| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enhanced Oil Recovery Market Size 2024 |

USD 27,828.4 million |

| Enhanced Oil Recovery Market, CAGR |

6.46% |

| Enhanced Oil Recovery Market Size 2032 |

USD 45,783.1 million |

Market Overview

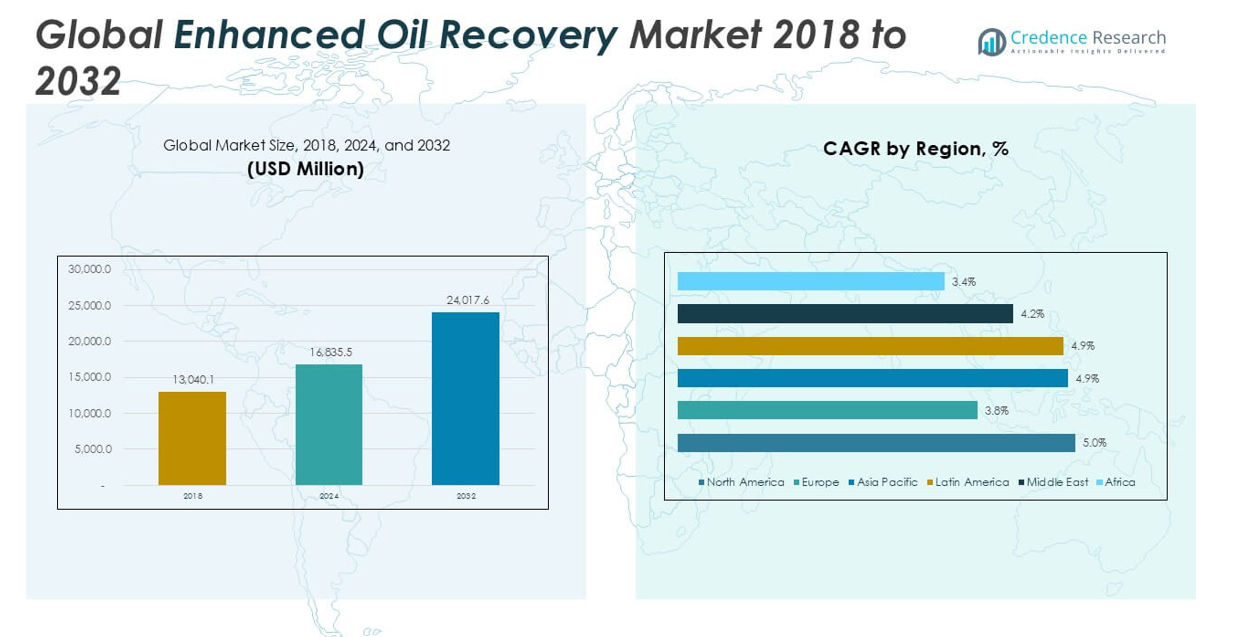

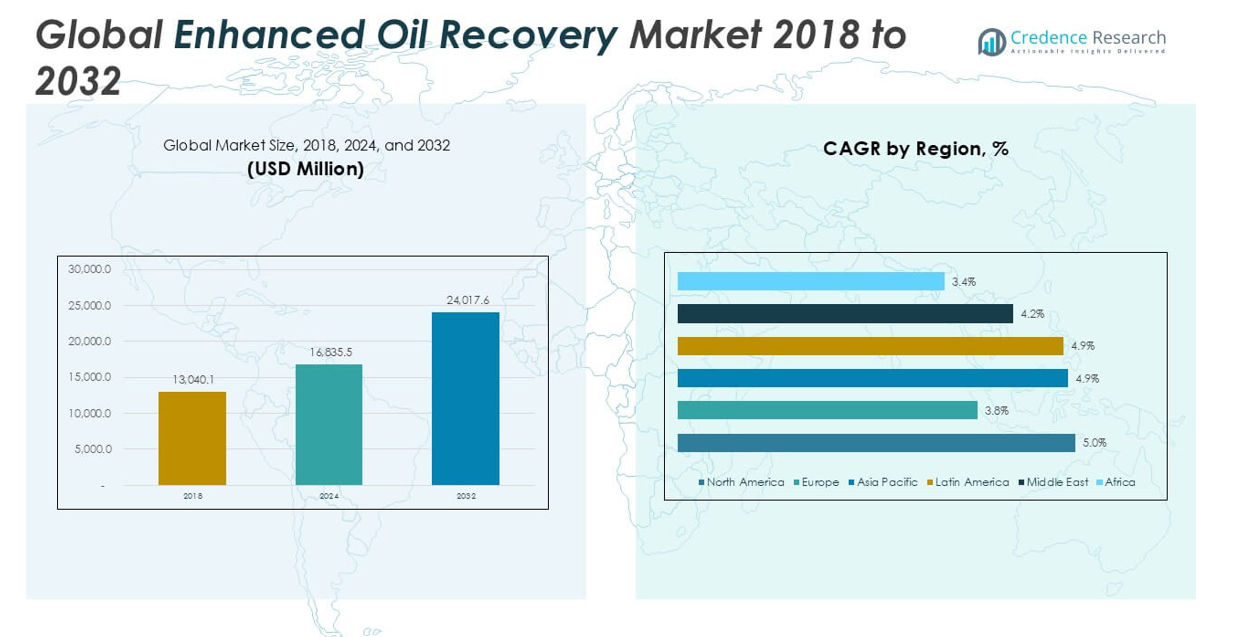

The Enhanced Oil Recovery market size was valued at USD 19,487.6 million in 2018, reached USD 27,828.4 million in 2024, and is anticipated to reach USD 45,783.1 million by 2032, at a CAGR of 6.46% during the forecast period.

The Enhanced Oil Recovery market is shaped by major players such as Petrobras, Exxon Mobil Corporation, Chevron Corporation, Royal Dutch Shell Plc, ConocoPhillips Company, Statoil ASA, BP p.l.c., Denbury Resources Inc., Suncor Energy Inc., and Lukoil, all of which maintain extensive portfolios and advanced capabilities across diverse EOR technologies. These companies drive innovation through substantial investment in research, development, and strategic collaborations, enabling them to address varying reservoir challenges globally. North America stands as the leading region, capturing 37.1% of the global market share in 2024, supported by mature oil fields, advanced infrastructure, and widespread adoption of gas and chemical injection methods. This leadership is reinforced by robust regulatory frameworks and ongoing investments in technological upgrades.

Market Insights

- The Enhanced Oil Recovery market was valued at USD 27,828.4 million in 2024 and is projected to reach USD 45,783.1 million by 2032, registering a CAGR of 6.46% during the forecast period.

- Strong demand for maximizing output from mature oil fields and increasing investments in advanced recovery technologies drive the market’s steady growth.

- Integration of carbon capture solutions and expansion into unconventional reservoirs represent key market trends, as companies seek both efficiency and environmental compliance.

- The market is highly competitive, with major players including Petrobras, Exxon Mobil Corporation, Chevron Corporation, and Royal Dutch Shell Plc, each focusing on technological innovation and broad project portfolios; high capital and operational costs act as significant restraints.

- North America leads the market with a 37.1% share in 2024, while gas injection remains the dominant segment by technology; Asia Pacific and the Middle East also show robust growth, driven by rising energy demand and increased adoption of EOR methods.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

In the Enhanced Oil Recovery market, the gas injection segment holds the largest market share, driven by its effectiveness in improving oil extraction rates from mature reservoirs. Gas injection methods, such as CO₂ and natural gas injection, increase reservoir pressure and enhance oil displacement, making them highly efficient for large-scale operations. This segment’s dominance is supported by technological advancements and regulatory incentives for carbon capture and storage. The adoption of gas injection continues to rise due to its cost efficiency, flexibility across different reservoir types, and alignment with sustainability goals.

