Chapter No. 1 : Introduction 35

1.1. Report Description 35

1.1.1. Purpose of the Report 35

1.1.2. USP & Key Offerings 35

1.2. Key Benefits for Stakeholders 35

1.3. Target Audience 36

1.4. Report Scope 37

Chapter No. 2 : Executive Summary 39

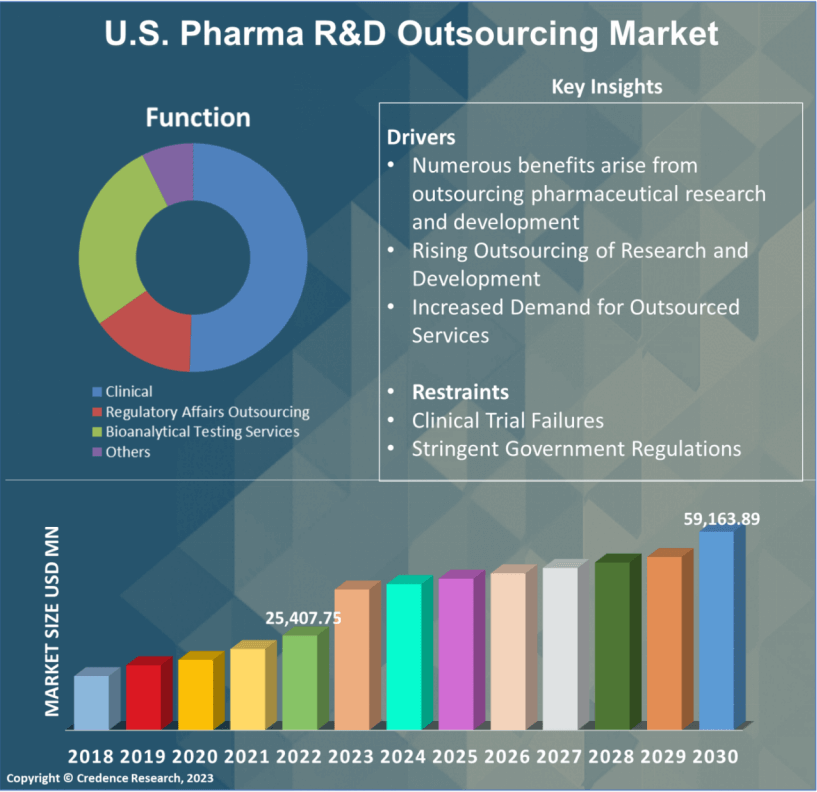

2.1. Pharma R&D Outsourcing Market Snapshot 39

2.2. U.S. Pharma R&D Outsourcing Market, 2017 – 2022 (USD Million) 40

Chapter No. 3 : Impact Analysis of COVID 19 & Russia-Ukraine War on Pharma R&D Outsourcing Market 41

