Market Overview

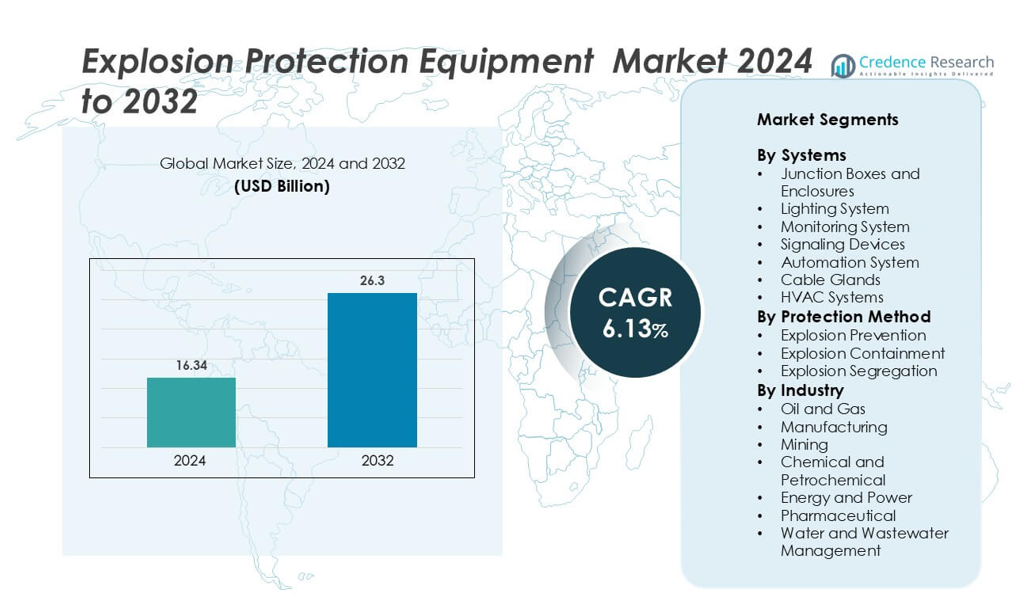

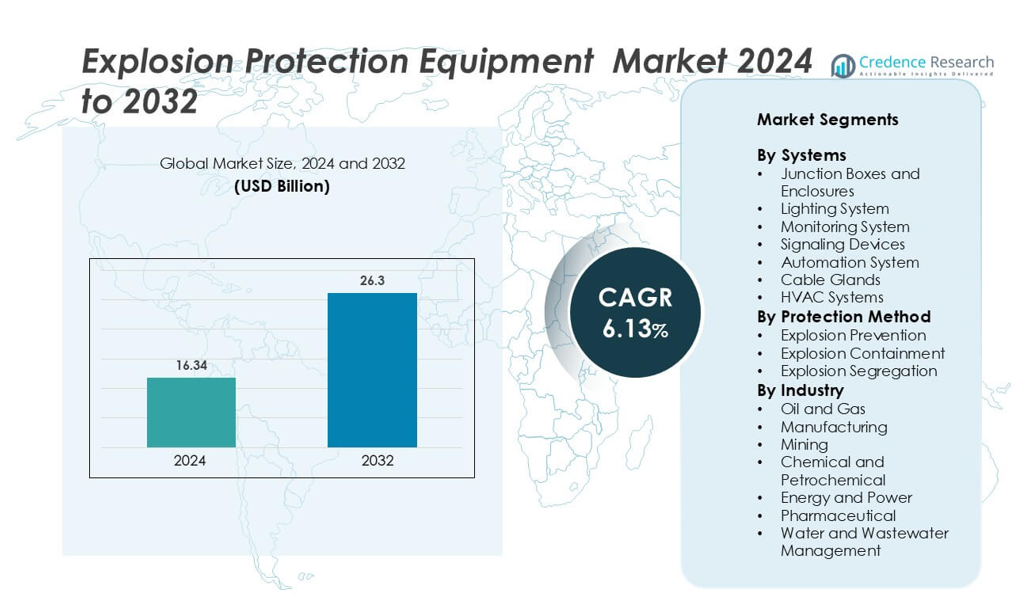

Explosion Protection Equipment Market size was valued USD 16.34 billion in 2024 and is anticipated to reach USD 26.3 billion by 2032, at a CAGR of 6.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Explosion Protection Equipment Market Size 2024 |

