Market Overview

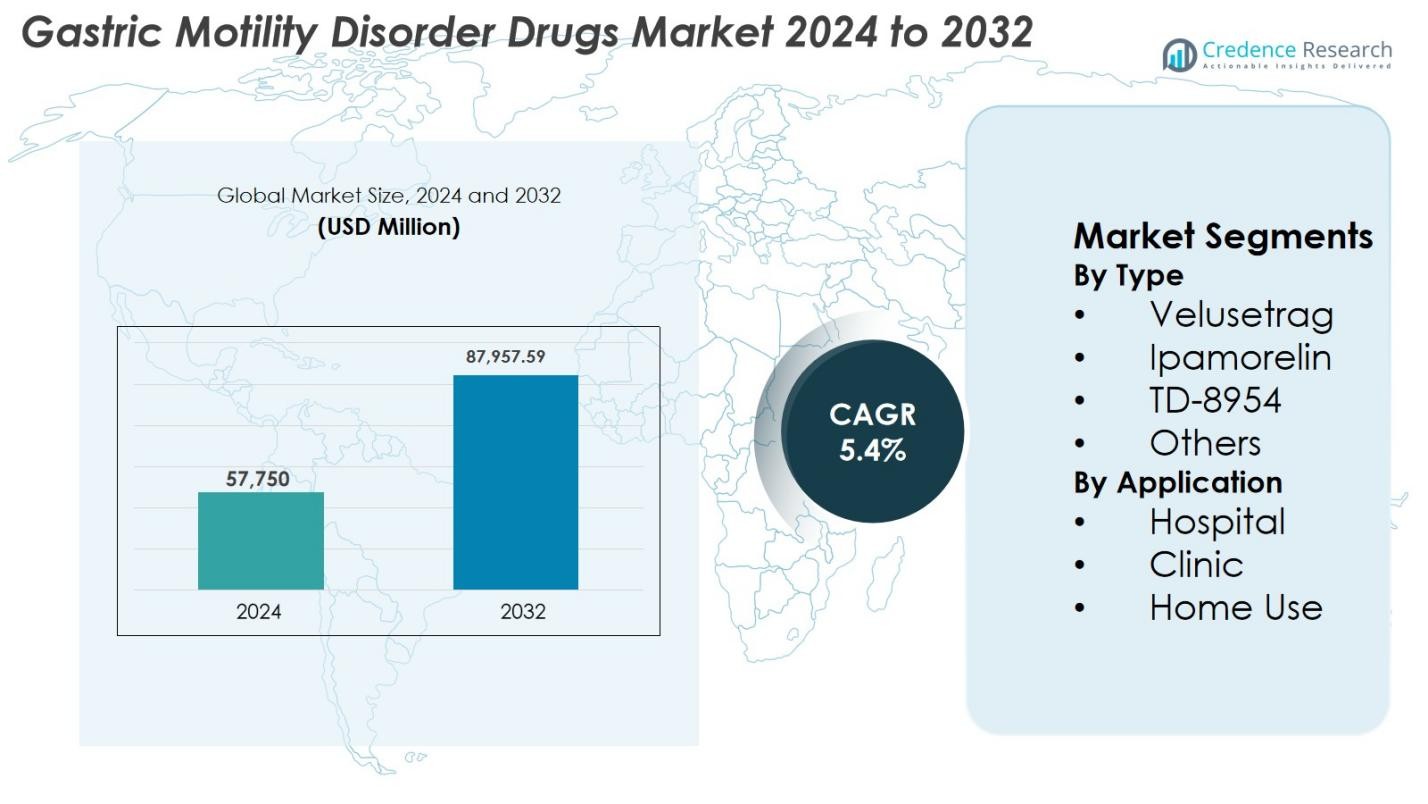

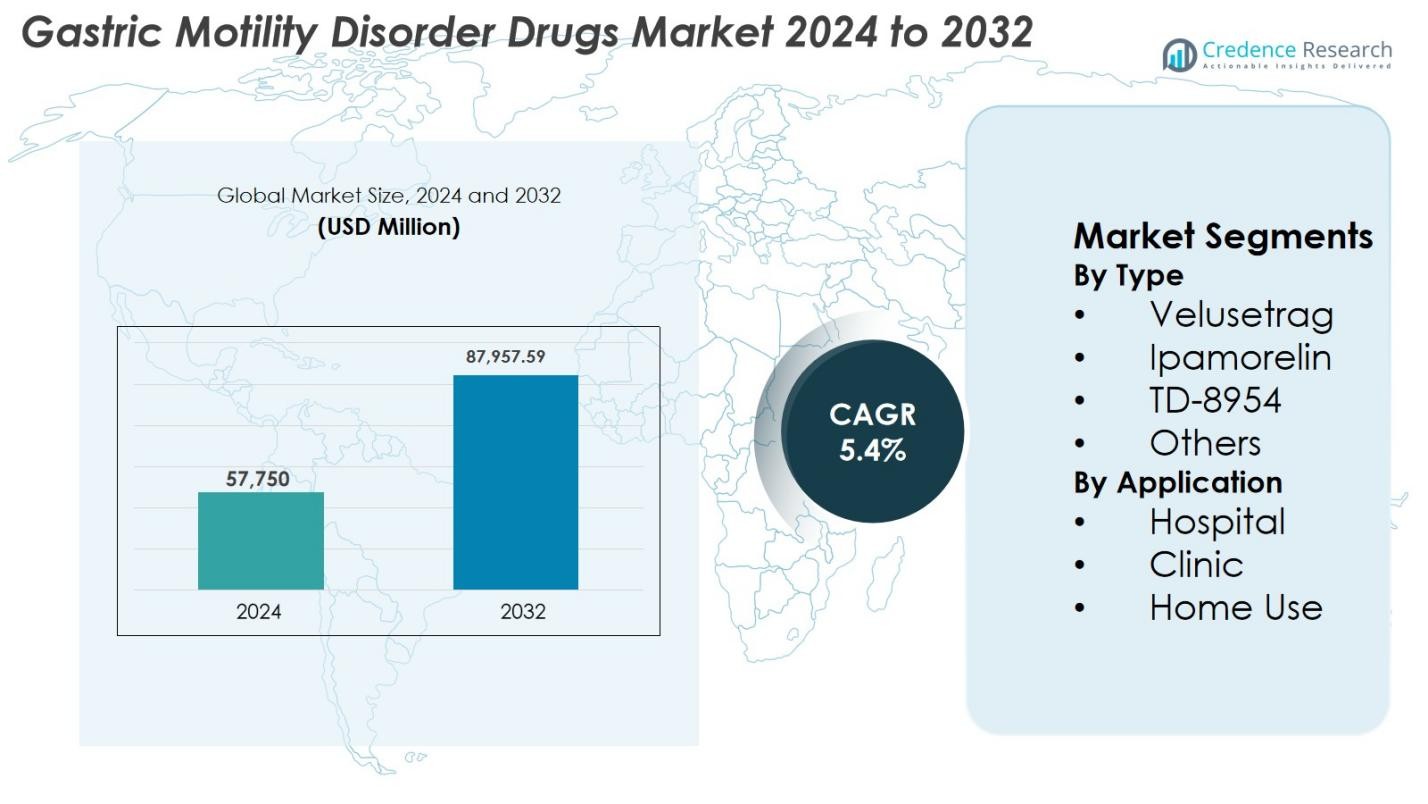

Gastric Motility Disorder Drugs Market size was valued at USD 57,750 Million in 2024 and is anticipated to reach USD 87,957.59 Million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gastric Motility Disorder Drugs Market Size 2024 |

USD 57,750 Million |

| Gastric Motility Disorder Drugs Market, CAGR |

5.4% |

| Gastric Motility Disorder Drugs Market Size 2032 |

USD 87,957.59 Million |

Gastric Motility Disorder Drugs Market is shaped by leading pharmaceutical companies including Sun Pharmaceutical Industries Ltd., Cipla Inc., Gilead Sciences, Biogen, Organon Group of Companies, AbbVie Inc., AstraZeneca, Salix Pharmaceuticals, Takeda Pharmaceutical Company Limited, and Pfizer Inc., all actively advancing prokinetic therapies and expanding global access. North America dominates the market with a 38.6% share in 2024, driven by strong diagnostic capabilities, high disease prevalence, and rapid adoption of next-generation 5-HT4 agonists. Europe follows with a 29.4% share supported by advanced healthcare infrastructure, favorable reimbursement policies, and widespread clinical uptake of emerging motility-enhancing drugs.

Market Insights

Market Insights

- Gastric Motility Disorder Drugs Market reached USD 57,750 Million in 2024 and will grow at a CAGR of 5.4% to reach USD 87,957.59 Million by 2032.

- Market growth is driven by rising prevalence of gastroparesis and functional GI disorders, increasing diagnosis rates, and the adoption of advanced prokinetic therapies including velusetrag, which led the type segment with 41.8% share.

- Key trends include strong R&D momentum in next-generation 5-HT4 agonists, expanding digital GI monitoring tools, and growing pipeline collaborations among pharmaceutical companies and research institutions.

