Table of Content

Chapter No. 1 :………. Introduction.. 37

1.1….. Report Description. 37

Purpose of the Report 37

USP & Key Offerings. 37

1.1.1.. Key Benefits for Stakeholders. 38

1.1.2.. Target Audience. 38

1.2….. Report Scope. 39

1.3….. Regional Scope. 40

Chapter No. 2 :………. Executive Summary. 41

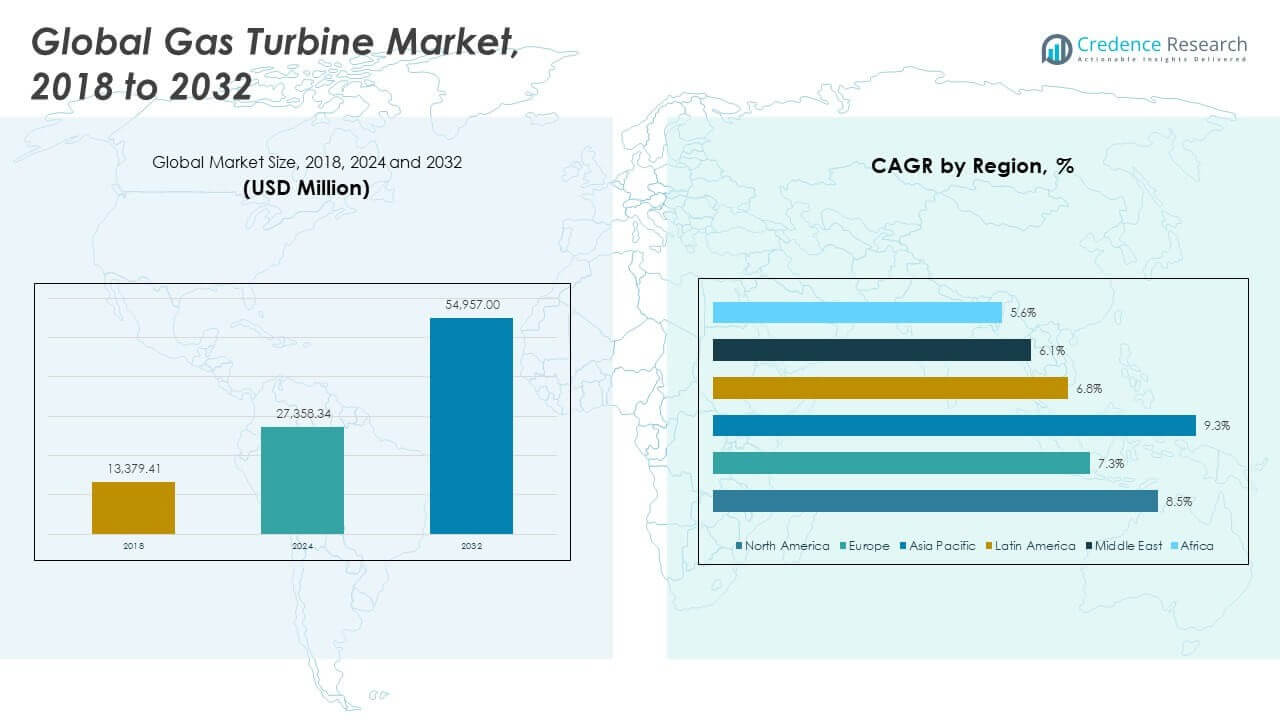

2.1….. Gas Turbine Market Snapshot 41

2.1.1.. Global Gas Turbine Market, Volume and Revenue, 2020 – 2033 (Units) (USD Million) 43

2.2….. Insights from Primary Respondents. 44

Chapter No. 3 :………. Gas Turbine Market – Industry Analysis. 45

3.1….. Introduction. 45

3.2….. Market Drivers. 46

3.2.1.. Shift to natural gas for cleaner power generation. 47

3.2.2.. Rising electricity demand from urbanization. 48

3.3….. Market Restraints. 49

3.3.1.. High capital costs for installation. 50

3.4….. Market Opportunities. 51

3.4.1.. Market Opportunity Analysis. 51

3.5….. Porter’s Five Forces Analysis. 52

3.6….. Value Chain Analysis. 53

3.7….. Buying Criteria. 54

Chapter No. 4 :………. Analysis Competitive Landscape. 55

4.1….. Company Market Share Analysis – 2024. 55

4.1.1.. Global Gas Turbine Market: Company Market Share, by Volume, 2024. 55

4.1.2.. Global Gas Turbine Market: Company Market Share, by Revenue, 2024. 56

4.1.3.. Global Gas Turbine Market: Top 6 Company Market Share, by Revenue, 2024. 57

4.1.4.. Global Gas Turbine Market: Top 3 Company Market Share, by Revenue, 2024. 58

4.2….. Global Gas Turbine Market Company Volume Market Share, 2024. 59

4.3….. Global Gas Turbine Market Company Revenue Market Share, 2024. 61

4.4….. Company Assessment Metrics, 2024. 63

4.4.1.. Stars. 63

4.4.2.. Emerging Leaders. 63

4.4.3.. Pervasive Players. 63

4.4.4.. Participants. 63

4.5….. Start-ups /SMEs Assessment Metrics, 2024. 64

4.5.1.. Progressive Companies. 64

4.5.2.. Responsive Companies. 64

4.5.3.. Dynamic Companies. 64

4.5.4.. Starting Blocks. 64

4.6….. Strategic Developments. 65

4.6.1.. Acquisitions & Mergers. 65

4.6.2.. New Product Launch. 65

4.6.3.. Regional Expansion. 66

4.7….. Key Players Product Matrix. 67

Chapter No. 5 :………. PESTEL & Adjacent Market Analysis. 69

5.1….. PESTEL. 69

5.1.1.. Political Factors. 69

5.1.2.. Economic Factors. 69

5.1.3.. Social Factors. 69

5.1.4.. Technological Factors. 69

5.1.5.. Environmental Factors. 69

5.1.6.. Legal Factors. 69

5.2….. Adjacent Market Analysis. 69

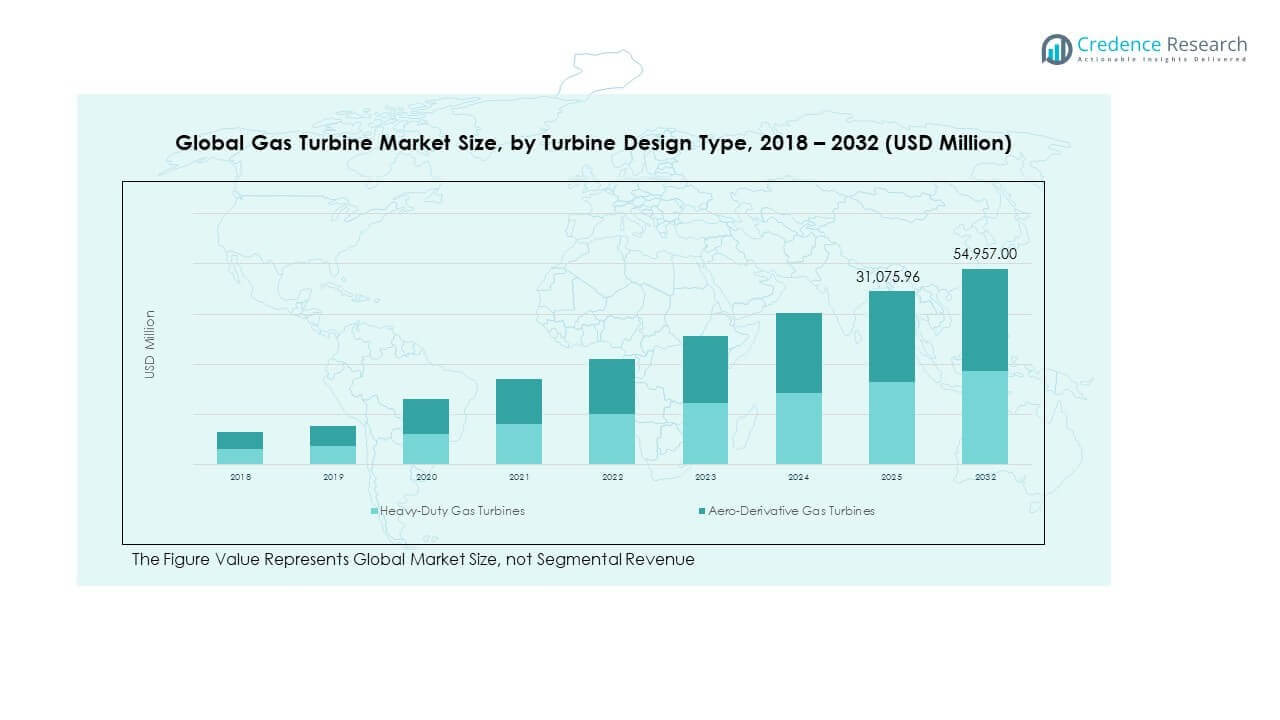

Chapter No. 6 :………. Gas Turbine Market – By Turbine Design Type Segment Analysis. 70