USD 16.34 billion |

| Explosion Protection Equipment Market, CAGR |

6.13% |

| Explosion Protection Equipment Market Size 2032 |

USD 26.3 billion |

The explosion protection equipment market is led by prominent companies such as Siemens AG, Honeywell International Inc., ABB Ltd., Rockwell Automation Inc., Pepperl+Fuchs SE, and Emerson Electric Co. These industry leaders focus on delivering advanced solutions, including explosion-proof junction boxes, cable glands, and automation systems, to meet stringent safety regulations across various sectors. North America holds the largest market share, accounting for approximately 31.1% in 2024, driven by the region’s robust industrial base, stringent safety standards, and significant investments in oil & gas, chemical, and manufacturing industries. Companies in North America are actively expanding their product portfolios and enhancing service capabilities to maintain their competitive edge in the market.

Market Insights

- The global explosion protection equipment market was valued at approximately USD 16.34 billion in 2024 and is projected to reach USD 26.3 billion by 2032, growing at a CAGR of 6.13% from 2024 to 2032.

- North America led the market with a 31% share in 2024, driven by stringent safety regulations and a strong industrial base in oil & gas, chemicals, and manufacturing sectors.

- The explosion prevention segment accounted for the largest revenue, approximately USD 16.34 billion in 2024, and is expected to maintain its dominance due to its proactive approach in hazardous environments.

- Asia-Pacific is anticipated to be the fastest-growing region, with India expected to register the highest CAGR from 2024 to 2032, fueled by rapid industrialization and increasing safety awareness.

- Key market players include Siemens AG, Honeywell International Inc., ABB Ltd., Rockwell Automation Inc., Pepperl+Fuchs SE, and Emerson Electric Co., focusing on technological advancements and compliance with international safety standards

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Systems

The explosion protection equipment market by system includes junction boxes and enclosures, lighting systems, monitoring systems, signaling devices, automation systems, cable glands, and HVAC systems. Junction boxes and enclosures hold the largest share due to their critical role in protecting electrical connections in hazardous zones. Their flameproof design prevents ignition sources from reaching explosive atmospheres, ensuring safety in industrial plants. These systems are widely adopted in oil & gas, chemical, and energy sectors. Rising demand for reliable electrical protection and regulatory compliance drives their dominance across global installations.

- For instance, Eaton Corporation’s Crouse-Hinds series EJB explosion-proof enclosures are rated for Class I, Division 1, Groups B, C, D and feature IP66 protection with copper-free aluminum bodies measuring up to 600 × 600 × 255 mm.

By Protection Method

The market is segmented into explosion prevention, explosion containment, and explosion segregation. Explosion prevention leads this segment, driven by its proactive approach to risk mitigation. Preventive systems detect and eliminate ignition sources before hazardous events occur. This method reduces downtime, improves operational safety, and aligns with strict industrial standards. High adoption in industries with flammable gases, vapors, and dust hazards boosts its market share. Companies increasingly favor prevention over containment, as it lowers costs associated with structural damage and post-incident recovery.

- For instance, ABB Ltd.’s flameproof motors for hazardous areas offer power output up to 7.5 MW with enclosure ratings up to IP 66 for zone IIB/IIC applications.

y Industry

The key industries include oil and gas, manufacturing, mining, chemical and petrochemical, energy and power, pharmaceutical, and water and wastewater management. Oil and gas hold the dominant share due to the sector’s high explosion risk and strict safety regulations. Refineries, offshore platforms, and storage facilities deploy advanced protection systems to secure critical infrastructure. The industry’s focus on operational continuity, regulatory compliance, and employee safety drives sustained investment in explosion-proof solutions. Rising global energy demand further accelerates technology adoption in this segment.

