| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Protein Based Sports Supplements Market Size 2024 |

USD 272.15 Million |

| France Protein Based Sports Supplements Market, CAGR |

7.23 % |

| France Protein Based Sports Supplements Market Size 2032 |

USD 475.58 Million |

Market Overview

France Protein Based Sports Supplements Market size was valued at USD 272.15 million in 2024 and is anticipated to reach USD 475.58 million by 2032, at a CAGR of 7.23 during the forecast period (2024-2032).

The France protein-based sports supplements market is experiencing robust growth, driven by increasing health awareness and a growing emphasis on fitness among the general population. Rising participation in sports, gym memberships, and active lifestyles has significantly boosted the demand for protein supplements as a convenient source of nutrition. Additionally, the trend toward clean-label and plant-based protein options is gaining momentum, catering to consumers seeking sustainable and allergen-free alternatives. The proliferation of e-commerce platforms and digital fitness influencers has further amplified product visibility and accessibility. Innovations in product formulations, including ready-to-drink protein beverages and functional snacks, are attracting a broader consumer base beyond professional athletes. Moreover, favorable government initiatives promoting physical wellness and nutritional education are encouraging consumers to adopt protein-rich diets. Collectively, these factors are reinforcing market growth and shaping the evolving landscape of protein-based sports supplements in France.

The France protein-based sports supplements market demonstrates strong geographical diversity, with demand thriving across urban and semi-urban regions driven by varying lifestyle patterns and fitness engagement levels. Northern and Southern France lead in consumer adoption due to their dense populations, higher fitness participation, and availability of premium health and wellness retail channels. In contrast, Eastern and Western France are experiencing steady growth, supported by rising awareness of nutritional benefits and increased access to e-commerce platforms. The market is highly competitive and features both global and regional players offering a wide range of protein supplement formats tailored to diverse consumer preferences. Key players operating in the France market include Volac International Ltd., FrieslandCampina (Vifit Sport), Bulk Powders, Arla Foods Ingredients Group P/S, Nutrend D.S., A.S., Multipower (Atlantic Grupa), Olimp Laboratories, Scitec Nutrition, and Reflex Nutrition. These companies focus on product innovation, clean-label ingredients, and sustainable sourcing to strengthen their market presence and appeal to health-conscious consumers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France protein-based sports supplements market was valued at USD 272.15 million in 2024 and is expected to reach USD 475.58 million by 2032, growing at a CAGR of 7.23% during the forecast period.

- The global protein-based sports supplements market was valued at USD 7,372.05 million in 2024 and is projected to reach USD 13,140.51 million by 2032, growing at a CAGR of 7.49%.

- Growing health awareness and an active lifestyle among consumers are driving the demand for protein-based supplements across various age groups.

- Increasing popularity of plant-based proteins and clean-label ingredients is shaping product innovation and attracting eco-conscious consumers.

- The market features strong competition with key players like Volac International Ltd., Arla Foods Ingredients, and Bulk Powders focusing on diversification and sustainable offerings.

- High product costs and limited awareness in some rural areas act as restraints for widespread adoption of sports supplements.

- Northern and Southern France show the highest demand due to greater urbanization, while Eastern and Western France are witnessing gradual growth.

- E-commerce expansion and personalized nutrition trends are opening new opportunities for market players.