6.1….. Gas Turbine Market Overview, by Turbine Design Type Segment 70

6.1.1.. Gas Turbine Market Volume Share, By Turbine Design Type, 2024 & 2033. 71

6.1.2.. Gas Turbine Market Revenue Share, By Turbine Design Type, 2024 & 2033. 72

6.1.3.. Gas Turbine Market Attractiveness Analysis, By Turbine Design Type. 73

6.1.4.. Incremental Revenue Growth Opportunity, by Turbine Design Type, 2026 – 2033. 74

6.1.5.. Gas Turbine Market Revenue, By Turbine Design Type, 2020, 2024, 2029 & 2033. 75

6.2….. Heavy-Duty Gas Turbines. 76

6.3….. Aero-Derivative Gas Turbines. 77

Chapter No. 7 :………. Gas Turbine Market – By Application (Energy & Power Only) Segment Analysis. 78

7.1….. Gas Turbine Market Overview, by Application (Energy & Power Only) Segment 78

7.1.1.. Gas Turbine Market Volume Share, By Application (Energy & Power Only), 2024 & 2033. 79

7.1.2.. Gas Turbine Market Revenue Share, By Application (Energy & Power Only), 2024 & 2033. 80

7.1.3.. Gas Turbine Market Attractiveness Analysis, By Application (Energy & Power Only) 81

7.1.4.. Incremental Revenue Growth Opportunity, by Application (Energy & Power Only), 2026 – 2033. 82

7.1.5.. Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020, 2024, 2029 & 2033. 83

7.2….. Power Generation. 84

7.3….. Industrial Power & Captive Generation. 85

7.4….. Oil & Gas (Non-propulsion) 86

Chapter No. 8 :………. Gas Turbine Market – By End-user Segment Analysis. 87

8.1….. Gas Turbine Market Overview, by End-user Segment 87

8.1.1.. Gas Turbine Market Volume Share, By End-user, 2024 & 2033. 88

8.1.2.. Gas Turbine Market Revenue Share, By End-user, 2024 & 2033. 89

8.1.3.. Gas Turbine Market Attractiveness Analysis, By End-user 90

8.1.4.. Incremental Revenue Growth Opportunity, by End-user, 2026 – 2033. 91

8.1.5.. Gas Turbine Market Revenue, By End-user, 2020, 2024, 2029 & 2033. 92

8.2….. Utility Companies. 93

8.3….. Independent Power Producers (IPPs) 94

8.4….. Oil & Gas Companies. 95

8.5….. Industrial & Commercial Users. 96

Chapter No. 9 :………. Gas Turbine Market – By Technology Segment Analysis. 97

9.1….. Gas Turbine Market Overview, by Technology Segment 97

9.1.1.. Gas Turbine Market Volume Share, By Technology, 2024 & 2033. 98

9.1.2.. Gas Turbine Market Revenue Share, By Technology, 2024 & 2033. 99

9.1.3.. Gas Turbine Market Attractiveness Analysis, By Technology. 100

9.1.4.. Incremental Revenue Growth Opportunity, by Technology, 2026 – 2033. 101

9.1.5.. Gas Turbine Market Revenue, By Technology, 2020, 2024, 2029 & 2033. 102

9.2….. Simple Cycle. 103

9.3….. Combined Cycle. 104

9.4….. Cogeneration (CHP) 105

Chapter No. 10 :…….. Gas Turbine Market – By Capacity Range Segment Analysis. 106

10.1… Gas Turbine Market Overview, by Capacity Range Segment 106

10.1.1. Gas Turbine Market Volume Share, By Capacity Range, 2024 & 2033. 107

10.1.2. Gas Turbine Market Revenue Share, By Capacity Range, 2024 & 2033. 108

10.1.3. Gas Turbine Market Attractiveness Analysis, By Capacity Range. 109

10.1.4. Incremental Revenue Growth Opportunity, by Capacity Range, 2026 – 2033. 110

10.1.5. Gas Turbine Market Revenue, By Capacity Range, 2020, 2024, 2029 & 2033. 111

10.2… Below 50 MW.. 112

10.3… 50–200 MW.. 113

10.4… Above 200 MW.. 114

Chapter No. 11 :…….. Gas Turbine Market – By Fuel Type Segment Analysis. 115

11.1… Gas Turbine Market Overview, by Fuel Type Segment 115

11.1.1. Gas Turbine Market Volume Share, By Fuel Type, 2024 & 2033. 116

11.1.2. Gas Turbine Market Revenue Share, By Fuel Type, 2024 & 2033. 117

11.1.3. Gas Turbine Market Attractiveness Analysis, By Fuel Type. 118

11.1.4. Incremental Revenue Growth Opportunity, by Fuel Type, 2026 – 2033. 119

11.1.5. Gas Turbine Market Revenue, By Fuel Type, 2020, 2024, 2029 & 2033. 120

11.2… Natural Gas. 121

11.3… Hydrogen-Blended Gas. 122

11.4… Synthetic & Low-Carbon Fuels. 123

11.5… Dual-Fuel 124

Chapter No. 12 :…….. Gas Turbine Market – By Component Segment Analysis. 125

12.1… Gas Turbine Market Overview, by Component Segment 125

12.1.1. Gas Turbine Market Volume Share, By Component, 2024 & 2033. 126

12.1.2. Gas Turbine Market Revenue Share, By Component, 2024 & 2033. 127

12.1.3. Gas Turbine Market Attractiveness Analysis, By Component 128

12.1.4. Incremental Revenue Growth Opportunity, by Component, 2026 – 2033. 129

12.1.5. Gas Turbine Market Revenue, By Component, 2020, 2024, 2029 & 2033. 130

12.2… Combustion Systems. 131

12.3… Turbine Blades & Rotors. 132

12.4… Compressors. 133

12.5… Generators. 134

12.6… Control & Monitoring Systems. 135

12.7… Heat Recovery Steam Generators (HRSGs) 136

Chapter No. 13 :…….. Gas Turbine Market – Regional Analysis. 137

13.1… Gas Turbine Market Overview, by Regional Segments. 137

13.2… Region. 138

13.2.1. Global Gas Turbine Market Revenue Share, By Region, 2024 & 2033. 138

13.2.2. Gas Turbine Market Attractiveness Analysis, By Region. 139

13.2.3. Incremental Revenue Growth Opportunity, by Region, 2025 – 2033. 140

13.2.4. Gas Turbine Market Revenue, By Region, 2020, 2024, 2029 & 2033. 141

Chapter No. 14 :…….. Gas Turbine Market – North America. 142

14.1… North America. 142

14.1.1. Key Highlights. 143

14.1.2. North America Gas Turbine Market Volume, By Country, 2020 – 2025 (Units) 144

14.1.3. North America Gas Turbine Market Revenue, By Country, 2020 – 2025 (USD Million) 145

14.1.4. North America Gas Turbine Market Volume, By Turbine Design Type, 2020 – 2025 (Units) 146

14.1.5. North America Gas Turbine Market Revenue, By Turbine Design Type, 2020 – 2025 (USD Million) 148

14.1.6. North America Gas Turbine Market Volume, By Application (Energy & Power Only), 2020 – 2025 (Units) 150

14.1.7. North America Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020 – 2025 (USD Million) 152

14.1.8. North America Gas Turbine Market Volume, By End-user, 2020 – 2025 (Units) 154

14.1.9. North America Gas Turbine Market Revenue, By End-user, 2020 – 2025 (USD Million) 156

14.1.10….. North America Gas Turbine Market Volume, By Technology, 2020 – 2025 (Units) 158

