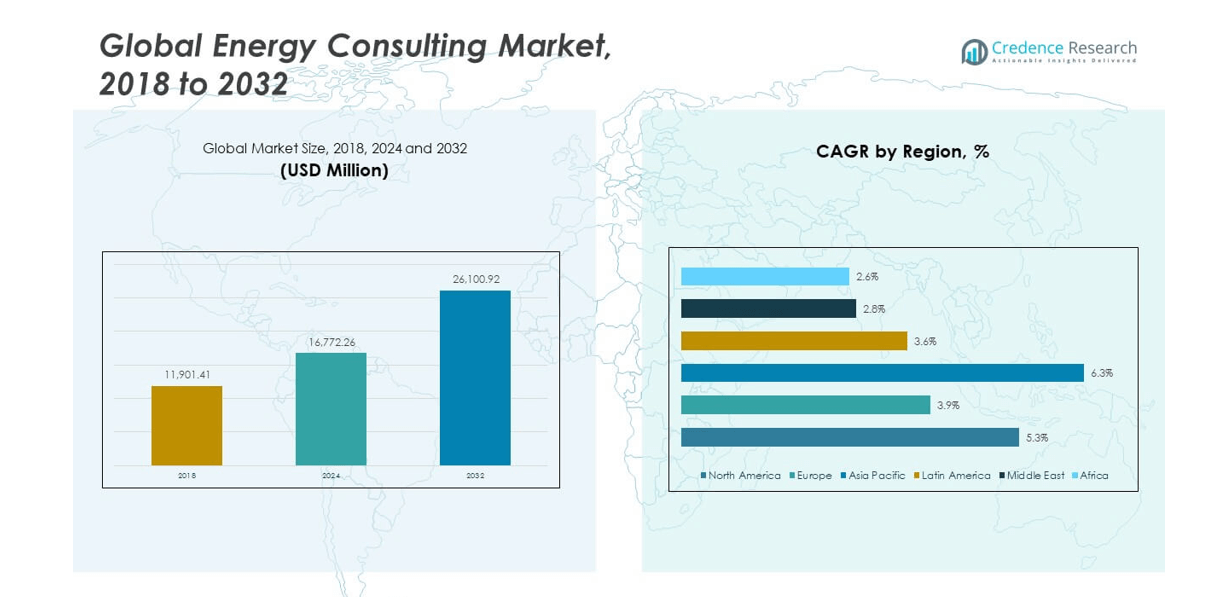

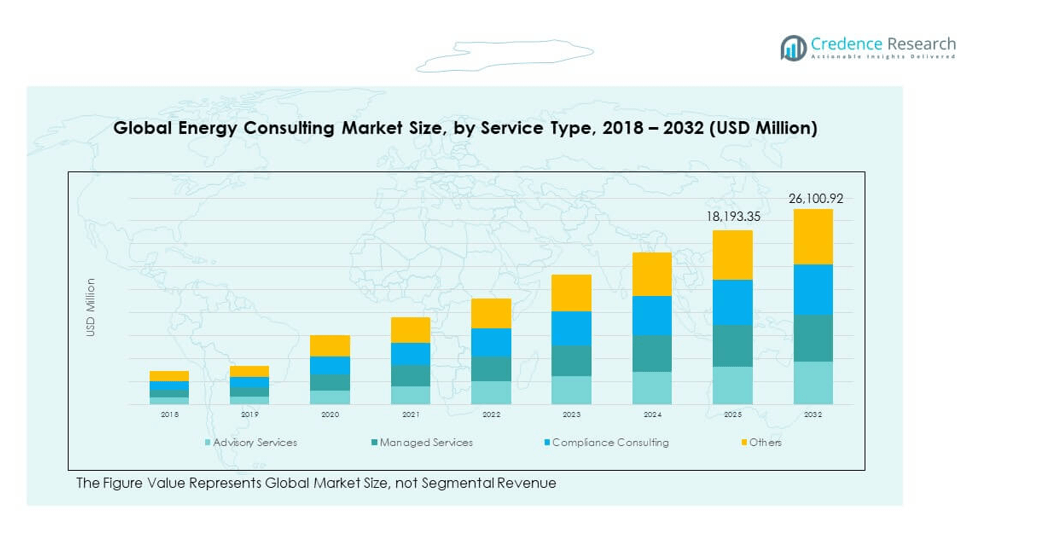

The Global Energy Consulting Market size was valued at USD 11,901.41 million in 2018 to USD 16,772.26 million in 2024 and is anticipated to reach USD 26,100.92 million by 2032, at a CAGR of 5.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Energy Consulting Market Size 2024 |

