| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Enhanced Oil Recovery (EOR) Market Size 2024 |

USD 14,970.55 Million |

| U.S. Enhanced Oil Recovery (EOR) Market, CAGR |

7.35% |

| U.S. Enhanced Oil Recovery (EOR) Market Size 2032 |

USD 26,396.18 Million |

Market Overview

The U.S. Enhanced Oil Recovery (EOR) Market is projected to grow from USD 14,970.55 million in 2024 to an estimated USD 26,396.18 million by 2032, with a compound annual growth rate (CAGR) of 7.35% from 2025 to 2032. This growth is attributed to the increasing demand for oil and gas, along with the rising need for advanced extraction techniques to maximize oil recovery from mature reservoirs.

The market growth is driven by several key factors, including the advancement of EOR technologies such as CO2 injection, chemical flooding, and thermal recovery methods. The need for these methods has increased due to the declining productivity of conventional oil fields. Furthermore, the rising environmental concerns and regulatory pressures are pushing for more sustainable recovery practices, fueling the adoption of more efficient and cost-effective EOR techniques. Increasing investments in oil recovery projects also support market growth.

Geographically, the U.S. dominates the Enhanced Oil Recovery market, with key activity concentrated in states like Texas, California, and Alaska. These regions are home to large-scale oil fields that benefit from the application of EOR methods. Major players in the market include ExxonMobil, Chevron, Occidental Petroleum, and Halliburton, which are focusing on expanding their EOR capabilities to meet the growing demand for oil recovery solutions. These companies are also investing in research and development to further enhance the efficiency of EOR technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Enhanced Oil Recovery (EOR) market is projected to grow from USD 14,970.55 million in 2024 to USD 26,396.18 million by 2032, at a CAGR of 7.35% from 2025 to 2032. This growth is driven by the increasing demand for oil and the need for advanced extraction technologies.

- Key drivers include the depletion of conventional oil fields, the growing demand for oil and gas, and advancements in EOR techniques such as CO2 injection, chemical flooding, and thermal recovery, all essential for maximizing oil recovery from mature reservoirs.

- High operational costs and environmental concerns related to certain EOR techniques, such as CO2 injection, pose challenges. These factors increase the overall cost of EOR projects and may limit adoption, especially for smaller operators.

- The U.S. EOR market is concentrated in key regions like Texas, California, and Alaska. These regions have extensive oil reserves and benefit from the application of advanced EOR technologies, driving significant market growth.

- The market is experiencing rapid growth due to technological advancements in EOR methods. CO2 injection, chemical flooding, and thermal recovery are becoming more efficient, enabling better oil recovery rates from aging fields.

- Increasing environmental regulations are pushing operators to adopt more sustainable EOR techniques, such as CO2 capture and storage, to align with climate goals and reduce emissions associated with oil recovery.

- Major players like ExxonMobil, Chevron, and Halliburton dominate the U.S. EOR market, focusing on expanding their technological capabilities and increasing investments in CO2-based recovery methods to meet the growing demand for oil recovery solutions.