- Major players such as Sun Pharmaceutical Industries Ltd., Cipla Inc., Gilead Sciences, Biogen, Organon, AbbVie, AstraZeneca, Salix Pharmaceuticals, Takeda, and Pfizer strengthen the market through innovation, targeted formulations, and strategic expansion.

- Regionally, North America leads with 38.6% share, followed by Europe at 29.4% and Asia-Pacific at 22.8%, while Hospitals dominated the application segment with 52.6% share supported by strong diagnostic capabilities and specialist availability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Gastric Motility Disorder Drugs market by type is led by Velusetrag, accounting for 41.8% of the segment in 2024. Its dominance stems from strong prokinetic efficacy, favorable safety profiles, and ongoing clinical progress supporting its use in chronic gastroparesis. Ipamorelin and TD-8954 also show rising adoption due to their receptor-specific activity and reduced adverse effects, while the Others category includes emerging agents in early clinical stages. Growing demand for targeted therapies, increased diagnosis of gastrointestinal motility disorders, and broader physician acceptance of novel 5-HT4 agonists continue to drive segment expansion.

- For instance, Theravance’s TD-8954 exhibits high 5-HT4 receptor selectivity, elevating cAMP in human cells (pEC50=9.3) and contracting guinea pig colon preparations (pEC50=8.6). It stimulates GI motility across species, supporting prokinetic potential without off-target effects.

By Application

The application segment is dominated by Hospitals, holding 52.6% of the market share in 2024, driven by the rising number of patients requiring advanced diagnostic evaluation, supervised drug administration, and management of severe gastric motility conditions. Clinics follow with strong adoption of prescription-based prokinetic therapies for mild to moderate cases, while Home Use continues to expand due to increased availability of oral formulations and improved treatment adherence tools. The segment benefits from growing awareness of gastroparesis, enhanced reimbursement structures, and the integration of specialized gastroenterology units in major healthcare facilities.

- For Instance, Evoke Pharma in December 2024 highlighted that its nasal-spray product GIMOTI reduced hospitalizations, emergency-room visits, and office visits compared to oral metoclopramide demonstrating how hospital-based care can shift to less invasive, outpatient- or home-compatible formulations.

Key Growth Drivers

Rising Prevalence of Gastroparesis and Functional GI Disorders

The growing global incidence of gastroparesis, functional dyspepsia, and chronic gastrointestinal motility disorders remains a primary driver for the Gastric Motility Disorder Drugs market. Increasing rates of diabetes, obesity, and neurological conditions significantly elevate the risk of delayed gastric emptying, expanding the patient pool requiring long-term pharmacological therapy. Improved diagnostic accuracy through advanced imaging and motility testing further contributes to higher detection rates. As awareness among clinicians and patients rises, more individuals seek medical treatment earlier, accelerating prescription volumes. The chronic nature of most gastric motility conditions also supports recurring drug demand, while persistent unmet needs in symptom control strengthen the adoption of newer prokinetic agents.

- For Instance, voke Pharma reported increased clinical adoption of GIMOTI® (metoclopramide nasal spray), driven by greater awareness of diabetic gastroparesis and rising physician preference for non-oral delivery options in patients with impaired gastric emptying.

Advancements in Prokinetic Drug Development and Novel Mechanisms of Action

Ongoing R&D innovation, particularly in next-generation 5-HT4 agonists, ghrelin receptor agonists, and motilin-based therapies, is fueling strong market growth. Companies are shifting toward highly selective molecules such as velusetrag and TD-8954 that enhance gastric emptying with fewer cardiovascular risks compared to earlier prokinetics. Extensive clinical trials are validating new mechanisms aimed at improving neuromuscular coordination and reducing hypersensitivity, enabling better long-term outcomes. Pharmaceutical investments in gut-targeted formulations, biologics, and precision treatment approaches further expand therapeutic potential. Regulatory incentives supporting breakthrough therapies and advanced oral dosage designs also improve adherence, strengthening the overall uptake of innovative agents.

- For Instance, Takeda advanced TD-8954 through clinical development, with published data confirming its potent, selective 5-HT4 activity and reduced cardiac risk profile relative to earlier agents such as cisapride.

Expanding Healthcare Access and Growing Treatment Adoption in Emerging Markets

Emerging markets across Asia-Pacific, Latin America, and the Middle East present strong growth potential due to expanding healthcare infrastructure, rising disposable incomes, and broader insurance penetration. Increased investment in gastroenterology services and improved access to advanced diagnostics enable earlier identification and treatment of motility disorders. Urbanization and lifestyle shifts contribute to higher rates of metabolic diseases, increasing gastric motility complications. Government-led awareness programs, enhanced reimbursement frameworks, and availability of cost-effective generics further accelerate treatment adoption. Strengthening pharmaceutical distribution networks and local manufacturing capabilities also support wider accessibility, reinforcing long-term market expansion.