USD 16,772.26 million |

| Energy Consulting Market, CAGR |

5.29% |

| Energy Consulting Market Size 2032 |

USD 26,100.92 million |

Market growth is driven by rising demand for energy transition strategies, regulatory compliance support, and operational efficiency. Organizations across industries are investing in expert advisory to align with decarbonization goals, improve energy performance, and manage risks. It benefits from expanding digital adoption, integration of renewables, and modernization of energy infrastructure. Increasing pressure to meet climate targets and optimize resource use further boosts the need for specialized consulting expertise.

North America and Europe lead the market due to advanced energy infrastructure, strong regulatory frameworks, and early adoption of clean technologies. Asia Pacific is emerging as a fast-growing region with large-scale renewable projects, industrial expansion, and policy support. The Middle East and Africa are exploring diversification strategies, while Latin America focuses on renewable integration and grid upgrades. This global spread reflects strong demand across both mature and emerging economies

Market Insights:

- The Global Energy Consulting Market was valued at USD 11,901.41 million in 2018, reached USD 16,772.26 million in 2024, and is projected to hit USD 26,100.92 million by 2032, growing at a CAGR of 5.29%.

- North America holds 42.2% of the market share, followed by Asia Pacific with 34.7% and Europe with 16.2%, driven by advanced infrastructure, policy support, and early renewable adoption.

- Asia Pacific is the fastest-growing region with 34.7% share, fueled by rapid industrialization, renewable investments, and expanding energy infrastructure.

- Advisory Services lead the service type segment, reflecting strong demand for strategic energy transition and regulatory guidance.

- Power Generation dominates the application segment, supported by renewable integration, capacity expansion, and modernization initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Focus on Energy Transition and Decarbonization Goals

The Global Energy Consulting Market gains momentum from the strong global shift toward low-carbon energy systems. Governments set ambitious net-zero targets, encouraging industries to adopt cleaner and more efficient energy models. Companies seek expert guidance to navigate complex regulatory frameworks and implement structured transition strategies. It enables organizations to assess emission levels, optimize energy use, and align operations with climate commitments. Renewable energy adoption across industrial sectors increases demand for advisory services. Consulting firms support businesses in developing transition roadmaps and integrating innovative energy solutions. Large enterprises prioritize carbon reduction to meet investor expectations and secure funding. This rising global transition strengthens market growth and service diversification.

- For instance, in April 2024, Baringa Partners completed the UK Renewables Deployment Supply Chain Readiness Study commissioned by the Department for Energy Security and Net Zero. The study focused on assessing the UK’s renewable energy supply chain to support future offshore wind deployment and policy planning.

Increasing Demand for Energy Efficiency and Operational Optimization

The focus on reducing operational costs and improving energy performance drives the need for expert consulting. Energy audits, performance assessments, and digital monitoring solutions enhance asset productivity. It allows companies to identify consumption patterns, minimize waste, and optimize energy flow. Growing energy prices and resource scarcity intensify the push for efficient operations. Organizations rely on consultants to adopt sustainable practices and meet environmental regulations. Smart building systems and automated controls create opportunities for advanced advisory services. Industrial sectors with high consumption benefit from customized efficiency strategies. This strong emphasis on cost-effective energy usage expands consulting service demand across key industries.