3.1. Impact Assessment of COVID-19 Pandemic, By Region 41

3.1.1. Impact of COVID-19 on U.S. Pharma R&D Outsourcing: 41

3.1.2. Geopolitical Impact on U.S. Pharma R&D Outsourcing: 42

3.1.3. Israel’s Role in Pharma R&D: 43

3.1.4. Considerations for the Future: 43

Chapter No. 4 : Pharma R&D Outsourcing Market – Industry Analysis 44

4.1. Introduction 44

4.2. Market Drivers 45

4.2.1. Numerous benefits arise from outsourcing pharmaceutical research and development 45

4.2.2. Rising Outsourcing of Research and Development 46

4.2.3. Increased Demand for Outsourced Services 46

4.3. Market Restraints 47

4.3.1. Clinical Trial Failures 47

4.3.2. Stringent Government Regulations 48

4.4. Market Opportunities 49

4.4.1. Emergence of Pharma R&D Outsourcing in Developing Countries 49

4.4.2. Increased R&D by Biopharmaceutical Vendors 50

4.5. Porter’s Five Forces Analysis 51

4.6. Value Chain Analysis 53

4.7. Buying Criteria 56

Chapter No. 5 : Analysis Competitive Landscape 57

5.1. Company Market Share Analysis – 2022 57

5.1.1. U.S. Pharma R&D Outsourcing Market: Top 5 Company Market Share, by Revenue 2022 57

5.1.2. U.S. Pharma R&D Outsourcing Market: Top 10 Company Market Share, by Revenue 2022 58

5.1. U.S. Pharma R&D Outsourcing Market Company Revenue Market Share, 2022 59

5.2. Company Assessment Metrics 60

5.2.1. Stars 60

5.2.2. Emerging Leaders 60

5.2.3. Pervasive Players 60

5.2.4. Participants 60

5.3. Key Players Product Matrix 61

Chapter No. 6 : PESTEL & Adjacent Market Analysis 65

6.1. PESTEL 65

6.1.1. Political Factors 65

6.1.2. Economic Factors 65

6.1.3. Social Factors 65

6.1.4. Technological Factors 65

6.1.5. Environmental Factors 66

6.1.6. Legal Factors 66

6.2. Adjacent Market Analysis 67

Chapter No. 7 : Pharma R&D Outsourcing Market – By Type Segment Analysis 70

7.1. Pharma R&D Outsourcing Market Overview, by Type Segment 70

7.1.1. Pharma R&D Outsourcing Market Revenue Share, By Type, 2022 & 2030 70

7.1.2. Pharma R&D Outsourcing Market Attractiveness Analysis, By Type 71

7.1.3. Incremental Revenue Growth Opportunity, by Type, 2023 – 2030 71

7.1.4. Pharma R&D Outsourcing Market Revenue, By Type, 2017 to 2022 72

7.2. Small Molecules 73

7.3. Biologics 74

Chapter No. 8 : Pharma R&D Outsourcing Market – By Therapy Area Segment Analysis 75

