Market Overview:

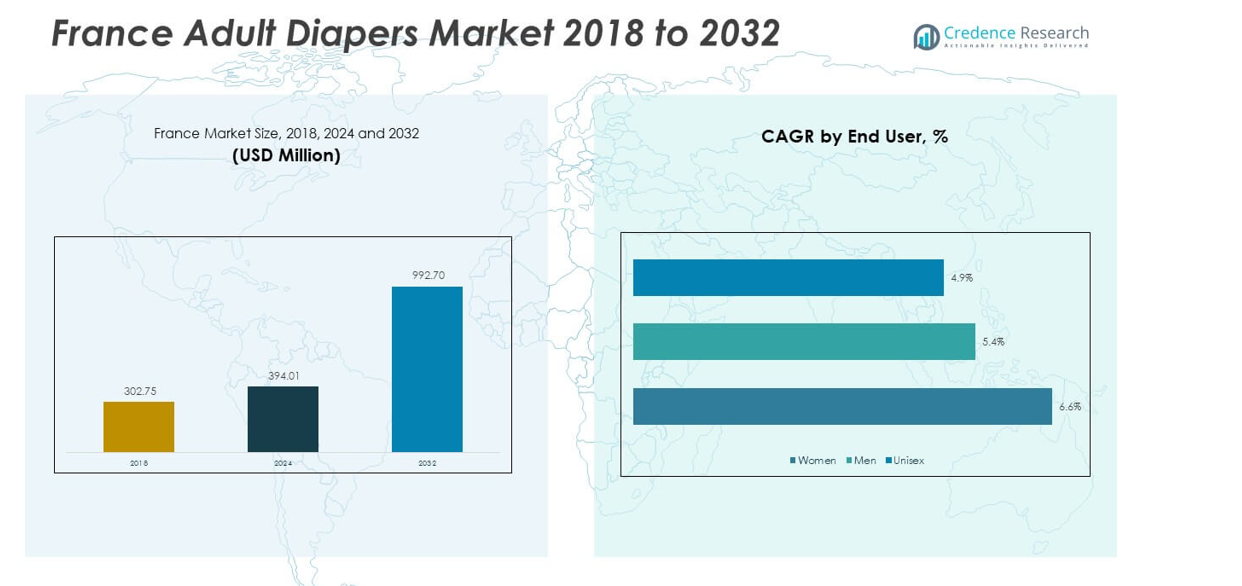

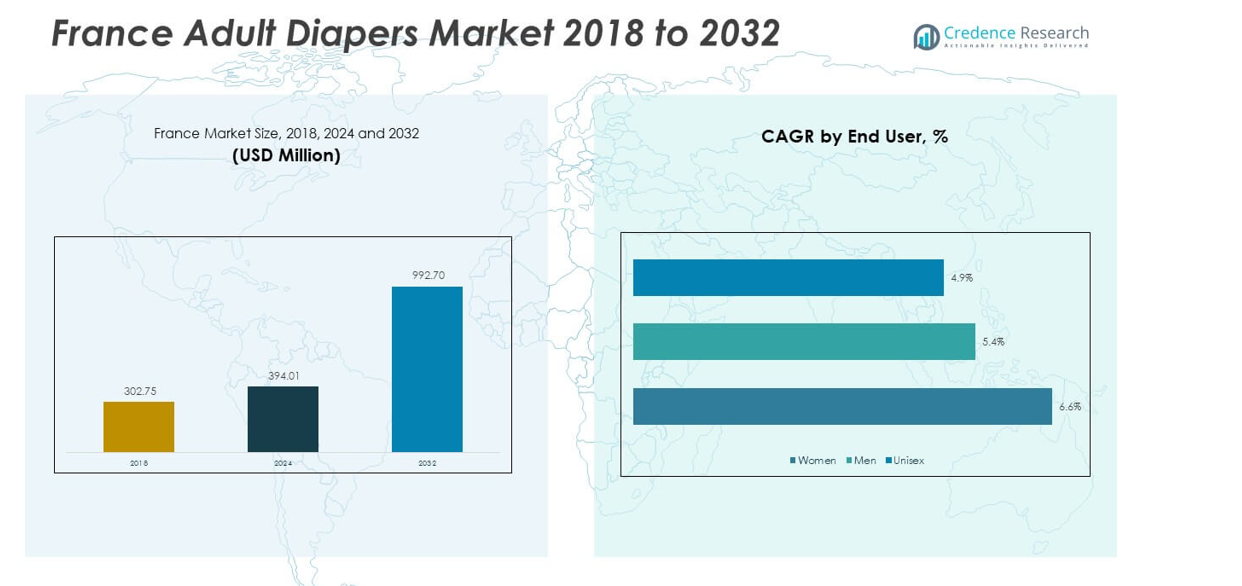

The France Adult Diapers Market size was valued at USD 302.75 million in 2018 to USD 394.01 million in 2024 and is anticipated to reach USD 992.70 million by 2032, at a CAGR of 12.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Adult Diapers Market Size 2024 |

USD 394.01 million |

| France Adult Diapers Market, CAGR |

12.24% |

| France Adult Diapers Market Size 2032 |

USD 992.70 million |

The France Adult Diapers Market is driven by an aging population, rising healthcare awareness, and lifestyle-related health conditions that increase the need for incontinence care. Growing acceptance of adult diapers as a practical healthcare product reduces stigma and boosts adoption. Technological advancements such as improved absorbent materials, skin-friendly fabrics, and odor-control features are enhancing product appeal. Distribution networks across pharmacies, supermarkets, and e-commerce platforms also strengthen market penetration, making adult diapers accessible to a wider consumer base across the country.

Geographically, urban regions in France dominate the adult diapers market due to higher healthcare infrastructure, awareness campaigns, and better retail accessibility. Rural areas are gradually emerging as growth zones, supported by expanding distribution and targeted health initiatives. Northern and western regions lead adoption owing to higher elderly populations and stronger purchasing power. Meanwhile, southern regions present untapped opportunities as cultural acceptance improves and healthcare access expands, supporting gradual adoption of adult incontinence products.

Market Insights:

- The France Adult Diapers Market was valued at USD 302.75 million in 2018, reached USD 394.01 million in 2024, and is projected to attain USD 992.70 million by 2032, expanding at a CAGR of 12.24%.

- Northern France led the market with a 34% share in 2024, supported by strong healthcare infrastructure and a dense elderly population, while Western France followed with 28% due to awareness programs and robust retail presence.

- Southern and Eastern France together accounted for 38% share in 2024, emerging as fast-growth regions fueled by rising cultural acceptance, improved healthcare access, and expanding e-commerce adoption.

