Market Overview:

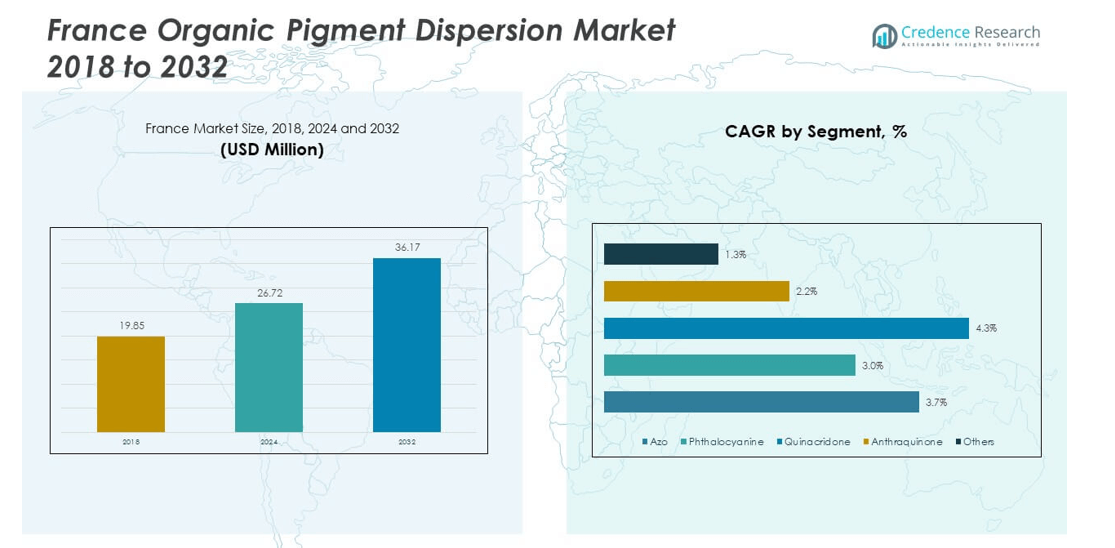

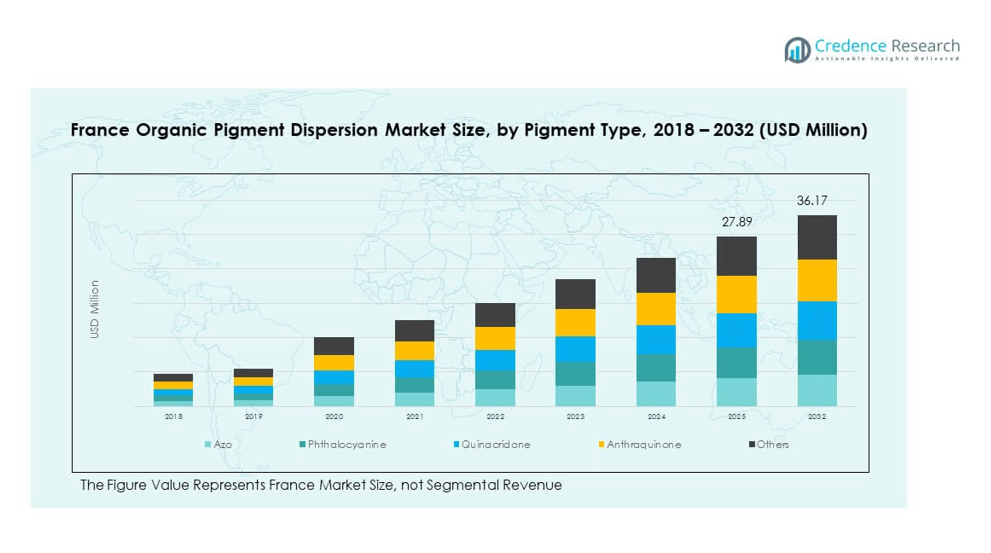

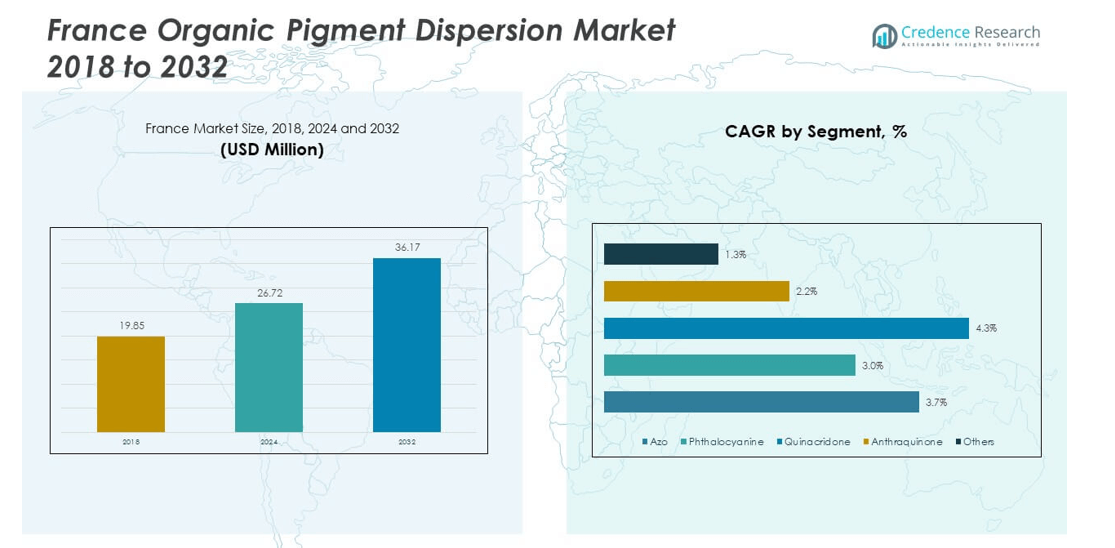

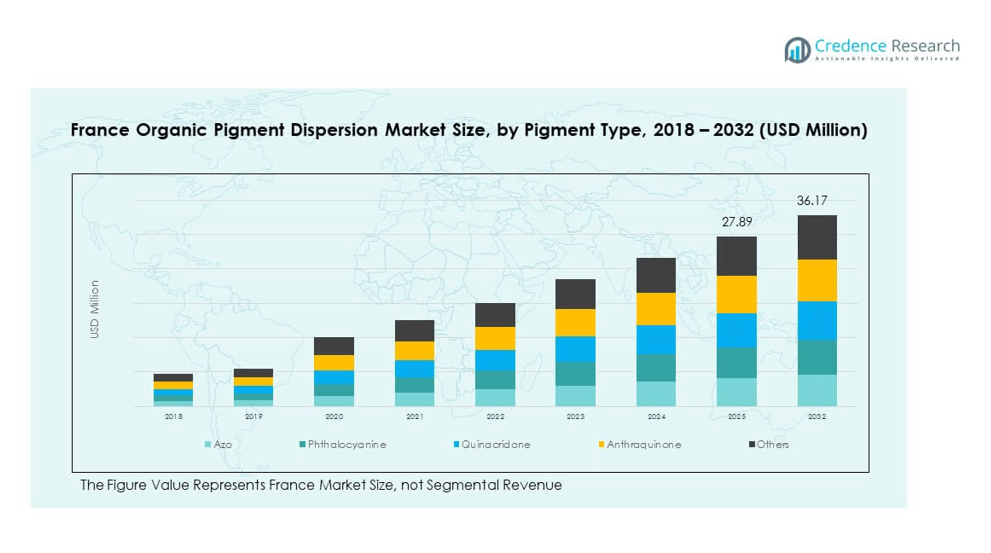

The France Organic Pigment Dispersion Market size was valued at USD 19.85 million in 2018 to USD 26.72 million in 2024 and is anticipated to reach USD 36.17 million by 2032, at a CAGR of 3.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Organic Pigment Dispersion Market Size 2024 |

USD 26.72 million |

| France Organic Pigment Dispersion Market, CAGR |

3.78% |

| France Organic Pigment Dispersion Market Size 2032 |

USD 36.17 million |

Growth in the France Organic Pigment Dispersion Market is driven by rising demand for eco-friendly solutions across packaging, coatings, and consumer goods industries. Regulatory pressure to minimize toxic chemicals and VOC emissions supports the shift toward organic dispersions. Manufacturers innovate with sustainable pigments that provide high color strength, durability, and compatibility with water-based systems. Consumer preference for safe, recyclable, and environmentally compliant products further strengthens market adoption. Expanding applications in automotive, construction, textiles, and cosmetics increase demand. Strong investments in research improve stability and efficiency of dispersions.

