| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Single-Use Bio-Processing Systems Market Size 2024 |

USD 639.62 million |

| France Single-Use Bio-Processing Systems Market CAGR |

15.93% |

| France Single-Use Bio-Processing Systems Market2032 |

USD 2,086.95 million |

Market Overview

The France Single-Use Bio-Processing Systems market size was valued at USD 639.62 million in 2024 and is anticipated to reach USD 2,086.95 million by 2032, at a CAGR of 15.93% during the forecast period (2024-2032).

The France Single-Use Bio-Processing Systems market is driven by several key factors, including the growing demand for cost-effective and efficient biomanufacturing solutions, particularly in the biopharmaceutical and biotechnology sectors. The increasing adoption of single-use technologies is fueled by their ability to reduce operational costs, minimize contamination risks, and enhance process flexibility. Additionally, the rising focus on personalized medicine, along with advancements in biologics and cell-based therapies, is propelling the market forward. Trends such as automation integration, digitalization of bioprocessing workflows, and an emphasis on sustainability are further contributing to market growth. As pharmaceutical companies seek to streamline production processes and reduce time-to-market for new therapies, the demand for single-use systems is expected to surge, positioning France as a key player in the global bioprocessing landscape.

The geographical landscape of the France Single-Use Bio-Processing Systems market is shaped by the presence of established biopharmaceutical hubs across Northern, Southern, Eastern, and Western France, each contributing to the sector’s development through infrastructure, research, and innovation. Northern France leads in industrial activity, supported by major research institutions, while Southern and Eastern regions are expanding rapidly due to increased investment in biologics and process development. Western France, though smaller, is emerging as a promising area driven by biotech clusters and academic collaborations. The market features strong competition among leading global and regional players, including Sartorius AG, Merck KGaA, Eppendorf AG, Lonza Group AG, and Getinge AB. Companies like Celltainer Biotech BV, RoSS GmbH, Elveflow, and Stedim Biotech also play a vital role by offering specialized and innovative solutions. These key players focus on expanding their product portfolios, investing in R&D, and forming strategic partnerships to strengthen their presence in the French market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Single-Use Bio-Processing Systems market was valued at USD 639.62 million in 2024 and is projected to reach USD 2,086.95 million by 2032, growing at a CAGR of 15.93%.

- The global single-use bio-processing systems market was valued at USD 17,326.05 million in 2024 and is projected to reach USD 57,663.39 million by 2032, growing at a CAGR of 16.22% from 2024 to 2032.

- Increased demand for biologics and personalized medicine is driving rapid adoption of single-use technologies across the biopharmaceutical industry.

- Automation, digitalization, and modular system designs are key trends improving process efficiency and flexibility in manufacturing.

- The market is competitive with key players such as Sartorius AG, Merck KGaA, Lonza Group AG, and Eppendorf AG focusing on innovation and strategic partnerships.

- High initial costs and concerns around product standardization and quality pose significant challenges to broader adoption.

- Northern and Southern France are leading regions, supported by robust infrastructure, R&D centers, and industry presence, while Eastern and Western France show growing potential.

- The shift toward sustainable production methods and regulatory support is further encouraging investment in single-use systems.

