| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Industrial Catalyst Market Size 2024 |

USD 1164.96 Million |

| France Industrial Catalyst Market, CAGR |

5.96% |

| France Industrial Catalyst Market Size 2032 |

USD 1851.1 Million |

Market Overview:

The France Industrial Catalyst Market is projected to grow from USD 1164.96 million in 2024 to an estimated USD 1851.1 million by 2032, with a compound annual growth rate (CAGR) of 5.96% from 2024 to 2032.

Several factors drive the demand for industrial catalysts in France. The country’s reliance on imported crude oil, primarily from nations like Kazakhstan, Russia, Saudi Arabia, and Iran, necessitates efficient refining processes to meet domestic energy needs. Catalysts are indispensable in these processes, enhancing efficiency and product quality. Additionally, stringent environmental regulations aimed at reducing emissions and promoting cleaner production methods have led industries to adopt advanced catalytic technologies. This shift aligns with France’s commitment to environmental sustainability and the global trend toward greener industrial practices. The rising investments in hydrogen production and carbon capture utilization and storage (CCUS) also stimulate demand for catalysts designed for these applications. Moreover, the growth of France’s pharmaceutical and specialty chemical sectors further contributes to the diversification of catalyst applications.

Regionally, France’s industrial catalyst market is influenced by its robust industrial base and strategic position within Europe. The presence of major industry players, such as Total Group, which operates six out of seven oil refineries in the country, underscores the significance of catalysts in the refining sector. Other notable companies like Exxon Mobil Corporation and INEOS also contribute to the market dynamics. Furthermore, the government’s emphasis on technological development and clean energy, as highlighted during events like COP29, indicates a supportive environment for the growth of the industrial catalyst market. Collaboration with EU member states and funding through European Union sustainability frameworks further strengthen regional innovation and catalyst research. Additionally, France’s proximity to key export markets such as Germany and the Benelux region positions it advantageously for industrial catalyst trade and distribution.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market is projected to grow from USD 1,164.96 million in 2024 to USD 1,851.1 million by 2032, at a CAGR of 5.96%, indicating steady long-term growth.

- The global industrial catalyst market is projected to grow from USD 31.56 billion in 2024 to USD 51.15 billion by 2032, with a CAGR of 6.22% from 2024 to 2032.

- France’s dependence on imported crude oil continues to fuel demand for high-efficiency catalysts in refining operations.

- Stringent emission and environmental regulations are driving the adoption of advanced and eco-friendly catalytic technologies.

- Growing investments in hydrogen production and CCUS are expanding opportunities for specialized catalysts in clean energy sectors.

- The chemical and specialty manufacturing industries are creating strong demand for selective and energy-efficient catalysts.

- High production costs and raw material dependency remain key challenges, especially for small and medium enterprises.

- Industrial hubs such as Île-de-France, Auvergne-Rhône-Alpes, and Provence-Alpes-Côte d’Azur lead catalyst demand due to their strong refining and chemical bases.

Market Drivers:

Expansion of the Refining and Petrochemical Industry

The continued development of France’s refining and petrochemical industry is a major driver of the industrial catalyst market. With a significant portion of the country’s crude oil being imported from nations such as Russia, Kazakhstan, and Saudi Arabia, the need for efficient and cost-effective refining operations has become increasingly critical. Industrial catalysts serve as essential components in the refining process, facilitating the conversion of crude oil into high-value products such as gasoline, diesel, and jet fuel. The demand for high-performance catalysts has grown in response to stricter product specifications and the necessity for better yield efficiency. As companies seek to enhance operational productivity and reduce process downtime, investment in advanced catalyst technologies is becoming a strategic priority.

Stringent Environmental and Emission Regulations

France’s commitment to environmental sustainability and regulatory compliance significantly contributes to the growth of its industrial catalyst market. Government-imposed regulations aimed at reducing greenhouse gas emissions, along with European Union directives promoting clean manufacturing practices, have encouraged industries to upgrade their catalytic systems. For instance, France has substantially increased its renewable energy target under its National Energy and Climate Plan (NECP) for 2030, aiming for 41.3% of renewables in final energy consumption. Catalysts are increasingly used in processes that lower pollutant formation, enable selective conversion, and support carbon capture initiatives. These environmental mandates have prompted refineries, chemical plants, and other industrial sectors to adopt catalysts that comply with strict emission norms while improving energy efficiency. This regulatory environment not only stimulates innovation in catalyst design but also encourages the deployment of eco-friendly catalytic processes across various industrial applications.