Report Scope

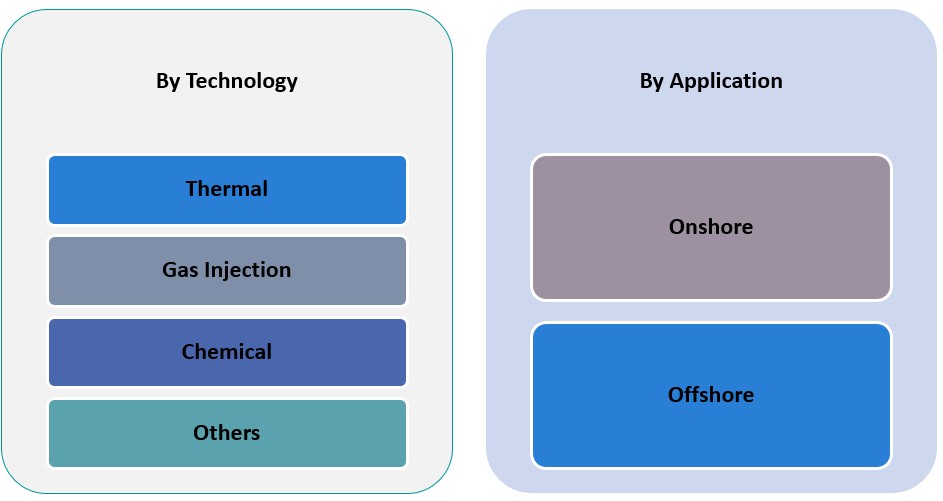

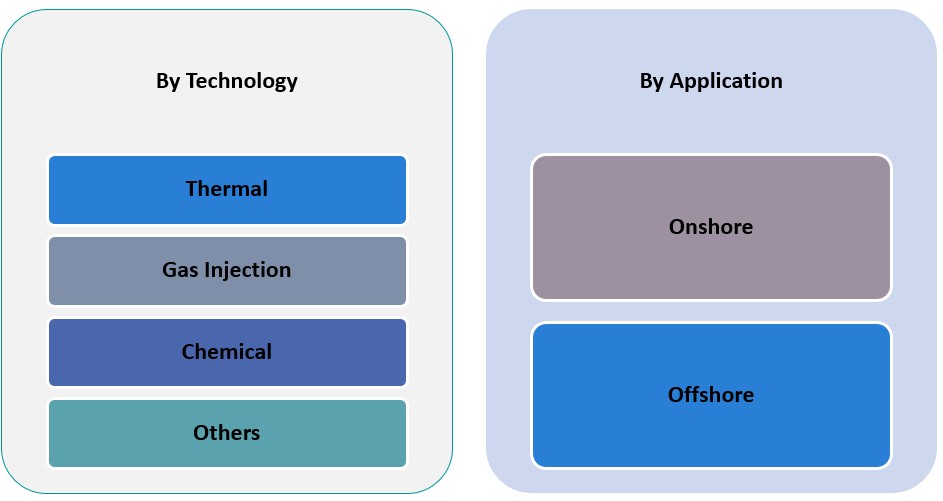

This report segments the US Enhanced Oil Recovery (EOR) market as follows:

Market Drivers

Depletion of Conventional Oil Reserves

The depletion of conventional oil reserves is one of the primary drivers of the U.S. Enhanced Oil Recovery (EOR) market. As oil fields mature, their ability to produce oil using traditional methods decreases, making it harder to extract the remaining oil. EOR technologies, such as CO2 injection, chemical flooding, and thermal recovery, offer viable solutions to enhance recovery rates from these aging fields. For instance, CO2 injection has been shown to increase oil recovery rates by up to 15% in certain reservoirs. By utilizing EOR, operators can access a higher percentage of the oil trapped in reservoirs, significantly increasing the overall productivity of mature oil fields. This necessity to recover more oil from existing reservoirs, as opposed to investing in new exploration projects, is a driving force behind the market’s growth. As oil reserves in the U.S. continue to face depletion, EOR has become a critical method for sustaining oil production levels and maximizing recovery potential.

Technological Advancements in EOR Methods

Technological advancements have played a crucial role in shaping the U.S. EOR market. Innovations in CO2 injection, chemical flooding, and thermal recovery techniques have drastically improved the efficiency of oil recovery, enabling companies to extract more oil from reservoirs that were previously considered unproductive. For instance, CO2 injection has become one of the most widely used EOR techniques due to its ability to increase oil recovery rates by up to 30-60%. Moreover, the development of novel chemical agents that facilitate better oil displacement and increase production from reservoirs is further boosting market growth. Advanced data analytics, coupled with real-time monitoring technologies, allows operators to optimize the EOR process, improving efficiency and reducing costs. These technological strides not only enhance the profitability of oil recovery but also extend the operational life of existing oil fields. Consequently, technological innovation continues to be a driving factor in the EOR market, as oil operators seek to maximize output from maturing fields.

Government Policies and Regulatory Support

Government policies and regulatory support are significant drivers of the U.S. Enhanced Oil Recovery market. The U.S. government has introduced several initiatives aimed at promoting sustainable oil production, including tax incentives and subsidies for the adoption of EOR technologies. Federal regulations encourage the oil and gas industry to adopt more efficient recovery techniques to reduce the environmental impact of traditional extraction methods. EOR is often seen as a more environmentally friendly alternative, especially with technologies like CO2 injection, which can also be used to reduce greenhouse gas emissions. Additionally, the U.S. Department of Energy (DOE) has consistently supported research into improving EOR technologies, further incentivizing the market. These policies not only reduce the operational cost for companies using EOR but also help maintain energy security and sustainability within the U.S. market. The regulatory environment is expected to continue evolving in a way that benefits the EOR sector, ensuring that recovery methods remain efficient, cost-effective, and environmentally sustainable.