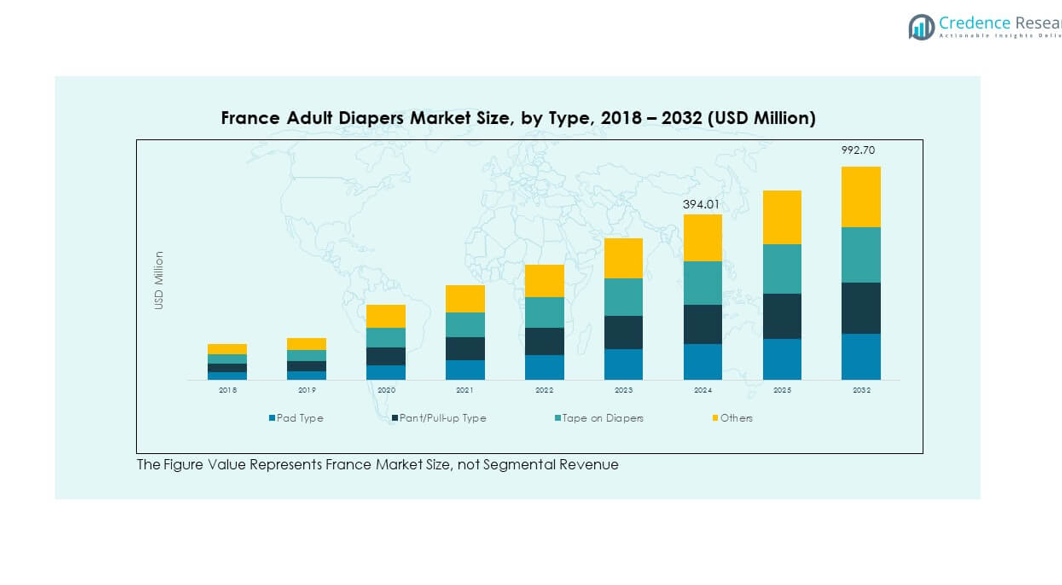

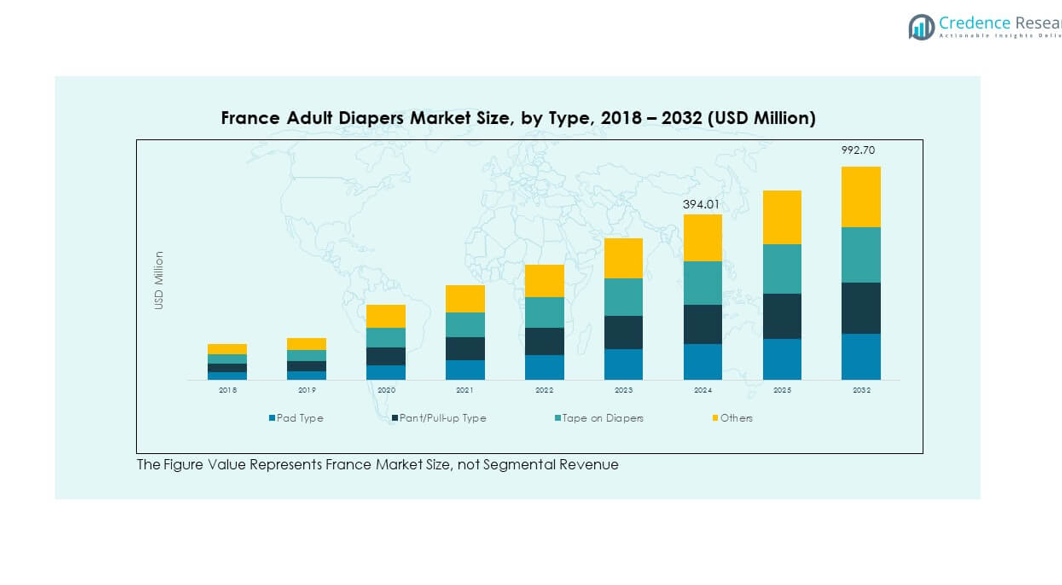

- By type, pad-type diapers dominated with around 40% share in 2024, driven by affordability and institutional adoption in healthcare facilities.

- Pant/pull-up types held nearly 30% of the market in 2024, gaining popularity among active users who prefer comfort, discretion, and ease of use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Elderly Population and Rising Healthcare Needs Driving Strong Demand:

The France Adult Diapers Market is expanding due to the rapidly increasing elderly population requiring better incontinence solutions. Longer life expectancy has led to higher demand for products that improve comfort and independence. Hospitals and nursing homes are also adopting adult diapers to enhance patient care standards. Awareness campaigns by healthcare providers have reduced the stigma linked to incontinence products. Consumers are recognizing the role of adult diapers in maintaining hygiene and dignity. Pharmacies and retail stores are capitalizing on this demographic trend by ensuring product availability. The growing elderly segment continues to serve as the backbone of market growth.

- For instance, Essity’s TENA brand is a global leader in continence care, providing adult incontinence products with breathable fabrics, such as ConfioAir technology, and odor-eliminating features. These products are highly favored in hospitals and eldercare facilities for improving patient comfort and skin health. Some TENA products, such as the Maxi Night pads, support up to 12 hours of leakage protection and are designed for discreet wear.