Regionally, Southern France leads the market due to the presence of aerospace, cosmetics, and luxury packaging industries supported by advanced trade infrastructure. Northern France contributes significantly, with strong demand from coatings and packaging sectors driven by industrial hubs. Central France remains a key contributor, with automotive and construction sectors fueling high-value pigment requirements. Emerging areas are embracing sustainable practices and advanced printing technologies, creating new growth avenues. Geographic diversity across the country ensures balanced development, with established regions sustaining dominance while smaller regions gradually strengthen their role in shaping the national pigment dispersion industry.

Market Insights

- The France Organic Pigment Dispersion Market size was USD 19.85 million in 2018, reached USD 26.72 million in 2024, and is projected at USD 36.17 million by 2032, growing at a CAGR of 3.78%.

- Southern France held the largest share at 39%, driven by aerospace, cosmetics, and luxury packaging demand; Northern France accounted for 32% with strong industrial hubs; Central France contributed 29% supported by automotive and construction sectors.

- Southern France, with 39% share, is the fastest-growing region, supported by trade infrastructure, exports, and advanced coating applications.

- Azo pigments dominated with 41% share in 2024, favored for cost efficiency and widespread packaging applications.

- Phthalocyanine pigments held 29% share in 2024, supported by strong adoption in plastics and printing inks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Eco-Friendly Pigment Solutions Across Key End-Use Industries

The France Organic Pigment Dispersion Market benefits from the strong push toward eco-friendly solutions. Industries such as packaging, textiles, and paints favor organic pigment dispersions due to their lower environmental footprint. Stringent EU regulations on chemical emissions enhance the need for safer alternatives. French manufacturers invest in sustainable production practices to align with green policies. Organic pigments offer high color strength and better compatibility with water-based formulations. This advantage supports their adoption across printing inks and coatings. Increasing awareness among consumers about product sustainability also drives usage. It strengthens the market’s long-term position within Europe.

- For example, BASF offers its AURASPERSE™ pigment dispersions portfolio, including AURASPERSE II, which are water-based dispersions designed with eco-friendly chemistry. These dispersions are free of APEOs, binding agents, and solvents, ensuring a strong environmental profile. The AURASPERSE II range is noted for its high pigment content, flowability, pumpability, and stability, making it highly suitable for water-based and emulsion systems in architectural and industrial coatings.

Government Regulations Encouraging Use of Safer Chemical Alternatives

Strict regulatory frameworks in France encourage the shift toward organic pigment dispersions. The REACH directive and local environmental standards restrict hazardous chemical use in pigments. This change pushes companies to adopt organic dispersions with lower toxicity and minimal VOC emissions. Large industrial buyers prefer vendors offering certified eco-compliant solutions. Government-backed initiatives for sustainable packaging further boost adoption across FMCG sectors. Organic dispersions also enhance recyclability of packaging materials, adding economic value. Manufacturers benefit from subsidies and incentives promoting green technologies. These regulatory pressures fuel steady growth in the France Organic Pigment Dispersion Market.

- For example, Clariant’s Hostatint™ A 100 pigment preparations offer high pigment loading and good rheological properties suitable for solvent-based industrial paint systems. These formulations avoid hazardous labeling and eliminate special flammability storage requirements, supporting safe handling and compatibility across numerous industrial coatings platforms.

Growing Applications in High-Performance Industrial and Specialty Coatings

Industrial and specialty coatings increasingly adopt organic pigment dispersions for advanced performance. Automotive coatings in France rely on dispersions offering durability and vibrant color retention. Organic pigments provide superior resistance to weathering compared to conventional options. This advantage supports their use in construction materials and outdoor applications. Manufacturers in France emphasize premium coatings to meet customer expectations in architecture and automotive sectors. Rising exports of high-performance paints further strengthen local demand. Organic dispersions also serve niche sectors like electronics packaging and medical devices. It reflects their expanding role in advanced industrial applications.