Report Scope

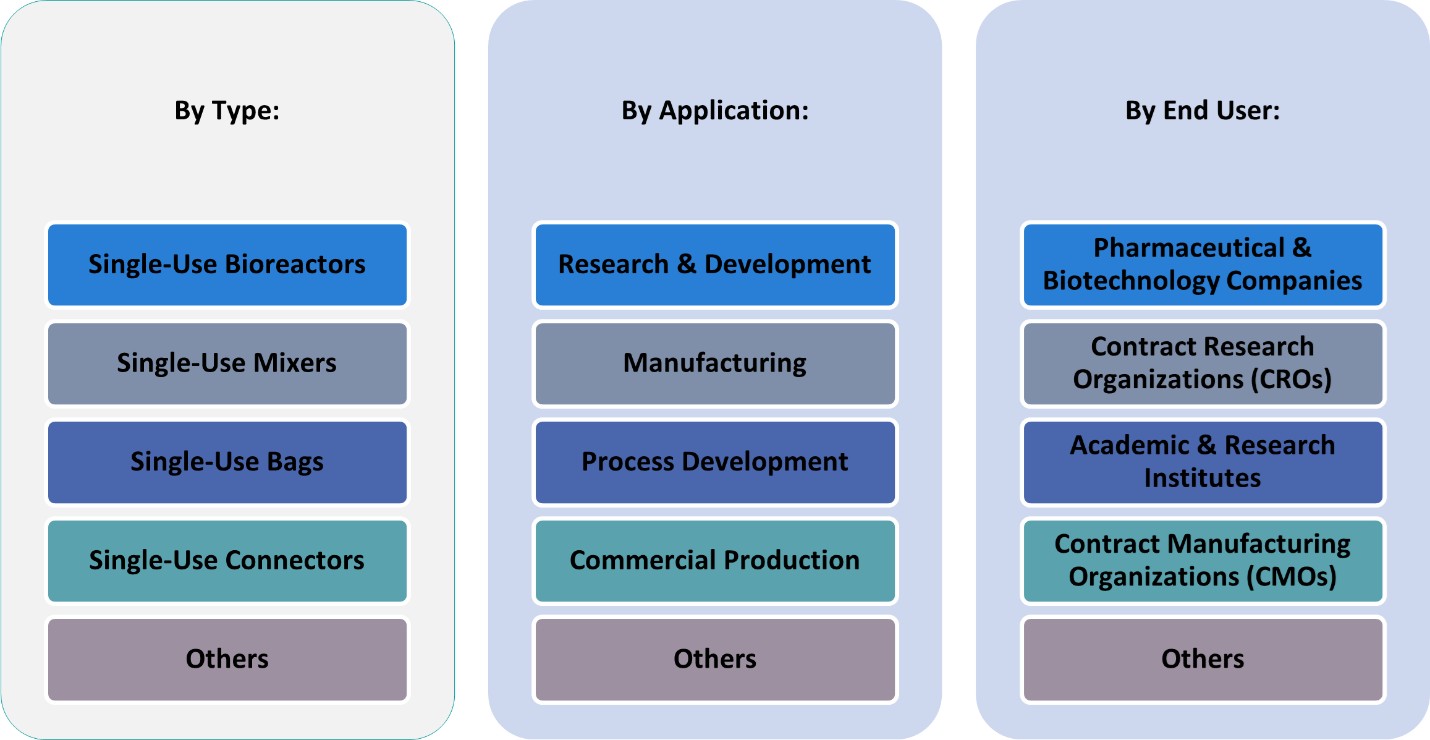

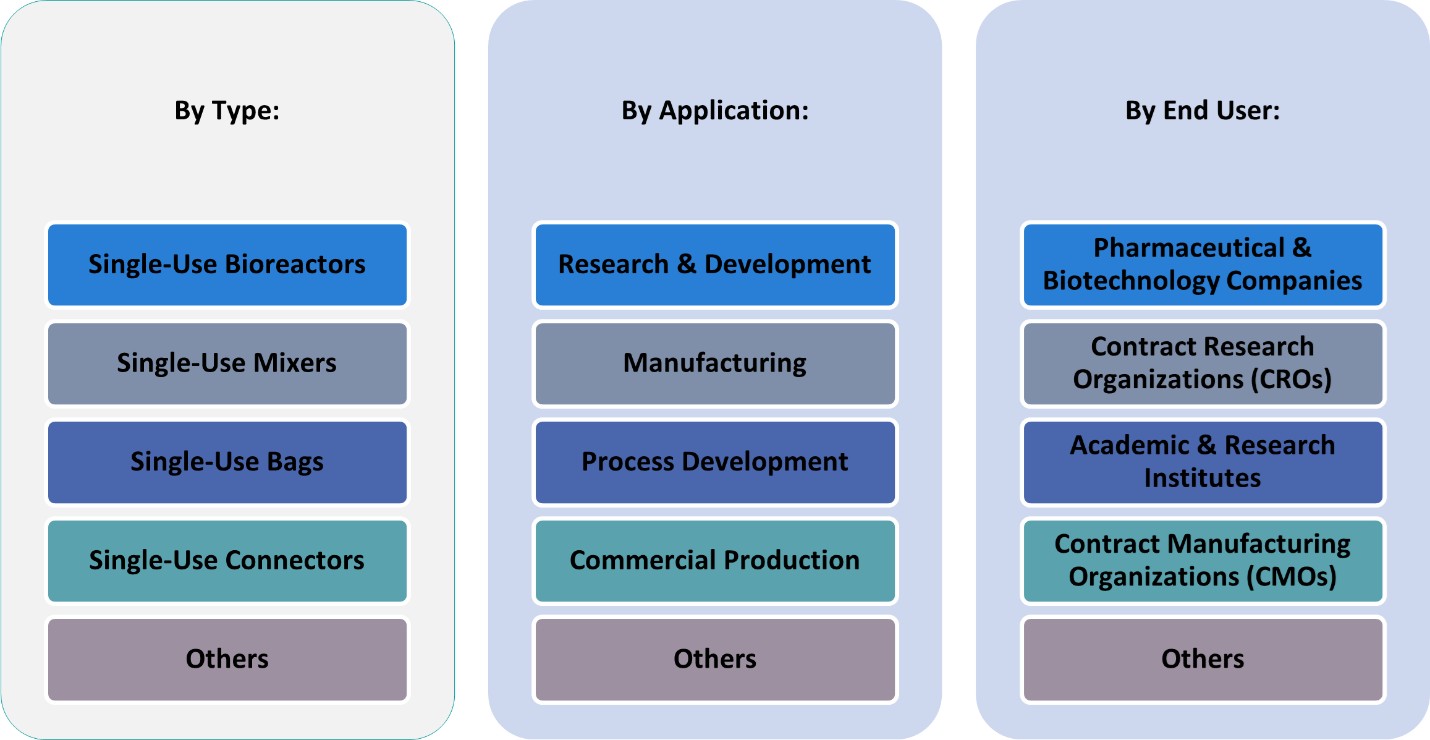

This report segments the France Single-Use Bio-Processing Systems Market as follows:

Market Drivers

Growing Demand for Biopharmaceuticals and Biologics

The increasing global demand for biopharmaceuticals and biologics is a primary driver for the growth of the France Single-Use Bio-Processing Systems market. As the pharmaceutical industry shifts towards biologic drugs, particularly monoclonal antibodies, gene therapies, and cell-based therapies, there is a growing need for efficient and cost-effective production methods. For instance, regulatory bodies and industry reports highlight the rising adoption of single-use technologies in biomanufacturing due to their ability to streamline production and reduce contamination risks. Single-use bioprocessing systems offer substantial advantages in these areas, including reduced risk of cross-contamination, quicker setup times, and more flexible production capacity. As the biopharmaceutical sector in France expands to meet the needs of both domestic and international markets, the demand for advanced, single-use technologies is expected to continue rising.

Regulatory and Environmental Pressures

Regulatory agencies, such as the European Medicines Agency (EMA), are increasingly emphasizing the importance of sustainability and environmental responsibility within the biopharmaceutical industry. For instance, regulatory frameworks are encouraging the adoption of single-use systems to reduce water consumption and sterilization waste, aligning with sustainability goals. Single-use bio-processing systems align with these regulatory trends by reducing the need for sterilization chemicals, water consumption, and energy use associated with traditional systems. Additionally, the growing environmental consciousness of consumers and regulators is prompting pharmaceutical companies to adopt more sustainable production practices. The move towards more sustainable bio-manufacturing processes in France, driven by both regulatory mandates and public pressure, is further fueling the demand for single-use systems as a greener alternative to conventional bioreactor setups.