Rising Demand in Chemical and Specialty Manufacturing

The growth of the chemical and specialty manufacturing sector in France has created additional momentum for the industrial catalyst market. For instance, French companies involved in pharmaceutical production have integrated enzyme-based catalysts to enhance reaction rates in drug synthesis, reducing production times and energy consumption. With France being a hub for chemical innovation and home to several leading multinational corporations, the demand for catalysts that enhance reaction rates, reduce energy consumption, and improve selectivity is steadily increasing. Additionally, the emergence of green chemistry practices has heightened the need for sustainable catalyst systems. This trend aligns with the broader shift toward decarbonization and circular economy principles, further reinforcing the market’s trajectory within the chemical manufacturing domain.

Advancements in Technology and R&D Investments

Ongoing technological advancements and increased investment in research and development further accelerate market growth in France. Public-private collaborations, funding from the European Union, and national initiatives focused on industrial innovation have supported the development of next-generation catalyst materials. These include nanostructured catalysts, zeolites, and metal-organic frameworks designed for improved activity and longevity. French universities, research institutes, and industrial players continue to explore innovative catalytic solutions to meet evolving industrial demands. The integration of digital tools such as artificial intelligence and process simulation in catalyst development is also optimizing performance and reducing lead times, thus strengthening France’s position in the global catalyst value chain.

Market Trends:

Shift Toward Sustainable Catalysis

A prominent trend shaping the France Industrial Catalyst Market is the growing shift toward sustainable catalysis. As environmental concerns intensify and the French government enforces stricter climate objectives, there has been a marked increase in the adoption of eco-friendly catalytic materials and processes. Catalysts that support bio-refining, renewable feedstocks, and low-emission manufacturing methods are gaining traction. According to industry insights, France’s renewable energy usage in industrial applications increased by 8% over the past two years, pushing manufacturers to adopt catalysts compatible with greener production lines. This transformation supports France’s national energy transition strategy and reinforces its commitment to the European Green Deal goals.

Increasing Role of Catalysts in Hydrogen and Ammonia Production

The rising interest in hydrogen and ammonia production in France is creating new growth avenues for catalyst technologies. France has committed over €7 billion to the development of a national hydrogen economy by 2030, and catalysts are crucial to both electrolyzer efficiency and ammonia synthesis. Industrial catalysts that enable more energy-efficient hydrogen production and facilitate ammonia cracking are seeing increased research and deployment. For example, new developments in nickel-based catalysts have improved the efficiency of steam methane reforming (SMR) for blue hydrogen production while integrating carbon capture technologies to reduce emissions. The application of catalysts in green hydrogen pathways, including water electrolysis and biomass gasification, is gaining momentum as industries aim to reduce carbon footprints and transition away from fossil fuel-based hydrogen. This trend underscores the growing intersection between the catalyst market and France’s clean energy ambitions.

Digitalization and Smart Manufacturing Integration

Another emerging trend in the French industrial catalyst space is the integration of digital technologies into manufacturing processes. Industries are increasingly implementing digital twins, machine learning algorithms, and process automation to optimize catalyst performance and reduce lifecycle costs. Data-driven modeling helps predict catalyst deactivation and enables real-time monitoring of reactions, leading to greater operational efficiency and reduced material waste. In a recent industrial survey, nearly 60% of French manufacturers reported investing in process digitization to support catalyst-driven optimization. This convergence of digital innovation and chemical processing enhances France’s competitiveness in the global industrial catalyst landscape.

Increased Collaboration in Research and Commercialization

Collaboration among academic institutions, government agencies, and private enterprises is on the rise, contributing to accelerated catalyst innovation in France. Universities such as Sorbonne and École Polytechnique, along with national research centers like CNRS, are actively partnering with industry leaders to develop high-performance catalytic materials tailored for specific applications. For instance, joint U.S.-French projects funded by NSF and ANR focus on developing earth-abundant metal catalysts for sustainable chemistry. The growing number of patents filed for advanced catalysts in France reflects a trend of intensified R&D efforts and knowledge-sharing, ultimately contributing to the commercialization of more efficient and sustainable catalytic systems across sectors.

Market Challenges Analysis:

High Production and Operational Costs

One of the primary restraints in the France Industrial Catalyst Market is the high cost associated with catalyst production and operational implementation. Manufacturing industrial catalysts often involves expensive raw materials for instance, platinum-based catalysts, widely used for their superior catalytic efficiency, incur significant expenses due to the volatile pricing of platinum caused by its limited global supply and high demand across industries such as automotive and electronics. Additionally, the synthesis and handling of these materials require specialized equipment and highly controlled environments, further increasing capital expenditure. These high upfront investments can pose challenges, particularly for small and medium-sized enterprises that may lack the financial resources to adopt advanced catalytic technologies.