Technological Advancements Driving Better Performance and Versatile Applications

Technology-driven improvements support wider use of organic pigment dispersions across industries. French producers invest in advanced dispersion technologies to improve particle size control and stability. This results in pigments offering uniform distribution and higher visual appeal. Improved formulations ensure compatibility with a range of substrates like plastics, polymers, and paper. Research labs in France collaborate with universities to enhance pigment performance. Customized solutions help meet sector-specific needs, especially in cosmetics and premium packaging. Rising investments in R&D support ongoing product innovation. The France Organic Pigment Dispersion Market gains a competitive edge from these advancements.

Market Trends

Increasing Adoption of Water-Based Inks and Coatings Across End-Use Industries

The France Organic Pigment Dispersion Market experiences growth from the rising use of water-based inks. These inks reduce VOC emissions, aligning with sustainability requirements. Packaging companies in France adopt water-based systems for safer operations. Print media and publishing houses also shift toward eco-compatible inks. Organic dispersions enhance performance of water-based formulations, improving adhesion and brightness. End users prefer them for reducing environmental liabilities while meeting regulatory norms. This trend shapes new opportunities for dispersion suppliers across industrial sectors. It reinforces France’s role as a hub for sustainable printing technologies.

Expansion of Customized Color Solutions for High-Value Applications

French industries increasingly demand tailored pigment dispersion solutions for niche applications. Luxury packaging and cosmetics sectors prefer exclusive colors to enhance brand identity. Organic dispersions offer flexibility for creating unique shades with high consistency. This customization allows manufacturers to cater to fast-changing consumer preferences. Companies develop digital color-matching technologies to deliver precision solutions. Tailored dispersions also support innovation in functional coatings and specialty textiles. The France Organic Pigment Dispersion Market benefits from the rising appeal of premium personalization. It supports long-term engagement with high-value clients in luxury industries.

- For example, DIC Corporation’s DAICURE HR series comprises high-sensitivity UV-curable offset inks known for prioritizing food safety and environmental compatibility. These formulations serve packaging applications and align with the company’s strong expertise in printing inks and organic pigments.

Integration of Digital Printing Technologies in Packaging and Textiles

Digital printing adoption is a key trend shaping the pigment dispersion market. Organic dispersions are compatible with modern digital presses requiring stable formulations. Packaging firms in France embrace digital printing for short-run and customizable designs. Textile manufacturers use organic dispersions to achieve bright, durable prints. This integration allows for rapid prototyping and faster market response. Consumer preference for on-demand designs accelerates adoption in fashion and retail sectors. Organic dispersions enable consistent quality across digital applications. It highlights the alignment of pigments with evolving digital platforms.

- For example, DuPont’s Artistri® digital inkjet portfolio serves global demand across packaging, textile, and commercial printing. The water-based pigment inks for packaging meet food-compliance regulations and support manufacturers moving toward safer, sustainable practices. The portfolio also holds multiple sustainability certifications OEKO-TEX® ECO PASSPORT, ZDHC MRSL Level 3, and GOTS highlighting DuPont’s commitment to environmental and regulatory standards.

Growing Research on Nanotechnology and Functional Pigment Dispersions

French research institutions explore nanotechnology applications to improve dispersion performance. Nanoparticle-based organic pigments deliver higher stability and brightness. These advanced dispersions offer enhanced UV resistance and improved weathering properties. Functional pigment dispersions also gain traction for smart coatings and responsive surfaces. They are explored for anti-microbial, self-cleaning, and energy-efficient applications. Partnerships between academic researchers and pigment manufacturers drive such innovation. This emerging field positions France as a leader in pigment-based functional materials. It ensures future market expansion beyond conventional applications.

Market Challenges Analysis

High Production Costs and Competitive Pressure from Inorganic Alternatives

The France Organic Pigment Dispersion Market faces challenges due to higher production costs. Organic pigments often require complex synthesis and advanced dispersion processes. This increases cost compared to traditional inorganic pigments. Price-sensitive industries like low-cost packaging sometimes resist adoption. The presence of cheaper inorganic alternatives intensifies competitive pressure. Companies must balance cost efficiency with sustainability advantages. Limited raw material availability further adds to pricing volatility. It creates barriers for smaller firms competing with global suppliers.