Report Scope

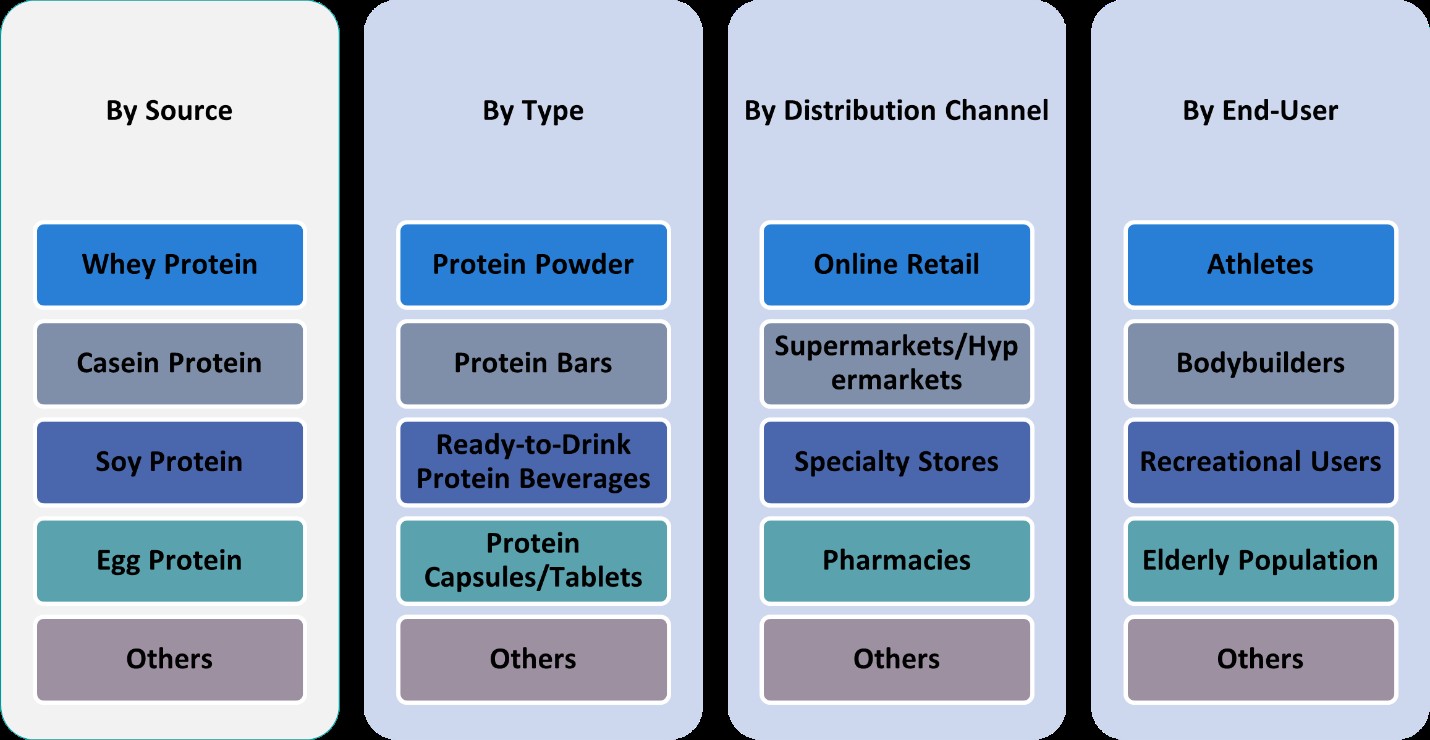

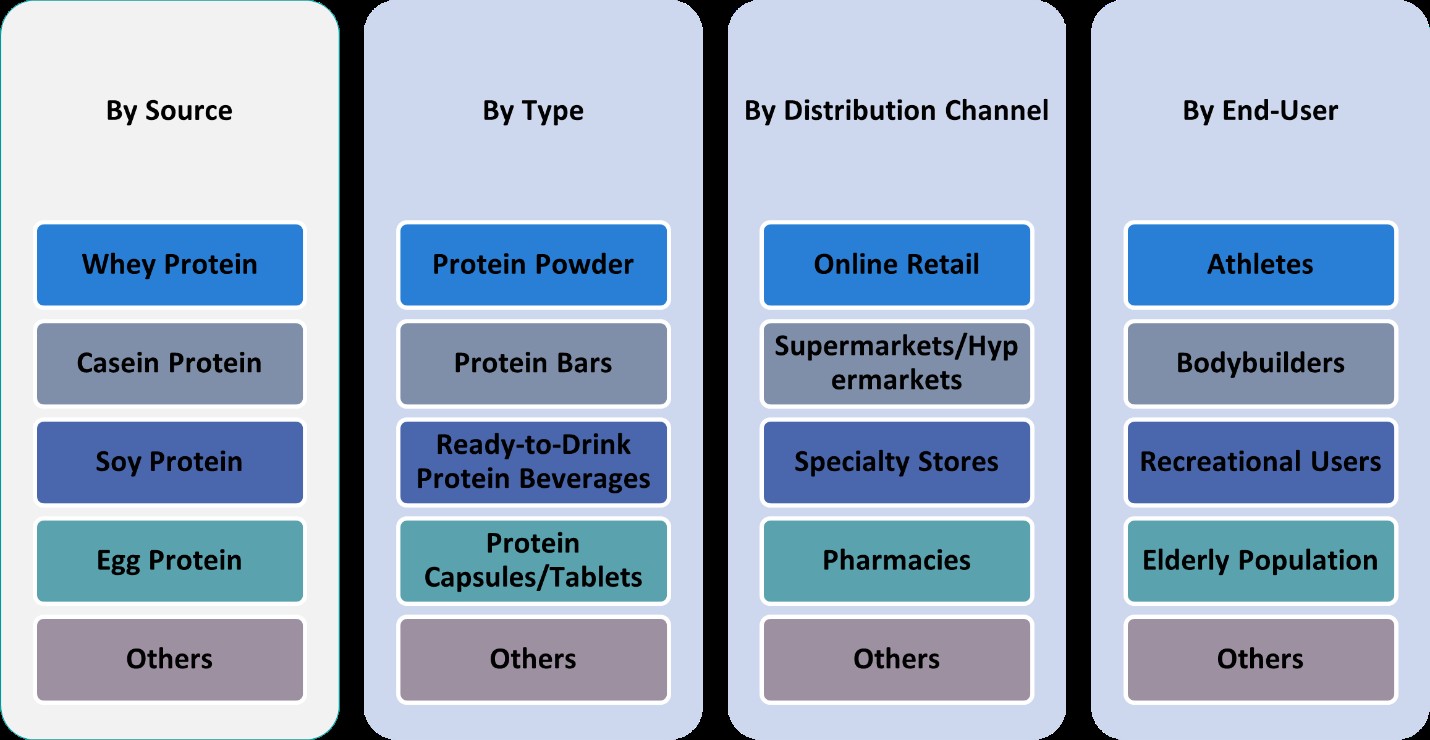

This report segments the France Protein Based Sports Supplements Market as follows:

Market Drivers

Rising Health Consciousness and Lifestyle Changes

A significant driver for the growth of protein-based sports supplements in France is the increasing health consciousness among consumers. With a growing awareness of the benefits of a balanced diet and regular exercise, more individuals are incorporating protein supplements into their daily routines to support muscle growth, weight management, and overall well-being. For instance, initiatives like France’s “National Nutrition and Health Program” (PNNS) have been instrumental in promoting healthier dietary habits and physical activity among citizens. Urbanization and changing work environments have led to more sedentary lifestyles, prompting individuals to adopt fitness regimes to maintain health. As a result, gym memberships and participation in fitness activities have increased substantially across urban centers. Consumers, especially millennials and Gen Z, are actively seeking functional food products that enhance performance and meet their dietary goals. This trend has created a favorable environment for the widespread adoption of protein-based supplements in daily nutrition, extending beyond professional athletes to general consumers.

Expanding Sports and Fitness Culture

The growing popularity of sports and fitness activities in France is a major contributor to the rising demand for protein-based sports supplements. For instance, government-led initiatives such as the “Sport for All” campaign have encouraged individuals of all age groups to engage in physical activities. France’s hosting of global sports events, including preparations for the 2024 Summer Olympics in Paris, has further amplified national interest in athletic performance and fitness. This has directly influenced the demand for nutritional support, including protein supplements, which are commonly used to aid recovery and enhance endurance. Furthermore, the increasing influence of fitness influencers and athletes on social media platforms has raised awareness about the benefits of protein supplementation, making it a staple among both amateur and professional fitness enthusiasts.

Innovation in Product Formulations and Delivery Formats

Continuous innovation in product formulations and delivery formats has significantly fueled market growth in France. Manufacturers are increasingly investing in research and development to create diverse, convenient, and appealing products that cater to evolving consumer preferences. The introduction of ready-to-drink protein shakes, protein-enriched snacks, and plant-based supplements has widened the consumer base. These innovations not only provide nutritional value but also offer portability and ease of consumption, aligning with the on-the-go lifestyles of modern consumers. Additionally, the clean-label trend has prompted brands to develop supplements free from artificial additives, allergens, and synthetic ingredients. The availability of protein products in a variety of flavors and formats has improved consumer experience, thereby driving repeat purchases and brand loyalty. This ongoing product diversification plays a pivotal role in expanding market reach across different age groups and dietary needs.