Key Growth Drivers

Rising Industrial Safety Regulations

Stringent safety regulations across industries are driving the adoption of explosion protection equipment. Governments and regulatory agencies are enforcing stricter standards to reduce workplace hazards in oil & gas, mining, chemical, and manufacturing facilities. These standards mandate the use of certified explosion-proof components, including junction boxes, cable glands, and signaling devices. Industries are investing in advanced systems to ensure compliance, avoid penalties, and protect personnel and assets. The rise in industrial automation and the presence of flammable materials further increase the need for protection systems. International standards such as ATEX and IECEx enhance equipment certification and drive market standardization. Growing pressure from insurers and environmental bodies also strengthens adoption, making regulatory compliance a major growth catalyst.

- For instance, Peppers Cable Glands Limited secured an IECEx Certificate No. CML 19.0049X, covering compliance with standards IEC 60079-0:2017, IEC 60079-1:2014-06 and IEC 60079-31:2013.

Expansion of High-Risk Industries

The rapid expansion of industries operating in hazardous environments fuels the demand for explosion protection equipment. Oil and gas, petrochemical, energy, and pharmaceutical sectors face heightened explosion risks due to flammable gases, vapors, and dust. Growing energy consumption and rising chemical production amplify the need for reliable safety infrastructure. Companies are modernizing facilities with advanced monitoring and control systems to reduce accident risks. Technological integration with IoT and automation enhances real-time hazard detection and containment capabilities. As industrial operations expand globally, especially in Asia-Pacific and the Middle East, the deployment of explosion-proof systems becomes essential to safeguard critical assets and ensure business continuity. This sectoral growth is a strong driver for market expansion.

- For instance, PureAire Monitoring Systems’s Explosion-Proof Universal Gas Monitor (EPU) detects toxic and combustible gases in concentrations down to parts-per-billion, operates within an enclosure dimension of 132.8 × 162.5 × 203.2 mm and weighs 3 kg.

Integration of Smart and Automated Protection Systems

Technological innovation plays a central role in driving the explosion protection equipment market. Smart protection systems enable real-time monitoring, automated shutdowns, and instant incident alerts. Integration with industrial IoT platforms allows predictive maintenance and faster response times, reducing the likelihood of catastrophic failures. Companies are investing in intelligent signaling and monitoring devices that improve situational awareness. Automation also helps reduce manual intervention in high-risk zones, ensuring safer and more efficient operations. The shift from conventional systems to smart, connected protection networks improves system reliability and compliance with international safety standards. As industries focus on digital transformation, the adoption of these advanced solutions continues to accelerate.

Key Trend & Opportunity

Growing Adoption of Wireless and Remote Monitoring

The increasing use of wireless and remote monitoring technologies creates strong opportunities in the explosion protection market. These solutions enable real-time equipment monitoring without exposing workers to hazardous environments. Remote control and diagnostics improve system uptime and operational efficiency. Manufacturers are introducing IoT-enabled sensors and signaling devices that integrate easily with existing control systems. Wireless solutions also lower installation costs and offer greater flexibility in plant layouts. This trend is particularly strong in offshore oil rigs, chemical processing facilities, and energy plants. As industries prioritize predictive maintenance and safety automation, remote monitoring becomes a key differentiator in explosion protection strategies.

- For instance, BARTEC Top Holding GmbH offers its EXaminer® wireless sensor that supports temperature range of -40 °C to +80 °C, has a nominal line-of-sight range of 300 m, and its battery life is rated for up to 8 years.