Strong Regulatory Support and Governmental Policy Alignment

Evolving energy regulations and climate policies accelerate the expansion of consulting services. Governments mandate strict compliance standards, carbon reporting, and sustainability goals across multiple industries. It increases the need for expert guidance to meet complex policy requirements. Consultants help organizations structure compliance strategies, minimize penalties, and achieve certifications. Public sector investment in energy modernization projects further boosts advisory demand. Global policy initiatives encourage renewable deployment, electrification, and infrastructure upgrades. Companies use consultants to align internal operations with regulatory frameworks. This close alignment between policy and consulting needs reinforces market relevance and long-term growth.

- For instance, the U.S. Department of Energy’s Partnership Intermediary Agreement FY2024 Report highlighted the role of intermediary partners in advancing clean energy innovation and collaboration. The report outlined how these agreements support technology transfer and accelerate the commercialization of energy solutions nationwide.

Growing Digitalization and Smart Infrastructure Integration

Widespread adoption of digital technologies and intelligent energy management solutions supports market expansion. Data-driven systems offer detailed insights into consumption, generation, and grid behavior. It enables consultants to design optimized energy strategies tailored to sector needs. Smart grids, IoT devices, and advanced software platforms enhance monitoring and control efficiency. Organizations invest in predictive analytics to manage resources with accuracy. Consulting firms provide guidance on digital integration, cybersecurity, and system optimization. Digitalization reduces inefficiencies, improves energy resilience, and supports sustainability commitments. This growing digital infrastructure strengthens the value proposition of consulting solutions.

Market Trends

Accelerated Adoption of Renewable Energy Integration and Storage Solutions

The Global Energy Consulting Market experiences rising demand for integrating renewable sources with storage systems. Companies prioritize clean power portfolios to reduce emissions and enhance energy independence. It drives the need for consulting support in project design, grid compatibility, and financing. Energy storage technologies become central to balancing intermittent renewable generation. Consulting firms help optimize system performance and stabilize supply-demand gaps. Corporate power purchase agreements accelerate renewable project deployment. Energy consultants play a key role in advising on hybrid system architectures. This accelerating integration trend enhances energy resilience and sustainability profiles.

- For instance, the National Renewable Energy Laboratory (NREL) conducted the Western Wind and Solar Integration Study to evaluate scenarios with up to 35% wind and solar power in the Western Interconnection. The study highlighted how improved transmission and system coordination can enhance renewable integration and grid reliability.

Expansion of Decentralized Energy and Microgrid Deployments

Decentralized power generation trends reshape energy consulting service models. Companies deploy microgrids to achieve flexibility, cost control, and improved energy security. It creates rising demand for advisory services in system design, regulatory compliance, and operational optimization. Consulting firms support feasibility assessments, investment planning, and implementation strategies. Microgrid adoption grows in commercial complexes, industrial parks, and remote areas. Resilience against grid disruptions makes decentralized solutions more attractive. Stakeholders seek customized consulting to address site-specific challenges. This expansion of microgrid projects reshapes the market landscape and service priorities.

Increased Integration of Advanced Data Analytics and AI Solutions

Growing reliance on analytics, AI, and machine learning tools is shaping consulting operations. Organizations use these tools for real-time energy forecasting, optimization, and decision-making. It enables consultants to provide high-precision, data-driven recommendations. AI platforms improve energy load predictions and operational reliability. Predictive maintenance strategies lower costs and improve equipment uptime. Consulting firms expand offerings by integrating intelligent software solutions. Enhanced visibility and control encourage faster client adoption. This analytics-driven trend strengthens the strategic importance of consulting in energy planning.

Rising Corporate Sustainability Commitments and Green Financing Access

Corporations increase their sustainability goals, driving structured energy planning. Green financing, carbon pricing, and ESG compliance encourage stronger action. It leads to higher engagement with consulting firms to design achievable targets. Advisory services align strategies with investor expectations and policy frameworks. Large enterprises demand integrated solutions covering energy transition, risk management, and reporting. Financial institutions support projects aligned with climate goals, reinforcing consulting demand. Consultants offer tailored decarbonization plans and performance tracking systems. This trend reflects the strategic role of consulting in shaping corporate energy strategies.