14.1.11. North America Gas Turbine Market Revenue, By Technology, 2020 – 2025 (USD Million) 159

14.1.12. North America Gas Turbine Market Volume, By Capacity Range, 2020 – 2025 (Units) 160

14.1.13. North America Gas Turbine Market Revenue, By Capacity Range, 2020 – 2025 (USD Million) 161

14.1.14……… North America Gas Turbine Market Volume, By Fuel Type, 2020 – 2025 (Units) 162

14.1.15. North America Gas Turbine Market Revenue, By Fuel Type, 2020 – 2025 (USD Million) 163

14.1.16….. North America Gas Turbine Market Volume, By Component, 2020 – 2025 (Units) 164

14.1.17. North America Gas Turbine Market Revenue, By Component, 2020 – 2025 (USD Million) 166

14.2… U.S. 167

14.3… Canada. 167

14.4… Mexico. 167

Chapter No. 15 :…….. Gas Turbine Market – Europe. 168

15.1… Europe. 168

15.1.1. Key Highlights. 169

15.1.2. Europe Gas Turbine Market Volume, By Country, 2020 – 2025 (Units) 170

15.1.3. Europe Gas Turbine Market Revenue, By Country, 2020 – 2025 (USD Million) 172

15.1.4. Europe Gas Turbine Market Volume, By Turbine Design Type, 2020 – 2025 (Units) 174

15.1.5. Europe Gas Turbine Market Revenue, By Turbine Design Type, 2020 – 2025 (USD Million) 176

15.1.6. Europe Gas Turbine Market Volume, By Application (Energy & Power Only), 2020 – 2025 (Units) 178

15.1.7. Europe Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020 – 2025 (USD Million) 180

15.1.8. Europe Gas Turbine Market Volume, By End-user, 2020 – 2025 (Units) 182

15.1.9. Europe Gas Turbine Market Revenue, By End-user, 2020 – 2025 (USD Million) 184

15.1.10…………….. Europe Gas Turbine Market Volume, By Technology, 2020 – 2025 (Units) 186

15.1.11….. Europe Gas Turbine Market Revenue, By Technology, 2020 – 2025 (USD Million) 187

15.1.12……….. Europe Gas Turbine Market Volume, By Capacity Range, 2020 – 2025 (Units) 188

15.1.13. Europe Gas Turbine Market Revenue, By Capacity Range, 2020 – 2025 (USD Million) 189

15.1.14……………….. Europe Gas Turbine Market Volume, By Fuel Type, 2020 – 2025 (Units) 190

15.1.15……… Europe Gas Turbine Market Revenue, By Fuel Type, 2020 – 2025 (USD Million) 191

15.1.16……………. Europe Gas Turbine Market Volume, By Component, 2020 – 2025 (Units) 192

15.1.17….. Europe Gas Turbine Market Revenue, By Component, 2020 – 2025 (USD Million) 194

15.2… UK. 196

15.3… France. 196

15.4… Germany. 196

15.5… Italy. 196

15.6… Spain. 196

15.7… Russia. 196

15.8… Belgium.. 196

15.9… Netherland. 196

15.10. Austria. 196

15.11. Sweden. 196

15.12. Poland. 196

15.13. Denmark. 196

15.14. Switzerland. 196

15.15. Rest of Europe. 196

Chapter No. 16 :…….. Gas Turbine Market – Asia Pacific. 197

16.1… Asia Pacific. 197

16.1.1. Key Highlights. 198

16.1.2. Asia Pacific Gas Turbine Market Volume, By Country, 2020 – 2025 (Units) 199

16.1.3. Asia Pacific Gas Turbine Market Revenue, By Country, 2020 – 2025 (USD Million) 201

16.1.4. Asia Pacific Gas Turbine Market Volume, By Turbine Design Type, 2020 – 2025 (Units) 203

16.1.5. Asia Pacific Gas Turbine Market Revenue, By Turbine Design Type, 2020 – 2025 (USD Million) 205

16.1.6. Asia Pacific Gas Turbine Market Volume, By Application (Energy & Power Only), 2020 – 2025 (Units) 207

16.1.7. Asia Pacific Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020 – 2025 (USD Million) 209

16.1.8. Asia Pacific Gas Turbine Market Volume, By End-user, 2020 – 2025 (Units) 211

16.1.9. Asia Pacific Gas Turbine Market Revenue, By End-user, 2020 – 2025 (USD Million) 213

16.1.10……….. Asia Pacific Gas Turbine Market Volume, By Technology, 2020 – 2025 (Units) 215

16.1.11. Asia Pacific Gas Turbine Market Revenue, By Technology, 2020 – 2025 (USD Million) 216

16.1.12….. Asia Pacific Gas Turbine Market Volume, By Capacity Range, 2020 – 2025 (Units) 217

16.1.13. Asia Pacific Gas Turbine Market Revenue, By Capacity Range, 2020 – 2025 (USD Million) 218

16.1.14………….. Asia Pacific Gas Turbine Market Volume, By Fuel Type, 2020 – 2025 (Units) 219

16.1.15… Asia Pacific Gas Turbine Market Revenue, By Fuel Type, 2020 – 2025 (USD Million) 220

16.1.16………. Asia Pacific Gas Turbine Market Volume, By Component, 2020 – 2025 (Units) 221

16.1.17. Asia Pacific Gas Turbine Market Revenue, By Component, 2020 – 2025 (USD Million) 223

16.2… China. 225

16.3… Japan. 225

16.4… South Korea. 225

16.5… India. 225

16.6… Australia. 225

16.7… Thailand. 225

16.8… Indonesia. 225

16.9… Vietnam.. 225

16.10. Malaysia. 225

16.11. Philippines. 225

16.12. Taiwan. 225

16.13. Rest of Asia Pacific. 225

Chapter No. 17 :…….. Gas Turbine Market – Latin America. 226

17.1… Latin America. 226

17.1.1. Key Highlights. 227

17.1.2. Latin America Gas Turbine Market Volume, By Country, 2020 – 2025 (Units) 228

17.1.3. Latin America Gas Turbine Market Revenue, By Country, 2020 – 2025 (USD Million) 230

17.1.4. Latin America Gas Turbine Market Volume, By Turbine Design Type, 2020 – 2025 (Units) 232

17.1.5. Latin America Gas Turbine Market Revenue, By Turbine Design Type, 2020 – 2025 (USD Million) 234

17.1.6. Latin America Gas Turbine Market Volume, By Application (Energy & Power Only), 2020 – 2025 (Units) 236

17.1.7. Latin America Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020 – 2025 (USD Million) 238

17.1.8. Latin America Gas Turbine Market Volume, By End-user, 2020 – 2025 (Units) 240

17.1.9. Latin America Gas Turbine Market Revenue, By End-user, 2020 – 2025 (USD Million) 242

17.1.10……. Latin America Gas Turbine Market Volume, By Technology, 2020 – 2025 (Units) 244

17.1.11. Latin America Gas Turbine Market Revenue, By Technology, 2020 – 2025 (USD Million) 245

17.1.12. Latin America Gas Turbine Market Volume, By Capacity Range, 2020 – 2025 (Units) 246

17.1.13. Latin America Gas Turbine Market Revenue, By Capacity Range, 2020 – 2025 (USD Million) 247

17.1.14………. Latin America Gas Turbine Market Volume, By Fuel Type, 2020 – 2025 (Units) 248

17.1.15. Latin America Gas Turbine Market Revenue, By Fuel Type, 2020 – 2025 (USD Million) 249

17.1.16…… Latin America Gas Turbine Market Volume, By Component, 2020 – 2025 (Units) 250