Cost-Effectiveness and Operational Efficiency

Single-use bio-processing systems are inherently more cost-effective than traditional stainless-steel bioreactors, as they reduce the need for complex cleaning and validation processes, which are often time-consuming and expensive. By eliminating the need for large-scale, capital-intensive infrastructure, single-use systems allow manufacturers to minimize both initial investment and operational costs. This enables smaller and mid-sized biopharma companies to enter the market with fewer financial barriers. The growing recognition of the cost benefits of single-use systems is driving their widespread adoption in France, further accelerating market growth.

Advancements in Manufacturing and Process Optimization

The integration of automation and digital technologies into single-use bio-processing systems is enhancing process control and efficiency. Automation allows for the real-time monitoring and adjustment of critical parameters, which significantly improves productivity and reduces human error. Furthermore, advancements in process optimization, including data analytics and predictive maintenance, are making single-use systems even more efficient. These technological innovations are attracting more biopharmaceutical companies to adopt single-use platforms, as they promise to increase throughput, shorten production cycles, and ensure consistent product quality. France’s commitment to innovation and investment in cutting-edge biomanufacturing technologies positions the market for continued growth.

Market Trends

Integration of Automation and Digital Technologies

The adoption of automation and digitalization is a prominent trend in France’s single-use bioprocessing systems market. Manufacturers are increasingly incorporating automated systems and digital tools such as real-time monitoring, predictive analytics, and process control software. These advancements enhance operational efficiency, reduce human error, and enable more precise control over bioprocessing parameters. The integration of automation facilitates faster production cycles and supports the scalability of manufacturing processes, aligning with the growing demand for biologics and personalized medicines.