- For instance, ExxonMobil has implemented CO₂ injection in the Wasson San Andres Unit in Texas, injecting over 500 million cubic feet of CO₂ per day to significantly increase oil production.

By Application

Within the application segment, onshore operations dominate the Enhanced Oil Recovery market, accounting for the highest revenue share. Onshore EOR projects benefit from lower operational complexities, easier infrastructure development, and reduced capital requirements compared to offshore projects. The onshore segment’s growth is fueled by the abundance of mature oil fields and the need to maximize output from existing assets. Increased investments in technology upgrades and favorable government policies further drive the adoption of EOR methods in onshore locations, maintaining its leadership in the market.

- For instance, Chevron’s Kern River Field in California has successfully applied steam flooding to over 1,400 wells, resulting in cumulative oil production surpassing 2 billion barrels.

Market Overview

Rising Demand for Oil from Mature Fields

The Enhanced Oil Recovery market experiences significant growth due to the increasing need to extract more oil from mature and declining reservoirs. Traditional extraction methods have left substantial quantities of recoverable oil underground, prompting producers to invest in advanced EOR technologies. This approach not only extends the operational life of existing fields but also maximizes resource utilization, which is vital in regions facing dwindling new discoveries and stricter production targets.

- For instance, Petrobras has extended the productive life of the Marlim field by using EOR techniques that have enabled the extraction of over 400 million barrels of additional oil.

Technological Advancements in EOR Methods

Continuous innovations in EOR technologies such as gas injection, chemical injection, and thermal processes serve as a major growth catalyst for the market. Enhanced efficiency, reduced operational costs, and improved recovery rates attract both established oil companies and new market entrants. Breakthroughs in carbon capture, storage, and digital monitoring further enhance the effectiveness of EOR techniques, making these methods more attractive for large-scale deployment.

- For instance, BP has deployed polymer flooding technology in the Dalia field offshore Angola, increasing recovery rates by approximately 200,000 barrels of oil per day.

Supportive Government Policies and Incentives

Many governments offer tax breaks, subsidies, and research funding to support the deployment of EOR projects, especially those that contribute to carbon capture and storage initiatives. These supportive policies not only reduce the financial burden on oil producers but also encourage the adoption of sustainable extraction practices. Such incentives stimulate investments and accelerate the commercialization of innovative EOR technologies in both developed and developing regions.

Key Trends & Opportunities

Integration of Carbon Capture and Storage (CCS)

A growing trend in the Enhanced Oil Recovery market is the integration of EOR projects with carbon capture and storage solutions. This approach allows companies to inject captured CO₂ into reservoirs for oil recovery, thereby reducing greenhouse gas emissions. The dual benefit of enhanced production and environmental compliance positions CCS-integrated EOR as an attractive opportunity for producers focused on sustainability and regulatory alignment.

- For instance, Denbury Resources has captured and utilized over 7 million metric tons of CO₂ annually for EOR operations in the Gulf Coast region.

Expansion into Unconventional Reservoirs

The development and application of EOR techniques in unconventional reservoirs present significant growth opportunities. Advancements in drilling and reservoir management enable EOR adoption in challenging geological conditions, such as shale formations and deepwater fields. This trend broadens the market’s potential, encouraging investment in R&D and supporting higher oil recovery rates from previously uneconomical resources.

- For instance, Shell’s EOR project in the Vito deepwater field in the Gulf of Mexico targets unconventional reservoirs at depths exceeding 4,000 meters, demonstrating the technical feasibility and success of such methods in complex environments.

Key Challenges

High Operational and Capital Costs

The implementation of advanced EOR methods requires significant investment in technology, equipment, and skilled labor, leading to high operational and capital expenditures. These costs often act as a barrier for small and mid-sized companies, limiting broader market adoption. Fluctuations in global oil prices can further deter investment in new EOR projects due to uncertain returns.