17.1.17. Latin America Gas Turbine Market Revenue, By Component, 2020 – 2025 (USD Million) 252

17.2… Brazil 254

17.3… Argentina. 254

17.4… Peru. 254

17.5… Chile. 254

17.6… Colombia. 254

17.7… Rest of Latin America. 254

Chapter No. 18 :…….. Gas Turbine Market – Middle East. 255

18.1… Middle East 255

18.1.1. Key Highlights. 256

18.1.2. Middle East Gas Turbine Market Volume, By Country, 2020 – 2025 (Units) 257

18.1.3. Middle East Gas Turbine Market Revenue, By Country, 2020 – 2025 (USD Million) 259

18.1.4. Middle East Gas Turbine Market Volume, By Turbine Design Type, 2020 – 2025 (Units) 261

18.1.5. Middle East Gas Turbine Market Revenue, By Turbine Design Type, 2020 – 2025 (USD Million) 263

18.1.6. Middle East Gas Turbine Market Volume, By Application (Energy & Power Only), 2020 – 2025 (Units) 265

18.1.7. Middle East Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020 – 2025 (USD Million) 267

18.1.8. Middle East Gas Turbine Market Volume, By End-user, 2020 – 2025 (Units) 269

18.1.9. Middle East Gas Turbine Market Revenue, By End-user, 2020 – 2025 (USD Million) 271

18.1.10………. Middle East Gas Turbine Market Volume, By Technology, 2020 – 2025 (Units) 273

18.1.11. Middle East Gas Turbine Market Revenue, By Technology, 2020 – 2025 (USD Million) 274

18.1.12…. Middle East Gas Turbine Market Volume, By Capacity Range, 2020 – 2025 (Units) 275

18.1.13. Middle East Gas Turbine Market Revenue, By Capacity Range, 2020 – 2025 (USD Million) 276

18.1.14…………. Middle East Gas Turbine Market Volume, By Fuel Type, 2020 – 2025 (Units) 277

18.1.15.. Middle East Gas Turbine Market Revenue, By Fuel Type, 2020 – 2025 (USD Million) 278

18.1.16……… Middle East Gas Turbine Market Volume, By Component, 2020 – 2025 (Units) 279

18.1.17. Middle East Gas Turbine Market Revenue, By Component, 2020 – 2025 (USD Million) 281

18.2… UAE. 283

18.3… KSA. 283

18.4… Israel 283

18.5… Turkey. 283

18.6… Iran. 283

18.7… Rest of Middle East 283

Chapter No. 19 :…….. Gas Turbine Market – Africa. 284

19.1… Africa. 284

19.1.1. Key Highlights. 285

19.1.2. Africa Gas Turbine Market Volume, By Country, 2020 – 2025 (Units) 286

19.1.3. Africa Gas Turbine Market Revenue, By Country, 2020 – 2025 (USD Million) 288

19.1.4. Africa Gas Turbine Market Volume, By Turbine Design Type, 2020 – 2025 (Units) 290

19.1.5. Africa Gas Turbine Market Revenue, By Turbine Design Type, 2020 – 2025 (USD Million) 292

19.1.6. Africa Gas Turbine Market Volume, By Application (Energy & Power Only), 2020 – 2025 (Units) 294

19.1.7. Africa Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020 – 2025 (USD Million) 296

19.1.8. Africa Gas Turbine Market Volume, By End-user, 2020 – 2025 (Units) 298

19.1.9. Africa Gas Turbine Market Revenue, By End-user, 2020 – 2025 (USD Million) 300

19.1.10………………. Africa Gas Turbine Market Volume, By Technology, 2020 – 2025 (Units) 302

19.1.11……. Africa Gas Turbine Market Revenue, By Technology, 2020 – 2025 (USD Million) 303

19.1.12…………. Africa Gas Turbine Market Volume, By Capacity Range, 2020 – 2025 (Units) 304

19.1.13.. Africa Gas Turbine Market Revenue, By Capacity Range, 2020 – 2025 (USD Million) 305

19.1.14…………………. Africa Gas Turbine Market Volume, By Fuel Type, 2020 – 2025 (Units) 306

19.1.15……….. Africa Gas Turbine Market Revenue, By Fuel Type, 2020 – 2025 (USD Million) 307

19.1.16……………… Africa Gas Turbine Market Volume, By Component, 2020 – 2025 (Units) 308

19.1.17……. Africa Gas Turbine Market Revenue, By Component, 2020 – 2025 (USD Million) 310

19.2… South Africa. 312

19.3… Egypt 312

19.4… Nigeria. 312

19.5… Algeria. 312

19.6… Morocco. 312

19.7… Rest of Africa. 312

Chapter No. 20 :…….. Company Profiles. 313

20.1… General Electric (GE) 313

20.1.1. Company Overview.. 313

20.1.2. Product Portfolio. 313

20.1.3. Financial Overview.. 314

20.2… Siemens Energy. 315

20.3… Mitsubishi Power 315

20.4… Ansaldo Energia. 315

20.5… Everllence (MAN Energy Solutions) 315

20.6… Company 6. 315

20.7… Company 7. 315

20.8… Company 8. 315

20.9… Company 9. 315

20.10. Company 10. 315

20.11. Company 11. 315

20.12. Company 12. 315

20.13. Company 13. 315

20.14. Company 14. 315

List of Figures

FIG NO. 1………. Global Gas Turbine Market Volume & Revenue, 2020 – 2033 (USD Million) 43

FIG NO. 2………. Porter’s Five Forces Analysis for Global Gas Turbine Market. 52

FIG NO. 3………. Value Chain Analysis for Global Gas Turbine Market. 53

FIG NO. 4………. Company Market Share Analysis, by Volume, 2024. 55

FIG NO. 5………. Company Market Share Analysis, by Revenue, 2024. 56

FIG NO. 6………. Company Share Analysis, 2024. 57

FIG NO. 7………. Company Share Analysis, 2024. 58

FIG NO. 8………. Gas Turbine Market – Company Volume Market Share, 2024. 59

FIG NO. 9………. Gas Turbine Market – Company Revenue Market Share, 2024. 61

FIG NO. 10…….. Company Assessment Metrics, 2024. 63

FIG NO. 11…….. Gas Turbine Market Volume Share, By Turbine Design Type, 2024 & 2033. 71

FIG NO. 12…….. Gas Turbine Market Revenue Share, By Turbine Design Type, 2024 & 2033. 72

FIG NO. 13…….. Market Attractiveness Analysis, By Turbine Design Type. 73

FIG NO. 14…….. Incremental Revenue Growth Opportunity by Turbine Design Type, 2026 – 2033. 74

FIG NO. 15…….. Gas Turbine Market Revenue, By Turbine Design Type, 2020, 2024, 2029 & 2033. 75

FIG NO. 16…….. Global Gas Turbine Market for Heavy-Duty Gas Turbines, Volume & Revenue (Units) (USD Million) 2020 – 2033. 76

FIG NO. 17…….. Global Gas Turbine Market for Aero-Derivative Gas Turbines, Volume & Revenue (Units) (USD Million) 2020 – 2033. 77

FIG NO. 18…….. Gas Turbine Market Volume Share, By Application (Energy & Power Only), 2024 & 2033. 79

FIG NO. 19…….. Gas Turbine Market Revenue Share, By Application (Energy & Power Only), 2024 & 2033. 80

FIG NO. 20…….. Market Attractiveness Analysis, By Application (Energy & Power Only) 81

FIG NO. 21…….. Incremental Revenue Growth Opportunity by Application (Energy & Power Only), 2026 – 2033. 82

FIG NO. 22…….. Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020, 2024, 2029 & 2033. 83

FIG NO. 23…….. Global Gas Turbine Market for Power Generation, Volume & Revenue (Units) (USD Million) 2020 – 2033. 84

FIG NO. 24…….. Global Gas Turbine Market for Industrial Power & Captive Generation, Volume & Revenue (Units) (USD Million) 2020 – 2033. 85

FIG NO. 25…….. Global Gas Turbine Market for Oil & Gas (Non-propulsion), Volume & Revenue (Units) (USD Million) 2020 – 2033. 86

