Market Overview

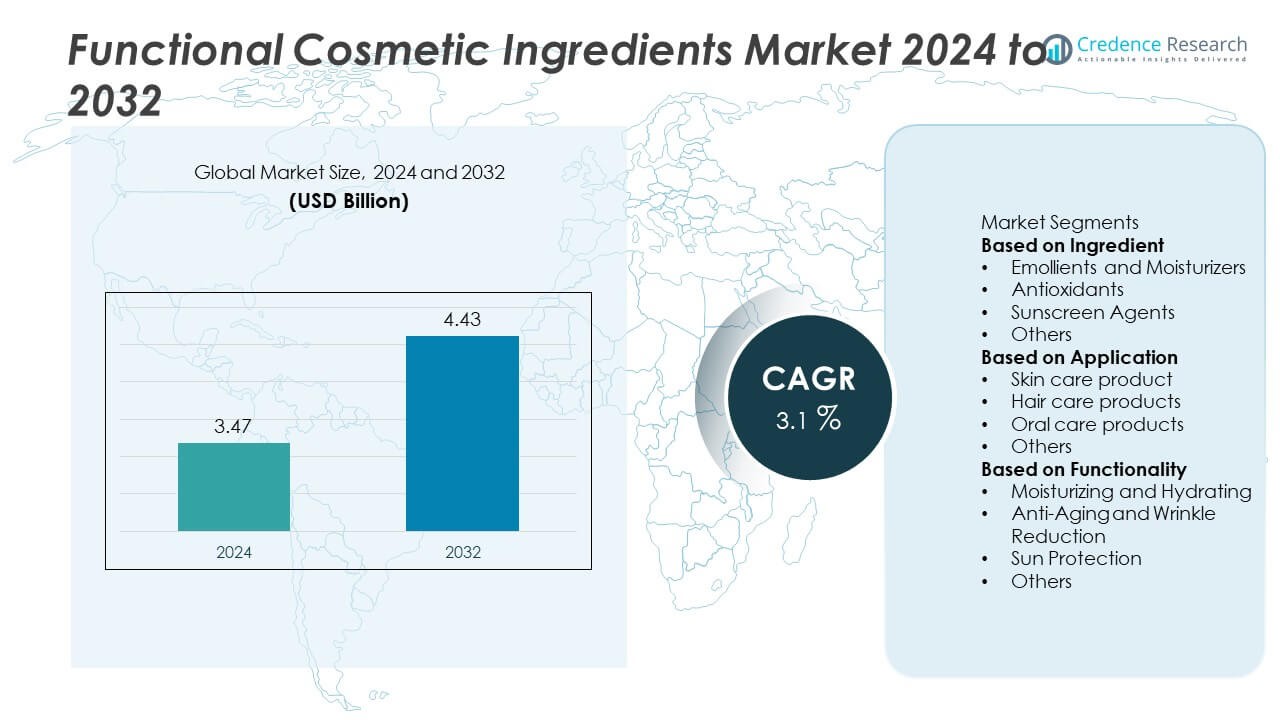

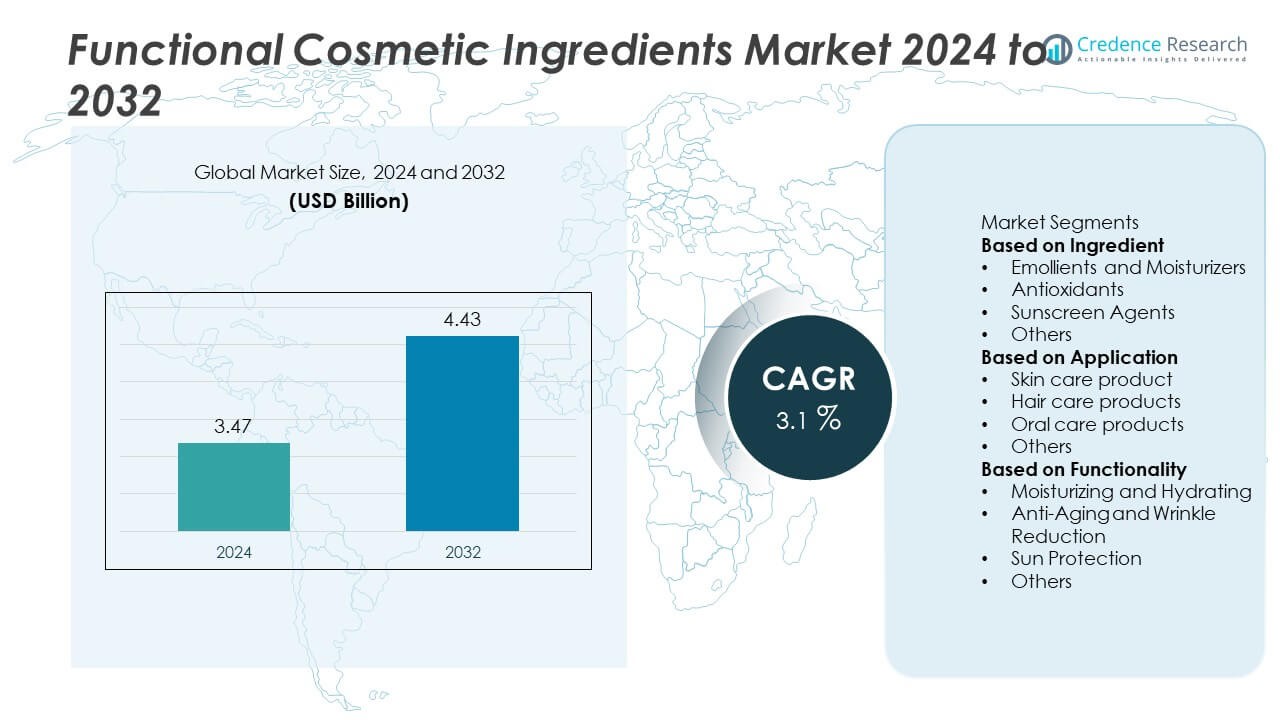

The Functional Cosmetic Ingredients Market was valued at USD 3.47 billion in 2024 and is projected to reach USD 4.43 billion by 2032, growing at a CAGR of 3.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Functional Cosmetic Ingredients Market Size 2024 |

USD 3.47 Billion |

| Functional Cosmetic Ingredients Market, CAGR |

3.1% |

| Functional Cosmetic Ingredients Market Size 2032 |

USD 4.43 Billion |

The top players in the functional cosmetic ingredients market include Clariant International Ltd., DSM Nutritional Products AG, Solvay SA, BASF SE, Lonza Group Ltd., Croda International Plc, Evonik Industries AG, Dow Inc., Givaudan SA, and Ashland Global Holdings Inc. These companies strengthen their positions through innovation in bio-based emollients, multifunctional antioxidants, and advanced ingredient delivery systems. Regionally, North America led with a 33% share in 2024, driven by high demand for premium skincare and anti-aging products, while Europe accounted for 29% share, supported by strong regulatory standards and sustainability-driven formulations. Asia-Pacific held 28% share, fueled by rising disposable incomes, cultural emphasis on skincare, and growing adoption of multifunctional cosmetics. Latin America and the Middle East & Africa followed with 6% and 4% shares, respectively, reflecting emerging but steadily growing adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Functional Cosmetic Ingredients market was valued at USD 3.47 billion in 2024 and is projected to reach USD 4.43 billion by 2032, growing at a CAGR of 3.1% during the forecast period.

- Growth is driven by rising demand for anti-aging, moisturizing, and sun protection ingredients, with emollients and moisturizers leading the ingredient segment at 41% share in 2024 due to their widespread use in skincare and hair care.

- Market trends highlight a strong shift toward bio-based, sustainable, and multifunctional ingredients, with consumers increasingly favoring natural antioxidants, hybrid formulations, and advanced delivery systems that enhance efficacy.

- The competitive landscape includes players such as Clariant International Ltd., DSM Nutritional Products AG, Solvay SA, BASF SE, Lonza Group Ltd., Croda International Plc, Evonik Industries AG, Dow Inc., Givaudan SA, and Ashland Global Holdings Inc., focusing on innovation, sustainability, and global expansion.