Growth of E-commerce and Digital Marketing Channels

The rapid expansion of e-commerce platforms and digital marketing strategies has greatly enhanced the visibility and accessibility of protein-based sports supplements in France. Online retail channels offer consumers a wide range of product options, competitive pricing, and doorstep delivery, making it convenient to purchase supplements regularly. In addition, the use of digital marketing tools such as influencer collaborations, targeted social media campaigns, and educational content has effectively communicated the benefits of protein supplementation to a broader audience. These strategies have been particularly successful in engaging younger, tech-savvy consumers who rely on online sources for product recommendations and health information. As more consumers shift toward online shopping for health and wellness products, the digital space continues to emerge as a crucial driver for the protein supplements market, supporting brand growth and consumer engagement across the country.

Market Trends

Rising Demand for Personalized and Goal-Oriented Nutrition

A significant trend shaping the France protein-based sports supplements market is the increasing consumer demand for personalized and goal-oriented nutrition. Modern consumers are no longer satisfied with generic, one-size-fits-all products. For instance, brands like MyProtein and Protéines France are offering online quizzes and personalized plans to help consumers select supplements tailored to their fitness goals, such as muscle building or post-workout recovery. This shift has driven manufacturers to invest in product customization, offering formulations that cater to specific objectives such as muscle building, endurance, weight management, or post-workout recovery. Brands are now providing online quizzes, personalized plans, and smart packaging that allows users to track intake and outcomes. This level of personalization is not only improving customer satisfaction but also fostering brand loyalty, as consumers perceive these products as more aligned with their unique lifestyle and fitness aspirations.

Surging Popularity of Plant-Based and Clean-Label Proteins

French consumers are increasingly shifting towards plant-based and clean-label protein supplements, motivated by health consciousness, ethical considerations, and environmental sustainability. Traditional animal-based proteins like whey and casein, although still popular, are facing competition from plant-derived proteins such as pea, hemp, rice, and soy. These alternatives are viewed as healthier and more digestible, particularly among vegans, vegetarians, and individuals with lactose intolerance. Clean-label trends are also influencing product development, with consumers preferring products free from artificial additives, GMOs, preservatives, and allergens. As a result, companies are reformulating their offerings to align with transparency and ingredient integrity. The combination of plant-based appeal and clean-label assurance is expanding the consumer base and elevating brand trust across the French market.

Scientific Backing and Ingredient Innovation Drive Consumer Trust

With increasing health literacy, French consumers are placing a greater emphasis on the scientific credibility of the sports supplements they consume. For instance, products supported by clinical trials and certifications from regulatory authorities like the French National Agency for Food Safety (ANSES) are gaining favor. This has pushed companies to invest in R&D, focusing on ingredient innovation and evidence-backed formulations. Proteins enriched with amino acids, probiotics, creatine, and adaptogens are now being incorporated to boost functional benefits. The rise of “nutraceuticals” supplements that offer both nutritional and therapeutic advantages reflects this trend. Brands that communicate their scientific backing clearly through packaging and marketing are more likely to gain consumer trust and differentiate themselves in a saturated market.

Functional Convenience and On-the-Go Formats Gain Traction

Another key trend is the growing preference for functional convenience. Today’s busy consumers in France are opting for protein supplements in convenient, portable formats that can be easily incorporated into their daily routines. Ready-to-drink protein beverages, protein bars, meal replacement shakes, and snackable protein bites are witnessing increased adoption. These formats offer not only high nutritional value but also time-saving benefits for people with active or hectic lifestyles. Additionally, the fusion of sports nutrition with functional foods — such as protein-fortified cereals, yogurts, and desserts — is expanding the appeal of supplements to a more mainstream audience. This convenience-driven consumption pattern is expected to remain a strong growth catalyst in the years ahead.