FIG NO. 26…….. Gas Turbine Market Volume Share, By End-user, 2024 & 2033. 88

FIG NO. 27…….. Gas Turbine Market Revenue Share, By End-user, 2024 & 2033. 89

FIG NO. 28…….. Market Attractiveness Analysis, By End-user. 90

FIG NO. 29…….. Incremental Revenue Growth Opportunity by End-user, 2026 – 2033. 91

FIG NO. 30…….. Gas Turbine Market Revenue, By End-user, 2020, 2024, 2029 & 2033. 92

FIG NO. 31…….. Global Gas Turbine Market for Utility Companies, Volume & Revenue (Units) (USD Million) 2020 – 2033. 93

FIG NO. 32…….. Global Gas Turbine Market for Independent Power Producers (IPPs), Volume & Revenue (Units) (USD Million) 2020 – 2033. 94

FIG NO. 33…….. Global Gas Turbine Market for Oil & Gas Companies, Volume & Revenue (Units) (USD Million) 2020 – 2033. 95

FIG NO. 34…….. Global Gas Turbine Market for Industrial & Commercial Users, Volume & Revenue (Units) (USD Million) 2020 – 2033. 96

FIG NO. 35…….. Gas Turbine Market Volume Share, By Technology, 2024 & 2033. 98

FIG NO. 36…….. Gas Turbine Market Revenue Share, By Technology, 2024 & 2033. 99

FIG NO. 37…….. Market Attractiveness Analysis, By Technology. 100

FIG NO. 38…….. Incremental Revenue Growth Opportunity by Technology, 2026 – 2033. 101

FIG NO. 39…….. Gas Turbine Market Revenue, By Technology, 2020, 2024, 2029 & 2033. 102

FIG NO. 40…….. Global Gas Turbine Market for Simple Cycle, Volume & Revenue (Units) (USD Million) 2020 – 2033. 103

FIG NO. 41…….. Global Gas Turbine Market for Combined Cycle, Volume & Revenue (Units) (USD Million) 2020 – 2033. 104

FIG NO. 42…….. Global Gas Turbine Market for Cogeneration (CHP), Volume & Revenue (Units) (USD Million) 2020 – 2033. 105

FIG NO. 43…….. Gas Turbine Market Volume Share, By Capacity Range, 2024 & 2033. 107

FIG NO. 44…….. Gas Turbine Market Revenue Share, By Capacity Range, 2024 & 2033. 108

FIG NO. 45…….. Market Attractiveness Analysis, By Capacity Range. 109

FIG NO. 46…….. Incremental Revenue Growth Opportunity by Capacity Range, 2026 – 2033. 110

FIG NO. 47…….. Gas Turbine Market Revenue, By Capacity Range, 2020, 2024, 2029 & 2033. 111

FIG NO. 48…….. Global Gas Turbine Market for Below 50 MW, Volume & Revenue (Units) (USD Million) 2020 – 2033. 112

FIG NO. 49…….. Global Gas Turbine Market for 50–200 MW, Volume & Revenue (Units) (USD Million) 2020 – 2033. 113

FIG NO. 50…….. Global Gas Turbine Market for Above 200 MW, Volume & Revenue (Units) (USD Million) 2020 – 2033. 114

FIG NO. 51…….. Gas Turbine Market Volume Share, By Fuel Type, 2024 & 2033. 116

FIG NO. 52…….. Gas Turbine Market Revenue Share, By Fuel Type, 2024 & 2033. 117

FIG NO. 53…….. Market Attractiveness Analysis, By Fuel Type. 118

FIG NO. 54…….. Incremental Revenue Growth Opportunity by Fuel Type, 2026 – 2033. 119

FIG NO. 55…….. Gas Turbine Market Revenue, By Fuel Type, 2020, 2024, 2029 & 2033. 120

FIG NO. 56…….. Global Gas Turbine Market for Natural Gas, Volume & Revenue (Units) (USD Million) 2020 – 2033. 121

FIG NO. 57…….. Global Gas Turbine Market for Hydrogen-Blended Gas, Volume & Revenue (Units) (USD Million) 2020 – 2033. 122

FIG NO. 58…….. Global Gas Turbine Market for Synthetic & Low-Carbon Fuels, Volume & Revenue (Units) (USD Million) 2020 – 2033. 123

FIG NO. 59…….. Global Gas Turbine Market for Dual-Fuel, Volume & Revenue (Units) (USD Million) 2020 – 2033. 124

FIG NO. 60…….. Gas Turbine Market Volume Share, By Component, 2024 & 2033. 126

FIG NO. 61…….. Gas Turbine Market Revenue Share, By Component, 2024 & 2033. 127

FIG NO. 62…….. Market Attractiveness Analysis, By Component. 128

FIG NO. 63…….. Incremental Revenue Growth Opportunity by Component, 2026 – 2033. 129

FIG NO. 64…….. Gas Turbine Market Revenue, By Component, 2020, 2024, 2029 & 2033. 130

FIG NO. 65…….. Global Gas Turbine Market for Combustion Systems, Volume & Revenue (Units) (USD Million) 2020 – 2033. 131

FIG NO. 66…….. Global Gas Turbine Market for Turbine Blades & Rotors, Volume & Revenue (Units) (USD Million) 2020 – 2033. 132

FIG NO. 67…….. Global Gas Turbine Market for Compressors, Volume & Revenue (Units) (USD Million) 2020 – 2033. 133

FIG NO. 68…….. Global Gas Turbine Market for Generators, Volume & Revenue (Units) (USD Million) 2020 – 2033. 134

FIG NO. 69…….. Global Gas Turbine Market for Control & Monitoring Systems, Volume & Revenue (Units) (USD Million) 2020 – 2033. 135

FIG NO. 70…….. Global Gas Turbine Market for Heat Recovery Steam Generators (HRSGs), Volume & Revenue (Units) (USD Million) 2020 – 2033. 136

FIG NO. 71…….. Global Gas Turbine Market Revenue Share, By Region, 2024 & 2033. 138

FIG NO. 72…….. Market Attractiveness Analysis, By Region. 139

FIG NO. 73…….. Incremental Revenue Growth Opportunity by Region, 2025 – 2033. 140

FIG NO. 74…….. Gas Turbine Market Revenue, By Region, 2020, 2024, 2029 & 2033. 141

FIG NO. 75…….. North America Gas Turbine Market Volume & Revenue, 2020 – 2033 (Units) (USD Million) 142

FIG NO. 76…….. Europe Gas Turbine Market Volume & Revenue, 2020 – 2033 (Units) (USD Million) 168

FIG NO. 77…….. Asia Pacific Gas Turbine Market Volume & Revenue, 2020 – 2033 (Units) (USD Million) 197

FIG NO. 78…….. Latin America Gas Turbine Market Volume & Revenue, 2020 – 2033 (Units) (USD Million) 226

FIG NO. 79…….. Middle East Gas Turbine Market Volume & Revenue, 2020 – 2033 (Units) (USD Million) 255

FIG NO. 80…….. Africa Gas Turbine Market Volume & Revenue, 2020 – 2033 (Units) (USD Million) 284

List of Tables

TABLE NO. 1. :… Global Gas Turbine Market: Snapshot. 41

TABLE NO. 2. :… Drivers for the Gas Turbine Market: Impact Analysis. 46

TABLE NO. 3. :… Restraints for the Gas Turbine Market: Impact Analysis. 49

TABLE NO. 4. :… North America Gas Turbine Market Volume, By Country, 2020 – 2025 (Units) 144

TABLE NO. 5. :… North America Gas Turbine Market Volume, By Country, 2026 – 2033 (Units) 144

TABLE NO. 6. :… North America Gas Turbine Market Revenue, By Country, 2020 – 2025 (USD Million) 145

TABLE NO. 7. :… North America Gas Turbine Market Revenue, By Country, 2026 – 2033 (USD Million) 145

TABLE NO. 8. :… North America Gas Turbine Market Volume, By Turbine Design Type, 2020 – 2025 (Units) 146

TABLE NO. 9. :… North America Gas Turbine Market Volume, By Turbine Design Type, 2026 – 2033 (Units) 147

TABLE NO. 10. :.. North America Gas Turbine Market Revenue, By Turbine Design Type, 2020 – 2025 (USD Million) 148