Complexity of Reservoir Geology

EOR techniques must be tailored to the specific geological characteristics of each reservoir, which adds technical complexity and risk. Unpredictable reservoir responses, compatibility issues, and variable recovery rates complicate project planning and execution. The complexity of geology often leads to increased timeframes and costs, impacting the overall feasibility of EOR deployment.

Regulatory and Environmental Concerns

Enhanced Oil Recovery operations, especially those involving chemicals and gas injection, face strict regulatory scrutiny over potential environmental impacts. Compliance with evolving safety and environmental standards can increase operational costs and cause project delays. Addressing public concerns and adhering to environmental guidelines remain critical challenges for industry participants.

Regional Analysis

North America

North America leads the Enhanced Oil Recovery market, reaching USD 10,327.52 million in 2024 and holding the largest market share at 37.1%. The region’s value increased from USD 7,175.32 million in 2018 and is projected to hit USD 17,168.67 million by 2032 at a CAGR of 6.6%. Widespread adoption of EOR technologies in the U.S. and Canada, robust infrastructure, and ongoing innovation drive North America’s dominance, supported by the concentration of mature oil fields and favorable regulatory policies.

Europe

Europe accounts for a 17.5% share of the Enhanced Oil Recovery market in 2024, with revenue growing to USD 4,877.13 million from USD 3,486.32 million in 2018. The region is set to reach USD 7,801.44 million by 2032, advancing at a CAGR of 6.1%. Progressive investments in EOR, particularly in the UK and Norway, and proactive government incentives for carbon mitigation foster steady market expansion and reinforce Europe’s competitive global standing.

Asia Pacific

Asia Pacific captures 21.6% of the Enhanced Oil Recovery market in 2024, valued at USD 6,353.62 million, up from USD 4,310.65 million in 2018. The region’s market is anticipated to reach USD 10,887.22 million by 2032, boasting the highest CAGR at 7.0%. Rapidly rising energy demand, growing investment in mature field technologies, and supportive government initiatives in China and India position Asia Pacific as a key growth region.

Latin America

Latin America holds an 8.0% market share in 2024, with Enhanced Oil Recovery revenues reaching USD 2,231.04 million, compared to USD 1,711.01 million in 2018. Expected to achieve USD 3,204.82 million by 2032 at a 4.7% CAGR, the region’s progress is led by Brazil and Venezuela, where mature fields and ongoing technological upgrades enable steady development despite modest growth rates.

Middle East

The Middle East represents 13.1% of the global Enhanced Oil Recovery market in 2024, with a value of USD 3,650.69 million, up from USD 2,490.51 million in 2018. The market is forecasted to climb to USD 6,212.77 million by 2032, advancing at a 6.9% CAGR. Large hydrocarbon reserves, advanced EOR techniques in Saudi Arabia and Oman, and increasing investment in field modernization maintain the region’s substantial role in global EOR expansion.

Africa

Africa holds the smallest share of the Enhanced Oil Recovery market at 1.4% in 2024, valued at USD 388.41 million, rising from USD 313.75 million in 2018. The market is projected to reach USD 508.19 million by 2032, growing at a CAGR of 3.4%. Slow technology adoption and infrastructure constraints hinder rapid growth, but new EOR projects in Nigeria and Angola and increased foreign investment offer opportunities for incremental gains.