Complexity in Catalyst Regeneration and Disposal

Another significant challenge lies in the regeneration and disposal of spent catalysts. While many industrial catalysts are designed for long-term use, they eventually deactivate and require proper disposal or regeneration to prevent environmental contamination. The regeneration process can be technically complex, requiring significant energy and the use of hazardous chemicals. In France, strict environmental regulations concerning waste management further complicate the process, requiring companies to invest in compliant waste-handling infrastructure. Improper handling of spent catalysts can also lead to regulatory penalties, adding to operational risks.

Supply Chain Disruptions and Raw Material Dependency

The France industrial catalyst sector is also vulnerable to supply chain disruptions, especially in sourcing critical raw materials from international markets. Dependence on imports for key components such as rare earth elements and transition metals makes the industry susceptible to geopolitical tensions, trade restrictions, and fluctuations in global commodity prices. These disruptions can affect production timelines and cost structures, creating uncertainty in the market. Addressing these challenges requires strategic investments in local sourcing, recycling capabilities, and material innovation to ensure long-term stability and competitiveness.

Market Opportunities:

The France Industrial Catalyst Market presents substantial growth opportunities driven by the nation’s commitment to energy transition and decarbonization. As France accelerates its shift toward cleaner energy sources and sustainable manufacturing, the demand for catalysts that enable energy-efficient, low-emission industrial processes is expected to increase. The country’s ambitious plans to expand hydrogen production, invest in carbon capture technologies, and scale up bio-refining offer significant potential for advanced catalyst applications. Catalysts tailored for use in green hydrogen generation, biomass conversion, and renewable feedstock processing are gaining prominence. These developments align with national and EU-level climate targets, making France an attractive market for catalyst innovation and deployment in sustainable industrial practices.

Additionally, France’s strong research infrastructure and support for public-private partnerships provide fertile ground for technological advancement in catalyst development. Institutions such as CNRS and CEA, alongside collaborations with industrial leaders, are driving research in nanocatalysis, solid acid catalysts, and metal-organic frameworks. This creates an enabling environment for startups and established players to develop customized, high-performance catalysts suited to diverse applications across petrochemicals, pharmaceuticals, and specialty chemicals. With increasing funding from EU programs like Horizon Europe and support for industrial modernization, the market is well-positioned to capitalize on advancements in smart manufacturing, AI-driven process optimization, and circular economy practices. As a result, stakeholders who invest in innovative, eco-efficient catalytic solutions are likely to benefit from long-term competitive advantage in the evolving French industrial landscape.