TABLE NO. 11. :.. North America Gas Turbine Market Revenue, By Turbine Design Type, 2026 – 2033 (USD Million) 149

TABLE NO. 12. :.. North America Gas Turbine Market Volume, By Application (Energy & Power Only), 2020 – 2025 (Units) 150

TABLE NO. 13. :.. North America Gas Turbine Market Volume, By Application (Energy & Power Only), 2026 – 2033 (Units) 151

TABLE NO. 14. :.. North America Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020 – 2025 (USD Million) 152

TABLE NO. 15. :.. North America Gas Turbine Market Revenue, By Application (Energy & Power Only), 2026 – 2033 (USD Million) 153

TABLE NO. 16. :.. North America Gas Turbine Market Volume, By End-user, 2020 – 2025 (Units) 154

TABLE NO. 17. :.. North America Gas Turbine Market Volume, By End-user, 2026 – 2033 (Units) 155

TABLE NO. 18. :.. North America Gas Turbine Market Revenue, By End-user, 2020 – 2025 (USD Million) 156

TABLE NO. 19. :.. North America Gas Turbine Market Revenue, By End-user, 2026 – 2033 (USD Million) 157

TABLE NO. 20. :.. North America Gas Turbine Market Volume, By Technology, 2020 – 2025 (Units) 158

TABLE NO. 21. :.. North America Gas Turbine Market Volume, By Technology, 2026 – 2033 (Units) 158

TABLE NO. 22. :.. North America Gas Turbine Market Revenue, By Technology, 2020 – 2025 (USD Million) 159

TABLE NO. 23. :.. North America Gas Turbine Market Revenue, By Technology, 2026 – 2033 (USD Million) 159

TABLE NO. 24. :.. North America Gas Turbine Market Volume, By Capacity Range, 2020 – 2025 (Units) 160

TABLE NO. 25. :.. North America Gas Turbine Market Volume, By Capacity Range, 2026 – 2033 (Units) 160

TABLE NO. 26. :.. North America Gas Turbine Market Revenue, By Capacity Range, 2020 – 2025 (USD Million) 161

TABLE NO. 27. :.. North America Gas Turbine Market Revenue, By Capacity Range, 2026 – 2033 (USD Million) 161

TABLE NO. 28. :.. North America Gas Turbine Market Volume, By Fuel Type, 2020 – 2025 (Units) 162

TABLE NO. 29. :.. North America Gas Turbine Market Volume, By Fuel Type, 2026 – 2033 (Units) 162

TABLE NO. 30. :.. North America Gas Turbine Market Revenue, By Fuel Type, 2020 – 2025 (USD Million) 163

TABLE NO. 31. :.. North America Gas Turbine Market Revenue, By Fuel Type, 2026 – 2033 (USD Million) 163

TABLE NO. 32. :.. North America Gas Turbine Market Volume, By Component, 2020 – 2025 (Units) 164

TABLE NO. 33. :.. North America Gas Turbine Market Volume, By Component, 2026 – 2033 (Units) 165

TABLE NO. 34. :.. North America Gas Turbine Market Revenue, By Component, 2020 – 2025 (USD Million) 166

TABLE NO. 35. :.. North America Gas Turbine Market Revenue, By Component, 2026 – 2033 (USD Million) 167

TABLE NO. 36. :.. Europe Gas Turbine Market Volume, By Country, 2020 – 2025 (Units) 170

TABLE NO. 37. :.. Europe Gas Turbine Market Volume, By Country, 2026 – 2033 (Units) 171

TABLE NO. 38. :.. Europe Gas Turbine Market Revenue, By Country, 2020 – 2025 (USD Million) 172

TABLE NO. 39. :.. Europe Gas Turbine Market Revenue, By Country, 2026 – 2033 (USD Million) 173

TABLE NO. 40. :.. Europe Gas Turbine Market Volume, By Turbine Design Type, 2020 – 2025 (Units) 174

TABLE NO. 41. :.. Europe Gas Turbine Market Volume, By Turbine Design Type, 2026 – 2033 (Units) 174

TABLE NO. 42. :.. Europe Gas Turbine Market Revenue, By Turbine Design Type, 2020 – 2025 (USD Million) 176

TABLE NO. 43. :.. Europe Gas Turbine Market Revenue, By Turbine Design Type, 2026 – 2033 (USD Million) 176

TABLE NO. 44. :.. Europe Gas Turbine Market Volume, By Application (Energy & Power Only), 2020 – 2025 (Units) 178

TABLE NO. 45. :.. Europe Gas Turbine Market Volume, By Application (Energy & Power Only), 2026 – 2033 (Units) 178

TABLE NO. 46. :.. Europe Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020 – 2025 (USD Million) 180

TABLE NO. 47. :.. Europe Gas Turbine Market Revenue, By Application (Energy & Power Only), 2026 – 2033 (USD Million) 180

TABLE NO. 48. :.. Europe Gas Turbine Market Volume, By End-user, 2020 – 2025 (Units) 182

TABLE NO. 49. :.. Europe Gas Turbine Market Volume, By End-user, 2026 – 2033 (Units) 182

TABLE NO. 50. :.. Europe Gas Turbine Market Revenue, By End-user, 2020 – 2025 (USD Million) 184

TABLE NO. 51. :.. Europe Gas Turbine Market Revenue, By End-user, 2026 – 2033 (USD Million) 184

TABLE NO. 52. :.. Europe Gas Turbine Market Volume, By Technology, 2020 – 2025 (Units) 186

TABLE NO. 53. :.. Europe Gas Turbine Market Volume, By Technology, 2026 – 2033 (Units) 186

TABLE NO. 54. :.. Europe Gas Turbine Market Revenue, By Technology, 2020 – 2025 (USD Million) 187

TABLE NO. 55. :.. Europe Gas Turbine Market Revenue, By Technology, 2026 – 2033 (USD Million) 187

TABLE NO. 56. :.. Europe Gas Turbine Market Volume, By Capacity Range, 2020 – 2025 (Units) 188

TABLE NO. 57. :.. Europe Gas Turbine Market Volume, By Capacity Range, 2026 – 2033 (Units) 188

TABLE NO. 58. :.. Europe Gas Turbine Market Revenue, By Capacity Range, 2020 – 2025 (USD Million) 189

TABLE NO. 59. :.. Europe Gas Turbine Market Revenue, By Capacity Range, 2026 – 2033 (USD Million) 189

TABLE NO. 60. :.. Europe Gas Turbine Market Volume, By Fuel Type, 2020 – 2025 (Units) 190

TABLE NO. 61. :.. Europe Gas Turbine Market Volume, By Fuel Type, 2026 – 2033 (Units) 190

TABLE NO. 62. :.. Europe Gas Turbine Market Revenue, By Fuel Type, 2020 – 2025 (USD Million) 191

TABLE NO. 63. :.. Europe Gas Turbine Market Revenue, By Fuel Type, 2026 – 2033 (USD Million) 191

TABLE NO. 64. :.. Europe Gas Turbine Market Volume, By Component, 2020 – 2025 (Units) 192

TABLE NO. 65. :.. Europe Gas Turbine Market Volume, By Component, 2026 – 2033 (Units) 193

TABLE NO. 66. :.. Europe Gas Turbine Market Revenue, By Component, 2020 – 2025 (USD Million) 194

TABLE NO. 67. :.. Europe Gas Turbine Market Revenue, By Component, 2026 – 2033 (USD Million) 195

TABLE NO. 68. :.. Asia Pacific Gas Turbine Market Volume, By Country, 2020 – 2025 (Units) 199

TABLE NO. 69. :.. Asia Pacific Gas Turbine Market Volume, By Country, 2026 – 2033 (Units) 200

TABLE NO. 70. :.. Asia Pacific Gas Turbine Market Revenue, By Country, 2020 – 2025 (USD Million) 201

TABLE NO. 71. :.. Asia Pacific Gas Turbine Market Revenue, By Country, 2026 – 2033 (USD Million) 202

TABLE NO. 72. :.. Asia Pacific Gas Turbine Market Volume, By Turbine Design Type, 2020 – 2025 (Units) 203