Rising Investments in Emerging Economies

Emerging economies are witnessing rapid industrialization and infrastructure growth, creating new opportunities for explosion protection equipment suppliers. Countries in Asia-Pacific, Latin America, and the Middle East are expanding their oil & gas, chemical, and manufacturing industries. Governments are adopting stricter safety regulations, aligning local standards with global frameworks. This shift drives demand for certified protection systems such as flameproof enclosures, HVAC systems, and signaling devices. Multinational companies are also investing in safety upgrades to comply with international norms. These developments create a favorable business environment for manufacturers and solution providers, expanding their customer base and regional footprint.

- For instance, Eaton Corporation’s Crouse-Hinds EJB explosion-proof enclosures are certified for Class I, Division 1 & 2 hazardous areas and Zones 1 & 2 under IECEx certificate IECEx ETL 13.0040U.

Focus on Energy Transition and Safety Modernization

The global shift toward cleaner energy and modernized infrastructure boosts the need for advanced explosion protection solutions. Renewable energy facilities, hydrogen production units, and biofuel plants are classified as high-risk zones. Companies are upgrading safety systems to support new energy production technologies. Integration of explosion-proof automation with clean energy operations improves process safety and sustainability. This trend encourages manufacturers to innovate and tailor solutions for new industries, expanding market scope. As energy transition accelerates globally, modern safety infrastructure becomes critical for ensuring operational reliability and regulatory compliance.

Key Challenge

High Installation and Maintenance Costs

The deployment of explosion protection equipment requires significant investment, especially for large industrial facilities. The high cost of certified systems such as explosion-proof junction boxes, monitoring devices, and cable glands poses a major challenge for small and medium enterprises. Ongoing maintenance and periodic inspections further add to operational expenses. These costs often discourage early adoption, particularly in developing economies. Additionally, retrofitting older infrastructure with modern safety systems can be complex and expensive. Companies must allocate large capital budgets to meet compliance standards, which can delay expansion plans and impact overall market penetration.

Complex Certification and Compliance Requirements

Explosion protection equipment must meet strict global certification standards, including ATEX, IECEx, and NEC. These regulatory frameworks require rigorous testing and documentation to ensure product safety and reliability. Navigating complex certification processes can be time-consuming and expensive for manufacturers. Variations in regional standards further complicate international trade and product deployment. Non-compliance risks legal penalties, operational shutdowns, and reputational damage. For end-users, selecting certified equipment that meets both local and international requirements can be challenging. This regulatory complexity acts as a barrier for market entry and slows the pace of technology adoption.

Regional Analysis

North America

North America holds a 31% share of the explosion protection equipment market, driven by strict safety regulations and high adoption of advanced protective systems. The U.S. leads due to strong enforcement of OSHA and NFPA standards across oil & gas, chemical, and energy sectors. High investment in industrial automation further supports technology integration. Leading manufacturers are expanding product portfolios with smart monitoring and prevention systems. Demand for explosion-proof junction boxes, cable glands, and signaling devices remains high. Growth is also supported by the presence of major industry players and continuous modernization of legacy industrial infrastructure.

Europe

Europe accounts for a 27% market share, supported by stringent ATEX directives and a well-established regulatory framework. Countries such as Germany, the UK, and France are key markets due to their advanced chemical and manufacturing industries. Strong focus on worker safety and energy transition accelerates adoption of explosion-proof technologies. Manufacturers are integrating monitoring systems with smart automation platforms to meet compliance needs. Growing renewable energy projects and modernization of oil refineries further drive demand. Europe’s leadership in standardization and technology innovation continues to strengthen its market position globally.

Asia-Pacific

Asia-Pacific commands a 26% share of the global market, driven by rapid industrialization and strong expansion of high-risk sectors. China, India, Japan, and South Korea are major contributors, with significant investments in oil & gas, mining, and manufacturing. Governments are tightening safety regulations and aligning with international certification standards. Rising infrastructure projects and energy production activities further support equipment deployment. Companies in the region are adopting explosion prevention solutions to reduce operational risks. Asia-Pacific’s large industrial base and cost-effective manufacturing make it a strategic growth hub for international suppliers.