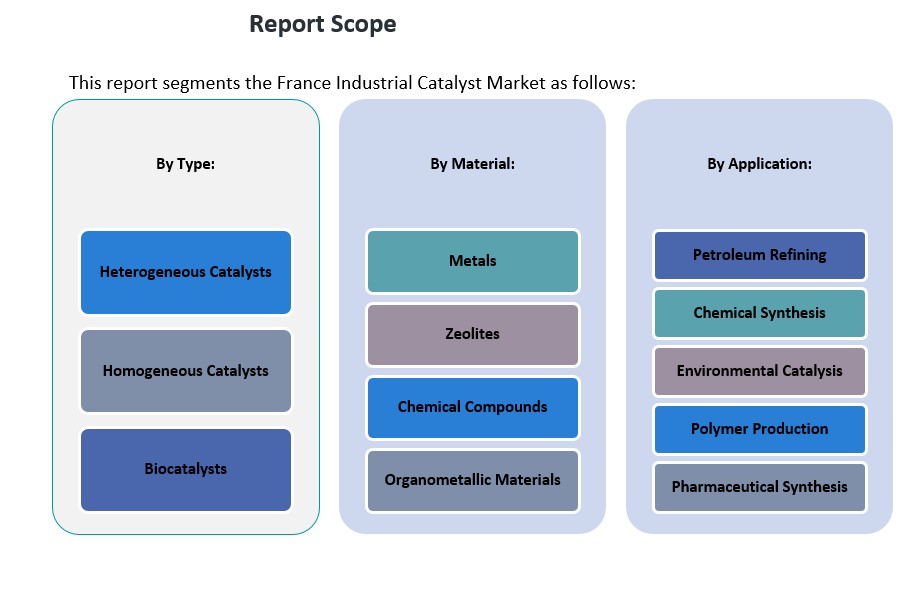

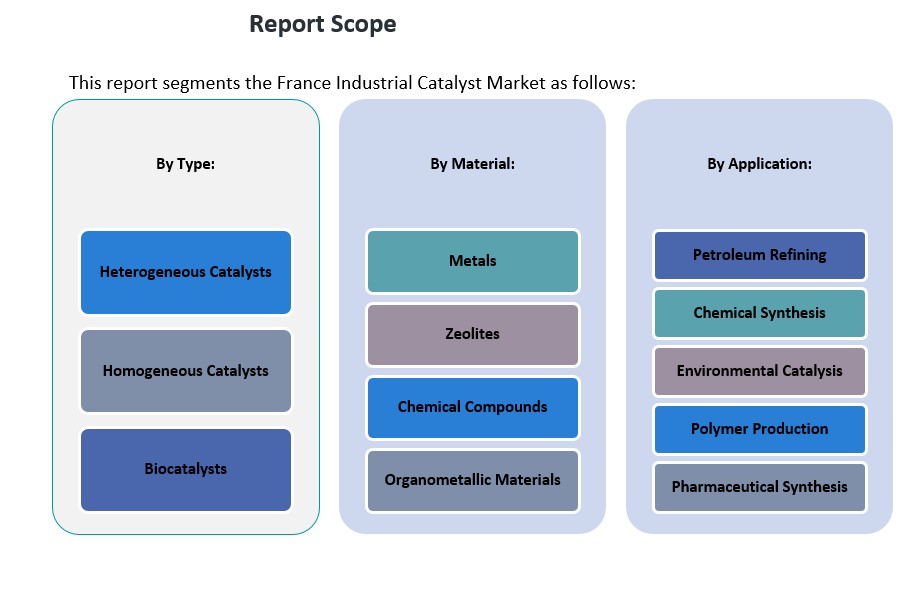

Market Segmentation Analysis:

The France Industrial Catalyst Market is segmented by type, application, and material, reflecting the diverse industrial demand and technological advancements within the country’s processing sectors.

By type, heterogeneous catalysts dominate the market due to their extensive use in large-scale industrial applications such as petroleum refining and environmental catalysis. Their ease of separation and reusability make them ideal for continuous processes. Homogeneous catalysts, while less prevalent, are essential in fine chemical and pharmaceutical synthesis where high selectivity is required. Biocatalysts are gaining traction with the rise of green chemistry and sustainable manufacturing practices, particularly in bio-based production processes.

By application, petroleum refining holds the largest share, driven by the country’s reliance on imported crude oil and the need for efficient refining operations. Chemical synthesis and environmental catalysis follow, supported by growing regulatory pressures and demand for cleaner processes. Polymer production and pharmaceutical synthesis also contribute significantly, benefiting from technological advancements and the expansion of specialty chemical manufacturing in France.

By material, metals such as platinum and palladium are widely used due to their high catalytic efficiency, especially in automotive and refining applications. Zeolites are preferred in cracking and petrochemical processes for their selectivity and thermal stability. Chemical compounds serve across multiple sectors, while organometallic materials are increasingly applied in specialty and fine chemical synthesis, offering high activity and functional versatility.

Segmentation:

By Type Segment

- Heterogeneous Catalysts

- Homogeneous Catalysts

- Biocatalysts

By Application Segment

- Petroleum Refining

- Chemical Synthesis

- Environmental Catalysis

- Polymer Production

- Pharmaceutical Synthesis

By Material Segment

- Metals

- Zeolites

- Chemical Compounds

- Organometallic Materials

Regional Analysis:

The industrial catalyst market in France is a vital component of the nation’s industrial sector, with significant contributions from various regions. While specific market share data by region within France is limited, an analysis of key industrial areas provides insight into the geographical distribution of catalyst demand.

Île-de-France

Île-de-France, encompassing the capital city of Paris, stands as the country’s primary industrial and economic hub. This region hosts a diverse range of industries, including chemical manufacturing, pharmaceuticals, and automotive production. The concentration of these industries in Île-de-France drives substantial demand for industrial catalysts, particularly in chemical synthesis and environmental applications. The region’s advanced infrastructure and proximity to research institutions further bolster its prominence in the catalyst market.

Auvergne-Rhône-Alpes

The Auvergne-Rhône-Alpes region is renowned for its robust chemical and petrochemical industries, particularly in cities like Lyon. This area serves as a significant center for chemical production, necessitating the extensive use of catalysts in processes such as polymerization and refining. The presence of major chemical companies and research centers in this region underscores its critical role in the national catalyst market.