- For instance, Ernst & Young (EY) Parthenon’s ESG and Sustainability Strategy practice supported client decarbonization and green financing across more than 120 countries as of 2025, delivering integrated energy transition frameworks combining capital allocation, ESG reporting, and portfolio decarbonization consulting for multinational firms.

Market Challenges Analysis

High Implementation Costs and Complex Infrastructure Modernization Needs

The Global Energy Consulting Market faces pressure from the high cost of transitioning to new systems. Many organizations delay large-scale projects due to capital constraints and long payback periods. It limits the ability to adopt advanced energy infrastructure quickly. Modernizing outdated grids and integrating digital systems require heavy investment. Smaller enterprises face barriers in accessing financing and technical support. This capital intensity slows down energy transition in emerging economies. Consultants must design cost-effective pathways to maintain project feasibility. These financial and infrastructure hurdles restrain market expansion despite strong policy support.

Regulatory Uncertainty and Slow Policy Harmonization Across Regions

Energy regulations differ widely between countries, creating fragmented market conditions. Policy gaps slow down cross-border investment and complicate implementation strategies. It leads to delays in energy project approvals and long compliance processes. Consultants face challenges aligning client strategies with inconsistent legal frameworks. Regions with underdeveloped regulatory systems experience slower energy modernization. Lack of clear incentives weakens investor confidence and project momentum. This regulatory complexity requires specialized advisory services with deep regional expertise. The uneven pace of policy harmonization remains a key barrier to market scalability.

Market Opportunities

Rising Energy Transition in Emerging Economies and Infrastructure Investments

The Global Energy Consulting Market sees strong opportunity growth in emerging economies with rising energy demand. Governments increase investments in renewable infrastructure, smart grids, and electrification projects. It encourages the private sector to seek expert consulting support for efficient deployment. Expanding industrial activity drives the need for structured energy planning. Consulting firms can provide strategic guidance on project design, technology selection, and operational integration. International funding programs offer new pathways for growth. These infrastructure developments strengthen consulting firms’ role in shaping sustainable energy landscapes.

Rapid Expansion of Digital Transformation and Service Diversification

Digital solutions create significant opportunities for service expansion in the consulting sector. AI, IoT, and cloud systems support advanced energy planning and operational control. It enables consultants to deliver precision-based solutions across multiple industries. Industries seek tailored services for risk mitigation, real-time monitoring, and predictive insights. Digital adoption improves client engagement and speeds up project implementation. Consulting firms can build specialized service portfolios around smart infrastructure. This transformation strengthens long-term growth prospects and competitive positioning.

Market Segmentation Analysis:

The Global Energy Consulting Market is structured across service type and application segments, reflecting diverse industry needs.

By service type, Advisory Services lead the market due to strong demand for strategic guidance on energy transition, infrastructure modernization, and investment planning. Companies depend on advisory expertise to navigate regulatory frameworks and align with sustainability goals. Managed Services gain momentum with growing interest in outsourced operational efficiency and digital monitoring. Compliance Consulting plays a critical role in helping organizations meet evolving environmental and safety regulations. Others include specialized consulting areas focused on emerging technologies and niche energy projects.

- For example, Wipro, in partnership with AusNet Services (Australia), successfully implemented SAP S/4HANA Cloudin 2025, achieving a major breakthrough in field operational efficiency through real-time geospatial mapping and asset management tools, benefitting more than 1,600 internal and external users and 50 energy retailers across the network.

By application, Power Generation dominates due to the rising need for renewable integration and capacity expansion. Oil & Gas maintains strong consulting demand for efficiency and decarbonization strategies. Utilities rely on consulting firms for grid modernization and smart infrastructure deployment. Industrial applications reflect increasing focus on energy optimization and digital transformation. Others cover diverse sectors adopting structured energy transition programs. This segmentation highlights a balanced mix of strategic advisory and operational support across industries.

- For example, ONGC’s Decarbonization Roadmap outlines ₹1 trillion (US$12 billion) green investmentsthrough 2030, targeting 10 GW of renewable capacity while reducing Scope 1 & 2 emissions by 17% between 2018–2023 and achieving net-zero emissions by 2038.