Market Challenges Analysis

Regulatory Constraints and Product Authenticity Concerns

One of the primary challenges in the France protein-based sports supplements market lies in navigating complex regulatory frameworks governing the labeling, safety, and health claims of nutritional products. French and European Union regulations impose stringent standards on dietary supplements, requiring clear substantiation of health benefits and transparent ingredient disclosures. For instance, the European Food Safety Authority (EFSA) mandates rigorous evaluations of health claims, while French regulations under Decree No. 2006-352 implement additional requirements for product registration and labeling. These compliance requirements can delay product launches, increase operational costs, and hinder innovation, particularly for smaller manufacturers with limited resources. Moreover, concerns over product authenticity and adulteration have heightened consumer skepticism. Instances of contamination, mislabeling, or inclusion of banned substances have raised red flags among regulatory bodies and end-users alike. As a result, consumers are becoming more cautious, demanding greater transparency, third-party testing, and clean-label certifications. These challenges necessitate consistent investment in quality assurance and legal compliance to maintain consumer trust and market credibility.

High Cost and Intense Market Competition

The high cost of protein-based sports supplements remains a significant barrier to widespread adoption, especially among price-sensitive consumers. Premium protein sources such as whey isolates, casein, and plant-based alternatives require expensive extraction and processing methods, leading to higher retail prices. For many casual fitness enthusiasts or those with modest incomes, these products may be perceived as non-essential or unaffordable, limiting their reach to a niche segment. Additionally, the France market is increasingly crowded with both domestic and international players offering similar product portfolios. This saturation intensifies competition, compelling brands to constantly differentiate through pricing strategies, innovation, or promotional campaigns. New entrants often struggle to establish market presence against well-known brands with established customer bases and distribution networks. Therefore, balancing product affordability while maintaining quality and distinctiveness is a continuous challenge for manufacturers operating in this evolving market landscape.

Market Opportunities

The France protein-based sports supplements market presents substantial opportunities for growth, driven by a rising health consciousness and the expanding fitness culture among various age groups. As consumers increasingly prioritize physical well-being and active lifestyles, demand for high-quality protein supplements continues to rise across a broader demographic beyond just athletes and bodybuilders. This shift includes older adults seeking to maintain muscle mass, busy professionals aiming for convenient nutritional support, and individuals pursuing weight management goals. The evolving consumer base offers companies the chance to diversify their product offerings and create targeted marketing strategies that resonate with niche audiences. Moreover, the incorporation of protein supplements into everyday diets is becoming more normalized, opening avenues for innovation in the form of functional foods and beverages, which combine convenience with health benefits.

Additionally, the growing preference for plant-based and sustainable nutrition presents a compelling opportunity for manufacturers to introduce environmentally friendly and ethically sourced protein products. French consumers are increasingly mindful of ingredient transparency, ecological impact, and clean-label standards, prompting a surge in demand for organic, non-GMO, and allergen-free supplements. Brands that can deliver protein products aligned with these values stand to gain significant competitive advantages. Furthermore, advancements in digital technologies enable personalized nutrition solutions and subscription-based models, enhancing customer engagement and retention. Companies that leverage data-driven insights to offer customized supplement plans or AI-based fitness recommendations are likely to capture a larger market share. Strategic partnerships with gyms, health influencers, and digital wellness platforms can also amplify brand visibility and trust. Altogether, the France protein-based sports supplements market offers fertile ground for innovation, sustainability, and personalized health solutions that align with evolving consumer preferences.

Market Segmentation Analysis:

By Type:

The France protein-based sports supplements market is segmented by type into protein powders, protein bars, ready-to-drink (RTD) protein beverages, protein capsules/tablets, and others. Among these, protein powders continue to dominate due to their high concentration, ease of use, and adaptability to various fitness goals. They appeal broadly to athletes, gym-goers, and individuals seeking muscle gain or recovery. However, RTD protein beverages and protein bars are rapidly gaining popularity as they offer convenience and portability, catering to busy lifestyles and on-the-go consumption habits. These products also attract a more general wellness-conscious audience, especially as snack alternatives. Protein capsules and tablets remain a niche category but are appreciated by consumers looking for precise dosages without the need for mixing or preparation. The “others” category, including protein-enriched snacks and desserts, is also expanding as companies explore innovative ways to integrate protein into everyday diets. This diversification of product types reflects growing consumer interest in functional, flexible, and time-saving nutritional solutions.