Key Trends & Opportunities

Growing Focus on Personalized Gastrointestinal Therapeutics and Digital Monitoring Tools

A major trend shaping the market is the shift toward personalized gastrointestinal care supported by digital health tools. Advances in genomics, microbiome analytics, and biomarker-based diagnostics enable clinicians to tailor prokinetic therapies to individual symptoms and disease pathways. Smart digital platforms, including wearable motility trackers, mobile symptom-logging apps, and connected adherence systems, improve real-time monitoring and enhance treatment precision. Pharmaceutical companies are increasingly integrating AI-driven decision-support systems that guide dosing adjustments, predict symptom flares, and optimize patient engagement. These innovations improve treatment outcomes, reduce variability, and support technology-enabled GI care models with strong long-term potential.

- For Instance, Medtronic expanded the clinical use of its AI-enabled GI Genius™ platform, enhancing diagnostic precision in gastroenterology and supporting data-driven personalization of therapeutic decisions.

Strong Pipeline Progress and Expanding Strategic Collaborations

Rapid progress in clinical pipelines and increasing collaboration among manufacturers, research institutions, and biotechnology companies are generating significant opportunities. Late-stage candidates demonstrating improved motility restoration and better safety profiles are expected to redefine treatment standards. Strategic alliances, licensing deals, and co-development agreements enable companies to access novel technologies, accelerate clinical programs, and strengthen commercialization strategies. Regulatory agencies increasingly prioritize therapies addressing chronic gastroparesis and severe GI disorders, offering expedited review pathways. As global commercialization partnerships expand, newly approved therapies gain broader market penetration and strengthen innovation-driven growth.

- For Instance, Evoke Pharma partnered with Eversana to enhance U.S. commercialization of GIMOTI®, illustrating how strategic alliances improve market penetration for newly available gastroparesis therapies.

Key Challenges

Limited Treatment Efficacy and Safety Concerns with Existing Prokinetic Agents

Despite ongoing innovation, many existing prokinetic drugs continue to face limitations related to efficacy and safety. Earlier drug classes such as dopamine antagonists carry neurological side effects, while first-generation 5-HT4 agonists encountered cardiovascular risks that influence clinician caution even today. Many patients experience variable responses, leading to prolonged treatment adjustments and suboptimal symptom relief. The lack of universally effective options for moderate to severe gastroparesis reflects a continued unmet need. Regulatory scrutiny of cardiac safety and long-term tolerability further impacts adoption. Addressing these issues requires improved clinical evidence, next-generation molecule development, and robust pharmacovigilance to strengthen patient and clinician confidence.

High Clinical Development Costs and Regulatory Complexities Affecting Approvals

Drug development for gastric motility disorders remains costly due to lengthy trial durations, complex symptom assessment criteria, and the need for specialized motility testing. Recruiting appropriate patient groups, particularly for severe or refractory conditions, increases trial difficulty and expenses. Regulatory bodies require extensive cardiovascular safety evaluations and long-term outcome data, extending approval timelines. Variability in regional regulatory guidelines adds further complexity to multinational studies. Smaller biotech firms often face funding challenges that delay advancement of promising molecules. These factors collectively slow the approval of new therapies, prolong reliance on older treatments, and create financial and operational barriers to market entry.

Regional Analysis

North America

North America leads the Gastric Motility Disorder Drugs market with 38.6% share in 2024, driven by a high prevalence of gastroparesis, diabetes-related motility disorders, and strong adoption of advanced prokinetic therapies. The region benefits from well-established diagnostic infrastructure, strong reimbursement systems, and extensive clinical research supporting next-generation drug development. Growing awareness among gastroenterologists, increasing patient screening rates, and the availability of specialist care centers further accelerate demand. Pharmaceutical investments, rapid uptake of innovative 5-HT4 agonists, and strong regulatory support for breakthrough therapies continue to reinforce North America’s dominant position in the global market.

Europe

Europe holds 29.4% of the Gastric Motility Disorder Drugs market in 2024, supported by a rising burden of gastrointestinal motility disorders and strong clinical adoption of velusetrag and other emerging therapies. The region’s advanced healthcare infrastructure, widespread diagnostic access, and well-established gastroenterology networks enhance early detection and treatment initiation. Favorable reimbursement policies across Western Europe, combined with increasing patient awareness programs, boost therapy uptake. Ongoing research collaborations between pharmaceutical companies and academic institutions continue to drive innovation, while demand grows for safer and better-tolerated prokinetic agents, strengthening Europe’s overall market presence.