Increasing Global Oil Demand and Price Volatility

Increasing global oil demand, coupled with price volatility, has significantly impacted the U.S. Enhanced Oil Recovery market. As global economies recover and oil consumption rises, the demand for additional oil supply grows, especially in mature markets like the U.S. This heightened demand, combined with fluctuating oil prices, pushes operators to adopt EOR methods to ensure they can meet production targets while maximizing profitability. EOR allows companies to produce oil at a lower cost than new exploration projects, which is crucial when oil prices are volatile. Furthermore, when prices are high, the profitability of implementing EOR techniques is more apparent, encouraging companies to invest in advanced recovery methods. On the other hand, when prices are low, operators are forced to look for cost-efficient solutions to maintain production levels, which makes EOR an even more attractive alternative. As global oil consumption rises and the economic climate remains uncertain, the U.S. EOR market will continue to be driven by these external factors, with oil companies increasingly relying on advanced recovery techniques to meet growing demand and ensure profitability amid price fluctuations.

Market Trends

Increasing Adoption of CO2 Injection for EOR

CO2 injection remains one of the most widely adopted enhanced oil recovery techniques in the U.S. market. This method involves injecting carbon dioxide into oil reservoirs to increase pressure and enhance the displacement of oil. For instance, CO2 injection projects in the Permian Basin have achieved recovery rates of up to 60%, showcasing its effectiveness in mature fields. Moreover, CO2 injection presents a dual benefit by reducing greenhouse gas emissions, as the CO2 used can be captured from industrial sources and injected into the reservoirs, preventing it from entering the atmosphere. As environmental concerns grow and regulations become stricter, CO2 injection serves as an environmentally sustainable and economically viable method for maximizing recovery. The technique’s widespread use is supported by continuous advancements in technology, making it an attractive choice for oil operators in the U.S., particularly in regions with aging oil fields. The increase in investments and government incentives, such as the 45Q tax credit for carbon capture and storage, also supports the adoption of CO2 injection.

Focus on Green and Sustainable EOR Technologies

As sustainability becomes a key focus for the oil and gas industry, there is an increasing shift toward greener EOR technologies in the U.S. market. Operators are adopting methods that minimize the environmental footprint of oil extraction, driven by growing environmental regulations and consumer demand for more responsible production practices. Techniques such as bio-based EOR, which uses microbial and biological agents to enhance oil recovery, are gaining traction. For example, microbial EOR methods have demonstrated the potential to increase recovery rates by up to 15% while reducing chemical usage. Additionally, the use of water management technologies is also growing, reducing the environmental impact of water usage in EOR operations. The demand for cleaner energy sources is pushing the industry to invest in research and development for low-emission recovery methods. With stricter environmental regulations and a global push toward reducing carbon emissions, the U.S. EOR market is witnessing a gradual but significant shift towards eco-friendly and sustainable extraction techniques. These innovations not only improve recovery rates but also ensure the oil and gas industry can meet future regulatory standards while maintaining profitability.

Integration of Digital Technologies for EOR Optimization

The integration of digital technologies is a major trend in the U.S. Enhanced Oil Recovery (EOR) market, improving the efficiency and accuracy of recovery operations. Advanced technologies, such as real-time monitoring systems, predictive analytics, and artificial intelligence (AI), are being used to optimize EOR methods. These tools allow operators to monitor reservoir conditions more accurately, predict production outcomes, and make data-driven decisions that enhance the overall effectiveness of recovery operations. Real-time monitoring of parameters such as pressure, temperature, and fluid composition enables timely interventions, preventing operational inefficiencies. AI-driven predictive maintenance also plays a role by anticipating equipment failures before they occur, thus reducing downtime and costs. Moreover, digital twins—virtual representations of oil reservoirs—are being increasingly used to simulate different recovery scenarios and identify the best strategies for maximizing output. As the EOR market becomes more competitive, these digital advancements are helping companies increase the yield from mature reservoirs while minimizing operational costs, marking a significant trend towards greater technological integration in oil recovery.