8.1. Pharma R&D Outsourcing Market Overview, by Therapy Area Segment 75

8.1.1. Pharma R&D Outsourcing Market Revenue Share, By Therapy Area, 2022 & 2030 75

8.1.2. Pharma R&D Outsourcing Market Attractiveness Analysis, By Therapy Area 76

8.1.3. Incremental Revenue Growth Opportunity, by Therapy Area, 2023 – 2030 76

8.1.4. Pharma R&D Outsourcing Market Revenue, By Therapy Area, 2017 to 2022 77

8.2. Oncology 78

8.3. Cardiovascular Diseases 79

8.4. Infectious Diseases 80

8.5. Musculoskeletal Disorders 81

8.6. Others 82

Chapter No. 9 : Pharma R&D Outsourcing Market – By End-user Segment Analysis 83

9.1. Pharma R&D Outsourcing Market Overview, by End-user Segment 83

9.1.1. Pharma R&D Outsourcing Market Revenue Share, By End-user, 2022 & 2030 83

9.1.2. Pharma R&D Outsourcing Market Attractiveness Analysis, By End-user 84

9.1.3. Incremental Revenue Growth Opportunity, by End-user, 2023 – 2030 84

9.1.4. Pharma R&D Outsourcing Market Revenue, By End-user, 2017 to 2022 85

9.2. Small & Mid-Sized Companies 86

9.3. Large Companies 87

Chapter No. 10 : Pharma R&D Outsourcing Market – By Function Segment Analysis 88

10.1. Pharma R&D Outsourcing Market Overview, by Function Segment 88

10.1.1. Pharma R&D Outsourcing Market Revenue Share, By Function, 2022 & 2030 88

10.1.2. Pharma R&D Outsourcing Market Attractiveness Analysis, By Function 89

10.1.3. Incremental Revenue Growth Opportunity, by Function, 2023 – 2030 90

10.1.4. Pharma R&D Outsourcing Market Revenue, By Function, 2017 to 2022 91

10.2. Clinical 92

10.3. Regulatory Affairs Outsourcing 93

10.4. Bioanalytical Testing Services 94

10.5. Others 95

Chapter No. 11 : Company Profiles 96

11.1. Charles River Laboratories 96

11.1.1. Company Overview 96

11.1.2. Product Portfolio 97

11.1.3. Financial Overview 97

11.2. ICON 98

11.2.1. Company Overview 98

11.2.2. Product Portfolio 99

11.2.3. Financial Overview 99

11.3. IQVIA 100

11.3.1. Company Overview 100

11.3.2. Product Portfolio 101

11.3.3. Financial Overview 101

11.4. Labcorp Drug Development 102

11.4.1. Company Overview 102

11.4.2. 102

11.4.3. Product Portfolio 103

11.4.4. Financial Overview 103

11.5. Medpace 104

11.5.1. Company Overview 104

11.5.2. Product Portfolio 105

11.5.3. Financial Overview 105

11.6. Parexel International Corporation 106

11.6.1. Company Overview 106

11.6.2. Product Portfolio 107

11.6.3. Financial Overview 107

11.7. Syneos Health 108

11.7.1. Company Overview 108

11.7.2. Product Portfolio 108

11.7.3. Financial Overview 109

11.8. Thermo Fisher Scientific 110

11.8.1. Company Overview 110

11.8.2. Product Portfolio 111

11.8.3. Financial Overview 111

11.9. Wuxi AppTec 112

11.9.1. Company Overview 112

11.9.2. Product Portfolio 113

11.9.3. Financial Overview 113

11.10. Lonza 114

11.10.1. Company Overview 114

11.10.2. Product Portfolio 115

11.10.3. Financial Overview 115

11.11. Boehringer Ingelheim 116

11.11.1. Company Overview 116

11.11.2. Product Portfolio 116

11.11.3. Financial Overview 117

11.12. Samsung Biologics 118

11.12.1. Company Overview 118

11.12.2. Product Portfolio 119

11.12.3. Financial Overview 119

11.13. AbbVie 120

11.13.1. Company Overview 120

11.13.2. Product Portfolio 121

11.13.3. Financial Overview 121

11.14. Advanced Clinical 122

11.14.1. Company Overview 122

11.14.2. Product Portfolio 122

11.14.3. Financial Overview 123

11.15. BioAnalytix 124

11.15.1. Company Overview 124

11.15.2. Product Portfolio 125

11.15.3. Financial Overview 125

11.16. Asymchem 126

11.16.1. Company Overview 126

11.16.2. Product Portfolio 127

11.16.3. Financial Overview 127

11.17. Alcami 128

11.17.1. Company Overview 128

11.17.2. Product Portfolio 128

11.17.3. Financial Overview 129

11.18. Catalent 130

11.18.1. Company Overview 130

11.18.2. Product Portfolio 131

11.18.3. Financial Overview 131

11.19. Curia U.S. 132

11.19.1. Company Overview 132

11.19.2. Product Portfolio 132

11.19.3. Financial Overview 133

11.20. ChemPartner 134

11.20.1. Company Overview 134

11.20.2. Product Portfolio 135

11.20.3. Financial Overview 135

11.21. CMED 136

11.21.1. Company Overview 136

11.21.2. Product Portfolio 136

11.21.3. Financial Overview 137

11.22. Criterium 138

11.22.1. Company Overview 138

11.22.2. Product Portfolio 139

11.22.3. Financial Overview 139

11.23. Cromos Pharma 140

11.23.1. Company Overview 140

11.23.2. Product Portfolio 141

11.23.3. Financial Overview 141

11.24. Evotec 142

11.24.1. Company Overview 142

11.24.2. Product Portfolio 143

11.24.3. Financial Overview 143

11.25. KBI Biopharma 144

11.25.1. Company Overview 144

11.25.2. Product Portfolio 144

11.25.3. Financial Overview 145

11.26. KCR S.A. 146

11.26.1. Company Overview 146

11.26.2. Product Portfolio 147

11.26.3. Financial Overview 147

11.27. Kemwell Biopharma 148

11.27.1. Company Overview 148

11.27.2. Product Portfolio 149

11.27.3. Financial Overview 149

11.28. Mesned Pharma Consult Center 150

11.28.1. Company Overview 150

11.28.2. Product Portfolio 150

11.28.3. Financial Overview 151

11.29. Medelis 152

11.29.1. Company Overview 152

11.29.2. Product Portfolio 152

11.29.3. Financial Overview 153

11.30. OCT Clinical 154

11.30.1. Company Overview 154

11.30.2. Product Portfolio 155

11.30.3. Financial Overview 155

11.31. ProTrials Research 156

11.31.1. Company Overview 156

11.31.2. Product Portfolio 157

11.31.3. Financial Overview 157

11.32. PROMETRIKA 158

11.32.1. Company Overview 158

11.32.2. Product Portfolio 158

11.32.3. Financial Overview 159

11.33. QPS 160

11.33.1. Company Overview 160

11.33.2. Product Portfolio 161

11.33.3. Financial Overview 161

11.34. Singota Solutions 162

11.34.1. Company Overview 162

11.34.2. Product Portfolio 163

11.34.3. Financial Overview 163

11.35. Sofpromed 164

11.35.1. Company Overview 164

11.35.2. Product Portfolio 164

11.35.3. Financial Overview 165

11.36. WuXi Biologics 166

11.36.1. Company Overview 166

11.36.2. Product Portfolio 167

11.36.3. Financial Overview 167

Chapter No. 12 : Research Methodology 168

12.1. Research Methodology 168

12.2. Phase I – Secondary Research 169

12.3. Phase II – Data Modeling 169

12.3.1. Company Share Analysis Model 170

12.3.2. Revenue Based Modeling 170

12.4. Phase III – Primary Research 171

12.5. Research Limitations 172

12.5.1. Assumptions 172

List of Figures

FIG NO. 1. U.S. Pharma R&D Outsourcing Market Revenue, 2017 – 2022 (USD Million) 40