Provence-Alpes-Côte d’Azur

Provence-Alpes-Côte d’Azur, with its strategic access to the Mediterranean, is home to key port cities like Marseille. This region facilitates the importation of crude oil and other raw materials essential for refining and chemical manufacturing. The local refineries and petrochemical plants rely heavily on catalysts for operations such as hydrocracking and desulfurization, making this region a significant contributor to the overall market demand.

Hauts-de-France

Hauts-de-France, located in the northern part of the country, has a strong industrial base with a focus on automotive manufacturing and associated chemical production. The region’s industries utilize catalysts in various applications, including emission control systems and material processing. The proximity to other European markets also enhances its strategic importance in the industrial catalyst landscape.

Key Player Analysis:

- BASF SE

- Johnson Matthey PLC

- Clariant AG

- Evonik Industries AG

- Haldor Topsoe A/S

- Arkema Group

- Akzo Nobel N.V.

- INEOS Group

- Umicore

- SABIC France

Competitive Analysis:

The France Industrial Catalyst Market is characterized by the presence of both global and domestic players competing across various segments such as refining, petrochemicals, and specialty chemicals. Key multinational corporations, including BASF SE, Clariant AG, and Johnson Matthey, maintain a strong presence through local subsidiaries and strategic partnerships with French industrial firms. These companies leverage advanced R&D capabilities to offer customized catalyst solutions aligned with evolving environmental and performance standards. Domestic players also contribute significantly, particularly in niche applications and catalyst regeneration services. The competitive landscape is shaped by innovation, regulatory compliance, and cost-efficiency, with firms investing in sustainable technologies and digital process integration to enhance value propositions. As demand grows for cleaner, high-performance catalysts, market participants are focusing on expanding product portfolios, strengthening distribution networks, and forming alliances with academic institutions to maintain technological leadership and market relevance in France’s evolving industrial ecosystem.

Recent Developments:

- In December 2024, BASF SE inaugurated its new Catalyst Development and Solids Processing Center in Ludwigshafen, Germany. This facility, built with a high double-digit million-euro investment, is equipped with cutting-edge process equipment to accelerate the development of innovative catalyst and process technologies.

- In February 2025, Johnson Matthey PLC entered a long-term collaboration with Bosch to develop zero-emission hydrogen technology. This partnership focuses on producing catalyst-coated membranes (CCM) for fuel cell stacks, which are integral to clean hydrogen fuel cell vehicles. The agreement was marked at Bosch’s fuel cell center in Stuttgart-Feuerbach, Germany.

- In January 2023, Evonik Catalyst integrated its alkoxides business into its Catalyst Business Line. This strategic move expanded Evonik’s portfolio by complementing heterogeneous catalysts with homogeneous catalysts. The integration was supported by an international network of production sites and an experienced team, solidifying catalysts as one of Evonik’s key growth areas.

Market Concentration & Characteristics:

The France Industrial Catalyst Market exhibits a moderately concentrated structure, dominated by a few key international players with well-established global footprints. Companies such as BASF SE, Clariant AG, and Johnson Matthey command a significant share of the market due to their advanced technologies, extensive product portfolios, and long-standing industry relationships. However, the presence of regional firms and specialized service providers ensures a competitive environment, particularly in niche and custom catalyst applications. The market is characterized by high entry barriers owing to the capital-intensive nature of catalyst production, stringent regulatory standards, and the technical complexity of manufacturing processes. Additionally, the industry relies heavily on continuous innovation, strong R&D capabilities, and collaboration with end-users to meet evolving efficiency and environmental requirements. Product differentiation, technological advancement, and adherence to sustainability goals remain critical factors shaping the market’s structure and competitive dynamics in France’s industrial catalyst sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, Application Segment and Material Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for eco-friendly and energy-efficient catalysts is expected to rise due to France’s decarbonization targets.

- Growth in green hydrogen and ammonia production will create new opportunities for advanced catalyst applications.

- Increasing investment in bio-refineries will drive demand for catalysts supporting biomass conversion processes.

- Expansion of the pharmaceutical and specialty chemical industries will boost the need for high-performance catalysts.

- Continued regulatory pressure on emissions will accelerate adoption of catalysts enabling cleaner industrial processes.

- Public-private R&D collaborations will foster innovation in nanocatalysis and sustainable catalyst technologies.

- Digitalization in manufacturing will enhance catalyst efficiency through predictive analytics and process optimization.

- Catalyst recycling and regeneration technologies will gain traction amid raw material cost concerns.

- Strategic partnerships between global leaders and French firms will strengthen local manufacturing capabilities.

- Integration with EU green industrial policies will support funding and market expansion across sectors.