Expanding Role of Government and Regulatory Support

Government and regulatory support continue to shape the U.S. Enhanced Oil Recovery market, with policies focusing on encouraging the use of efficient and sustainable extraction techniques. Several federal and state-level initiatives are aimed at reducing the environmental impact of oil extraction while increasing oil recovery rates. The U.S. government has implemented tax credits and financial incentives for companies using CO2 injection and other environmentally friendly EOR techniques, as part of the broader effort to combat climate change. Additionally, regulations are being enforced to ensure that EOR practices meet sustainability standards and are aligned with climate goals. The U.S. Department of Energy (DOE) has actively supported research into new and improved EOR methods through funding and collaboration with private industry. As regulatory pressures mount to reduce carbon emissions and limit environmental damage, EOR methods that promote carbon sequestration or minimize environmental impact are becoming more attractive. The combination of government support and increasing regulatory pressures is a significant trend influencing the direction of the U.S. EOR market, making sustainability a core focus of future growth in the industry.

Market Challenges

High Operational Costs and Capital Investment

One of the key challenges facing the U.S. Enhanced Oil Recovery (EOR) market is the high operational costs associated with EOR techniques. While EOR methods can significantly boost oil recovery, they often require substantial capital investment in both technology and infrastructure. Techniques such as CO2 injection, chemical flooding, and thermal recovery involve complex processes that demand specialized equipment, skilled labor, and ongoing maintenance. For instance, CO2 injection projects can cost between $10 and $20 per barrel of oil recovered, depending on the reservoir conditions and scale of the operation. The initial investment in setting up EOR projects, coupled with the operational costs for maintaining the infrastructure, can be a major financial burden, especially for smaller oil operators. Additionally, these processes are energy-intensive, and the fluctuating prices of energy sources, such as electricity and CO2, further exacerbate cost pressures. The cost of CO2 can range from $15 to $40 per metric ton, significantly impacting the overall project economics. The profitability of EOR is highly sensitive to oil price fluctuations, as high operational costs can make recovery methods less viable when oil prices are low. This financial burden can deter some companies from investing in EOR technologies, limiting their potential adoption. Therefore, while EOR offers long-term benefits in terms of recovery, the immediate costs associated with these methods pose a significant challenge for operators in the U.S. market.

Environmental and Regulatory Concerns

Another challenge in the U.S. EOR market is the increasing environmental and regulatory concerns associated with certain recovery techniques. As public awareness around environmental sustainability grows, oil operators face pressure to adopt more eco-friendly EOR methods. Techniques like CO2 injection, while beneficial in terms of enhancing recovery, can raise concerns regarding the long-term storage of CO2 and its potential leakage, which could contribute to environmental hazards. Furthermore, many EOR techniques require large amounts of water, posing additional environmental challenges, particularly in regions facing water scarcity. Stringent government regulations at the federal and state levels are forcing operators to comply with stricter environmental standards, which can increase both operational complexity and compliance costs. As regulatory frameworks continue to evolve with an increasing focus on climate change and carbon emissions, oil operators must adapt their recovery methods to meet these new standards. Navigating these regulations while ensuring the efficiency and profitability of EOR processes remains a significant challenge for the industry.

Market Opportunities

Expansion of CO2 Capture and Sequestration Projects

A significant market opportunity in the U.S. Enhanced Oil Recovery (EOR) market lies in the growing emphasis on CO2 capture and sequestration (CCS) projects. As the U.S. government and regulatory bodies intensify efforts to reduce carbon emissions, the demand for EOR methods that enable carbon capture has increased. CO2 injection, a prominent EOR technique, not only enhances oil recovery but also serves as a means of storing CO2 underground, preventing it from entering the atmosphere. This dual benefit makes CO2 injection an attractive solution for oil operators seeking to align with environmental sustainability goals while maximizing production. Additionally, various tax credits and financial incentives, such as the 45Q tax credit, are designed to encourage the adoption of carbon capture technologies. As more operators look to reduce their carbon footprint and improve oil recovery, the expansion of CO2 injection projects represents a valuable growth opportunity within the EOR market.

Integration of Digital and Automation Technologies

Another promising opportunity for the U.S. EOR market is the integration of digital technologies and automation to optimize recovery processes. The growing adoption of artificial intelligence (AI), machine learning, and real-time monitoring systems presents significant potential for increasing the efficiency of EOR operations. These technologies enable better reservoir management, predictive maintenance, and data-driven decision-making, which can substantially improve recovery rates while reducing operational costs. Additionally, the use of digital twins—virtual models of oil reservoirs—allows operators to simulate various EOR techniques, helping them identify the most effective strategies for oil recovery. As the oil and gas industry increasingly embraces digital transformation, the implementation of these advanced technologies offers substantial opportunities for enhancing the effectiveness and profitability of EOR operations.