Middle East & Africa

The Middle East & Africa represent a 10% market share, supported by large-scale oil & gas operations and energy infrastructure investments. Countries such as Saudi Arabia, UAE, and South Africa are adopting advanced protection systems to secure refineries, offshore platforms, and processing units. The region’s dependence on hydrocarbon production increases explosion risks, driving the need for reliable containment and prevention solutions. International safety standards are gaining traction, encouraging adoption of certified equipment. Growing investments in energy diversification, including hydrogen and renewables, also create new opportunities for explosion protection technologies.

Latin America

Latin America holds a 6% share of the explosion protection equipment market, with Brazil and Mexico as key contributors. The region’s growth is driven by increasing investments in oil & gas, chemical processing, and energy infrastructure. Governments are strengthening workplace safety standards, encouraging companies to adopt certified protection solutions. The use of explosion-proof enclosures, signaling devices, and cable glands is expanding in industrial plants. While regulatory frameworks are still developing, rising foreign investments and industrial automation initiatives are improving safety compliance. Market penetration is expected to grow steadily as modernization continues across key industries.

Market Segmentations:

By Systems

- Junction Boxes and Enclosures

- Lighting System

- Monitoring System

- Signaling Devices

- Automation System

- Cable Glands

- HVAC Systems

By Protection Method

- Explosion Prevention

- Explosion Containment

- Explosion Segregation

By Industry

- Oil and Gas

- Manufacturing

- Mining

- Chemical and Petrochemical

- Energy and Power

- Pharmaceutical

- Water and Wastewater Management

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the explosion protection equipment market is characterized by strong participation from global leaders such as Siemens AG, OMEGA Engineering, Inc., Rockwell Automation Inc, Honeywell International Inc, Pepperl+Fuchs SE, ABB Ltd, BARTEC Top Holding GmbH, Cortem S.p.A., Xylem Inc., and Emerson Electric Co. These companies focus on developing advanced prevention and containment systems to address strict safety regulations across industries. Their product portfolios cover explosion-proof junction boxes, monitoring systems, signaling devices, and automation solutions. North America leads the market with a 31% share, followed by Europe with 27% and Asia-Pacific with 26%. Major players are expanding through strategic partnerships, product innovation, and digital integration to strengthen their competitive position and meet growing demand in high-risk sectors such as oil & gas, energy, chemical processing, and manufacturing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- OMEGA Engineering, Inc.

- Rockwell Automation Inc

- Honeywell International Inc

- Pepperl+Fuchs SE

- ABB Ltd

- BARTEC Top Holding GmbH

- Cortem S.p.A.

- Xylem Inc.

- Emerson Electric Co

Recent Developments

- In June 2024, Honeywell International Plc. acquired the Enraf Holding B.V. agreement valued at approximately USD 260 million. The company consists of six groups, including a division called Enraf Fluid Technology, which is a custom-engineered explosion-proof precision blending and additive metering equipment manufacturer.

- In March 2024, Emerson Electric ltd launched a new Acoustic Particle Monitor, Rosemount SAM42, for measuring entrained sand in the oil & gas wells output. The new products feature explosion proof protection along with onboard data processing.

Report Coverage

The research report offers an in-depth analysis based on System, Protection method, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing regulatory pressure will accelerate investments in explosion-proof systems.

- Integration of IoT will make monitoring and prevention more precise and automated.

- Demand for smart signaling and control devices will increase across industries.

- Asia-Pacific will emerge as a key growth hub with rapid industrialization.

- North America and Europe will maintain leadership due to strict safety standards.

- Rising energy transition projects will create new application areas for protective equipment.

- Manufacturers will expand portfolios with advanced prevention and containment solutions.

- Remote monitoring adoption will enhance operational safety and reduce downtime.

- Strategic partnerships and mergers will shape market consolidation and competitiveness.

- Continuous innovation will improve system efficiency and drive long-term market growth.