- Regionally, North America held 33% share, followed by Europe at 29% and Asia-Pacific at 28%, while Latin America and the Middle East & Africa accounted for 6% and 4% shares, respectively.

Market Segmentation Analysis:

By Ingredient

Emollients and moisturizers dominated the functional cosmetic ingredients market in 2024, accounting for a 41% share. Their leadership stems from widespread use in skin care, hair care, and personal care formulations, where they provide hydration, smooth texture, and barrier protection. Rising consumer demand for natural and bio-based emollients such as plant oils and butters further drives this segment. Antioxidants and sunscreen agents follow, fueled by growing awareness of anti-aging and UV protection. Emollients and moisturizers remain the leading ingredient type due to their versatile applications across daily-use cosmetic products.

- For instance, BASF is a major global producer of personal care ingredients, including emollients from its Cetiol® line. These Cetiol® esters are used in numerous cosmetic product formulations, where they contribute to hydration and skin barrier reinforcement.

By Application

The skin care product segment led the functional cosmetic ingredients market in 2024 with a 46% share. Demand is driven by growing consumer focus on anti-aging, moisturizing, and sun protection benefits in creams, serums, and lotions. Rising awareness of preventive skin care, coupled with innovations in clean-label and multifunctional formulations, further supports dominance of this segment. Hair care and oral care products also contribute significantly, supported by demand for scalp hydration, anti-dandruff solutions, and whitening toothpaste. However, skin care continues to lead due to its role in addressing diverse consumer concerns and global beauty trends.

- For instance, dsm-firmenich supplies UV filters under its Parsol® brand, which are incorporated into sunscreens and moisturizers worldwide to provide SPF protection in skin care applications.

By Functionality

Moisturizing and hydrating functionality held the largest share in 2024 at 39%, driven by strong demand across skin care and hair care products. Consumers increasingly seek products that combat dryness, enhance skin elasticity, and improve overall appearance, supporting steady growth of this category. Anti-aging and wrinkle reduction followed closely, supported by rising demand from aging populations and younger consumers adopting preventive care routines. Sun protection also showed strong adoption, fueled by awareness of UV-related skin damage. Moisturizing and hydrating functions remain dominant, as they serve as essential features in most personal care formulations.

Key Growth Drivers

Rising Demand for Anti-Aging Solutions

The growing preference for anti-aging cosmetics strongly drives the functional cosmetic ingredients market. Consumers across both mature and emerging markets increasingly seek products with wrinkle reduction, skin-firming, and collagen-boosting properties. Ingredients such as peptides, retinoids, and antioxidants are in high demand to address concerns linked to aging and environmental exposure. The rising aging population worldwide, combined with younger demographics adopting preventive skincare routines, continues to expand the market. This trend ensures strong long-term demand for high-performance functional ingredients in anti-aging and rejuvenation-focused formulations.

- For instance, Givaudan’s bioactive peptide PrimalHyal™ Ultrafiller has demonstrated rapid anti-aging effects, with a 9% reduction in crow’s feet wrinkle length in 1 hour and a 26.5% reduction in deep crow’s feet wrinkles number in 6 hours.

Increasing Popularity of Natural and Bio-Based Ingredients

Consumers are shifting toward natural and sustainable cosmetic ingredients, fueling growth in the functional cosmetic ingredients market. Plant-based emollients, botanical extracts, and naturally derived antioxidants are increasingly replacing synthetic alternatives. This demand is reinforced by clean-label trends and regulatory encouragement for eco-friendly solutions. Brands are investing in R&D to develop safe, effective, and biodegradable alternatives that meet consumer expectations. With heightened focus on transparency and sustainability, natural functional cosmetic ingredients are expected to drive future product launches and market expansion.

- For instance, BASF’s Verdessence® portfolio includes biopolymers such as Verdessence Tara, produced from renewable tara gum seeds to serve sustainable skin and hair care formulations worldwide.