Market Segmentations:

By Technology

- Thermal Injection

- Gas Injection

- Chemical Injection

By Application

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Enhanced Oil Recovery market features a mix of global energy majors and specialized service providers, each leveraging technological innovation, extensive field experience, and strategic partnerships to strengthen their market positions. Leading companies such as Petrobras, Exxon Mobil Corporation, Chevron Corporation, Royal Dutch Shell Plc, ConocoPhillips Company, Statoil ASA, BP p.l.c., Denbury Resources Inc., Suncor Energy Inc., and Lukoil maintain robust portfolios of EOR projects spanning both onshore and offshore assets. These players consistently invest in research and development to improve recovery efficiency and reduce operational costs, while also integrating advanced digital solutions and carbon management strategies. Competitive differentiation centers on the ability to deploy diverse EOR technologies such as gas, thermal, and chemical injection tailored to complex reservoir conditions. Collaborations with technology partners and sustained capital investment allow market leaders to scale operations and secure long-term growth, even in the face of fluctuating oil prices and evolving regulatory requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Petrobras

- Exxon Mobil Corporation

- Chevron Corporation

- Royal Dutch Shell Plc

- ConocoPhillips Company

- Statoil ASA

- BP p.l.c.

- Denbury Resources Inc.

- Suncor Energy Inc.

- Lukoil

Recent Developments

- In 2025, Lukoil remains a significant player in enhanced oil recovery (EOR), particularly in Russia and surrounding regions. The company focuses on deploying EOR techniques, including chemical and gas injection, to counteract declining production in mature oil fields. Lukoil is a leading EOR operator and also among the top oil and gas companies in terms of cumulative emissions due to its extensive upstream activities, according to the IEA.

- In 2025, Suncor Energy is a key player in the Enhanced Oil Recovery (EOR) market, particularly in Canada, actively developing and utilizing advanced chemical and thermal EOR techniques to maximize oil recovery from oil sands and mature reservoirs. This aligns with the wider industry trend towards improving operational efficiency and sustainability by adopting advanced EOR technologies to increase production while minimizing environmental impact.

- In May 2025, Shell announced the start of production at the FPSO Alexandre de Gusmão in the Mero field offshore Brazil, as part of the Libra Consortium. Similar to Petrobras, this new FPSO indicates a focus on maximizing recovery from deepwater pre-salt fields.

- In January 2025, Chevron’s affiliate, Tengizchevroil LLP (TCO), initiated oil production at the Future Growth Project (FGP) in the Tengiz oil field in Kazakhstan. This expansion project, which includes enhanced sour gas injection, aims to significantly increase oil output from the field. The FGP is designed to boost production by 260,000 barrels per day, representing a major step in long-term pressure maintenance and increased oil recovery through gas EOR.

Market Concentration & Characteristics

The Enhanced Oil Recovery Market exhibits moderate to high concentration, with a few multinational corporations dominating global operations through their extensive technical expertise, substantial capital resources, and diversified project portfolios. It features a competitive environment where leading players, including Petrobras, Exxon Mobil Corporation, Chevron Corporation, Royal Dutch Shell Plc, and BP p.l.c., continually invest in research and development to enhance recovery efficiencies and reduce operational costs. The market is characterized by high entry barriers due to the significant capital requirements, complex regulatory environment, and the need for advanced technological capabilities. It responds to global oil demand fluctuations, advances in EOR technologies, and evolving environmental standards. The adoption of gas, chemical, and thermal injection methods enables companies to tailor solutions to varied reservoir conditions, supporting both onshore and offshore development. Regional concentration remains strong in North America, Asia Pacific, and the Middle East, where mature oil fields and favorable regulatory frameworks sustain long-term investment and growth opportunities.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- EOR technologies will expand into unconventional and deepwater reservoirs to meet growing energy needs.

- Gas injection methods will gain traction due to carbon management synergy.

- Chemical EOR will advance with tailored polymers and surfactants.

- Thermal injection will advance in heavy oil regions, particularly in Asia Pacific.

- Digitalization and AI will optimize reservoir monitoring and injection control.

- Collaboration between oil majors and technology firms will accelerate innovation.

- Regulatory support for carbon capture will promote integrated EOR‑CCS projects.

- Smaller operators will adopt modular EOR solutions to extend mature field life.

- Geopolitical stability in key regions will influence future capital investment.

- Sustainability reporting will shape EOR adoption aligned with ESG mandates.