Increasing Prevalence of Lifestyle Diseases Creating Greater Need for Incontinence Solutions:

Rising lifestyle-related health conditions such as obesity, diabetes, and hypertension have increased cases of bladder-related disorders. Patients dealing with chronic diseases often require adult diapers during treatment or recovery phases. The France Adult Diapers Market is benefiting from the higher incidence of incontinence among younger adults as well. Healthcare professionals frequently prescribe adult diapers as a practical solution for maintaining hygiene during long-term illness. Product demand has also grown among post-surgical patients. The acceptance of adult diapers in home care environments supports further adoption. It highlights how changing health conditions are reshaping consumer needs.

Technological Innovations Enhancing Comfort and Usability of Advanced Adult Diapers:

Innovation in absorbent materials and skin-friendly fabrics has significantly improved product performance. Features like odor control, wetness indicators, and breathable layers increase consumer trust. The France Adult Diapers Market is influenced by companies investing heavily in R&D to meet diverse needs. Manufacturers are focusing on slim, discreet designs that reduce bulkiness without compromising efficiency. Eco-friendly and biodegradable options are also emerging to meet sustainability goals. Retailers emphasize premium products that appeal to health-conscious buyers. It reinforces the importance of technology as a driver of long-term adoption.

Expanding Distribution Networks Increasing Accessibility Through Multiple Sales Channels:

The rise of supermarkets, pharmacies, and e-commerce platforms has boosted product accessibility across urban and rural areas. Online platforms provide a convenient way to compare brands and purchase discreetly. The France Adult Diapers Market benefits from this multichannel presence, which expands reach and improves affordability. Local pharmacies play a key role in building consumer trust. Retailers also focus on offering discounts and subscription models to encourage repeat purchases. Hospitals and healthcare distributors support bulk procurement for institutional use. It ensures that consumers across regions can easily access adult diapers.

Market Trends:

Rising Popularity of Sustainable and Eco-Friendly Adult Diaper Products Among Consumers:

Consumers are increasingly seeking products that align with sustainability goals. Manufacturers are launching biodegradable adult diapers to meet this growing expectation. The France Adult Diapers Market is seeing greater adoption of products made with plant-based or recyclable materials. Brands are marketing eco-friendly products as premium options with added environmental benefits. This shift reflects stronger consumer awareness about waste reduction. Governments and advocacy groups also support sustainable consumption practices. It reinforces the importance of sustainability as a long-term trend shaping demand.

Premiumization of Adult Diaper Products Offering Enhanced Comfort and Lifestyle Appeal:

Premium adult diapers are gaining popularity due to rising demand for comfort, discretion, and style. Manufacturers are developing high-absorbency, soft-touch, and skin-friendly variants for health-conscious consumers. The France Adult Diapers Market benefits from the growing preference for high-quality products with advanced features. Branding strategies highlight dignity, confidence, and lifestyle improvement. Consumers are willing to pay more for products offering superior comfort. Marketing campaigns emphasize premium quality to differentiate brands. It demonstrates how lifestyle-driven purchasing behavior strengthens the market.

- For instance, Hartmann Group’s MoliCare all-in-one adult diapers available in France provide skin pH maintenance at 5.5 and include two elasticated side panels for ergonomic handling, significantly reducing skin rash risk while delivering high absorbency for both mobile and bedridden users.

Integration of Smart and Digital Technologies Transforming Incontinence Care Solutions:

Smart diapers with sensors and real-time monitoring capabilities are entering the market. These innovations alert caregivers when a diaper needs changing, improving efficiency. The France Adult Diapers Market is influenced by such advancements, especially in hospitals and elderly care homes. Technology-driven solutions reduce discomfort and prevent health complications. Care facilities adopt smart products to improve patient management. Parents and caregivers also embrace digital tools for convenience. It shows how technology adoption shapes the modern incontinence care landscape.

Growth of E-Commerce and Subscription Models Revolutionizing Product Access and Buying Patterns:

E-commerce platforms are becoming dominant sales channels for adult diapers in France. Consumers prefer the privacy, variety, and convenience offered by online purchases. The France Adult Diapers Market benefits from subscription-based delivery models that ensure regular supply. Retailers highlight discounts, loyalty programs, and discreet packaging to build consumer trust. Direct-to-consumer sales also strengthen brand-customer relationships. Online platforms expand product reach to underserved areas. It illustrates how digital retail strategies are reshaping consumer purchasing behavior.