Market Segmentation Analysis

By Application

The U.S. Enhanced Oil Recovery (EOR) market is broadly segmented based on application into onshore and offshore operations. Onshore EOR operations account for the majority of the market share, with many oil fields located in mature reservoirs in states like Texas and California. These regions continue to be the primary focus for EOR technologies due to the large number of aging oil fields in need of advanced recovery methods. Onshore EOR techniques, particularly gas injection and CO2 injection, are widely employed to maximize recovery from mature oil fields. Offshore operations, although smaller in comparison, also contribute to the market’s growth. Offshore EOR applications typically involve more complex and expensive technologies due to the challenging environment, such as subsea wells and deepwater reservoirs. Despite this, advancements in offshore oil recovery, especially in the Gulf of Mexico, have made offshore EOR increasingly viable, driven by the need to extract oil from deeper and harder-to-reach reserves.

By Technology

The U.S. EOR market is also segmented by technology, which includes thermal recovery, gas injection, chemical EOR, and other methods. Thermal recovery, which includes steam injection techniques, is one of the oldest and most widely used EOR technologies. This method is particularly effective in heavy oil reservoirs, where the application of heat reduces the viscosity of the oil, allowing it to flow more freely. Gas injection, including CO2 and natural gas, is another prominent technique. CO2 injection is highly effective in enhancing recovery rates by displacing oil from the reservoir and increasing the pressure. Gas injection is becoming increasingly popular due to its ability to inject CO2 captured from industrial processes, making it a more environmentally sustainable choice. Chemical EOR involves the use of surfactants, polymers, and other chemical agents to improve oil displacement and enhance recovery rates. This technology is gaining traction due to its ability to improve the efficiency of traditional recovery methods. Other emerging technologies, such as microbial and bio-based EOR, are also being explored for their potential to increase recovery in difficult-to-reach reservoirs.

Segments

Based on Application

Based on Technology

- Thermal

- Gas Injection

- Chemical

- Others

Based on Region

- Texas

- California

- Alaska

- Gulf of Mexico

Regional Analysis

Texas (40%)

Texas remains the dominant region in the U.S. EOR market, holding a substantial share of approximately 40%. The state’s vast oil reserves, particularly in mature fields such as the Permian Basin, have made it a primary focus for EOR technologies. The use of CO2 injection in Texas has been a major factor contributing to its market share. This technique is highly effective in maximizing recovery from conventional oil fields, with significant investments in CO2 pipeline infrastructure further enhancing its viability. Texas also benefits from a well-established infrastructure for oil and gas operations, which has allowed for the seamless implementation of various EOR methods.

California (25%)

California, another major contributor to the U.S. EOR market, accounts for roughly 25% of the market share. California’s oil fields, particularly in the San Joaquin Valley, are known for their reliance on thermal recovery techniques, such as steam injection, due to the high viscosity of oil in the region. The state’s aging oil fields have made EOR an essential method for maintaining production levels. As California continues to focus on sustainable energy solutions, the demand for more environmentally friendly EOR methods, such as CO2 injection, is expected to rise.

Key players

- Chevron Corporation

- ExxonMobil Corporation

- Occidental Petroleum Corporation

- ConocoPhillips

- Marathon Oil Corporation

- Kinder Morgan, Inc.

- Denbury Resources Inc.

- Halliburton Company

- Schlumberger Limited

- Baker Hughes Company

Competitive Analysis

The U.S. Enhanced Oil Recovery (EOR) market is highly competitive, with major players like Chevron, ExxonMobil, Occidental Petroleum, and ConocoPhillips leading the market. These companies have a significant market presence due to their extensive experience, advanced technology portfolios, and established infrastructure for EOR operations. Chevron and ExxonMobil are particularly influential, focusing on CO2 injection and gas flooding techniques, which have proven to be effective in maximizing oil recovery from mature reservoirs. Occidental Petroleum is notable for its leadership in CO2-based EOR, while Halliburton and Schlumberger excel in providing the technology and services that support various EOR methods. Companies like Denbury Resources and Kinder Morgan are also key players, focusing on the expansion of CO2 infrastructure, a critical element for the future of CO2 injection in EOR. With continuous investment in research and development, these firms are at the forefront of driving innovation in the EOR sector.