Hybrid Systems Combining Single-Use and Stainless-Steel Technologies

Hybrid bioprocessing systems that combine single-use technologies with traditional stainless-steel equipment are gaining traction in France. These hybrid systems offer the flexibility to scale production while maintaining cost-effectiveness. For instance, official statistics indicate that hybrid systems are increasingly adopted to optimize production efficiency while maintaining regulatory compliance. By integrating both technologies, manufacturers can optimize production processes, reduce capital expenditures, and enhance the adaptability of their operations to meet varying production demands. This trend reflects the industry’s move towards more versatile and efficient manufacturing solutions.

Focus on Sustainability and Regulatory Compliance

Sustainability is becoming a central focus in the French biopharmaceutical industry, influencing the adoption of single-use bioprocessing systems. These systems are perceived as more environmentally friendly due to their reduced water and energy consumption compared to traditional systems. For instance, France’s Anti-Waste and Circular Economy Law encourages businesses to adopt circular practices, reducing waste and promoting sustainable production. Additionally, the French government’s Anti-Waste and Circular Economy Law, which aims to minimize waste and promote recycling, is encouraging manufacturers to adopt more sustainable practices. Compliance with such regulations is driving the shift towards single-use technologies, which align with environmental and regulatory standards.

Customization and Modular Solutions for Diverse Applications

There is a growing trend towards customization and modularity in single-use bioprocessing systems in France. Manufacturers are increasingly offering tailored solutions that can be adapted to specific production needs, such as varying batch sizes or specialized biologic products. Modular systems allow for greater flexibility, enabling companies to reconfigure their production lines quickly in response to changing market demands or regulatory requirements. This trend supports the industry’s move towards more agile and responsive manufacturing processes.

Market Challenges Analysis

High Cost of Single-Use Systems

While single-use bioprocessing systems offer numerous benefits, their high initial cost remains a significant challenge for many biopharmaceutical manufacturers in France. Despite the operational savings from reduced cleaning and validation procedures, the upfront investment in single-use equipment, including bioreactors, filtration units, and other consumables, can be substantial. Smaller and mid-sized companies may find these costs prohibitive, potentially limiting their ability to adopt such technologies. Furthermore, the need for frequent replacement of components adds ongoing expenses, making the cost of ownership higher compared to traditional systems. This financial barrier could slow down the widespread adoption of single-use technologies, particularly among emerging biopharma companies.

Concerns Over Quality and Standardization

Another challenge faced by the France Single-Use Bio-Processing Systems market is the variability in product quality and a lack of standardization across different suppliers. As the market for single-use technologies grows, concerns regarding the consistency and reliability of materials used in production processes have surfaced. For instance, industry analyses highlight that the lack of standardized testing for extractables and leachables in single-use systems raises concerns about product consistency and regulatory compliance. There is a need for more rigorous quality control and standardized procedures to ensure that single-use components perform reliably at scale. Manufacturers may face challenges in integrating these systems into their existing processes while maintaining product consistency and regulatory compliance. Additionally, variability in the performance of different single-use components could pose risks to the quality of biopharmaceutical products, which is a critical issue in an industry where precision and reliability are paramount. These concerns hinder the broader acceptance of single-use systems and highlight the need for more robust standardization efforts across the market.

Market Opportunities

The France Single-Use Bio-Processing Systems market presents significant opportunities driven by the growing demand for biologics and personalized medicine. As the biopharmaceutical industry continues to expand, the need for efficient, scalable, and cost-effective production methods has never been more crucial. Single-use systems offer advantages that align perfectly with this demand, including flexibility, reduced operational costs, and quicker time-to-market for new therapies. With the increasing prevalence of cell and gene therapies, as well as monoclonal antibodies, there is a rising need for platforms that can handle complex production processes while maintaining high standards of quality. This creates a substantial opportunity for manufacturers of single-use bio-processing equipment to capitalize on the expanding biologics market, particularly in France, which serves as a key hub for biopharma innovation in Europe.

Additionally, as regulatory agencies push for more sustainable manufacturing practices, single-use systems provide a clear advantage. These systems require less water, energy, and cleaning chemicals compared to traditional bioreactor setups, aligning with growing environmental concerns and regulatory mandates. As France continues to implement policies that encourage sustainability and circular economy practices, biopharma companies are increasingly turning to single-use solutions to reduce their environmental footprint. The opportunity for suppliers to develop more eco-friendly, customizable, and modular single-use systems is immense, with potential for growth in both existing and new market segments. By focusing on innovation and sustainability, companies in the France Single-Use Bio-Processing Systems market can capitalize on these trends, positioning themselves as leaders in the global bioprocessing landscape.