Expansion of Skin Care and Personal Grooming Trends

Skin care remains the largest application segment, supported by rising awareness of self-care and daily grooming practices. Increasing demand for multifunctional products that provide hydration, sun protection, and anti-aging benefits drives higher ingredient usage. Social media influence and beauty standards further accelerate consumer spending on skin care products. Rapid urbanization, growing disposable incomes, and the popularity of premium beauty brands also contribute. As consumers continue to prioritize wellness and personal care, functional cosmetic ingredients integrated into skincare solutions experience consistent growth.

Key Trends & Opportunities

Shift Toward Multifunctional and Hybrid Formulations

The market is witnessing a strong shift toward multifunctional cosmetic formulations that combine hydration, anti-aging, and sun protection benefits in a single product. Functional cosmetic ingredients like hyaluronic acid, niacinamide, and SPF agents are widely integrated to meet consumer demand for convenience and efficiency. This trend opens opportunities for brands to innovate hybrid products that address multiple skin concerns while offering value for money.

- For instance, Croda International supplies its Crodarom® botanical actives, which are used in hybrid skin-care products that offer benefits such as moisturizing, antioxidant, and UV-protective functions.

Technological Advancements in Ingredient Delivery Systems

Advanced delivery technologies such as encapsulation, nanotechnology, and sustained-release systems are creating opportunities in the functional cosmetic ingredients market. These innovations improve ingredient stability, absorption, and targeted delivery, ensuring better efficacy. Cosmetic companies are increasingly investing in these technologies to differentiate products and enhance consumer satisfaction. This technological progress supports the development of next-generation cosmetics that combine performance, safety, and long-lasting benefits.

- For instance, Evonik Industries offers a range of peptide and lipid-based delivery systems for cosmetics and pharmaceuticals, with technologies designed to improve stability, solubility, and targeted delivery.

Key Challenges

Stringent Regulatory Frameworks

Strict regulations on cosmetic ingredients present a major challenge for manufacturers. Compliance with safety standards in regions such as the EU, US, and Asia requires extensive testing and certifications. Delays in approvals, reformulation requirements, and restrictions on certain chemicals increase operational costs. This challenge often slows product launches and impacts market growth, especially for smaller players with limited resources.

High Costs of Premium Ingredients

The rising demand for advanced, natural, and bioactive ingredients comes with higher production and sourcing costs. Premium functional ingredients like peptides, botanical extracts, and nano-encapsulated actives are expensive, creating pricing pressures for cosmetic brands. Smaller companies in cost-sensitive markets may struggle to balance affordability with performance. This limits accessibility for price-conscious consumers, restraining wider adoption in certain regions.

Regional Analysis

North America

North America held a 33% share of the functional cosmetic ingredients market in 2024, driven by strong consumer demand for premium skin care and personal grooming products. The United States leads the region, with high adoption of anti-aging, moisturizing, and sun protection formulations supported by a large aging population and advanced R&D capabilities. Regulatory oversight from the FDA ensures quality and safety, further strengthening consumer trust. Canada also contributes steadily, supported by growing interest in natural and organic cosmetic solutions. The region’s established beauty brands and innovation-driven industry sustain its leadership position globally.

Europe

Europe accounted for a 29% share of the functional cosmetic ingredients market in 2024, supported by strict EU regulations and rising demand for clean-label and sustainable formulations. Countries such as Germany, France, and the UK are major contributors, with strong adoption of natural emollients, antioxidants, and sun protection ingredients. Growth is reinforced by the popularity of luxury and dermatologically tested products, coupled with high consumer awareness of skin health. The region is also a hub for innovation, as brands invest in eco-friendly and multifunctional formulations. Europe remains a mature but highly competitive market with strong sustainability focus.

Asia-Pacific

Asia-Pacific captured a 28% share of the functional cosmetic ingredients market in 2024, making it one of the fastest-growing regions. Expanding middle-class populations in China, India, and Southeast Asia are fueling demand for affordable yet effective skin and hair care products. South Korea and Japan continue to lead in innovation, driving global trends with multifunctional and advanced formulations. Increasing disposable incomes, rising awareness of personal grooming, and strong cultural emphasis on skincare further drive growth. With urbanization and a young consumer base seeking preventive care, Asia-Pacific is expected to be a critical driver of market expansion.