Market Challenges Analysis:

Social Stigma and Limited Awareness Hindering Widespread Consumer Adoption Across Demographics:

The France Adult Diapers Market faces challenges from the lingering stigma linked to incontinence care. Many adults perceive diaper usage as a loss of dignity, limiting adoption. Awareness campaigns have helped, but social barriers remain strong. Younger consumers often avoid the products due to embarrassment. Limited open discussion of incontinence issues creates hesitation among patients and families. Healthcare providers continue to promote education, but progress is gradual. It restricts broader acceptance and slows down overall market growth.

Rising Raw Material Prices and Supply Chain Constraints Impacting Product Affordability:

Manufacturers face increasing pressure from rising costs of raw materials like superabsorbent polymers and pulp. Global supply chain disruptions add to production delays and higher expenses. The France Adult Diapers Market is challenged by the need to maintain affordability while ensuring product quality. Price-sensitive consumers may shift to low-cost alternatives, affecting brand loyalty. Companies struggle to balance premium product development with cost management. Import restrictions and logistic hurdles also impact availability. It highlights how cost challenges restrict expansion opportunities.

Market Opportunities:

Growing Home Healthcare Adoption and Rising Caregiver Demand Creating Strong Sales Prospects:

The France Adult Diapers Market is gaining opportunities through the growth of home healthcare services. Families and caregivers prefer reliable incontinence products for daily care needs. The demand for easy-to-use diapers supports increased adoption among patients outside hospitals. Retailers target this segment with bulk offers and convenience-driven packaging. Consumers are also adopting subscription services to ensure continuous supply. It shows strong opportunity in catering to household care environments.

Emerging Market Segments Through Youth and Lifestyle-Related Incontinence Needs Expanding Demand:

Younger adults experiencing incontinence due to lifestyle diseases represent a new growth area. The France Adult Diapers Market benefits from shifting consumer attitudes and increased openness toward solutions. Marketing strategies emphasize discretion and lifestyle support for active individuals. Companies are introducing slim, fashion-forward designs appealing to younger demographics. Rising acceptance in this group highlights significant untapped potential. It creates room for innovation and diversified product offerings.

Market Segmentation Analysis:

By Type

The France Adult Diapers Market is segmented into pad type, pant/pull-up type, tape-on diapers, and others. Pad type products hold strong appeal due to their convenience and cost-effectiveness. Pant/pull-up types are gaining traction among active users for comfort and ease of use. Tape-on diapers remain essential in healthcare facilities, offering better adjustment for bedridden patients. The others category includes niche products catering to specific needs, contributing to product diversity and consumer choice.

- For instance, Ontex’s iD Expert Slip pad-type product is widely used in French hospitals for semi-mobile and bedridden patients, offering long-wear capacity and reliable leakage control with an effective tape fastening system.

By End-User

The market is divided into women, men, and unisex categories. Women represent a leading segment, driven by higher demand linked to health conditions and longer life expectancy. Men’s usage is gradually increasing as awareness of incontinence care expands. Unisex products attract widespread adoption in institutions, offering simplified inventory and cost benefits. It demonstrates balanced growth across gender-specific and unisex solutions.

- For instance, the global adult incontinence market sees a significant share for female-specific adult diapers, reported as in some recent market analysis. This is largely driven by the higher prevalence of incontinence among women due to factors like childbirth and menopause. Meanwhile, unisex products, such as those from the well-known TENA line, are widely utilized in institutional settings like hospitals and nursing homes for the ease of inventory management they provide.

By Distribution Channel

E-commerce and offline channels define the sales landscape. E-commerce is expanding rapidly, supported by discreet purchasing options, wide product availability, and subscription services. Offline channels, including pharmacies, supermarkets, and specialty stores, continue to dominate with strong consumer trust and accessibility. It reflects how balanced retail networks support both urban and rural demand, ensuring broad reach and sustained sales momentum.