Segmentation:

By Service Type

- Advisory Services

- Managed Services

- Compliance Consulting

- Others

By Application

- Power Generation

- Oil & Gas

- Utilities

- Industrial

- Others

By Region

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Regional Analysis:

North America

The North America Global Energy Consulting Market size was valued at USD 5,072.79 million in 2018 to USD 7,072.85 million in 2024 and is anticipated to reach USD 11,038.07 million by 2032, at a CAGR of 5.3% during the forecast period. North America holds a significant market share of 42.2%. The region benefits from strong regulatory frameworks, advanced energy infrastructure, and early adoption of digital technologies. It leads in renewable integration, smart grid expansion, and efficiency projects across utilities and industries. Governments and private enterprises prioritize decarbonization targets, driving the demand for consulting services. It experiences strong growth from power generation modernization and distributed energy systems. Energy consultants support clients in navigating complex policy structures and deploying advanced energy management solutions. Strategic investments in hydrogen, offshore wind, and storage systems enhance service opportunities. This regional strength positions North America as a global leader in energy consulting solutions.

Europe

The Europe Global Energy Consulting Market size was valued at USD 2,051.15 million in 2018 to USD 2,719.08 million in 2024 and is anticipated to reach USD 3,813.81 million by 2032, at a CAGR of 3.9% during the forecast period. Europe accounts for a 16.2% share of the global market. It is supported by strong environmental policies, decarbonization goals, and a mature renewable energy ecosystem. European nations maintain ambitious net-zero commitments, driving structured consulting demand. Energy efficiency regulations create opportunities across industrial and utility sectors. It benefits from active electrification programs and rising renewable energy investment. The region prioritizes clean hydrogen, offshore wind, and grid interconnection projects. Consulting firms play a key role in supporting policy alignment and energy transition strategies. Europe remains a critical hub for innovative consulting approaches and climate-focused solutions.

Asia Pacific

The Asia Pacific Global Energy Consulting Market size was valued at USD 3,743.79 million in 2018 to USD 5,546.62 million in 2024 and is anticipated to reach USD 9,353.06 million by 2032, at a CAGR of 6.3% during the forecast period. Asia Pacific holds a market share of 34.7%. The region experiences strong demand due to rapid urbanization, rising energy needs, and increasing infrastructure development. Governments prioritize renewable expansion, electrification, and industrial modernization. Energy consulting plays a key role in guiding investments and technology adoption. It benefits from growing private sector participation and cross-border collaboration. Emerging economies such as China and India drive large-scale renewable and smart grid deployments. Consulting firms provide expertise in financing structures, system optimization, and policy compliance. This dynamic growth positions Asia Pacific as the fastest-growing regional market in this sector.

Latin America

The Latin America Global Energy Consulting Market size was valued at USD 525.13 million in 2018 to USD 730.20 million in 2024 and is anticipated to reach USD 996.43 million by 2032, at a CAGR of 3.6% during the forecast period. Latin America represents a market share of 5.0%. The region experiences increasing demand for consulting services driven by grid modernization and renewable energy adoption. Governments focus on solar and wind energy projects to diversify the energy mix. It benefits from growing private investment in clean energy infrastructure. Regulatory reforms in several countries improve the investment climate. Energy consultants support project development, compliance, and capacity-building initiatives. Brazil remains the leading market, followed by Argentina and Chile. Consulting services help address operational challenges and optimize energy infrastructure. This growth reflects rising interest in sustainable energy solutions across Latin America.

Middle East

The Middle East Global Energy Consulting Market size was valued at USD 300.33 million in 2018 to USD 382.88 million in 2024 and is anticipated to reach USD 491.43 million by 2032, at a CAGR of 2.8% during the forecast period. The region accounts for a 2.5% share of the global market. The Middle East is transitioning from traditional oil and gas dependence toward a more diversified energy structure. Governments launch ambitious renewable programs to meet energy security and sustainability goals. It focuses on utility-scale solar, hydrogen, and grid modernization projects. Consulting demand grows as the region explores energy diversification strategies. Energy advisors play a vital role in regulatory alignment and infrastructure development. Strategic partnerships with international firms strengthen capability building. This gradual transition highlights a growing need for structured energy consulting services.