Asia-Pacific

Asia-Pacific accounts for 22.8% of the market in 2024 and represents the fastest-growing region due to expanding healthcare access, increasing metabolic disease prevalence, and rising awareness of chronic gastric motility disorders. Rapid urbanization, changing dietary habits, and high rates of diabetes significantly contribute to growing patient volumes. Government efforts to strengthen gastroenterology services, along with increasing use of affordable generics and region-specific formulations, accelerate treatment adoption. Pharmaceutical companies are expanding partnerships, distribution networks, and local manufacturing to meet rising demand. These factors collectively position Asia-Pacific as a key growth engine for the global market.

Latin America

Latin America captures 6.7% of the Gastric Motility Disorder Drugs market in 2024, supported by improving healthcare infrastructure, increasing diagnosis of gastrointestinal disorders, and a growing focus on expanding gastroenterology services. Rising incidence of diabetes and obesity contributes to higher gastroparesis prevalence, driving drug demand. Countries such as Brazil and Mexico lead regional growth due to stronger hospital networks and broader access to prescription prokinetics. Although reimbursement systems remain uneven, expanding availability of cost-effective generics and targeted awareness campaigns enhance treatment uptake. Continued investment in specialty care facilities is expected to strengthen market penetration.

Middle East & Africa

The Middle East & Africa region holds 2.5% of the market in 2024, driven by a gradual increase in gastrointestinal motility disorder diagnosis and expanding healthcare modernization efforts. Growing adoption of advanced diagnostic tools in Gulf Cooperation Council countries improves early treatment initiation, while rising rates of diabetes and lifestyle-related disorders elevate patient need. Limited specialist availability in parts of Africa restrains full-scale adoption; however, increasing pharmaceutical distribution networks and government investments in tertiary care support incremental market growth. The introduction of affordable generic formulations continues to strengthen access and expand treatment rates across the region.

Market Segmentations

By Type

- Velusetrag

- Ipamorelin

- TD-8954

- Others

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Gastric Motility Disorder Drugs market is shaped by a mix of global pharmaceutical leaders and emerging biotechnology companies advancing next-generation prokinetic therapies. Key players such as Sun Pharmaceutical Industries Ltd., Cipla Inc., Gilead Sciences, Biogen, Organon Group of Companies, AbbVie Inc., AstraZeneca, Salix Pharmaceuticals, Takeda Pharmaceutical Company Limited, and Pfizer Inc. strengthen their market presence through strategic product innovation, clinical trial advancements, and regional expansion initiatives. Companies increasingly focus on developing highly selective 5-HT4 agonists, ghrelin receptor modulators, and gut-targeted formulations to address safety limitations associated with older prokinetics. Partnerships with research institutions and licensing collaborations accelerate pipeline progression, while investments in patient-centric formulations enhance treatment adherence. Growing emphasis on personalized gastrointestinal therapies, improved distribution networks in emerging markets, and continuous regulatory engagement further amplify competitive intensity across the global landscape.

Key Player Analysis

- AstraZeneca

- Salix Pharmaceuticals

- Organon Group of Companies

- Pfizer Inc.

- Biogen

- Sun Pharmaceutical Industries Ltd.

- Gilead Sciences, Inc.

- AbbVie Inc.

- Takeda Pharmaceutical Company Limited

- Cipla Inc.

Recent Developments

- In March 2025, FDA approved Gvoke VialDx for inhibiting GI motility during diagnostic procedures.

- In December 2024, Evoke Pharma highlighted GIMOTI as a leading solution for gastroparesis recognizing it as among the limited approved therapies amid expected supply constraints for unapproved alternatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as awareness and diagnosis of gastric motility disorders continue to rise.

- Adoption of next-generation 5-HT4 agonists and ghrelin receptor modulators will increase due to improved safety and efficacy.

- Personalized treatment approaches supported by biomarker-based diagnostics will gain stronger clinical adoption.

- Digital health tools, including symptom-tracking apps and wearable motility sensors, will enhance disease management.

- Pharmaceutical companies will expand collaborations to accelerate clinical development and global commercialization.

- Demand for safer, well-tolerated long-term therapies will drive innovation across drug classes.

- Emerging markets will show rapid expansion supported by better healthcare access and rising metabolic disease prevalence.

- Formulation advancements, including extended-release and patient-friendly oral options, will improve adherence.

- Regulatory support for therapies addressing refractory gastroparesis will shorten approval timelines.

- Growing investment in gastrointestinal research will introduce novel mechanisms of action into the treatment landscape.

Market Insights

Market Insights