Segmentation:

- By Type

- Pad Type

- Pant/Pull-up Type

- Tape on Diapers

- Others

- By End-User

- By Distribution Channel

- E-Commerce

- Offline Channel

Regional Analysis:

Northern France Leading with Strong Healthcare Infrastructure and High Adoption

Northern France accounts for the largest share of the France Adult Diapers Market, representing around 34% of the total market. The region benefits from a dense elderly population, strong healthcare facilities, and advanced distribution channels. Urban centers in the north drive higher adoption rates due to greater awareness and disposable income. Pharmacies and retail chains dominate sales, supported by institutional demand from hospitals and nursing homes. The region also witnesses higher acceptance of premium products offering advanced comfort and eco-friendly features. It sets a benchmark for other regions in terms of both volume and value.

Western France Showing Steady Growth Through Awareness Campaigns and Retail Expansion

Western France holds about 28% market share, supported by expanding retail networks and rising awareness of incontinence solutions. The region shows strong acceptance among elderly populations but also among middle-aged adults with lifestyle-related conditions. Supermarkets and pharmacies in urban hubs ensure easy access, while rural areas are gradually being covered through mobile healthcare programs. The market in this region also benefits from government-backed health awareness campaigns. It demonstrates consistent demand for both affordable and premium adult diaper variants. Western France continues to emerge as a vital contributor to national growth.

Southern and Eastern France Emerging as High-Potential Regions with Expanding Reach

Southern and Eastern France together capture nearly 38% of the France Adult Diapers Market, with southern regions slightly ahead. The demand is expanding in these areas due to improving healthcare access and growing cultural acceptance of incontinence care. Rising investments in e-commerce platforms have boosted sales, offering privacy and convenience to consumers. Distribution remains a key challenge in certain rural areas, but ongoing infrastructure improvements are reducing these gaps. Hospitals and care facilities in these regions are increasingly procuring bulk orders to support patient needs. It highlights how emerging geographies are transforming into future growth hubs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The France Adult Diapers Market is highly competitive, shaped by global brands and strong regional players. Leading companies such as Kimberly-Clark, Essity, Unicharm, and Procter & Gamble dominate through product innovation, brand equity, and wide distribution networks. European manufacturers like Ontex and Paul Hartmann AG leverage local presence to strengthen their position. It is defined by frequent product upgrades, eco-friendly innovations, and premium product launches. Intense price competition from private labels challenges established brands. Companies are investing in sustainability and comfort-focused designs to capture health-conscious consumers. Strategic expansions in both offline and online channels further intensify rivalry.

Recent Developments:

- In June 2025, Ontex Group NV introduced its iD Discreet range across Europe, including France, targeting healthcare partners. The range incorporates discreet, breathable designs intended to enhance confidence and comfort for people living with incontinence, and is distributed through pharmacies and care institutions.

- August 2025, Ontex announced the expansion of its diaper and training pant sizes for better consumer fit and leak protection, effective from 2026. This includes new sizes designed to meet growing market demand and accommodate varying developmental needs.

- Paul Hartmann AG navigated a challenging market environment in the first half of 2025 with organic sales growth and continued investment in quality adult incontinence products, confirming its sustained market activity and commitment to product availability in France.

- Abena A/S continues to provide advanced maximum absorbency adult diapers in 2025, such as the Abena Slip Premium Level 4, designed for severe incontinence with features including a breathable design, secure fit, and wetness indicators, showing product enhancements focused on user comfort and skin health.

Report Coverage:

The research report offers an in-depth analysis based on type, end-user, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising elderly population will sustain long-term demand for adult diapers in France.

- Lifestyle-related health issues will expand adoption among younger adults.

- Premium product categories will gain traction due to comfort and eco-friendly features.

- E-commerce platforms will continue to grow, offering discreet purchasing options.

- Healthcare institutions will remain key buyers, driving bulk procurement demand.

- Technological innovations such as smart diapers will improve adoption in care facilities.

- Regional expansion across southern and eastern France will unlock untapped opportunities.

- Private labels will increase competition by offering affordable alternatives.

- Sustainability and biodegradable materials will emerge as central product differentiators.

- Strong brand investments in awareness campaigns will reduce stigma and boost adoption.