Africa

The Africa Global Energy Consulting Market size was valued at USD 208.22 million in 2018 to USD 320.63 million in 2024 and is anticipated to reach USD 408.13 million by 2032, at a CAGR of 2.6% during the forecast period. Africa contributes a 1.9% share to the global market. The region is at an early stage of energy transition, with growing demand for electrification and grid access. Governments and investors emphasize renewable integration to meet rising energy needs. It faces structural challenges but also offers strong opportunities for infrastructure expansion. Consulting firms play a key role in capacity development, project financing, and regulatory frameworks. Solar and mini-grid projects dominate investment priorities across several countries. International funding supports energy modernization initiatives. This emerging market provides long-term opportunities for strategic consulting engagements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- McKinsey & Company

- Deloitte

- Accenture

- Navigant Consulting (Guidehouse)

- Wood Mackenzie

- ICF International

- Bain & Company

- KPMG

- PwC (PricewaterhouseCoopers)

- EY (Ernst & Young)

Competitive Analysis:

The Global Energy Consulting Market is highly competitive, with established global firms and specialized regional players shaping the landscape. It features a mix of strategy-focused consultancies, technical advisory providers, and integrated service firms. Leading companies include McKinsey & Company, Deloitte, Accenture, Navigant Consulting (Guidehouse), Wood Mackenzie, ICF International, Bain & Company, KPMG, PwC, and EY. These firms strengthen their market presence through digital integration, sustainability solutions, and strategic partnerships. Competition centers on expertise in energy transition, regulatory compliance, and technology implementation. Firms invest in advanced analytics, AI platforms, and smart grid advisory capabilities to enhance service differentiation. Strategic mergers, acquisitions, and geographic expansions help capture emerging opportunities. Specialized consulting firms target niche areas such as renewable integration, ESG strategy, and hydrogen development, increasing competitive intensity.

Recent Developments:

- In September 2025, Accenture announced its intent to acquire the French Orlade Group to bolster its capabilities in capital project management for the energy, utilities, rail, aerospace, and defense industries. The acquisition, announced on September 22, 2025, is expected to expand Accenture’s Industry X infrastructure practice by adding more than 200 professionals from Orlade’s global network.

- In July 2025, Deloitte expanded its capabilities in energy-related analytics through a strategic partnership with Palantir Technologies. The collaboration led to the creation of the Deloitte-Palantir Enterprise Operating System (EOS), which integrates Deloitte’s domain expertise with Palantir’s Foundry and AIP AI platforms.

- In June 2025, Bain & Company announced a new strategic partnership with Terralytiq to accelerate supply chain decarbonization for clients across sectors including energy and manufacturing. The collaboration integrates Terralytiq’s environmental data management technology with Bain’s consulting expertise to help organizations manage carbon emissions, enhance transparency, and achieve sustainability goals within their energy operations.

- In March 2025, Wood Mackenzie launched its new Lens Power & Renewables platform on March 4, 2025. This product suite, combining multi-commodity analytics, market intelligence, and geospatial data, provides a 360-degree view of renewable power sector opportunities. It enables clients to assess risk, evaluate investments, and identify growth prospects across global energy markets.

Report Coverage:

The research report offers an in-depth analysis based on Service Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Energy Consulting Market will expand steadily with growing focus on energy transition and decarbonization.

- Demand for consulting in renewable integration and grid modernization will increase across all major regions.

- Digital platforms and AI-driven analytics will shape next-generation service models.

- Energy efficiency consulting will gain importance as industries prioritize cost optimization.

- Government policy support and regulatory frameworks will strengthen service demand globally.

- Private and public sector partnerships will accelerate large-scale energy transformation projects.

- Hydrogen, offshore wind, and battery storage will emerge as key focus areas for consultants.

- Specialized advisory firms will grow in niche segments like ESG strategy and compliance.

- Asia Pacific will remain the fastest-growing region supported by industrial expansion and renewable investments.

- Strategic mergers and acquisitions will continue to reshape the competitive landscape and service portfolios.