Regulatory Barriers and Supply Chain Instability Affecting Market Growth

Strict EU regulations create compliance challenges for pigment manufacturers. Meeting eco-label standards requires significant investment in R&D and certification. Smaller firms struggle with these costs, reducing market participation. Supply chain disruptions, such as raw material shortages, hinder steady production. Dependence on imports of certain organic pigment precursors adds risk. Global trade uncertainties also affect pricing and delivery timelines. Companies in France face difficulties maintaining consistent supply across sectors. The France Organic Pigment Dispersion Market must adapt to overcome these structural barriers.

Market Opportunities

Rising Scope of Eco-Friendly Pigments in Premium Packaging and Consumer Goods

The France Organic Pigment Dispersion Market benefits from opportunities in premium packaging. Brands in luxury cosmetics and beverages demand sustainable pigments for strong visual impact. Organic dispersions allow vibrant colors while supporting recyclability goals. Consumer preference for eco-friendly products strengthens demand across these segments. Packaging firms integrate such pigments to meet both brand image and compliance standards. This creates long-term growth opportunities for suppliers offering certified eco-friendly dispersions. It reinforces the market’s position in high-value consumer goods industries.

Expanding Applications in Smart Coatings and Emerging Functional Materials

Smart coatings and functional materials open new opportunities for organic dispersions. Industries experiment with pigments offering anti-bacterial, UV-protective, and energy-saving properties. French research collaborations accelerate the development of such advanced dispersions. Construction, automotive, and electronics sectors adopt these innovations to meet evolving demands. Organic dispersions support versatile performance, ensuring compatibility with advanced substrates. The France Organic Pigment Dispersion Market gains relevance in futuristic industrial applications. It highlights the market’s ability to extend beyond conventional decorative use.

Market Segmentation Analysis

By pigment type, azo pigments hold the dominant share in the France Organic Pigment Dispersion Market due to their cost-effectiveness and wide use in packaging and coatings. Phthalocyanine pigments follow with strong demand from plastics and printing inks, driven by their excellent weather and chemical resistance. Quinacridone pigments serve high-value applications in cosmetics and automotive coatings where durability and vibrant shades are required. Anthraquinone pigments contribute a smaller but stable share in specialty applications. Other pigment types, including niche organic formulations, expand steadily through tailored solutions for textiles and specialty polymers. It demonstrates strong diversity in pigment type adoption across the French market.

- For example, DIC Corporation, a globally recognized leader in pigments, now produces and markets the Paliogen® series of azo pigments.

By application, paints and coatings remain the largest segment of the France Organic Pigment Dispersion Market, fueled by construction, automotive, and industrial demand. Printing inks form the next major segment, supported by packaging industry requirements and rising adoption of water-based formulations. Plastics and polymers account for a significant share, especially in consumer goods and industrial products. Textiles adopt organic dispersions for durable prints and eco-friendly solutions, aligning with sustainability goals. Cosmetics leverage premium organic pigments for safety and high-performance color applications. Other applications, including niche industrial uses, contribute to market diversity. It reflects broad adoption across multiple sectors in France.

- For example, Cosmetics leverage premium organic pigments for safety and high-performance color applications; Sudarshan’s Sudaperm™ pigment series is formally registered and supported in EU REACH documents for use in cosmetics and specialty colorants.

Segmentation

By Pigment Type

- Azo

- Phthalocyanine

- Quinacridone

- Anthraquinone

- Others

By Application

- Printing Inks

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Cosmetics

- Others

Regional Analysis

Northern France Market Dynamics and Growth Contribution

Northern France holds a market share of 32% in the France Organic Pigment Dispersion Market. Strong industrial presence in Lille, Rouen, and Le Havre drives adoption across printing inks and coatings. The region benefits from proximity to major European trade routes, supporting exports of pigment dispersions. Large packaging firms located in this subregion demand eco-friendly pigments to align with EU green standards. Northern France also houses several R&D hubs that encourage collaboration between pigment manufacturers and research institutes. It strengthens regional competitiveness and ensures steady adoption in diverse applications.