TABLE NO. 73. :.. Asia Pacific Gas Turbine Market Volume, By Turbine Design Type, 2026 – 2033 (Units) 203

TABLE NO. 74. :.. Asia Pacific Gas Turbine Market Revenue, By Turbine Design Type, 2020 – 2025 (USD Million) 205

TABLE NO. 75. :.. Asia Pacific Gas Turbine Market Revenue, By Turbine Design Type, 2026 – 2033 (USD Million) 205

TABLE NO. 76. :.. Asia Pacific Gas Turbine Market Volume, By Application (Energy & Power Only), 2020 – 2025 (Units) 207

TABLE NO. 77. :.. Asia Pacific Gas Turbine Market Volume, By Application (Energy & Power Only), 2026 – 2033 (Units) 207

TABLE NO. 78. :.. Asia Pacific Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020 – 2025 (USD Million) 209

TABLE NO. 79. :.. Asia Pacific Gas Turbine Market Revenue, By Application (Energy & Power Only), 2026 – 2033 (USD Million) 209

TABLE NO. 80. :.. Asia Pacific Gas Turbine Market Volume, By End-user, 2020 – 2025 (Units) 211

TABLE NO. 81. :.. Asia Pacific Gas Turbine Market Volume, By End-user, 2026 – 2033 (Units) 211

TABLE NO. 82. :.. Asia Pacific Gas Turbine Market Revenue, By End-user, 2020 – 2025 (USD Million) 213

TABLE NO. 83. :.. Asia Pacific Gas Turbine Market Revenue, By End-user, 2026 – 2033 (USD Million) 213

TABLE NO. 84. :.. Asia Pacific Gas Turbine Market Volume, By Technology, 2020 – 2025 (Units) 215

TABLE NO. 85. :.. Asia Pacific Gas Turbine Market Volume, By Technology, 2026 – 2033 (Units) 215

TABLE NO. 86. :.. Asia Pacific Gas Turbine Market Revenue, By Technology, 2020 – 2025 (USD Million) 216

TABLE NO. 87. :.. Asia Pacific Gas Turbine Market Revenue, By Technology, 2026 – 2033 (USD Million) 216

TABLE NO. 88. :.. Asia Pacific Gas Turbine Market Volume, By Capacity Range, 2020 – 2025 (Units) 217

TABLE NO. 89. :.. Asia Pacific Gas Turbine Market Volume, By Capacity Range, 2026 – 2033 (Units) 217

TABLE NO. 90. :.. Asia Pacific Gas Turbine Market Revenue, By Capacity Range, 2020 – 2025 (USD Million) 218

TABLE NO. 91. :.. Asia Pacific Gas Turbine Market Revenue, By Capacity Range, 2026 – 2033 (USD Million) 218

TABLE NO. 92. :.. Asia Pacific Gas Turbine Market Volume, By Fuel Type, 2020 – 2025 (Units) 219

TABLE NO. 93. :.. Asia Pacific Gas Turbine Market Volume, By Fuel Type, 2026 – 2033 (Units) 219

TABLE NO. 94. :.. Asia Pacific Gas Turbine Market Revenue, By Fuel Type, 2020 – 2025 (USD Million) 220

TABLE NO. 95. :.. Asia Pacific Gas Turbine Market Revenue, By Fuel Type, 2026 – 2033 (USD Million) 220

TABLE NO. 96. :.. Asia Pacific Gas Turbine Market Volume, By Component, 2020 – 2025 (Units) 221

TABLE NO. 97. :.. Asia Pacific Gas Turbine Market Volume, By Component, 2026 – 2033 (Units) 222

TABLE NO. 98. :.. Asia Pacific Gas Turbine Market Revenue, By Component, 2020 – 2025 (USD Million) 223

TABLE NO. 99. :.. Asia Pacific Gas Turbine Market Revenue, By Component, 2026 – 2033 (USD Million) 224

TABLE NO. 100. : Latin America Gas Turbine Market Volume, By Country, 2020 – 2025 (Units) 228

TABLE NO. 101. : Latin America Gas Turbine Market Volume, By Country, 2026 – 2033 (Units) 229

TABLE NO. 102. : Latin America Gas Turbine Market Revenue, By Country, 2020 – 2025 (USD Million) 230

TABLE NO. 103. : Latin America Gas Turbine Market Revenue, By Country, 2026 – 2033 (USD Million) 231

TABLE NO. 104. : Latin America Gas Turbine Market Volume, By Turbine Design Type, 2020 – 2025 (Units) 232

TABLE NO. 105. : Latin America Gas Turbine Market Volume, By Turbine Design Type, 2026 – 2033 (Units) 232

TABLE NO. 106. : Latin America Gas Turbine Market Revenue, By Turbine Design Type, 2020 – 2025 (USD Million) 234

TABLE NO. 107. : Latin America Gas Turbine Market Revenue, By Turbine Design Type, 2026 – 2033 (USD Million) 234

TABLE NO. 108. : Latin America Gas Turbine Market Volume, By Application (Energy & Power Only), 2020 – 2025 (Units) 236

TABLE NO. 109. : Latin America Gas Turbine Market Volume, By Application (Energy & Power Only), 2026 – 2033 (Units) 236

TABLE NO. 110. : Latin America Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020 – 2025 (USD Million) 238

TABLE NO. 111. : Latin America Gas Turbine Market Revenue, By Application (Energy & Power Only), 2026 – 2033 (USD Million) 238

TABLE NO. 112. : Latin America Gas Turbine Market Volume, By End-user, 2020 – 2025 (Units) 240

TABLE NO. 113. : Latin America Gas Turbine Market Volume, By End-user, 2026 – 2033 (Units) 240

TABLE NO. 114. : Latin America Gas Turbine Market Revenue, By End-user, 2020 – 2025 (USD Million) 242

TABLE NO. 115. : Latin America Gas Turbine Market Revenue, By End-user, 2026 – 2033 (USD Million) 242

TABLE NO. 116. : Latin America Gas Turbine Market Volume, By Technology, 2020 – 2025 (Units) 244

TABLE NO. 117. : Latin America Gas Turbine Market Volume, By Technology, 2026 – 2033 (Units) 244

TABLE NO. 118. : Latin America Gas Turbine Market Revenue, By Technology, 2020 – 2025 (USD Million) 245

TABLE NO. 119. : Latin America Gas Turbine Market Revenue, By Technology, 2026 – 2033 (USD Million) 245

TABLE NO. 120. : Latin America Gas Turbine Market Volume, By Capacity Range, 2020 – 2025 (Units) 246

TABLE NO. 121. : Latin America Gas Turbine Market Volume, By Capacity Range, 2026 – 2033 (Units) 246

TABLE NO. 122. : Latin America Gas Turbine Market Revenue, By Capacity Range, 2020 – 2025 (USD Million) 247

TABLE NO. 123. : Latin America Gas Turbine Market Revenue, By Capacity Range, 2026 – 2033 (USD Million) 247

TABLE NO. 124. : Latin America Gas Turbine Market Volume, By Fuel Type, 2020 – 2025 (Units) 248

TABLE NO. 125. : Latin America Gas Turbine Market Volume, By Fuel Type, 2026 – 2033 (Units) 248

TABLE NO. 126. : Latin America Gas Turbine Market Revenue, By Fuel Type, 2020 – 2025 (USD Million) 249

TABLE NO. 127. : Latin America Gas Turbine Market Revenue, By Fuel Type, 2026 – 2033 (USD Million) 249

TABLE NO. 128. : Latin America Gas Turbine Market Volume, By Component, 2020 – 2025 (Units) 250

TABLE NO. 129. : Latin America Gas Turbine Market Volume, By Component, 2026 – 2033 (Units) 251

TABLE NO. 130. : Latin America Gas Turbine Market Revenue, By Component, 2020 – 2025 (USD Million) 252

TABLE NO. 131. : Latin America Gas Turbine Market Revenue, By Component, 2026 – 2033 (USD Million) 253

TABLE NO. 132. : Middle East Gas Turbine Market Volume, By Country, 2020 – 2025 (Units) 257