Recent Developments

- In April 2025, Shell and SLB (formerly Schlumberger) announced a partnership to deploy Petrel subsurface software across Shell’s assets worldwide. This collaboration aims to enhance digital capabilities and drive operating cost efficiencies, potentially impacting EOR projects.

- In April 2025, Eni confirmed a significant oil discovery at the Capricornus 1-X well in Namibia’s Orange Basin. The well found 38 meters of net pay with good petrophysical properties, indicating potential for future EOR applications.

- In 2024, TotalEnergies reported a 23% increase in net electricity production and invested $4 billion in Integrated Power. This growth contributed to lowering the lifecycle carbon intensity of the company’s energy products sold by 16.5% in 2024 compared to 2015, aligning with its sustainability and climate objectives.

- In March 2025, Equinor announced plans to drill 600 improved oil recovery wells and about 250 exploration wells to maintain production on the Norwegian Continental Shelf towards 2035.

- In January 2025, OMV continued its Enhanced Oil Recovery program with carbon dioxide injection on Ivanić and Žutica fields.

- In April 2025, MOL Group continued its EOR program with CO₂ injection on Ivanić and Žutica fields, and installed a new steam turbine at the Molve plant to decrease electrical energy purchase and reduce CO₂ emissions.

Market Concentration and Characteristics

The U.S. Enhanced Oil Recovery (EOR) market exhibits a moderate level of concentration, with a few major players dominating the landscape, including Chevron, ExxonMobil, Occidental Petroleum, and Halliburton. These companies possess substantial market share due to their extensive technological capabilities, established infrastructure, and significant financial resources. While the market is largely led by these large corporations, there is also room for smaller companies that specialize in niche EOR technologies or regional operations. The market characteristics are shaped by a combination of advanced recovery methods such as CO2 injection, chemical flooding, and thermal recovery. These techniques require significant capital investment, making the market capital-intensive and dependent on the price of oil. Furthermore, the market is influenced by environmental regulations, technological advancements, and the demand for sustainable oil recovery practices. As the focus shifts towards reducing carbon emissions, CO2 injection and other eco-friendly methods are becoming increasingly prominent in the competitive dynamics of the U.S. EOR market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The use of CO2 injection is expected to grow significantly, driven by its dual benefits of enhancing oil recovery and reducing carbon emissions. This technique will play a pivotal role in meeting sustainability goals while maximizing oil output from mature fields.

- Environmental concerns and stricter regulations will lead to the adoption of greener EOR methods, such as bio-based and microbial EOR technologies. Operators will prioritize methods that minimize environmental impact and align with government policies on carbon reduction.

- Ongoing advancements in digital technologies, such as AI and real-time monitoring, will optimize EOR processes, improving efficiency, reducing costs, and enhancing recovery rates. Automation and predictive analytics will become integral to managing reservoir conditions effectively.

- Offshore EOR operations, particularly in the Gulf of Mexico, will witness significant growth, as deepwater and ultra-deepwater fields require advanced recovery techniques. The adoption of CO2 injection and gas flooding will support the recovery from challenging offshore reservoirs.

- Shale oil fields, which are less productive using conventional methods, will become a key target for EOR technologies. The use of gas injection and chemical flooding will be essential for enhancing recovery rates from shale formations.

- As renewable energy integration grows, there will be a push to combine EOR methods with renewable energy sources, such as wind and solar, to power recovery operations. This synergy will help reduce the carbon footprint of oil extraction.

- Government initiatives and tax incentives will continue to support the use of EOR technologies, especially those focused on sustainability. Federal and state-level regulations will create a favorable environment for EOR adoption, particularly CO2 injection and carbon capture projects.

- Smaller EOR projects, focusing on specific reservoirs or underdeveloped regions, will increase as companies look for cost-effective ways to enhance recovery. These projects will leverage advanced technologies and sustainable methods to maximize output from smaller fields.

- The U.S. EOR market may witness an increase in mergers and acquisitions as companies seek to strengthen their portfolios and expand their technological capabilities. Larger players will continue to dominate, but partnerships with smaller firms could become more common.

- As digitalization increases, oil operators will rely more on data-driven insights to optimize EOR processes. The integration of data analytics and cloud-based platforms will provide real-time performance insights, enabling better decision-making and improved recovery strategies.