By Source:

In terms of protein source, the market includes whey protein, casein protein, soy protein, egg protein, and others. Whey protein holds the largest share due to its high biological value, rapid absorption rate, and strong clinical backing for muscle synthesis and recovery. Casein protein follows as a preferred choice for sustained-release protein, often used before bedtime or during extended fasting periods. Meanwhile, soy protein is witnessing rising demand, driven by the growing vegan and lactose-intolerant consumer segments. Egg protein, valued for its complete amino acid profile, maintains a niche presence, particularly among consumers seeking non-dairy animal protein. The “others” segment includes newer sources such as pea, hemp, rice, and mixed plant-based proteins, which are increasingly embraced for their environmental benefits and clean-label appeal. The shift toward alternative protein sources signals a broader trend toward ethical consumption and sustainability. This evolution in consumer preferences creates opportunities for brands to diversify their sourcing strategies and cater to health- and environmentally-conscious demographics.

Segments:

Based on Type:

- Protein Powder

- Protein Bars

- Ready-to-Drink Protein Beverages

- Protein Capsules/Tablets

- Others

Based on Source:

- Whey Protein

- Casein Protein

- Soy Protein

- Egg Protein

- Others

Based on End- User:

- Athletes

- Bodybuilders

- Recreational Users

- Elderly Population

- Others

Based on Distribution Channel:

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies

- Others

Based on the Geography:

- Northern France

- Southern France

- Eastern France

- Western France

Regional Analysis

Northern France

Northern France holds the largest share of the France protein-based sports supplements market, accounting for approximately 34% in 2024. This dominance is primarily attributed to the region’s high concentration of urban centers, such as Paris and Lille, where fitness culture and health awareness are strongly embedded in the lifestyle. The growing number of gyms, fitness clubs, and wellness centers in this region supports the robust demand for protein supplements. Moreover, Northern France has a dense network of retail and e-commerce platforms, enabling easy access to a wide variety of sports nutrition products. Consumers in this region show a preference for premium, personalized, and plant-based options, reflecting higher disposable incomes and advanced health consciousness. Additionally, the presence of local and international supplement brands in the Paris metropolitan area enhances product availability and marketing visibility, further strengthening regional demand.

Southern France

Southern France contributes approximately 27% of the market share and is rapidly emerging as a growth-centric region for protein-based sports supplements. Cities such as Marseille, Nice, and Toulouse are witnessing a cultural shift toward fitness and well-being, driven by younger demographics and increasing participation in outdoor sports. The region’s Mediterranean lifestyle, which emphasizes nutrition and physical activity, aligns well with the use of protein supplements for energy, recovery, and muscle maintenance. Southern France also benefits from a growing number of health food stores and fitness-oriented retailers, especially in urban and coastal areas. Consumer preferences here lean toward natural, organic, and plant-derived proteins, creating opportunities for clean-label and vegan brands. Seasonal tourism and an influx of health-conscious visitors further support local sales, especially for ready-to-drink protein beverages and convenient formats that suit active lifestyles.

Eastern France

Eastern France holds a 20% share of the national protein-based sports supplements market, with demand concentrated in cities like Strasbourg, Metz, and Dijon. The region is characterized by a balanced mix of urban and rural populations, where awareness of fitness and nutrition is steadily growing. While Eastern France has historically been more conservative in adopting sports supplements, this perception is changing as younger consumers and athletes increasingly integrate protein products into their dietary routines. The region also benefits from proximity to Germany and Switzerland, where cross-border influence encourages the adoption of international trends in sports nutrition. Educational institutions and sports universities in this region further promote the use of evidence-based supplements, driving interest in whey and casein protein. However, growth remains moderate compared to other regions, indicating untapped potential for both domestic and international brands willing to invest in targeted outreach and education.

Western France

Western France accounts for approximately 19% of the protein-based sports supplements market, with key cities including Nantes, Rennes, and Bordeaux contributing to regional demand. The market in this region is driven by a growing interest in holistic wellness, fitness tourism, and a focus on preventive health. Consumers are showing a heightened interest in functional foods and beverages, often incorporating protein supplements as part of balanced diets rather than for intense athletic performance. The agricultural heritage of this region also fosters awareness around natural and organic sourcing, encouraging brands to promote eco-friendly packaging and sustainable protein ingredients. While the market is relatively smaller compared to the north, Western France offers a loyal consumer base that values quality and transparency. Local businesses and gyms often partner with supplement brands for community-based promotions and product sampling, enhancing brand visibility and consumer trust in this expanding regional segment.