Central France Market Structure and Competitive Strength

Central France accounts for 29% of the France Organic Pigment Dispersion Market. Industrial clusters in Paris and Lyon fuel demand in paints, polymers, and specialty textiles. Major automotive and construction industries in this region require durable dispersions with high weather resistance. Local firms collaborate with global suppliers to meet specialized needs in advanced coatings. Strong logistics networks ensure efficient distribution of pigments across domestic markets. Central France stands out for high-value applications, including premium packaging and cosmetics. It reinforces its position through continuous technological advancements in dispersion processes.

Southern France Market Expansion and Sectoral Opportunities

Southern France holds 39% of the France Organic Pigment Dispersion Market, leading in regional share. Marseille, Toulouse, and Nice act as commercial centers for pigment consumption across multiple industries. The aerospace and luxury goods sectors boost demand for high-performance organic dispersions. Southern France’s port facilities support large-scale imports and exports of pigment raw materials. Regional growth is driven by investments in sustainable coatings and advanced textile manufacturing. Strong demand from cosmetics brands in this subregion strengthens the overall market outlook. It positions Southern France as the fastest-growing hub within the national pigment industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Clariant AG

- Heubach GmbH

- Lanxess AG

- Venator Materials PLC

- Cabot Corporation

- Ferro Corporation

- DIC Corporation

- Sudarshan Chemical Industries

- Heubach Group

Competitive Analysis

The France Organic Pigment Dispersion Market is highly competitive, with global and domestic players investing in product innovation and market expansion. BASF SE, Clariant AG, and DIC Corporation hold strong positions due to advanced portfolios and wide distribution networks. Heubach GmbH and Sudarshan Chemical Industries enhance competition through specialized pigment offerings targeting sustainable applications. Companies focus on water-based dispersions, high-performance coatings, and customized color solutions to secure market share. Strategic initiatives such as acquisitions, regional expansions, and product launches remain central to growth. It reflects a competitive environment shaped by compliance with EU regulations and rising customer demand for eco-friendly pigments. Smaller firms leverage niche applications in textiles and cosmetics to maintain presence. The market balance is defined by innovation capacity and responsiveness to sustainability-driven demand.

Recent Developments

- In April 2025, BASF SE introduced Lamesoft OP Plus, a new wax-based and biodegradable opacifier dispersion with a high natural content (NOC = 92.3% to 98.5%). The innovative product is positioned as an alternative to synthetic, acrylate-based ingredients, supporting sustainable solutions for the personal care and pigment dispersion sectors, and is actively promoted in the European market, including France.

- In March 2025, Sudarshan Chemical Industries finalized the acquisition of Heubach Group in a definitive deal, resulting in a global pigment powerhouse with 19 operational sites and a strong commercial presence across Europe, including France. This combination is designed to create a comprehensive product portfolio for high-quality pigments and dispersions.

- In July 2025, Sun Chemical, a wholly owned subsidiary of DIC Corporation, launched a new effect pigment called Chione Electric Amber SB90D, expanding its Chione Electric product line with a shimmering amber hue. This pigment is designed for vegan beauty products in cosmetics, skin, and sun care, offering enhanced chroma, UV stability, and non-staining properties.

- In November 2023, Heubach GmbH expanded its cooperation with TER Chemicals to include inorganic colored pigments, anti-corrosion pigments, and pigment preparations in Germany and Austria. This partnership aims to enhance product availability for coatings and related applications.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France Organic Pigment Dispersion Market will expand with rising demand for eco-friendly pigments across packaging and coatings.

- Growth will accelerate through stronger adoption of water-based formulations that comply with EU emission standards.

- Increased collaboration between manufacturers and research institutes will lead to advanced pigment technologies.

- Cosmetics and luxury packaging will remain high-value sectors driving consistent demand for customized dispersions.

- Digital printing adoption in textiles and packaging will support faster penetration of organic pigment dispersions.

- Nanotechnology and functional pigments will open new opportunities in smart coatings and high-performance applications.

- Strong investment in R&D will improve pigment stability, color strength, and substrate compatibility.

- Supply chain optimization and port facilities in Southern France will reinforce export opportunities.

- Competitive intensity will increase as global players expand local presence and enhance product portfolios.

- The France Organic Pigment Dispersion Market will benefit from regulatory incentives promoting sustainable chemical practices.