TABLE NO. 133. : Middle East Gas Turbine Market Volume, By Country, 2026 – 2033 (Units) 258

TABLE NO. 134. : Middle East Gas Turbine Market Revenue, By Country, 2020 – 2025 (USD Million) 259

TABLE NO. 135. : Middle East Gas Turbine Market Revenue, By Country, 2026 – 2033 (USD Million) 260

TABLE NO. 136. : Middle East Gas Turbine Market Volume, By Turbine Design Type, 2020 – 2025 (Units) 261

TABLE NO. 137. : Middle East Gas Turbine Market Volume, By Turbine Design Type, 2026 – 2033 (Units) 261

TABLE NO. 138. : Middle East Gas Turbine Market Revenue, By Turbine Design Type, 2020 – 2025 (USD Million) 263

TABLE NO. 139. : Middle East Gas Turbine Market Revenue, By Turbine Design Type, 2026 – 2033 (USD Million) 263

TABLE NO. 140. : Middle East Gas Turbine Market Volume, By Application (Energy & Power Only), 2020 – 2025 (Units) 265

TABLE NO. 141. : Middle East Gas Turbine Market Volume, By Application (Energy & Power Only), 2026 – 2033 (Units) 265

TABLE NO. 142. : Middle East Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020 – 2025 (USD Million) 267

TABLE NO. 143. : Middle East Gas Turbine Market Revenue, By Application (Energy & Power Only), 2026 – 2033 (USD Million) 267

TABLE NO. 144. : Middle East Gas Turbine Market Volume, By End-user, 2020 – 2025 (Units) 269

TABLE NO. 145. : Middle East Gas Turbine Market Volume, By End-user, 2026 – 2033 (Units) 269

TABLE NO. 146. : Middle East Gas Turbine Market Revenue, By End-user, 2020 – 2025 (USD Million) 271

TABLE NO. 147. : Middle East Gas Turbine Market Revenue, By End-user, 2026 – 2033 (USD Million) 271

TABLE NO. 148. : Middle East Gas Turbine Market Volume, By Technology, 2020 – 2025 (Units) 273

TABLE NO. 149. : Middle East Gas Turbine Market Volume, By Technology, 2026 – 2033 (Units) 273

TABLE NO. 150. : Middle East Gas Turbine Market Revenue, By Technology, 2020 – 2025 (USD Million) 274

TABLE NO. 151. : Middle East Gas Turbine Market Revenue, By Technology, 2026 – 2033 (USD Million) 274

TABLE NO. 152. : Middle East Gas Turbine Market Volume, By Capacity Range, 2020 – 2025 (Units) 275

TABLE NO. 153. : Middle East Gas Turbine Market Volume, By Capacity Range, 2026 – 2033 (Units) 275

TABLE NO. 154. : Middle East Gas Turbine Market Revenue, By Capacity Range, 2020 – 2025 (USD Million) 276

TABLE NO. 155. : Middle East Gas Turbine Market Revenue, By Capacity Range, 2026 – 2033 (USD Million) 276

TABLE NO. 156. : Middle East Gas Turbine Market Volume, By Fuel Type, 2020 – 2025 (Units) 277

TABLE NO. 157. : Middle East Gas Turbine Market Volume, By Fuel Type, 2026 – 2033 (Units) 277

TABLE NO. 158. : Middle East Gas Turbine Market Revenue, By Fuel Type, 2020 – 2025 (USD Million) 278

TABLE NO. 159. : Middle East Gas Turbine Market Revenue, By Fuel Type, 2026 – 2033 (USD Million) 278

TABLE NO. 160. : Middle East Gas Turbine Market Volume, By Component, 2020 – 2025 (Units) 279

TABLE NO. 161. : Middle East Gas Turbine Market Volume, By Component, 2026 – 2033 (Units) 280

TABLE NO. 162. : Middle East Gas Turbine Market Revenue, By Component, 2020 – 2025 (USD Million) 281

TABLE NO. 163. : Middle East Gas Turbine Market Revenue, By Component, 2026 – 2033 (USD Million) 282

TABLE NO. 164. : Africa Gas Turbine Market Volume, By Country, 2020 – 2025 (Units) 286

TABLE NO. 165. : Africa Gas Turbine Market Volume, By Country, 2026 – 2033 (Units) 287

TABLE NO. 166. : Africa Gas Turbine Market Revenue, By Country, 2020 – 2025 (USD Million) 288

TABLE NO. 167. : Africa Gas Turbine Market Revenue, By Country, 2026 – 2033 (USD Million) 289

TABLE NO. 168. : Africa Gas Turbine Market Volume, By Turbine Design Type, 2020 – 2025 (Units) 290

TABLE NO. 169. : Africa Gas Turbine Market Volume, By Turbine Design Type, 2026 – 2033 (Units) 290

TABLE NO. 170. : Africa Gas Turbine Market Revenue, By Turbine Design Type, 2020 – 2025 (USD Million) 292

TABLE NO. 171. : Africa Gas Turbine Market Revenue, By Turbine Design Type, 2026 – 2033 (USD Million) 292

TABLE NO. 172. : Africa Gas Turbine Market Volume, By Application (Energy & Power Only), 2020 – 2025 (Units) 294

TABLE NO. 173. : Africa Gas Turbine Market Volume, By Application (Energy & Power Only), 2026 – 2033 (Units) 294

TABLE NO. 174. : Africa Gas Turbine Market Revenue, By Application (Energy & Power Only), 2020 – 2025 (USD Million) 296

TABLE NO. 175. : Africa Gas Turbine Market Revenue, By Application (Energy & Power Only), 2026 – 2033 (USD Million) 296

TABLE NO. 176. : Africa Gas Turbine Market Volume, By End-user, 2020 – 2025 (Units) 298

TABLE NO. 177. : Africa Gas Turbine Market Volume, By End-user, 2026 – 2033 (Units) 298

TABLE NO. 178. : Africa Gas Turbine Market Revenue, By End-user, 2020 – 2025 (USD Million) 300

TABLE NO. 179. : Africa Gas Turbine Market Revenue, By End-user, 2026 – 2033 (USD Million) 300

TABLE NO. 180. : Africa Gas Turbine Market Volume, By Technology, 2020 – 2025 (Units) 302

TABLE NO. 181. : Africa Gas Turbine Market Volume, By Technology, 2026 – 2033 (Units) 302

TABLE NO. 182. : Africa Gas Turbine Market Revenue, By Technology, 2020 – 2025 (USD Million) 303

TABLE NO. 183. : Africa Gas Turbine Market Revenue, By Technology, 2026 – 2033 (USD Million) 303

TABLE NO. 184. : Africa Gas Turbine Market Volume, By Capacity Range, 2020 – 2025 (Units) 304

TABLE NO. 185. : Africa Gas Turbine Market Volume, By Capacity Range, 2026 – 2033 (Units) 304

TABLE NO. 186. : Africa Gas Turbine Market Revenue, By Capacity Range, 2020 – 2025 (USD Million) 305

TABLE NO. 187. : Africa Gas Turbine Market Revenue, By Capacity Range, 2026 – 2033 (USD Million) 305

TABLE NO. 188. : Africa Gas Turbine Market Volume, By Fuel Type, 2020 – 2025 (Units) 306

TABLE NO. 189. : Africa Gas Turbine Market Volume, By Fuel Type, 2026 – 2033 (Units) 306

TABLE NO. 190. : Africa Gas Turbine Market Revenue, By Fuel Type, 2020 – 2025 (USD Million) 307

TABLE NO. 191. : Africa Gas Turbine Market Revenue, By Fuel Type, 2026 – 2033 (USD Million) 307

TABLE NO. 192. : Africa Gas Turbine Market Volume, By Component, 2020 – 2025 (Units) 308

TABLE NO. 193. : Africa Gas Turbine Market Volume, By Component, 2026 – 2033 (Units) 309

TABLE NO. 194. : Africa Gas Turbine Market Revenue, By Component, 2020 – 2025 (USD Million) 310

TABLE NO. 195. : Africa Gas Turbine Market Revenue, By Component, 2026 – 2033 (USD Million) 311