Key Player Analysis

- Volac International Ltd.

- FrieslandCampina (Vifit Sport)

- Bulk Powders

- Arla Foods Ingredients Group P/S

- Nutrend D.S., A.S.

- Multipower (Atlantic Grupa)

- Olimp Laboratories

- Scitec Nutrition

- Reflex Nutrition

Competitive Analysis

The France protein-based sports supplements market is characterized by intense competition, driven by the presence of both international giants and specialized regional brands. Leading players such as Volac International Ltd., FrieslandCampina (Vifit Sport), Bulk Powders, Arla Foods Ingredients Group P/S, Nutrend D.S., A.S., Multipower (Atlantic Grupa), Olimp Laboratories, Scitec Nutrition, and Reflex Nutrition are shaping the market through innovation, quality, and customer-centric strategies. These companies are investing heavily in R&D to develop new product formulations that cater to evolving consumer preferences, such as plant-based proteins, low-sugar variants, and functional blends for muscle recovery and weight management. Brand differentiation plays a crucial role, with companies focusing on clean-label ingredients, sustainable sourcing, and packaging innovations to stand out in a saturated market. Strategic partnerships with fitness influencers, gyms, and e-commerce platforms further help expand visibility and consumer trust. As digital health and personalized nutrition gain traction, these players are also leveraging data analytics and subscription models to enhance customer engagement and loyalty.

Recent Developments

- In March 2025, Quest Nutrition introduced Quest Protein Milkshakes, ready-to-drink beverages with a category-leading 45 grams of protein per bottle. Available in chocolate, vanilla, and strawberry flavors, these shakes cater to high-protein diets with minimal sugar and carbs.

- In December 2024, Dymatize launched Performance Protein Shakes and Energyze Pre-Workout Powder. The ready-to-drink shakes contain 30 grams of high-quality proteins along with BCAAs for muscle recovery and growth.

- In November 2024, Myprotein expanded operations in India by manufacturing locally to meet growing demand. The brand introduced localized flavors such as Kesar Badam and Nimbu Pani and launched Clear Whey Isolate as a refreshing alternative to traditional protein shakes.

- In January 2024, Abbott launched Protality, a high-protein weight-loss shake designed for individuals on weight-loss medications. Each serving contains 30 grams of protein and is tailored to preserve muscle mass while supporting weight loss.

Market Concentration & Characteristics

The France protein-based sports supplements market exhibits a moderate to high level of market concentration, with a few key players holding a significant share due to their strong brand presence, broad product portfolios, and well-established distribution networks. Companies such as Volac International Ltd., Arla Foods Ingredients Group P/S, and FrieslandCampina (Vifit Sport) have cemented their positions through consistent innovation, quality assurance, and customer-focused marketing. The market is characterized by a blend of global and regional brands competing on factors such as product differentiation, pricing strategies, and sustainability practices. Consumer demand is increasingly leaning towards clean-label, plant-based, and functional supplements, prompting players to invest in research and development. Additionally, the rise of online retail and personalized nutrition has encouraged companies to adopt direct-to-consumer models. Despite growing competition, brand loyalty and regulatory compliance remain key barriers to entry, making the market attractive yet challenging for new entrants seeking rapid scale-up.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for protein-based sports supplements in France is expected to grow steadily due to rising health consciousness.

- Consumers are increasingly seeking clean-label and natural protein supplements.

- E-commerce channels will play a significant role in supplement distribution and accessibility.

- Plant-based protein supplements are anticipated to gain popularity among vegan and lactose-intolerant consumers.

- Innovation in flavor and formulation will continue to influence consumer preferences.

- Endorsements by fitness influencers and athletes will drive market growth and brand visibility.

- The expanding fitness and gym culture will contribute to higher supplement consumption.

- Regulatory support for safe and approved ingredients will encourage product development.

- Premium and personalized protein products will witness increased adoption.

- Collaborations between sports nutrition brands and fitness centers will enhance market penetration.