Market Segmentation Analysis:

By Type:

The France Single-Use Bio-Processing Systems market is segmented into several key types, each addressing specific needs in biopharmaceutical production. Single-use bioreactors are a dominant segment, providing the flexibility and scalability required for cell culture processes. These systems are increasingly preferred due to their lower capital investment and faster setup times, making them ideal for research, development, and small-scale production. Single-use mixers also play a vital role, facilitating efficient blending and homogenization of ingredients during bioprocessing. The growing adoption of single-use mixers in cell culture and vaccine production processes further drives their demand. Single-use bags, used for storing and transporting biological materials, are another critical component, offering ease of use and eliminating the risk of contamination. Single-use connectors, which ensure secure fluid transfer between components, are essential for maintaining sterile conditions in bio-manufacturing. Other types of single-use components, such as filtration systems, contribute to optimizing overall bioprocessing workflows.

By Application:

The market for France Single-Use Bio-Processing Systems is also categorized based on application. In the research and development (R&D) segment, single-use systems are increasingly used for early-stage testing and process optimization, offering flexibility and faster turnaround times. As biopharmaceutical companies scale their operations, the manufacturing segment sees significant demand for single-use systems due to their cost-effectiveness and ease of integration into production lines. The process development segment benefits from the versatility of single-use systems, enabling the rapid testing of different production methods. Commercial production, especially of biologics and vaccines, has also become a major application area for single-use systems, as they can be quickly adapted to meet the needs of large-scale production while minimizing contamination risks. Other applications, including quality control and packaging, further expand the market, providing growth opportunities for various single-use components tailored to specific needs within biomanufacturing.

Segments:

Based on Type:

- Single-Use Bioreactors

- Single-Use Mixers

- Single-Use Bags

- Single-Use Connectors

- Others

Based on Application:

- Research & Development

- Manufacturing

- Process Development

- Commercial Production

- Others

Based on End- User:

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Contract Manufacturing Organizations (CMOs)

- Others

Based on the Geography:

- Northern France

- Southern France

- Eastern France

- Western France

Regional Analysis

Northern France

Northern France holds the largest market share, accounting for approximately 35% of the total market. This region benefits from a high concentration of biopharmaceutical companies and research institutions focused on developing biologics and advanced therapies. The presence of key industry players in cities such as Lille and Paris, as well as well-established infrastructure for bioprocessing, positions Northern France as the leading market region. The demand for single-use bio-processing systems is bolstered by the region’s focus on innovation, clinical trials, and the production of cell-based therapies.

Southern France

Southern France follows with a market share of 25%, driven primarily by the strong pharmaceutical and biotechnology sectors located in cities like Marseille and Toulouse. Southern France is renowned for its commitment to sustainable and cutting-edge biomanufacturing practices, making it an attractive hub for the adoption of single-use bio-processing systems. The region also benefits from favorable regulatory conditions and government support for biopharma innovation. As the demand for biologics and personalized medicine grows, Southern France is experiencing an increase in the adoption of single-use technologies, particularly for small- to medium-scale production and process development applications.

Eastern France

Eastern France holds a market share of 20%, with significant growth potential in the coming years. The region is home to numerous pharmaceutical manufacturing facilities, with a particular focus on vaccine production and process development. The proximity to Germany and Switzerland enhances Eastern France’s position as a biomanufacturing hub, contributing to the growth of single-use bio-processing systems adoption. The region’s strong network of scientific research institutions, coupled with its established expertise in biologics production, provides a solid foundation for continued market expansion.

Western France

Western France accounts for approximately 15% of the market share. While it is a smaller player compared to the other regions, Western France has experienced steady growth in the adoption of single-use bio-processing systems. The region’s biotech clusters, including Nantes and Rennes, are emerging as important contributors to the biopharmaceutical industry. The growth of the biosimilars sector and increasing investment in manufacturing facilities are expected to drive demand for single-use systems in this region. Additionally, Western France is capitalizing on its strong educational and research institutions to support innovation in biomanufacturing, further driving market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sartorius AG