FIG NO. 2. Comparison of Research Costs in US and India 46

FIG NO. 3. Key Factors in Failure of Clinical Trials 47

FIG NO. 4. Porter’s Five Forces Analysis for U.S. Pharma R&D Outsourcing Market 51

FIG NO. 5. Company Share Analysis, 2022 57

FIG NO. 6. Company Share Analysis, 2022 58

FIG NO. 7. Pharma R&D Outsourcing Market – Company Revenue Market Share, 2022 59

FIG NO. 8. Company Assessment Metrics 60

FIG NO. 9. Pharma R&D Outsourcing Market Revenue Share, By Type, 2022 & 2030 70

FIG NO. 10. Market Attractiveness Analysis, By Type 71

FIG NO. 11. Incremental Revenue Growth Opportunity by Type 71

FIG NO. 12. Pharma R&D Outsourcing Market Revenue, By Type, 2017 to 2022 72

FIG NO. 13. U.S. Pharma R&D Outsourcing Market for Small Molecules, Revenue (USD Million) 2017 – 2030 73

FIG NO. 14. U.S. Pharma R&D Outsourcing Market for Biologics, Revenue (USD Million) 2017 – 2030 74

FIG NO. 15. Pharma R&D Outsourcing Market Revenue Share, By Therapy Area, 2022 & 2030 75

FIG NO. 16. Market Attractiveness Analysis, By Therapy Area 76

FIG NO. 17. Incremental Revenue Growth Opportunity by Therapy Area 76

FIG NO. 18. Pharma R&D Outsourcing Market Revenue, By Therapy Area, 2017 to 2022 77

FIG NO. 19. U.S. Pharma R&D Outsourcing Market for Oncology, Revenue (USD Million) 2017 – 2030 78

FIG NO. 20. U.S. Pharma R&D Outsourcing Market for Cardiovascular Diseases, Revenue (USD Million) 2017 – 2030 79

FIG NO. 21. U.S. Pharma R&D Outsourcing Market for Infectious Diseases, Revenue (USD Million) 2017 – 2030 80

FIG NO. 22. U.S. Pharma R&D Outsourcing Market for Musculoskeletal Disorders, Revenue (USD Million) 2017 – 2030 81

FIG NO. 23. U.S. Pharma R&D Outsourcing Market for Others, Revenue (USD Million) 2017 – 2030 82

FIG NO. 24. Pharma R&D Outsourcing Market Revenue Share, By End-user, 2022 & 2030 83

FIG NO. 25. Market Attractiveness Analysis, By End-user 84

FIG NO. 26. Incremental Revenue Growth Opportunity by End-user 84

FIG NO. 27. Pharma R&D Outsourcing Market Revenue, By End-user, 2017 to 2022 85

FIG NO. 28. U.S. Pharma R&D Outsourcing Market for Small & Mid-Sized Companies, Revenue (USD Million) 2017 – 2030 86

FIG NO. 29. U.S. Pharma R&D Outsourcing Market for Large Companies, Revenue (USD Million) 2017 – 2030 87

FIG NO. 30. Pharma R&D Outsourcing Market Revenue Share, By Function, 2022 & 2030 88

FIG NO. 31. Market Attractiveness Analysis, By Function 89

FIG NO. 32. Incremental Revenue Growth Opportunity by Function 90

FIG NO. 33. Pharma R&D Outsourcing Market Revenue, By Function, 2017 to 2022 91

FIG NO. 34. U.S. Pharma R&D Outsourcing Market for Clinical, Revenue (USD Million) 2017 – 2030 92

FIG NO. 35. U.S. Pharma R&D Outsourcing Market for Regulatory Affairs Outsourcing, Revenue (USD Million) 2017 – 2030 93

FIG NO. 36. U.S. Pharma R&D Outsourcing Market for Bioanalytical Testing Services, Revenue (USD Million) 2017 – 2030 94

FIG NO. 37. U.S. Pharma R&D Outsourcing Market for Others (Euglena, etc.), Revenue (USD Million) 2017 – 2030 95

FIG NO. 38. Research Methodology – Detailed View 168

FIG NO. 39. Research Methodology 169

List of Tables

TABLE NO. 1. : U.S. Pharma R&D Outsourcing Market: Snapshot 23

TABLE NO. 2. : Drivers for the Pharma R&D Outsourcing Market: Impact Analysis 29

TABLE NO. 3. : Restraints for the Pharma R&D Outsourcing Market: Impact Analysis 31