Latin America

Latin America held a 6% share of the functional cosmetic ingredients market in 2024, led by Brazil and Mexico. Demand is fueled by rising interest in personal care and grooming, particularly among younger consumers. Growing urbanization and expanding middle-class populations support the adoption of skin care and hair care products containing moisturizing and anti-aging ingredients. However, economic instability and price sensitivity in some markets limit premium product penetration. Despite these challenges, regional manufacturers are increasingly adopting bio-based and affordable functional ingredients to meet consumer demand, driving gradual but consistent growth across Latin America.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share of the functional cosmetic ingredients market in 2024, supported by increasing demand for premium and luxury beauty products in the UAE and Saudi Arabia. Rising awareness of skincare benefits, combined with growing adoption of sun protection products due to climatic conditions, drives ingredient consumption. South Africa also contributes, with expanding use of moisturizers and hair care products. However, reliance on imports and high product costs remain barriers in some areas. With growing urban populations and rising disposable incomes, the region offers long-term growth opportunities for global players.

Market Segmentations:

By Ingredient

- Emollients and Moisturizers

- Antioxidants

- Sunscreen Agents

- Others

By Application

- Skin care product

- Hair care products

- Oral care products

- Others

By Functionality

- Moisturizing and Hydrating

- Anti-Aging and Wrinkle Reduction

- Sun Protection

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the functional cosmetic ingredients market is shaped by leading companies such as Clariant International Ltd., DSM Nutritional Products AG, Solvay SA, BASF SE, Lonza Group Ltd., Croda International Plc, Evonik Industries AG, Dow Inc., Givaudan SA, and Ashland Global Holdings Inc. These players focus on innovation, sustainability, and product diversification to strengthen their global presence. Continuous investment in R&D enables the development of advanced ingredients, including bio-based emollients, multifunctional antioxidants, and novel delivery systems. Companies are increasingly aligning with clean-label and eco-friendly trends, ensuring compliance with evolving regulatory standards in Europe and North America while expanding into high-growth regions such as Asia-Pacific. Strategic collaborations, acquisitions, and partnerships remain central to enhancing market share and global distribution capabilities. With growing demand for multifunctional and natural solutions, competition is intensifying, driving innovation across anti-aging, sun protection, and hydrating ingredient categories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, BASF SE also announced advances in microbiome and retinol delivery systems, exploring the role of Corynebacteria in collagen modulation.

- In May 2025, Clariant International Ltd. launched its new “Clariant Beauty” portfolio, unveiling sustainable ingredient solutions like GlowCytocin™, Melicica™, Aristoflex™ SUN and Nipaguard™ SCE Vita.

- In April 2025, Croda International Plc presented their KeraBio™ K31 at In-Cosmetics Global—a biomimetic ingredient aimed at strengthening hair bonds at molecular level.

- In April 2025, BASF SE introduced Verdessence® Maize to South America, a fully renewable biopolymer for hair care applications with performance on par to synthetic polymers.

Report Coverage

The research report offers an in-depth analysis based on Ingredient, Application, Functionality and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for anti-aging and wrinkle-reduction ingredients will continue to drive market growth.

- Natural and bio-based cosmetic ingredients will gain stronger adoption with clean-label trends.

- Emollients and moisturizers will remain the leading ingredient category across skincare and haircare.

- Multifunctional products combining hydration, sun protection, and anti-aging will see higher demand.

- Asia-Pacific will emerge as the fastest-growing region due to rising disposable incomes and beauty awareness.

- North America and Europe will sustain leadership supported by strict regulatory standards and premium product demand.

- Companies will invest in advanced ingredient delivery systems to improve efficacy and absorption.

- Partnerships and acquisitions will strengthen global distribution networks and innovation pipelines.

- Rising popularity of male grooming and personal care will expand market opportunities.

- Sustainability initiatives will push manufacturers toward eco-friendly, biodegradable, and safe ingredient solutions.