- Merck KGaA

- Eppendorf AG

- Celltainer Biotech BV

- Lonza Group AG

- Getinge AB

- RoSS GmbH

- Elveflow

- Finesse Solutions

- Stedim Biotech

Competitive Analysis

The France Single-Use Bio-Processing Systems market is highly competitive, with prominent players focusing on innovation, partnerships, and expanding their product portfolios to maintain a strong foothold. Key industry leaders include Sartorius AG, Merck KGaA, Eppendorf AG, Celltainer Biotech BV, Lonza Group AG, Getinge AB, RoSS GmbH, Elveflow, Finesse Solutions, and Stedim Biotech. Leading companies are investing significantly in research and development to enhance system performance, scalability, and compatibility with evolving biopharmaceutical needs. Innovation remains a core strategy, with a focus on automation, modularity, and integration of digital technologies to improve efficiency and process control. Many players are also forming strategic partnerships and alliances with biotech firms, research institutions, and contract manufacturing organizations to expand their market presence and accelerate technology adoption. In addition to product innovation, companies are also concentrating on expanding their manufacturing capabilities and service networks across France to better serve local demand and comply with regional regulations. Customization and client-specific solutions are becoming increasingly important, especially for biomanufacturers working on personalized medicine and small-batch production. With sustainability becoming a key market driver, several competitors are also developing environmentally conscious single-use systems, further intensifying the competition and shaping future market dynamics.

Recent Developments

- In April 2025, Thermo Fisher Scientific launched the 5L DynaDrive Single-Use Bioreactor, a bench-scale system designed for seamless scalability from 1 to 5,000 liters. This new bioreactor offers a 27% productivity increase over glass bioreactors, enhanced sustainability with biobased films, and consistent performance across different scales, supporting both large and small biopharma manufacturers. The DynaDrive S.U.B. supports robust production across scales and has the flexibility to accommodate a variety of cell lines and processing modalities.

- In April 2025, Sartorius Stedim Biotech entered a strategic partnership with Tulip Interfaces to drive digital transformation in single-use bioprocessing. The collaboration introduced Biobrain® Operate powered by Tulip, a suite of digital manufacturing applications that integrate with Sartorius equipment to reduce process variability, digitize operations, and ensure regulatory compliance. This partnership aims to advance paperless manufacturing and optimize resource efficiency in bioprocessing.

- In March 2025, Corning introduced new technologies to support advanced therapy applications, including the Ascent™ Fixed Bed Reactor (FBR) and expanded cell expansion platforms like HYPERStack®, HYPERFlask®, and CellSTACK®. These platforms feature closed systems and automation to reduce contamination risk and enhance scalability for bioprocess applications.

- In April 2023, Merck KGaA launched the Ultimus® Single-Use Process Container Film, featuring ten times greater abrasion resistance than other films, improved durability, and leak resistance for single-use assemblies. The technology is now available in Mobius® 3D process containers, enhancing operational efficiency and cell growth performance.

Market Concentration & Characteristics

The France Single-Use Bio-Processing Systems market demonstrates a moderately high level of market concentration, characterized by the presence of a few dominant multinational firms alongside a growing number of specialized and regional players. These companies drive innovation, shape industry standards, and influence pricing dynamics through their strong R&D capabilities and extensive distribution networks. The market is marked by rapid technological advancements, with increasing emphasis on automation, scalability, and environmental sustainability. Product differentiation is significant, as manufacturers offer tailored solutions to meet the specific needs of biologics production, personalized medicine, and small-batch manufacturing. Customer loyalty and long-term contracts also contribute to market stability, particularly within established biopharmaceutical companies. Additionally, the market displays dynamic characteristics, including fast-paced innovation, frequent collaborations, and evolving regulatory frameworks. As demand for efficient, flexible, and contamination-free production grows, the market continues to attract new entrants and investments, fostering a competitive yet innovation-driven landscape across the French bio-processing sector.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily due to increasing demand for biologics and personalized therapies.

- Adoption of automation and digital monitoring tools will enhance process efficiency and control.

- Sustainability concerns will drive the development of eco-friendly and recyclable single-use components.

- Modular and customizable systems will gain popularity for their flexibility in small-batch and multi-product facilities.

- Strategic collaborations between manufacturers and biotech firms will support innovation and faster deployment.

- Regulatory compliance and standardization will become critical for broader adoption across manufacturing scales.

- Increased investments in local production capabilities will reduce dependence on imports and improve supply chain resilience.

- Research institutions and startups will play a bigger role in driving niche product development.

- Training and upskilling of workforce will be essential to maximize benefits from advanced single-use technologies.

- Market consolidation may occur as leading players acquire smaller firms to expand capabilities and portfolios.